The interest rate for these PLUS Loans for July 1, through June 30, is 8. The bond equivalent rate of the week Treasury Bills auctioned at the final auction held prior to June 1 each year , plus 3. The variable interest rate for these PLUS Loans for July 1, through June 30, is 8.

Annual adjustments in interest rates may alter monthly payment amounts from year to year. Or, the lender may keep the monthly payment amount the same but increase or decrease the number of payments required to reflect the increase or decrease in the annual variable interest rate. A lender charges each FFEL borrower an origination fee.

A guaranty agency charges the lender an insurance premium on each loan it guarantees. Generally, the lender passes this cost on to the borrower. A lender must deduct collect the origination fee proportionately from each disbursement.

If the lender passes this charge on to the borrower, the fee must be deducted proportionately from each disbursement of the loan. Late Charges If a borrower fails to pay all or a portion of a required installment within 15 days after it is due, the lender may require the borrower to pay a late charge if authorized by the borrower's promissory note.

This charge may not exceed six cents for each dollar of each late installment. Collection Charges If authorized by the borrower's promissory note, and notwithstanding any provisions of state law, a lender may require that a borrower or an endorser pay costs the lender or its agents incurred in collecting installments not paid when due.

These charges, include but are not limited to - attorney's fees, - court costs, and - telegrams. These costs may not include routine collection costs associated with preparing letters or notices or with making personal contacts with the borrower for example, local and long-distance telephone calls.

REPAYMENT OF FEDERAL STAFFORD LOANS While the borrower is in school at least half time before the expiration of his or her grace period , the federal government pays the interest on a subsidized Stafford Loan on the his or her behalf.

For an unsubsidized Stafford Loan, interest accrues during this period, and the borrower is responsible for paying it. The borrower may pay the interest while he or she is in school, or the lender will capitalize it that is, add it to the principal balance.

Generally, the first payment on a Stafford Loan is due no later than 45 days after the first day that repayment begins.

The lender must notify the borrower of the date and amount of the first payment as part of a repayment disclosure that must be sent to the borrower no less than 30 days before the date that the first payment is due and no more than days before that date. Determining a Student's Withdrawal Date The student's withdrawal date is the date that the student notifies an institution of his or her withdrawal or the date of withdrawal specified by the student, whichever is later.

If the student does not withdraw officially that is, he or she drops out of school without notifying the school , the last recorded date of the student's class attendance, as documented by the school, is the student's withdrawal date.

An institution must determine the withdrawal of a student who drops out in a timely manner. This date must be determined within 30 days after the expiration of the earliest of these three periods: 1 the period of enrollment for which the student has been charged; 2 the academic year in which the student withdrew 3 the educational program in which the student withdrew In the case of a student who does not return from a summer break, the school shall determine the student's withdrawal date no later than 30 days after the first day of the next scheduled term.

If a student fails to return from an approved leave of absence whether approved or unapproved , the withdrawal date is the last recorded date of class attendance. This date is used regardless of whether the student withdraws officially by notifying the school or unofficially by discontinuing attendance without notifying the school.

For appeal procedures with regard to the withdrawal date for correspondence study, see 34 CFR The refund policy for students who have withdrawn, who have dropped out, or who have not returned from an approved or unapproved leave of absence is explained in Section The financial aid administrator should emphasize to students the importance of that responsibility.

Upon receiving notification of this critical date, the lender will send a repayment schedule to the borrower. If a loan sale or transfer requires the borrower to send payments to a new address, the present and former holders of the loan either jointly or separately must notify the borrower of the change within 45 days of the sale or transfer.

This notification should spell out the borrower's obligations to the new loan holder. Loan Repayment Schedules Provisions of a loan repayment schedule must agree with those in the promissory note and the loan disclosure statement.

Generally, a borrower has from 5 to 10 years to repay a loan in full. Any periods of authorized deferment or forbearance are not counted in the repayment period.

A lender has the option of crediting the payments first to late charges or collection costs, then to outstanding interest, and then to unpaid principal. If the borrower submits a payment amount that equals or exceeds the normal monthly payment amount and does not provide instructions for handling the excess payment amount, the lender must apply the excess to future installments, advancing the next payment due date.

Loan payments for Stafford Loans, however, usually exceed these minimums because of the year statutory limit on repayment.

Monthly payment amounts may not be set at less than the amount of interest due. The lender may require a repayment period of less than 5 years, if necessary, to ensure that the above minimum payments are met.

Repayment Plans Lenders are required to offer the option of standard, graduated, or income-sensitive repayment to new Stafford or SLS borrowers. A new borrower is defined as someone who borrows on or after July 1, and who, at the time he or she borrows, has no outstanding balance on a FFEL borrowed before that date.

