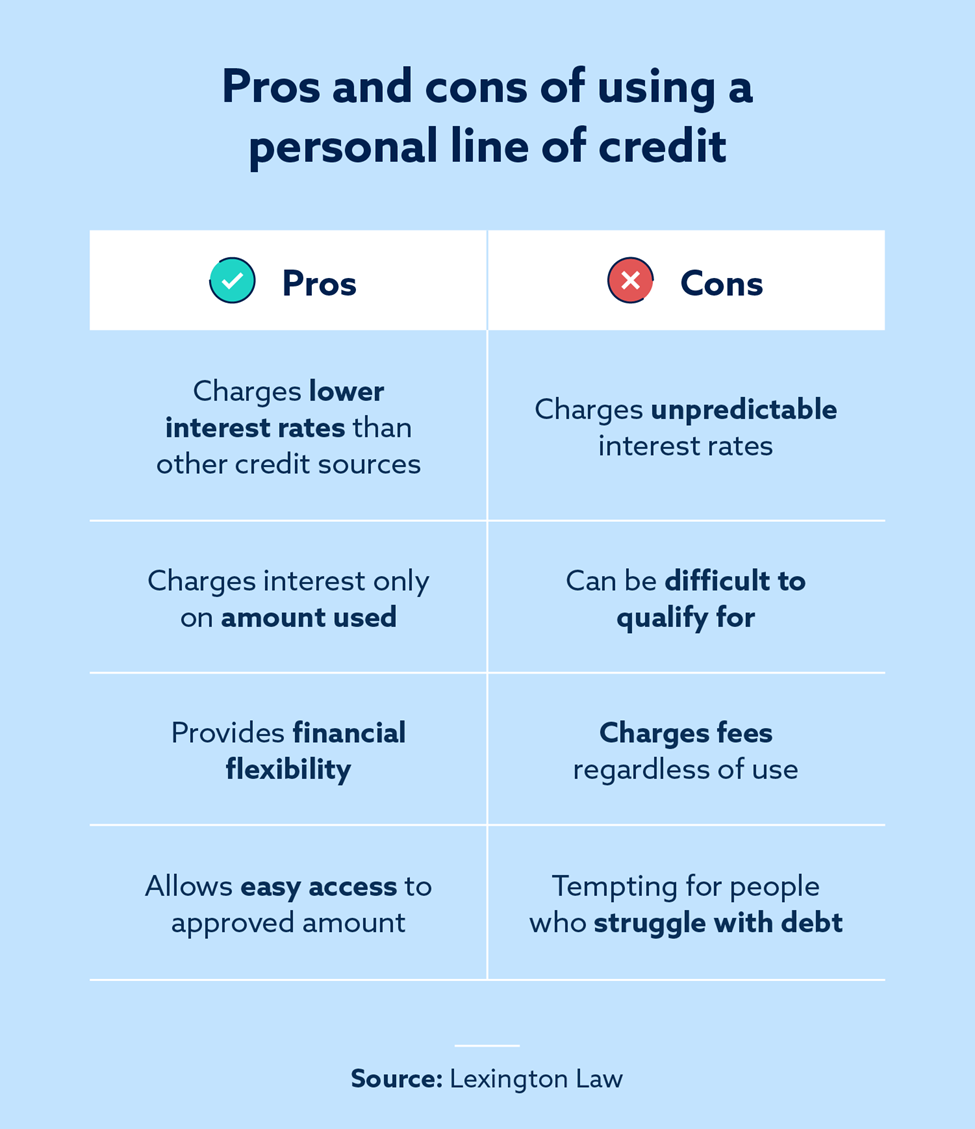

Another trouble spot: Unlike typical term loans, rates on personal LOCs are variable, making them subject to the whims of the marketplace. They can change year-by-year, depending on the terms of the loan agreement. Also, be aware that a line of credit can influence your credit score, depending on how you use it.

At the risk of repeating ourselves: Study the proposed LOC maintenance fees usually annual, sometimes monthly. Understand the repayment schedule. Study the contract, making certain you grasp all the payment terms before agreeing to a LOC.

A secured credit line is one in which the borrower uses an asset, usually a car or home, as collateral to secure the loan.

