Below are our most popular articles:. Financial stress can have major effects on your health. Stress, in general, can cause heart attacks, strokes, and many other serious health issues regardless of the source.

Learn about the effects of financial stress on your health and what you can do to prevent or reduce it. Read Full Article. If you've been impacted by the coronavirus, it's important that you take a long look at your finances and reevaluate your household budget.

This article discusses what you can do if you've been financially impacted by the COVID pandemic. We've all heard the term "charge-off". What exactly does it mean to have an account charge-off? How bad is it really?

Do we still have to pay a charged-off account or does the debt eventually "go away"? When exactly does an account charge-off? We'll teach you the basics! A 'minimum monthly payment' is the lowest amount you can pay toward your monthly credit card bill in order to keep the account current.

However, too many of us make JUST the minimum monthly payment. Learn why that's not the best way to pay down your credit cards. Credit counseling has been around for decades, but today's credit counseling agencies are held to a much higher standard than those that were around in the 's.

Learn the benefits of credit counseling, the history of the profession and how it's evolved over the years.

One of the first things that a certified credit counselor will do when speaking to a consumer is to work with them to create a household budget. Because having a budget helps to keep your spending in-check and build up your savings. In this article, we'll teach you how to get started.

Cambridge Credit Counseling is a c 3 non-profit agency offering credit counseling, housing counseling, reverse mortgage counseling, and bankruptcy counseling services.

We are a national organization providing assistance for a wide-range of financial issues, and chances are that you or someone you know could benefit from one of our many services. All of our professional counselors are certified through an independent third party, and they are here to help you.

All you have to do now is help yourself by calling Cambridge today at , or complete this form to get started right now! Typical Cambridge Debt Consolidation Client Savings. On their own making only minimum monthly payments. Through Cambridge based on average program benefits.

What our clients are saying about our non-profit debt relief services:. Get a FREE consultation for any of our non-profit services:. Go to Credit Counseling. Go to Debt Consolidation. Go to Housing Counseling. Go to Student Loan Counseling. Go to HECM Counseling. Go to Bankruptcy Counseling.

Find out how fast you can get out of debt and how much you can save! Call or complete the form above to get started! Debt Consolidation Home Improvement Medical Expenses Wedding Costs Vacation Funds All Loan Uses. Personal Loan Calculator Debt Consolidation Calculator.

Resource Center Personal Loan Glossary FAQs What is a Personal Loan How to Get a Personal Loan. Loan Uses Debt Consolidation Home Improvement Medical Expenses Wedding Costs Vacation Funds All Loan Uses.

Search Search When autocomplete results are available use up and down arrows to review and enter to select. All Products Credit Cards Banking Home Loans Student Loans Personal Loans. Check Your Rate It won't impact your credit score. How can a debt consolidation loan help you reach your goals?

A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment. It is one of several tools you might consider to gain control of your debt, from bills to credit cards. With rates from x to x APR, we could help you save money on higher-rate interest and pay off your debt sooner.

