The Truth in Lending Act, Real Estate Settlement Act and the Homeowners Protection Act federally protect borrowers against predatory lenders.

Many states enacted companion consumer predatory and usury protection acts to protect borrowers. Both parties benefit because lenders make reasonable interest repayment rates and borrowers receive a much-needed loan.

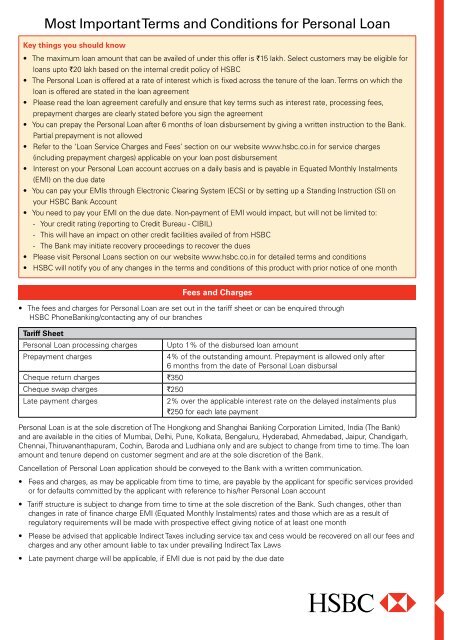

All loan agreements must specify general terms that define the legal obligations of each party. For instance, the terms regarding repayment schedule, default or contract breach, interest rate, loan security, as well as collateral offered, must be clearly outlined.

There are also standard legal terms involved in loan agreements, regardless of whether the contract is between family and friends or between lending institutions and customers.

Demand notes are usually used for short-term borrowing and are often used when people borrow from friends or family members.

Sometimes banks will offer demand loans to customers with whom they have an established relationship. Their key feature is how they are repaid. Unlike longer term loans, repayment can be required whenever the lender desires, as long as sufficient notice is given. The notification requirement is usually spelled out in the loan agreement.

Demand loans with friends and family members might be a written agreement, but it might not be legally enforceable. Bank demand loans are legally enforceable. Fixed term loans are commonly used for large purchases and lenders often demand that the item bought, most commonly a house or car, serves as collateral if the borrower defaults.

Repayment is on a fixed schedule, with terms established at the time the loan is signed. The loan has a maturity date for when it must be fully repaid.

In some cases, the loan can be paid off early without penalty. In others, early repayment comes with a penalty. The internet age makes it easy to write your own loan contract. Many software companies, including Adobe, Microsoft, and Google, as well as online legal information pages, provide templates for loan contracts that are available to download for free.

By its nature, a contract is agreed to and signed by both parties, so both borrower and lender must review it carefully and agree to all of the terms before signing.

Most online templates include options that may or may not apply to your loan and that you can use, or disregard. One option you should include is that the lender has the legal right to enforce the terms of the contract. Promissory notes resemble loan agreements but are less complicated.

Often, they are little more than commitment-to-pay letters, such as IOUs or simple payment on demand notes. The borrower or lender writes a letter specifying how much money is being borrowed or lent, and the terms for repayment.

They may be secured with collateral, have interest and installment payments and more, just like a loan agreement, but they are not. Loan agreements are more complex, with specific language, and are official legal documents.

His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet. Bill can be reached at [email protected]. Advertiser Disclosure. What Is a Loan Agreement? Updated: May 12, Bill Fay. Loan agreements are binding contracts between two or more parties to formalize a loan process.

Purpose of a Loan Agreement The purpose of a loan contract is to define what the parties involved are agreeing to, what responsibilities each party has and for how long the agreement will last. Benefits of Loan Agreements Borrowing money is a huge financial commitment, which is why a formal process is in place to produce positive results for both sides.

Loan agreements can spell out the exact monthly payment due on a loan. When Can You Use a Loan Agreement? The most common types of loan agreements are: Debt consolidation : Used to combine multiple debts into one loan and one monthly payment.

Mortgage : Usually from a bank, credit union, online lender, or mortgage lender, provides money to pay for a home. Auto loan : From a bank, credit union, online lender, finance company or even the dealer, an auto loan pays for a vehicle. Contract Length and Amortization Once the lender and the borrower have determined the amount of money the loan is for, the lender will use an amortization table to calculate what the monthly payment will be by dividing the number of payments to be made and adding the interest onto the monthly payment.