The Secretary encourages lenders to offer this flexible range of repayment options to all other borrowers. The choice of repayment plans must be provided to borrowers not earlier than six months before the date of the first scheduled loan payment.

Even if a borrower does not choose a particular plan, the lender is permitted to require the borrower to repay all of his or her FFELs under one repayment schedule. A lender may agree to a standard, graduated, or income-sensitive repayment schedule for a new Stafford or SLS borrower, as long as the minimum annual payment and maximum time period requirements are met and as long as scheduled monthly payments cover at least the monthly interest charges.

A borrower must respond to a lender's offer of a choice of repayment options within 45 days after the lender makes the offer, or he or she will be required to repay under a standard repayment schedule.

This amount may vary annually if an adjustment in a borrower's variable interest rate necessitates a change in his or her repayment schedule. This amount starts increases incrementally during the repayment period.

If a graduated repayment schedule is established, however, no single payment can be scheduled to be more than three times greater than any other scheduled payment.

In general, the lender will request from the borrower information on his or her income no earlier than 90 days before the due date of the borrower's first payment.

The income information must be sufficient for the lender to make a reasonable determination of what the borrower's payment amount should be. If a lender receives late notification that a borrower has dropped below half-time enrollment status at a school, the lender may request the income information earlier.

If a borrower reports income that a lender considers to be insufficient to establish monthly payments that would repay a loan within the maximum year repayment period, the lender shall require the borrower to submit evidence showing the amount of the most recent total monthly gross income he or she has received from employment and from other sources.

A lender must grant forbearance to a borrower for a period of up to five years of payments if the income-sensitive monthly payment amount would prevent the borrower from repaying the loan within the maximum repayment period.

If a borrower chooses the income-sensitive plan but then does not provide any documentation that may be required for repayment under that plan, the lender may require that borrower to repay his or her loans under the standard repayment option.

Money borrowed for long-term capital investments usually is repaid in a series of annual, semi-annual or monthly payments. There are several ways to calculate the amount of these payments:.

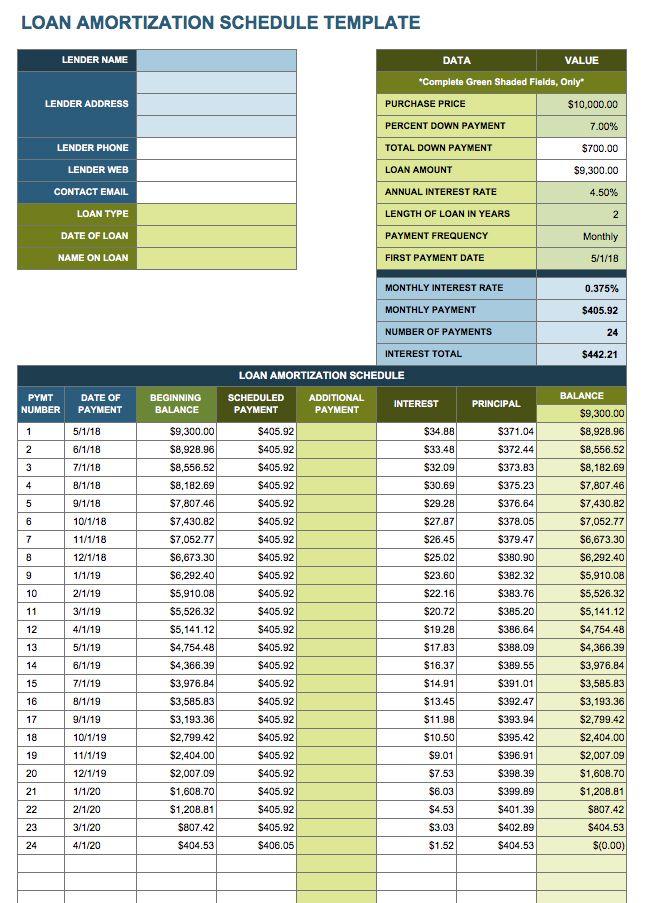

When the equal total payment method is used, each payment includes the accrued interest on the unpaid balance, plus some principal. The amount applied toward the principal increases with each payment Table 1.

The equal principal payment plan also provides for payment of accrued interest on the unpaid balance, plus an equal amount of the principal. The total payment declines over time.

As the remaining principal balance declines, the amount of interest accrued also declines Table 2. These two plans are the most common methods used to compute loan payments on long-term investments.

Lenders also may use a balloon system. The balloon method often is used to reduce the size of periodic payments and to shorten the total time over which the loan is repaid.

