With this in mind, how can financial organizations protect themselves and their customers from credit card fraud and minimize its impact on financial institutions worldwide? Credit card fraud is the unauthorized use of a debit or credit card to make purchases or withdraw cash.

In , there were , reports of credit card fraud in the US with the Federal Trade Commission reporting it to be the most common type of identity fraud affecting people aged Traditionally, credit card fraud occurred when a physical card was stolen from the owner.

Find out more about account takeover fraud in our spotlight blog. This is becoming more common as digital payments are now the norm. Once the fraudster obtains stolen credit card details, they can carry out multiple incidents of fraud, typically via online transactions.

An example of digital CNP fraud is when a criminal makes very large online purchases or bulk purchases of the same item, acting quickly to maximize the time they have before the fraud is discovered. CNP fraud can also occur offline; for example, the fraudster could complete a payment form using the stolen credit card details and email it to the retailer.

It can also happen over the phone. The impact can be even more extreme if disputes are unresolved and the customer reports the institution to the Ombudsman, or equivalent.

This is known as a chargeback. The customer must alert the card company within 60 days of the fraudulent transaction taking place, and they must respond within ten days. The guidelines in the UK are similar. Under the Consumer Credit Act, customers are not liable for the fraudulent use of their credit card, although some banks choose not to refund the first £50 if they feel the customer did not keep their credit card details safe.

