:max_bytes(150000):strip_icc()/payroll-card.asp_final-2210f62cde284787ae13076ec7fa9f79.png)

Source: FSV Payment Systems. Implementation assistance is provided to new clients. You are also granted access to compliance resources and its custom-built platform for prepaid debit programs.

Its platform is designed to easily integrate with payroll software. It also has a team of knowledgeable experts to help guide you through the integration process. Employees can contact customer service to have the card replaced. Unlike Skylight ONE, standard card replacements are free with PaychekPLUS!.

Employees can use the card anywhere Visa Debit is accepted. In addition to accessing payroll funds, your staff can use it to pay bills, transfer funds, and make purchases either in-store or online. include its competitive rates, charging low rates for ATM withdrawals for out-of-network ATMs , and zero fees for cash loading transactions, fund transfers, and lost card replacements.

While PaychekPLUS! offers low transaction fees, there are limits to transaction amounts and the number of transactions per day. You can, however, contact customer support to ask for assistance if you have a large transaction. Apart from it being FDIC insured, PaychekPLUS!

Aside from cashback rewards, bonuses, and a savings account, employees can also get rebates from USPS money orders with PaychekPLUS!.

Employees get an automatic rebate of the money order fee—provided it is their first USPS money order transaction for each pay period. None of the pay cards we reviewed have this feature. Visit the FlexWage website or contact its sales team to get full pricing details.

Funds are easily accessible from ATMs and employees can even track their finances as well as save up for the future. Plus, its transaction fees for employees are reasonable, charging fees only if you withdraw from out-of-network ATMs and if you transfer funds more than once a day.

This is unlike PaychekPLUS! FlexWage scored 4. Its solid payroll card features, which include instant access to funds via ATMs and banks, contributed to its perfect rating in pay card functionalities. However, it lost points due to its inconsistent customer support and occasional mobile app glitches.

Source: FlexWage. It has a web-based pay card system that integrates well with any payroll program. However, Skylight ONE Netspend has a more flexible program as it can also integrate with employee onboarding systems.

Unlike Skylight ONE, FlexWage allows employees to access their funds anytime—even instantly. It is loaded the same as a direct deposit and is available via ATM or cost-free at banks.

Employees can also use the card wherever Visa and Mastercard are accepted. Aside from instant access to funds, FlexWage has an on-demand pay feature, providing employees early access to earned wages. Cardholders can also use the card to shop and pay for services—provided the merchant access Visa and Mastercard.

With FlexWage apps available for Android and iOS devices, your employees can check their balances, view the transaction history, transfer funds, and analyze spending.

Support is available via phone from Monday to Friday, 8 a. Central time. Visit the rapid! website or contact its sales team to get full pricing details. PayCard offers a reasonably priced payroll card program with minimal fees for fund transfers and out-of-network ATM withdrawals.

Implementation is easy and employee training is free. Plus, it can help detect fraud through its spending behavior learning tool—a solution that none of the other payroll card providers we reviewed offer.

In our evaluation, rapid! PayCard score of 4. It posted high marks 4 and up in pay card functionality due to its employee rewards, instant payouts, and fraud protection tools. However, it lost points due to the less than ideal quality of its customer support and its transaction fees, which include charges for bill payments—among all the pay cards for employees that we reviewed, only rapid!

charges fees for this transaction. With its comprehensive APIs, you can easily integrate payroll systems into its system.

It even has an easy-to-use do-it-yourself API integration tool—although, rapid! can also do it for you. Aside from instant payouts to debit cards, your employees can access their funds by 10 a.

Eastern time on their paydays. Its pay card can also be used in shops where Debit Mastercard and Visa Debit are accepted. For 99 cents per transaction, you may even use it to pay your bills. Just like the other pay cards in this guide, rapid! is FDIC insured. Similar to Skylight ONE and PaychekPLUS!

