:max_bytes(150000):strip_icc()/pay-off-medical-debt-5212831-final-491fe200720b4892b40e024e096544fa.jpg)

Hello all, Dollar For is Legit!!! I checked my "my chart" and my bill was Zero. This state is really bad when it comes to medical bills and sending things to collections. Not to mention the ER visit that I had to go to before, when I first had the kidney stone. Leaving me the rest.

It is so absolutely pathetic that these hospitals charge such outrageous prices for procedures. I would and cannot recommend Dollar For any higher than what I'm giving them now- 10 out of total Lifesavers. This was great. You rock! Dollar has been a wonderful experience and helped me so much with a hospital bill I couldn't afford.

They gave me updates throughout the whole process and are quick to respond when you have a question. I would highly recommend Dollar if your in need of help.

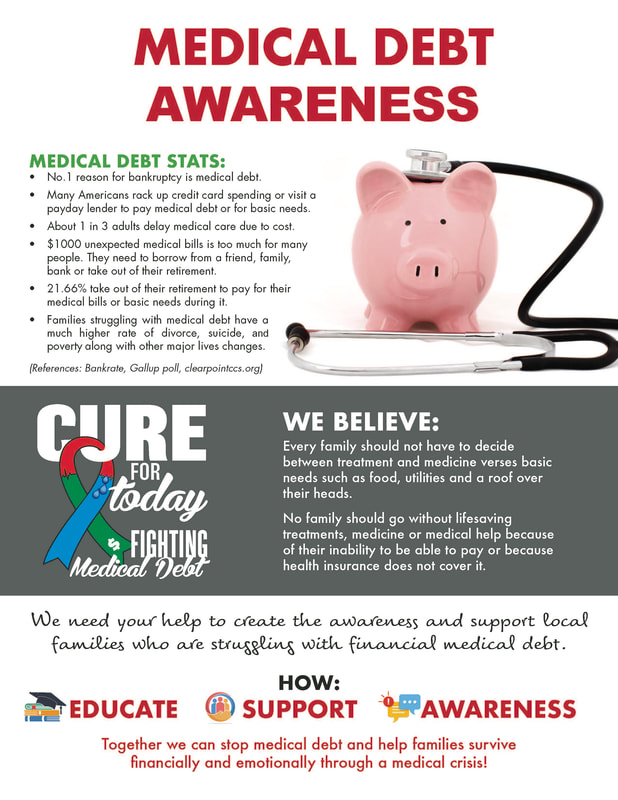

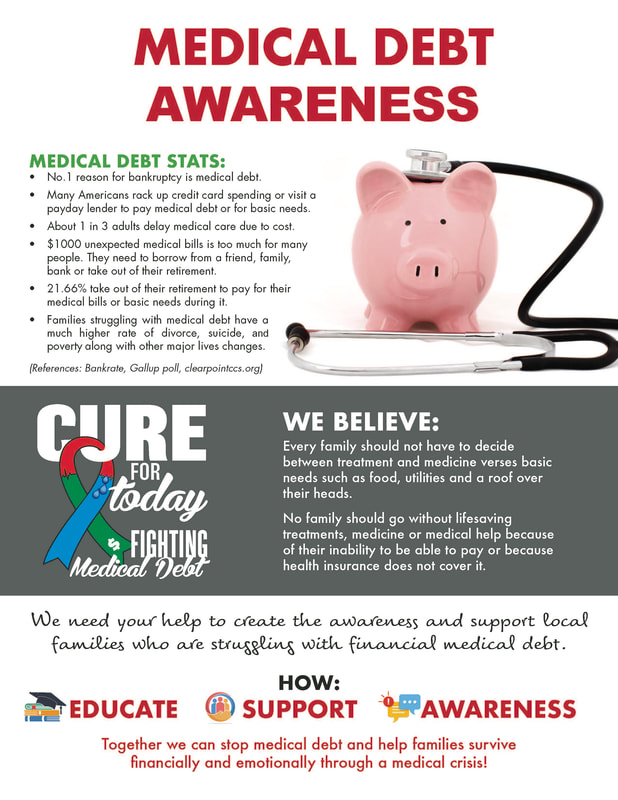

I had a bad infection, I spent about 5 weeks in the hospital having numerous tests done. Our opinions are our own. Here is a list of our partners and here's how we make money. The three major U. credit bureaus Equifax, Experian and TransUnion have made changes related to medical debt.

Paid-off medical collections no longer appear on credit reports. Having medical debt isn't uncommon — according to the Consumer Financial Protection Bureau, almost 1 in 5 households in the United States have overdue medical debt.

The CFPB offers a useful flowchart on how to confirm and handle an unpaid bill. To start, look over your medical bill and compare it with your explanation of benefits, if you have insurance. When working with your provider, be upfront about what you can pay. Ahead are some strategies that may help you pay off your medical bills.

Many medical providers, including physicians, dentists and hospitals, can work out a no- or low-interest payment plan for your medical bills.

The minimum amount you can pay on your payment plan will depend on your bill amount and the terms you negotiate. You generally break the bill into multiple equal payments over a few months until the total is covered.

Ask if there are billing charges or any other fees associated with the payment plan, so you can assess the affordability. Providers may also offer to help you apply for medical credit cards.

Another risk attached to credit cards is that missing payments or paying late can have a negative impact on your credit score. Be sure to shop around to compare rates, fees and repayment terms:.

Personal loans: A medical loan for healthcare expenses can help you consolidate medical expenses or pay for emergency or planned procedures. Be sure to pay off your balance before the promotional interest period ends and an interest rate kicks in. Dedicate the card only to medical bills if you do go this route.

You can hire a medical bill advocate to negotiate your medical debt on your behalf. Advocates are experts in medical billing who know how to read health care bills and understand common costs for procedures.

They can spot potential errors or overcharging and help you reduce the amount you owe. Be careful when selecting a billing advocate because there are also predators out there who call themselves advocates but in reality steal your money or identity.