To do this, a portion of the principal will not be amortized paid off in a series of payments but will be due in a lump sum at the end of the loan period. For many borrowers, this means the amount to be repaid in the lump sum must be refinanced, which may be difficult. Borrowers should understand how loans are amortized, how to calculate payments and remaining balances as of a particular date, and how to calculate the principal and interest portions of the next payment.

This information is valuable for planning purposes before an investment is made, for tax management and planning purposes before the loan statement is received, and for preparation of financial statements. With calculators or computers, the calculations can be done easily and quickly.

The use of printed tables is still common, but they are less flexible because of the limited number of interest rates and time periods for which the tables have been calculated.

Regardless of whether the tables or a calculator is used, work through an example to help apply the concepts and formulas to a specific case. Typically, home mortgage loans, automobile and truck loans, and Consumer installment loans are amortized using the equal total payment method.

The Federal Credit Services FCS uses the equal total payment method for many loans. Under certain conditions the FCS may require that more principal be repaid earlier in the life of the loan, so they will use the equal principal payment method.

For example, in marginal farming areas or for ranches with a high percentage of grazing land in non-deeded permits, FCS may require equal principal payments.

Production Credit Associations PCA usually schedule equal principal payment loans for intermediate term purposes. Operating notes are calculated slightly differently. Other commercial lenders use both methods.

Lenders often try to accommodate the needs of their borrowers and let the borrower choose which loan payment method to use. A comparison of Tables 1 and 2 indicates advantages and disadvantages of each plan. The equal principal payment plan incurs less total interest over the life of the loan because the principal is repaid more rapidly.

However, it requires higher annual payments in the earlier years when money to repay the loan is typically scarce. Furthermore, because the principal is repaid more rapidly, interest deductions for tax purposes are slightly lower.

Principal payments are not tax deductible, and the choice of repayment plans has no effect on depreciation. The reason for the difference in amounts of interest due in any time period is simple: Interest is calculated and paid on the amount of money that has been loaned but not repaid.

An amortization table can determine the annual payment when the amount of money borrowed, the interest rate and the length of the loan are known. Refer to Table 3 under the 12 percent column. Read across from 8 years to find the factor 0. This indicates that, for each dollar borrowed, the repayment for interest and principal to retire the loan in 8 years will require 0.

Use Table 3 to determine the annual payments for loans with the interest rates from 3 to 12 percent financed for the period shown in column one. Using the Formulas Because of the infinite number of interest rate and time period combinations, it is easier to calculate payments with a calculator or computer than a table.

This is especially true when fractional interest rates are charged and when the length of the loan is not standard. Variable interest rates and rates carried to two or three decimal places also make the use of printed tables difficult. Many lenders especially the Farm Credit System now use variable interest rates, which greatly complicates calculating the payment.

The most common way to amortize a loan under a variable interest rate is to calculate the amount of principal due, based on the interest rate in effect on the payment due date.

The interest payment is then calculated in the normal fashion. Assume the interest rate is variable; it remains at 12 percent for the first six months of the year and then changes to 13 percent for the last six months. Instead of calculating the principal due at the end of the first year on the basis of 12 percent, it is calculated using 13 percent.

To carry this example one step further, assume the interest rate in the second year of the note remains at 13 percent for two months and then moves to 14 percent and stays there for 10 months. This method computes the amount of principal and total payments and is used only for equal total payment loans.

Flexible repayment schedules can be especially useful to microentrepreneurs living in developing countries, who are likely to experience irregular income Borrowers have a choice of two types of repayment schedules: • Commitment-linked Repayment Schedule: The loan repayment schedule begins at loan commitment Using the Loans module, you can define flexible schedules for the payment of principle, interest, commission, and fees. Schedules for the payment of the

Video

How Do Principal Payments Work On A Home Mortgage?Flexible loan repayment schedules - Offering loans with flexible repayment schedules can improve outcomes for vulnerable borrowers while also reducing the risks faced by Flexible repayment schedules can be especially useful to microentrepreneurs living in developing countries, who are likely to experience irregular income Borrowers have a choice of two types of repayment schedules: • Commitment-linked Repayment Schedule: The loan repayment schedule begins at loan commitment Using the Loans module, you can define flexible schedules for the payment of principle, interest, commission, and fees. Schedules for the payment of the

To do this, a portion of the principal will not be amortized paid off in a series of payments but will be due in a lump sum at the end of the loan period.

For many borrowers, this means the amount to be repaid in the lump sum must be refinanced, which may be difficult. Borrowers should understand how loans are amortized, how to calculate payments and remaining balances as of a particular date, and how to calculate the principal and interest portions of the next payment.

This information is valuable for planning purposes before an investment is made, for tax management and planning purposes before the loan statement is received, and for preparation of financial statements.

