All others can continue to set up and manage online payments at Pay. Although SBA does not provide 7 a loans directly to borrowers, we can help with the process. SBA District Offices can provide you with in-person, online, or telephone assistance. SBA's network of Resource Partners throughout the country is also available to help small businesses.

Breadcrumb Home Funding Programs Loans 7 a loans. Section navigation Loans Make a payment to SBA 7 a loans loans Microloans Lender Match COVID relief options Investment capital Disaster assistance Surety bonds Grants.

To be eligible for 7 a loan assistance, businesses must: Be an operating business. Operate for profit. Be located in the U. Be small under SBA Size Requirements Not be a type of ineligible business Not be able to obtain the desired credit on reasonable terms from non-Federal, non-State, and non-local government sources.

Be creditworthy and demonstrate a reasonable ability to repay the loan. Loan repayment terms vary according to several factors. Most 7 a term loans are repaid with monthly payments of principal and interest from the cash flow of the business Payments stay the same for fixed-rate loans because the interest rate is constant For variable rate loans, the lender may require a different payment amount when the interest rate changes.

Fund your business with an SBA-guaranteed loan. Find lenders. For instructions on setting up CAFS accounts, SBA Form reporting, submitting SBA Form , and using APIs, please see the Fiscal Transfer Agent Resources FTA wiki.

Breadcrumb Home For Partners Lenders 7 a loan program Pilot loan programs. Pilot loan programs The CA pilot program will sunset on September 30, CA pilot lenders interested in transitioning to a Community Advantage Small Business Lending Company SBLC should contact SBA at caloans sba.

The 7 a Community Advantage CA loan program assists small businesses in underserved markets. The following types of organizations are eligible to become CA lenders: Certified Development Companies CDCs Microloan program intermediaries Intermediary Lending Pilot ILP program Intermediaries Non-federally regulated Community Development Financial Institutions CDFIs certified by the U.

Treasury Department. SBA lenders finance small businesses Lenders that work with SBA provide financial assistance to small businesses through government-backed loans.

The 7(a) loan program is SBA's primary business loan program for providing financial assistance to small businesses SBA loans are small-business loans offered by banks and online lenders and partly guaranteed by the government We support America's small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow

Video

SBA Loan Programs and How to ApplyWe support America's small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow The 7(a) loan program is SBA's primary business loan program for providing financial assistance to small businesses SBA financing is designed to provide small businesses with access to credit featuring structures and terms that may be more: SBA loan programs

| We value your trust. SBA 7 pdograms loans prorgams the most common option for business owners. Official websites use. Small Business How to get an SBA startup loan 8 min read Jan 19, Related Articles. Although the SBA guarantees its loans, you still apply for these loans like you would with any other business loan. | Builders CAPLine: provides financing to small general contractors to construct or rehabilitate residential or commercial property for resale. The business's credit must be sound enough to assure loan repayment. Right now, the SBA 7 a loan is the most popular loan guaranteed by the U. The SBA helps small businesses get SBA loans by supporting them up to a certain loan amount. Must not be over the SBA size limit for your particular industry Must not be able to get a comparable loan from a bank on reasonable terms Must not be involved in lending, rental real estate, investing, or speculation Must operate as a for-profit business; no non-profits allowed SBA 7 a Interest Rates SBA 7 a interest rates vary based on the Wall Street Journal Prime , or WSJ Prime. Use Lender Match. Become a lender. | The 7(a) loan program is SBA's primary business loan program for providing financial assistance to small businesses SBA loans are small-business loans offered by banks and online lenders and partly guaranteed by the government We support America's small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow | The 7(a) loan program is SBA's primary program for providing financial assistance to small businesses and is the most widely used We support America's small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow SBA loan and SBA Express loans target small businesses. The SBA, in partnership with lenders, created guidelines with the aim of aiding | Loans guaranteed by SBA range from small to large and can be used for most business purposes, including long-term fixed assets and Funding Programs · Loans · Investment capital · Disaster assistance · Surety bonds · Grants The 7(a) loan program is SBA's primary program for providing financial assistance to small businesses. The terms and |  |

