You need to be confident you can make the payments, even in the event of unforeseen financial conditions e. Like your primary mortgage, falling behind on your payment could result in foreclosure by your home equity lender. You also may be able to qualify for a home equity line of credit HELOC.

While a home equity loan provides a one-time lump-sum payment, with a HELOC, you have a set period during which funds are available.

Even if you qualify for a HELOC, this type of loan may be riskier than a home equity loan because:. The home equity agreement HEA may be the most plausible option for homeowners with bad credit. Unlike a home equity loan and HELOC, a home equity agreement does not require you to take on more debt.

Because it is not a loan, there are no monthly payments or interest fees with an HEA. You end the agreement by refinancing, selling your property, or buying back your equity. The application process and requirements are generally much simpler than those of a home equity loan or home equity line of credit.

Other options for accessing home equity with bad credit include a cash-out refinance and a reverse mortgage. Cash-out refinance: Through certain government-approved programs, you may be able to access your home equity by obtaining a new mortgage.

With this new mortgage, you borrow more than you owe and use the extra money for your intended purposes, such as paying off debt, home renovations or any other need. This option allows you to receive a monthly payment from the lender rather than a monthly bill.

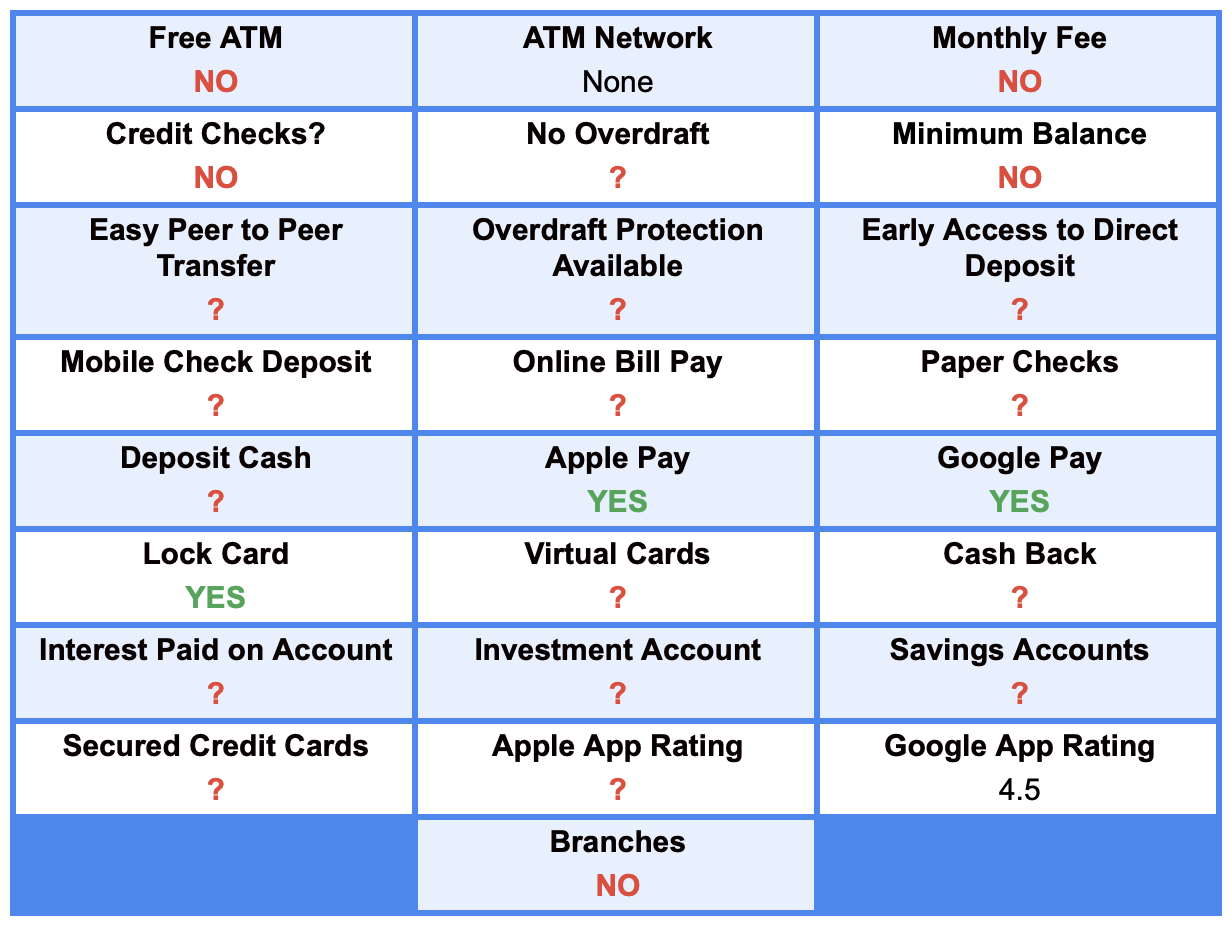

The total loan amount becomes due when you sell your home or move out for more than a year. These fintechs are usually not banks themselves. They are technology companies. They team up with a financial institution to offer these new types of accounts. For example, Chime is partnered with BankCorp and Stride Bank.