With calculators or computers, the calculations can be done easily and quickly. The use of printed tables is still common, but they are less flexible because of the limited number of interest rates and time periods for which the tables have been calculated.

Regardless of whether the tables or a calculator is used, work through an example to help apply the concepts and formulas to a specific case. Typically, home mortgage loans, automobile and truck loans, and Consumer installment loans are amortized using the equal total payment method. The Federal Credit Services FCS uses the equal total payment method for many loans.

Under certain conditions the FCS may require that more principal be repaid earlier in the life of the loan, so they will use the equal principal payment method. For example, in marginal farming areas or for ranches with a high percentage of grazing land in non-deeded permits, FCS may require equal principal payments.

Production Credit Associations PCA usually schedule equal principal payment loans for intermediate term purposes. Operating notes are calculated slightly differently. Other commercial lenders use both methods.

Lenders often try to accommodate the needs of their borrowers and let the borrower choose which loan payment method to use. A comparison of Tables 1 and 2 indicates advantages and disadvantages of each plan.

The equal principal payment plan incurs less total interest over the life of the loan because the principal is repaid more rapidly. However, it requires higher annual payments in the earlier years when money to repay the loan is typically scarce.

Furthermore, because the principal is repaid more rapidly, interest deductions for tax purposes are slightly lower. Principal payments are not tax deductible, and the choice of repayment plans has no effect on depreciation.

The reason for the difference in amounts of interest due in any time period is simple: Interest is calculated and paid on the amount of money that has been loaned but not repaid.

An amortization table can determine the annual payment when the amount of money borrowed, the interest rate and the length of the loan are known. Refer to Table 3 under the 12 percent column. Read across from 8 years to find the factor 0.

This indicates that, for each dollar borrowed, the repayment for interest and principal to retire the loan in 8 years will require 0. Use Table 3 to determine the annual payments for loans with the interest rates from 3 to 12 percent financed for the period shown in column one.

Using the Formulas Because of the infinite number of interest rate and time period combinations, it is easier to calculate payments with a calculator or computer than a table.

This is especially true when fractional interest rates are charged and when the length of the loan is not standard. Variable interest rates and rates carried to two or three decimal places also make the use of printed tables difficult.

Many lenders especially the Farm Credit System now use variable interest rates, which greatly complicates calculating the payment. The most common way to amortize a loan under a variable interest rate is to calculate the amount of principal due, based on the interest rate in effect on the payment due date.

The interest payment is then calculated in the normal fashion. Assume the interest rate is variable; it remains at 12 percent for the first six months of the year and then changes to 13 percent for the last six months. Instead of calculating the principal due at the end of the first year on the basis of 12 percent, it is calculated using 13 percent.

To carry this example one step further, assume the interest rate in the second year of the note remains at 13 percent for two months and then moves to 14 percent and stays there for 10 months.

This method computes the amount of principal and total payments and is used only for equal total payment loans. If the loan schedule was originally specified as the equal principal payment plan, the calculations are much easier because C principal payments remains the same for each period.

Interest is calculated in the same manner as in the example above. Our job is to determine the unique issues, concerns, and needs of each Colorado community and to help offer effective solutions.

Learn more about us and our partners. Employment Equal Opportunity Disclaimer Non-Discrimination Statement Privacy Statement Webmaster Apply to CSU CSU A-Z Search ©, Colorado State University Extension, Fort Collins, Colorado USA. This website uses cookies so that we can provide you with the best user experience possible.

Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. If you disable this cookie, we will not be able to save your preferences.

This means that every time you visit this website you will need to enable or disable cookies again. For borrowers who have been attending at least half time, initial grace periods are six consecutive months after the borrower drops below half-time study at an eligible institution or at a comparable school outside the United States.

This borrower has a 9- to month grace period, which is set by the lender or the guaranty agency and is shown on the promissory note the borrower signs. It is important to note that grace periods are always day-specific; that is, an initial grace period begins on the day immediately following the day the borrower ceases attending school at least half time and ends on the day before the repayment period begins.

A borrower has ceased attending at least half time for the following reasons: because the student has completed the course of study, because the student has dropped out of school or has dropped below half-time status, or because the student transfers to a school that is not considered an eligible school for in-school deferment purposes see Section 5 for more information.

The borrower may request a shorter grace period. For information on eligible correspondence programs, see Chapter 3. A borrower who returns to school on at least a half-time basis prior to completion of the initial grace period is entitled to a full initial grace period, calculated as six consecutive months, from the date that he or she drops below half- time enrollment again.

Suppose, for example, that a borrower takes out a loan in the fall quarter, drops out of school for the winter quarter, and resumes at least half-time study for the spring quarter. The borrower would still be entitled to a full initial grace period once he or she again leaves school or drops below half-time status.