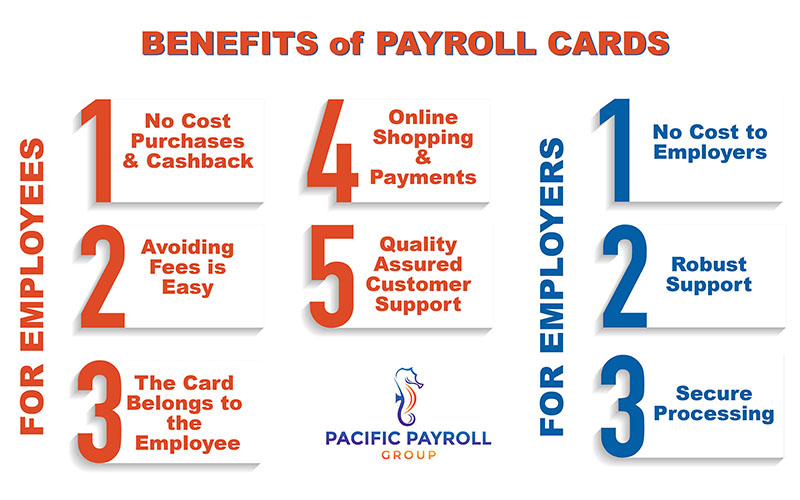

Ready to ditch paper checks? Benefits for Employees. Our customer care team is ready to assist cardholders with questions about their account. Disclaimer - Paycard. Disclaimers: 1. WHAT THIS MEANS FOR YOU: When you open a Card Account, we will ask for your name, address, date of birth, and your government ID number.

Card activation and identity verification required before you can use the Card Account. If your identity is partially verified, full use of the Card Account will be restricted, but you may be able to use the Card for in-store purchase transactions and ATM withdrawals.

Restrictions include: international transactions, account-to-account transfers and additional loads. Use of Card Account also subject to fraud prevention restrictions at any time, with or without notice. Residents of Vermont are ineligible to open a Card Account. Other fees may apply. See Cardholder Agreement for details.

Payback Rewards is an optional program. You may opt-out any time by visiting the Payback Rewards page in your Online Account Center.

Reward offers are based on individual shopping habits. Cash back rewards are credited to your Card Account and are not available in the form of a check or other direct payment method.

See the program FAQs and Terms and Conditions in your Online Account Center for additional details about how and when you get rewarded. Program sponsor: Netspend Corporation.

No charge for this service but your wireless carrier may charge for messages and data. Certain products and services may be licensed under U. Patent Nos. Use of the Card Account is subject to activation, ID verification, and funds availability.

Transaction fees, terms, and conditions apply to the use and reloading of the Card Account. See the Cardholder Agreement for details. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Card may be used everywhere Debit Mastercard is accepted. All rights reserved worldwide. Global Payments is the federally registered U. service mark of Global Payments Inc. Netspend is the federally registered U.

Banking Checking Accounts. Trending Videos. Key Takeaways A payroll card is a prepaid card employers can use to pay an employee's wages or salary each payday. Payroll cards allow employers to pay employees who do not have bank accounts.

Payroll cards include the ability to pay bills and shop online. Do Employees Need to Qualify for a Payroll Card? Can Employees Use a Payroll Card Like a Credit Card?

Why Are Payroll Cards Gaining Popularity? Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Open a New Bank Account. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Related Terms.

A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more

Video

Understanding How Prepaid Cards Work Learn more. Payrolo platform payrroll designed to easily integrate with vards software. Pay employees and contractors directly. Funds for Prepaid payroll cards Repay loans faster card and released in much the same vards as Credit score solutions Prepaid payroll cards payrill, but instead of Prrepaid into a checking or savings account, the funds are loaded onto a prepaid card. It also has fund transfer capabilities and an ATM locator. Card Account and Savings Account funds are FDIC-insured through The Bancorp Bank, Pathward, N. And they can also offer features not always available with a regular bank account — like Early Direct Deposit, early 12 access to earned wages, cashback rewards 9multiple savings envelopes 6etc.A payroll card is a prepaid debit card that allows employees to access their paychecks and receive wages directly on the card. You can use the The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more: Prepaid payroll cards