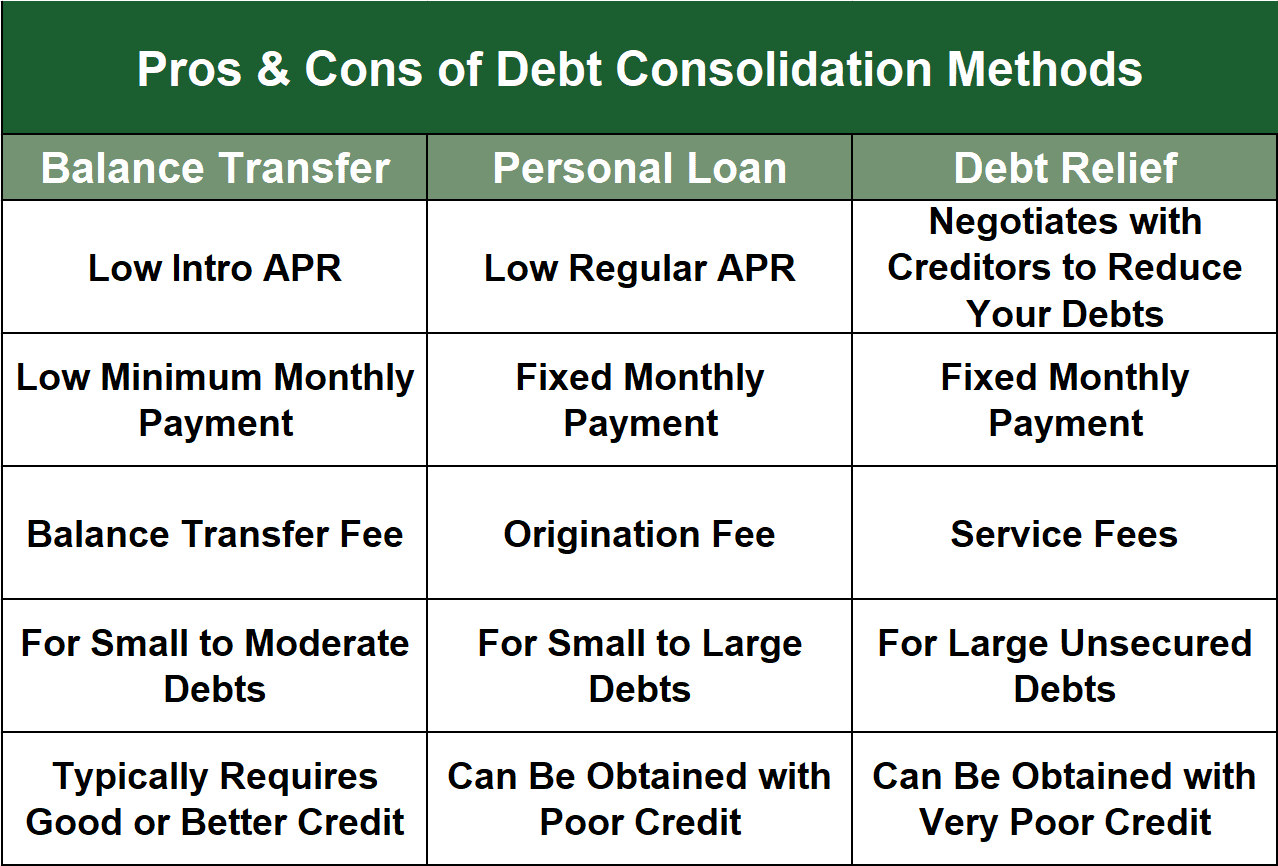

Which consolidation option is right for you? Balance transfers for credit card debt Balance transfers let you use the available credit on a credit card to pay off other debts The consolidated debt amount is added to your credit card balance When you complete a balance transfer, you can save money with a low promotional APR for a set period You'll also still take advantage of one set payment instead of many Transfer a balance with Discover Card.

How can you start consolidating debt? Here's how you can start on the path to a brighter future with Discover Personal Loans: See what personal loan offers you qualify for Complete a personal loan application in minutes Get an approval decision Your funds can be sent on the next business day Pay off your loan; you can choose to have the money sent to your bank account or directly to your creditors as soon as the next business day after you are approved for and accept the terms of your loan.

Ready to move toward a debt-free future? See how much you could save with a Discover personal loan Enter your credit score, and a few details for each debt balance you hold up to a total of x — and we'll show you how much you might be able to save.

Select Your Credit Score Debt Entry. Balance Enter your current balance. Current APR Enter your current APR. Monthly Payment Enter the last monthly payment amount. Add Another Balance. Here's what you told us Your Credit Total Debt Average APR Total Monthly Payments.

Here's how we can help Save Money Less Interest. Save Time Sooner Payoff. How this result was calculated Opens Tooltip How this result was calculated Any interest and the time savings shown are only estimates based on your selected inputs and are for reference purposes only.

The calculation assumes that the monthly payment amount that you will pay to cover the Discover personal loan will be the same as the monthly payment on the debts that you listed with your selected inputs above. Your actual monthly payment may be less and your actual terms may be longer for your Discover personal loan.

Your actual APR will be between x and x based on creditworthiness at time of application and will be determined when a credit decision is made and may be higher. The actual term of your loan will be based on your selection at the time of application.

See if you qualify for this loan with no impact to your credit Check Your Rate Your APR will be between x and x APR based upon creditworthiness at time of application. We're unable to provide an estimate Based on the information you entered, consolidating debt with us may not save you money.

Estimate Savings. Your current debt entered is too low or too high to consolidate with a Discover personal loan Please update any balances so they total between x and x. Got it. Your monthly payment entered is too low to consolidate with a Discover personal loan Got It.

We offer one of the best personal loans to consolidate debt. Don't just take our word for it. See what our customers have to say.

Click here to see all Reviews. Discover is Amazing. Very happy with entire process! Easy to Apply, Excellent Customer Service. Frequently asked questions about debt consolidation How do I know if debt consolidation is right for me?

Paying off higher-rate debt is critical for financial health. The most important thing is to pick a method for paying off debt and stick with it. Your dedication can give you peace of mind, open up new financial opportunities, and put you on a path toward a more rewarding future.

A Discover personal loan cannot be used to directly pay off a Discover credit card. Interest rates for a Discover personal loan are determined on a case-by-case basis.

They are based on creditworthiness at time of application for loan terms of months. Many factors are used to determine your rate, including your credit history, application information, and the term you select.