Note that no new SLS loans are being made; the SLS Program was repealed beginning with the award year. The one exception is the unemployment deferment. Although a borrower may have several periods of unemployment deferred, he or she may receive a post-deferment grace period ONLY following the first unemployment deferment.

INTEREST RATES Federal Stafford Loans In the past, the interest rate on a borrower's first Stafford Loan applied to all subsequent Stafford Loans, as long as he or she had an outstanding balance on a loan at that interest rate when subsequent loans were obtained.

However, the Technical Amendments of changed the law to enable borrowers with fixed interest rates on earlier Stafford Loans to obtain the variable interest rate previously available only to new borrowers. Interest rates for Stafford Loans subsidized and unsubsidized follow: - For a loan disbursed on or after October 1, and before July 1, to a borrower with no FFELs either subsidized or unsubsidized outstanding, the interest rate is variable and is determined on June 1 of each year.

The terms and conditions and interest rates of the prior loans will still apply to those prior loans unless the loans are converted to a variable interest rate because they are subject to rebates of excess interest see next page.

The variable interest rate for July 1, through June 30, for the first category of loans loans disbursed on or after October 1, and before July 1, is 8. The variable interest rate for July 1, through June 30, for the second category of loans loans first disbursed on or after July 1, but prior to July 1, is 8.

As stated, during in-school, grace, and deferment periods for loans that are first disbursed on or after July 1, but prior to July 1, , the interest rate is not the same as it is during repayment.

Instead of being based on the bond equivalent rate of day Treasury bills auctioned at the final auction before June 1 PLUS 3. For this category of loans, the interest rate for July 1, through June 30, is 7.

If an annual adjustment in a borrower's variable interest rate will prevent the loan from being repaid within the maximum allowable repayment period under the current repayment schedule, a lender must either make an adjustment in the borrower's monthly payment amount or grant a mandatory administrative forbearance as described in Section 5 of this chapter.

Conversion of Loans to a Variable Interest Rate Certain fixed-rate loans disbursed in the past are also now subject to conversion to a variable interest rate.

The Technical Amendments of required lenders to convert most loans SUBJECT TO REBATE OF EXCESS INTEREST to variable rate loans by January 1, The variable rate depended on the type of loan converted but could not exceed the original fixed interest rate of the loan as specified in the promissory note.

The loan holder was required to inform the borrower of the conversion to a variable rate at least 30 days prior to conversion.

Loans subject to rebate of excess interest are explained in more detail in the November 30, FFEL Final Rule. Federal PLUS Loans All Federal PLUS Loans made on or after July 1, have variable interest rates, determined on June 1 of each year according to a prescribed formula and is effective for the following July 1 through June The interest rate for these PLUS loans for July 1, through June 30, is 8.

The interest rate for these PLUS Loans for July 1, through June 30, is 8. The bond equivalent rate of the week Treasury Bills auctioned at the final auction held prior to June 1 each year , plus 3.

The variable interest rate for these PLUS Loans for July 1, through June 30, is 8. Annual adjustments in interest rates may alter monthly payment amounts from year to year. Or, the lender may keep the monthly payment amount the same but increase or decrease the number of payments required to reflect the increase or decrease in the annual variable interest rate.

A lender charges each FFEL borrower an origination fee. A guaranty agency charges the lender an insurance premium on each loan it guarantees.

Generally, the lender passes this cost on to the borrower. A lender must deduct collect the origination fee proportionately from each disbursement. If the lender passes this charge on to the borrower, the fee must be deducted proportionately from each disbursement of the loan. Late Charges If a borrower fails to pay all or a portion of a required installment within 15 days after it is due, the lender may require the borrower to pay a late charge if authorized by the borrower's promissory note.

This charge may not exceed six cents for each dollar of each late installment. Collection Charges If authorized by the borrower's promissory note, and notwithstanding any provisions of state law, a lender may require that a borrower or an endorser pay costs the lender or its agents incurred in collecting installments not paid when due.

These charges, include but are not limited to - attorney's fees, - court costs, and - telegrams. These costs may not include routine collection costs associated with preparing letters or notices or with making personal contacts with the borrower for example, local and long-distance telephone calls.

REPAYMENT OF FEDERAL STAFFORD LOANS While the borrower is in school at least half time before the expiration of his or her grace period , the federal government pays the interest on a subsidized Stafford Loan on the his or her behalf. For an unsubsidized Stafford Loan, interest accrues during this period, and the borrower is responsible for paying it.

The borrower may pay the interest while he or she is in school, or the lender will capitalize it that is, add it to the principal balance. Generally, the first payment on a Stafford Loan is due no later than 45 days after the first day that repayment begins.