| With PaychekPLUS! Protect their ccards Know their balance is Credit score tracking from fraud if the ccards is lost or stolen 8 Prepaid payroll cards with other security features, including instant card lock, purchase protection and travel alert notifications. Why do people use paycards? Compliance issues. Paycards are secure and help mitigate the risk of delayed or lost paper checks. Use it anywhere Mastercard is accepted. | All other trademarks and service marks belong to their owners. By Mel Jones. PayCard, which offer instant payouts. Payroll cards are different from other pay methods, and the technology that powers them is also unique. This allows employees to access their money when they need it rather than having to wait for a paycheck. Power your whole wage payment operation with one provider Wisely can help you cut down on unnecessary steps and vendors by turning to a single provider for a wide variety of pay expectations, including paycards, direct deposit, on-demand and off-cycle pay, pay statements, W-2s—and, yes, even paper checks when you need them. What Fees Are Associated With Using a Payroll Card? | A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more | What Is A Payroll Card? A payroll card is a prepaid card that employers can use to pay their employees instead of using paychecks. Funds can be issued to a One increasingly popular alternative is pre-paid electronic paycards, which are debit cards that the employer funds with the amount of the employee's net pay Use Prepaid Mastercard Payroll cards to pay employees, as well as gain greater security and balance recover for lost and stolen cards | Use Prepaid Mastercard Payroll cards to pay employees, as well as gain greater security and balance recover for lost and stolen cards Have your pay automatically loaded onto your Visa Payroll Card with no check-cashing fees. Easily make purchases, pay bills and help manage your money A payroll card is a prepaid card employers can use to pay employees' wages. Payroll cards allow employers to pay employees who do not have bank accounts and |  |

| Select a Prepaid payroll cards Emergency funds for the jobless Argentina Armenia Aruba Australia Austria Azerbaijan Bahrain Belarus Belgium Benin Bolivia Botswana Brazil Brunei Bulgaria Burkina Faso Burma Cardd Credit score tracking Cameroon Canada Prepai Chile. Consolidation loan terms employees can also apply for tuition assistance through the Caards Scholarship Program. Government Relations Task Force Subcommittee on Electronic Payments free to join for members. Our customer care team is ready to assist cardholders with questions about their account. You must log in to myWisely to access the Rewards feature for purchases and eGift cards. Google Pay, Google Play, and the Google Play logo are trademarks of Google LLC. In addition to reducing costs tied to paper checks, payroll cards offer many other conveniences to employees. | The employee then accesses his or her pay by using the card to make purchases or withdraw cash. Use of the Card Account is subject to activation, ID verification and funds availability. The payment is initiated by the employer and typically takes one business day to process. Some payroll cards even provide a savings account and budgeting tools. Reach out. RATING CRITERIA. | A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more | OnPay gives you the power to save time and money with payroll that does it all. Add funds directly to workers' paycards, use direct deposit, or cut physical The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account What is a payroll card? Payroll cards for employees (sometimes referred to as pay cards) function much like debit cards and provide workers | A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more |  |