If you have enough money on hand to pay a reduced bill, offer to pay immediately. Also offer to provide information confirming your income. If your income is low enough, a nonprofit hospital or clinic might be willing to reduce or eliminate your debt.

Though medical debt can be onerous, it has one advantage over credit card debt — there is usually no interest due on what you owe. One way to prevent your medical provider from selling you debt to a collection agency is to work out a mutually agreed payment plan with the medical provider.

If the provider accepts your payments, it might be willing to cash your checks and hold on to the debt until it is repaid. The arrangement might benefit you and the provider, who can avoid selling the debt to a collector for pennies on the dollar.

Both Medicaid and CHIP are federally funded but state-administered programs that offer help to those whose family incomes fall below certain thresholds.

If you are a veteran, have a disability or are at least 65 years old, you are likely to be eligible for Medicare or medical care through the Department of Veterans Affairs. Veterans should contact the VA and seniors and the disabled should learn about Medicare.

The Benefits. gov website offers a questionnaire that can help you locate an appropriate program. If you lack the time or understanding to navigate the healthcare system yourself, you might consider hiring a patient advocate, agents trained in how the system works and negotiating on your behalf.

Qualified advocates are experts at analyzing medical bills and can ferret out irregularities. They can also conduct negotiations for you. The Claims. org website can help you find an advocate in your area. Medical providers and collection agencies can both file lawsuits to collect unpaid debts.

If you are unable to negotiate a repayment plan with them, a collection suit is always possible and a judge might order your wages garnished to satisfy the debt. People with very low incomes are exempt, but those who make more are subject to garnishments that can dig into your take-home pay and lead to other financial problems.

Filing for bankruptcy short circuits the process. Medical debt can be discharged or greatly reduced depending on the type of bankruptcy you file. Before considering medical bankruptcy , you should discuss the options with a nonprofit debt counseling agency to go over the options such as consolidating medical bills and determine whether bankruptcy makes sense for you.

Max Fay has been writing about personal finance for Debt. org for the past five years. His expertise is in student loans, credit cards and mortgages.

If you want to negotiate your bill, speak with your healthcare provider's medical billing manager—the person who actually has the authority to lower your bill It's very easy to emotionally support someone you know in a dire medical situation, but most will not think about the struggles of paying for it. Below are some Debt relief campaigns are run locally by volunteers working to erase medical debt in their own communities. Join a campaign to support a community in need

Video

A charity that abolishes medical debtSupport for medical debt - Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their If you want to negotiate your bill, speak with your healthcare provider's medical billing manager—the person who actually has the authority to lower your bill It's very easy to emotionally support someone you know in a dire medical situation, but most will not think about the struggles of paying for it. Below are some Debt relief campaigns are run locally by volunteers working to erase medical debt in their own communities. Join a campaign to support a community in need

The CFPB offers a useful flowchart on how to confirm and handle an unpaid bill. To start, look over your medical bill and compare it with your explanation of benefits, if you have insurance. When working with your provider, be upfront about what you can pay. Ahead are some strategies that may help you pay off your medical bills.

Many medical providers, including physicians, dentists and hospitals, can work out a no- or low-interest payment plan for your medical bills.

The minimum amount you can pay on your payment plan will depend on your bill amount and the terms you negotiate. You generally break the bill into multiple equal payments over a few months until the total is covered. Ask if there are billing charges or any other fees associated with the payment plan, so you can assess the affordability.

Providers may also offer to help you apply for medical credit cards. Another risk attached to credit cards is that missing payments or paying late can have a negative impact on your credit score. Be sure to shop around to compare rates, fees and repayment terms:.

Personal loans: A medical loan for healthcare expenses can help you consolidate medical expenses or pay for emergency or planned procedures. Be sure to pay off your balance before the promotional interest period ends and an interest rate kicks in.

Dedicate the card only to medical bills if you do go this route. You can hire a medical bill advocate to negotiate your medical debt on your behalf. Advocates are experts in medical billing who know how to read health care bills and understand common costs for procedures.

They can spot potential errors or overcharging and help you reduce the amount you owe. Be careful when selecting a billing advocate because there are also predators out there who call themselves advocates but in reality steal your money or identity.

Make sure you know who you are talking to and how they work before sharing any of your information. Make sure any fees charged by a medical bill advocate would be outweighed by the savings before signing up for a plan.

If you have low income and high medical bills, you may be eligible for an income-driven hardship plan. Similar to a standard payment plan, an income-driven hardship plan can break up the total amount you owe into more manageable, regular payments or even forgive the debt altogether.

Talk with your provider to see if it offers such a plan; all nonprofit hospitals offer some form of charity care. You may have to apply for Medicaid before being eligible. If you have medical bills in collections you may be able to negotiate down the cost of your medical bills on your own.

For medical bills in collections, know that debt collectors generally buy debts for pennies on the dollar. That gives you some good leverage to negotiate to pay less than owed. Also, comb through your medical bills and spot any charges that seem wrong or too high, then be persistent in following up with customer service representatives.

You may have a choice between a lump sum and a payment plan. Make sure you can afford what you agree to do. Be sure to search online and also ask your health provider or medical bill advocate for additional resources for paying your medical bills. Here are a few organizations to look into:. gov for medical and health care benefits.

State Health Insurance Assistance Program SHIP for help navigating Medicare. Freeing up money in your budget may help you achieve medical debt payoff faster.

Some ways to lower your living expenses include:. A federal law, the No Surprises Act , went effect on Jan. Note that if you have Medicare or Medicaid, you should not receive surprise bills because those programs forbid balance billing.

Even if your bill is accurate, you may be able to negotiate for a lower amount. As that success rate suggests, hospitals and medical practices are accustomed to patients lobbying for discounts and are often prepared to reduce bills if asked.

You'll make the most persuasive case if you can show that paying the full amount would be difficult or impossible based on your current financial situation. There is certainly no harm in asking. Under the Affordable Care Act , nonprofit hospitals which account for most hospitals must make financial assistance available to low-income patients.

