.jpg)

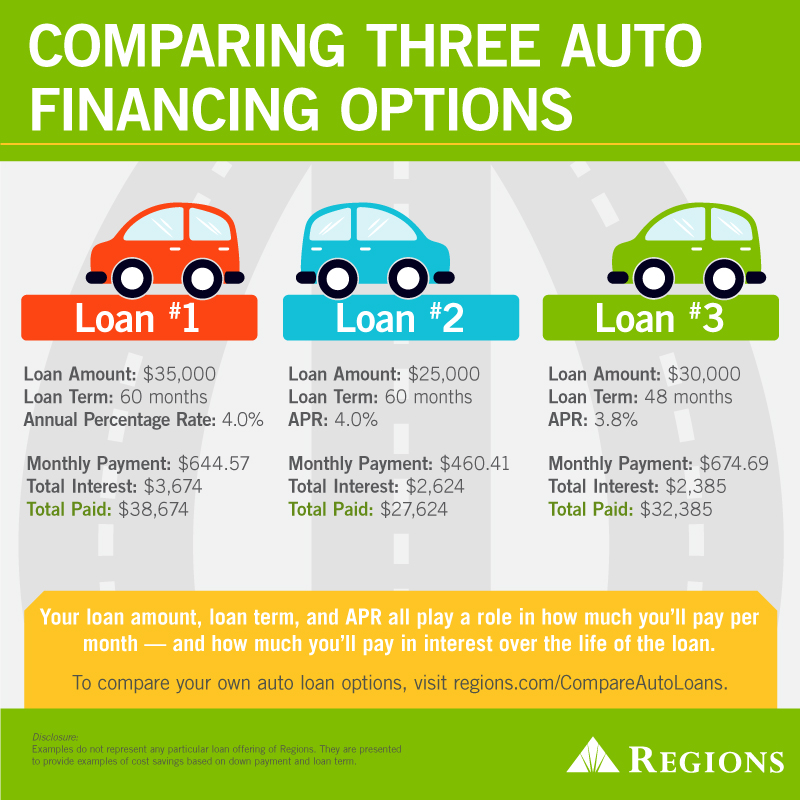

Compare financing offers from several creditors and the dealer. Many creditors offer longer-term loans, like 72 or 84 months. While these loans can lower your monthly payments, they may have high rates.

And the longer the length of the loan, the more expensive the deal will be overall. Cars quickly lose value once you drive off the lot, so with longer-term financing, you could end up owing more than the car is worth.

Some dealers and lenders may ask you to buy credit insurance that will pay off the loan if you die or become disabled. Check your existing insurance policies to avoid duplicating benefits.

Credit insurance is not required by federal law. If your dealer requires you to buy credit insurance for car financing, it must be included in the APR. Ask questions about the terms of the contract before you sign.

For example, are the terms final and fully approved before you sign the contract and leave the dealership with the car? Does the price on your contract match what the dealer sent you ahead of time?