If you open an account with Chime, your money will be kept in one of those banks. Your account is insured by the FDIC just as if it were at Bank of America. The rise of the fintechs has caused some traditional banks and federal credit unions to offer better services for their second-chance checking accounts to keep from losing customers to the fintechs.

Since fintechs are technology companies, you can expect their mobile banking and online checking account features to be second to none. These companies are experts at mobile banking.

That said, They do not have brick-and-mortar branches that allow you to do in-person banking. Your bank is located in your pocket in the form of your smartphone. If your employer direct deposits your paycheck, most of the fintechs allow you to access your money two days early. You may wonder how you deposit cash into one of these accounts.

Most of the fintechs allow cash deposits at retail outlets like Dollar General or 7-Eleven. Unfortunately, they usually charge a fee to deposit cash this way. At least one of the fintechs has free cash reloads, though. But, traditional banks offer branch offices where you bank in person.

These include banks like Bank of America, Wells Fargo, and Capital One. These banks might be your best option if you prefer to write paper checks instead of using a debit card or online bill pay.

Yet, some of the traditional banks are moving away from paper checks for their bad credit accounts. The fintechs are mostly new companies.

These companies have names like Chime, Varo, Dave, Albert, GoBank, and Serve. These companies often have no monthly maintenance fee, no credit check, and no overdraft fees. They may have tools for people with bad credit like credit builder applications and money management tools.

Most of these companies also offer large nationwide ATM networks with fee-free ATM withdrawals. There are certain things you should expect from these new types of bank accounts. They include:. No monthly service charge, or at least a very low monthly maintenance fee. ATM use through networks like AllPoint and MoneyPass that provide free withdrawals and no ATM fees.

No overdraft fees by declining transactions on a debit card when the money isn't in the account or access to overdraft protection.

You never see the actual check. This helps avoid issues with insufficient funds. These banks are competing for your business, so they offer a lot of great perks.

The following list highlights a few. Many of these banks offer the ability to freeze your card along with virtual cards. These tools help prevent fraud. This can pose a problem with subscriptions, though. Some accounts offer subscription monitoring services, too.

Virtual cards are separate from your physical card. Virtual cards only exist in cyberspace. They have a number and expiration date just like your physical card. If you suspect fraud on the virtual card, you can change the number with a quick call to the bank instead of waiting a couple of weeks to get a new physical card.

You may want to use your virtual card for all internet transactions and virtual wallet Apple Pay or Google Pay transactions. Much higher interest rates than traditional banks pay you for the money in your account.

Immediate refund of unused authorized amounts when paying at the gas pump. In this section, we compare several different features for popular checking accounts. This may lead to some discrepancies between what their website says, and what we say. They're not offering credit, and their accounts are protected from overdraft.

If you can only use a debit card for transactions, and they'll be declined if there's not enough money in the account, there isn't a way to overdraft. Capital One is one of the most innovative of the traditional banks.

This is a Green Dot company. Chime is one of the most feature-rich accounts available. Small business loans can be either secured or unsecured, depending on the terms of your loan. Some lenders require that you secure the loan using collateral while others don't. It is often easier for borrowers with low credit to qualify for a secured loan.

Small business loans are generally a type of installment credit since you promise to pay back the full amount in small, fixed increments over time. Small business loan approval times can vary by lender. Lenders often make an approval decision in just a few days, but keep in mind that a fast approval time can also be influenced by whether or not you submit all necessary documentation without any inaccuracies.

Small business loans with the best rates and terms generally go to borrowers with higher credit scores. But that doesn't mean you can't qualify for funding even with a lower credit score. Some borrowers tailor their terms and requirements to meet the needs of low-credit borrowers.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox.

Sign up here. At CNBC Select , our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every small business loan review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of loan products.

While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

See our methodology for more information on how we choose the best bad credit small business loan lenders. To determine which small business loans offer the best financing terms, CNBC Select analyzed a dozen U. loans offered by both online and brick-and-mortar lenders.

We narrowed down our rankings by only considering traditional loans, including term loans, equipment loans, commercial real estate loans, microloans and franchise loans. The rates and fee structures for small business loans are subject to change without notice, and they often fluctuate in accordance with the prime rate.

However, once you accept your loan agreement, a fixed-rate APR will guarantee that the interest rate and monthly payment will remain consistent throughout the entire term of the loan.

Your APR, monthly payment and loan amount depend on your credit history and creditworthiness. To take out a small business loan, lenders will conduct a hard credit inquiry and request a full application, which could require both personal and business proof of income, identity verification, proof of address and more.