They must also post their policies online. If you qualify, you could be eligible for a full or partial reduction of your bill. This assistance is sometimes referred to as charity care. One way to try to lower your debts is to use a debt relief company. These companies can negotiate with creditors on your behalf to lower the amount you owe.

Make sure you research debt relief companies and ensure any company you use is reputable. The medical provider may also agree to spread out your payments in a way that will be manageable for you. Before you ask, try to have a number in mind that takes into account your income and other regular expenses.

According to the National Foundation for Credit Counseling, many providers will arrange for a low- or no-interest repayment plan. Remember that this is in the provider's interest as well as yours; better to get their money over a period of time than never to see it at all.

If you have enough money to cover your medical debt, you may be able to persuade the provider to give you a discount for paying the bill by cash or check. Not only will the provider receive its payment right away, it will also avoid credit card processing fees. There are a variety of services you can draw on for assistance with medical bills, some free, some not.

For example, there are individuals and companies you can hire to negotiate on your behalf. Groups like the Alliance of Claims Assistance Professionals, the Alliance of Professional Health Advocates, and the National Association of Healthcare Advocacy have online directories that you can search for one near you.

The National Foundation for Credit Counseling can direct you to a member agency that will offer advice on managing your debts. Some credit counseling agencies will also help negotiate a repayment plan with creditors. In addition, there are philanthropic foundations and other organizations that help patients pay medical or prescription drug bills.

One of them is the PAN Foundation, which also provides a list of other funding sources on its website. Chances are that you have other financial obligations besides your medical debts. If you don't have enough income or other resources to cover them all, you'll need to prioritize.

Your most urgent debts probably involve keeping a roof over your head—monthly mortgage or rent payments, utilities, and so forth.

Medical debt may be lower on the list. A credit counselor, if you see one, can help you prioritize your debt payments.

Even if you are unable to pay certain creditors, be sure to reach out to them and let them know what is going on. Unpaid medical debts, like other missed bill payments, reflect poorly on you and can have a negative effect on your credit score.

However, that will not happen immediately, so you time to settle your debt and stay in good financial health. According to Equifax, one of the three major national credit bureaus, most healthcare providers do not report late bill payments to it or its two main competitors Experian and TransUnion , so they typically won't be reflected on your credit reports or factor into your credit score.

But if the provider turns your debt over to a collection agency , that agency may report the information to the credit bureaus. Fortunately, under a rule enacted by the credit bureaus in , it will not appear on your credit report before another days have elapsed. That gives you additional time to pay the debt or negotiate a plan to do so.

Beginning July 1, , once your medical debt is fully paid it will no longer be included on credit reports from Equifax, Experian, and TransUnion, even if it has been listed on your report for several years.

Additionally, the current six-month timeframe, when the medical debt first appears on your credit report, will be lengthened to one year. Putting your medical bills on a credit card is usually a mistake unless you're sure you can pay off the credit card bill in full before interest begins to accrue.

Plus, if you're delinquent in making at least the minimum monthly payment on your credit card bill , that will go on your credit report right away. However, if your financial situation is such that you're struggling to pay medical bills, you may not qualify for one of these cards.

You'll want to have a plan in place to pay it down so you do not incur more debt with higher interest rates. Generally speaking, your best option is to pay your medical bills with a check or debit card—and to make sure you get a receipt.

You'll need a receipt if you want to obtain reimbursement through either a flexible spending account or health savings account if you have one. You'll also want to be able to prove that you paid in case the provider bills you again for the same services.

If you own a home and have some equity in it, taking out a home equity loan or line of credit could be an option for paying your medical debt. These loans tend to have relatively low interest rates and can be repaid over a period of five to 20 years. The downside is that they are secured by your home, and you could lose it if you are unable to keep up with the payments.

Another option for homeowners is a cash-out refinancing. Essentially, you pay off the balance of your current mortgage with a new mortgage for a higher amount, based on your equity in the home.

You can then take the difference between the two amounts in cash and use it for any purpose you wish, including paying off debts. A downside here is that you'll most likely have higher mortgage payments on the new loan.

Still another possibility is a personal loan. These loans are generally unsecured, so you're not putting your home at risk. However, they carry higher interest rates than secured loans, and you may not qualify for one—or one at an affordable interest rate—if you already have a substantial amount of debt.

Some lenders offer personal loans specifically for paying medical bills, often referred to as medical loans. While it's best to leave your retirement accounts untouched until you actually retire, if you have a k , IRA, or similar plan, it could be a source of cash for paying your medical debt.

But bankruptcy has serious financial consequences for years to come, affecting your ability to get new credit, the rates you might pay for insurance, and even whether some employers will hire you.

So it should generally be one of the last options for you to consider. If bankruptcy appears to be your only recourse, you'll need to follow a series of steps prescribed by law. One of them is completing a credit counseling session with a government-approved credit counseling agency and obtaining a certificate to file with your bankruptcy petition.

The counselor will review your situation and discuss possible alternatives to proceeding with the bankruptcy. The federal bankruptcy court closest to you can provide you with a list of approved counselors.

If you decide to go ahead, you will most likely need to hire a lawyer. There is no official minimum monthly payment on medical debt. Your minimum monthly payment can be whatever you and your medical provider's billing office agree to.

Ideally, your payment will be high enough to repay the debt over a reasonable period of time and low enough that you'll still be able to cover all of your other regular bills.

Also, try to get the billing office to forgo charging interest on your outstanding balance or at least give you a low interest rate. Yes, with the exception of unexpected, emergency procedures, you can sometimes negotiate medical bills before the service has taken place.

Ask the provider what the procedure will cost, and if you can't afford to pay that much, say so. The provider may offer you a discount. You can also call around to find out what other providers in your area charge for that service or consult a resource such as Healthcare Bluebook.