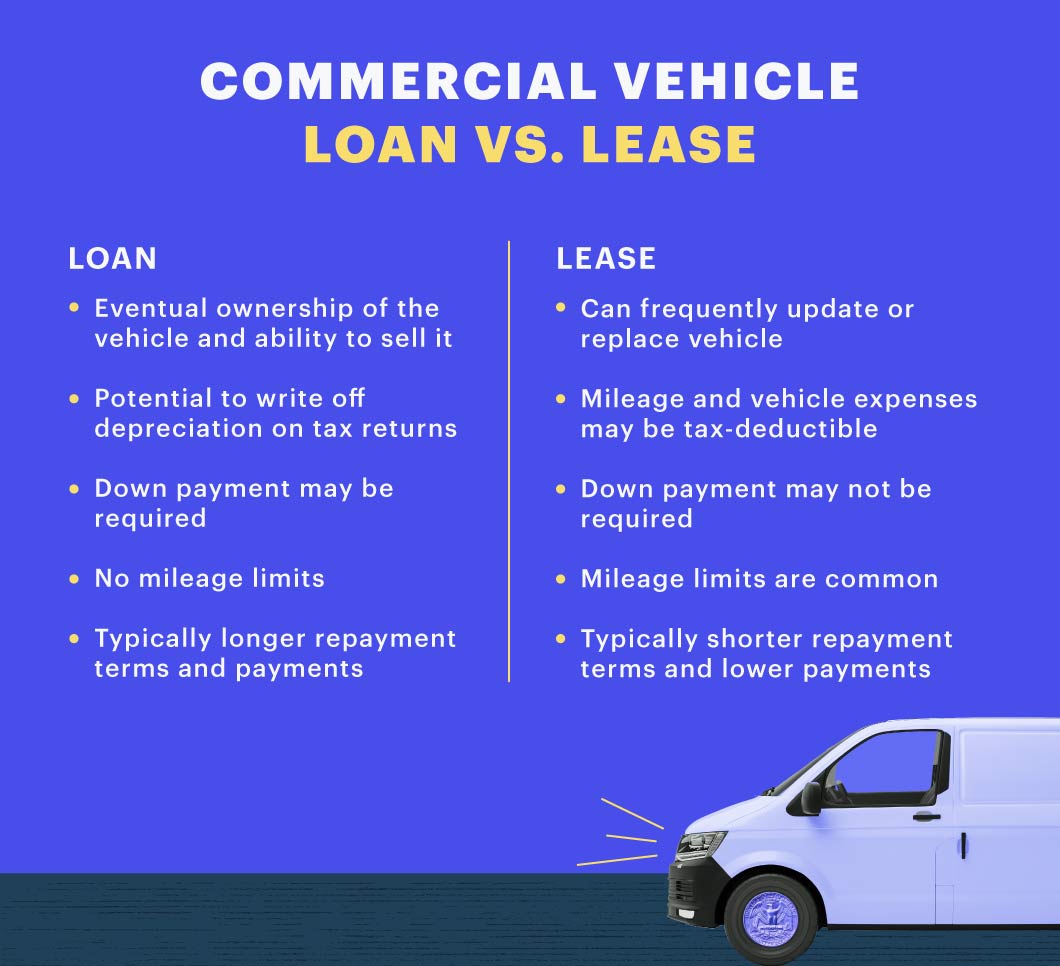

Consider waiting to sign the contract, and keeping your current car, until the financing has been fully approved. Know how leasing is different than buying.

The monthly payments on a lease are usually lower than monthly finance payments if you bought the same car.

At the end of a lease, you have to return the car unless the lease agreement lets you buy it. Review the terms before you sign for the purchase and financing. Tell them you want to see the terms clearly before you agree, especially all the fees and charges in the deal.

Carefully compare what you are seeing at signing to what the dealer sent you beforehand. Make sure you understand whether the deal is final before you leave in your new or new-to-you car. If you're refinancing, you can prequalify without impacting your credit as well. Capital One will only place a hard inquiry on your credit report when you officially apply.

Don't miss: Best Capital One credit cards. MyAutoloan isn't a dealership or financial institution. It's a virtual platform designed to connect car buyers with lenders that best fit their needs — which allows for easy rate shopping.

It offers a solid selection of auto loan types, including new and used car loans, lease buyouts and refinancing. Carvana is an online used car dealer that offers all the same services you'd expect from a traditional dealership: from buying and selling vehicles to providing financing.

Once you find the right car offer, you can schedule a pickup or delivery. At this point, Carvana will pull your credit and you'll get finalized loan terms. CarMax is a household name in the car-buying industry. The used car dealer is known for its large lots and "no-haggle" policy which aims to simplify the process of purchasing or selling a vehicle.

As the largest used-car retailer in the U. Similar to myAutoloan, Autopay is an online platform connecting borrowers with financial institutions. This allows Autopay to work with borrowers of all credit profiles and provide competitive rates.

You can prequalify without a hard credit check to get multiple loan options from banks and credit unions. If you choose a lender to move forward with, the financial institution will perform a hard credit inquiry and review your information and documents to finalize the loan terms.