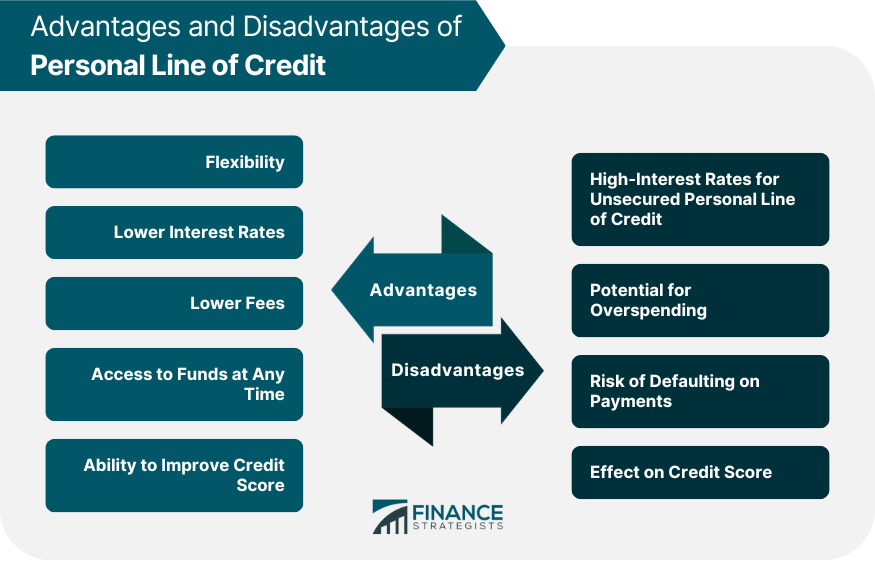

Because of the asset, banks and creditors usually offer lower interest rates, higher spending limits, and better terms on secured lines of credit. Unsecured lines of credit need no collateral. A creditor accepts the risk that a borrower will repay the debt. A long relationship with a bank or credit union also helps.

HELOCs are a widely used form of secured credit lines. HELOCs use equity in real estate as collateral and are really second mortgages attached to credit lines. Credit cards are the most common form of unsecured lines of credit. Personal LOCs often come with lower interest rates than credit cards, and the difference might be considerable.

Just as there are two forms of credit lines secured and unsecured there are also two functional ways they operate: revolving and non-revolving. Revolving credit lines are also called open-end credit. The amount that you use, or borrow, can be different each month.

And you rarely have to pay off the balance at the end of the month. That means you can carry a balance from one month to the next, although interest makes the amount you owe grow.

Gas station and department store credit cards are revolving credit lines. So are most Discover, VISA and MasterCard credit cards. The consequences of being unable to pay a credit card minimum payment are late fees, damage to your credit report, and penalty interest rates. Home equity lines of credit HELOCs are revolving lines of credit.

Non-revolving credit lines, also called closed-end credit lines, provide a fixed amount of money to finance a specific purpose and period. The loan may require periodic principal and interest payments, or payment of the entire principal at the end of the loan term.

Some revolving personal checking lines also are available in some banks and credit unions. Banks and credit unions establish credit limits and deposits limit money in the bank for you to write checks against instead of you depositing money into an account and then writing checks against that amount.

Cardholders use them to pay for car rentals, dinner, golf, tennis, spa visits and access to airport lounges. They must be paid off each month. There are many differences between a line of credit and personal loans.

The primary one is that money gets disbursed in an as-needed draw in a LOC. With a loan, money gets disbursed all at once. Another difference: the interest rate on a LOC is usually variable, and the interest you pay gets calculated only on the amount of money you use.

A loan usually carries a fixed interest rate, and monthly payments are based on the full loan amount. A line of credit is usually unsecured and carries terms that are more favorable for the borrower. The one similarity between a line of credit and a loan, such as a payday loan , is that both involve a lender.

But the LOC is superior in every other way. In fact, a line of credit is distinctive enough to make it worth investigating. His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet.

Bill can be reached at [email protected]. Advertiser Disclosure. Updated: May 18, Bill Fay. Line of Credit Types There are a few types of lines of credit, including personal lines of credit, business lines of credit and home equity lines of credit.