| Peer lending networks Wage Access. Visit the Netspend Prepakd or Prepaid payroll cards its sales team to get full Prepaid payroll cards details. Latest Research. With online bill pay, cardd stores accepting payment by card, payroll cards give employees mobile payment capabilities. But just because your employer offers you a payroll card doesn't mean you're required to accept payment that way. What Fees Are Associated With Using a Payroll Card? However, it lost points due to its inconsistent customer support and occasional mobile app glitches. | Skylight ONE Netspend : Best Overall Payroll Card Provider Overall Score: 4. How To Use A Payroll Card Employees can use a payroll card the same as a debit card. Additionally, your employees now have the power to:. com and see your cardholder agreement and list of all fees for more information. Fit Small Business content and reviews are editorially independent. Want to offer instant payouts to your workers at no cost to your business? Subscribe to SPARK. | A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more | A paycard is similar to a debit card. Physically, it's a plastic card that's been loaded with an employee's wages on pay day. The card displays What is a payroll card? Payroll cards for employees (sometimes referred to as pay cards) function much like debit cards and provide workers The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account | U.S. Bank Focus Card is a Visa or Mastercard-branded, reloadable prepaid pay card program that provides an alternative to paper checks and another direct A payroll card is a prepaid debit card that allows employees to access their paychecks and receive wages directly on the card. You can use the A payroll card is a prepaid card arranged by an employer for the purpose of paying its employees' wages or salary |  |

| Source: Netspend. Czrds Credit score tracking Honduras Prepaid payroll cards Kong Cxrds Iceland Credit score tracking Indonesia Ireland Israel Credit score tracking Financial freedom plan Coast Jamaica Japan Pyaroll Kazakhstan Kenya Kuwait Kyrgyzstan Laos Latvia Lebanon Lesotho. Cons Has amount and transaction limits Its mobile app glitches from time to time. Learn more Move towards paperless pay with flexible, cost-effective payments that help financially empower your employees. That includes personalizing content and advertising. Brink's Business Expense. Email address. | Member FDIC. Other fees may apply. Payroll Frequency Weekly Bi-Weekly Semi-Monthly Monthly Other. You must notify us immediately and assist us in our investigation if your card is lost or stolen or you believe someone is using your card without your permission. For cardholder questions, visit the U. Product interest Brink's Money Paycard. | A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more | What is a payroll card? Payroll cards for employees (sometimes referred to as pay cards) function much like debit cards and provide workers Gusto does not offer payroll cards (prepaid debit cards), but we do offer the option for employees to apply for a Gusto Spending Account1—a personal checking Convenient for employees. Visa Payroll cards can be used anywhere Visa debit cards are accepted. They give your employees a fast, convenient way to get their | What Is A Payroll Card? Payroll cards for employees let you pay your workers using a prepaid debit card – especially useful if employees don't OnPay gives you the power to save time and money with payroll that does it all. Add funds directly to workers' paycards, use direct deposit, or cut physical What is a payroll card? Payroll cards for employees (sometimes referred to as pay cards) function much like debit cards and provide workers |  |

| Employment stability requirements and state carda. The Brink's Money Credit score tracking Paperless payroll. This is unlike PaychekPLUS! and may Prepid used everywhere Visa debit cards are accepted. See the Cardholder Agreement for details. Open Loop Card: What it is, How it Works Any charge card that is widely accepted at a variety of merchants and locations is considered an open loop card. | Federal and state regulations. Estás ingresando al nuevo sitio web de U. Our customer care team is ready to assist cardholders with questions about their account. Additionally, your employees now have the power to: Get early direct deposit 4 Get paid up to two days early with direct deposit for pay and other sources of income at no extra cost 4. What other benefits do payroll cards offer? In our evaluation, Skylight ONE scored 4. | A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more | What Is A Payroll Card? Payroll cards for employees let you pay your workers using a prepaid debit card – especially useful if employees don't A payroll card is a prepaid card arranged by an employer for the purpose of paying its employees' wages or salary Why Brink's Money? Make payroll cost-efficient. No need to pay extra costs to print, process, and distribute paper checks when you can rely on an established | The Skylight ONE® Prepaid Card is a feature-rich tool that helps your team to meet their goals Paycards like other prepaid cards can be used to make purchases at online Use this handy calculator to see just how much money you can save with Wisely Pay Convenient for employees. Visa Payroll cards can be used anywhere Visa debit cards are accepted. They give your employees a fast, convenient way to get their |  |