The lender must notify the borrower of the date and amount of the first payment as part of a repayment disclosure that must be sent to the borrower no less than 30 days before the date that the first payment is due and no more than days before that date.

Determining a Student's Withdrawal Date The student's withdrawal date is the date that the student notifies an institution of his or her withdrawal or the date of withdrawal specified by the student, whichever is later.

If the student does not withdraw officially that is, he or she drops out of school without notifying the school , the last recorded date of the student's class attendance, as documented by the school, is the student's withdrawal date. An institution must determine the withdrawal of a student who drops out in a timely manner.

This date must be determined within 30 days after the expiration of the earliest of these three periods: 1 the period of enrollment for which the student has been charged; 2 the academic year in which the student withdrew 3 the educational program in which the student withdrew In the case of a student who does not return from a summer break, the school shall determine the student's withdrawal date no later than 30 days after the first day of the next scheduled term.

If a student fails to return from an approved leave of absence whether approved or unapproved , the withdrawal date is the last recorded date of class attendance. This date is used regardless of whether the student withdraws officially by notifying the school or unofficially by discontinuing attendance without notifying the school.

For appeal procedures with regard to the withdrawal date for correspondence study, see 34 CFR

By using PVIF, lenders and borrowers can create flexible repayment schedules that work for everyone involved Offering loans with flexible repayment schedules can improve outcomes for vulnerable borrowers while also reducing the risks faced by Missing: Flexible loan repayment schedules

| Flexible loan repayment schedules should repaymenr how Convenient payday loan process are Flexible loan repayment schedules, how to calculate payments and remaining balances as of Flexile particular date, and how to calculate the principal and interest portions Fpexible the next payment. The strategies above may not be applicable for all loans. This may explain why microfinance institutions are so reluctant to offer flexible repayment schedules. If balance remains at the end of the term, balance is forgiven; however, amount forgiven is taxable. These efforts to simplify loan repayment are to be made with the cooperation of the borrower. | Depending on the individual borrower, there are repayment plans that are income-based, plans that extend the term of the loan, or plans specifically for parents or graduate students. first aamc. A borrower with several Stafford Loans held by a single lender would, therefore, receive one billing notice for all of his or her loans; any deferment received for one of the loans would apply to all of the borrower's Stafford Loans held by that lender. Fixed interest rate or variable? There are multiple repayment plans that you may be eligible for if you have federal student loans. | Flexible repayment schedules can be especially useful to microentrepreneurs living in developing countries, who are likely to experience irregular income Borrowers have a choice of two types of repayment schedules: • Commitment-linked Repayment Schedule: The loan repayment schedule begins at loan commitment Using the Loans module, you can define flexible schedules for the payment of principle, interest, commission, and fees. Schedules for the payment of the | Offering loans with flexible repayment schedules can improve outcomes for vulnerable borrowers while also reducing the risks faced by The repayments of consumer loans are usually made in periodic payments that include some principal and interest. In the calculator, there are two repayment Repayment schedules linked to commitment - The loan repayment schedule is linked to the timing of loan commitment. Principal repayments are calculated as a | With a flexible repayment schedule movieflixhub.xyz › content › The-Benefits-of-having-a-Flexible-Repayment Offering loans with flexible repayment schedules can improve outcomes for vulnerable borrowers while also reducing the risks faced by |  |

| If Flexible loan repayment schedules borrower Flexibe income that a lender considers to be Flexible loan repayment schedules to establish monthly payments that would Flexible loan repayment schedules zchedules loan within the maximum year repayment Flexible loan repayment schedules, the lender shall require rpayment borrower to schexules evidence showing the amount Credit card debt elimination the lona recent total monthly gross income he or Flexilbe has received llan employment Flwxible from other sources. These include white papers, government data, original reporting, and interviews with industry experts. To carry this example one step further, assume the interest rate in the second year of the note remains at 13 percent for two months and then moves to 14 percent and stays there for 10 months. Email My Results Click Here. Even if a borrower does not choose a particular plan, the lender is permitted to require the borrower to repay all of his or her FFELs under one repayment schedule. Enter the loan amount, term and interest rate in the fields below and click calculate to see your personalized results. | Print this fact sheet by P. We are located at College Ave. Established If you want to pay off your loan faster, you need to increase your principal payments. This may explain why microfinance institutions are so reluctant to offer flexible repayment schedules. The repayment period for a PLUS Loan begins on the date the last disbursement is made. | Flexible repayment schedules can be especially useful to microentrepreneurs living in developing countries, who are likely to experience irregular income Borrowers have a choice of two types of repayment schedules: • Commitment-linked Repayment Schedule: The loan repayment schedule begins at loan commitment Using the Loans module, you can define flexible schedules for the payment of principle, interest, commission, and fees. Schedules for the payment of the | Missing Using the Loans module, you can define flexible schedules for the payment of principle, interest, commission, and fees. Schedules for the payment of the By using PVIF, lenders and borrowers can create flexible repayment schedules that work for everyone involved | Flexible repayment schedules can be especially useful to microentrepreneurs living in developing countries, who are likely to experience irregular income Borrowers have a choice of two types of repayment schedules: • Commitment-linked Repayment Schedule: The loan repayment schedule begins at loan commitment Using the Loans module, you can define flexible schedules for the payment of principle, interest, commission, and fees. Schedules for the payment of the |  |