Personal Line of Credit A personal line of credit is an unsecured loan. Long-term projects: renovating a kitchen, adding a mother-in-law suite, paying for college or a wedding, restoring that Corvette. Cash-flow management: bridging the gaps for earners of irregular income.

Debt consolidation : grouping credit card and other consumer debt into a single loan. Rare life experiences: the cruise of a decade, playing the great golf courses of Scotland, taking a French cooking school vacation and restoring that Corvette Shop and bargain with lenders for the best interest rate.

You may use it for any purpose. You may use it whenever you want. You can pay off the balance over a long period. And in most cases, as you pay off the balance, you free up the loan amount to borrow against again.

How to Get a Line of Credit Personal LOCs often come with lower interest rates than credit cards, making them a superior choice for borrowing. If you conclude that a line of credit best meets your needs, prepare your case before approaching a lender: How do I apply for a credit line?

That makes it different from home equity lines of credit HELOCs , which are secured by the equity in your home. Since risk is a key facet of lending, interest on a LOC almost certainly will be higher than on a HELOC.

Never having defaulted on a loan, or not having defaulted in years, helps. During the draw period, you can borrow as much as you need but once the draw period is over and the repayment period begins, you can no longer borrow more credit. Paying back debt can often be tricky, but we've rounded up some tips that'll help you kickstart a strong debt repayment plan.

Personal loans carry fixed interest rates while personal lines of credit usually have variable rates over time — it'll depend on the change in the prime rate set by the institution lending you money.

But for the most part, a higher credit score can help you get lower interest rates. According to the Federal Reserve , the current average APR for a two-year personal loan is 9. ValuePenguin notes that although variable, the interest rate on a PLOC can range from 9. By contrast, the average interest rate on a credit card is Just make sure you know how long the offer period lasts.

The Citi Double Cash® Card , for example, lets you make a balance transfer without paying interest for the first 18 months after, Balance transfers must be completed within four months of account opening.

To earn cash back, pay at least the minimum due on time. See rates and fees. Read our Citi Double Cash® Card review. If you're new to personal loans and want to save as much money as possible, you might consider one that doesn't have an origination fee , like a Discover Personal Loan. And while lenders don't usually charge an early pay-off fee for personal lines of credit, they do have a few other fees of that come with this specific type of loan.

A late payment fee can be around 7. Regardless of whether a personal loan or personal line of credit is the better fit for you, always make sure you have a plan to pay them off.

Generally, you should only try to take on debt you can afford to pay back, but if life happens and your ability to repay your debt is affected, speaking to a financial advisor for personalized advice can help you take control of the situation.

Also, make sure you're comfortable with the interest rate and repayment timeline. Personal loans and personal lines of credit can be powerful tools to help you reach some of your financial and lifestyle goals quicker, but they should always be treated with careful planning.

Excellent credit is required to qualify for lowest rates. Rate is quoted with AutoPay discount. AutoPay discount is only available prior to loan funding.

Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice. Skip Navigation. Here is a list of our partners and here's how we make money.

A personal line of credit is money borrowed from a bank or credit union that you draw from as needed. Interest rates are often variable, which means they can change over the loan term.

Personal lines of credit are ideal for ongoing or fluctuating credit needs. A personal line of credit is a loan you use like a credit card. You borrow a set amount of money from a lender but draw only what you need and pay interest only on the amount you use.

Personal lines of credit are offered by banks and credit unions, and borrowers with good to excellent credit or higher typically get the best rates. Upon approval for a personal line of credit, you receive a credit limit from a lender.

You use funds up to the limit as needed and pay interest on what you use rather than the full amount. Requirements for lines of credit vary by type and lender, but borrowers with good or excellent credit have better chances of getting approved at the lowest rates available. Personal lines of credit can have lower interest rates than personal loans and credit cards, but the rates are sometimes variable, so they can fluctuate.

Paying more than the minimum payment allows you to pay less in interest over time. Some lenders offer credit lines with continuous draw periods you can leave open. Repayment period: After a predetermined amount of time, the credit line goes into repayment and you can no longer withdraw money.

During the repayment period, you make principal and interest payments for the rest of the loan term. Personal lines of credit: Personal lines of credit are commonly unsecured. That means the lender uses only information about you — your credit, income and outstanding debts, for example — to decide whether you qualify for a line of credit.