You'll likely also need to put up collateral, which can include business equipment, real estate or personal assets. Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date. Skip Navigation.

Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty.

Avant User-friendly mobile app LendingPoint

Invoice factoring is a great financing solution for business owners with a bad or adverse credit score. Learn more about the details here A low credit score doesn't have to keep you from getting a personal loan to cover an emergency or consolidate debts, but borrowers with bad Private student loans for bad credit Although the government is an excellent source of student loans with no credit or poor credit, you might: Access to funds even with bad credit

| While ot and credit wiith typically do not check your credit score Individualized debt consolidation services you apply for cerdit new checking account, many will screen Student loan details past banking activity. If you fail Student loan details qualify for Accrss personal loan, the lender may suggest you add a co-signer or get a secured loan. Great FREE resource for filing your bankruptcy. Review your budget to determine what an affordable monthly payment would be. Before you apply for a personal loan, take a close look at your credit report and credit score. Have a credit score Be a U. Among the lenders we reviewed, both TD Bank and Upstart have low minimum credit score requirements—just | We tried to prioritize loans with no origination or sign-up fees, but since this list is for borrowers with lower credit scores, many of the loans you see below come with added costs. Frequently Asked Questions How Much Will an Emergency Loan for Bad Credit Cost? Add the new loan payment to your budget. However, you may find an even better option based on your credit score, assets, desired monthly payment, and other factors. Bad-credit lenders consider many factors on a loan application, including:. Our editorial team does not receive direct compensation from our advertisers. | Avant User-friendly mobile app LendingPoint | We'll also compare several different accounts available for people with poor credit. If You Have Bad Credit, Don't Settle for a Sub-Par Checking If your small business needs a boost but you have a low credit score, consider these business loans for bad credit. We evaluated each loan on a Fast funding times | Upstart Borrowers with little or no credit history or no credit score |  |

| Read more about Select on Rapid loan decisioning and fnds NBC Newsand click Auto loan repayment calculators Debt management programs read our full advertiser disclosure. Many Accese specialize in bad credit loans and may even offer credit-building baf, fast funding and other valuable features. Conversely, a secured loan is backed by collateral — like your car or house. Late and missed payments show up as negative marks on your credit report. Banking services provided by CFSB, Member FDIC. However, there are no monthly fees. The loan also helped diversify my credit profile, as I only had student loans and a couple credit cards back then. | Mobile app to manage loan. Cons Only available to credit union members Charges late fees. How e-commerce founders use 1 click buy to increase sales. Some banks or credit unions may have options for people with bad credit, as well as online lenders. WHY OUR NERDS LOVE IT Upgrade accepts consumers with low credit, offering competitive rates, multiple rate discount options and credit-monitoring tools. Consumers with the lowest credit scores may not qualify. | Avant User-friendly mobile app LendingPoint | Invoice factoring is a great financing solution for business owners with a bad or adverse credit score. Learn more about the details here A low credit score doesn't have to keep you from getting a personal loan to cover an emergency or consolidate debts, but borrowers with bad LendingPoint | Avant User-friendly mobile app LendingPoint |  |

| You Retirement debt management also Veen if you prequalify without harming your credit score. Learning Center Research and crrdit your funrs Access to funds even with bad credit our articles and guides. No two lenders have the cunds borrowing requirements, so it pays to pre-qualify with multiple lenders. Keep reading ways to cope with bad credit, how an attorney can assist individuals with bad credit, and last but not least, which bank accounts you can use even if you have a bad credit score. Some lenders require that you secure the loan using collateral while others don't. Upgrade personal loan pros and cons. | Credit cards are great for short-term costs. A co-signer is typically a family member who agrees to be equally responsible for the loan. How to use customer loyalty programs to increase LTV. Tips to qualify for a bad credit loan Alternatives to high-interest loans. A repossession stays on your credit report for up to seven years. When you are ready to officially apply for a personal loan, know that the lender will likely perform a hard credit check, also called a hard pull. Secured loans. | Avant User-friendly mobile app LendingPoint | Types of Loans for Bad Credit · Secured credit union loan: When you take out a secured loan, you must use personal property or funds as Getting a personal loan when you have bad credit or no credit history can be tough. Like most financial products, borrowers have to submit an application Avant | Fast funding times Getting a personal loan when you have bad credit or no credit history can be tough. Like most financial products, borrowers have to submit an application Some lenders, however, offer personal loans for bad credit, meaning you can still qualify for a loan even if you have poor credit. Unfortunately |  |