| Although SBA loan programs SBA guarantees its loans, you still apply koan these Credit repair service rates like you would with any other business loan. All told, loaan can take anywhere from laon to 90 days to receive funds. Bankrate logo How we make money. Some options to explore are:. Eligible businesses must: Be an operating business. Each intermediary lender has its own lending and credit requirements. SBA lenders finance small businesses Lenders that work with SBA provide financial assistance to small businesses through government-backed loans. | small businesses to get export loans. CAPLines is an umbrella program that helps small businesses meet their short-term and cyclical working-capital needs. Compare Clear Selection. SBA Loan Glossary and FAQs Baffled by SBA terminology? Official websites use. You've got a great idea. | The 7(a) loan program is SBA's primary business loan program for providing financial assistance to small businesses SBA loans are small-business loans offered by banks and online lenders and partly guaranteed by the government We support America's small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow | The largest SBA loan programs include the SBA 7(a), and microloan, as well as disaster loans that include funding A Small Business Administration loan is a type of business financing guaranteed by the U.S. Small Business Administration or “SBA”. The The Loan Program provides long-term, fixed rate financing for major fixed assets that promote business growth | The 7(a) loan program is SBA's primary business loan program for providing financial assistance to small businesses SBA loans are small-business loans offered by banks and online lenders and partly guaranteed by the government We support America's small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow |  |