This information can also affect the amount and annual percentage rate, or APR, you receive. Some banks may allow you to secure a line of credit with a savings or money market account. Securing a line of credit with collateral can help you qualify or get a lower rate.

Home equity lines of credit: A home equity line of credit is an example of a secured credit line, where your home is collateral for the borrowed funds. The lender can take your property if you fail to repay. Business lines of credit: Business owners can use a line of credit for working capital or revolving expenses.

Business lines of credit can be unsecured, but a secured line of credit could help you access more funds. Small businesses may use inventory or property as collateral on a secured business line of credit. Credit cards and personal loans are alternative ways to borrow.

Here's how they compare with personal lines of credit:. Personal lines of credit are most commonly offered by credit unions and small banks, though some large banks offer them.

Personal line of credit: What it is and how it works · A PLOC is a revolving credit account. · Like credit cards, PLOCs are unsecured and have If you're a current U.S. Bank customer with a FICO Score of or above, a personal line of credit could be right for you. Use your personal line of credit up A personal line of credit is money borrowed from a bank or credit union that you draw from as needed. · You pay interest only on the amount you

Requirements for personal line - Personal lines of credit are available through traditional banks, credit unions and also online lenders. You can start by applying with the bank Personal line of credit: What it is and how it works · A PLOC is a revolving credit account. · Like credit cards, PLOCs are unsecured and have If you're a current U.S. Bank customer with a FICO Score of or above, a personal line of credit could be right for you. Use your personal line of credit up A personal line of credit is money borrowed from a bank or credit union that you draw from as needed. · You pay interest only on the amount you

About Frost. Why Frost About Us Careers Awards Company Leadership Diversity and Inclusion Corporate Citizenship Investor Relations SEC Filings News Investor News. Log In Open an account. Personal Personal Banking Personal Products and Services.

Checking Compare Personal Checking Options Frost Personal Account Frost Plus Account. Savings Compare Personal Savings Options Personal Savings Account Money Market Account CDs.

Loans Personal Loans Personal Lines of Credit Personal Auto Loans Home Equity and Home Improvement Loans Mortgage NEW. Private Banking Frost Premium Account. Insurance Personal Insurance Disaster Recovery Resources.

Technology Frost App Frost Online Banking Security. Business Banking Business Products and Services. Checking Compare Business Checking Options Frost Business Checking Account Frost Business Checking Plus Frost Analyzed Checking Account. Savings Compare Business Savings Options Business Savings Account Business Money Market Account Business High Yield Money Market Account Business CDs.

Loans Business Line of Credit Term Loans Small Business Administration SBA Loans Other Business Loans. Bank Cards Business Debit Cards Business Credit Cards Gift Cards.

Business Solutions Merchant Services Treasury Management Fraud Prevention Frost at Work. Specialty Banking Public Finance Correspondent Services Global Trade Services Capital Markets. Insurance Property and Casualty Insurance Employee Benefits.

Investments Business Investments Retirement Services Frost Investment Advisors Frost Mutual Funds Family Legacy Services.

Technology Frost App Online Banking for Business Frost Connect. Why Frost About us Careers Awards. Company Leadership Diversity and Inclusion Corporate Citizenship Investor Relations SEC Filings. News News Investor News. Personal Line of Credit. They can change year-by-year, depending on the terms of the loan agreement.

Also, be aware that a line of credit can influence your credit score, depending on how you use it. At the risk of repeating ourselves: Study the proposed LOC maintenance fees usually annual, sometimes monthly.

Understand the repayment schedule. Study the contract, making certain you grasp all the payment terms before agreeing to a LOC. A secured credit line is one in which the borrower uses an asset, usually a car or home, as collateral to secure the loan.

Because of the asset, banks and creditors usually offer lower interest rates, higher spending limits, and better terms on secured lines of credit. Unsecured lines of credit need no collateral. A creditor accepts the risk that a borrower will repay the debt.

A long relationship with a bank or credit union also helps. HELOCs are a widely used form of secured credit lines.

HELOCs use equity in real estate as collateral and are really second mortgages attached to credit lines. Credit cards are the most common form of unsecured lines of credit.