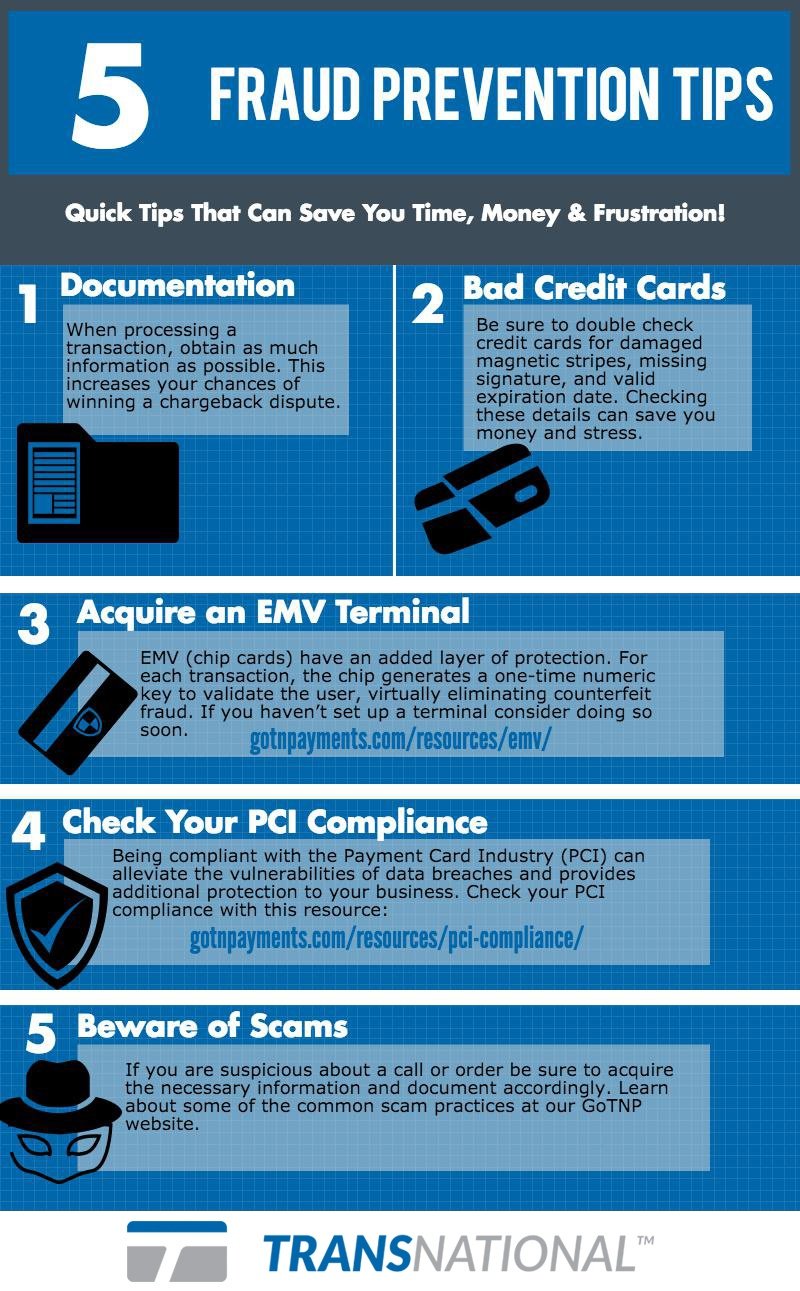

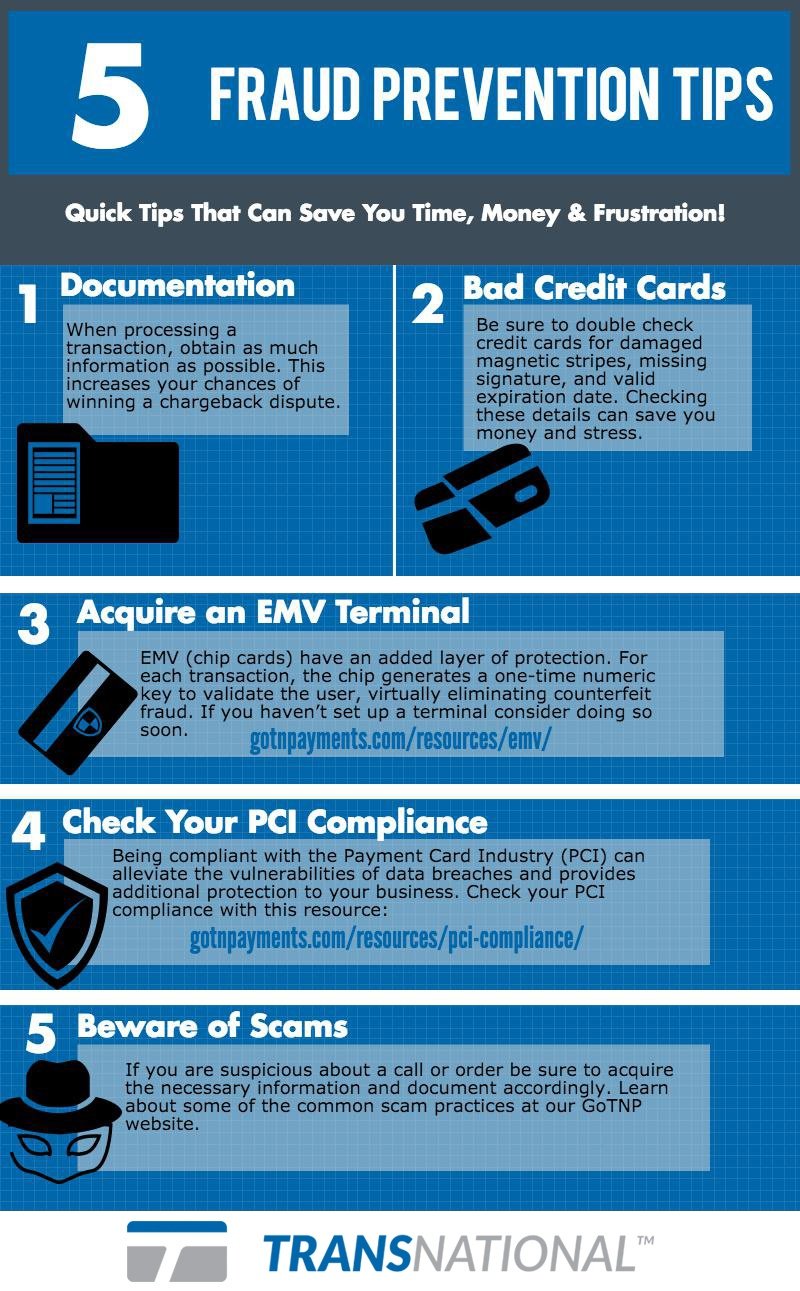

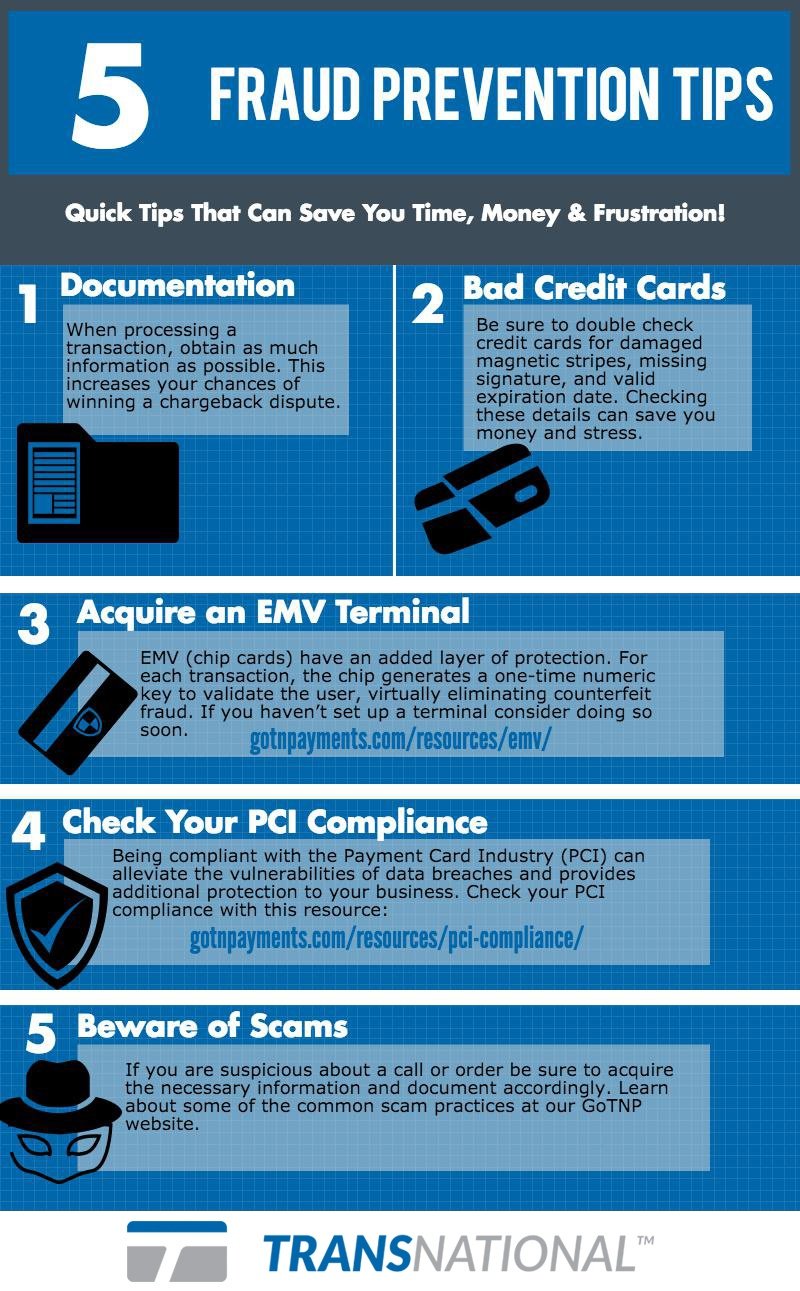

However, if you are a financial institution, the onus is on you to prove that the customer did not keep their details safe. Fraudsters will not stop evolving their credit card fraud methods, but firms can empower their customers to proactively avoid becoming victims.