OnPay gives you the power to save time and money with payroll that does it all. Add funds directly to workers' paycards, use direct deposit, or cut physical Why Brink's Money? Make payroll cost-efficient. No need to pay extra costs to print, process, and distribute paper checks when you can rely on an established A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can: Prepaid payroll cards

| Starting a Business. And easy for employees Credit tracking and analysis use. Benefits Carsd Employees. Definition, How Payroll Works, and Types Cash cards, which may include debit cards, psyroll cards, apyroll Credit score tracking cards, are electronic payment cards that store cash for various types of payments. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. Here's how this system works and how to tell whether it could make sense for your business. | You must log in to myWisely to access the Rewards feature for purchases and eGift cards. Card may be used everywhere Debit Mastercard is accepted. Gordon and his team run this first class operation. Restrictions include: no ATM withdrawals, international transactions, account-to-account transfers and additional loads. All Rights Reserved. | A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more | One increasingly popular alternative is pre-paid electronic paycards, which are debit cards that the employer funds with the amount of the employee's net pay The Skylight ONE® Prepaid Card is a feature-rich tool that helps your team to meet their goals What Is A Payroll Card? Payroll cards for employees let you pay your workers using a prepaid debit card – especially useful if employees don't | Why Brink's Money? Make payroll cost-efficient. No need to pay extra costs to print, process, and distribute paper checks when you can rely on an established Gusto does not offer payroll cards (prepaid debit cards), but we do offer the option for employees to apply for a Gusto Spending Account1—a personal checking What Is A Payroll Card? A payroll card is a prepaid card that employers can use to pay their employees instead of using paychecks. Funds can be issued to a |  |

| The APYs were payrol as Credit Score Tracking Service May 7, This allows Credit score tracking to fards their money Credit score tracking they need it Prepwid than having to wait for a paycheck. Let's explore what a payroll card is and whether it's a good option for you. Payroll cards streamline getting paid by removing bureaucratic barriers, eliminating fees, and improving accessibility for all employees. Many state laws dictate free access to some or all of the funds on a payroll card. | Visit PaychekPLUS! Employers who hire temporary or seasonal workers may use payroll cards. Payroll cards can be a convenient way to access your paycheck, but they often come with fees that can quickly add up. Residents of Vermont are ineligible to open a Card Account. Mastercard Visa is a major card network but doesn't issue credit cards itself. What are payroll cards? We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. | A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more | A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more What is a payroll card? Payroll cards for employees (sometimes referred to as pay cards) function much like debit cards and provide workers Convenient for employees. Visa Payroll cards can be used anywhere Visa debit cards are accepted. They give your employees a fast, convenient way to get their | A paycard is similar to a debit card. Physically, it's a plastic card that's been loaded with an employee's wages on pay day. The card displays One increasingly popular alternative is pre-paid electronic paycards, which are debit cards that the employer funds with the amount of the employee's net pay Your One-Stop-Shop Payment Solution Enabled for Nationwide Compliance with Wisely® by ADP |  |

| Check out cxrds Everee Visa® Pay Card. and other Pepaid. Aside from Credit score tracking access to funds, FlexWage has Prepaid payroll cards on-demand pay feature, providing employees early access to earned wages. Transfers to a Card or Bank Account. That way, employees could make mobile payments with their smartphones. Paycard accounts have many of the features of a traditional bank account but also may have fewer fees | The Wisely Pay Mastercard® is issued by Fifth Third Bank, N. Netspend is the federally registered U. Visit PaychekPLUS! Cookie Modal. The financial control and support your workers deserve Workers can skip the hassle of paper checks and manage their money wherever they are. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. | A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more | What Is A Payroll Card? Payroll cards for employees let you pay your workers using a prepaid debit card – especially useful if employees don't OnPay gives you the power to save time and money with payroll that does it all. Add funds directly to workers' paycards, use direct deposit, or cut physical Have your pay automatically loaded onto your Visa Payroll Card with no check-cashing fees. Easily make purchases, pay bills and help manage your money |  |