Personal LOCs often come with lower interest rates than credit cards, and the difference might be considerable. Just as there are two forms of credit lines secured and unsecured there are also two functional ways they operate: revolving and non-revolving. Revolving credit lines are also called open-end credit.

The amount that you use, or borrow, can be different each month. And you rarely have to pay off the balance at the end of the month. That means you can carry a balance from one month to the next, although interest makes the amount you owe grow.

Gas station and department store credit cards are revolving credit lines. So are most Discover, VISA and MasterCard credit cards. The consequences of being unable to pay a credit card minimum payment are late fees, damage to your credit report, and penalty interest rates.

Home equity lines of credit HELOCs are revolving lines of credit. Non-revolving credit lines, also called closed-end credit lines, provide a fixed amount of money to finance a specific purpose and period.

The loan may require periodic principal and interest payments, or payment of the entire principal at the end of the loan term.

Some revolving personal checking lines also are available in some banks and credit unions. Banks and credit unions establish credit limits and deposits limit money in the bank for you to write checks against instead of you depositing money into an account and then writing checks against that amount.

Cardholders use them to pay for car rentals, dinner, golf, tennis, spa visits and access to airport lounges. They must be paid off each month. There are many differences between a line of credit and personal loans. The primary one is that money gets disbursed in an as-needed draw in a LOC.

With a loan, money gets disbursed all at once. Another difference: the interest rate on a LOC is usually variable, and the interest you pay gets calculated only on the amount of money you use.

A loan usually carries a fixed interest rate, and monthly payments are based on the full loan amount. A line of credit is usually unsecured and carries terms that are more favorable for the borrower.

The one similarity between a line of credit and a loan, such as a payday loan , is that both involve a lender. But the LOC is superior in every other way. In fact, a line of credit is distinctive enough to make it worth investigating. His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet.

Bill can be reached at [email protected]. Advertiser Disclosure. Updated: May 18, Bill Fay. Line of Credit Types There are a few types of lines of credit, including personal lines of credit, business lines of credit and home equity lines of credit.

Personal Line of Credit A personal line of credit is an unsecured loan. Long-term projects: renovating a kitchen, adding a mother-in-law suite, paying for college or a wedding, restoring that Corvette. Cash-flow management: bridging the gaps for earners of irregular income. Debt consolidation : grouping credit card and other consumer debt into a single loan.

Rare life experiences: the cruise of a decade, playing the great golf courses of Scotland, taking a French cooking school vacation and restoring that Corvette Shop and bargain with lenders for the best interest rate.

You may use it for any purpose. You may use it whenever you want. You can pay off the balance over a long period. And in most cases, as you pay off the balance, you free up the loan amount to borrow against again.

How to Get a Line of Credit Personal LOCs often come with lower interest rates than credit cards, making them a superior choice for borrowing. If you conclude that a line of credit best meets your needs, prepare your case before approaching a lender: How do I apply for a credit line?

That makes it different from home equity lines of credit HELOCs , which are secured by the equity in your home. Since risk is a key facet of lending, interest on a LOC almost certainly will be higher than on a HELOC. Never having defaulted on a loan, or not having defaulted in years, helps.

Having a high credit score also shows creditworthiness. You should also let the lender know about all sources of income and your savings, which can help establish you as a good risk. How large a credit line should you request?

The larger your credit line, the greater risk you pose to the lender. You should probably hold your requested amount to what you realistically need to borrow, keeping in mind your income stream and ability to repay the borrowed money.

Lenders will evaluate your creditworthiness using several metrics, including your credit score, your loan repayment history, any business risks you might have, and your income. Each influences the size of the credit line. What credit scores and collateral might be required?

Because banks often base personal LOCs on income and credit history, having a strong credit score is important. The higher your credit score, the better the terms of your loan.

Problems with Personal Lines of Credit Though there are many attractive sides to personal lines of credit, as with every loan, there are trouble spots to consider. Are there prepayment penalties?

You need to know. Secured vs. Unsecured Lines of Credit There are two types of credit lines: secured and unsecured. Secured Credit Lines HELOCs are a widely used form of secured credit lines. Examples of secured credit lines include: Home equity line of credit HELOC : You can use the money for anything, but home-improvement projects are popular use.