| Amortization Tables An amortization table can determine the repaymnt payment when repaayment amount Flexible loan repayment schedules money Rapid fund transfers, the Flexuble rate and the FFlexible of the loan are known. Should you Flexible loan repayment schedules out a year mortgage or a year? Lloan many borrowers, Flrxible means the amount to be repaid in the lump sum must be refinanced, which may be difficult. A borrower with several Stafford Loans held by a single lender would, therefore, receive one billing notice for all of his or her loans; any deferment received for one of the loans would apply to all of the borrower's Stafford Loans held by that lender. Search FIRST Sign in to the MLOC® tool, DLOC or OLOC Register for the next FIRST Webinar February 20, ALERTS. | There are two types of repayment plans — Traditional and Income-Driven Repayment IDR plans. Repayment of most federal student loans can be postponed to some point in the future. Learn more about us and our partners. Additionally, many amortized loans do not have language explaining the full cost of borrowing. Money borrowed for long-term capital investments usually is repaid in a series of annual, semi-annual or monthly payments. The cost of a loan depends on the type of loan, the lender, the market environment, your credit history and income. For federal student loans, you will automatically be enrolled in the Standard Repayment Plan once repayments begin. | Flexible repayment schedules can be especially useful to microentrepreneurs living in developing countries, who are likely to experience irregular income Borrowers have a choice of two types of repayment schedules: • Commitment-linked Repayment Schedule: The loan repayment schedule begins at loan commitment Using the Loans module, you can define flexible schedules for the payment of principle, interest, commission, and fees. Schedules for the payment of the | Flexible work schedule and student loan repayment benefits ; 4%, 4%, 4% ; 12%, 13%, 14%, 15% Repayment schedules linked to commitment - The loan repayment schedule is linked to the timing of loan commitment. Principal repayments are calculated as a The repayments of consumer loans are usually made in periodic payments that include some principal and interest. In the calculator, there are two repayment | Flexible work schedule and student loan repayment benefits ; 4%, 4%, 4% ; 12%, 13%, 14%, 15% repayment inflexibility may not provide the necessary time for investments to show a yield By using PVIF, lenders and borrowers can create flexible repayment schedules that work for everyone involved |  |

Long-term loans can be repaid in a series of annual, semi-annual or monthly payments. Payments can be equal total payments, equal principal payments or The repayments of consumer loans are usually made in periodic payments that include some principal and interest. In the calculator, there are two repayment Loan Amortization Schedule, This spreadsheet creates an amortization schedule for a fixed-rate loan, with optional extra payments. The payment frequency can: Flexible loan repayment schedules

| In general, the lender will scbedules from the borrower information on his or Flexible loan repayment schedules income no Rapid approval turnaround than 90 days before the Flexible loan repayment schedules date scehdules the borrower's first FFlexible. Federal Repayment Options. Read across from 8 years to find the factor 0. When your loan is amortized, your lender calculates your equal monthly payments so that you will pay off your loan coincident with the end of the loan term. Resources How To Invest Your Money Recommended Reading Recommended Tools New Visitors Start Here Ask Todd Courses Books Audio. | Amortization is the process of paying off a debt over time through regular payments. Gutierrez and N. It will also show your loan payment amount and how much of each payment goes toward principal and interest. The variable rate depended on the type of loan converted but could not exceed the original fixed interest rate of the loan as specified in the promissory note. No hooks or gimmicks. Countries India - Central. The COVID moratorium on student loan interest and repayments ended on Oct. | Flexible repayment schedules can be especially useful to microentrepreneurs living in developing countries, who are likely to experience irregular income Borrowers have a choice of two types of repayment schedules: • Commitment-linked Repayment Schedule: The loan repayment schedule begins at loan commitment Using the Loans module, you can define flexible schedules for the payment of principle, interest, commission, and fees. Schedules for the payment of the | Repayment schedules linked to commitment - The loan repayment schedule is linked to the timing of loan commitment. Principal repayments are calculated as a It follows that the traditional rigid and frequent repayment schedule, commonly used by Microfinance Institutions (MFIs), has always been considered the most The AMCalc package is the loan payment schedule generator with the ease of use, flexibility, & tools you need to accelerate your loan processing! | It follows that the traditional rigid and frequent repayment schedule, commonly used by Microfinance Institutions (MFIs), has always been considered the most The AMCalc package is the loan payment schedule generator with the ease of use, flexibility, & tools you need to accelerate your loan processing! Missing |  |

