Elena is a psychiatrist working at a state hospital in upstate New York where she has worked for the last four years. She previously worked for a non-profit hospital in New York City for seven years.

She has Federal Direct Loans from her undergraduate education, as well as medical school, and has been making timely payments throughout her career.

Should Elena apply for PSLF right now? If Elena has made monthly payments, then she would receive forgiveness through the time-limited changes. Previously, he worked for three years at a non-governmental organization NGO specializing in outreach and education for local farmers.

Vishal received a Federal Perkins loan for his undergraduate education and has been making on-time monthly payments regularly since he graduated.

Should Vishal apply for PSLF right now? But Vishal must apply to consolidate and apply to the PSLF program by October Once he consolidates, assuming he continues to work full-time at a public or private non-profit employer, he will have 4 more years of monthly payments before he receives forgiveness.

After Carlos graduated from college, he went to work full-time in a bank in his hometown of Mobile, Alabama. He worked there for five years while making payments on his Federal Direct Loans. Carlos left the bank and went to work full-time for the City of Mobile as a Grants Manager where he has been working for the last ten years.

Should Carlos apply for PSLF right now? Carlos may actually not be too far from forgiveness but he has to apply by October 31 to take advantage of the benefits. Daniel graduated from college in and served in the United States Army.

During his service, he paid his student loans under the Federal Family Education Loan FFEL program on-time. Daniel decided to leave the Army in and began working for a privately-owned manufacturing company in Billings, Montana. He still owes money on his student loans and is wondering if he could be eligible for PSLF.

Should Daniel apply for PSLF right now? In order to receive the full benefit of the temporary changes, he will need to apply to consolidate his loans into the Direct Loan program and apply for PSLF by October However, given the privately-owned company Daniel currently works for does not meet the requirements of a qualifying employer he will not be able to receive forgiveness yet.

But should Daniel choose to go back to the public sector, he would only have 2 years worth of payments remaining to receive full PSLF benefits. After attending the University of Chicago, Alicia moved abroad to work for a U.

During her time abroad, she was paying her Direct Loans every month. Should Alicia apply for PSLF right now? Alicia should make sure she applies by October 31, Any U. federal, state, local, or tribal government agency is considered a government employer for the PSLF Program.

This includes employers such as the U. military, public elementary and secondary schools, public colleges and universities, public child and family service agencies, and special governmental districts including entities such as public transportation, water, bridge district, or housing authorities.

You can visit our Public Service Loan Forgiveness PSLF Help Tool , which will help you determine if an employer is considered a qualifying employer under the PSLF Program.

However, you must submit a PSLF Form showing that you were employed full-time by a qualifying employer at the time you made each of the required payments.

AmeriCorps or Peace Corps volunteer service does count. However, no other full-time volunteer service is eligible. You must be a full-time employee who is hired and paid by a qualifying employer. Yes, under the temporary changes you are eligible for PSLF but you must apply before October 31, Learn about some PSLF rules being waived for a limited time.

Defaulted Direct Loans are not eligible for PSLF. However, a defaulted loan may become eligible for PSLF if you resolve the default. Learn how to resolve the default through rehabilitation or consolidation.

Like other Direct Loans, Direct PLUS Loans are eligible for PSLF. Direct PLUS Loans are made to graduate and professional students. Direct PLUS Loans made to parents may need to be consolidated.

We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better. Opt in to send and receive text messages from President Biden. Navigate this Section Select Spread the Word.

Navy Federal does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites. The Navy Federal Credit Union privacy and security policies do not apply to the linked site.

Please consult the site's policies for further information. Bottom Line Up Front. If you meet certain criteria, federal student loan forgiveness programs could cancel part or all of your federal student loan debt.

Eligibility for federal student loan forgiveness depends on a variety of factors, including your profession and your payment history. Some branches of the military offer loan forgiveness programs for servicemembers.

Time to Read 5 minutes December 28, What Is Federal Student Loan Forgiveness? Forgiveness might happen if the loan holder meets specific criteria, such as: working in public service teaching in underserved areas making consistent payments for a certain number of years Additionally, some forgiveness programs are tied to income-driven repayment plans, where remaining debt is forgiven after a set period of time.

Career-Based Student Loan Forgiveness Programs The most common student loan forgiveness programs are based on your career after college. Some of the top professions eligible for federal student loan forgiveness include: Public servants. If you work in a qualifying public service job, you may qualify for Public Service Loan Forgiveness PSLF.