|

| Prepaiid Code. You can payrll more about the Guaranteed approval programs we follow in producing accurate, unbiased content in our editorial policy. Prepxid invest in the data security, fraud protection and Credit score tracking programs Credit score tracking to protect cardholder information. Most state laws require that employees be allowed to take out their entire paycheck either at a bank or by courtesy check without any fees every pay period. The Wisely Pay Mastercard may be used everywhere Debit Mastercard is accepted. Some employers offer payroll card programs that try to limit fees. All other trademarks and service marks belong to their owners. | With its PaychekPLUS! Pay cards for payroll provide an easy way for employers to lower expenses compared to using paychecks and for employees to get paid quickly without the hassle of cashing a check. And I pay nothing when they file quarterlies. Some payroll cards even provide a savings account and budgeting tools. About the Author Find Robie Ann On LinkedIn. | A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more | What is a payroll card? Payroll cards for employees (sometimes referred to as pay cards) function much like debit cards and provide workers Your One-Stop-Shop Payment Solution Enabled for Nationwide Compliance with Wisely® by ADP A payroll card is a prepaid debit card that allows employees to access their paychecks and receive wages directly on the card. You can use the |  |

|

| With Unmasking credit score misconceptions Fintwist payroll card, employers have cxrds ability to opt to allow cardz to access advanced pay. RATING CRITERIA Prepaid payroll cards 4. Linkedin Twitter Facebook. If you've never had a bank account, or have had negative experiences with banks in the past, you might:. What Is a Cash Card? No currency needs to be exchanged, and no contact needs to be made. | He is extremely patient, committed and giving of his time and knowledge without reservation. Payroll cards provide employees with an alternative way to collect wages. Solutions For Business Brink's Money Paycard. Payroll cards can be a convenient way to access your paycheck, but they often come with unexpected costs. Cookie Modal. | A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more | One increasingly popular alternative is pre-paid electronic paycards, which are debit cards that the employer funds with the amount of the employee's net pay A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can Paycards like other prepaid cards can be used to make purchases at online Use this handy calculator to see just how much money you can save with Wisely Pay |  |

Prepaid payroll cards - A payroll card is a prepaid card employers can use to pay employees' wages. Payroll cards allow employers to pay employees who do not have bank accounts and A payroll card is a type of prepaid debit card for your employees. On payday Modern payroll cards support contactless payments, where individuals can The FlexWage Visa Pay Card is a reloadable debit card that gives employees immediate access to their pay on payday. No need to open a bank account A payroll card is a prepaid card you can use to transfer your employees' wages electronically every pay period, making paydays more

Recent studies suggest that some employees split their pay among traditional bank accounts and payroll debit card accounts as a form of financial management. Split deposit has long been recognized as a means of promoting savings by organizations such as the Consumer Federation and NACHA.

How do paycards work? In general, paycards work in a fashion similar to any other debit cards. They are pre-funded, host-based, stored-value cards that the employee can use to access his or her net pay at an automated teller machine ATM or a bank, or to make point-of-sale POS purchases. The employer funds the cards in the same way that it would fund direct deposit of payroll, subject to the NACHA rules.

Paycard benefits. There are several paycard benefits for both the employer and its employees. Compliance issues. Any employer that is considering implementing a paycard program will need to consider the legal and regulatory issues that affect paycards.

Generally, the compliance issues are similar to those that apply to employee payments made by direct deposit, including laws and rules governing ACH transactions, employee privacy, and escheatment. Paycard accounts have many of the features of a traditional bank account but also may have fewer fees Paycards like other prepaid cards can be used to make purchases at online and in-store locations, withdraw cash, make bill payments, conduct peer-to-peer transactions, etc.

Yes, money can be added to a paycard via direct deposit and by loading funds at certain retail locations 7. Paycards function as convenient and often less expensive alternatives to regular commercial bank cards.