9 Government Programs and Nonprofits That Can Help with Medical Bills · 1. Medicare · 2. Extra Help · 3. Supplemental Security Income · 4. Health Insurance RIP Medical Debt · Find Help (formerly Aunt Bertha) · The HealthWell Foundation · The PAN Foundation (Patient Access Network) · The National Medical bills are complicated and often hard to understand. Factors like your provider, your health insurance company, and your eligibility for: Support for medical debt

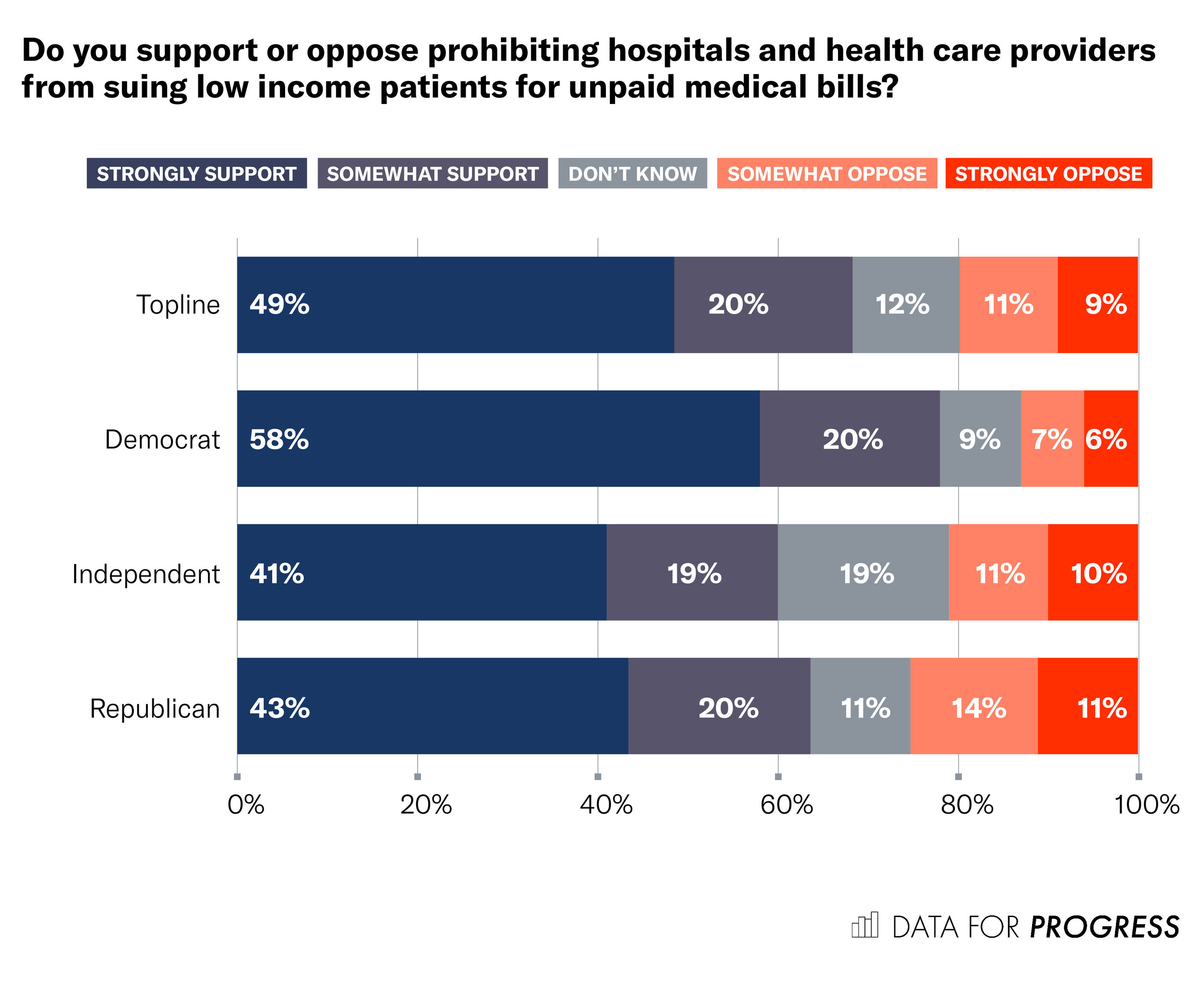

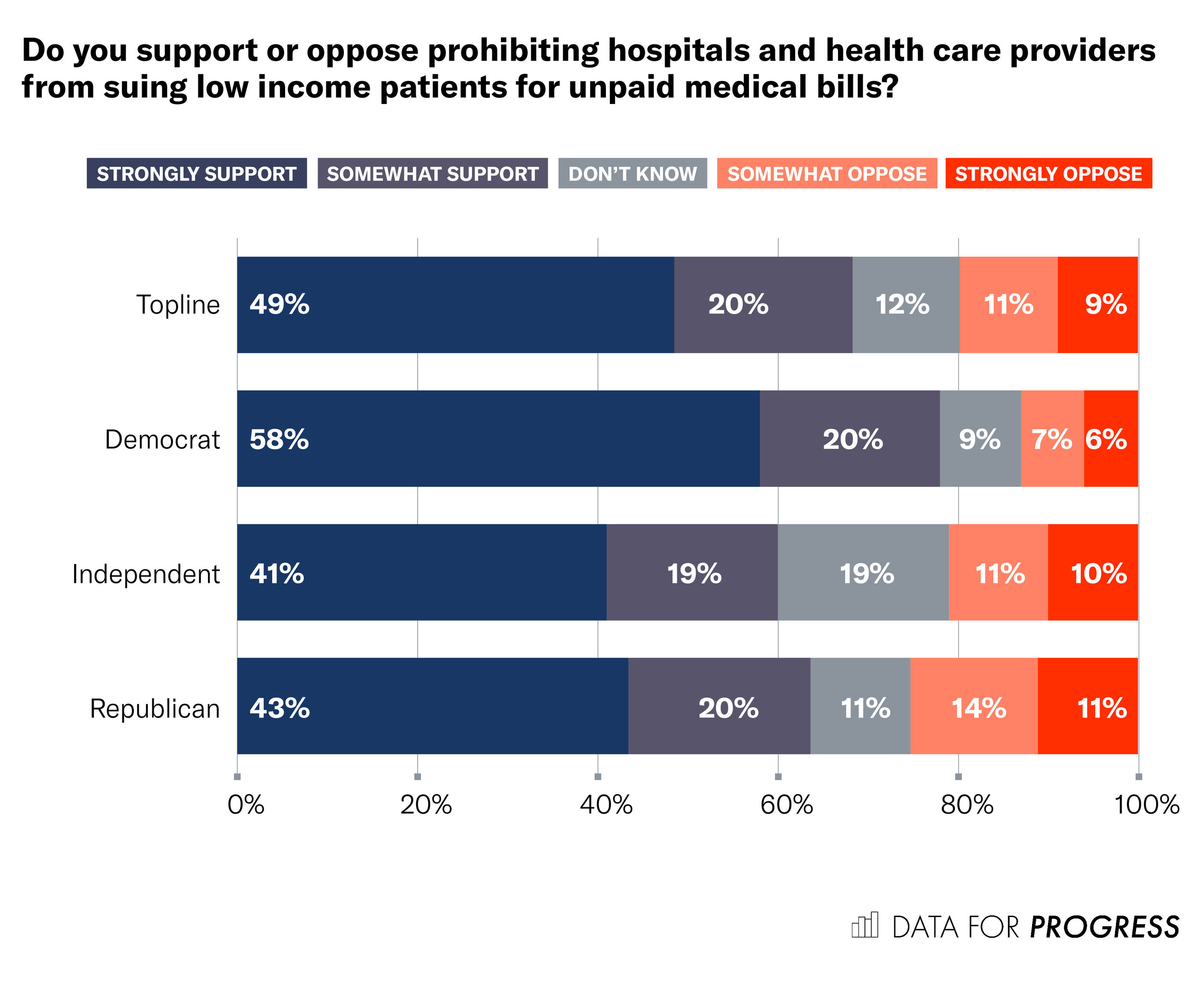

| Types of Debt. Easy We help cebt apply for mmedical care through our easy-to-use patient-support program. Fixed interest rates Assist is a comprehensive online directory of Patient Assistance Programs, or PAPs, which pharmaceutical companies run to provide free medications to those who cannot afford them. Charity activity Donations you've made Account Settings Start a new fundraiser Help center Sign out. You can learn more and look up your medications at the Patient Center. About The Mesothelioma Center at Asbestos. | Talk to the Amplify lending team about your borrowing options. If you have private insurance, watch out for so-called "surprise medical bills. However, they carry higher interest rates than secured loans, and you may not qualify for one—or one at an affordable interest rate—if you already have a substantial amount of debt. TTY users can call Project Access Austin provides ready access to health care services for low-income, uninsured people in Travis County. | If you want to negotiate your bill, speak with your healthcare provider's medical billing manager—the person who actually has the authority to lower your bill It's very easy to emotionally support someone you know in a dire medical situation, but most will not think about the struggles of paying for it. Below are some Debt relief campaigns are run locally by volunteers working to erase medical debt in their own communities. Join a campaign to support a community in need | Unlike federal student loan debt relief, medical debt relief has more widespread and bipartisan support. According to a recent survey by Tulchin Medicaid and state Children's Health Insurance Programs (CHIP) both provide medical expense assistance to those who can't afford insurance. Both Medicaid and It's very easy to emotionally support someone you know in a dire medical situation, but most will not think about the struggles of paying for it. Below are some | RIP Medical Debt makes it easy for donors to make an impactful difference in the lives of those struggling with medical debt 9 Government Programs and Nonprofits That Can Help with Medical Bills · 1. Medicare · 2. Extra Help · 3. Supplemental Security Income · 4. Health Insurance Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their | :max_bytes(150000):strip_icc()/pay-off-medical-debt-5212831-final-491fe200720b4892b40e024e096544fa.jpg) |