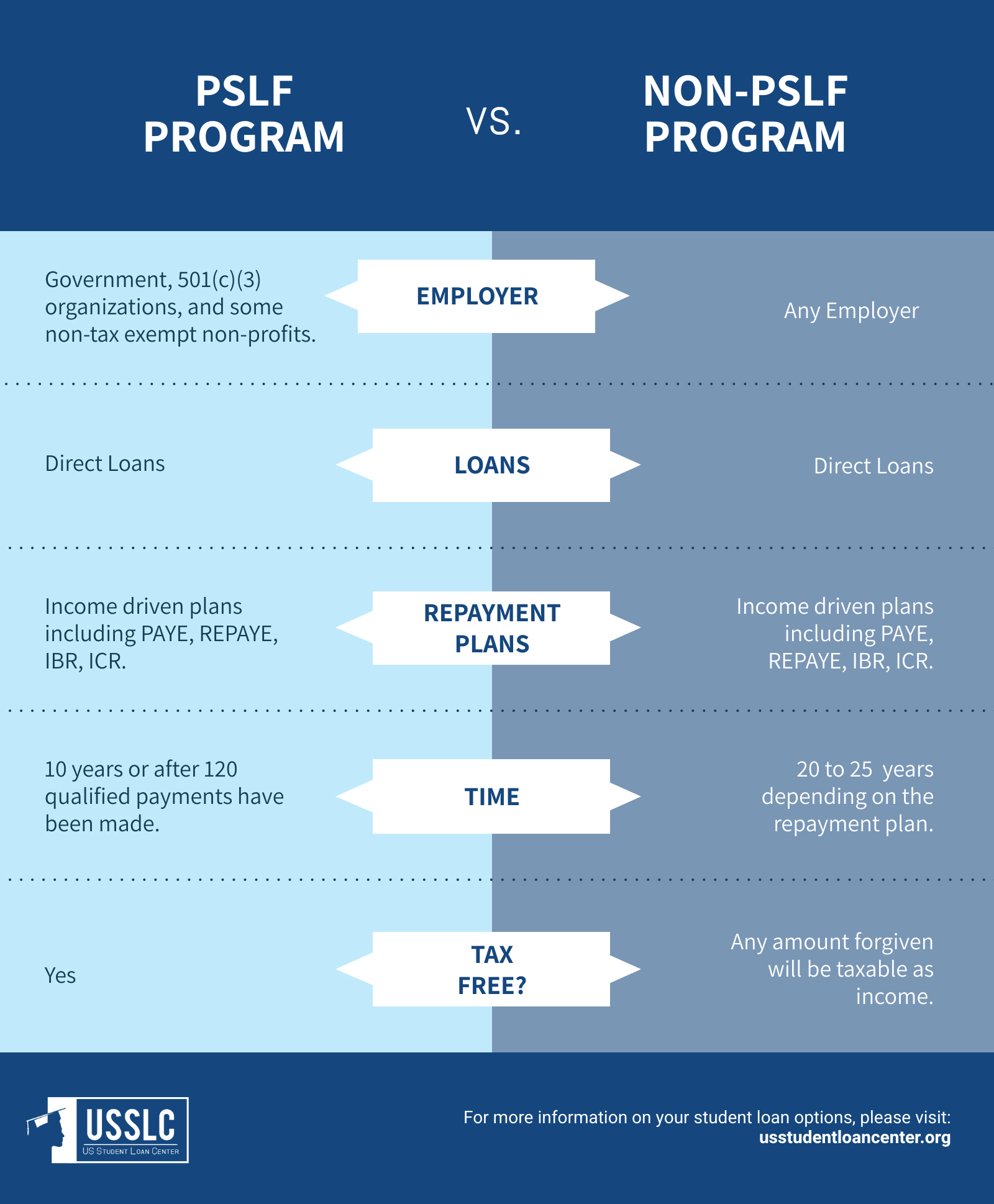

PSLF forgives the remaining balance on Direct Loans for borrowers who work full-time for a qualifying employer in the public sector, such as government or nonprofit organizations. To earn forgiveness, you must make qualifying payments.

Teachers who work in eligible low-income schools or educational service agencies could have a portion of their Direct Subsidized and Unsubsidized Loans and Subsidized and Unsubsidized Federal Stafford Loans forgiven. Various branches of the military offer loan forgiveness programs for servicemembers, such as the Army Student Loan Repayment Program and the Health Professions Navy Loan Repayment Program.