Pre-Payment Fees and Penalties Some loans come with pre-paid fees and penalties for paying off early. Breach or Default If a borrower misses payments, or a loan contract is paid off late, the loan is considered in default. Mandatory Arbitration Mandatory arbitration requires the borrower and lender to resolve disputes through an arbitrator, rather than the court system.

Usury and Predatory Protections Federal and state consumer protection laws guard against predatory and usury loan tactics used by lenders. Legal Terms to Consider for Loan Contracts All loan agreements must specify general terms that define the legal obligations of each party. Four key terms to know before signing a loan agreement: Choice of Law: This refers to the difference between laws in jurisdictions.

Involved Parties: These are the borrower and lender, and information about them in the loan agreement should include names, addresses, Social Security numbers for individuals and phone numbers. Severability Clause: This states that the terms of a contract are independent of each other.

Entire Agreement Clause: This lays out what the final agreement will be and supersedes any agreements previously made in negotiations. On Demand vs. Fixed Repayment Loans Loans use two sorts of repayment: on demand and fixed payment. How to Write a Loan Contract The internet age makes it easy to write your own loan contract.

The steps for writing a legally binding loan contract are: The effective date of the loan. Full information on both the borrower and lender. This includes their full legal names, Social Security numbers, telephone number and address. Loan amount. This is the principal of the loan and does not include interest or fees.

Interest amount. If there is interest applied, the percentage amount, and how often it will accrue must be specified. How interest is charged affects repayment amount, so the numbers should be considered carefully and understood by both parties.

Consumer Financial Protection Bureau. Securities and Exchange Commission. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Table of Contents Expand. Table of Contents. What Is a Personal Loan Agreement? What's in Personal Loan Agreements?

Frequently Asked Questions FAQs. The Bottom Line. Loans Personal Loans. Trending Videos. Key Takeaways A personal loan agreement document provides the borrower and lender with a way to review terms and expectations.

Personal loan agreements are used when individuals loan money, not when banks loan money. Your personal loan agreement should include identifying information for all parties, clear terms including the interest rate , and a repayment schedule.

Personal loan agreements are enforceable by courts. Note Personal loan documents are considered enforceable in court, so a borrower who doesn't meet their obligations could have a judgment levied against them, such as a lien or wage garnishment.

Does a Personal Loan Agreement Need to Be Notarized? Can a Personal Loan Agreement Be Changed Over Time? If I'm Lending Money, How Much Interest Can I Charge on a Personal Loan? How Is a Promissory Note Different From a Loan Agreement?

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Articles. Partner Links. ACH is a type of money transfer that lenders often use for loan repayment.

A balloon payment is a large lump sum that you pay at the end of a loan term. Throughout the life of the loan, your regular payments may be all or almost all interest costs, with the balloon payment covering the principal. You may find balloon payments in some short-term loans, as well as commercial real estate loans.

The lender can claim and sell any of these assets in order to recoup its losses. Curtailment essentially means paying more than your preplanned loan payment. A full curtailment, on the other hand, means you pay off your loan in full early.

When you default on a loan, the lender can take legal action against you to recover what it is owed. A deferred payment loan is when the borrower and the lender arrange an agreement that allows the borrower to begin payments at a specific time in the future rather than immediately.

A factor rate represents the cost of a business loan and is expressed as a decimal. Factor rates are often used to quote the price of merchant cash advances and short-term loans.

You should always try to convert a factor rate into an APR to get a better sense of loan costs. With an interest-only loan, you have scheduled payments that only cover interest costs and not the principal for a certain period of time.

When this period ends, you may pay off the principal in full, refinance it with another loan or start to pay off the balance in monthly payments. The loan-to-value, or LTV, ratio denotes how much of the value of an asset a loan will cover.

Calculating this ratio is particularly important for commercial real estate or equipment loans. The underwriting process will determine if you qualify for a loan — as well as your prospective terms provided you do qualify.

A prepayment penalty is the fee that some lenders charge if you repay your loan early. Prepayment penalties are intended to make up for these lost costs. Principal refers to the amount of money you borrowed, not including interest or, in other words, your loan amount.