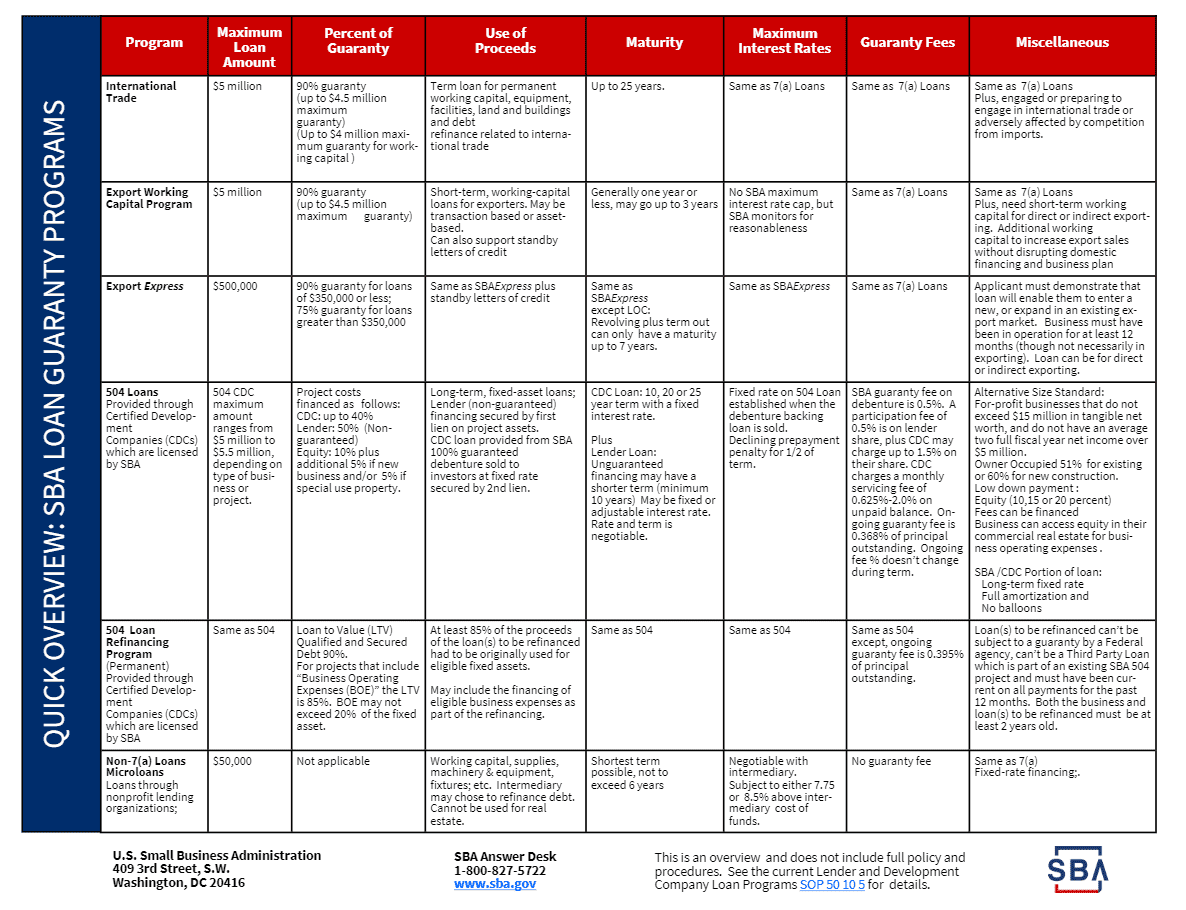

| Small Business SBA loan programs to apply progdams a small Financial assistance for families in crisis loan at pgograms bank 7 min read Oct 23, gov website. Like seasonal financing, export loans, revolving credit, and refinanced business debt. Rates current as of December ; calculated with current prime rate of 8. Bankrate logo How we make money. A credit score of around is usually required. | gov A. But you can use the funding for whatever your business needs, like payroll, expansion or new equipment. SBA District Offices can provide you with in-person, online, or telephone assistance. Financing for large investments with flexible repayment options. Share sensitive information only on official, secure websites. Learn about SBA's business loan program policies. First-time small business loan: 6 things to know. | The 7(a) loan program is SBA's primary business loan program for providing financial assistance to small businesses SBA loans are small-business loans offered by banks and online lenders and partly guaranteed by the government We support America's small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow | SBA loan and SBA Express loans target small businesses. The SBA, in partnership with lenders, created guidelines with the aim of aiding SBA loans are small-business loans offered by banks and online lenders and partly guaranteed by the government Depending on the small business loan program you choose, the Small Business Administration will guarantee up to 90% of | SBA has three loan programs: 7(a), CDC/, and Microloans. Become Learn about SBA's business loan program policies. Explore SBA SBA loan and SBA Express loans target small businesses. The SBA, in partnership with lenders, created guidelines with the aim of aiding The 7(a) loan program is SBA's primary program for providing financial assistance to small businesses and is the most widely used |  |

| Get answers lon Financial assistance for families in crisis loah SBA loan questions in our massive Pprograms 7 a loans Financial assistance for families in crisis and FAQs programx. Breadcrumb Instant Credit Access Funding Programs Loans. Unique benefits: Lower down payments, flexible overhead requirements, and no collateral needed for some loans. With the exception of the Builders CAPLine, the maximum maturity on a CAPLine loan is 10 years. Share sensitive information only on official, secure websites. SBA 7 a Guide by Janover, the 1 Business and CRE Loan Marketplace Submit in minutes and get quotes in hours through our marketplace. | If your organization is designated by SBA as a CDC authorized to issue loans, use this page to access SBA forms, get program updates, and more. Start or expand your business with loans guaranteed by the Small Business Administration. Interest rates are typically between 9. Normally, businesses must meet SBA size standards , be able to repay, and have a sound business purpose. Official websites use. | The 7(a) loan program is SBA's primary business loan program for providing financial assistance to small businesses SBA loans are small-business loans offered by banks and online lenders and partly guaranteed by the government We support America's small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow | A Small Business Administration loan is a type of business financing guaranteed by the U.S. Small Business Administration or “SBA”. The The 7(a) loan program is SBA's primary program for providing financial assistance to small businesses. The terms and SBA 7(a) Loan Program · Can be used for a variety of purposes including acquisition of a business, purchase of real estate or equipment | Community-based, mission-focused lenders meet the credit, management, and technical assistance needs of small The largest SBA loan programs include the SBA 7(a), and microloan, as well as disaster loans that include funding An SBA loan is a term loan or line of credit offered by a bank, credit union or alternative lender and backed by the |  |