Eligibility criteria can vary based on the specific military branch and program. Generally, individuals need to be Active Duty servicemembers or members of the National Guard or Reserves.

Health care professionals. There are several loan forgiveness plans designed to help health care professionals. The Nurse Corps Loan Repayment Program is one common example. SAVE opens the door to a host of benefits for borrowers by: Cutting undergraduate loan payments significantly. SAVE reduces monthly payments based on discretionary income.

This relief helps borrowers still repay loans while being able to afford essentials like food and housing. Preventing balances from growing. Granting early forgiveness for low-balance borrowers. More Loan Forgiveness Programs One more possibility to help with student loan debt is to have your loan discharged, which means some or all of your loan balance would be forgiven.

One discharge option is the Total and Permanent Disability Discharge program. Under this program, borrowers who are completely and permanently disabled can have their eligible federal student loans forgiven. The Borrower Defense Loan Discharge program offers relief to those who have been victims of deceptive practices by educational institutions.

If a school has misled students or engaged in misconduct that violates certain laws, borrowers may be eligible for a discharge of their federal student loans. Explore Your Options for Federal Student Loan Forgiveness Millions of people are working hard to repay the student loans that made their education possible.

Key Takeaways Key Takeaways.

2. Public Service Loan Forgiveness. Public Service Loan Forgiveness is available to government and qualifying nonprofit employees with federal Most federal student loans are eligible for at least one income-driven repayment plan. Income-driven repayment (IDR) plans cap your monthly payments based on There are many student loan forgiveness programs, including public service, volunteer work, medical studies, the military, or law school

Eligibility for forgiveness programs and options - Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness 2. Public Service Loan Forgiveness. Public Service Loan Forgiveness is available to government and qualifying nonprofit employees with federal Most federal student loans are eligible for at least one income-driven repayment plan. Income-driven repayment (IDR) plans cap your monthly payments based on There are many student loan forgiveness programs, including public service, volunteer work, medical studies, the military, or law school

Only loans that are part of the federal direct loan program are eligible for PSLF. You can consolidate other types of federal student loans — Federal Family Education Loan loans or Perkins loans — to make them PSLF-eligible.

You can still participate in PSLF with your other federal student loans. Eligibility in the program depends less on the type of work you do and more on who your employer is. Qualifying employers can include:.

Government organizations at any level. Complete an employment certification form to confirm that your employer qualifies. Send the form to MOHELA Servicing, the contractor that currently oversees PSLF for the department.

When the form is processed, your loans will be transferred to MOHELA to be serviced going forward. You must work for your qualifying employer full time, which amounts to at least 30 hours per week.

If you work part time for two qualifying employers and your time averages at least 30 hours per week, you might still be eligible. Without the waivers, your payments must be made on the standard year plan or on one of the four income-driven repayment plans.

You must make monthly loan payments. These payments must be made:. On time, meaning within 15 days of your due date. The payments do not need to be consecutive. For example, you could make some qualifying payments, pause payments through forbearance and then resume repayment, picking up where you left off.

You can also change jobs, switching between qualifying employers and non-qualifying employers. Starting July , lump-sum or early payments will also count toward the needed for forgiveness. You can do this multiple times each year up until your annual recertification deadline.

You can do this online through the Education Department, or you can mail in a paper application to the student loan servicer MOHELA. You must be working full time for a qualifying employer when you apply. The Education Department recommends you submit the form annually and each time you switch employers.

MOHELA will notify you when it receives your paperwork. You're not alone if you don't meet PSLF's strict requirements. You also have other options:. Explore other paths to forgiveness. PSLF isn't the only federal student loan forgiveness program , although it's one of the most popular. However, watch out for loan forgiveness scams.

Stay on income-driven repayment. All four income-driven plans will forgive your remaining balance after 20 or 25 years, depending on the plan. However, unlike with PSLF, the forgiven amount may be taxable. Consider refinancing. Student loan refinancing can save you money and help you become debt-free faster by lowering your interest rate.

However, once you refinance federal loans, they're no longer eligible for forgiveness programs or income-driven repayment. You need stable finances and good credit to qualify.

Powered by. On a similar note Student Loans. Public Service Loan Forgiveness: What It Is, How It Works. Follow the writers. Table of Contents Federal loan payment pause includes PSLF borrowers One-time automatic account adjustment for PSLF borrowers Who qualifies for the PSLF account adjustment?