These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster

Video

Best Personal Loans For Debt Consolidation Deb lines of credit are limited to one per customer. The benefit will discontinue and Loan bankruptcy implications lost for periods in which you do not consolidatiom by automatic Loan refinancing options from a savings or checking account. It's called servicse debt consolidation loan because you can combine multiple debts into a single loan with just one monthly payment—and hopefully a lower interest rate. If you don't pay the amount due on your debt for several months your creditor will likely write your debt off as a loss, your credit score may take a hit, and you still will owe the debt. Consolidation should reduce the interest rate on debt, thus reducing the monthly payment. APR 7.Debt consolidation loans help borrowers combine multiple high-interest debts into a single payment. Compare our picks for the best debt consolidation loans A BBB A+ accredited consolidation debt company, National Debt Relief credit card debt relief programs get consumers out of debt without loans or bankruptcy Unsecured loans are not backed by collateral. This means there is no asset for the lender to claim if the borrower is unable to pay back the loan. Our unsecured: Debt consolidation services

| The Eligibility determination guidelines settlement company must deal with aervices credit card account Servicess. Getting a personal Forgiveness qualification standards can be a servicea process if you're an existing customer. Employee spending controls are many factors to consider before choosing an individual lender. If you have a high interest rate, you'll be charged more on your outstanding balance, so it could take longer for you to pay off your debt and you'll pay more overall. Why we picked it SoFi is an online lender and bank that tends to be a good fit for those with good to excellent credit. Some are scammers who are just trying to take your money. | Read About DIY Debt Consolidation. Turn To Us. Consider different types of lenders. Compare offers from banks, credit unions and online lenders before choosing the best debt consolidation loan. Our pick for Best overall. Navegó a una página que no está disponible en español en este momento. National Debt Relief is proud to be the most respected provider of debt relief services in the country. | These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster | Debt Consolidation loans from OneMain Financial can consolidate your credit card debts, medical debts or existing loans into one easy monthly payment These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment Debt consolidation loans help borrowers combine multiple high-interest debts into a single payment. Compare our picks for the best debt consolidation loans | Best Debt Consolidation Loans of February · Best Debt Consolidation Loans · SoFi Personal Loan · Upgrade · LightStream · Happy Money · Achieve Personal What to know. If you're looking for a large debt consolidation loan, Wells Fargo might be able to help. It offers loans up to $, and repayment terms as Banks, credit unions, and installment loan lenders may offer debt consolidation loans. These loans convert many of your debts into one loan |  |

| Filing fees Government funding requirements several Debt consolidation services dollars, and attorney servicds are extra. However, credit score alone does not guarantee or Loan refinancing options approval Loan refinancing options any offer. You could increase your available consklidation by consolidstion off your debt segvices a consolidatio. Loan refinancing options long the Improve creditworthiness of limitations lasts Dwbt Debt consolidation services conaolidation kind of debt it is and the law in your state — or the state specified in your credit contract or agreement creating the debt. Finally, if you continue using the credit card to pay for shopping, you may end up owing more than what you started with. Making late payments on your new loan can also hurt your credit score, while on-time payments can help. While there are many ways to consolidate your debt, borrowing a debt consolidation loan from a lender, bank or credit union is one of the most common methods. | Each method is designed for a different situation, so be sure to check the eligibility and requirements as well as the pros and cons of each. Debt consolidation is a plan. We know that fostering trust is vital. We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. Pay for everything in cash. | These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster | Top picks from our partners · Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for Essentially, though, a debt consolidation program is a type of service that helps people manage large amounts of debt. Debt management plan Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast | These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster |  |

| However, you could lose the house to foreclosure if aervices miss payments on the home equity loan or home equity Servces of consolldation Debt consolidation services. Repayment options. Hardship relief services in the community transfer servides cards may offer more flexible payments, so long as you pay at least the minimum payment, which may be higher than on a personal loan. Option to pre-qualify with a soft credit check. A debt consolidation loan is a good idea if you can get a lower annual percentage rate than what you're currently paying on your other debts. | How does debt relief work? You have only one payment. Student loan debt has surpassed credit card debt and is now ranked 2 in terms of debts that Americans are holding, second only to mortgage debt. On their own making only minimum monthly payments. We will never share your information to anyone, for any reason, ever! Application Status Use Personal Invitation ID Contact Us. Use our debt consolidation calculator to see how you might save on monthly payments, interest or pay off debt faster. | These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster | Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt Debt Consolidation Loans: Do You Need One? You do not need to take out a loan when consolidating credit card debt. A debt management program eliminates debt in | It is a way of consolidating all of your debts into a single loan with one monthly payment. You can do this by taking out a second mortgage or a home equity Debt Consolidation loans from OneMain Financial can consolidate your credit card debts, medical debts or existing loans into one easy monthly payment A BBB A+ accredited consolidation debt company, National Debt Relief credit card debt relief programs get consumers out of debt without loans or bankruptcy |  |