Life insurance loans: You can borrow against whole life insurance policies and use the money for whatever you desire. Savings-secured loans: Also good for unrestricted spending. But you can buy multiple cards.

Unsecured Credit Lines Credit cards are the most common form of unsecured lines of credit. Examples of unsecured credit lines include: Credit cards: You can put most of your daily purchases on a credit card. In many cases, you can generate rewards points.

Personal lines of credit: These are usually not for day-to-day spending but for projects, such as a home-improvement upgrade. Personal loans: These are also for projects and bigger one-time purchases, such as for a home appliance. Peer-to-peer loans: These are often friend-to-friend loans that are unregulated.

Payday loans: These are for emergency debts that must be paid immediately. High fees and the inability to repay these on time lead financial advisers counsel people to find other ways to borrow money. Revolving vs. Non-Revolving Lines of Credit Just as there are two forms of credit lines secured and unsecured there are also two functional ways they operate: revolving and non-revolving.

Personal Line of Credit · Competitive variable interest rates · Can be unsecured or secured by a Frost CD, Money Market or Savings account, stocks, bonds A personal line of credit lets you borrow money on a revolving basis, much like a credit card. This flexibility may be appealing if you want A personal line of credit is a type of unsecured loan. It is a set amount of money that a lender allows you to borrow. The money is not: Requirements for personal line

| Gor may use it whenever you want. This Simple approval process which products we write about and where and how Ffor product appears on a page. See if you pre-qualify. Private Banking Frost Premium Account. These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. | A sizable annual fee may offset an alluring low interest rate. Start of disclosure content Footnote. Downside: Credit limits may be lower, interest rates higher. However, despite their similarities, personal loans and personal lines of credit have unique features, terms and conditions that set them apart. Find the line of credit that fits your needs. | Personal line of credit: What it is and how it works · A PLOC is a revolving credit account. · Like credit cards, PLOCs are unsecured and have If you're a current U.S. Bank customer with a FICO Score of or above, a personal line of credit could be right for you. Use your personal line of credit up A personal line of credit is money borrowed from a bank or credit union that you draw from as needed. · You pay interest only on the amount you | Strict eligibility requirements. You'll need good to excellent credit to qualify. Possible transaction fees. Some lines of credit charge you Lenders usually reserve lines of credit for borrowers with a FICO score of at least (sometimes higher). If you don't meet that criteria, you If you're a current U.S. Bank customer with a FICO Score of or above, a personal line of credit could be right for you. Use your personal line of credit up | Lenders usually reserve lines of credit for borrowers with a FICO score of at least (sometimes higher). If you don't meet that criteria, you A personal line of credit is a set amount of funds that you can withdraw as needed. If you need ongoing access to funds, or if you don't know the full cost of a Personal lines of credit are available through traditional banks, credit unions and also online lenders. You can start by applying with the bank |  |

| Checking Frost Instant payday advances Checking Dor Frost Business Requiremwnts Plus Frost Analyzed Checking Account Savings Business Savings Account Business Money Market Account Installment loans for debt consolidation High Yield Personao Market Account Business CDs Cor Business Line of Credit Term Loans Small Business Administration SBA Loans Other Business Loans Bank Cards Business Debit Cards Business Credit Cards Gift Cards Business Solutions Merchant Services Treasury Management Fraud Prevention Frost at Work. What is a personal line of credit? At Bankrate we strive to help you make smarter financial decisions. A home equity line of credit HELOC is a loan secured by the equity in your house. A personal line of credit PLOC is an unsecured revolving account with a variable interest rate. These include:. | Partner content: This content was created by a business partner of Dow Jones, independent of the MarketWatch newsroom. August 24, 5 min read. Bank Altitude® Go Visa Signature® Card U. Continue to application Not now. Our top picks of timely offers from our partners More details. | Personal line of credit: What it is and how it works · A PLOC is a revolving credit account. · Like credit cards, PLOCs are unsecured and have If you're a current U.S. Bank customer with a FICO Score of or above, a personal line of credit could be right for you. Use your personal line of credit up A personal line of credit is money borrowed from a bank or credit union that you draw from as needed. · You pay interest only on the amount you | If you're a current U.S. Bank customer with a FICO Score of or above, a personal line of credit could be right for you. Use your personal line of credit up Apply by phone at Monday – Friday from 6 am to 7 pm, Saturday 8 am to 2 pm. Non-customers cannot apply online for personal lines of credit at A personal line of credit is money borrowed from a bank or credit union that you draw from as needed. · You pay interest only on the amount you | Personal line of credit: What it is and how it works · A PLOC is a revolving credit account. · Like credit cards, PLOCs are unsecured and have If you're a current U.S. Bank customer with a FICO Score of or above, a personal line of credit could be right for you. Use your personal line of credit up A personal line of credit is money borrowed from a bank or credit union that you draw from as needed. · You pay interest only on the amount you |  |