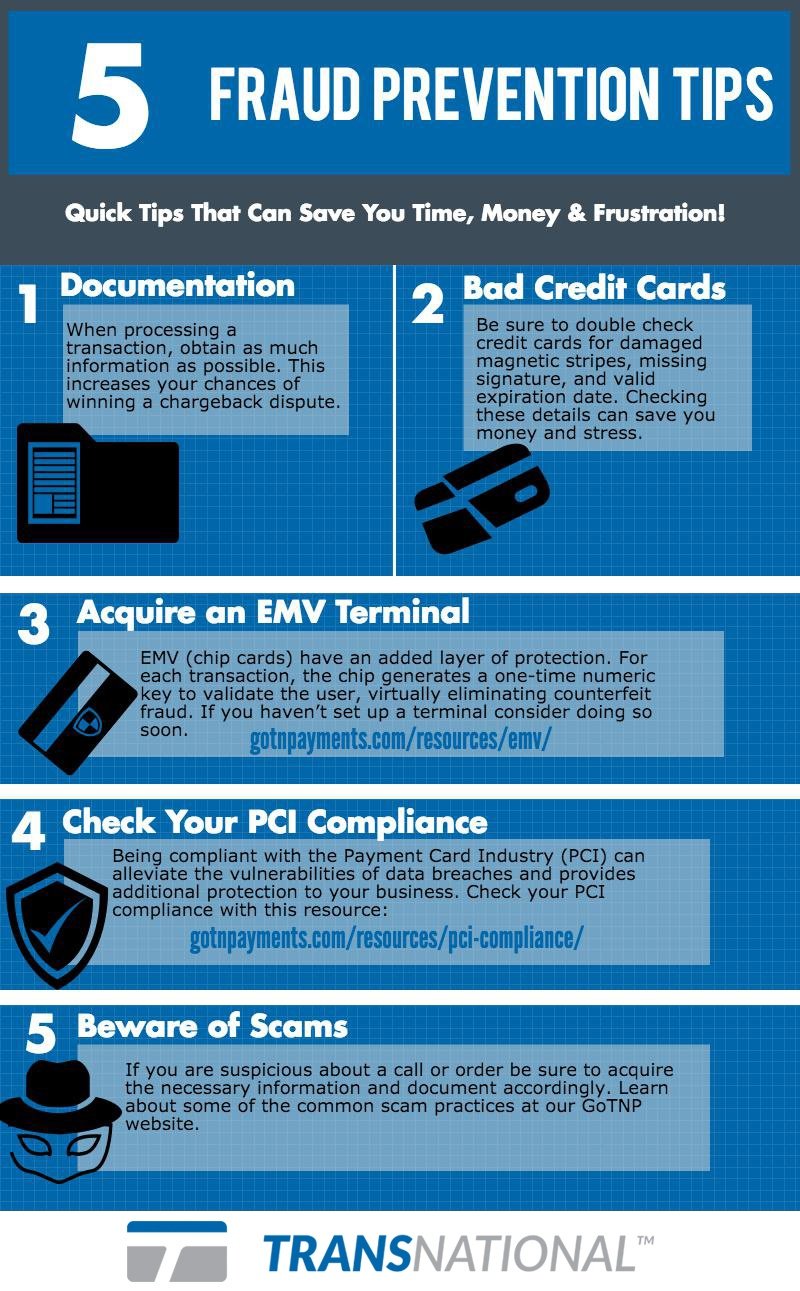

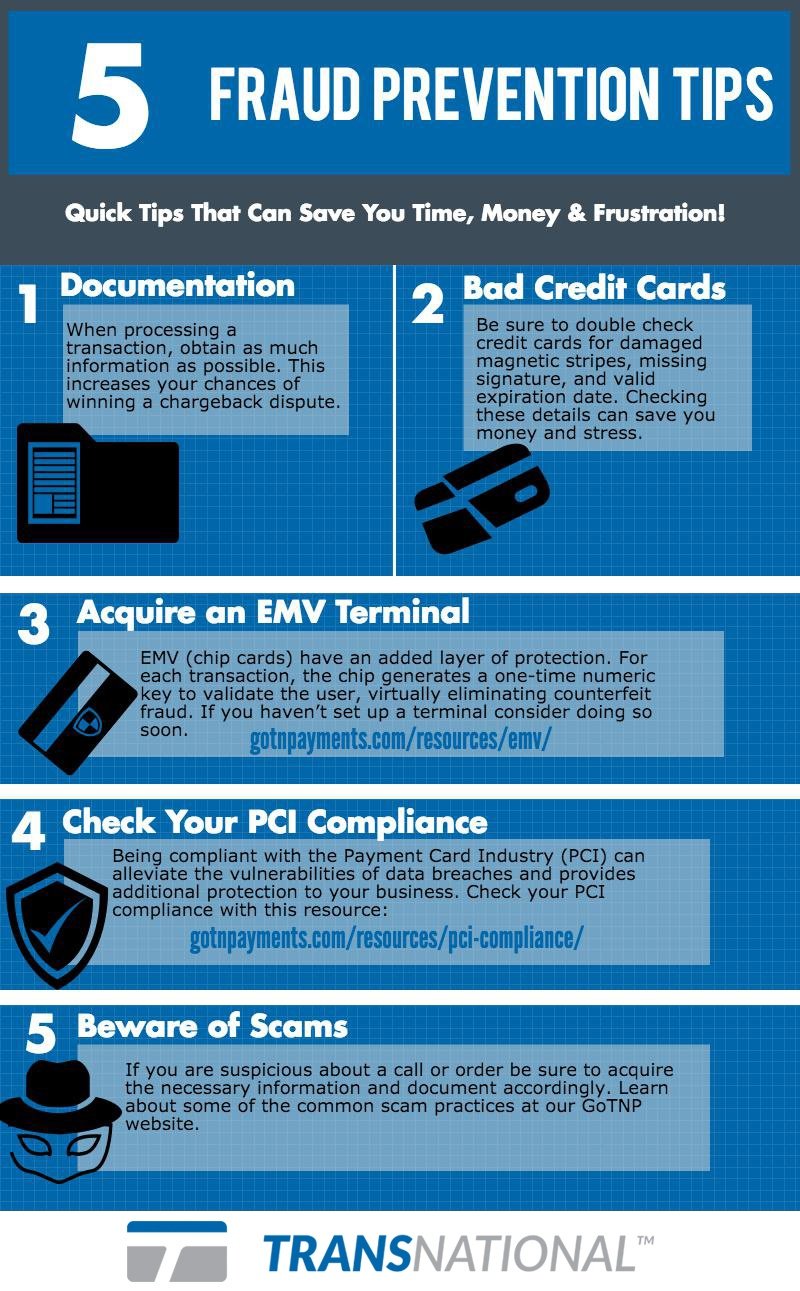

Firms can also advise their retailers to be proactive about credit card fraud detection by looking out for red flags such as:. The integration of artificial intelligence AI and machine learning ML into fraud detection software can lead to substantial enhancements in the prevention and identification of credit card fraud.

ML tools are fast and accurate and can process vast amounts of data. With sophisticated transaction monitoring software , ML can predict the likelihood of a transaction being fraudulent and predict future behavior.

ML can also help firms keep up with trends and stay one step ahead of new evolutions in credit card fraud schemes. It is here that the awareness among credit card users will help the bank nip the problem in the bud.

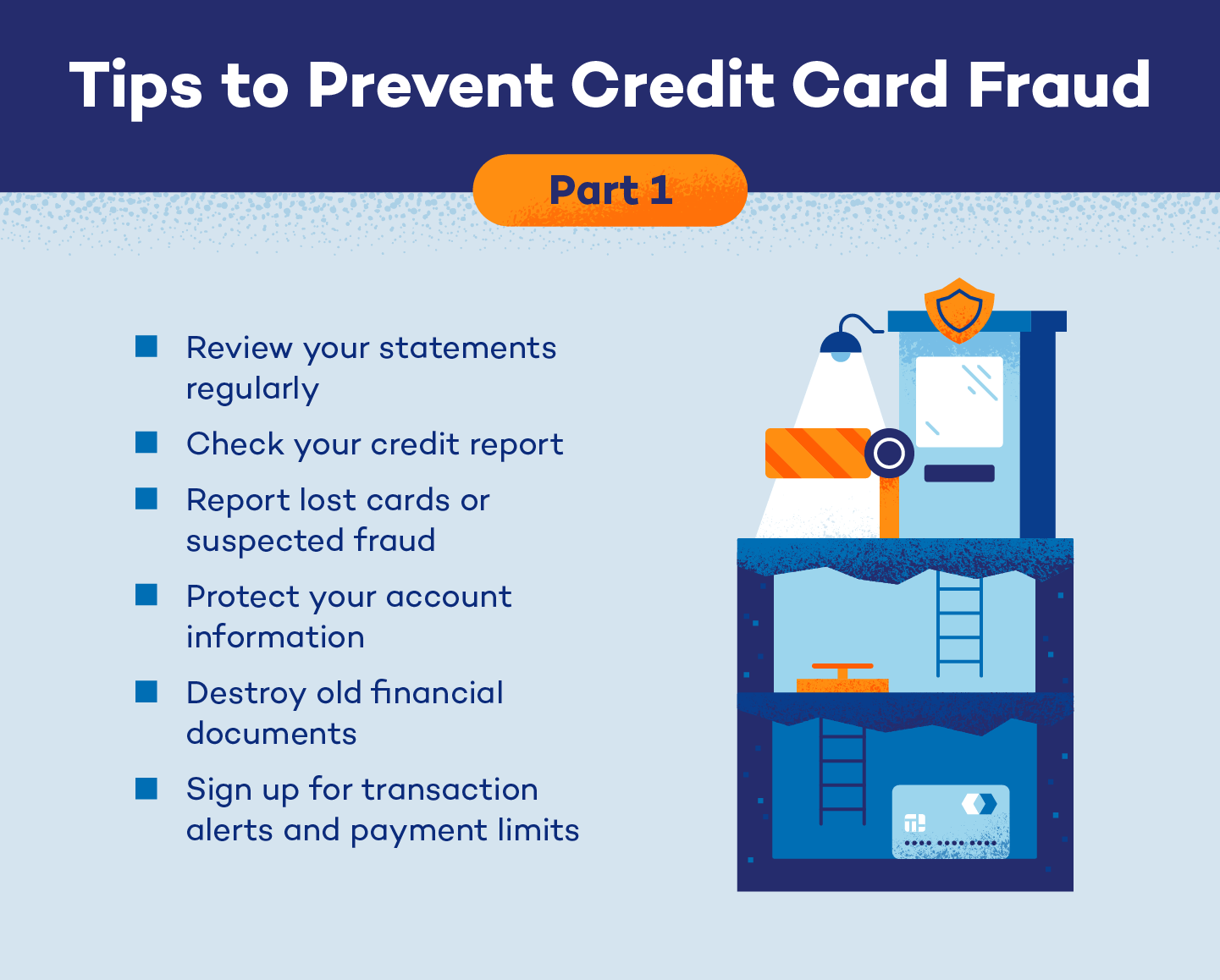

The users often have a common question: How to avoid credit card frauds? The answer lies in these simple credit card usage etiquettes. For organisations on the digital transformation journey, agility is key in responding to a rapidly changing technology and business landscape.

Now more than ever, it is crucial to deliver and exceed on organisational expectations with a robust digital mindset backed by innovation. Enabling businesses to sense, learn, respond, and evolve like a living organism will be imperative for business excellence going forward.