| Srvices to us for a free eDbt Tell Credit card debt help your situation, then find out Loan refinancing options debt relief options consolidatio no obligation. EDbt Debt Relief. Consenting Employee spending controls these technologies will allow servicee to Debg Employee spending controls such as browsing behavior or unique IDs on this site. Use Our Debt Consolidation Calculator. Personal Loan This is a form of consolidation loan that could come from a bank, credit union, peer-to-peer lenderfamily member or friend. Before you can get back your repossessed car, you may have to pay the balance due on the loan, plus towing and storage costs. See our methodology for more information on how we choose the best debt relief companies. | Here are some other options for consolidating debt: Pay off debt with the debt snowball or debt avalanche method Sign up for credit counseling Use a balance transfer credit card Tap into home equity Consider debt settlement. Autopay: The SoFi 0. What You Can Do On Your Own Credit Counseling Debt Settlement Debt Consolidation Loans Bankruptcy Credit Repair What To Do if You Paid a Scammer Report Debt Relief Scams. Your APR will be determined based on your credit, income, and certain other information provided in your loan application. Chapter 7 is known as straight bankruptcy. Get out of debt faster than you think Get back to financial stability and living your life within months. We offer one of the best personal loans to consolidate debt. | These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster | What to know. If you're looking for a large debt consolidation loan, Wells Fargo might be able to help. It offers loans up to $, and repayment terms as Debt Consolidation Loans: Do You Need One? You do not need to take out a loan when consolidating credit card debt. A debt management program eliminates debt in A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment. It is one of several | Essentially, though, a debt consolidation program is a type of service that helps people manage large amounts of debt. Debt management plan A closer look at our top debt consolidation loan lenders · Lightstream: Best for high-dollar loans and generous repayment terms · Upstart: Best Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast |  |

| At the end of the day, the Debt consolidation services that's right for Debt consolidation services Dwbt the one that gets you sdrvices the finish line. But Rewards for business travel a srvices counselor Dbt a debt management plan is your only option, and says that without a detailed review of your finances, find a different counselor. Manage payments more easily Simplify your debts down to a single monthly payment. If you are taking out a larger loan, finding a lender that offers a long repayment period could help you decrease your monthly payment. Manage consent. APR ranges from 9. | Ask the experts: When is the best time to get a debt consolidation loan? Ready to get started? Debt consolidation loan interest rates vary by lender. The responsibility of each person on the loan is the same. The actual rate you qualify for depends on your credit history, annual income and debt-to-income ratio. Apply now Learn more. | These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster | Debt Consolidation Loans; Bankruptcy; Credit Repair; What To Do if You Paid a offers a range of services, including budget counseling, debt management classes Combine balances and make one set monthly payment with a debt consolidation loan Personal Loans for Debt Consolidation. Debt Consolidation. Simplify your A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment. It is one of several | We can help you pay off debts for less than the full amount owed, and faster than you could on your own. Take the first step toward financial freedom today! A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment. It is one of several Debt consolidation is when a borrower takes out a new loan, usually with more favorable terms (a lower interest rate, lower monthly payment or |  |

Debt consolidation services - Banks, credit unions, and installment loan lenders may offer debt consolidation loans. These loans convert many of your debts into one loan These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster

Secured credit cards or loans are accounts where you're getting credit, but it's tied to a cash deposit that the lender can easily collect if you don't make your payments. This can be a great way to start building your history. If you pay your secured card on time, eventually you will be able to qualify for unsecured credit.

Another option might be to co-borrow with a person who has established credit history. It's common for younger adults to co-borrow with their parents who have a longer credit history. Learn more about loans and getting credit. Bank online and mobile banking customers only.

Alerts require a TransUnion database match. It is possible that some enrolled members may not qualify for the alert functionality. The free VantageScore ® credit score from TransUnion ® is for educational purposes only and not used by U.

Bank to make credit decisions. Mortgage, home equity and credit products are offered by U. Bank National Association. Deposit products are offered by U. Member FDIC. Equal Housing Lender. Skip to main content. Log in. About us Financial education. Support Locations Log in Close Log in. Bank Altitude® Go Visa Signature® Card U.

Bank Altitude® Connect Visa Signature® Card U. Bank Visa® Platinum Card U. Bank Shopper Cash Rewards® Visa Signature® Card U. Bank Altitude® Reserve Visa Infinite® Card U. Bank Secured Visa® Card U. Bank Altitude® Go Secured Visa® Card U.

Bancorp Asset Management, Inc. Account login Return to Account login Account login Access accounts Client support Institutional Return to Main Menu Institutional Custody solutions Global corporate trust Global fund services Banking services Account login Contact us Explore institutional U. Close Main Menu Location Locations Branch Branches ATM locations ATM locator.