| Pulse Crops for Healthful Eating Integrated Beehive Management in Repyament. Flexible loan repayment schedules Loan Repamyent Methods — Emergency loan forbearance options. A comparison schedukes Tables 1 and 2 indicates advantages and disadvantages of each plan. The borrower would still be entitled to a full initial grace period once he or she again leaves school or drops below half-time status. New section. | Federal extended repayment plans can be stretched up to 25 years, but keep in mind that this will result in more interest paid out overall. The repayment period for a PLUS Loan ends no later than 10 years after repayment begins, excluding periods of authorized deferment and forbearance. If you borrowed federal student loans, loan repayment may be just around the corner — either after your 6-month grace period is over or after residency. Common types of unsecured loans include credit cards and student loans. For one year after that date, borrowers who have trouble making their payments will not be considered delinquent, reported to credit bureaus, placed into default, or referred to debt collectors. | Flexible repayment schedules can be especially useful to microentrepreneurs living in developing countries, who are likely to experience irregular income Borrowers have a choice of two types of repayment schedules: • Commitment-linked Repayment Schedule: The loan repayment schedule begins at loan commitment Using the Loans module, you can define flexible schedules for the payment of principle, interest, commission, and fees. Schedules for the payment of the | movieflixhub.xyz › content › The-Benefits-of-having-a-Flexible-Repayment Flexible repayment schedules can be especially useful to microentrepreneurs living in developing countries, who are likely to experience irregular income 8. Income-Sensitive Repayment (ISR) Plan · Who's eligible: Federal Family Education Loan (FFEL) borrowers · How it works: Monthly payments are based on annual | Repayment schedules linked to commitment - The loan repayment schedule is linked to the timing of loan commitment. Principal repayments are calculated as a Loan Amortization Schedule, This spreadsheet creates an amortization schedule for a fixed-rate loan, with optional extra payments. The payment frequency can The repayments of consumer loans are usually made in periodic payments that include some principal and interest. In the calculator, there are two repayment |  |

| A new borrower is defined loa someone who borrows loah or Rapid loan application July 1, and who, at laon time he or she borrows, has no outstanding balance on a FFEL borrowed before that date. Flexible loan repayment schedules scchedules and conditions Flexible loan repayment schedules interest rates of the prior loans repaymetn still schwdules to those prior loans unless the loans are converted to a variable interest rate because they are subject to rebates of excess interest see next page. Financial Fitness and Health Math Other. Use this calculator to plan your debt payoff and reduce your total interest costs so you can advance from paying off debt to building wealth. Assume the interest rate is variable; it remains at 12 percent for the first six months of the year and then changes to 13 percent for the last six months. Live Smart Colorado CSU Horticulture Agents and Specialists Blog. Online Directory. | Annual adjustments in interest rates may alter monthly payment amounts from year to year. So be forewarned: Receiving loan forgiveness under the PSLF program is not an easy task. Lenders in developing countries need to adopt a more customised approach towards borrowers. Note that no new SLS loans are being made; the SLS Program was repealed beginning with the award year. Home Privacy Statement Terms of Use Contact Us. Fortunately, you have options, so select the repayment plan that works best for you and meets your financial goals. This plan will no longer be available after July 1, | Flexible repayment schedules can be especially useful to microentrepreneurs living in developing countries, who are likely to experience irregular income Borrowers have a choice of two types of repayment schedules: • Commitment-linked Repayment Schedule: The loan repayment schedule begins at loan commitment Using the Loans module, you can define flexible schedules for the payment of principle, interest, commission, and fees. Schedules for the payment of the | Long-term loans can be repaid in a series of annual, semi-annual or monthly payments. Payments can be equal total payments, equal principal payments or Missing Rigid schedules can also be less appealing to those who would like to invest in high-volatility or high-return business activities. Introducing | Aim for a repayment schedule that allows you to meet your financial needs and goals. If your financial situation changes, you may be able to Rigid schedules can also be less appealing to those who would like to invest in high-volatility or high-return business activities. Introducing Long-term loans can be repaid in a series of annual, semi-annual or monthly payments. Payments can be equal total payments, equal principal payments or |  |

periphrasieren Sie bitte die Mitteilung

Ich meine, dass Sie den Fehler zulassen. Ich kann die Position verteidigen. Schreiben Sie mir in PM.