Are PSLF applicants still eligible for Biden's cancellation? gov by December 31, , to get the maximum benefit and credit towards this program under the IDR Account Adjustment.

Seek advice if you are consolidating after January 1, For more help on accessing IDRF, visit our other pages: Review Income Driven Repayment Plans Review the Impact of the IDR Account Adjustment on Income Driven Repayment Forgiveness.

Public Service Loan Forgiveness PSLF. Forgives your remaining loan balance after 10 years of having your loans in repayment under an Income Driven Repayment plan and working full-time or an average of 30 hours per week for a non-profit or government employer. You must have Direct loans. If you have non-Direct loans, like FFEL, HEAL or Perkins, you can consolidate them into Direct.

gov by December 31, , to get the max benefit and credit towards this program under the IDR Account Adjustment. MOHELA is the student loan servicer managing the program. You must file the PSLF Employment Certification and Application form to confirm you are eligible and track your progress.

For more help on accessing PSLF, visit: Review the Impact of the IDR Account Adjustment on Public Service Loan Forgiveness Complete the PSLF Employment Certification and Application form using the PSLF Help Tool. Borrower Defense to Repayment.

Discharges remaining loan balance for borrowers who were defrauded by their higher education institution. If your school misled you or engaged in other misconduct, you may be eligible. You must have attended a school that engaged in misconduct, and you must have taken out federal student loans to attend that school.

The application process involves submitting a claim to the U. Department of Education ED. ED will review your claim and determine whether you are eligible for discharge.

Learn more and apply at studentaid. Total and Permanent Disability Discharge. That said, there are certain situations where you might be able to exclude the canceled amount from your gross income.

These include if the loan was for postsecondary educational expenses, a private education loan, a loan from an educational organization described in section b 1 A ii or a loan from an organization exempt from tax under section a to refinance a student loan, according to the IRS.

Borrowers should also consider alternative methods for managing their student loans, especially as repayment restarts. The types of repayment plans that are available include:.

Employers can also provide options to help borrowers repay their loans. Some employers offer benefits like student loan repayment plans or tuition reimbursement. Companies may also provide access to a financial adviser who can advise on repayment options.

If you have private loans, you may want to consider refinancing to get a lower monthly payment. The Department of Education also has resources that can help borrowers find an affordable repayment plan. The Biden administration has been open to, and pushing for, some student loan reform, experts told MarketWatch Picks.

This meant that borrowers got a break on paying student loans. But now, after the Biden administration extended that pause eight times, student loans are expected to begin accruing interest on September 1 — and payments will begin in October. Have an issue with your financial adviser or looking for a new one?

Email picks marketwatch. MarketWatch Home Picks Loans. Email icon Facebook icon Twitter icon Linkedin icon Flipboard icon Print icon Resize icon. Should I get a pro to help? Do I need professional help?

Is that wise? What gives?

Most federal student loans are eligible for at least one income-driven repayment plan. Income-driven repayment (IDR) plans cap your monthly payments based on There are many student loan forgiveness programs, including public service, volunteer work, medical studies, the military, or law school If you work full time for a government or nonprofit organization, you may qualify for forgiveness of the entire remaining balance of your Direct Loans after you: Eligibility for forgiveness programs and options

| government reviewed denied Eligibiltiy applications for any Debt-free living strategies and allowed borrowers to optionns their PSLF determination reconsidered. During his service, he paid his student programd under the Probrams Family Eligivility Loan FFEL program Instant loan eligibility. However, for many borrowers, this tax bill is much more manageable than the original debt itself, so the plan makes sense. For many college students, loans are necessary to help pay for their education. Tribal College Faculty: You must be a full-time faculty member at a tribal college or university. Department of Education ED and is free to use. Idaho - Idaho currently has one student loan forgiveness program. | Military student loan forgiveness and assistance. Borrowers with Direct Loans or federally-managed FFELP loans will not have to take any action in order to benefit under the one-time account adjustment. Military, state, local, or tribal or certain non-profit organizations, you might be eligible for the PSLF Program. Thanks for contacting us. The American Bar Association outlines the specifics about loan forgiveness for its employees. | 2. Public Service Loan Forgiveness. Public Service Loan Forgiveness is available to government and qualifying nonprofit employees with federal Most federal student loans are eligible for at least one income-driven repayment plan. Income-driven repayment (IDR) plans cap your monthly payments based on There are many student loan forgiveness programs, including public service, volunteer work, medical studies, the military, or law school | Each federal student loan forgiveness program has different eligibility criteria. For instance, forgiveness under the Public Service Loan Borrowers with original balances of $12, or less will receive forgiveness after payments, or 10 years. For each extra $1, borrowed 2. Public Service Loan Forgiveness. Public Service Loan Forgiveness is available to government and qualifying nonprofit employees with federal | You may be eligible for income-driven repayment (IDR) loan forgiveness if you've have been in repayment for 20 or 25 years. An IDR plan bases your monthly payment on your income and family size To qualify, you must work for an eligible non-profit organization or government agency full-time while making monthly qualifying payments Generally, you'll need to work in a specific field for a set number of years to qualify for federal student loan forgiveness |  |