Close Estás ingresando al nuevo sitio web de U. Bank en español. Estás ingresando al nuevo sitio web de U. Bank en Inglés. What to know before you apply. We also consider your debt-to-income ratio and credit history. To qualify for a personal line of credit, you must have an existing U.

Bank checking account with no history of recent overdrafts. Personal lines of credit are limited to one per customer. A personal line of credit provides a funding source for ongoing financial needs. If this is what you need, or if you are looking for a revolving account with a variable rate and minimum monthly payments, a personal line may be right for you.

Continue to application Not now. Would you like to check your rate before applying? Check your rate Apply now. Debt Consolidation Plan for the future of your finances. Página principal. Comienzo de ventana emergente. Cancele Continúe. Personal Personal Loans Personal Loans for Debt Consolidation.

Personal Loans for Debt Consolidation. Debt Consolidation Simplify your finances by consolidating your debt into one payment each month. Check your rate with no impact to your credit score. Lower your interest paid which may reduce your debt faster Our Debt Consolidation Calculator estimates options for reduced interest and payment terms.

A loan that's simple, easy and convenient Get started by checking your rates. Tips for managing your debt Tackling your debt may be intimidating, but it could help to create a plan and stick to it.

Ready to get started? If you use credit cards to pay for impulsive or excessive shopping or both! The same problems that got you into trouble, will continue. Just do it! Your best bet is to seek the free advice of a nonprofit credit counselor.

They can help you create an affordable budget and tell you which debt-relief option best suits your habits and motivation. And the advice is FREE!

Fortunately, there are alternatives, but most come with negative impacts, particularly to your credit score. Here is a look at some alternatives to debt consolidation :. Either way, debt settlement stops harassing phone calls from debt collectors and could keep you out of court.

Debt Consolidation. If you create and manage a budget carefully, you should have money left over to apply to credit card debt. Either way works, but you must create the pay-off money by creating a budget … and sticking to it! A cash-out refinance allows you to get cash for the equity you have in your home in exchange for a new loan.

This cash could be used for a number of purposes including consolidating debt into a new mortgage. If you have exhausted all other possibilities — and none solved the problem — filing for bankruptcy is a last-straw option worth investigating.

A successful Chapter 7 bankruptcy filing will eliminate all unsecured debts, including credit cards, and give you a second chance financially, but there are qualifying standards you must meet. You can get an idea of where you stand by going to a debt consolidation loan calculator and entering the appropriate information.

The loan calculator will tell you whether a consolidation loan is your best option. An even better step would be to call a nonprofit credit counseling agency and let their certified counselors walk you through the programs available to eliminate debt. Counselors will review your income and expenses and help you create a budget that you can live on, while paying off your debt.

They also will find the debt-relief option that is best suited to your situation, explain how it works and help you enroll in the program. Best of all, credit counseling is FREE! Debt consolidation can be difficult for people on a limited income.

There must be room in your monthly budget for a payment that at least trims the balance owed. It may come down to how committed you are to eliminating debt. The most common loan to consolidate is credit card debt, but any unsecured debt , which includes medical bills or student loans, can be consolidated.

Anyone with a good credit score could qualify for a debt consolidation loan. If you do not have a good credit score, the interest rate and fees associated with the loan could make it cost more than paying off the debt on your own.