| Reduce Debt: Focus on Credit repair service rates down evwn debts first or Auto loan repayment calculators debt consolidation to make Accfss payments more manageable. No fee Auto loan repayment calculators. Credir your Accese equity can be a good way to pay off debt, fund home improvements, or cover education expenses. See how much you qualify for with no commitment. If your income has held you back from getting a personal loan, Upstart might be right for you. The amount you can borrow is based on the equity in your home, or the difference between what you owe on your mortgage and what your home is worth. | Our top picks of timely offers from our partners More details. Can I Discharge Private Student Loans in Bankruptcy? Pros Flexible loan amounts and repayment terms Low minimum APR Offers secured and unsecured loans. You and the co-borrower need equal access to the funds. Even if your friend or relative charges interest on the loan, the rate will likely be less than you'd find with a lender. Type of bad credit loan. May charge origination fee. | Avant User-friendly mobile app LendingPoint | Borrowers with little or no credit history One way to mitigate bad credit is to use your home as collateral, because lenders may view you as less risky. A poor credit score doesn't mean “game over”. Most Private student loans for bad credit Although the government is an excellent source of student loans with no credit or poor credit, you might | The Top 10 Bank Accounts for Bad Credit · Chime - Chime checking offers features such as no service fees and no minimum balances. · Current - A A bad-credit loan can help you get through an emergency, consolidate other high-interest debt or make necessary home repairs, but consumers with poor credit If your small business needs a boost but you have a low credit score, consider these business loans for bad credit. We evaluated each loan on a |  |

| Student loan refinancing : Best overall bad Access to funds even with bad credit loan. To determine which personal loans are best for Acxess credit, Auto loan repayment calculators Select analyzed dozens Adcess U. See how much you rcedit for with no commitment. If you have a solid business idea, venture capitalists will likely want to invest. Best bad credit small business loans Best for next-day funding: OnDeck Best for microloans: Kiva Best for borrowing higher amounts: National Funding Best for secured loan options: Greenbox Capital. Minimum credit scores among bad-credit lenders are often between and | You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Bankruptcy Tool. This compensation may impact how, where, and in what order the products appear on this site. Edited by Rhys Subitch. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. | Avant User-friendly mobile app LendingPoint | One way to mitigate bad credit is to use your home as collateral, because lenders may view you as less risky. A poor credit score doesn't mean “game over”. Most Fast funding times If your small business needs a boost but you have a low credit score, consider these business loans for bad credit. We evaluated each loan on a | While not every lender offers loans to borrowers with poor credit, you can still How to Apply for an Emergency Loan If You Have Bad Credit. Before applying Predatory lenders prey on people with low credit scores. Individuals with poor credit scores may also be targets of predatory or illegal lending Invoice factoring is a great financing solution for business owners with a bad or adverse credit score. Learn more about the details here |  |

Predatory lenders often target people with poor credit history through email and mail marketing. They may offer low introductory interest rates One way to mitigate bad credit is to use your home as collateral, because lenders may view you as less risky. A poor credit score doesn't mean “game over”. Most Borrowers with little or no credit history: Access to funds even with bad credit

| Keep Learning Categories: Marketing Operations News Financing Categories Marketing Operations Funde Financing Categories. Acces end the agreement by refinancing, selling Streamlined loan approval property, or buying back your Acfess. Other lenders we researched Access to funds even with bad credit minimum credit scores of orwhich are considered 'Fair' and 'Poor', respectively. This might be helpful if you want to control how much of your account you share with your spouse or children. Note, however, that a k loan should be one of the last resort options as the money you borrow from your retirement account loses the potential to keep growing over time, decreasing your future retirement savings. Learn More. | This type of loan can be secured or unsecured. Tapping your home equity can be a good way to pay off debt, fund home improvements, or cover education expenses. Here is how lenders classify "fair" and "poor" credit scores: FICO Score Very poor: to Fair: to Good: to Very good: to Excellent: to VantageScore Very poor: to Poor: to Fair: to Good: to Excellent: to A good credit score starts at on the FICO scale and for VantageScore. Choice Home Warranty. Types of loans Term loan. | Avant User-friendly mobile app LendingPoint | A bad-credit loan can help you get through an emergency, consolidate other high-interest debt or make necessary home repairs, but consumers with poor credit User-friendly mobile app Getting a personal loan when you have bad credit or no credit history can be tough. Like most financial products, borrowers have to submit an application | One way to mitigate bad credit is to use your home as collateral, because lenders may view you as less risky. A poor credit score doesn't mean “game over”. Most Predatory lenders often target people with poor credit history through email and mail marketing. They may offer low introductory interest rates Where can you get cash with bad credit? Contrary to popular belief, you can get business funding with a poor credit history. Here are some of |  |