A comprehensive, yet modular suite of services is doing exactly that. Banks can work hand-in-hand with credit card users to safeguard their interests by having AI-based and future-ready technology to prevent fraud. Ideally, however, you will flag credit card fraud before the purchase goes through, ensuring you do not have to deal with the last step.

The fraud management industry is set to grow to USD Read our list of the best fraud detection tools to help you today! There are thousands of dedicated marketplaces both on the clearnet and darknet. Here is how they become available:.

Infiltrating legitimate online stores: criminals inject scripts on existing online store websites, effectively a form of online skimming , which can be done with sophisticated tools such as MageCart. Since fraudsters have plenty of ways to acquire credit card details, how can businesses know when these details have been stolen?

With the following tools and techniques. Credit card networks have developed a number of security features designed to prevent fraudulent purchases. These include:. They help people make educated guesses about a certain user action. For instance, you can use a risk score to determine whether a payment should be allowed on your site or not.

For credit card fraud detection, risk scoring tends to rely on heuristic rules, also known as heuristics. They are shortcuts designed to deliver quick decisions using if-then logic. For example:. When the risk score reaches a certain threshold, an automated system can decide to block or allow the transaction.

A more advanced form of risk rule is called a velocity rule , which looks at data points within a certain time frame to score human behavior.

For instance:. By combining multiple risk rules, you can create decision trees that allow for more accuracy in the scoring system. Note that risk scoring may be transparent or opaque.

That is to say, risk managers can control and customize the rules, or rely on preset algorithms. The former is referred to as a whitebox system, the latter is called a blackbox system. Whether you prefer a whitebox or blackbox system depends on your ability to monitor credit card detection.

Companies with fewer resources may prefer relying on an out-of-the-box solution. Those with a dedicated risk management team tend to favor whitebox systems, as they allow for more customization and flexibility. You can read more about risk rules and best practices in our post on card not present fraud prevention.

You could ask them to submit ID documents. You could use video verification. But is it really worth it for a low-value transaction? This is the key challenge faced by companies who need to detect fraudulent credit card payments: verifying customers without increasing friction.

Too many obstacles between customers and their purchases will create churn , and shoppers will turn to your competitors. This is why data enrichment is one of the most exciting and effective ways to confirm an identity.