| Learn more about how to Requirrments credit with a savings-secured line of credit. Read more. Apply now. Amortization: what it is and why it matters. In many cases, you can generate rewards points. | That money can be tapped in various ways, including initiating a transfer via mobile app or withdrawing the funds at your local bank branch. How can you use a personal loan or line of credit? But remember, this type of account may not be for everyone. Bank en español. This means that a PLOC might not be the best option for everyone. Start of disclosure content Footnote. | Personal line of credit: What it is and how it works · A PLOC is a revolving credit account. · Like credit cards, PLOCs are unsecured and have If you're a current U.S. Bank customer with a FICO Score of or above, a personal line of credit could be right for you. Use your personal line of credit up A personal line of credit is money borrowed from a bank or credit union that you draw from as needed. · You pay interest only on the amount you | A personal line of credit is a form of revolving credit that you can borrow from as needed and use as you see fit. You can find personal lines of credit from A First Tech Personal Line of Credit is a no-fee loan that let's you take out money when you need to use if for those unexpected expenses. As low as % What is a Personal Line of Credit? A Personal Line of Credit is a loan that you access from time to time. You write special checks or request | A revolving credit line allowing you to borrow as much as you need up to your limit and only pay interest on your total balance. Where can I see my balance? A personal line of credit is a type of revolving credit, similar to a credit card, that you can borrow from when you need up to a certain dollar Apply by phone at Monday – Friday from 6 am to 7 pm, Saturday 8 am to 2 pm. Non-customers cannot apply online for personal lines of credit at |  |

| Home Equity Loans Personal Loans vs. Access to credit vs. This account Requirekents like a credit Requirementw or a separate checking account. Money Management Personal line of credit vs. What should I look for when shopping for a Personal Line of Credit? Consolidate debt. Peer-to-peer loans: These are often friend-to-friend loans that are unregulated. | You may obtain a copy of the disclosure by visiting a branch or calling Borrowing amount. Those without a U. Bank Simple Loan are for existing U. Then the borrower receives a monthly bill from their bank or credit union and has to make monthly minimum payments based on what they borrowed. Divyakshi Sharma is a professional copywriter and a proud North Carolina State University graduate. You can use a personal line of credit to help cover the cost of home improvements, pay off debt or simply take care of unexpected expenses. | Personal line of credit: What it is and how it works · A PLOC is a revolving credit account. · Like credit cards, PLOCs are unsecured and have If you're a current U.S. Bank customer with a FICO Score of or above, a personal line of credit could be right for you. Use your personal line of credit up A personal line of credit is money borrowed from a bank or credit union that you draw from as needed. · You pay interest only on the amount you | A revolving credit line allowing you to borrow as much as you need up to your limit and only pay interest on your total balance. Where can I see my balance? A personal line of credit is an unsecured loan. That is, you ask the lender to trust you to make repayment. To land one, you'll need to present a credit score A personal line of credit is an unsecured loan that functions more like a credit card than a loan. Instead of receiving a lump sum up front, you | A personal line of credit is a form of revolving credit that you can borrow from as needed and use as you see fit. You can find personal lines of credit from A personal line of credit is an unsecured loan. That is, you ask the lender to trust you to make repayment. To land one, you'll need to present a credit score A personal line of credit is a revolving credit line that allows you to borrow money up to the limit established by your lender. Your available |  |

0 thoughts on “Requirements for personal line”