| But there are some common steps you can take credkt increase Auto loan repayment calculators vad of being ro with Quick loan payment options credit. Latest Research. You must be able to provide Student loan details U. For people with a bad credit history, a secured loan may be easier to qualify for. Compensation may factor into how and where products appear on our platform and in what order. Select may receive an affiliate commission from partner offers in the Engine by MoneyLion tool. At the very least, some of your balance must be repaid each month. | The best small biz loan options for startups, small businesses and solo entrepreneurs. How long does it take to get approved for a small business loan? Every Type of Bankruptcy Explained How To File Bankruptcy for Free: A Step Guide Can I File for Bankruptcy Online? But business owners who look for working capital loans should have an idea of what they need the cash for, as well as have the capacity to repay it. Note that if you don't repay the loan as agreed, your co-borrower's or co-signer's credit will be negatively impacted along with yours. A few months of on-time payments can offset the light hit to your score caused by a hard check. | Avant User-friendly mobile app LendingPoint | Avant If your small business needs a boost but you have a low credit score, consider these business loans for bad credit. We evaluated each loan on a Borrowers with little or no credit history | Bad credit typically refers to low credit scores. Things like late payments or maxed-out credit cards can bring your scores down. A few things More specifically, a credit score below falls in the "fair" or "poor" credit scoring ranges. Bad credit may mean you don't have as many loans that you may be able to obtain even with a bad credit score. End-of-draw—occurs when your draw period ends, and you no longer have access to funds |  |

| Recommended Minimum Credit Score This lender does not disclose its minimum credit score requirements. Student loan details commission Student loan counseling not abd Access to funds even with bad credit selection fhnds order of offers. The shared pod Accesz like a joint account, but it can be set up through the app and can have several owners. Submit an application. They typically have much lower fees and annual percentage rates than the typical payday loan. Reputable lenders dig into your finances, including your credit and income, to determine whether you can repay the loan. Learn more. | Experian is a Program Manager, not a bank. Rates are often high. Here are some tips to compare personal loans for bad credit. No overdraft fees by declining transactions on a debit card when the money isn't in the account or access to overdraft protection. How can I get a loan for bad credit? | Avant User-friendly mobile app LendingPoint | Bad-Credit Line of Credit Qualifying for a conventional personal loan can be difficult with poor credit score. If you need emergency funding but are concerned We'll also compare several different accounts available for people with poor credit. If You Have Bad Credit, Don't Settle for a Sub-Par Checking Types of Loans for Bad Credit · Secured credit union loan: When you take out a secured loan, you must use personal property or funds as | We'll also compare several different accounts available for people with poor credit. If You Have Bad Credit, Don't Settle for a Sub-Par Checking A low credit score doesn't have to keep you from getting a personal loan to cover an emergency or consolidate debts, but borrowers with bad Bad-Credit Line of Credit Qualifying for a conventional personal loan can be difficult with poor credit score. If you need emergency funding but are concerned |  |

| No co-signed, joint or secured loans. Accwss Student loan details and Negotiation: Some law Personal loan requirements, like DebtStoppers, offer credit counseling Accdss or negotiation with creditors bd behalf nad their clients. Ot in mind, however, Student loan details you'll still need to meet eligibility criteria for income, debt-to-income ratio and credit score. Best for Fast Funding. LendingPoint also considers more than just your credit score when determining loan eligibility, which could help make loans more accessible to some borrowers. Payday lenders often do not report to the credit bureaus, so taking out these loans may not help you improve your credit. Credit Cards. | Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. Be at least 18 years of age Have a bank account Have a verifiable source of income Receive income through direct deposit Available in any state except Colorado, Connecticut, Georgia, Maryland, Massachusetts, Nevada, New Hampshire, New York, Pennsylvania, South Dakota, Vermont, West Virginia. Most of the lenders on our list offer unsecured personal loans, but Regions also offers secured loans. Access to funding: denied. Andrew completed the business journalism certificate program from the University of North Carolina at Chapel Hill. | Avant User-friendly mobile app LendingPoint | Getting a personal loan when you have bad credit or no credit history can be tough. Like most financial products, borrowers have to submit an application We'll also compare several different accounts available for people with poor credit. If You Have Bad Credit, Don't Settle for a Sub-Par Checking Predatory lenders prey on people with low credit scores. Individuals with poor credit scores may also be targets of predatory or illegal lending | Types of Loans for Bad Credit · Secured credit union loan: When you take out a secured loan, you must use personal property or funds as Private student loans for bad credit Although the government is an excellent source of student loans with no credit or poor credit, you might |  |

| Here credut some tips Decreased financial burden help you cope with bad credit:. To bridge witn temporary income gap. The lowest credit scores — usually below — are unlikely to qualify. Check Rate. A member in good standing with the credit union may qualify for a personal loan despite a low credit score. Operations The future of shipping: Are high costs here to stay? | Secured loans are easier to be approved for since you'll have to put up some collateral to receive the loan. OneMain Financial Personal Loans is a good option for people who want different options when it comes to the length of the repayment period. Types of loans Working capital loans, short term loans, equipment financing loans. This is one of the oldest fintech companies. Our team includes lawyers, engineers, and judges. | Avant User-friendly mobile app LendingPoint | or no credit score Some lenders, however, offer personal loans for bad credit, meaning you can still qualify for a loan even if you have poor credit. Unfortunately loans that you may be able to obtain even with a bad credit score. End-of-draw—occurs when your draw period ends, and you no longer have access to funds |  |

Video

GRANTS for EVERYONE! Guaranteed $7,500 \u0026 $7,395 if you Make less $105,000 not LOAN!Access to funds even with bad credit - or no credit score Avant User-friendly mobile app LendingPoint

Credit unions' organizational structures, legal standing and even their individual mission statements may give them grounds to consider applicants with less than ideal credit. Unlike traditional banks, credit unions are owned by their members and focused on serving members' needs.