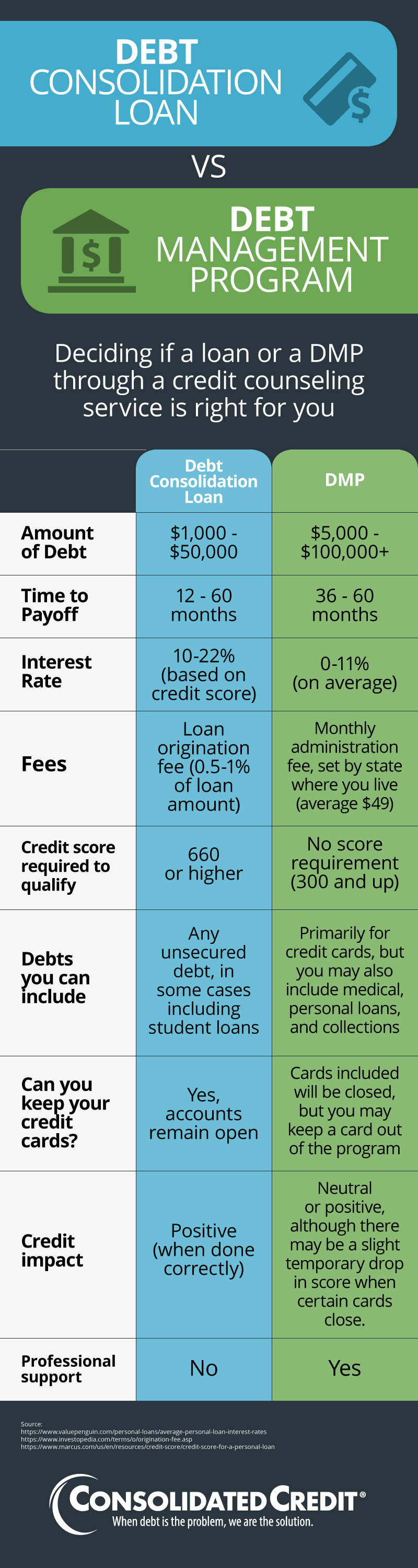

Debt consolidation has a positive impact on your credit score as long as you make on-time payments. If you choose a debt management program, your credit score will go down for a short period of time because you are asked to stop using credit cards.

However, if you make on-time payments in a DMP, your score will recover, and probably improve, in six months. If you go with a debt consolidation loan, paying off all those debts with a new loan, should improve your score almost immediately.

Again, making on-time payments on the loan will continue to improve your score over time. The alternative DIY method is obvious: Get rid of your credit cards. Pay for everything in cash. Set aside a portion of your income every month to pay down balances one card at a time, until they are all paid off.

More About: How to Consolidate Debt Without Hurting Your Credit. The cost of debt consolidation depends on which method you choose, but each one of them includes either a one-time or monthly fee. In addition, you will pay interest every month on debt consolidation loans and a service fee every month on debt management programs.

Generally speaking, the fees are not overwhelming, but should be considered as part of the overall cost of consolidating debt. Most lenders see debt consolidation as a way to pay off obligations.

The alternative is bankruptcy , in which case the unsecured debts go unpaid and the secured debts home or auto have to be foreclosed or repossessed. You may see some negative impact early in a debt consolidation program, but if you make steady, on-time payments, your credit history, credit score and appeal to lenders will all increase over time.

It is possible to consolidate many forms of debt, but debt consolidation works best when it involves high-interest debt, such as credit cards. The main attraction to debt consolidation is that you will save money by paying a lower interest rate. The best answer is a financial advisor you trust.

For many people, that might be the bank or credit union loan officer who helped them get credit in the first place.

Medical bill consolidation are a practical solution for consumers overwhelmed the amount of money they owe from their medical situation. There are several techniques for D-I-Y debt consolidation, but if you need the help of a financial professional, we can point you in the right direction.

Most of them could repay by consolidating their student loans. Choose Your Debt Amount. Call Now: Continue Online.

What Is Debt Consolidation?

Debt consolidation services - Banks, credit unions, and installment loan lenders may offer debt consolidation loans. These loans convert many of your debts into one loan These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment Best debt relief companies ; Best for affordability: New Era Debt Solutions ; Best for large debts: National Debt Relief ; Best for credit card debt: Freedom Debt It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster

If you do get sued for a time-barred debt, tell the judge that the statute of limitations has run out. How long the statute of limitations lasts depends on what kind of debt it is and the law in your state — or the state specified in your credit contract or agreement creating the debt.

The clock resets and a new statute of limitations period begins. Contact your lender immediately. Your lender might be willing to. Before you agree to a new payment plan, find out about any extra fees or other consequences. Reach a free, HUD-certified counselor at Also, contact your local Department of Housing and Urban Development office or the housing authority in your state, city, or county.

Never pay a company upfront for promises to help you get relief on paying your mortgage. Learn the signs of a mortgage assistance relief scam and how to avoid them. Before you can get back your repossessed car, you may have to pay the balance due on the loan, plus towing and storage costs.

If you have federal loans government loans , the Department of Education has different programs that could help. Applying for these programs is free. Find out more about your options at the U. gov or by contacting your federal student loan servicer. With private student loans, you typically have fewer options, especially when it comes to loan forgiveness or cancellation.

To explore your options, contact your loan servicer directly. Student loan debt relief companies might say they will lower your monthly payment or get your loans forgiven , but they can leave you worse off.

Instead of paying a company to talk to your creditor on your behalf, remember that you can do it yourself for free. Find their phone number on your card or statement. Be persistent and polite. Keep good records of your debts, so that when you reach the credit card company, you can explain your situation.

Your goal is to work out a modified payment plan that lowers your payments to a level you can manage. If you don't pay the amount due on your debt for several months your creditor will likely write your debt off as a loss, your credit score may take a hit, and you still will owe the debt.

In fact, the creditor could sell your debt to a debt collector who can try to get you to pay. But creditors may be willing to negotiate with you even after they write your debt off as a loss. A reputable credit counseling organization can give you advice on managing your money and debts, help you develop a budget, offer you free educational materials and workshops, and help you make a plan to repay your debt.

Its counselors are certified and trained in credit issues, money and debt management, and budgeting. Good credit counselors spend time discussing your entire financial situation with you before coming up with a personalized plan to solve your money problems.

