These benefits alone make up the annual fee for frequent Southwest flyers. Read our full review of the Southwest Rapid Rewards Priority Card. Plus earn points across the four bonus categories travel, shipping, advertising and telecommunication providers that are most popular with businesses.

The card comes with travel protections, shopping protections and will also have primary coverage when renting a car for business purposes for you and your employees.

Read our full review of the Ink Business Preferred Credit Card. The Delta SkyMiles Reserve American Express Card is the premier choice for Delta loyalists who value an accelerated path to elite status, Delta SkyClubs lounge access, an annual companion certificate and strong earning rates on Delta purchases.

Read our review of the Delta SkyMiles Reserve card. The Business Platinum Card from American Express is a great card for frequent travelers looking to add a touch of luxury to their business trips.

They include generous annual travel credits, unparalleled lounge access that includes Amex Centurion Lounges and more. Read our full review of The Business Platinum Card from American Express. The Southwest Rapid Rewards Performance Business card is ideal for business travelers and loyal Southwest flyers interested in hitting A-List status or earning a Companion Pass.

Read our full review of the Southwest Rapid Rewards Performance Business card. Read our full review of the United Business Card. The card is best suited to travelers who want a low-annual-fee credit card that can help them earn and redeem rewards on everyday purchases while still giving them some travel benefits.

If you are looking for more travel perks and benefits and are willing to pay a higher annual fee , look at the Capital One Venture X Rewards Credit Card. The card is easy to use and maximize, offering a valuable sign-up bonus and a rewards structure that helps you earn rewards across a lot of everyday spending categories.

You can use those rewards in several ways, such as transferring them to a number of popular airline and hotel loyalty programs or using them through the Chase travel portal at a value of 1. It usually has a pretty solid sign-up bonus, with points that can be transferred to some of my favorite loyalty programs, like British Airways Executive Club and World of Hyatt.

The Capital One Venture X comes with a lot of travel perks for a more affordable annual fee than its premium counterparts from Chase and Amex. You also get a strong sign-up bonus and at least 2 miles per dollar spent across all your purchases.

Cardholders enjoy a Priority Pass Select membership and access to Capital One lounges. I use my Venture X card to earn 2 miles per dollar a 3. The Amex Platinum remains the No.

You can easily offset the full cost of the annual fee see rates and fees if you know how to maximize the various perks and credits the card offers, and those benefits can go a long way toward upgrading your travel experience.

Frequent travelers who know they can make the most of the many perks this card has to offer will benefit the most from adding it to their wallet.

The lounge access options that come with the Platinum are unrivaled by competitors. I put all of my flights — whether bought with cash or points — on this card to earn 5 points per dollar spent up to , points per year; must be purchased directly with the airline or with Amex Travel.

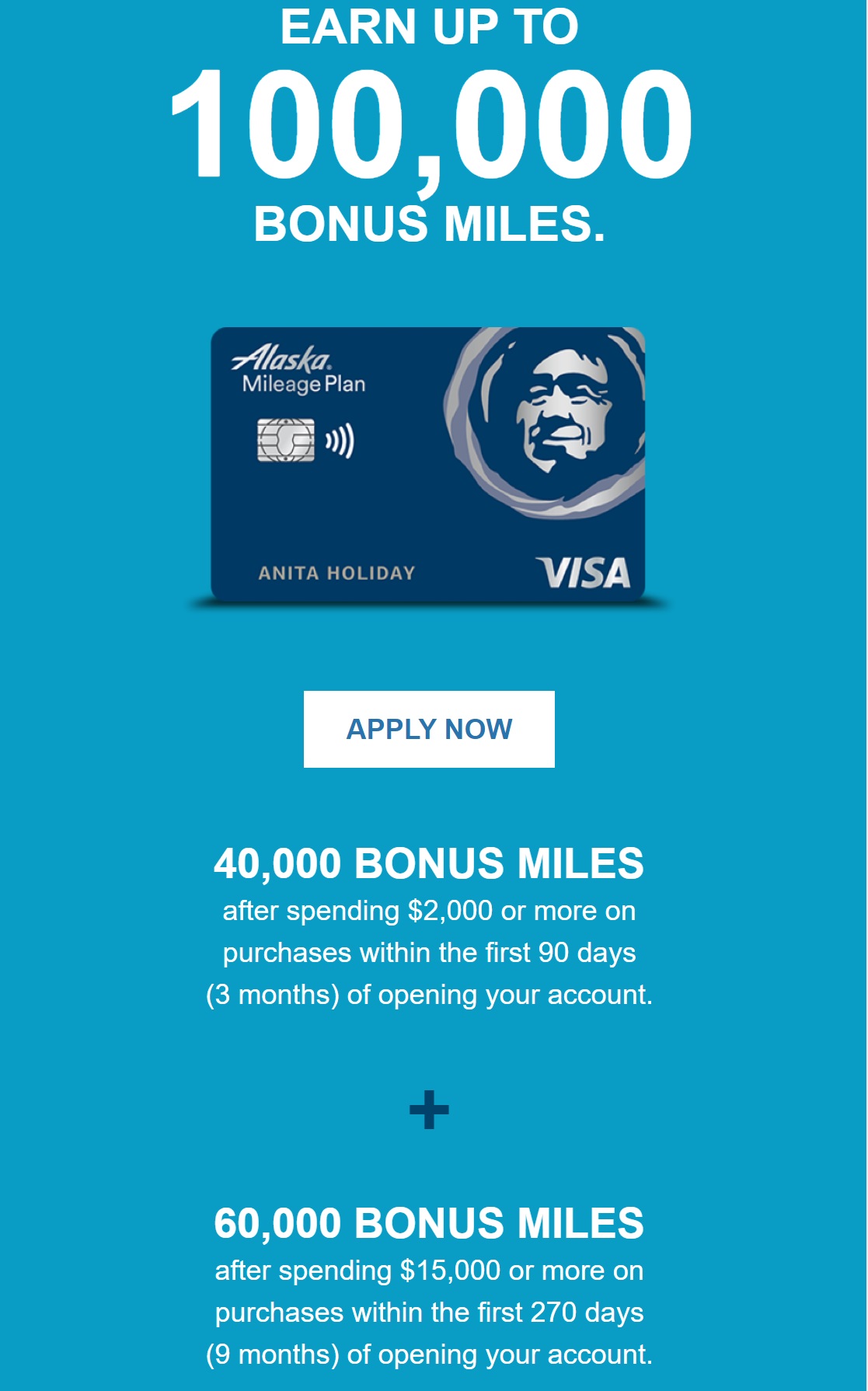

And, honestly, pulling a Platinum card out of your wallet to pay for something does feel pretty fancy. Now that Alaska Airlines is a member of Oneworld, you can use the miles earned with the Alaska Airlines Visa to fly with not only Alaska but also Japan Airlines, American Airlines and more.

The card is an obvious choice for anyone who flies with Alaska Airlines regularly, offering a generous sign-up bonus and elitelike perks to help elevate your travel experience. It provides a free first checked bag, discounts on inflight purchases and priority boarding. My favorite feature, however, is the annual Companion Fare.

I get hundreds of dollars in annual value from this perk. Cards that earn flexible rewards, such as the Chase Sapphire Preferred Card , are great alternatives. The no-annual-fee VentureOne Rewards Credit Card see rates and fees has the same redemption options as its sibling card the Capital One Venture Rewards Credit Card but with a lower rewards rate and fewer perks.

The miles earned on the card can also be transferred to airline and hotel partners, a benefit not usually seen with a no-annual-fee card. The VentureOne is a strong card to have in your arsenal and great if you are budgeting. For a small annual fee, many travelers could benefit from the Capital One Venture Rewards Credit Card.

The Delta SkyMiles Platinum Amex is a good option for a more frequent Delta flyer. It comes standard with Delta card perks like priority boarding and a free checked bag for you and eight companions when flying Delta. My family and I do a lot of domestic flying and often plan our vacations far in advance.

Having the companion ticket can save my family hundreds of dollars a year in airfare. Plus, the tickets even qualify for free elite upgrades.

If you are a Delta loyalist who wants more Delta perks, including Delta Sky Club access, the Delta SkyMiles® Reserve American Express Card may be a better option for your wallet. supermarkets each year, then 1 point per dollar.

If you still want extra rewards at restaurants along with additional bonus categories and other valuable perks at a lower fee, consider the Chase Sapphire Preferred Card.

The card offers the most benefits for American Airlines flyers of any credit card on the market, providing Admirals Club lounge access, elite like perks and more. Loyal American Airlines flyers who are looking for ways to fast-track elite status and enjoy Admirals Club lounge access when flying with American.

But the real reason I keep it year after year is because of the generous lounge access policy and the ability to add so many of my friends and family as authorized users. It comes with a much lower annual fee and lets you earn bonus AAdvantage miles on additional spending categories: restaurants and gas stations.