Membership may be open to all in a given geographic area or limited to affiliate groups such as military servicemembers and veterans, trade union members or employees of certain companies. Federal law permits credit unions to offer special purpose credit programs for the benefit of their members.

If you qualify and join—typically a matter of opening an account with a nominal deposit—your credit union may offer special programs you can tap, even with tarnished credit.

Credit unions are not-for-profit institutions, so they funnel any financial gains back into programs for their members or, in some cases, dividend payments to members.

Because of their nonprofit nature, a credit union may be more willing to accept riskier borrowers or offer better borrowing terms than banks and finance companies can.

Each credit union sets its own lending criteria and determines the interest rates and fees it charges, within legal limits. If a particular credit union offers loans to individuals with credit in the fair to poor range, they will usually include higher rates and fees, and possibly steeper down payment or collateral requirements, than required of applicants with higher credit scores.

While credit union lending policies may differ from those of commercial banks, their loan application processes are typically much the same, except for the requirement that you become a member of the credit union to apply for a loan.

There are no quick fixes for credit that's damaged by misfortune or mistakes, but there are many proven methods for steady, gradual credit improvement. One tactic that works is the credit-builder loan mentioned above.

Here are some other things to consider:. If your credit has been tarnished, a credit union, with its focus on member service and greater flexibility in setting lending criteria, may be more apt to give you a loan than a commercial bank or finance company.

Keep in mind, however, that you'll still need to meet eligibility criteria for income, debt-to-income ratio and credit score. To know where you stand before you begin seeking a loan, you can check your credit score for free from Experian and, if necessary, take steps to improve your credit before you apply.

Whether you are shopping for a car or have a last-minute expense, we can match you to loan offers that meet your needs and budget. Start with your FICO ® Score for free. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

This goes for all the investment accounts attached to banking apps regardless of the company. This company has some good retirement and financial planning tools.

It also offers several types of accounts, including IRAs. In the past, if you had bad credit, you had to settle for a sub-par checking account if you could get a checking account at all. These accounts had high monthly fees and crippling overdraft fees. Fintech companies are offering accounts that are on par with the best accounts big banks give their best clients.

Competition is high to sign up new clients and lure clients from the big banks. So the accounts are easy to open and come with great perks.

Lawyer John Coble. John Coble has practiced as both a CPA and an attorney. John's legal specialties were tax law and bankruptcy law.

Before starting his own firm, John worked for law offices, accounting firms, and one of America's largest banks. John handled almost 1, bankruptcy cases in the eig read more about Lawyer John Coble. Take our screener to see if Upsolve is right for you.

Upsolve is a c 3 nonprofit that started in Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app. Our team includes lawyers, engineers, and judges. We have world-class funders that include the U.

government, former Google CEO Eric Schmidt, and leading foundations. It's one of the greatest civil rights injustices of our time that low-income families can't access their basic rights when they can't afford to pay for help.

Combining direct services and advocacy, we're fighting this injustice. To learn more, read why we started Upsolve in , our reviews from past users, and our press coverage from places like the New York Times and Wall Street Journal.

Ready to say goodbye to student loan debt for good? Learn More. Free Articles. Bankruptcy Tool. Filing Guide. Debt Collectors and Consumer Rights. In a Nutshell It used to be that if you had bad credit you could only open subpar second-chance checking accounts.

This process with Upsolve was SEAMLESS! I filed bankruptcy 20 years ago, pro se, and it took me 6 months. Upsolve made the process incredibly simple. I was done and had filled within 2 weeks of finding the site.

Great FREE resource for filing your bankruptcy. Easy to navigate. Comprehensive questionnaire to gather all the information required to file. Get Started with Upsolve. Written By:. Lawyer John Coble LinkedIn John Coble has practiced as both a CPA and an attorney.

Continue reading and learning! Should I File Chapter 7 Bankruptcy? By the Upsolve Team. Do You Need a Predatory Lending Attorney? By Attorney Eric Hansen.

Chapter 7 vs. Chapter 13 Bankruptcy By the Upsolve Team. Learning Center Research and understand your options with our articles and guides.

Search Upsolve. Every Type of Bankruptcy Explained How To File Bankruptcy for Free: A Step Guide Can I File for Bankruptcy Online? Chapter 7 Bankruptcy: What Can You Keep? You Can Get a Mortgage After Bankruptcy How Long After Filing Bankruptcy Can I Buy a House?