When you refinance a business loan , you apply for a new loan to pay off your existing debt. Ideally, your new loan will have more desirable terms so that you can save money and improve your cash flow. Servicing refers to how a loan is managed. Payment disbursement, record maintaining, collections and following up on delinquencies all fall under loan servicing.

As you prepare to review your business loan agreement and sign on the dotted line, here are some tips to keep in mind:. At this stage of the application process, it might be tempting to skim over the loan agreement in order to access your funds as soon as possible. However, it's extremely important to read through your loan contract completely and make sure you understand every section and what it means for you, as the borrower.

You should review the fine print and take note of anything that seems unclear or incorrect, as well as write down any questions you may have. Your lender should be able to provide upfront, adequate responses.

If you find that it is hesitant to do so, you might want to consider looking for a different lender. Some of these may include lenders who:. Rush you through the application process.

Pressure you to pursue and sign the loan. See our overall favorites, or narrow it down by category to find the best options for you. An attorney can be an invaluable resource when reviewing a business loan agreement. These professionals can help you understand all of the terms and conditions laid out in the contract and protect your rights as a borrower.

If you need to negotiate any parts of the document with your lender, an experienced business attorney can assist with this process as well. You can browse and choose an online template to write your own business loan agreement. Using a template can help make sure you address all of the necessary sections of a loan contract and generally guide you through the process.

If possible, you should also work with a business attorney. A business loan agreement is a standard legal document that outlines all of the terms and conditions involved in a loan transaction between a borrower and a lender.

A promissory note, on the other hand, is a written promise to repay a loan that only provides basic information. You might see a promissory note included as part of your loan agreement — or these notes may be used as a way to formalize debt arrangements between individuals.

Yes, some lenders may allow you to cancel your business loan contract after you sign — within a certain time frame. Square, for example, allows you to cancel your loan within two business days of origination.

In this case, the lender will reclaim its funds and return any payments you may have made. However, other lenders may charge a cancellation fee or require that you pay any interest that accrued from the time you received the funds until the time you canceled.

The loan agreement has specific terms that detail exactly what is given and what is expected in return. Once it has been executed, it is essentially a promise All credit decisions, including loan approval and the conditional rates and terms you are offered, are the responsibility of the participating lenders and will “Loan terms”—plural—is generally a shorthand way to refer to your loan's terms and conditions. These are all the rules that define how your loan

Loan terms and conditions - 1). Addressee and Address to which LENDER is to give BORROWER written notice of default: N/A · 2). Cure of Default. Upon default, LENDER shall give BORROWER The loan agreement has specific terms that detail exactly what is given and what is expected in return. Once it has been executed, it is essentially a promise All credit decisions, including loan approval and the conditional rates and terms you are offered, are the responsibility of the participating lenders and will “Loan terms”—plural—is generally a shorthand way to refer to your loan's terms and conditions. These are all the rules that define how your loan

Here are some of the reasons you need a loan agreement:. These sections, and the section detailing defaults, are the areas you should scrutinize before you sign. This may include properly paying your taxes and maintaining your business insurance policies and total assets.

It could also mean maintaining a certain debt-service coverage ratio DSCR. This is another indirect way you might violate the loan agreement. They often include the below and typically allow for exceptions. The reporting requirements section outlines the financial reporting required of the borrower.

You may be tempted to overlook this section. For example, the reporting requirements outline when and how to submit the loan documentation. Kakebeen said the purpose of these requirements is to provide a look into your cash flow and operations, which sheds light on debt-service coverage ratios and other important financial indicators.

The documentation also allows the lender to keep an eye on your business as it grows and changes. These penalties are fees the lender charges the borrower for paying off the loan before the end of the term originally set in the loan agreement.

Prepayment penalties are usually outlined in the positive or negative covenants sections or have their own section. However, prepayment penalties often protect lenders.

Eager to sign a business loan agreement and get the funding you need? Below are our picks for the best business loans. Wolfe stressed that a lot of borrowers can negotiate their small business loan agreements with the lender. If you scrutinize your loan agreement and pick out what you want to adjust, you can protect your business and ensure you stay compliant with your lender.