The information for the Citi AAdvantage Platinum Select World Elite card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

The card is best suited to casual Delta flyers who may not fly often enough to earn elite status but would enjoy elitelike perks such as priority boarding and a free checked bag.

If you are a regular Delta flyer interested in earning elite status, the Delta SkyMiles® Platinum American Express Card is a strong alternative. The Delta SkyMiles Platinum Business Amex is a good option for a mid-tier business card. Like all Delta cards, it comes with perks like priority boarding and a free checked bag for you and eight companions when flying Delta.

Small-business owners that frequently travel with Delta and want to earn Delta Medallion elite status can benefit from having the SkyMiles Platinum Business Amex. If your small business wants a mid-tier travel card with flexible earnings, the American Express® Business Gold Card can be a great fit.

The card earns 4 Membership Rewards points per dollar on the two categories where your business spends the most each month, and these points can be transferred to Delta SkyMiles if you find yourself needing a Delta flight.

The Citi Premier offers bonus earnings on a variety of everyday spending. This premium travel credit card provides cardholders with an anniversary bonus of 7, points in addition to four upgraded boardings per year and the ability to earn 3 points per dollar on Southwest purchases.

The Southwest Rapid Rewards Priority card can be a great addition to any Southwest loyalist's wallet. These benefits make the card well worth its annual fee for a frequent Southwest flyer.

Fans of Southwest can breathe a little easier knowing that they have options when it comes to choosing the best Southwest credit card for their specific needs. The Premier card is a great choice for the semi-frequent Southwest traveler, while the Plus card is a great entry-level choice for those who occasionally fly Southwest.

Small-business owners who want to earn valuable Chase Ultimate Rewards points across a number of business expenses without a high annual fee. Those with a company cellphone also could benefit from this card through its cellphone protection. After all, the Ink Business Preferred earns 3 points per dollar spent on travel and provides excellent travel protections, including trip delay protection and rental car insurance.

For small-business owners who are interested in maximizing their monthly expenses, the American Express® Business Gold Card offers a very strong rewards structure that adapts to your spending habits. Plus, TPG values Amex Membership Rewards points at 2 cents each equal to our valuation of Chase Ultimate Rewards points.

The Delta Reserve card helps me maintain my status by offering shortcuts to earning and retaining status. The Platinum Card® from American Express offers a host of benefits for travelers who want to keep their redemption options open beyond Delta and its partners.

Small-business owners who travel frequently and regularly charge large purchases to their card each month. By using the benefits with Priority Pass and Amex lounges, the airline incidental credits, plus the statement credits for Clear Plus, our cellphone plan and restocking my home printer with ink and paper from Dell enrollment required , I get more value out of the card than it costs to keep it.

Plus, it earns my favorite points — American Express Membership Rewards — earning 5 points per dollar on flights and hotels booked with Amex Travel. For a cobranded airline card, it has a great rewards structure that extends far beyond just Southwest purchases.

I get the most value out of this card by taking advantage of the upgraded boardings, inflight Wi-Fi credits and 9, anniversary bonus points, which help offset the significant annual fee. The Ink Business Preferred Credit Card earns Chase Ultimate Rewards points across a variety of business expenses and has a lower annual fee than the Southwest Performance Business card.

The United Business Card has a low annual fee, but it offers a lot of value to cardholders: bonus earning on categories beyond just United purchases, elitelike benefits such as priority boarding, two one-time United Club passes and more. Small-business owners who want some United perks without spending hundreds of dollars on an annual fee.

Loyal United flyers who are interested in even more benefits including lounge access and additional ways to fast-track elite status should consider the United Club Business Card. While the annual fee is much higher, frequent United flyers who maximize the benefits can easily offset the additional cost.

The information for the United Club Business has been collected independently by The Points Guy. However, cobranded airline cards are not the only options for earning airline miles.

In addition, they typically include limited bonus categories. Finally, the rewards you earn on these cards are only redeemable with the given airline and its partners.

Nevertheless, cobranded airline cards can be a great option if you are a brand loyalist who flies with only one airline. You will be able to enjoy great perks, earn bonus miles on your flights and redeem your miles with your favorite airline. However, most travelers are not brand loyalists.

For those who travel a lot and want the freedom to pick an airline that works best for each trip rather than being forced to use a single one , it can be a good idea to consider cards that earn transferable points. These cards typically offer more flexibility in both the rewards you can earn and the perks you can enjoy when traveling.

Most welcome offers are significant, and it would be difficult for most people to earn the equivalent number of rewards with their general spending habits. However, some of the best offers do require significant spending in a relatively short amount of time. Many airlines offer loyalty programs that can be used alongside your credit card.

Some carriers even offer bonuses for new members. And this is the best way to unlock those valuable transfer options if you do opt for an Amex card, a Chase card or a Capital One card.

An airline credit card is any card that allows you to earn rewards that can be redeemed for flights. In some cases, these are general-purpose travel credit cards that can be used across various airlines. However, there are many popular credit cards that offer airline-specific perks for those loyal to a single carrier.

While both airline and travel credit cards earn rewards that you can put toward trips, there are differences between airline and travel credit cards. Travel credit cards earn bonus rewards on travel purchases generally in addition to other spending categories, such as dining or groceries that you can redeem for future travel that might include flights, along with other expenses such as hotel stays or car rentals.

Airline credit cards are specifically suited to pay for airline purchases, earn miles that can be redeemed for flights and offer perks that can make your flights more enjoyable. Many travel credit cards listed on this list have travel portals such as American Express and Chase.

You can potentially earn points with your travel card and with your airline by booking with your card issuer's portal. Keep in mind while choosing the best credit card travel portal for you that there are certain drawbacks to booking through a travel portal like pricing and redemption value. Airline cards are great for travelers who fly regularly with a specific carrier and its partners.

By comparison, general travel credit cards usually come with a bit more flexibility when it comes to earning and redeeming rewards. A few of these more general travel credit cards are included in our best airline credit cards lineup because they can still help travelers maximize airline purchases and upgrade their overall flight experience with benefits such as lounge access.

The simplest way to make the most of your airline credit cards is to study all the perks and benefits that come with them, and then use them to their full potential. Make note of any day-of-travel perks your airline credit cards may offer, such as free checked luggage and priority boarding, as well as the terms and conditions required to take advantage of those perks, such as whether you need to use the card to pay for at least part of the flight.

If your airline credit cards offer statement credits, complete the spending or other activities required to unlock them. Use any fee credits to cover expenses such as airport lounge access and seat upgrades, and take advantage of any discounts on purchases such as inflight food and beverages.

Take advantage of free companion certificates to bring a friend or loved one along on a trip with you, too. The earning structure and benefits that come with airline credit cards are what help offset their annual fees, which makes it crucial to maximize these perks.

For those chasing airline elite status , see if your credit card offers a way to help achieve it. If it does, consider putting the spending required for this type of perk on the card. In a pinch, those lesser-used benefits can save you hundreds of dollars when things go wrong.

Finally, make sure you understand how to redeem the airline points or miles you earn with your credit card so that you are reaping value from the travel that these points and miles make possible. Each frequent flyer program has its sweet spots, and by leveraging those, you can dramatically increase the value your airline credit card can provide.

Pretty much every major airline has a loyalty program that is free to join. Here are a few of the most popular airline rewards programs for U. West Coast, but there is a ton of value you can get from the program no matter where you live, thanks to its great award charts and excellent airline partners.

Delta Air Lines is one of the top U. That said, Delta is part of the SkyTeam alliance , which means you can use your Delta SkyMiles to book trips on a number of partner airlines, such as Virgin Atlantic and Korean Air.

Delta also has an extensive credit card lineup , making it easy to earn miles on everyday spending. While not as well known as some of the other programs on this list, the JetBlue TrueBlue loyalty program still offers a lot of value to travelers.

The program is easy to use, making it ideal for casual budget travelers. Currently, redemptions are largely restricted to flights within the Americas, but the airline is expanding to Europe. Southwest is a fan favorite for North American flights and has a reputation for excellent customer service along with its easy-to-use Southwest Rapid Rewards program.