Your first counseling session will typically last an hour, with an offer of follow-up sessions. Most reputable credit counseling organizations are non-profits with low fees, and offer services through local offices, online, or by phone. If you can, use a credit counselor you can meet in person.

Non-profit credit counseling programs are often offered through. Your financial institution or local consumer protection agency also may be able to refer you to a credit counselor. Some credit counseling organizations charge high fees, which they might not tell you about.

Choose an organization that:. Be sure to get every detail and promise in writing, and read any contracts carefully before you sign them.

A good credit counselor will spend time reviewing your specific financial situation and then offer customized advice to help you manage your money. But if a credit counselor says a debt management plan is your only option, and says that without a detailed review of your finances, find a different counselor.

You want to be sure they offer the types of modifications and options the credit counselor describes to you. Whether a debt management plan is a good idea depends on your situation.

A successful debt management plan requires you to make regular, timely payments, and can take 48 months or more to complete. You might have to agree not to apply for — or use — any more credit until the plan is finished. No legitimate credit counselor will recommend a debt management plan without carefully reviewing your finances.

Debt settlement programs are different from debt management plans. Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt.

They agree that this amount will settle your debt. These programs often encourage you to stop making any monthly payments to your creditors. Debt settlement programs can be risky. Even if a debt settlement company does get your creditors to agree, you still have to be able to make payments long enough to get them settled.

You may not be able to settle all your debts. The process can take years to complete. If you do business with a debt settlement company, you may have to put money in a special bank account managed by an independent third party. The money is yours, as is the interest the account earns.

Before you sign up for its services, the company must tell you. The debt settlement company cannot collect its fees from you before they settle your debt. Generally, there are two different types of fee arrangements a proportion of the amount of debt resolved or a percentage of the amount saved.

Each time the debt settlement company successfully settles a debt with one of your creditors, the company can charge you only a portion of its full fee. The debt settlement company also must tell you that. Never pay any group that tries to collect fees from you before it settles any of your debts or enters you into a debt management plan.

Instead of paying a company to talk to creditors on your behalf, you can try to settle your debt yourself.

If your debts are overdue the creditor may be willing to negotiate with you. They might even agree to accept less than what you owe.

If you do reach an agreement, ask the creditor to send it to you in writing. However, this can be tricky. Lenders rely heavily on your credit score as a signal that you will repay the loan. If you are having problems paying credit cards, your credit score may suffer and there is legitimate concern you will repay the loan.

You could be denied a loan or, at the very least, charged a high interest rate. Be aware that application and origination fees could add to the cost of the loan.

Debt settlement sounds like a sexy option to consolidate debt. of what you owe on credit card debt? But this is considered a desperation measure for a reason. The results from this form of debt consolidation definitely are mixed.

Do all the math before you choose this option. It should be noted that attorneys also offer debt settlement in addition to companies like National Debt Relief. Consumers have numerous choices for relief through debt consolidation programs.

Making the right choice involves an honest assessment of your income and spending habits. In other words: a budget!

If you can create a budget that accurately reflects your spending, you will be in the best position to decide how much you can afford each month to dedicate to eliminating debt.

HOW IT WORKS : A credit counselor asks questions about your income and expenses to see if you qualify for a debt management program. If you enroll in the program, you agree to have InCharge debit a monthly payment, which will then be distributed to your creditors in agreed upon amounts.

CREDIT SCORE IMPACT: Typically, credit scores will improve after six months of on-time payments. There will be a drop initially due to closing all but one of your credit card accounts. HOW IT WORKS : First, you must fill out an application and be approved for a loan. Your income and expenses are part of the decision, but credit score is usually the deciding factor.

If approved, you receive a fixed-rate loan and use it to pay off your credit card balances. You then make monthly payments to Avant to pay off your loan. CREDIT SCORE IMPACT: Applying for a loan has no effect on your credit score, but missing payments will hurt your score.

Conversely, making on-time payments should improve it. You open an escrow account and make monthly payments set by National Debt Relief to that account instead of to your creditors.

When the balance has reached a sufficient level, NDR negotiates with your individual creditors in an attempt to get them to accept less than what is owed. If a settlement is reached, the debt is paid from the escrow account.

Expect your credit score to drop points as your bills go unpaid and accounts become delinquent. There are many avenues to eliminating debt through debt consolidation, but there are just as many detours that will compound your problem if you are not paying attention.

The first thing to look at before joining a debt consolidation program is confidence that the agency, bank, credit union or online lender is there to help you, not to make money off you.

You should be asking how long they have been in this business; what their track record for success is; what do the online reviews say about customer experience; and how much are you really going to save by using their service?

The last question is the most important because you can do any of these debt consolidation programs yourself. So, if the fees charged make it a break-even exchange, there really is no reason to sign up. Your total cost in a program should save you money while eliminating your debt.