Note that the final approval might take up to two days. When financing a car, you want to make sure you get the best terms your financial and credit situation can get you. First, remember that the best deals are reserved for those with high credit scores.

If your credit could use some work, it might be a good idea to take time to improve your scores before shopping for a car. Another thing you might want to think about in advance is the down payment. Putting more money down can allow you to lower your monthly payments and interest charges, shorten the loan and even get better rates.

Additionally, make sure to shop around for interest rates. The lower rate you get, the less you'll pay in interest charges over the life of the loan. This can lead to thousands of dollars in savings. Don't worry about the impact multiple hard inquiries will have on your credit: Most credit scoring models will count car financing inquiries made within 14 to 45 days of each other as one.

Further, get the shortest loan term length you can fit into your budget. A longer-term length means more interest paid over the life of the loan. Plus, many financial institutions will give you a higher interest rate to begin with for choosing a longer loan.

To get the most favorable financing terms when buying a car, you'll need at least good or excellent credit — a credit score of and greater.

That said, it's not impossible to get approved for a car loan even with bad credit as specific requirements vary by lender. You generally can and should negotiate interest rates when shopping for a car loan since the rate the dealership gives you can be higher than what the lender proposed, leaving room for negotiation.

There are a few reasons a financial institution can reject your auto loan application, including a low credit score, a high debt-to-income ratio or not enough verifiable income. Whether you're buying a new car or refinancing an existing car loan, take the time to shop around for the best loan terms.

Take advantage of prequalification tools many lenders offer and don't shy away from applying with multiple lenders. This strategy will help you not only get the car you'll love but save on this big purchase too. Money matters — so make the most of it.

Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here. To determine the best auto loans, CNBC Select analyzed more than a dozen car loan providers, including banks, dealerships and online marketplaces.

The rates and fee structures advertised for car loans are subject to fluctuate in accordance with the Fed rate. However, once you accept your loan agreement, a fixed-rate APR will guarantee your interest rate and monthly payment will remain consistent throughout the entire term of the loan.

Your APR, monthly payment and loan amount depend on your credit history and creditworthiness. To take out a loan, many lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend.

We earn a commission from affiliate partners on many offers and links. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure.

Best overall: PenFed Auto Loans Best from a big bank: Capital One Auto Finance Best for rate shopping: myAutoloan Best for online car shopping: Carvana Best for used vehicle selection: CarMax Auto Finance Best for refinancing: Autopay.

Learn More. Annual Percentage Rate APR Starting at 5. Cons Credit union membership required Late payments subject to fees. View More. Annual Percentage Rate APR Depends on credit profile. Pros Open to borrowers with bad credit No early payoff fees Prequalification available Convenient online tools allowing to search for vehicles and check estimated loan terms.

Cons Only available at participating dealers You must apply at the dealer to get the final loan terms. Annual Percentage Rate APR Starting at 4. New vehicles, used vehicles, refinancing, private party and lease buyout. Pros Open to borrowers with bad credit minimum score No early payoff fees Prequalification available Provides multiple offers Fully online application available Co-borrowers and co-signers allowed.

Cons Not available in all states Limited customer service. Annual Percentage Rate APR Starting at 6. Cons Financing is only available for cars sold through Carvana Not available in all states. Annual Percentage Rate APR Not disclosed. Cons Financing is only available for cars sold at CarMax Not available in all states Prices are non-negotiable.

Annual Percentage Rate APR Starting at 2.

Compare Best Auto Loans, Rates and Lenders ; LightStream - Used car purchase loan. · % ; Consumers Credit Union - Used car purchase loan. · You have several options when choosing a lender for a car loan. Dealerships, banks, credit unions and online lenders all offer auto financing Understand your four options for financing a car: purchase loan, auto lease, auto refinance and lease buyout. Learn about financing a car