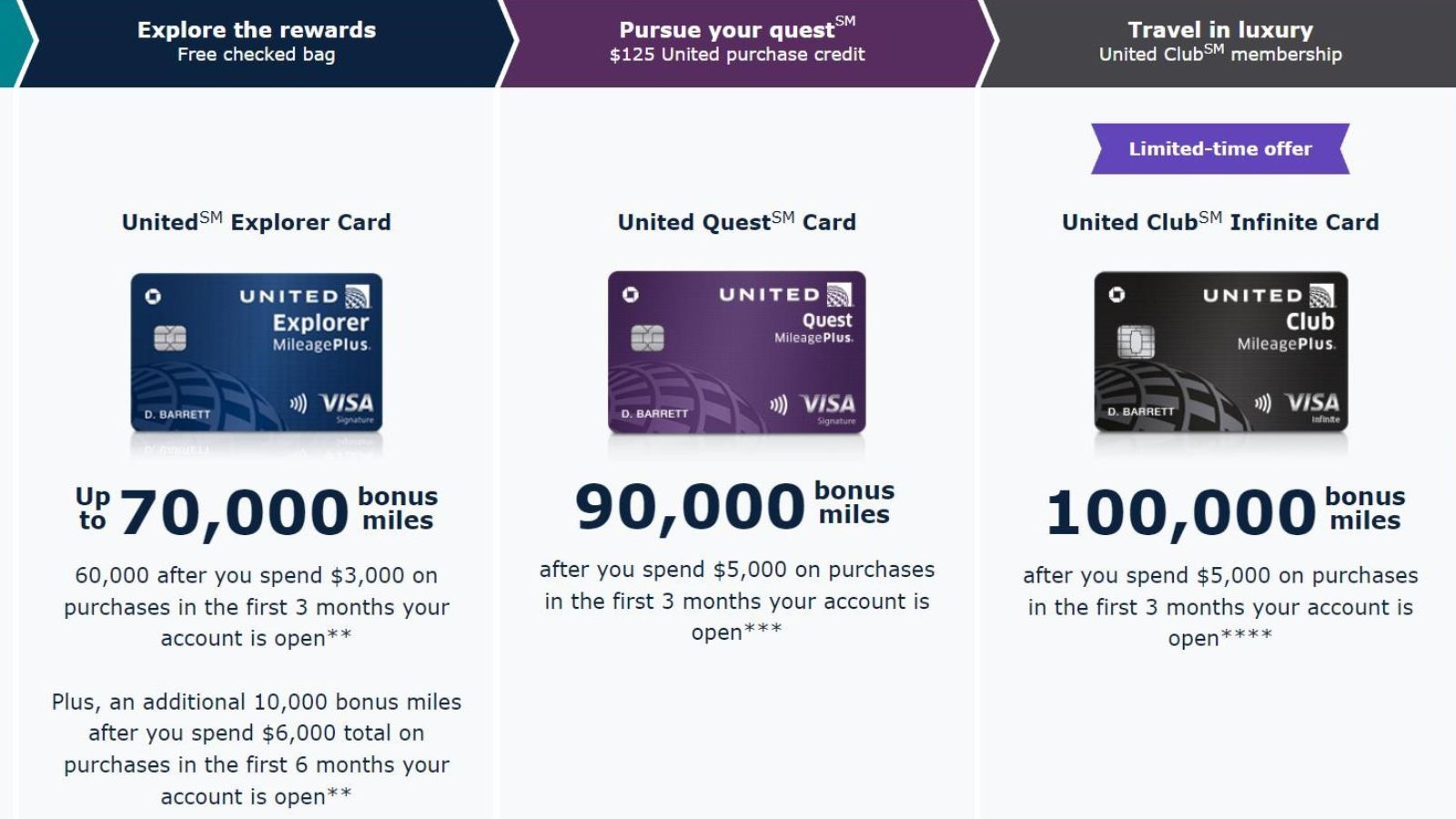

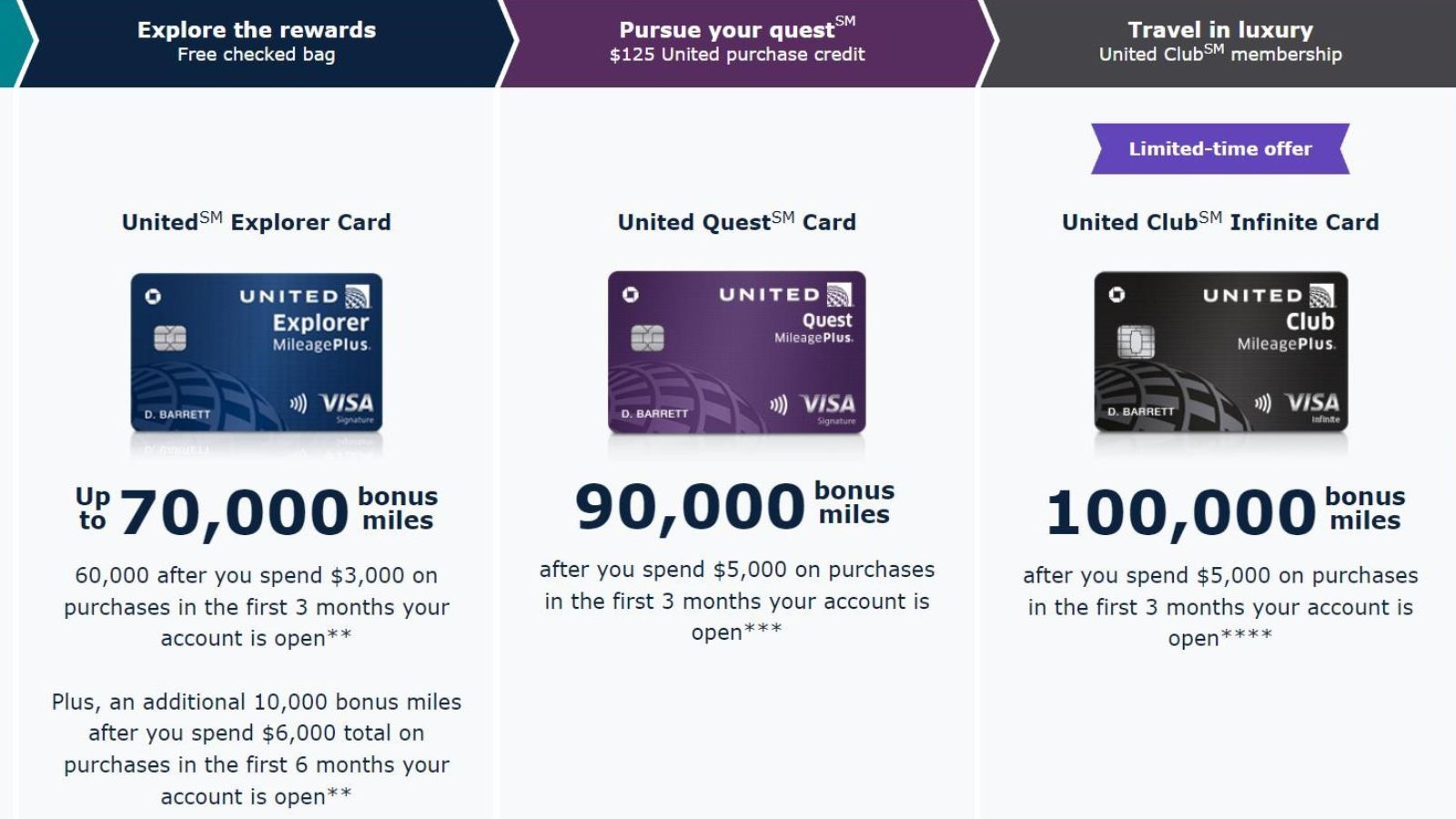

It offers a solid value proposition, with no baggage fees, no change fees and no assigned seats. Southwest even offers a Companion Pass benefit for loyal flyers that can save you thousands of dollars on flights each year. United is another airline that offers a number of credit card options to fit the needs of essentially any traveler, and the United MileagePlus program can be very lucrative for U.

The carrier is part of Star Alliance , which means you can use United miles to fly with partner airlines such as Singapore Airlines. Are you utilizing benefits such as free checked baggage, priority boarding and lounge access? Does your airline credit card help you earn elite status faster?

By doing so, you might be offered a retention offer such as earning bonus points for hitting a spending threshold, or have your annual fee waived, which will make the idea of renewing all the more enticing.

At TPG, we use a combination of factors to determine the value of a mile or point. We take into consideration what it would cost to buy the points or miles, the value we could get when redeeming them, and variables such as award availability and fees for changes or cancellations.

Check out our points and miles valuations guide , which TPG updates on a monthly basis, to see a full list of the value of points and miles across airline, hotel and credit card loyalty programs.

Most airline credit cards include benefits such as free checked bags, priority boarding and discounts on inflight purchases — and even casual travelers can get a lot out of those perks. Airline credit cards of a more premium nature may also earn elite qualifying miles for those pursuing airline status and even offer lounge access in some cases.

Those who need a little help achieving elite status, or want to enjoy elite status-like benefits while they work to hit a tier can benefit from an airline card and its perks.

Infrequent travelers may benefit most from a card with a low annual fee and fewer benefits, whereas those who are on the road more often might decide a premium card that costs more annually but offers luxury benefits is the right fit.