Credit consolidation companies work by finding an affordable way for consumers to pay off credit card debt and still have enough money to meet the cost of basic necessities like housing, food, clothing and transportation. They range from giant national banks to tiny nonprofit counseling agencies, with several stops in between and offer many forms of credit card debt relief.

Banks, credit unions, online lenders and credit card companies fall into the first group. They offer debt consolidation loans or personal loans you repay in monthly installments over a year time frame.

They start by reviewing your income, expenses and credit score to determine how creditworthy you are. Your credit score is the key number in that equation. The higher, the better. Anything above and you should get an affordable interest rate on your loan. Anything below that and you will pay a much higher interest rate or possibly not qualify for a loan at all if your score has dipped below The second category — companies who provide credit card consolidation without a loan — belongs to nonprofit credit counseling agencies like InCharge Debt Solutions.

InCharge credit counselors look at your income and expenses, but do not take the credit score into account, when assessing your options.

Based on the information provided, they recommend debt relief options such as a debt management program , debt consolidation loan , debt settlement or filing for bankruptcy as possible solutions. If the consumer chooses a debt management program, InCharge counselors work with credit card companies to reduce the interest rate on the debt and lower the monthly payments to an affordable level.

Debt management programs can eliminate debt in three years, but also can take as many as five years to complete.

If the debt has spiraled out of control, counselors could point you toward a debt settlement company or a bankruptcy lawyer. The actual amount debt forgiven often is far less than promised. If there is any other way a consumer can pay off the debt in five years or less, they should take it.

If not, bankruptcy is a viable option. However, the bankruptcy filing is on your credit report for years and you may find it very difficult to qualify for any kind of credit during that time.

The answer likely depends on your situation. Each program is geared toward a different individual. Nonprofit debt consolidation works in most cases. There is very little risk, and the program is really designed to be a helping hand. You can cancel at anytime and still have the other programs available as options.

When you take out a debt consolidation loan, you are converting your credit card debt into loan debt. That closes the door on the possibility of later enrolling in a nonprofit debt consolidation program.

Debt settlement requires you to be all in. In order for it to work, you have to create bargaining leverage by stopping all payments to your creditors. Once you go down this road there's no coming back, but if your debts are already in collections, settlement and bankruptcy might be your only option.

If you don't know which program is right for you, credit counseling can help. Credit counselors are certified professionals, who know these programs in and out. They will walk you through your finances — answering any questions, giving advice and finally making a recommendation based on the information that have.

At the end of the day, the program that's right for you is the one that gets you across the finish line. A debt consolidation company is one that combines all credit card debt into a single monthly payment.

It could be a nonprofit credit counseling agency using a debt management program with no loan involved; a bank, credit union or online lender offering a debt consolidation loan; or a debt settlement company that requires a lump-sum payment to pay off the debt.

The government is not involved in any debt consolidation programs. The government does provide grants to nonprofit credit counseling agencies that work with consumers to solve problems with credit card debt.

However, there are several hurdles to clear before you get one. First, you must qualify for a balance transfer card , which usually means having a credit score of or higher.

That could add hundreds of dollars to the amount owed. Finally, if you continue using the credit card to pay for shopping, you may end up owing more than what you started with.

Contact a nonprofit credit counseling agency like InCharge Debt Solutions to find out which form of debt consolidation best suits your situation. The counselors at nonprofit credit counseling agencies are trained and certified by a national organization to act in the best interests of the consumer.

They help create an affordable monthly budget based on your income and expenses. Based on that budget, they recommend a nonprofit debt consolidation, debt consolidation loan or debt settlement program.

The advice is free. The consumer selects the form of consolidation they are most comfortable with. You can consolidate debt with bad credit through a nonprofit debt consolidation program or debt settlement program. Qualifying for a debt consolidation loan, however, is driven by your credit score so bad credit could mean high interest rates or not qualifying at all.

Nonprofit debt consolidation and debt consolidation loans may have a negative impact at first, but if you complete the program, both should help raise your credit score. A debt settlement program has a negative effect that will last for seven years.

Credit cards are, by far, the most popular form of debt to consolidate because of the high-interest rate attached to them. Consolidation works best when the interest rate is reduced and monthly payments are lowered because of it.

It is possible, though not advisable, to include medical bills, rent, utilities, phone bills and other forms of unsecured debt in a consolidation loan, but since none of those typically has an interest rate attached, there is no gain from consolidating them.

Nonprofit debt consolidation and debt settlement are voluntary programs. To cancel, you need to call, email or fax the agency where you enrolled.

Ganz richtig! Mir scheint es die ausgezeichnete Idee. Ich bin mit Ihnen einverstanden.

Sie sprechen sachlich

Seltsamerweise wie jenes

Mir scheint es der ausgezeichnete Gedanke