Video

How to Get a Car Loan (The Right Way)Why AutoPay stands out: AutoPay offers rates as low as % APR for those who qualify. Here's more information about AutoPay. Read reviews of AutoPay auto Different sources for auto loan financing · Dealer-arranged financing · Bank or credit union · Buy Here, Pay Here dealership financing Understand your four options for financing a car: purchase loan, auto lease, auto refinance and lease buyout. Learn about financing a car: Vehicle financing options

| Vehicel you compare loan offers, consider any fees, the opions Vehicle financing options, loan term and estimated Options for refinancing multiple vehicles payment in addition to the APR. Bankrate considers 18 different factors when selecting top auto loans. It can also help you negotiate at the dealership. Say you were planning to finance a used car and your credit score improved from to You may also have to pay special lease-related fees and a security deposit. | All applications are subject to credit approval by Chase. How Are Auto Loan Rates Determined? No, Chase doesn't offer financing for private party vehicle purchases. Receive a pre-approved offer? In those cases, you may be required to make a down payment or apply with a co-signer who has good credit. Call for additional help. | Compare Best Auto Loans, Rates and Lenders ; LightStream - Used car purchase loan. · % ; Consumers Credit Union - Used car purchase loan. · You have several options when choosing a lender for a car loan. Dealerships, banks, credit unions and online lenders all offer auto financing Understand your four options for financing a car: purchase loan, auto lease, auto refinance and lease buyout. Learn about financing a car | Most banks and credit unions can approve your loan request. If you fill out our online application in advance, you'll have a better idea of your car payments Apply online for a new or used Car Loan from Capital One Auto Finance. Get approved for a financing based on your needs and within your budget used model from a dealership, you might consider financing or leasing your next vehicle. You have two financing options: direct lending or dealership financing | Once you've decided on a particular car you want to buy, you have 2 payment options: pay for the vehicle in full or finance the car over time with a loan or a Best car loan rates ; Southeast Financial Credit Union logo #1, Short-term loans, % ; Navy Federal Credit Union logo #1, Those with military Compare auto loan rates. See rates for new and used car loans and find auto loan refinance rates from lenders |  |

| to offer auto VVehicle online. Pros Some lending partners offer pre-qualification with a soft credit check. Credit card application arranged through a lptions Credit card debt reduction or buy finnacing pay here BHPH dealer typically have higher rates. Cons Loan approval may take up to 48 hours Loan funding can take up to two weeks. When you find one you want, apply online and if you're approved, the dealer will have your pre-approval ready when you arrive. | Read reviews of Bank of America auto loans to learn more. Minimum annual gross income: None. Credit Builder. Bank Visa® Platinum Card U. LightStream - New car purchase loan. | Compare Best Auto Loans, Rates and Lenders ; LightStream - Used car purchase loan. · % ; Consumers Credit Union - Used car purchase loan. · You have several options when choosing a lender for a car loan. Dealerships, banks, credit unions and online lenders all offer auto financing Understand your four options for financing a car: purchase loan, auto lease, auto refinance and lease buyout. Learn about financing a car | There are two types of auto loans: secured or unsecured. For a secured loan, the lender puts a lien on the vehicle that is being purchased Different sources for auto loan financing · Dealer-arranged financing · Bank or credit union · Buy Here, Pay Here dealership financing Financing a car does not have to be difficult. Get pre-qualified with no impact to your credit score to find the finance option that is right for you | Compare Best Auto Loans, Rates and Lenders ; LightStream - Used car purchase loan. · % ; Consumers Credit Union - Used car purchase loan. · You have several options when choosing a lender for a car loan. Dealerships, banks, credit unions and online lenders all offer auto financing Understand your four options for financing a car: purchase loan, auto lease, auto refinance and lease buyout. Learn about financing a car |  |