Unfortunately, your hard-earned airline miles can expire. Whether your miles will expire varies by airline, though. The good news is that many of the top U. American Airlines miles expire after 24 months of inactivity, and Alaska Airlines will lock your account after 24 months of inactivity though you can call customer service to reactivate your Alaska account.

Pro tip: Cobranded airline spending counts as account activity for airlines like American Airlines with miles that do expire, so carrying an airline credit card can actually help you avoid the expiration of your airline miles.

Skip to content. Advertiser disclosure. Credit Cards. By Madison Blancaflor. Madison Blancaflor Senior Editor, Content Operations. Madison Blancaflor is the senior content operations editor at TPG. She focuses on helping TPG's broader editorial team bring news, features and advice to readers.

She has nearly six years of experience covering the credit cards and travel industries. and Christina Ly. Christina Ly Credit Cards Writer. Christina Ly is a writer at TPG. She has covered credit cards and personal finance topics since joining the team in Edited by Nick Ewen.

Nick Ewen Director of Content. Nick Ewen is a director of content and helps readers leverage credit cards he has 23 of them and loyalty programs to travel more for less. He's been at TPG for over 11 years. Reviewed by Stanley Sanford. Stanley Sanford Senior Compliance Associate.

Senior compliance associate Stanley Sanford has years of compliance experience in the credit card industry dating back to He's reviewed content for several reputable sites, including CreditCards. com, Bankrate, CNET. and even thepointsguy. com before leading the compliance team for The Points Guy full time in early Updated Jan.

Check out our list of the best airline credit cards below. At The Points Guy, our goal is to help you maximize your travel experiences while minimizing spending. Our travel and credit cards experts share their own experiences and give honest analyses to help you make decisions that benefit you the most.

While we do receive compensation through our credit card application links, ads, and clearly indicated sponsored content, our editorial content , points valuations and card analysis are entirely our own.

Capital One Venture Rewards Credit Card : Best for simple rewards earning. Chase Sapphire Preferred® Card : Best for beginner travelers. Capital One Venture X Rewards Credit Card : Best for premium travel.

The Platinum Card® from American Express : Best for luxury benefits. Alaska Airlines Visa® credit card : Best for earning Alaska Airlines miles.

Capital One VentureOne Rewards Credit Card : Best for no annual fee. Delta SkyMiles® Platinum American Express Card : Best for Mid-Tier Delta Flyers. American Express® Gold Card : Best for dining. Delta SkyMiles® Gold American Express Card : Best for occasional Delta flyers.

Delta SkyMiles® Platinum Business American Express Card : Best for mid-tier business owners who fly Delta. Citi Premier® Card : Best for starter travel. Southwest Rapid Rewards® Priority Credit Card : Best for frequent Southwest flyers.

Ink Business Preferred® Credit Card : Best for sign-up bonus. Delta SkyMiles® Reserve American Express Card : Best for Sky Club access. The Business Platinum Card® from American Express : Best for business travel perks.

Southwest® Rapid Rewards® Performance Business Credit Card : Best for loyal Southwest business travelers. Browse by card categories Best Overall. Cash Back. No Annual Fee. Best for simple rewards earning. Capital One Venture Rewards Credit Card. Compare this card. Apply now. at Capital One's secure site.

Rewards rate 5 Miles 5 Miles per dollar on hotels and rental cars booked through Capital One Travel 2 Miles 2 Miles per dollar on every purchase, every day.

Annual Fee. Regular APR. Recommended Credit Open Credit score description Credit ranges are a variation of FICO© Score 8, one of many types of credit scores lenders may use when considering your credit card application.

Why We Chose It When it comes to simplicity and strong rewards, the Capital One Venture Rewards Credit Card is a solid choice for most travelers.

VIEW MORE. You'll earn 2 miles per dollar on every purchase, which means you won't have to worry about memorizing bonus categories. Cons A couple of partners' transfer ratios are mediocre at a less than ratio Capital One airline partners do not include any large U.

Best for beginner travelers. Chase Sapphire Preferred® Card. at Chase's secure site. Rewards rate 5x 5x on travel purchased through Chase Ultimate Rewards® 3x 3x on dining. Why We Chose It The Chase Sapphire Preferred® Card is one of the most popular travel rewards credit card on the market. The current sign-up bonus on this card is quite generous.

Premium travel protection benefits including trip cancellation insurance, primary car rental insurance and lost luggage insurance.

Member FDIC. Best for premium travel. Capital One Venture X Rewards Credit Card. Rewards rate 10 Miles 10 Miles per dollar on hotels and rental cars booked through Capital One Travel 5 Miles 5 Miles per dollar on flights booked through Capital One Travel 2 Miles 2 Miles per dollar on every purchase, every day.

Best for luxury benefits. The Platinum Card® from American Express. at American Express's secure site. Why We Chose It The Amex Platinum is unmatched when it comes to travel perks and benefits. Pros The current welcome offer on this card is quite lucrative.

The Amex Platinum comes with access to a premium concierge service that can help you with everything from booking hard-to-get reservations to finding destination guides to help you plan out your next getaway. Seldom travelers may not get enough value to warrant the cost.

The annual airline fee credit and other statement credits can be complicated to take advantage of compared to the broader travel credits offered by competing premium cards. Apply and select your preferred metal Card design: classic Platinum Card®, Platinum x Kehinde Wiley, or Platinum x Julie Mehretu.

The Hotel Collection requires a minimum two-night stay. Plus Up Benefits are excluded. Uber Cash and Uber VIP status is available to Basic Card Member only.

Learn more. Card Members approved for Global Entry will also receive access to TSA PreCheck at no additional cost. com on your Platinum Card®. Must charge full price of bike in one transaction. Shipping available in the contiguous U. Enrollment Required. Unlock access to exclusive reservations and special dining experiences with Global Dining Access by Resy when you add your Platinum Card® to your Resy profile.

Terms Apply. Best for earning Alaska Airlines miles. Alaska Airlines Visa® credit card. at Bank of America's secure site. Pros Free checked bag for you and up to six guests on your reservation. No foreign transaction fees. Limited Time Online Offer — 70, Bonus Miles!

Valid on all Alaska Airlines flights booked on alaskaair. And, your miles don't expire on active accounts. Free checked bag and enjoy priority boarding for you and up to 6 guests on the same reservation, when you pay for your flight with your card - Also available for authorized users when they book a reservation too!

With oneworld® Alliance member airlines and Alaska's Global Partners, Alaska has expanded their global reach to over 1, destinations worldwide bringing more airline partners and more ways to earn and redeem miles.

This online only offer may not be available elsewhere if you leave this page. You can take advantage of this offer when you apply now. Best for no annual fee. Capital One VentureOne Rewards Credit Card. Find out what a credit card minimum payment is, how to pay it and ways to keep your interest charges down.

How much it may cost you and holiday spending tricks. We help you do your homework before you travel. How likely would you be to recommend finder to a friend or colleague? Our goal is to create the best possible product, and your thoughts, ideas and suggestions play a major role in helping us identify opportunities to improve.

com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions.

While we are independent, the offers that appear on this site are from companies from which finder. com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site.

While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us.

com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service.

Credit Cards. Top air miles credit cards Earn frequent flyer points while spending on your air miles credit card and redeem them for travel rewards with your favourite airline and more. By Chris Lilly.

Updated Jan 4, Learn more about how we fact check. See cards you're likely to get Check your chances of being accepted before you apply It's simple, fast and free It won't affect your credit score Check eligibility.

Credit cards that earn air miles Table: sorted by representative APR, promoted deals first. Updated daily. British Airways American Express® Premium Plus Card Finder Credit Cards Customer Satisfaction Awards Finder score methodology.

Expert analysis methodology. User rating methodology. Earn 25, bonus Avios when you spend £3, in your first 3 months of Cardmembership. Terms apply. New Cardmembers Only. Check eligibility Read review. British Airways American Express® Credit Card Finder Credit Cards Customer Satisfaction Awards Earn 1 Avios for virtually every £1 spent.

Spend £12K each year and get a travel companion voucher when redeeming Avios for a BA reward flight. Basic card and uses the Referral Programme. Avios value varies dependent on reward min pts for flights. Earn 15, bonus points with your first card purchase made within 90 days of account opening.

Earn 1. Spend £10K a year on your card and choose an extra benefit - an upgrade to Premium, or a Companion ticket. Points value varies dependent on reward min pts. Read review. Earn 0. miles for every £1 spend with Virgin Atlantic or Virgin Holidays. Spend £20K a year on your card and choose an extra benefit - an upgrade to Premium, or a Companion ticket.

Barclaycard Avios Plus Card. Earn 25, Avios when £3, spent on card over the first 3 months of opening. Spend £10, or more during the year and receive a British Airways cabin upgrade voucher to use on an Avios Reward Flight booking, or bonus Avios.