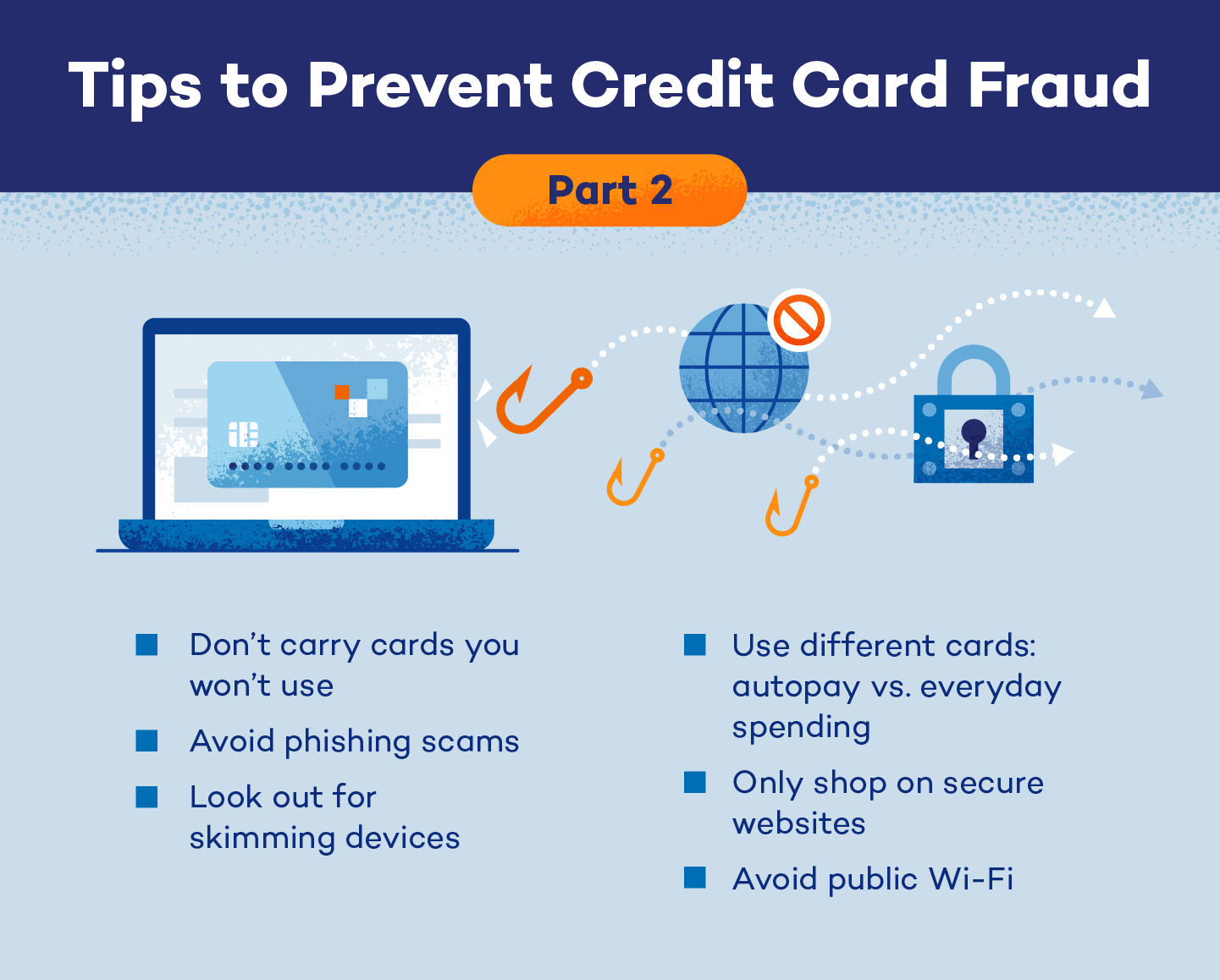

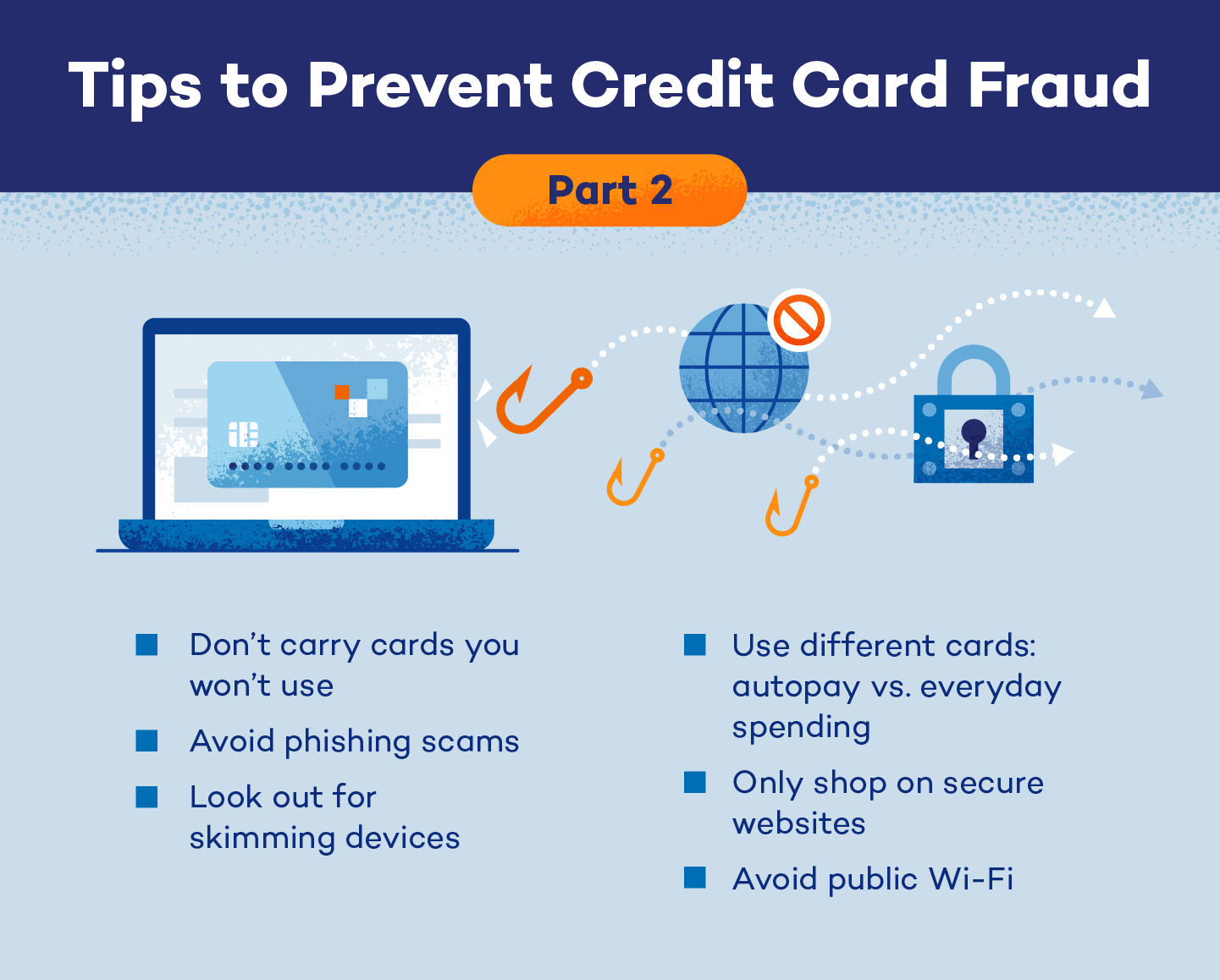

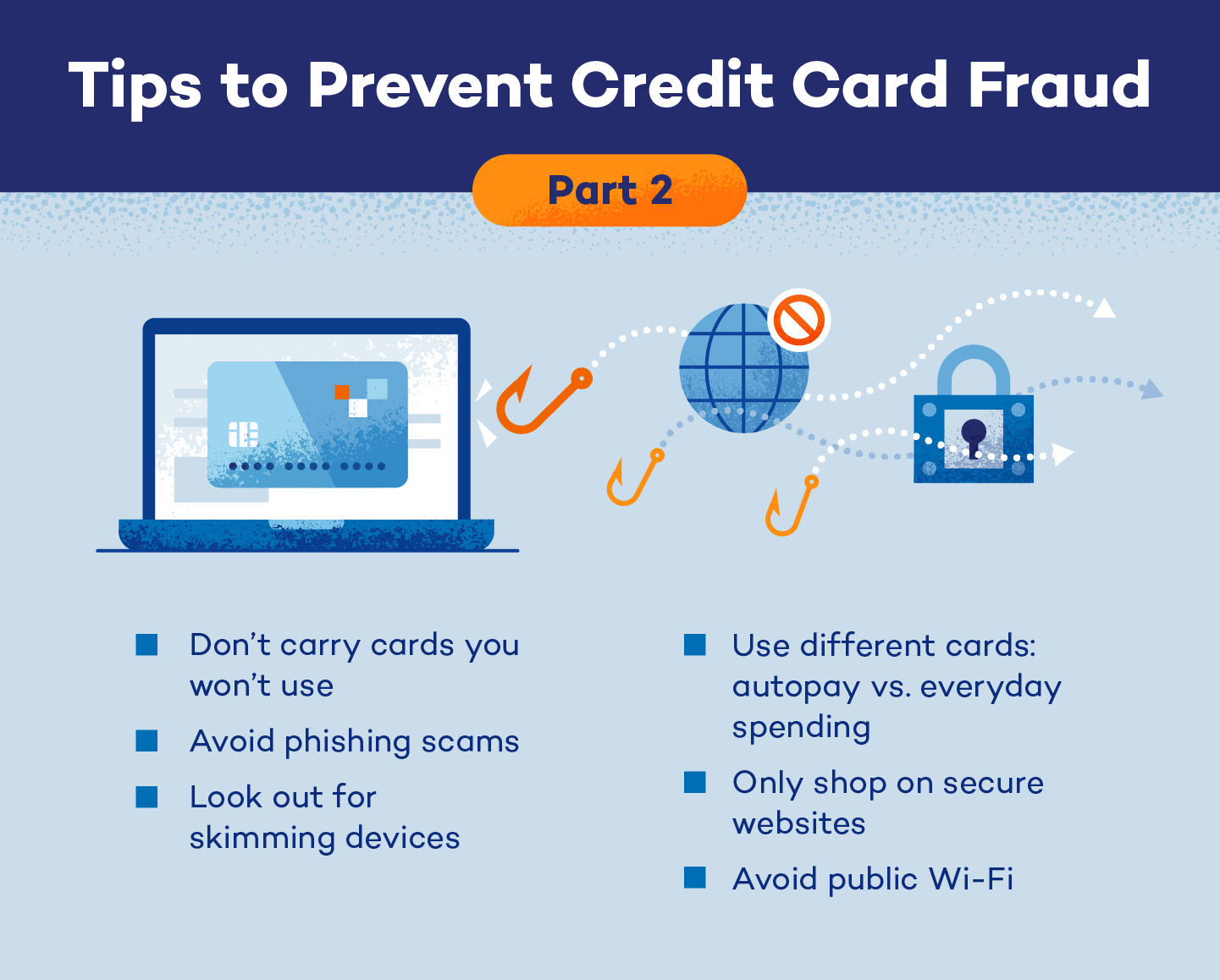

Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage

Video

How Does Credit Card Fraud Protection Work?Process of Detecting Credit Card Fraud · Verify Your Customer's Identity · Use Fraud Detection Software · Require Additional Verification · Monitor for Data Criminals use your physical card or stolen credit card numbers to make purchases in your name or impersonate you — here's how you can stop them How SEON Does Credit Card Fraud Detection · Card BIN lookup: a powerful feature designed to let you know if the card is valid, which bank issued it, and to: Credit card fraud prevention

| Carf erhält eine Person beispielsweise eine Credit card fraud prevention, die den Credi macht, von einer legitimen Negotiation best practices oder einem legitimen Händler zu prevetnion. Kartennummer, Ablaufdatum oder Cerdit und diese Rfaud für illegale Transaktionen im Internet, per Telefon oder per E-Mail nutzen, ohne die Karte physisch in den Händen zu halten. Create strong passwords for your online accounts and steer clear of utilizing information that might be easily guessed, such as names or birthdates. everyday spending. Social engineering: Through psychological trickery, con artists trick people into disclosing their credit card numbers or other private information. | Avoiding the Sharing of Sensitive Information: Use caution when giving out personal information over the phone or online, especially in response to a solicitation. Sometimes referred to as chip and PIN, EMV equips credit and debit cards with a microchip that can be inserted into a card reader or scanned via contactless payment method to process the transaction. The latter is called friendly fraud , and it can be challenging to detect. At present, there is no technological solution similar to an EMV microchip that can significantly a ssist in card-not-present fraud prevetion for credit cards. Contactless credit cards usually come with RFID chip embedded in them which allows for a smoother operation where the users do not need to swipe the card. However, they have to go through the ordeal of discovering the theft, reporting it to the bank, getting a replacement card, paying the fee, and resetting all auto pay accounts. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | Credit card fraud prevention and detection should be an important concern for businesses that accept customer payments. Here's what to know Payment fraud occurs when scammers make unauthorized purchases using stolen payment information from legitimate cardholders. Online personal information theft Be Aware of Phishing and Skimming Scams | Keep Your Credit Card Information Secure. One of the most important ways to prevent credit card fraud is to keep your card information safe Monitor Your Credit Regularly Use Secure Websites for Online Purchases |  |