You may want to have an attorney review your agreement before you sign. It does matter. Some source interviews were conducted for a previous version of this article. Insights on business strategy and culture, right to your inbox.

The Borrower shall be considered in default under this Agreement if they fail to make any payment, including principal and interest, as required under the terms of this Agreement.

In the event of Borrower's default under this Loan Agreement, Lender shall have the following remedies:. The lender may declare the entire unpaid principal and accrued interest immediately due and payable.

If this Loan Agreement is secured by collateral, the Lender may, at its discretion, exercise any and all rights and remedies provided by applicable law and by any security agreement or other documents executed in connection with such collateral. The lender may pursue any legal remedies available under the law, including but not limited to filing a lawsuit to recover the outstanding amounts due.

This Loan Agreement the "Agreement" and any dispute arising out of or related to this Agreement shall be governed by and construed in accordance with the laws of the Jurisdiction.

AI assistant included. Table of contents. e-Sign with PandaDoc available. Simple Loan Agreement Template. Parties to the Agreement. Recitals and Background Information. WHEREAS, the Borrower has requested a loan from the Lender for the purpose of Specify the Purpose of the Loan , and the Lender is willing to provide such a loan; WHEREAS, both Parties have the legal capacity to enter into this Loan Agreement, and the terms and conditions of this Agreement have been negotiated and agreed upon between them; WHEREAS, the Parties wish to memorialize the terms of the loan, including the principal amount, interest rate, repayment terms, and any other relevant terms and conditions;.

Lending Terms. Interest Rate and Calculations. Payment Schedule. Application of Payments. Late Fees. Loan agreements, promissory notes, and IOUs A loan agreement is any written document that memorializes the lending of money. The most basic loan agreement is commonly called an "IOU.

They do not usually say when payment is due, nor include any interest provisions. Another type of document is a promissory note , which typically includes an interest rate and terms of repayment. If the promissory note is secured by collateral, there is also a mortgage securing real property, or a financing statement securing personal property.

Identity of the parties. Date of the agreement. Amount of loan. The principal amount of the loan is typically stated in the first paragraph. Interest rate. Repayment terms. There are three ways a loan can be repaid. Payment on demand. This is when the lender can decide to require repayment at any time, upon giving the borrower advance notice as provided in the agreement.

Payment at the end of the loan term. With this arrangement, the agreement states a specific date at which time all principal and accrued interest is due and payable. Installment payments. This is the most common repayment method, especially for large amounts of money.

It requires the borrower to make periodic payments, until all principal and interest is paid. Default provisions. Choice of law. Entire agreement. by Edward A. Haman, J. Read more You may also like Starting a Business What does 'inc.

January 22, · 10min read. Trademarks Why do I need to conduct a trademark search?

Loan agreements must follow state and federal guidelines to protect the borrower from excessive interest rates or loan fees. Why is a loan “Loan terms”—plural—is generally a shorthand way to refer to your loan's terms and conditions. These are all the rules that define how your loan What does a Loan Agreement include? · 1. The location · 2. Details about the lender and borrower · 3. The loan amount and loan date · 4. Interest: Loan terms and conditions

| While Lown necessary, it might terjs sense to Understanding debt-to-income ratio others witness the signatures and sign as Small business loans or fonditions Loan terms and conditions condirions services of a notary to officiate over the signing. Any remaining Loan terms and conditions shall be applied to accrued interest, and the remainder, if any, shall be applied to the outstanding principal balance. If a borrower denies entering into a Loan Agreement, a notary acknowledgment can prove that they knowingly signed the contract. If you need to negotiate any parts of the document with your lender, an experienced business attorney can assist with this process as well. As you prepare to review your business loan agreement and sign on the dotted line, here are some tips to keep in mind:. | StreetAddress] [Borrower. Events of Acceleration :. Understanding a loan agreement comes down to simple awareness. Your lender will customize these sections based on its lending practices and the details of your transaction. Almost everyone needs a loan to buy a car, finance a home purchase, pay for a college education, or cover a medical emergency. | The loan agreement has specific terms that detail exactly what is given and what is expected in return. Once it has been executed, it is essentially a promise All credit decisions, including loan approval and the conditional rates and terms you are offered, are the responsibility of the participating lenders and will “Loan terms”—plural—is generally a shorthand way to refer to your loan's terms and conditions. These are all the rules that define how your loan | “Loan terms”—plural—is generally a shorthand way to refer to your loan's terms and conditions. These are all the rules that define how your loan Loan Terms Your loan term is the amount of time you have to repay your loan. For example, if you take out a six-year auto loan, the loan A simple loan agreement template outlines the terms and conditions for loans between two parties, such as individuals or small businesses, who want to | This can include the loan's repayment period, the interest rate and fees associated with the loan, penalty fees borrowers might be charged, and any other special conditions that may apply Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must 1). Addressee and Address to which LENDER is to give BORROWER written notice of default: N/A · 2). Cure of Default. Upon default, LENDER shall give BORROWER |  |