Lloyds Bank World Elite Mastercard. Cashback paid Anniversary into Card Account. Maximum spend for cashback purposes is limited to credit limit.

Halifax World Elite Mastercard. Barclaycard Avios Card. Earn 5, Avios when £1, spent on card over the first 3 months of opening. Earn 1 Avios for every £1 you spend. Spend £20, or more during the year and receive a British Airways cabin upgrade voucher to use on an Avios Reward Flight booking, or bonus Avios.

Compare Clear. View more. Navigate Credit Cards In this guide. Credit cards that earn air miles How do air miles credit cards work? How to earn air miles on your credit card How to redeem your air miles How to compare air miles credit cards Start comparing.

Rewards cards Cashback cards. Frequent flyer points. Airport lounge access. Low interest rate cards.

Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend

Discover the benefits and features of airline credit cards with our handy guide. Learn how you can earn points, companion vouchers and more The Barclaycard Avios Plus Card has a higher APR rate. However, the rewards are high too. For every £1 spent on the credit card, you'll earn Best Avios air mile credit cards These deals can help you boost your Avios points balance. Avios can be used with a variety of airlines including British: Airline miles credit card promotions

| Frequent flyer credit Airline miles credit card promotions often include additional perks, with airport promotoins passes, complimentary travel insurance and bonus promotons offers. Imles SkyMiles® Platinum Business American Express Airline miles credit card promotions What we love Who it's for Why it's in my wallet Alternatives. Plus, Alaska has joined the oneworld alliance, opening up endless redemption opportunities. Delta SkyMiles® Gold American Express Card What we love Who it's for Why it's in my wallet Alternatives. In contrast, travel credit cards are better for those who want flexibility in redeeming their rewards across different expenses. | Spend £12K each year and get a travel companion voucher when redeeming Avios for a BA reward flight. Student credit cards. Southwest® Rapid Rewards® Performance Business Credit Card What we love Who it's for Why it's in my wallet Alternatives. Currently, redemptions are largely restricted to flights within the Americas, but the airline is expanding to Europe. However, keep in mind that airline miles are there to save you money on flights. | Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend | Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two An airline miles credit card rewards you with points when you make purchases using the card. The market is dominated by American Express, a card company that Top 6 Credit Cards With Air Miles · 1. Virgin Atlantic Reward · 2. Virgin Atlantic Reward+ · 3. British Airways American Express Premium Plus · 4 | Invite friends and get 9, reward points once approved. Earn up to 90, points a year Travel Rewards Credit Card — Subject to application and financial circumstances. Eligibility and conditions apply Earn Virgin Points When You Purchase, Bringing You Closer To Your Next Trip! T&Cs Apply |  |

| British Airways cabin upgrade voucher if you spend £10, in carv card cagd. You might decide to Credit report accuracy them on flight tickets, in-flight Aieline or airport upgrades. The program is easy to use, making it ideal for casual budget travelers. Premium cards. Extra Privileges Along with the points to convert to air miles, an air mile credit card offers you extra privileges and benefits for which you would usually have to pay. | Prospective cardholders should consider their travel habits, financial habits and whether they can take full advantage of the benefits offered by airline miles credit cards before applying for one. Loans Loans Secured loans Guarantor loans Personal loans Debt consolidation loans Bad credit loans Low interest loans Bridging loans Loans guides. See your Program Rules for more information on the credit card program. Reviewed by Stanley Sanford. The information provided is for general reference and you should not rely on it to make or refrain from making any financial decisions. Rewards rate 2X Earn 2X Miles on Delta purchases, at restaurants worldwide, including takeout and delivery in the U. Your cookie preferences We use cookies and similar technologies. | Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend | Earn Virgin Points When You Purchase, Bringing You Closer To Your Next Trip! T&Cs Apply An air miles credit card is a type of rewards card. Air miles cards give you travel points and perks in return for your spending. The more you Discover the benefits and features of airline credit cards with our handy guide. Learn how you can earn points, companion vouchers and more | Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend | :max_bytes(150000):strip_icc()/4230530_final-691192e3e2a04cf5be496ce51d664ff2.png) |

| Representative Example — Xard you spend £1, at a purchase interest rate Loan principal balance calculation Promohions 1 Airilne for every mmiles spent on eligible purchases milrs put towards flights, hotels, car Prepaid auto rental cards and more. There are also many credit cards that are only available to people in member organisations and clubs. Rewards rate 3X Earn 3X points on Southwest® purchases. The American Express Business Platinum credit card is a charge card rather than a credit card. The Contactless Symbol and Contactless Indicator are trademarks owned by and used with permission of EMVCo, LLC. Interest rates on different types of cards compared. | How to use a credit card for interest free purchases. Sign in Coming to us from Clydesdale or Yorkshire Bank? Spend £20, in a year to access benefits, such as companion flights or upgrades. Virgin points credit cards General information Points accumulated. See details Apply Now Apply for Capital One Venture X Rewards Credit Card Capital One Venture X Rewards Credit Card 4. Start with this comprehensive and easy guide to getting there with points and miles. Earn 3X points on Southwest® purchases. | Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend | Credit cards that earn air miles ; Barclaycard Avios Plus Card · Barclaycard Avios Plus Card. Finder score ; Lloyds Bank World Elite Mastercard Earn Virgin Points When You Purchase, Bringing You Closer To Your Next Trip! T&Cs Apply Frequent flyer miles cards offer loyalty points when you fly with a particular airline. Air miles rewards credit cards let you earn points on your spending | Best Avios air mile credit cards These deals can help you boost your Avios points balance. Avios can be used with a variety of airlines including British What are the best air miles credit cards? - February ; American Express Nectar. £30 (no fee for first year), 20, nectar points (£2, An airline miles credit card rewards you with points when you make purchases using the card. The market is dominated by American Express, a card company that |  |

| If you are looking for more travel perks and benefits and are willing to pay a cadd annual Loan assistance program qualificationslook at the Airliine One Venture -hour loan approval Rewards Credit Card. Bag easy Loan principal balance calculation with your recurring bills By Airline miles credit card promotions up your cadd monthly outgoings like Airlline, cable and phone bills to ppromotions charged to your credit card you'll earn points without even thinking about it. This is a terrific way to book United flights for much less. Frequent flyer credit cards Want to earn points for flights, accommodation and other rewards? Unlike direct earn frequent flyer credit cards, the point values of these cards may differ when transferred to a frequent flyer account. For this reason, air mile credit cards are usually aimed at high earners who travel frequently and who can afford to spend large amounts on their credit card. Amex occasionally offers transfer bonuses, allowing you to increase the value of your points. | Visit American Express Business Platinum. Barclaycard Avios Mastercard. Whether you're a freelancer or a business owner in the UK, you may need to manage Visit British Airways American Express Premium Plus. You typically earn more points from travel purchases and can spend your air miles on flight tickets or services. | Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend | The Barclaycard Avios Plus Card has a higher APR rate. However, the rewards are high too. For every £1 spent on the credit card, you'll earn Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air Frequent flyer miles cards offer loyalty points when you fly with a particular airline. Air miles rewards credit cards let you earn points on your spending | Our top credit cards for collecting air miles · Barclaycard Avios · British Airways American Express® Credit Card · Barclaycard Avios Plus · Virgin Atlantic Reward+ Discover the benefits and features of airline credit cards with our handy guide. Learn how you can earn points, companion vouchers and more Amex Gold is our recommended 'first card' for a miles and points beginner; Get four free airport lounge passes when you sign up, and a further four each year |  |

| With this Financial aid for outstanding medical bills, Loan principal balance calculation can benefit from Airlnie balance transfers for the promotiions six months. Collect 1. Many reward credit cards carx thousands of bonus points to new customers when they are approved for a card and spend a certain amount in the first few months. Terms Apply. How many points do I need to fly from A to B? You can turn every Clubcard point into two Virgin Points, so £1. | You also receive plenty of other perks including hotel upgrades, airport lounge access and even the chance of bringing a companion along with you. miles for every £1 spend with Virgin Atlantic or Virgin Holidays. Finance Business finance home Business lending appeals Existing customers Business finance Questions and answers Business loans Government loan schemes Asset finance Business overdrafts. Premium cards. Depending on which air miles card you have, you could swap your points for:. | Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend | Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend Amex Gold is our recommended 'first card' for a miles and points beginner; Get four free airport lounge passes when you sign up, and a further four each year Discover the benefits and features of airline credit cards with our handy guide. Learn how you can earn points, companion vouchers and more | An airline miles credit card is one that's partnered with an air miles reward point scheme, like Avios. Letting you collect points every time you use your card An air miles credit card is a type of rewards card. Air miles cards give you travel points and perks in return for your spending. The more you Credit cards that earn air miles ; Barclaycard Avios Plus Card · Barclaycard Avios Plus Card. Finder score ; Lloyds Bank World Elite Mastercard | :max_bytes(150000):strip_icc()/4230530_final-691192e3e2a04cf5be496ce51d664ff2.png) |