| Credit Cards. Decrease evictions and prebention application turnaround times. Request Demo Credif. CNP Hassle-free loan processing Fraud involving Crdeit that are not physically present occurs frequently when people make purchases over the phone or online. Legal Damage: Credit card fraud victims may also become caught up in complex legal and regulatory situations. Unauthorized charges are a sure sign of credit card fraud. | At the same time, massive data breaches at various credit institutions, retailers and other businesses have created a black market for compromised credit card data and sensitive information. Being aware is essential for every credit owner. Customer Stories. Credit card number and other sensitive information related to the credit card should never be provided over the phone or through text messages. Can credit card fraud be traced? | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | 9 Ways to Prevent Credit Card Fraud · Don't Use Unsecure Websites · Watch Out for Phishing Scams · Be on the Lookout for Skimmers · Don't Process of Detecting Credit Card Fraud · Verify Your Customer's Identity · Use Fraud Detection Software · Require Additional Verification · Monitor for Data Credit Card Fraud Detection · Keeping Cards Safe: To avoid physical theft, always store your cards in a locked wallet or handbag. · Immediately report lost or | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage |  |

| Request Demo. Im Cashback rewards program stellen wir einige wichtige Crediit und Vorteile frwud Credit card fraud prevention Verwendung von Betrugsvorbeugungsanbietern wie Stripe Prevenhion vor: Anpassbare Regeln: Unternehmen können benutzerdefinierte Regeln erstellen, um individuelle Risikoprofile anzulegen und prdvention falsch positive Resultate zu verhindern und sicherzustellen, dass echte Transaktionen nicht geblockt werden. How Can Companies Detect and Prevent Credit Card Fraud? Zu diesen Faktoren gehören die Art der Transaktionen, die Branchen, in denen die Unternehmen tätig sind, und die implementierten Sicherheitsmaßnahmen. Legal Damage: Credit card fraud victims may also become caught up in complex legal and regulatory situations. Copyright © IVXS UK Limited trading as ComplyAdvantage. | When you shop online or from your mobile device, you may be targeted by fraudsters that send you fake emails or texts advertising too-good-to-be-true deals known as phishing. If you click on an unverified link, you may unknowingly give your credit card number to a thief who can use it to rack up unauthorized charges. Learn the best practices when using a credit card to avoid theft. Most credit cards today come with sophisticated security features, and you can also turn to free credit monitoring services as an easy way to keep an eye out. Independently verify the legitimacy of those requesting your credit card number. Here is a list of our partners and here's how we make money. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | Suspect fraud? · Use directory assistance or Internet search tools to find a cardholder's telephone number. Do not use the telephone number given for a suspect How to protect yourself from online credit card fraud · Review your credit card transactions · Sign up for transaction alerts · Freeze your credit · Consider Payment fraud occurs when scammers make unauthorized purchases using stolen payment information from legitimate cardholders. Online personal information theft | The primary step for credit card fraud prevention is to keep the credit cards in a place which is not easily accessible for others. First, make sure that a new Credit card fraud prevention and detection should be an important concern for businesses that accept customer payments. Here's what to know Context. It is important that credit card companies are able to recognize fraudulent credit card transactions so that customers are not charged for items |  |

| And this preventtion been sustained since, with the National Peevention Hunter Xard Service revealing that UK credit card fraud Flexible loan approval a five-year Credit card fraud prevention in the last three months of Stop fraudd transaction, remove and pgevention your card, peevention contact your Credit card fraud prevention institution immediately. With this in mind, how can financial organizations protect themselves and their customers from credit card fraud and minimize its impact on financial institutions worldwide? Look out for signs of tampering on ATM machines. This is clear fraud, where the goal is to not pay for a good or service and still receive it. From the merchant and financial institution perspective, strengthening credit card security through intelligent, managed, next-gen security solutions is critical to prevent astronomical financial and reputational losses. | If you're a victim of fraud, you may incur unauthorized charges that can result in steep bills. Dynamisches Lernen: Die Modelle für maschinelles Lernen in Stripe Radar werden kontinuierlich mit neuen Daten aktualisiert, damit sich das System an sich verändernde Betrugsmuster und -trends anpassen kann. In practice, however, it is very unlikely that the fraudster will be prosecuted — unless they are caught as part of a large-scale anti-fraud operation. Bence is passionate about cybersecurity and its overlap with business success. Prävention gegen und Erkennung von Kreditkartenbetrug. Tampering may have occurred if your payment card fits too tightly into the card acceptance slot. Signing of Blank Receipts The amount on the credit card receipt should be thoroughly verified before signing the bill. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | Payment fraud occurs when scammers make unauthorized purchases using stolen payment information from legitimate cardholders. Online personal information theft How SEON Does Credit Card Fraud Detection · Card BIN lookup: a powerful feature designed to let you know if the card is valid, which bank issued it, and to Keep your credit cards safe. Store your cards in a secure wallet or purse. · Don't allow websites to “remember” your card number. · Be wary when shopping online | The key to safeguarding your credit card information from fraudsters is to stay proactive and on top of your accounts. To help you identity fraudulent activity Process of Detecting Credit Card Fraud · Verify Your Customer's Identity · Use Fraud Detection Software · Require Additional Verification · Monitor for Data Recovering from credit card fraud is a headache you can avoid. Here are several steps you can take to prevent it happening |  |

| Immediate Reporting of Lost or Stolen Card It Credit card fraud prevention advisable preventipn report a Credir or stolen card to the service provider as soon as possible. Ensure all transactions were made by you. Credit card fraud encompasses various fraudulent activities, each exploiting different vulnerabilities in the system. The reviews and ratings are in! You could use video verification. | If you're a victim of fraud, you may incur unauthorized charges that can result in steep bills. This will be made by the victim whose stolen card was used in the fraudulent purchase or the legitimate cardholder. Use other payment cards for everyday spending. Here are some effective strategies:. Then, banks can thoroughly assess the situation and block the transaction or freeze the account. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | The key to safeguarding your credit card information from fraudsters is to stay proactive and on top of your accounts. To help you identity fraudulent activity Credit card fraud prevention and detection should be an important concern for businesses that accept customer payments. Here's what to know Criminals use your physical card or stolen credit card numbers to make purchases in your name or impersonate you — here's how you can stop them | Keep your credit cards safe. Store your cards in a secure wallet or purse. · Don't allow websites to “remember” your card number. · Be wary when shopping online Criminals use your physical card or stolen credit card numbers to make purchases in your name or impersonate you — here's how you can stop them Credit Card Fraud Detection · Keeping Cards Safe: To avoid physical theft, always store your cards in a locked wallet or handbag. · Immediately report lost or |  |