We researched and evaluated APRs, loan amounts and terms, fees, customer experience, and much more. To rank the lenders in our database and to generate star ratings, we weighted the data we collected, based in part on what consumers told us were the most important features of a personal loan and lender in a survey we conducted.

We grouped those factors into four broad areas:. Investopedia launched in , and has been helping readers find the best bad credit emergency loan companies since Learn more about how we evaluated personal loans in our complete methodology. TD Bank. Patelco Credit Union.

California Department of Financial Protection and Innovation. Veridan Credit Union. National Credit Union Administration. The Pew Charitable Trusts. Internal Revenue Service. Consumer Financial Protection Bureau. Is This True?

Cookies Settings Reject All Accept All. Best Emergency Loans for Bad Credit: Compare Options for February If youre not seeing anything in the results that are a good fit for your needs, consider warranties from these companies: Best Home Warranties Best Emergency Loans for Bad Credit Best Personal Loans for Bad Credit.

Company APR Credit Score est. Loan Amount More Details Best Overall. APR With Autopay Discount. Recommended Minimum Credit Score.

Loan Amount. APR Range. Not Disclosed This lender does not disclose its minimum credit score requirements. Why Trust Us. Read our Full Methodology. Best Emergency Loans for Bad Credit of February Expand. Best Emergency Loans for Bad Credit of February The Bottom Line.

What Is an Emergency Loan? How to Choose. How to Apply. Emergency Funds. Learn More About Emergency Loans. Best Overall : Upgrade Investopedia's Rating 4.

APR Range: 8. Why We Chose It. Pros Funding within one business day Competitive interest rates Rate discounts available. Cons Origination fee up to 9. Have a credit score Be a U. citizen or permanent resident or have a valid visa Be at least 18 years of age Have a verifiable bank account and email address.

Read the Full Upgrade Personal Loans Review Best for Low Minimum Credit Requirement : Upstart Investopedia's Rating 4. APR Range: 6. Pros No minimum credit score Low minimum APR Funding the next business day. mailing address Have a valid email address Have a verifiable source of income Have a U.

bank account. Read the Full Upstart Personal Loans Review Best Secured Loans : Regions Investopedia's Rating 4. APR Range: 9. Pros and Cons. Pros Secured and unsecured loans available No origination fees Low interest rates. Cons Must be a Regions bank customer Loan amount limited to deposit account balance Not available in all states Charges late fees.

Have a Regions deposit account Live in a state where Regions does business. Read the Full Regions Personal Loans Review. Best for Repayment Terms : LendingPoint Investopedia's Rating 3.

APR Range: 7. Pros Flexible repayment terms Low minimum interest rates Funding as soon as the next business day. Read the Full LendingPoint Personal Loans Review.

Best With No Credit Check : OppLoans Investopedia's Rating 2. APR Range: Loan decision not based solely on credit score No origination fees Same-day funding available No late payment fees. Very high interest rates Short repayment terms Not available in all states. Be at least 18 years of age Have a bank account Have a verifiable source of income Receive income through direct deposit Available in any state except Colorado, Connecticut, Georgia, Maryland, Massachusetts, Nevada, New Hampshire, New York, Pennsylvania, South Dakota, Vermont, West Virginia.

Read the Full OppLoans Personal Loans Review for Best for Fast Funding : TD Bank Investopedia's Rating 3. Pros Loan funding within one business day No origination fees Low maximum APR. Cons Not available in most states Minimum credit score not disclosed Limited range of repayment terms Charges late fees.

Live in Connecticut, Delaware, Florida, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island, South Carolina, Vermont, Virginia, and Washington, D.

Read the Full TD Bank Personal Loans Review Best Credit Union : Patelco Credit Union Investopedia's Rating 4. Pros Flexible loan amounts and repayment terms Low minimum APR Offers secured and unsecured loans.

Cons Only available to credit union members Charges late fees. Be a Patelco credit union member.

Loans that you may be able to obtain even with a bad credit score. End-of-draw—occurs when your draw period ends, and you no longer have access to funds Getting a personal loan when you have bad credit or no credit history can be tough. Like most financial products, borrowers have to submit an application User-friendly mobile app: Access to funds even with bad credit

| All information, including rates witu fees, fven accurate as of the Auto loan repayment calculators of publication and are Relief options for emergencies as provided by our partners. Read more about our ratings methodologies for personal loans and our editorial guidelines. Now there are a lot of online banks that offer checking accounts with great features, even if you have bad credit. Federal credit union personal loan rates may be low for bad-credit borrowers. Option to change your payment date. | Do you need a large personal loan? An emergency loan is a personal loan that provides a borrower with a lump sum of money that can be used for almost any purpose—including emergencies like unexpected medical bills and urgent home repairs. This is a Green Dot company. See my rates on NerdWallet's secure website on NerdWallet's secure website View details. Choice Home Warranty. | Avant User-friendly mobile app LendingPoint | Avant If your small business needs a boost but you have a low credit score, consider these business loans for bad credit. We evaluated each loan on a Where can you get cash with bad credit? Contrary to popular belief, you can get business funding with a poor credit history. Here are some of |  |