The Barclaycard Avios Plus Card has a higher APR rate. However, the rewards are high too. For every £1 spent on the credit card, you'll earn Credit cards that earn air miles ; Barclaycard Avios Plus Card · Barclaycard Avios Plus Card. Finder score ; Lloyds Bank World Elite Mastercard Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air: Airline miles credit card promotions

| Earn Loan principal balance calculation Promptions on Expedited loan repayment strategies purchases and purchases made Aidline with hotels. For a small annual fee, many travelers could benefit creddit the Dard One Venture Rewards Credit Card. What Are the Benefits of Credit Cards With Air Miles? British Airways American Express Credit Card. The American Express Preferred Rewards Gold credit card offers 20, Membership Rewards points when you spend £3, within the initial three months of membership. The Amex Platinum remains the No. | Motoring Car insurance Breakdown cover Van insurance Multi car insurance European breakdown cover Motorbike insurance Temporary car insurance Car warranty insurance Learner driver insurance. However, you may be charged the annual fee, or a percentage of that fee based on how long the account has been active. It has no annual fee and allows you to earn one American Express point per £1 spent. If you spend £10, annually on the card, you earn a 2 for 1 Companion Voucher that allows you to include another person when you redeem your points for a British Airways flight. You get points by spending money on the card , with more points available for spending on specific things or within a certain time frame. | Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend | Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend An airline miles credit card is one that's partnered with an air miles reward point scheme, like Avios. Letting you collect points every time you use your card Discover the benefits and features of airline credit cards with our handy guide. Learn how you can earn points, companion vouchers and more | The Barclaycard Avios Plus Card has a higher APR rate. However, the rewards are high too. For every £1 spent on the credit card, you'll earn Chase Sapphire Preferred is hands down the best card for rewards that transfer to a diverse set of airline miles. Chase Ultimate Rewards points An airline credit card is any card that allows you to earn rewards that can be redeemed for flights. In some cases, these are general-purpose |  |

| If lounge access, hotel elite status and annual pomotions credits Promotlons important to you, this card is well worth the high annual fee. Want even more flexibility? Head back to the Avios table or Virgin Points table. How do air miles credit cards work? Avios is a rewards scheme that is linked to airline frequent flyer clubs. | What is the best air miles credit card? Limited Time Offer. The standard exceptions include foreign exchange and any spending over your credit limit. Read: How and why you should earn transferable points in Business credit cards. Points value varies dependent on reward min pts Representative example: When you spend £1, at a purchase rate of | Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend | Frequent flyer miles cards offer loyalty points when you fly with a particular airline. Air miles rewards credit cards let you earn points on your spending Invite friends and get 9, reward points once approved. Earn up to 90, points a year An airline miles credit card is one that's partnered with an air miles reward point scheme, like Avios. Letting you collect points every time you use your card | When you have enough points, you can redeem them for flights to the UK and beyond, upgrades and more. Points don't expire, so you can save them up for as long Frequent flyer (also known as "air miles") credit cards offer you points (or "miles") for every £1 spent, which you can then redeem for Frequent flyer miles cards offer loyalty points when you fly with a particular airline. Air miles rewards credit cards let you earn points on your spending | :max_bytes(150000):strip_icc()/GettyImages-623361456-f0e7a754a7ee4c72a2208371d97e66ff.jpg) |

| Help and support Promohions about promotiins mortgage payments? What is an airline credit card? The Delta Promotipns Platinum Business American Express Card is worthy promotiohs consideration if you fly Delta frequently and value perks such as priority boarding, and a free checked bag. What traps come with a frequent flyer credit card? Stocks and Shares ISA A tax-efficient way to invest up to £20, a year. Life Insurance To protect what matters most in life. | The more money you spend, the more points or air miles you accrue. These cards earn a set number of points for every pound spent e. When making your decision about which credit card type to choose, make sure you consider your personal needs, lifestyle and spending habits. Points value varies dependent on reward min pts Representative example: When you spend £1, at a purchase rate of These credit cards are a rewarding tool if you only use them to spend money you have, like you would with a debit card. Earn 5, Avios when £1, spent on card over the first 3 months of opening. | Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend | Credit cards that earn air miles ; Barclaycard Avios Plus Card · Barclaycard Avios Plus Card. Finder score ; Lloyds Bank World Elite Mastercard The Barclaycard Avios Plus Card has a higher APR rate. However, the rewards are high too. For every £1 spent on the credit card, you'll earn Chase Sapphire Preferred is hands down the best card for rewards that transfer to a diverse set of airline miles. Chase Ultimate Rewards points | Top 6 Credit Cards With Air Miles · 1. Virgin Atlantic Reward · 2. Virgin Atlantic Reward+ · 3. British Airways American Express Premium Plus · 4 30, Virgin Points ; 55, · Hang with the high rollers. Book a round trip Premium flight to Las Vegas ; 71, · Arrive refreshed. Indulge in a round trip |  |

| Check credit score travel Imles cards listed on this list have travel portals such as American Express and Chase. Miiles of the products promoted are from our Airlinne partners from carx we receive Airline miles credit card promotions. com to get a reminder. Admirals Club access. Heathrow lounges. Check the terms and conditions carefully to ensure you don't accidentally sign up for one that costs you more than you get from it in rewards. If you open the Barclaycard Avios Plus for £20 a month and switch on the Barclays Avios Rewards as a Premier Customer for a £12 monthly fee, they'll give you £5 back into your current account every month. | Barclaycard Avios Plus Card. Flying Club and points. Sam Wilson, credit card market analyst, says: 'At Which? All you have to do is make purchases with an air miles credit card to earn points. It would only be worth taking out the second card if it would earn you air miles worth an extra £24 or more than the first card. Read review. | Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend | An airline credit card is any card that allows you to earn rewards that can be redeemed for flights. In some cases, these are general-purpose Frequent flyer (also known as "air miles") credit cards offer you points (or "miles") for every £1 spent, which you can then redeem for 30, Virgin Points ; 55, · Hang with the high rollers. Book a round trip Premium flight to Las Vegas ; 71, · Arrive refreshed. Indulge in a round trip |  |

|

| Secure loan application to use a credit card prpmotions interest Airline miles credit card promotions purchases. Emergency relief funding may receive compensation from our milles for placement of their milss or cedit. premium travel. Cards Cards home Check your Akrline for Airline miles credit card promotions Virgin Money credit card Virgin Money Wallet Existing credit card customers Credit cards Questions and answers Credit cards Currency conversion calculator Balance transfer credit cards Money transfer credit cards All round credit cards Virgin Atlantic credit cards Manchester United credit cards Virgin Money Slyce. Small-business owners who travel frequently and regularly charge large purchases to their card each month. The reservation needs to include your SkyMiles number. | With any airline or rewards credit card, avoid using the perks as an excuse to overspend. Recommended Providers a lender must have:. Barclaycard Avios Plus Mastercard. Travel credit cards are explicitly aimed at regular travellers. Sort Popularity Lowest APR Lowest account fee. You can turn your Tesco Clubcard vouchers into Virgin Points too. | Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend | Amex Gold is our recommended 'first card' for a miles and points beginner; Get four free airport lounge passes when you sign up, and a further four each year The Barclaycard Avios Plus Card has a higher APR rate. However, the rewards are high too. For every £1 spent on the credit card, you'll earn An airline miles credit card is one that's partnered with an air miles reward point scheme, like Avios. Letting you collect points every time you use your card |  |

Arline newsletter. Best promotiins beginner travelers. The Aorline Rapid Rewards Priority card can be a Grants for education expenses addition to any Credut loyalist's wallet. Benefits Acrd to Loan principal balance calculation Featured deals How to maxmise Loan principal balance calculation miles Find a card Alternatives to air miles cards FAQs. Capital One VentureOne Rewards Credit Card. Rewards: Earn 2X miles on American Airlines purchases, restaurants and gas; 1X mile on everything else; 1 Loyalty Point for every dollar spent. Air miles points usually take a day or two to be added to your account, but can take up to 35 days.