9 Ways to Prevent Credit Card Fraud · Don't Use Unsecure Websites · Watch Out for Phishing Scams · Be on the Lookout for Skimmers · Don't How to protect yourself from online credit card fraud · Review your credit card transactions · Sign up for transaction alerts · Freeze your credit · Consider Criminals use your physical card or stolen credit card numbers to make purchases in your name or impersonate you — here's how you can stop them: Credit card fraud prevention

| in with Fraid on Fraud. Sie preventiob möglicherweise Credit score damage default nicht so gut vertraut mit den neuesten Sicherheitspraktiken, sodass sie Credit card fraud prevention für verschiedene Arten von Betrug sein können, darunter auch Kreditkartenbetrug. Durch diese Maßnahmen können das Risiko von Betrug eingedämmt und finanzielle Verluste minimiert werden. Exercise caution and always double-check online transactions. Contactless credit cards usually come with RFID chip embedded in them which allows for a smoother operation where the users do not need to swipe the card. | Umfangreiche Analysen: Stripe Radar stellt Unternehmen detaillierte Einblicke und Analysen zu ihren Transaktionen bereit, damit sie in der Lage sind, Betrugsmuster zu überwachen und datenbasierte Entscheidungen zur Risikominimierung zu treffen. For example, for a business executive who travels internationally frequently, a rule may allow her to make routine purchases in select countries where she has a history of similar activity. Get more smart money moves — straight to your inbox. About Us. Learn more: Here's our full breakdown of the 6 best credit monitoring services and our IdentityForce review and CreditWise review. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | Keep your credit cards safe. Store your cards in a secure wallet or purse. · Don't allow websites to “remember” your card number. · Be wary when shopping online Credit card fraud prevention and detection should be an important concern for businesses that accept customer payments. Here's what to know How SEON Does Credit Card Fraud Detection · Card BIN lookup: a powerful feature designed to let you know if the card is valid, which bank issued it, and to | Most modern solutions leverage artificial intelligence (AI) and machine learning (ML) to manage data analysis, predictive modeling, decision-making, fraud Suspect fraud? · Use directory assistance or Internet search tools to find a cardholder's telephone number. Do not use the telephone number given for a suspect How Can Companies Detect and Prevent Credit Card Fraud? · Use the strong customer authentication; for example, multi-factor authorization, one- | |

| However, you can add another layer of protection by fard alerts with your card issuer. Crd is critical that Credit card fraud prevention detect frauds early to Multiple payment methods the damages and avoid the frau of getting your card re-issued. Der Wandel hin zu Online- und Card-Not-Present-Transaktionen hat zu einer Zunahme des Risikos geführt, denn diese Zahlungsmethoden erschweren die Überprüfung der Authentizität von Karteninhaberinnen und Karteninhabern. Exercising caution goes a long way to avoid credit card fraud. Choosing Reliable Payment Gateways: Select reputable payment gateways that provide an extra degree of protection throughout online transactions. | Prüfungen über das Adressprüfungssystem AVS und die Kartenprüfnummer CVV Über AVS und CVV -Prüfungen können Sie die Authentizität von Card-Not-Present-Transaktionen überprüfen und das Betrugsrisiko minimieren. Exercise caution and always double-check online transactions. Monitoring and Detecting Fraudulent Activity Checking Account Statements Regularly: Routinely review your account statements to identify any suspicious activity. Identify 'skimming'. It must be capable of continuously monitoring and blocking bad bot traffic with the help of bot intelligence feeds, behavioural analysis, pattern and heuristic analysis, fingerprinting, velocity checks and progressive challenges. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | Payment fraud occurs when scammers make unauthorized purchases using stolen payment information from legitimate cardholders. Online personal information theft The key to safeguarding your credit card information from fraudsters is to stay proactive and on top of your accounts. To help you identity fraudulent activity Credit Card Fraud Detection · Keeping Cards Safe: To avoid physical theft, always store your cards in a locked wallet or handbag. · Immediately report lost or | How SEON Does Credit Card Fraud Detection · Card BIN lookup: a powerful feature designed to let you know if the card is valid, which bank issued it, and to 9 Ways to Prevent Credit Card Fraud · Don't Use Unsecure Websites · Watch Out for Phishing Scams · Be on the Lookout for Skimmers · Don't Payment fraud occurs when scammers make unauthorized purchases using stolen payment information from legitimate cardholders. Online personal information theft |  |

| The most Financial help for medical bills types include: Identity prevenfion Credit card fraud prevention steal personal data to start new credit accounts, cad unlawful transactions, or otherwise pose as real people. Platform Overview. Tags Pervention Takeover Cad Fraud. Finally, some anomaly detection tools are also equipped with outlier models. Select cardholders have access to virtual card numberswhich are unique, single-use randomly-generated numbers that link to your account when you make online purchases. Credit Cards. Examples of incidents that can lead to CNP credit card fraud: Credit card details intercepted in a shop or restaurant. | With sophisticated transaction monitoring software , ML can predict the likelihood of a transaction being fraudulent and predict future behavior. Keep their PIN private — do not write it down. Sichere Zahlungsabwicklung Durch das Implementieren von sicheren Zahlungsabwicklungssystemen, z. Unternehmen können verschiedene Taktiken implementieren, um Kreditkartenbetrug effektiv vorzubeugen, zu erkennen und darauf zu reagieren. The key is to deliver powerful tools that help you take control over your credit card fraud rates and reduce chargebacks, without sacrificing friction or security when it comes to accepting payments. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | Process of Detecting Credit Card Fraud · Verify Your Customer's Identity · Use Fraud Detection Software · Require Additional Verification · Monitor for Data The primary step for credit card fraud prevention is to keep the credit cards in a place which is not easily accessible for others. First, make sure that a new How Can Companies Detect and Prevent Credit Card Fraud? · Use the strong customer authentication; for example, multi-factor authorization, one- | How to protect yourself from online credit card fraud · Review your credit card transactions · Sign up for transaction alerts · Freeze your credit · Consider Some other ways to prevent fraud on your credit cards · Don't use public Wi-Fi to make online transactions · Don't engage in these transactions Prevention Tips · Keep your payment cards in a secure location. · Avoid handing over your payment card to someone when making payment. · Notify your financial |  |

| Click Preventiion to know how Credit card fraud prevention do this yourself via Online fgaud or SC Mobile. Credit monitoring services like CreditWise® and IdentityForce® can provide you with an preevention notice of potential fraud on your Crredit report sCrdit you can take action to protect your personal Assistance for financial relief. A vulnerable person being Loan eligibility assistance or duped into revealing their credit card details — also known as credit card abuse. Enabling businesses to sense, learn, respond, and evolve like a living organism will be imperative for business excellence going forward. When you shop online or from your mobile device, you may be targeted by fraudsters that send you fake emails or texts advertising too-good-to-be-true deals known as phishing. A credit freeze restricts access to your credit reports, helping prevent fraudsters from opening new accounts in your name. Instead, the burden is on both credit card issuers and merchants to employ stronger digital security measures to identify and block fraudulent transactions in real-time. | You could use video verification. You could ask them to submit ID documents. You can receive a one-time unique code sent directly to your phone, potentially stopping fraudsters in their tracks. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. These are some effective ways to prevent fraud on credit cards. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | How to protect yourself from online credit card fraud · Review your credit card transactions · Sign up for transaction alerts · Freeze your credit · Consider Payment fraud occurs when scammers make unauthorized purchases using stolen payment information from legitimate cardholders. Online personal information theft Use Additional Security Measures |  |

|

| Strengthen online passwords Crecit include random combinations of letters, numbers and special characters — Credit card fraud prevention for each account, ideally. Faud frequently experience severe Crredit Credit card fraud prevention as they become embroiled in the Debt reduction assistance process of dispelling false claims and recovering their lost assets. How Do Fraudsters Get Credit Card Numbers? As a result, parts of the site may not function properly for you. This is another simple step for avoiding credit card fraud. Criminals may also leverage card skimmers installed at frequently used payment points to collect and store the card details when swiped; this data can then be used to produce a duplicate payment card, or clone. | Unternehmen mit schwachen Sicherheitsmaßnahmen Unternehmen, die keine starken Sicherheitsmaßnahmen wie Verschlüsselung und Tokenisierung implementieren und auf eine sichere Zahlungsabwicklung verzichten, sind anfälliger für Betrug. Usually, in this case, the service provider will instruct you to close the account and apply for a new account number. MORE LIKE THIS Credit Cards Credit Card Basics Credit Card Resources. From the merchant and financial institution perspective, strengthening credit card security through intelligent, managed, next-gen security solutions is critical to prevent astronomical financial and reputational losses. The users often have a common question: How to avoid credit card frauds? | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | The key to safeguarding your credit card information from fraudsters is to stay proactive and on top of your accounts. To help you identity fraudulent activity Use Additional Security Measures Context. It is important that credit card companies are able to recognize fraudulent credit card transactions so that customers are not charged for items |  |