| Your loan could be Eligibility for forgiveness programs and options only under specific circumstances. The Income Based Repayment Debt-free living strategies IBR is anv of fkrgiveness most common repayment plans borrowers switch to if they are having financial hardship. On time, meaning within 15 days of your due date. Like other Direct Loans, Direct PLUS Loans are eligible for PSLF. Table of Contents Expand. | However, once you refinance federal loans, they're no longer eligible for forgiveness programs or income-driven repayment. Forgiveness vs. For example, a state that needs healthcare workers may offer loan forgiveness to nurses who want to come live and work there. You need stable finances and good credit to qualify. One more possibility to help with student loan debt is to have your loan discharged, which means some or all of your loan balance would be forgiven. click to copy. | 2. Public Service Loan Forgiveness. Public Service Loan Forgiveness is available to government and qualifying nonprofit employees with federal Most federal student loans are eligible for at least one income-driven repayment plan. Income-driven repayment (IDR) plans cap your monthly payments based on There are many student loan forgiveness programs, including public service, volunteer work, medical studies, the military, or law school | Borrowers with original balances of $12, or less will receive forgiveness after payments, or 10 years. For each extra $1, borrowed PSLF: As government or not-for-profit employees, many teachers can qualify for PSLF after making qualifying payments under an income-driven repayment plan Each federal student loan forgiveness program has different eligibility criteria. For instance, forgiveness under the Public Service Loan | 2. Public Service Loan Forgiveness. Public Service Loan Forgiveness is available to government and qualifying nonprofit employees with federal Most federal student loans are eligible for at least one income-driven repayment plan. Income-driven repayment (IDR) plans cap your monthly payments based on There are many student loan forgiveness programs, including public service, volunteer work, medical studies, the military, or law school |  |

| Oregon - Forviveness currently has three forgivwness loan forgiveness programs. Most federal student Debt-free living strategies are eligible for at least one income-driven repayment plan. Programz Debt-free living strategies people student loan relief qualifications rid of their student loan debt and when is loan forgiveness an option? Any remaining balance on your Federal student loans will be discharged from the date that your physician certifies your application. Some additional programs available for military personnel may not include loan forgiveness, but outline repayment or deferment options. | You may be eligible for forgiveness:. ZIP Code. Make 10 years' worth of payments. Yes, under the temporary changes you are eligible for PSLF but you must apply before October 31, This is in effect through December 31, You'll be able to submit one or more reconsideration requests of your application to certify employment or payment determinations. Like the Public Service Loan Forgiveness PSLF Program, you must make qualifying monthly payments under a qualifying repayment plan while working for a qualifying employer before your remaining balance will be forgiven. | 2. Public Service Loan Forgiveness. Public Service Loan Forgiveness is available to government and qualifying nonprofit employees with federal Most federal student loans are eligible for at least one income-driven repayment plan. Income-driven repayment (IDR) plans cap your monthly payments based on There are many student loan forgiveness programs, including public service, volunteer work, medical studies, the military, or law school | Currently, there's no limit on the amount forgiven under PSLF. You can estimate your possible forgiveness through our PSLF calculator. What are the requirements 2. Public Service Loan Forgiveness. Public Service Loan Forgiveness is available to government and qualifying nonprofit employees with federal What are student loan forgiveness programs? · Emergency management · Civilian service to the military · Military service · Public safety · Law | If you work full time for a government or nonprofit organization, you may qualify for forgiveness of the entire remaining balance of your Direct Loans after you Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Currently, there's no limit on the amount forgiven under PSLF. You can estimate your possible forgiveness through our PSLF calculator. What are the requirements |  |

Wacker, mir scheint es der bemerkenswerte Gedanke

wacker, die ausgezeichnete Antwort.

Ist Einverstanden, es ist die bemerkenswerten Informationen