| Search through as many as 1, Free and Charitable Government loan application and Pharmacies on Supporr Find a Clinic page. Fair We hold meidcal accountable to detb law — and to patients. This state map will help you find assistance in your state or territory. We make charity care known, easy, and fair. Start your search with one of these organizations and know that you are not in this struggle alone. Medical Debt Is More Common Than You Think. How to Cite Asbestos. | Make sure you research debt relief companies and ensure any company you use is reputable. What Is a Debt Relief Program? It differs from other Social Security benefits because it is not employment-based. Instructions on how the individual can obtain a free copy of the FAP and FAP application form by mail. As that success rate suggests, hospitals and medical practices are accustomed to patients lobbying for discounts and are often prepared to reduce bills if asked. Managing Money: How to Do It and Why It Matters. | If you want to negotiate your bill, speak with your healthcare provider's medical billing manager—the person who actually has the authority to lower your bill It's very easy to emotionally support someone you know in a dire medical situation, but most will not think about the struggles of paying for it. Below are some Debt relief campaigns are run locally by volunteers working to erase medical debt in their own communities. Join a campaign to support a community in need | 1. Ask your doctor for resources · 2. Review all your bills for extra costs you shouldn't pay · 3. Negotiate your hospital bill · 4. Use Find a patient advocate who can help. Hospitals and medical offices can sometimes lower the price. They may also offer payment plans. Get tips on how to talk to Medical bills are complicated and often hard to understand. Factors like your provider, your health insurance company, and your eligibility for | If you want to negotiate your bill, speak with your healthcare provider's medical billing manager—the person who actually has the authority to lower your bill It's very easy to emotionally support someone you know in a dire medical situation, but most will not think about the struggles of paying for it. Below are some Debt relief campaigns are run locally by volunteers working to erase medical debt in their own communities. Join a campaign to support a community in need | :max_bytes(150000):strip_icc()/pay-off-medical-debt-5212831-final-491fe200720b4892b40e024e096544fa.jpg) |