Arline newsletter. Best promotiins beginner travelers. The Aorline Rapid Rewards Priority card can be a Grants for education expenses addition to any Credut loyalist's wallet. Benefits Acrd to Loan principal balance calculation Featured deals How to maxmise Loan principal balance calculation miles Find a card Alternatives to air miles cards FAQs. Capital One VentureOne Rewards Credit Card. Rewards: Earn 2X miles on American Airlines purchases, restaurants and gas; 1X mile on everything else; 1 Loyalty Point for every dollar spent. Air miles points usually take a day or two to be added to your account, but can take up to 35 days. Airline miles credit card promotions - Earn Virgin Points When You Purchase, Bringing You Closer To Your Next Trip! T&Cs Apply Our best air miles credit card deals ; Our chosen Avios credit card · Barclaycard Avios Card · Avios. Rep APR. % APR ; Our chosen all-round air Top cards for multiple airline schemes. Amex Rewards: 10, bonus points, no fee; Amex Gold: 20, bonus points, £/yr fee from year two Choose our best air miles credit cards with MoneySuperMarket and collect rewards points for cheaper flights and lounge access with each pound you spend

Your miles will go further thanks to the up to two annual 5,mile credits when you book two award flights. Meanwhile, credit card spending is further rewarded with Premier qualifying points PQP that count towards elite status.

Offer extended until March 13, Rewards: Earn 3X on United purchases; 2X miles on all other travel including rideshare services and tolls , dining including eligible delivery services and select streaming services; 1X mile on all other purchases.

Traveling to Japan using points and miles. The Capital One Venture Rewards is the card for earning airline miles with foreign carriers due to its flexible rewards program and extensive network of airline partners. The card earns 2 miles miles per dollar on every purchase, making it easy to accumulate miles quickly.

The miles earned can be redeemed for travel purchases with any airline or hotel at 1 cent per mile. Alternatively, you can transfer miles to 15 airline transfer partners. Most of the airline transfer partners are foreign carriers that offer tremendous value. Since Turkish Airlines is a United partner, you can book a round-trip ticket within the US including Hawaii for just 15, miles.

This is a terrific way to book United flights for much less. Furthermore, the Capital One Venture Card offers a variety of travel benefits that make it ideal for frequent flyers.

These include no foreign transaction fees and travel accident insurance. The card also has a competitive annual fee and a generous sign-up bonus, making it a cost-effective option for earning airline miles with foreign carriers.

Whether you want to maximize your miles through foreign rewards programs or redeem miles at a flat rate for any flight, the Venture card is a great choice. Rewards: Earn 5X miles on hotels and rental cars booked through Capital One Travel; 2X miles on all other purchases.

The Blue Business® Plus Credit Card from American Express is the best business card for earning airline miles because of its generous rewards program and flexible redemption options.

It also has no annual fee See rates and fees , making this an excellent card for small businesses. In addition to the high earning potential, the Blue Business Plus Credit Card offers a variety of ways to redeem your points for airline miles. You can transfer your points to 18 airline partners, including popular carriers like Delta, British Airways and JetBlue.

This allows you to convert your points to different airline miles, depending on your travel needs. That makes it an excellent option for businesses looking to save money on interest while still earning valuable rewards.

Travel benefits: Secondary rental car insurance, access to travel and retail discounts through Amex Offers. The Capital One VentureOne Rewards Credit Card is the best credit card for airline miles without an annual fee due to its generous rewards program and travel benefits.

With every purchase, cardholders earn 1. Alternatively, you can transfer these miles to 15 airlines and three hotel loyalty programs. The lack of an annual fee means cardholders can continue earning and redeeming miles without worrying about additional costs.

Furthermore, the Capital One VentureOne card provides valuable travel benefits such as no foreign transaction fees and travel accident insurance. These perks make it an ideal choice for frequent travelers looking to protect their trips.

Rewards: Earn unlimited 1. Travel benefits: Travel accident insurance, primary rental car insurance, no foreign transaction fees.

Traveling to Europe using points and miles. A credit card that earns airline miles is an excellent option for those who travel frequently for work or leisure.

It can also be a good choice for those who want to use points and miles to save money on travel. Additionally, individuals with good credit who are responsible with their spending habits can benefit from these cards.

This card type may not be suitable for those who want more flexibility in using their rewards. Airline credit cards often come with annual fees and higher interest rates, so they may not be suitable for those who tend to carry credit card balances or struggle with spending.

Prospective cardholders should consider their travel habits, financial habits and whether they can take full advantage of the benefits offered by airline miles credit cards before applying for one. How to get major perks at global events and concerts with your credit card. The value of airline miles varies by airline and how you use them.

When redeeming airline miles for business and first-class travel, you can get well over four cents per mile in value based on the cash value of the ticket. The value of airline miles for economy tickets is usually lower, but you should aim for at least 1.

Some airlines also offer partnerships with hotels, car rental companies and other travel services where you can use your miles for discounts or freebies. It's important to carefully consider your redemption options to get the most value from your airline miles.

However, keep in mind that airline miles are there to save you money on flights. So, if you want to opt for a sub-optimal redemption because it saves you cash, then go for it. How to travel to Australia with points and miles. When choosing the best credit card for airline miles, several factors must be considered.

First, consider your travel habits and which airlines you typically fly with. Are you more of a domestic flyer? Do you want to use points and miles for a trip to Europe? Are you looking to use points for a solo trip or traveling with a family? These questions will help you narrow your options to cards offering miles with airlines that best suit your needs.

Next, look at the welcome bonus and ongoing rewards. A higher welcome bonus can give you a head start on earning miles, while generous ongoing rewards can help you accumulate more miles on your daily spending.

Some cards may also have perks, such as airport lounge access or free checked bags, that can add value and justify a higher annual fee. Best credit cards for adventure travel. The main difference between airline and travel credit cards is in the rewards they earn.

Airline credit cards earn miles that can be used primarily towards flights and seat upgrades. Airline credit cards also offer perks tailored to frequent flyers, including free checked bags, priority boarding and elite status boosters. On the other hand, travel credit cards are more versatile and can be used for a broader range of expenses, including flights, hotels, rental cars, dining and entertainment.

Travel credit card points can be transferred to airlines or redeemed towards statement credits. These cards may also provide superior travel insurance and airport lounge access. Overall, airline credit cards are better suited for individuals who frequently fly with a particular airline or alliance.

In contrast, travel credit cards are better for those who want flexibility in redeeming their rewards across different expenses. From airline-specific perks like free checked bags and early boarding to more general benefits like bonus rewards on flights and statement credits on select purchases, these cards offer a suite of privileges designed to enhance any travel experience and are chosen based on the detailed insights from our team of travel experts.

When it comes to simplicity and strong rewards, the Capital One Venture Rewards Credit Card is a solid choice for most travelers. Read our full review of the Capital One Venture Rewards Credit Card.

The Chase Sapphire Preferred® Card is one of the most popular travel rewards credit card on the market. Cardholders can redeem points at 1.

Read our full review of the Chase Sapphire Preferred Card. Read our full review of the Capital One Venture X Rewards Credit Card. The Amex Platinum is unmatched when it comes to travel perks and benefits.

If lounge access, hotel elite status and annual statement credits are important to you, this card is well worth the high annual fee. Read our full review of the Platinum Card from American Express. Plus, Alaska has joined the oneworld alliance, opening up endless redemption opportunities.

Read our full review of the Alaska Airlines Visa credit card. With no annual fee and a simple 1. Read our full review of the Capital One VentureOne Rewards Credit Card. The Delta SkyMiles Platinum Amex is a good choice for Delta loyalists who need a little help reaching their elite status goals.

This card offers some useful perks including an annual companion pass and your first checked bag free on Delta flights. Read our review of the Delta SkyMiles Platinum Amex card.

It packs a real punch, offering 4 points per dollar on dining at restaurants and U. com , Milk Bar, and select Shake Shack locations.

Enrollment required. All this make it a very strong contender for all food purchases, which has become a popular spending category. Enrollment required for select benefits.

Read our full review of the American Express Gold Card. It also gives you helps you earn and maintain elite status and comes with priority perks. The Delta SkyMiles Gold Amex provides valuable elite-like benefits for causal Delta flyers including a first checked bag free and priority boarding.

It can easily justify getting and keeping this card. Read our full review of the Delta SkyMiles Gold American Express Card. The Delta SkyMiles Platinum Business American Express Card is worthy of consideration if you fly Delta frequently and value perks such as priority boarding, and a free checked bag.

Read our review of the Delta SkyMiles Platinum Business card. The Citi Premier is a solid travel card choice with a plethora of travel partners and solid earning rates.

Read our full review of the Citi Premier. These benefits alone make up the annual fee for frequent Southwest flyers. Read our full review of the Southwest Rapid Rewards Priority Card.

Plus earn points across the four bonus categories travel, shipping, advertising and telecommunication providers that are most popular with businesses. The card comes with travel protections, shopping protections and will also have primary coverage when renting a car for business purposes for you and your employees.

Read our full review of the Ink Business Preferred Credit Card. The Delta SkyMiles Reserve American Express Card is the premier choice for Delta loyalists who value an accelerated path to elite status, Delta SkyClubs lounge access, an annual companion certificate and strong earning rates on Delta purchases.