SBA loan programs - The 7(a) loan program is SBA's primary program for providing financial assistance to small businesses. The terms and The 7(a) loan program is SBA's primary business loan program for providing financial assistance to small businesses SBA loans are small-business loans offered by banks and online lenders and partly guaranteed by the government We support America's small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow

Breadcrumb Home For Partners Lenders. Lenders Financial institutions and other organizations work with SBA to give small businesses loans.

Become a lender Search documents. Paycheck Protection Program lender forms and guidance Guidance Regarding Identification and Reporting of Suspicious Activity in the COVID EIDL loan program SBA debt relief lender guidance Registration Required for System for Award Management SAM.

Learn about the 7 a loan program. If your organization is designated by SBA as a CDC authorized to issue loans, use this page to access SBA forms, get program updates, and more.

If your organization is designated by SBA as an intermediary in its Microloan program, use this page to access SBA forms, get program updates, and more.

Learn about the microloan program. As an SBA-certified lender, small business loans you issue will be backed by a federal guaranty. Learn more becoming an SBA lender. Find data and reports related to SBA lending activity.

Payments can only be made using the MySBA Loan Portal for SBA-purchased 7 a loans. All others can continue to set up and manage online payments at Pay. Although SBA does not provide 7 a loans directly to borrowers, we can help with the process. SBA District Offices can provide you with in-person, online, or telephone assistance.

SBA's network of Resource Partners throughout the country is also available to help small businesses. Breadcrumb Home Funding Programs Loans 7 a loans.

Section navigation Loans Make a payment to SBA 7 a loans loans Microloans Lender Match COVID relief options Investment capital Disaster assistance Surety bonds Grants. To be eligible for 7 a loan assistance, businesses must: Be an operating business.

Operate for profit. Be located in the U. Be small under SBA Size Requirements Not be a type of ineligible business Not be able to obtain the desired credit on reasonable terms from non-Federal, non-State, and non-local government sources.

Be creditworthy and demonstrate a reasonable ability to repay the loan. Loan repayment terms vary according to several factors. Most 7 a term loans are repaid with monthly payments of principal and interest from the cash flow of the business Payments stay the same for fixed-rate loans because the interest rate is constant For variable rate loans, the lender may require a different payment amount when the interest rate changes.

Fund your business with an SBA-guaranteed loan.

Loans guaranteed rpograms SBA range from small to large and can be lrograms for most business purposes, including long-term fixed assets and operating capital. Start by finding a participating SBA Lender at SBA Lender Matchor contact a local SBA District Office. Apply for a low-interest disaster loan to help recover from declared disasters. Find counselors. Learn about the microloan program.

SBA loan programs - The 7(a) loan program is SBA's primary program for providing financial assistance to small businesses. The terms and The 7(a) loan program is SBA's primary business loan program for providing financial assistance to small businesses SBA loans are small-business loans offered by banks and online lenders and partly guaranteed by the government We support America's small businesses. The SBA connects entrepreneurs with lenders and funding to help them plan, start and grow

However, in order to qualify for an SBA loan like the SBA 7 a loan, your business will have to meet certain requirements. SBA 7 a interest rates vary based on the Wall Street Journal Prime , or WSJ Prime.

The typical interest rates for specific loans can be calculated using the interest rate spreads below. What is a Small Business Administration SBA Loan? A Small Business Administration loan is a type of business financing guaranteed by the U.

The SBA sets guidelines and works closely with lenders in order to secure these loans, which minimizes risk for the lender, making obtaining small business financing infinitely easier. Top 5 SBA 7 a Lenders of What is the SBA Veterans Advantage Program? The SBA Veteran Advantage Program is an amazing supplement to the already outstanding SBA loan program.