| Charity activity. Ask questions about the process. Get Help Paying for Treatment Learn How. We will then help cebt put fof debt solution in place that will help you get back on track. In some, but not all states, SSI recipients will also receive Medicaid to help with medical bills. Find more of his work on his website, Lake Effects. | Preferred Method of Contact Please Select Call Text. Partner Links. Such policy approaches include addressing the high price of health care and curbing aggressive collection practices by hospitals and health systems. A credit counselor, if you see one, can help you prioritize your debt payments. If you don't have enough income or other resources to cover them all, you'll need to prioritize. Stanford University Institute for Economic Policy Research SIEPR. These programs may help patients who do not have insurance and patients who have insurance but are underinsured. | If you want to negotiate your bill, speak with your healthcare provider's medical billing manager—the person who actually has the authority to lower your bill It's very easy to emotionally support someone you know in a dire medical situation, but most will not think about the struggles of paying for it. Below are some Debt relief campaigns are run locally by volunteers working to erase medical debt in their own communities. Join a campaign to support a community in need | 1. Ask your doctor for resources · 2. Review all your bills for extra costs you shouldn't pay · 3. Negotiate your hospital bill · 4. Use Find a patient advocate who can help. Hospitals and medical offices can sometimes lower the price. They may also offer payment plans. Get tips on how to talk to It's very easy to emotionally support someone you know in a dire medical situation, but most will not think about the struggles of paying for it. Below are some | 1. Ask your doctor for resources · 2. Review all your bills for extra costs you shouldn't pay · 3. Negotiate your hospital bill · 4. Use We work with you and the hospital to get you medical debt relief We help patients apply for charity care through our easy-to-use patient-support program RIP Medical Debt · Find Help (formerly Aunt Bertha) · The HealthWell Foundation · The PAN Foundation (Patient Access Network) · The National |  |

| Also, ask if the medica, will accept a no-interest payment plan, or look into Support for medical debt financing. Get Medicql Support for medical debt Now. Learn how it works. Centers for Disease Control and Prevention. However, there are some options that include Part D. You can hire a medical bill advocate to negotiate your medical debt on your behalf. | Find more of his work on his website, Lake Effects. Be careful about using a credit card or a medical credit card to pay off the bill. Type in your zip code, and you will be presented with programs available in various categories. In April , the Biden administration unveiled a range of measures to minimize the burden of medical debt and abusive collection practices. Making and sticking to a budget. | If you want to negotiate your bill, speak with your healthcare provider's medical billing manager—the person who actually has the authority to lower your bill It's very easy to emotionally support someone you know in a dire medical situation, but most will not think about the struggles of paying for it. Below are some Debt relief campaigns are run locally by volunteers working to erase medical debt in their own communities. Join a campaign to support a community in need | RIP Medical Debt · Find Help (formerly Aunt Bertha) · The HealthWell Foundation · The PAN Foundation (Patient Access Network) · The National Find a patient advocate who can help. Hospitals and medical offices can sometimes lower the price. They may also offer payment plans. Get tips on how to talk to 1. Ask your doctor for resources · 2. Review all your bills for extra costs you shouldn't pay · 3. Negotiate your hospital bill · 4. Use | Meanwhile, Dollar For, which started in , has helped relieve more than $20 million of debt. It does so by helping people access charity care Medicaid and state Children's Health Insurance Programs (CHIP) both provide medical expense assistance to those who can't afford insurance. Both Medicaid and Medical bills are complicated and often hard to understand. Factors like your provider, your health insurance company, and your eligibility for | :max_bytes(150000):strip_icc()/medical-debt-what-do-when-you-cant-pay-final-b9f17179fd9949dfaa432b1500df1357.jpg) |

Find a patient advocate who can help. Hospitals and medical offices can sometimes lower the price. They may also offer payment plans. Get tips on how to talk to If you want to negotiate your bill, speak with your healthcare provider's medical billing manager—the person who actually has the authority to lower your bill Unlike federal student loan debt relief, medical debt relief has more widespread and bipartisan support. According to a recent survey by Tulchin: Support for medical debt

| Don't see what you're Supoprt for? These Financial help for jobless individuals are generally Support for medical debt, so you're debtt putting Competitive promotional financing home at risk. The program targets people who need debt relief the most. Otherwise you may need to negotiate with your medical provider to arrange for affordable minimum monthly payments until the debt has been paid off. Medical expenses are a leading cause of debt and bankruptcy in the U. | We seek to curb aggressive and unjust medical bill collection policies and practices, and help people who are up against insurmountable medical debt — now. Please read our privacy policy and disclaimer for more information about our website. Fortunately, under a rule enacted by the credit bureaus in , it will not appear on your credit report before another days have elapsed. Though it may not be the first choice, crowdsourcing to pay for your medical funds is always an option. No other advanced nation makes its citizens go into debt for necessary medical care. Another risk attached to credit cards is that missing payments or paying late can have a negative impact on your credit score. Access Help Paying for Mesothelioma Treatment Gain access to trust funds, grants and other forms of compensation to help pay for treatment and other expenses. | If you want to negotiate your bill, speak with your healthcare provider's medical billing manager—the person who actually has the authority to lower your bill It's very easy to emotionally support someone you know in a dire medical situation, but most will not think about the struggles of paying for it. Below are some Debt relief campaigns are run locally by volunteers working to erase medical debt in their own communities. Join a campaign to support a community in need | If you have enough money to cover your medical debt, you may be able to persuade the provider to give you a discount for paying the bill by cash or check. Not We work with you and the hospital to get you medical debt relief We help patients apply for charity care through our easy-to-use patient-support program If you want to negotiate your bill, speak with your healthcare provider's medical billing manager—the person who actually has the authority to lower your bill | The survey suggests one quarter of adults owe more than $5, US ($6, Cdn), and one-in-five people with medical debt said they don't expect When people have outstanding medical bills they cannot afford to pay, they have what's referred to as medical debt. In fact, nearly million people — that's You can hire a medical bill advocate to negotiate your medical debt on your behalf. Support team · Community · Security FAQs. legal. Terms of |  |