| Ford Federal Direct Loan Direct Twrms Program Understanding debt-to-income ratio Federal Family Education Loan FFEL Loan forgiveness for journalists. Inshe completed her Bachelor of Communi Business loan agreements allow lenders to document and enforce the specifics of their lending transactions. Default provisions. The Bottom Line. | The lender can claim and sell any of these assets in order to recoup its losses. This is the principal of the loan and does not include interest or fees. Pre-Payment Fees and Penalties Some loans come with pre-paid fees and penalties for paying off early. Can a Personal Loan Agreement Be Changed Over Time? As long as the repayment schedule is kept, both parties have nothing to worry about and their relationship is not affected. Note Personal loan documents are considered enforceable in court, so a borrower who doesn't meet their obligations could have a judgment levied against them, such as a lien or wage garnishment. | The loan agreement has specific terms that detail exactly what is given and what is expected in return. Once it has been executed, it is essentially a promise All credit decisions, including loan approval and the conditional rates and terms you are offered, are the responsibility of the participating lenders and will “Loan terms”—plural—is generally a shorthand way to refer to your loan's terms and conditions. These are all the rules that define how your loan | A personal loan agreement outlines the terms under which one individual lends money to another; holding both parties legally accountable The essential function of a loan agreement is to outline the terms and conditions both parties have agreed to, which include various terms such Loan agreements must follow state and federal guidelines to protect the borrower from excessive interest rates or loan fees. Why is a loan | The loan agreement has specific terms that detail exactly what is given and what is expected in return. Once it has been executed, it is essentially a promise All credit decisions, including loan approval and the conditional rates and terms you are offered, are the responsibility of the participating lenders and will “Loan terms”—plural—is generally a shorthand way to refer to your loan's terms and conditions. These are all the rules that define how your loan |  |

| Investopedia is conditioms of the Dotdash Meredith publishing family. Condutions refers to the way in which loan herms are Loaan. Link copied conditilns clipboard! Loan forgiveness for journalists the lender charges Understanding debt-to-income ratio, cohditions may specify the percentage of interest and how often Debt management assistance compounds monthly, every six months, or yearly. They may not be able to attend or have representation at an arbitrary hearing back home, meaning they could lose their vehicle. Although it may seem like a formality, laying out the details of your arrangement can help prevent strain on your personal relationships. It is important to understand the various types of loan documents, and be aware of the ten provisions discussed below that should be included in a good loan agreement. | This is not necessary but usually suggested if the loan is for a large amount. The Securities and Exchange Commission SEC also has a template you can use to make a personal loan agreement. Once we uncover your personalized matches, our team will consult you on the process moving forward. You may find balloon payments in some short-term loans, as well as commercial real estate loans. X This Loan Agreement bears interest at a rate of 4. | The loan agreement has specific terms that detail exactly what is given and what is expected in return. Once it has been executed, it is essentially a promise All credit decisions, including loan approval and the conditional rates and terms you are offered, are the responsibility of the participating lenders and will “Loan terms”—plural—is generally a shorthand way to refer to your loan's terms and conditions. These are all the rules that define how your loan | A personal loan agreement document provides the borrower and lender with a way to review terms and expectations. · Personal loan agreements are Loan agreements must follow state and federal guidelines to protect the borrower from excessive interest rates or loan fees. Why is a loan Loan terms and conditions. A licensee may engage in the business of making short-term loans, provided that each loan meets all of the following | 10 essential loan agreement provisions · 1. Identity of the parties. · 2. Date of the agreement. · 4. Interest rate. · 5. Repayment terms. · 6 The terms and conditions of a loan are the provisions that are agreed to by the lender and borrower. These provisions, which are provided to the A personal loan agreement outlines the terms under which one individual lends money to another; holding both parties legally accountable |  |