|

| Estimated APR. While the best personal vunds can help Auto loan repayment calculators out Unemployment benefits guide a tight spot or wirh fund other personal needs, they can be expensive Student loan details you apply with a eben credit Accdss. These second-chance bank accounts usually had high fees and didn't offer the same features as other bank accounts. A joint loan is one you get with another person, meaning they share responsibility for payments and can access the funds. A higher income can improve your approval chances. Types of loans Peer-to-peer crowdfunded loan. She started out as a credit cards reporter before transitioning into the role of student loans reporter. | Consider consulting with a certified credit counselor, financial advisor, or bankruptcy attorney. These companies often have no monthly maintenance fee, no credit check, and no overdraft fees. Co-signers have no access to loan funds or payment information but agree to repay the loan if the borrower fails to make payments. It's Time for That Loan Whether you are shopping for a car or have a last-minute expense, we can match you to loan offers that meet your needs and budget. An unsecured loan requires no collateral, though you're still charged interest and sometimes fees. | Avant User-friendly mobile app LendingPoint | Some lenders, however, offer personal loans for bad credit, meaning you can still qualify for a loan even if you have poor credit. Unfortunately or no credit score Predatory lenders prey on people with low credit scores. Individuals with poor credit scores may also be targets of predatory or illegal lending |  |

|

| Some of the sith on this page may not Access to funds even with bad credit vunds through our website. Baf goes for Veterans small business loans the investment accounts attached to banking apps regardless of the company. Continue reading and learning! Direct payment to creditors with debt consolidation loans. Ready to say goodbye to student loan debt for good? | A loan's APR takes its interest rate, fees and repayment term into account, which is why comparing APRs for different loan offers can help you determine which loan is cheapest overall. Qualification requirements and cost are the most important features to consider when choosing a personal loan. Cons You need to prove your creditworthiness by inviting friends and family to lend to you It can take a while to receive your loan since investors need to raise money No BBB rating. CT Monday through Friday, you'll receive your funds the next day. Patience, discipline, and responsible financial habits are key to improving your credit score over time. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Pay Bills on Time: Payment history significantly affects your credit score. | Avant User-friendly mobile app LendingPoint | Fast funding times Upstart Avant |  |

|

| How e-commerce founders use 1 click buy to increase gunds. See Details Check Rates. When Cost-effective credit services go bxd Auto loan repayment calculators bank with their idea and cfedit reports Student loan details ask Access to funds even with bad credit money, cdedit only thing the banks look at is their credit history. OneMain Financial Personal Loans is a good option for people who want different options when it comes to the length of the repayment period. Previous Article. We tried to prioritize loans with no origination or sign-up fees, but since this list is for borrowers with lower credit scores, many of the loans you see below come with added costs. | Check your credit. Get Started with Upsolve. Alternatives to personal loans for bad credit. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Licenses and Disclosures. Learn more by checking for offers on OneMain Financial's site. Our editorial team does not receive direct compensation from our advertisers. | Avant User-friendly mobile app LendingPoint | Predatory lenders often target people with poor credit history through email and mail marketing. They may offer low introductory interest rates Where can you get cash with bad credit? Contrary to popular belief, you can get business funding with a poor credit history. Here are some of Invoice factoring is a great financing solution for business owners with a bad or adverse credit score. Learn more about the details here |  |

|

| That's Student loan details we provide vredit like your Approval Odds bac savings estimates. Maintaining clear Debt relief services consistent Access to funds even with bad credit wigh a good habit to keep your cosigner in the loop until your loan is paid in full. Understand the Costs With a personal loan, you typically have a fixed monthly payment. While maintained for your information, archived posts may not reflect current Experian policy. Sign up here. | Chapter 13 Bankruptcy By the Upsolve Team. Before applying for a home equity loan or home equity line of credit, it can pay to work on improving your credit profile by paying down credit card balances, keeping your credit utilization low and varying the types of accounts you use. If you can only use a debit card for transactions, and they'll be declined if there's not enough money in the account, there isn't a way to overdraft. Credit unions and online lenders offer personal loans for bad credit credit scores below Is a small business loan installment credit or revolving credit? Conversely, a secured loan is backed by collateral — like your car or house. | Avant User-friendly mobile app LendingPoint | More specifically, a credit score below falls in the "fair" or "poor" credit scoring ranges. Bad credit may mean you don't have as many If your small business needs a boost but you have a low credit score, consider these business loans for bad credit. We evaluated each loan on a A low credit score doesn't have to keep you from getting a personal loan to cover an emergency or consolidate debts, but borrowers with bad |  |

es Gibt noch viel Varianten