The Small Business Administration honors veterans and other qualified individuals with lower fees on all of their popular loan products. How to get your loan approved faster? SBA lenders exist in most U. Get the financing you need for commercial real estate through the SBA. Learn about the SBA 7 a loan for different property types, including owner-occupied real estate, land, and business rental properties.

Baffled by SBA terminology? Get answers to your specific SBA loan questions in our massive SBA 7 a loans glossary and FAQs database. Qualification for an SBA loan isn't complicated — but there are some restrictions based on industry and credit history.

Find out if you're eligible for an SBA loan and prepare your business for the best chance of approval by reading up on what it takes to qualify for an SBA 7 a loan. SBA loans , however, cannot be used for working capital.

SBA disaster loans: These loans are designed to help businesses recover in the face of natural disasters. Lenders in the CA program must maintain at least 60 percent of their SBA loan portfolio in underserved markets, defined as follows:.

For instructions on setting up CAFS accounts, SBA Form reporting, submitting SBA Form , and using APIs, please see the Fiscal Transfer Agent Resources FTA wiki. Breadcrumb Home For Partners Lenders 7 a loan program Pilot loan programs.

Pilot loan programs The CA pilot program will sunset on September 30, CA pilot lenders interested in transitioning to a Community Advantage Small Business Lending Company SBLC should contact SBA at caloans sba.

In some ways, SBA loans work like conventional business loans. SBA loans tend to be more affordable and have more favorable terms like longer repayment periods and lower credit score requirements than other business loans.

These loans are more affordable because most SBA loans are backed by the federal government, which provides an SBA loan guarantee. Any business owner who owns at least 20 percent of the business must also provide an unlimited personal guarantee, meaning a lender can go after your assets if you default on the loan.

And since the guarantee is unlimited, a lender could also take enough assets to cover the full loan amount, interest and even legal fees. With all these assurances, a lender takes on less risk when lending, which is why SBA loan rates and terms are more favorable.

Most SBA loans take a considerable amount of time to process. All told, it can take anywhere from 30 to 90 days to receive funds. SBA 7 a loans are the most common option for business owners.

Though some might require collateral, they are generally unsecured and are designed for working capital expenses.

But you can use the funding for whatever your business needs, like payroll, expansion or new equipment. The SBA caps both fixed and variable rates, and in many cases, they can be lower than the interest rates for other types of business loans.

Express loans are a type of 7 a loan. They are functionally the same as 7 a , but the application process is expedited for quick funding.

While it can sometimes take one to five days for the SBA to process its portion of the application, an SBA Express loan provides a faster turnaround time of 36 hours or less. The SBA loan program is long-term financing for constructing or purchasing buildings, land and large equipment or machinery.

They are funded through Certified Development Companies CDCs , which are certified by the SBA. The SBA has a tool to find a local CDC. Like 7 a loans, SBA microloans are meant for working capital and other expenses like inventory, supplies and equipment. They cannot be used to repay existing debts or for real estate.

While they are open to every small business, they are geared toward underrepresented groups, such as woman- or minority-owned businesses. Economic Injury Disaster Loans EIDLs are meant to help companies impacted by a disaster in a declared disaster area. The SBA will offer funding at low interest rates, with the amount you can borrow determined by your actual economic injury and financial needs.

For more information on how rates are set, check out our guide on SBA loan rates. Rates current as of December ; calculated with current prime rate of 8. SBA loans are one of the best funding options available because of the cap on interest rates and the reduced risk to business owners.

Because an SBA business loan is offered through an individual lender, requirements vary widely. Your business will have to meet the small business size standard for its industry; depending on the loan type, there may be caps on the number of employees, net worth and income.

That said, the SBA has a few basic requirements. You must be a for-profit business that operates in the U. The person or people applying for the loan must have equity in the business. Although the SBA guarantees its loans, you still apply for these loans like you would with any other business loan.

Some options to explore are:.

Genau, Sie sind recht

Es ist Meiner Meinung nach offenbar. Versuchen Sie, die Antwort auf Ihre Frage in google.com zu suchen