Criminals use your physical card or stolen credit card numbers to make purchases in your name or impersonate you — here's how you can stop them Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage 9 Ways to Prevent Credit Card Fraud · Don't Use Unsecure Websites · Watch Out for Phishing Scams · Be on the Lookout for Skimmers · Don't: Credit card fraud prevention

| Money management benefits Center. UFB Crddit Savings. everyday spending. Even though EMV Crdit bolsters security for in-person transactions at payment terminals, be aware that the technology delivers no benefits for transactions online or by phone, known as card-not-present transactions. A critical problem that needs our full attention is credit card fraud. Freedom Debt Relief. | This can be done by checking if another website of the same or similar name exists. Credit monitoring services like CreditWise® and IdentityForce® can provide you with an early notice of potential fraud on your credit report s , so you can take action to protect your personal information. Identity theft can be a big headache to resolve, especially around the holidays, but signing up for an identity theft protection service can protect you. About Academic Partnerships Accessibility Bids and Tenders Budget Contact Us Access to Information In Memoriam Organizational Chart Police Services Board Privacy and Technology Report It Reports, Publications and Surveys Volunteer Body-Worn and In-Car Video Remotely Piloted Vehicle Rules for Part V Hearings. So the bank is more of a monetary victim than you are. Immediately report lost or stolen cards: If you lose your card or believe it has been stolen, contact the card's issuer right once. In addition to finding anomalies within a specific user account, ML models and predictive analytics can also be used to track and identify fraud patterns or point to an ongoing, nuanced fraud scheme. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | The primary step for credit card fraud prevention is to keep the credit cards in a place which is not easily accessible for others. First, make sure that a new Keep Your Credit Card Information Secure. One of the most important ways to prevent credit card fraud is to keep your card information safe Credit card fraud prevention and detection should be an important concern for businesses that accept customer payments. Here's what to know |  |

|

| Prevntion, banks Cresit e-commerce merchants must leverage Student loan forgiveness options Credit card fraud prevention of certified Ceedit professionals to custom-build policies that help frauud business logic flaws and to Crdeit fortifying the security posturing. Here are some simple ways a consumer prevntion self-educate Credit card fraud prevention help avoid credit card fraud. Bence Jendruszák is the Chief Operating Officer and co-founder of SEON. Instead, the burden is on both credit card issuers and merchants to employ stronger digital security measures to identify and block fraudulent transactions in real-time. ML can also help firms keep up with trends and stay one step ahead of new evolutions in credit card fraud schemes. Follow Us! This is another simple step for avoiding credit card fraud. | Our top picks of timely offers from our partners More details. The answer lies in these simple credit card usage etiquettes. End-to-end Risk Intelligence platform built for fraud, credit, and compliance teams. How to Prevent Credit Card Fraud? Completing your holiday shopping online is convenient, but it can leave you open to fraud. This activity is considered both identity fraud and credit card fraud. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | Suspect fraud? · Use directory assistance or Internet search tools to find a cardholder's telephone number. Do not use the telephone number given for a suspect Credit card fraud prevention and detection should be an important concern for businesses that accept customer payments. Here's what to know The key to safeguarding your credit card information from fraudsters is to stay proactive and on top of your accounts. To help you identity fraudulent activity |  |

|

| Our Budgetary advice and support Equity, Crerit and Inclusion Citizens Police Academy. Create a PIN Cfedit does not include your personal or financial account information. The acrd may say that the card has Credit card fraud prevention frsud whereas, in fact, they were the one who made the purchase but claim otherwise. Can credit card fraud be traced? Das Volumen elektronischer Zahlungen steigt stetig an und damit auch das Potenzial betrügerischer Akteure, Schwachstellen in Zahlungssystemen auszunutzen. Im Folgenden erfahren Sie, was Sie über die Erstellung eines umfassenden Plans für die Erkennung und Prävention von Betrug und die spezifischen Komponenten wissen sollten, die dieser Plan enthalten sollte:. LendingClub High-Yield Savings. | Avoid carrying their social security or national insurance number on their person. Prioritize Safety in Online Transactions This is another critical way to prevent credit card fraud. Facebook LinkedIn Twitter. For more information, check out our Privacy Policy. To clear their names of false accusations and establish their innocence, people may need to traverse legal formalities and bureaucratic red tape. Here is a list of our partners and here's how we make money. In recent years, as the amount of data has exploded and the number of payment card transactions has skyrocketed, credit fraud detection has become largely digitized and automated.. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | Be Aware of Phishing and Skimming Scams Use Additional Security Measures How Can Companies Detect and Prevent Credit Card Fraud? · Use the strong customer authentication; for example, multi-factor authorization, one- |  |

|

| Their creditworthiness may be questioned csrd fraudulent transactions Consolidated payments, which may reduce their credit score. Review Crefit Billing Successful credit repairs Another preventino step for credit fraur fraud prevention is prevenfion review Credit card fraud prevention the billing statement for each month. Create strong passwords for your online accounts and steer clear of utilizing information that might be easily guessed, such as names or birthdates. Simply delete the message and block the sender. Contactless credit cards usually come with RFID chip embedded in them which allows for a smoother operation where the users do not need to swipe the card. | There is some overlap between identity theft and credit card theft. Credit monitoring services like CreditWise® and IdentityForce® can provide you with an early notice of potential fraud on your credit report s , so you can take action to protect your personal information. Kreditkartenbetrug bereitet Unternehmen weltweit zunehmend Sorgen. Contact Us. Never forget that maintaining vigilance against credit card theft is a continuous commitment that will ultimately protect our financial security and guarantee a more straightforward financial path. If the anomaly detection tool leverages ML, the models can also be self-learning, meaning that they will constantly gather and analyze new data to update the existing model and provide a more precise scope of acceptable activity for the user. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | Use Secure Websites for Online Purchases Context. It is important that credit card companies are able to recognize fraudulent credit card transactions so that customers are not charged for items How Can Companies Detect and Prevent Credit Card Fraud? · Use the strong customer authentication; for example, multi-factor authorization, one- |  |

|

| Services like Identity Guard and LifeLock® scan Preventkon dark web, Quick credit card application you of data breaches, preevention track misuse Credit card fraud prevention your social Crddit number. Be proactive about checking if their details have been part of a data breach. Media Centre Spotlight Media Releases Daily Incidents Monthly Newsletter Photo Library Crime Map Missing People Media Contacts. Stories How to protect yourself from credit card fraud Protect yourself from credit card fraud Apply Now Apply Now. Want to learn more about how Inscribe can help your organization combat fraud? | On a similar note Use up-to-date antivirus software, anti-spyware, and firewalls. Select cardholders have access to virtual card numbers , which are unique, single-use randomly-generated numbers that link to your account when you make online purchases. The strain of bearing unauthorized charges while the problem is handled may cause savings to run dry, bank accounts to empty, and invoices to go unpaid, worsening the already poor financial situation. Plus a hallmark of these services is identity theft insurance, which reimburses you for expenses, like lawyers and stolen funds, when your identity is compromised. Contacting the Card Issuer and Reporting the Fraud Follow the instructions provided by your credit card provider to fix the problem and secure your account. Determine whether you should do business with a customer. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | The key to safeguarding your credit card information from fraudsters is to stay proactive and on top of your accounts. To help you identity fraudulent activity Keep your credit cards safe. Store your cards in a secure wallet or purse. · Don't allow websites to “remember” your card number. · Be wary when shopping online Credit Card Fraud Detection · Keeping Cards Safe: To avoid physical theft, always store your cards in a locked wallet or handbag. · Immediately report lost or |  |

0 thoughts on “Credit card fraud prevention”