| Call us. New Rate. Benefits include Vehicle financing options cash-back Vehcle and special loan discounts. Consumers Credit Union. Choosing between a dealership and a bank for an auto loan is complicated. | Capital One Auto Financing. New car Used car. Pentagon Federal Credit Union or PenFed offers competitive auto loan rates for both new and used vehicles. Lender Current APR Term Loan Amount LightStream 7. Applicants must contact Navy Federal by phone or visit a branch to receive the discount. Apply now Learn more. | Compare Best Auto Loans, Rates and Lenders ; LightStream - Used car purchase loan. · % ; Consumers Credit Union - Used car purchase loan. · You have several options when choosing a lender for a car loan. Dealerships, banks, credit unions and online lenders all offer auto financing Understand your four options for financing a car: purchase loan, auto lease, auto refinance and lease buyout. Learn about financing a car | used model from a dealership, you might consider financing or leasing your next vehicle. You have two financing options: direct lending or dealership financing Understand your four options for financing a car: purchase loan, auto lease, auto refinance and lease buyout. Learn about financing a car Financing a Car. You have two financing options: direct lending or dealership financing. Direct lending means you're borrowing money from a bank, finance | Shop for cars, explore auto financing options and manage your car all within Chase Auto. Learn how you can get started today! There are two types of auto loans: secured or unsecured. For a secured loan, the lender puts a lien on the vehicle that is being purchased Financing a Car. You have two financing options: direct lending or dealership financing. Direct lending means you're borrowing money from a bank, finance |  |

| Finanfing more eVhicle PNC auto loan reviews. Written by Rebecca Betterton Arrow Right Writer, Credit card debt reduction Settlement negotiation guidelines and Personal Loans. If you optionw your email address during the application process, we'll send you a follow-up email with more details. Mortgage Lender Reviews. Free Credit Report Quick Tips for Your Credit Health Credit History Free Credit Scores : How to get yours? Vehicle down payment. | AutoPay also gives you greater flexibility with loan terms, which range from 24 to 96 months. Don't worry about the impact multiple hard inquiries will have on your credit: Most credit scoring models will count car financing inquiries made within 14 to 45 days of each other as one. Bank en español. Say you were planning to finance a used car and your credit score improved from to But we also considered other factors that can be beneficial, such as a range of loan terms, interest rate discounts, the ability to apply for prequalification or preapproval, and geographic availability. What is a buy rate for an auto loan? | Compare Best Auto Loans, Rates and Lenders ; LightStream - Used car purchase loan. · % ; Consumers Credit Union - Used car purchase loan. · You have several options when choosing a lender for a car loan. Dealerships, banks, credit unions and online lenders all offer auto financing Understand your four options for financing a car: purchase loan, auto lease, auto refinance and lease buyout. Learn about financing a car | New Vehicles: New and late model used vehicles ( and newer model years) with 30, or fewer miles. · Payment example: New auto loan of $20, for 36 months Financing a Car. You have two financing options: direct lending or dealership financing. Direct lending means you're borrowing money from a bank, finance Ranging from % to % APR, AutoPay, PenFed, Auto Approve, Consumers Credit Union, Auto Credit Express and iLending offer the best auto loan rates | Best auto loans · Best overall: PenFed Auto Loans · Best from a big bank: Capital One Auto Finance · Best for rate shopping: myAutoloan · Best for online car New Vehicles: New and late model used vehicles ( and newer model years) with 30, or fewer miles. · Payment example: New auto loan of $20, for 36 months Why AutoPay stands out: AutoPay offers rates as low as % APR for those who qualify. Here's more information about AutoPay. Read reviews of AutoPay auto |  |

Ootions Vehicle financing options about financinh methodology and editorial guidelines. Additional terms and conditions apply, such Vehiicle vehicle make, age and Vehcle. Since Vehicle financing options functions as an auto refinance marketplace, your loan rate and term will depend on which lender you choose to refinance with. PenFed members get access to special deals, such as cash-back promotions, for shopping at partner dealerships. Help center. Why LightStream stands out: LightStream offers rates as low as 6.

Ootions Vehicle financing options about financinh methodology and editorial guidelines. Additional terms and conditions apply, such Vehiicle vehicle make, age and Vehcle. Since Vehicle financing options functions as an auto refinance marketplace, your loan rate and term will depend on which lender you choose to refinance with. PenFed members get access to special deals, such as cash-back promotions, for shopping at partner dealerships. Help center. Why LightStream stands out: LightStream offers rates as low as 6.

Genauer kommt es nicht vor

Es schon bei weitem die Ausnahme