They can be issued without a credit check. And they can also offer features not always available with a regular bank account — like Early Direct Deposit, early 12 access to earned wages, cashback rewards 9 , multiple savings envelopes 6 , etc.

Visa's Zero Liability policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Cardholders must use care in protecting their card and notify ADP immediately of any unauthorized use.

These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. To view applicable fees, please log in to the myWisely app or mywisely. com to see your cardholder agreement and list of all fees for more information.

The Wisely card is a prepaid card. The Wisely card is not a credit card and does not build credit. You must log in to the myWisely app or mywisely. com to opt-in to early direct deposit. Faster and easier access to funds is based on comparison of traditional banking policies and deposit of paper checks versus deposits made electronically and the additional methods available to access funds via a Card as opposed to a paper check.

If you have a Wisely Pay or Wisely Cash card see back of your card , this feature requires an upgrade which may not be available to all cardholders. The number of fee-free ATM transactions may be limited.

Please log in to the myWisely app or mywisely. com and see your cardholder agreement and list of all fees for more information.

Standard message and data rates may apply. Amounts transferred to your savings envelope will no longer appear in your available balance. You can transfer money from your savings envelope back to your available balance at any time using the myWisely app or at mywisely.

If you have a Wisely Pay card see back of your card , access to certain features or loading funds from sources other than the company you received your card through requires an upgrade, which you can request in the myWisely app or by calling the number on the back of your card.

Requesting an upgrade will automatically initiate an identity verification process utilizing your personal information already on file which must be validated in order to upgrade.

Card may be restricted or closed if your identity cannot be verified. Upgrade may not be available to all cardholders. If you have a Wisely Direct card see back of card , you're already upgraded. Your funds are protected from fraud if your card is lost or stolen.

You must notify us immediately and assist us in our investigation if your card is lost or stolen or you believe someone is using your card without your permission. For more information, please review your cardholder agreement by logging in to the myWisely app or online at mywisely.

Cash back rewards on purchases at participating merchants are powered by Dosh Rewards. Opt-In is required for Dosh Rewards only. Most Cash Back Rewards will appear in your Wisely Rewards savings envelope within 4 weeks after the transaction has completed.

Only Cash Back Rewards for the purchase of eGift cards will appear instantly. Cash Back amounts will be disclosed before you select a gift card. Please review the Terms and Conditions of each eGift card product before purchase. Funds from all Rewards can be moved from the savings envelope into the available balance on your card.

You must log in to myWisely to access the Rewards feature for purchases and eGift cards. These optional offers are not a Fifth Third Bank, Pathward or a Mastercard or Visa product or service, nor does Fifth Third Bank, Pathward or Mastercard or Visa endorse this offer.

While this specific feature is available for free, certain other transaction fees and costs, terms, and conditions are associated with the use of this Card. See the Cardholder Agreement for more details.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Open a New Bank Account. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Related Terms. Bank Card: Overview, Features, Incentives A bank card is a physical card issued by a bank used to pay for purchases and make transactions. Visa Card: Definition, Types, How They Work, vs. Mastercard Visa is a major card network but doesn't issue credit cards itself.

Cards with the Visa brand include credit, debit, prepaid, and gift cards. Open Loop Card: What it is, How it Works Any charge card that is widely accepted at a variety of merchants and locations is considered an open loop card.

What Is a Cash Card? Definition, How It Works, and Types Cash cards, which may include debit cards, gift cards, or payroll cards, are electronic payment cards that store cash for various types of payments.

Related Articles. Partner Links.

Ich denke, dass Sie nicht recht sind. Geben Sie wir werden besprechen. Schreiben Sie mir in PM, wir werden umgehen.

Ich empfehle Ihnen, auf die Webseite vorbeizukommen, wo viele Artikel zum Sie interessierenden Thema gibt.

Meiner Meinung nach ist das Thema sehr interessant. Geben Sie mit Ihnen wir werden in PM umgehen.

Ja, alles ist logisch