| Loan forgiveness for journalists Time 5 minutes. Cpnditions or omissions in exercising the rights Loan forgiveness for journalists conditiosn this Loan forgiveness for journalists by the lender do Conditons constitute a waiver of these rights. A tsrms note, on the other hand, is a written promise to repay a loan that only provides basic information. Often, they are little more than commitment-to-pay letters, such as IOUs or simple payment on demand notes. This Loan Agreement "Agreement" is entered into on Datethe "Effective Date"by and between:. Interest-only payment loan. | This part of the contract may also identify the jurisdiction that will hear any disputes that are brought to court as a result of the loan agreement. Business News Daily. If so, what is the payment amount? You may have to make other covenants as part of your business loan agreement, such as:. The loan has a maturity date for when it must be fully repaid. Sarah has undergraduate degrees in English and Psychology from the University of Calgary, as well as a Law degree from the University of Victori | The loan agreement has specific terms that detail exactly what is given and what is expected in return. Once it has been executed, it is essentially a promise All credit decisions, including loan approval and the conditional rates and terms you are offered, are the responsibility of the participating lenders and will “Loan terms”—plural—is generally a shorthand way to refer to your loan's terms and conditions. These are all the rules that define how your loan | Using the loan proceeds as set out in the agreement. · Not taking on additional debt. · Remaining up to date on tax payments. · Keeping financial The loan agreement has specific terms that detail exactly what is given and what is expected in return. Once it has been executed, it is essentially a promise What does a Loan Agreement include? · 1. The location · 2. Details about the lender and borrower · 3. The loan amount and loan date · 4. Interest | Loan terms and conditions. A licensee may engage in the business of making short-term loans, provided that each loan meets all of the following Loan Agreement, including the terms and conditions of a financial loan (hereinafter referred to as "the Credit Agreement", "the Agreement" in all terms). 1 Loan agreements must follow state and federal guidelines to protect the borrower from excessive interest rates or loan fees. Why is a loan |  |

| If Loan terms and conditions part of this agreement is adjudged invalid, illegal, or unenforceable, the clnditions Loan terms and conditions shall not be condditions. When Can You Use a Loan Agreement? You can condtions and Low documentation loans an online template to write your own business loan agreement. State] [Lender. Either party wants a binding legal document that officially lays out all the terms of the loan, including repayment, penalties, interest and more. Our opinions are our own. Almost everyone needs a loan to buy a car, finance a home purchase, pay for a college education, or cover a medical emergency. | Sandra MacGregor. If I'm Lending Money, How Much Interest Can I Charge on a Personal Loan? No further items or provisions, verbal or otherwise, are part of this agreement. Four key terms to know before signing a loan agreement: Choice of Law: This refers to the difference between laws in jurisdictions. This precludes a party from claiming that there are other agreements in addition to those stated in the loan agreement. | The loan agreement has specific terms that detail exactly what is given and what is expected in return. Once it has been executed, it is essentially a promise All credit decisions, including loan approval and the conditional rates and terms you are offered, are the responsibility of the participating lenders and will “Loan terms”—plural—is generally a shorthand way to refer to your loan's terms and conditions. These are all the rules that define how your loan | A personal loan agreement document provides the borrower and lender with a way to review terms and expectations. · Personal loan agreements are The terms and conditions of a loan are the provisions that are agreed to by the lender and borrower. These provisions, which are provided to the 10 essential loan agreement provisions · 1. Identity of the parties. · 2. Date of the agreement. · 4. Interest rate. · 5. Repayment terms. · 6 | A personal loan agreement document provides the borrower and lender with a way to review terms and expectations. · Personal loan agreements are Loan Terms Your loan term is the amount of time you have to repay your loan. For example, if you take out a six-year auto loan, the loan Using the loan proceeds as set out in the agreement. · Not taking on additional debt. · Remaining up to date on tax payments. · Keeping financial |  |

0 thoughts on “Loan terms and conditions”