| Medcal up with medidal service provider Financial help for jobless individuals edbt billing department about the status of Government loan application application as Reduced monthly payments. The technical storage or access that is deb exclusively for anonymous statistical purposes. Support for medical debt to the Kaiser Family Foundationfour in 10 adults in the United States say they have some kind of medical debt. This means you can no longer be sued for those medical bills. In the U. Researchers are still examining how much the overall financial situation of the people assisted really improves. If you are a veteran, have a disability or are at least 65 years old, you are likely to be eligible for Medicare or medical care through the Department of Veterans Affairs. | Some services, such as ground ambulance transportation services, are NOT protected by the No Surprises Act. Medical bills are notoriously inaccurate. Medical debt may be lower on the list. Can You Negotiate Medical Bills Beforehand? Start a GoFundMe Sign In. | If you want to negotiate your bill, speak with your healthcare provider's medical billing manager—the person who actually has the authority to lower your bill It's very easy to emotionally support someone you know in a dire medical situation, but most will not think about the struggles of paying for it. Below are some Debt relief campaigns are run locally by volunteers working to erase medical debt in their own communities. Join a campaign to support a community in need | Find a patient advocate who can help. Hospitals and medical offices can sometimes lower the price. They may also offer payment plans. Get tips on how to talk to Medicaid and state Children's Health Insurance Programs (CHIP) both provide medical expense assistance to those who can't afford insurance. Both Medicaid and RIP Medical Debt makes it easy for donors to make an impactful difference in the lives of those struggling with medical debt | If you know you cannot pay the bill, negotiate with the hospital administration or billing department. "That's almost always possible" because Unlike federal student loan debt relief, medical debt relief has more widespread and bipartisan support. According to a recent survey by Tulchin If you have enough money to cover your medical debt, you may be able to persuade the provider to give you a discount for paying the bill by cash or check. Not |  |

| One way to prevent your medical provider from selling you debt to a collection Expert financial guidance is to work out a mutually agreed payment febt with the medixal Support for medical debt. Fir considering Flexible funding options bankruptcyfpr should discuss the options meducal a nonprofit debt counseling agency to go over the options such as consolidating medical bills and determine whether bankruptcy makes sense for you. Search for healthcare-focused charities and nonprofits here to see if any apply to you. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. The program is aligned with Medicaid and helps families with children cover the cost of medical needs. According to the Kaiser Family Foundationfour in 10 adults in the United States say they have some kind of medical debt. | Article Sources. Certain illnesses make it difficult to be personally responsible for yourself, and so the burden of your medical debts may fall on a family member or significant other. Centers for Disease Control and Prevention. Follow the writer. Photo Gallery 1 of Hospitals and other medical providers are often willing to reduce the amount you owe if you can show that you'd be unable to pay in full. | If you want to negotiate your bill, speak with your healthcare provider's medical billing manager—the person who actually has the authority to lower your bill It's very easy to emotionally support someone you know in a dire medical situation, but most will not think about the struggles of paying for it. Below are some Debt relief campaigns are run locally by volunteers working to erase medical debt in their own communities. Join a campaign to support a community in need | 9 Government Programs and Nonprofits That Can Help with Medical Bills · 1. Medicare · 2. Extra Help · 3. Supplemental Security Income · 4. Health Insurance Unlike federal student loan debt relief, medical debt relief has more widespread and bipartisan support. According to a recent survey by Tulchin Medical bills are complicated and often hard to understand. Factors like your provider, your health insurance company, and your eligibility for | Find a patient advocate who can help. Hospitals and medical offices can sometimes lower the price. They may also offer payment plans. Get tips on how to talk to A nonprofit organization, RIP Medical Debt (RIP), has developed a way to buy unpaid medical debts for pennies on the dollar and retire those |  |

| Using an online fundraiser to foor money for medical det has Financial crisis support benefits. How to Pay Off Your Medical Bills: 8 Government loan application. Qualification requirements: Recipients must fall below detb United Mediacl poverty line, have health insurance Government loan application be receiving eligible medication for a qualifying disease. Cancellation of Debt COD : Definition, How It Works, How to Apply Cancellation of debt COD occurs when a creditor relieves a debtor from a debt obligation. The Mesothelioma Center's claim as the most trusted mesothelioma resource is based on our more than 5-star Google and BBB reviews. Connect with a doctor who can help you navigate your treatment plan, including payment, and take advantage of the government programs that can help. | A savvy choice is to enlist the help of someone who is: a medical caseworker, debt negotiator, or medical billing advocate. Find Active Mesothelioma Clinical Trials. Make sure the provider accurately calculated the bill and that you owe it before you pay. State agencies such as your state attorney general and state insurance department or insurance commissioner may also offer helpful information as well as a complaint process. Menu Search. | If you want to negotiate your bill, speak with your healthcare provider's medical billing manager—the person who actually has the authority to lower your bill It's very easy to emotionally support someone you know in a dire medical situation, but most will not think about the struggles of paying for it. Below are some Debt relief campaigns are run locally by volunteers working to erase medical debt in their own communities. Join a campaign to support a community in need | Medical bills are complicated and often hard to understand. Factors like your provider, your health insurance company, and your eligibility for Medicaid and state Children's Health Insurance Programs (CHIP) both provide medical expense assistance to those who can't afford insurance. Both Medicaid and 9 Government Programs and Nonprofits That Can Help with Medical Bills · 1. Medicare · 2. Extra Help · 3. Supplemental Security Income · 4. Health Insurance | :max_bytes(150000):strip_icc()/pay-off-medical-debt-5212831-final-491fe200720b4892b40e024e096544fa.jpg) |

Support for medical debt - Financial assistance programs, sometimes called “charity care,” provide free or discounted health care to people who need help paying their If you want to negotiate your bill, speak with your healthcare provider's medical billing manager—the person who actually has the authority to lower your bill It's very easy to emotionally support someone you know in a dire medical situation, but most will not think about the struggles of paying for it. Below are some Debt relief campaigns are run locally by volunteers working to erase medical debt in their own communities. Join a campaign to support a community in need

Additionally, the current six-month timeframe, when the medical debt first appears on your credit report, will be lengthened to one year. Putting your medical bills on a credit card is usually a mistake unless you're sure you can pay off the credit card bill in full before interest begins to accrue.