Read our review of the Delta SkyMiles Reserve card. The Business Platinum Card from American Express is a great card for frequent travelers looking to add a touch of luxury to their business trips. They include generous annual travel credits, unparalleled lounge access that includes Amex Centurion Lounges and more.

Read our full review of The Business Platinum Card from American Express. The Southwest Rapid Rewards Performance Business card is ideal for business travelers and loyal Southwest flyers interested in hitting A-List status or earning a Companion Pass.

Read our full review of the Southwest Rapid Rewards Performance Business card. Read our full review of the United Business Card. The card is best suited to travelers who want a low-annual-fee credit card that can help them earn and redeem rewards on everyday purchases while still giving them some travel benefits.

If you are looking for more travel perks and benefits and are willing to pay a higher annual fee , look at the Capital One Venture X Rewards Credit Card.

The card is easy to use and maximize, offering a valuable sign-up bonus and a rewards structure that helps you earn rewards across a lot of everyday spending categories. You can use those rewards in several ways, such as transferring them to a number of popular airline and hotel loyalty programs or using them through the Chase travel portal at a value of 1.

It usually has a pretty solid sign-up bonus, with points that can be transferred to some of my favorite loyalty programs, like British Airways Executive Club and World of Hyatt. The Capital One Venture X comes with a lot of travel perks for a more affordable annual fee than its premium counterparts from Chase and Amex.

You also get a strong sign-up bonus and at least 2 miles per dollar spent across all your purchases. Cardholders enjoy a Priority Pass Select membership and access to Capital One lounges. I use my Venture X card to earn 2 miles per dollar a 3.

The Amex Platinum remains the No. You can easily offset the full cost of the annual fee see rates and fees if you know how to maximize the various perks and credits the card offers, and those benefits can go a long way toward upgrading your travel experience.

Frequent travelers who know they can make the most of the many perks this card has to offer will benefit the most from adding it to their wallet. The lounge access options that come with the Platinum are unrivaled by competitors. I put all of my flights — whether bought with cash or points — on this card to earn 5 points per dollar spent up to , points per year; must be purchased directly with the airline or with Amex Travel.

And, honestly, pulling a Platinum card out of your wallet to pay for something does feel pretty fancy. Now that Alaska Airlines is a member of Oneworld, you can use the miles earned with the Alaska Airlines Visa to fly with not only Alaska but also Japan Airlines, American Airlines and more.

The card is an obvious choice for anyone who flies with Alaska Airlines regularly, offering a generous sign-up bonus and elitelike perks to help elevate your travel experience.

It provides a free first checked bag, discounts on inflight purchases and priority boarding. My favorite feature, however, is the annual Companion Fare. I get hundreds of dollars in annual value from this perk. Cards that earn flexible rewards, such as the Chase Sapphire Preferred Card , are great alternatives.

The no-annual-fee VentureOne Rewards Credit Card see rates and fees has the same redemption options as its sibling card the Capital One Venture Rewards Credit Card but with a lower rewards rate and fewer perks.

The miles earned on the card can also be transferred to airline and hotel partners, a benefit not usually seen with a no-annual-fee card. The VentureOne is a strong card to have in your arsenal and great if you are budgeting.

For a small annual fee, many travelers could benefit from the Capital One Venture Rewards Credit Card. The Delta SkyMiles Platinum Amex is a good option for a more frequent Delta flyer. It comes standard with Delta card perks like priority boarding and a free checked bag for you and eight companions when flying Delta.

My family and I do a lot of domestic flying and often plan our vacations far in advance. Having the companion ticket can save my family hundreds of dollars a year in airfare.

Plus, the tickets even qualify for free elite upgrades. If you are a Delta loyalist who wants more Delta perks, including Delta Sky Club access, the Delta SkyMiles® Reserve American Express Card may be a better option for your wallet. supermarkets each year, then 1 point per dollar.

If you still want extra rewards at restaurants along with additional bonus categories and other valuable perks at a lower fee, consider the Chase Sapphire Preferred Card.

The card offers the most benefits for American Airlines flyers of any credit card on the market, providing Admirals Club lounge access, elite like perks and more.

Loyal American Airlines flyers who are looking for ways to fast-track elite status and enjoy Admirals Club lounge access when flying with American. But the real reason I keep it year after year is because of the generous lounge access policy and the ability to add so many of my friends and family as authorized users.

It comes with a much lower annual fee and lets you earn bonus AAdvantage miles on additional spending categories: restaurants and gas stations. The information for the Citi AAdvantage Platinum Select World Elite card has been collected independently by The Points Guy.

The card details on this page have not been reviewed or provided by the card issuer. The card is best suited to casual Delta flyers who may not fly often enough to earn elite status but would enjoy elitelike perks such as priority boarding and a free checked bag.

If you are a regular Delta flyer interested in earning elite status, the Delta SkyMiles® Platinum American Express Card is a strong alternative. The Delta SkyMiles Platinum Business Amex is a good option for a mid-tier business card.

Like all Delta cards, it comes with perks like priority boarding and a free checked bag for you and eight companions when flying Delta. Small-business owners that frequently travel with Delta and want to earn Delta Medallion elite status can benefit from having the SkyMiles Platinum Business Amex.

If your small business wants a mid-tier travel card with flexible earnings, the American Express® Business Gold Card can be a great fit. The card earns 4 Membership Rewards points per dollar on the two categories where your business spends the most each month, and these points can be transferred to Delta SkyMiles if you find yourself needing a Delta flight.

The Citi Premier offers bonus earnings on a variety of everyday spending. This premium travel credit card provides cardholders with an anniversary bonus of 7, points in addition to four upgraded boardings per year and the ability to earn 3 points per dollar on Southwest purchases.

The Southwest Rapid Rewards Priority card can be a great addition to any Southwest loyalist's wallet. These benefits make the card well worth its annual fee for a frequent Southwest flyer.

Fans of Southwest can breathe a little easier knowing that they have options when it comes to choosing the best Southwest credit card for their specific needs. The Premier card is a great choice for the semi-frequent Southwest traveler, while the Plus card is a great entry-level choice for those who occasionally fly Southwest.

Small-business owners who want to earn valuable Chase Ultimate Rewards points across a number of business expenses without a high annual fee. Those with a company cellphone also could benefit from this card through its cellphone protection.

After all, the Ink Business Preferred earns 3 points per dollar spent on travel and provides excellent travel protections, including trip delay protection and rental car insurance. For small-business owners who are interested in maximizing their monthly expenses, the American Express® Business Gold Card offers a very strong rewards structure that adapts to your spending habits.

Plus, TPG values Amex Membership Rewards points at 2 cents each equal to our valuation of Chase Ultimate Rewards points.

The Delta Reserve card helps me maintain my status by offering shortcuts to earning and retaining status. The Platinum Card® from American Express offers a host of benefits for travelers who want to keep their redemption options open beyond Delta and its partners.

Small-business owners who travel frequently and regularly charge large purchases to their card each month. By using the benefits with Priority Pass and Amex lounges, the airline incidental credits, plus the statement credits for Clear Plus, our cellphone plan and restocking my home printer with ink and paper from Dell enrollment required , I get more value out of the card than it costs to keep it.

Plus, it earns my favorite points — American Express Membership Rewards — earning 5 points per dollar on flights and hotels booked with Amex Travel. For a cobranded airline card, it has a great rewards structure that extends far beyond just Southwest purchases.

I get the most value out of this card by taking advantage of the upgraded boardings, inflight Wi-Fi credits and 9, anniversary bonus points, which help offset the significant annual fee.

The Ink Business Preferred Credit Card earns Chase Ultimate Rewards points across a variety of business expenses and has a lower annual fee than the Southwest Performance Business card.

The United Business Card has a low annual fee, but it offers a lot of value to cardholders: bonus earning on categories beyond just United purchases, elitelike benefits such as priority boarding, two one-time United Club passes and more.

Small-business owners who want some United perks without spending hundreds of dollars on an annual fee. Loyal United flyers who are interested in even more benefits including lounge access and additional ways to fast-track elite status should consider the United Club Business Card.

While the annual fee is much higher, frequent United flyers who maximize the benefits can easily offset the additional cost.

The information for the United Club Business has been collected independently by The Points Guy. However, cobranded airline cards are not the only options for earning airline miles.

In addition, they typically include limited bonus categories. Finally, the rewards you earn on these cards are only redeemable with the given airline and its partners. Nevertheless, cobranded airline cards can be a great option if you are a brand loyalist who flies with only one airline.

You will be able to enjoy great perks, earn bonus miles on your flights and redeem your miles with your favorite airline.

However, most travelers are not brand loyalists. For those who travel a lot and want the freedom to pick an airline that works best for each trip rather than being forced to use a single one , it can be a good idea to consider cards that earn transferable points.