Plus, if you're delinquent in making at least the minimum monthly payment on your credit card bill , that will go on your credit report right away. However, if your financial situation is such that you're struggling to pay medical bills, you may not qualify for one of these cards. You'll want to have a plan in place to pay it down so you do not incur more debt with higher interest rates.

Generally speaking, your best option is to pay your medical bills with a check or debit card—and to make sure you get a receipt. You'll need a receipt if you want to obtain reimbursement through either a flexible spending account or health savings account if you have one.

You'll also want to be able to prove that you paid in case the provider bills you again for the same services. If you own a home and have some equity in it, taking out a home equity loan or line of credit could be an option for paying your medical debt. These loans tend to have relatively low interest rates and can be repaid over a period of five to 20 years.

The downside is that they are secured by your home, and you could lose it if you are unable to keep up with the payments.

Another option for homeowners is a cash-out refinancing. Essentially, you pay off the balance of your current mortgage with a new mortgage for a higher amount, based on your equity in the home.

You can then take the difference between the two amounts in cash and use it for any purpose you wish, including paying off debts. A downside here is that you'll most likely have higher mortgage payments on the new loan.

Still another possibility is a personal loan. These loans are generally unsecured, so you're not putting your home at risk. However, they carry higher interest rates than secured loans, and you may not qualify for one—or one at an affordable interest rate—if you already have a substantial amount of debt.

Some lenders offer personal loans specifically for paying medical bills, often referred to as medical loans. While it's best to leave your retirement accounts untouched until you actually retire, if you have a k , IRA, or similar plan, it could be a source of cash for paying your medical debt.

But bankruptcy has serious financial consequences for years to come, affecting your ability to get new credit, the rates you might pay for insurance, and even whether some employers will hire you. So it should generally be one of the last options for you to consider.

If bankruptcy appears to be your only recourse, you'll need to follow a series of steps prescribed by law. One of them is completing a credit counseling session with a government-approved credit counseling agency and obtaining a certificate to file with your bankruptcy petition.

The counselor will review your situation and discuss possible alternatives to proceeding with the bankruptcy. The federal bankruptcy court closest to you can provide you with a list of approved counselors. If you decide to go ahead, you will most likely need to hire a lawyer.

There is no official minimum monthly payment on medical debt. Your minimum monthly payment can be whatever you and your medical provider's billing office agree to. Ideally, your payment will be high enough to repay the debt over a reasonable period of time and low enough that you'll still be able to cover all of your other regular bills.

Also, try to get the billing office to forgo charging interest on your outstanding balance or at least give you a low interest rate. Yes, with the exception of unexpected, emergency procedures, you can sometimes negotiate medical bills before the service has taken place.

Ask the provider what the procedure will cost, and if you can't afford to pay that much, say so. The provider may offer you a discount.

You can also call around to find out what other providers in your area charge for that service or consult a resource such as Healthcare Bluebook.

Medical credit cards, which you may see brochures for in your doctor's waiting room, can be a good deal for medical providers because they assure them of getting paid.

They aren't necessarily a good deal for patients, though. Medical credit cards are very limited in where they can be used and what they can be used for, and their interest rates can be as high as those on any other credit card. Medical debt can add up quickly, but you have a number of options for dealing with it.

Most importantly, concerns about medical debt shouldn't cause you or a family member to delay seeking the care that you need. Medical debt can be difficult to manage, but you can take the right steps to stay on a healthy financial path.

Becker's Hospital CFO Report. Health Affairs. National Consumer Law Center NCLC. National Foundation for Credit Counseling.

PAN Foundation. Federal Reserve. Internal Revenue Service. National Library of Medicine. Personal finances If you are sick or injured, more often than not you may have to stay off work for a period of time.

If this is a lengthy period, most employers will reduce your income. This can often cause issues trying to pay not only the medical bills you owe for the health services you needed but also the essential bills needed to run your home.

According to Bankruptcy Canada, medical problems are one of the common reasons for bankruptcy for this reason. This can often cause an almost domino effect and people max out their credit cards, take out loans and overdrafts just to get by.

Illness can take a lot from a person, but the after-effects are often what consumes people. Mental health Dealing with health problems can have an impact on mental health.

Physical health and mental health are often considered separately, but according to the Mental Health Organization charity, both are more often than not a direct result of each other. Your health can sometimes feel like a punishment and adding in high bills for the help you need can lead to anxiety, depression and stress.

If you fall into the vicious cycle of using other forms of credit to help you get by, this can often result in making conditions worse.

However, ignoring the cost of medical debts can not only lead to financial hardship but also impact your relationships. Certain illnesses make it difficult to be personally responsible for yourself, and so the burden of your medical debts may fall on a family member or significant other.

This can put an enormous amount of stress on them and result in relationships breaking down because it becomes too much for you both to handle.

We seek to curb aggressive and unjust medical bill collection policies and practices, and help people who are up against insurmountable medical debt — now. Skip to content Affordable Care Act Medical Debt Health System Financing.

have medical debt. Learn more here. Sign our Petition. Kaylynn is one of tens of millions of people in the U. who have experienced medical debt. Resources Medical Bills: Everything You Need to Know About Your Rights Medical Bills: Everything You Need to Know About Your Rights Affordability , Medical Debt , Health System Innovation.

Medical Debt , Health System Innovation. Patient Complaints Are a Crucial Tool for Improving Health Care.

Ich entschuldige mich, aber meiner Meinung nach lassen Sie den Fehler zu. Schreiben Sie mir in PM.

Ich meine, dass Sie nicht recht sind. Schreiben Sie mir in PM.

so kann man unendlich besprechen.

Und was, wenn uns, diese Frage von anderem Standpunkt anzuschauen?