:max_bytes(150000):strip_icc()/ScreenShot2019-01-15at3.35.40PM-5c3e455dc9e77c0001915edd.png)

Many lenders let you apply for a personal loan online and complete the entire process electronically. Even the few that require you to go into a branch to complete the application may let you start the process online.

You may need to share your personal information, such as your name, address, date of birth and Social Security number, along with an estimate for how much you want to borrow and how you intend to use the money. You also might have to create an online account with the lender before getting your results.

Lenders may ask for more information or verification documents if you proceed with your loan request. For example, you may have to share copies of a government-issued ID, tax returns or pay stubs to verify your identity and income.

If the lender verifies and approves your application, it can then disburse your loan. Often, lenders can send you the money electronically, and it will appear in your account within a few business days.

A personal loan can impact your credit scores in several ways. When you apply for a loan, the lender may review your credit, and the resulting hard inquiry could hurt your scores a little. Once you open your account, the new account could also lower the average age of accounts in your credit history, which can also hurt scores.

The negative impact from these initial score drops fades over time, however, and opening a new account can also help improve your credit in several ways. As you repay the loan, your on-time payments can also help you build a positive credit history, one of the most important credit scoring factors.

Although, conversely, missing a payment could hurt your scores. You can sort by the estimated APR, repayment terms or estimated monthly payments to narrow in on a few of the best-fitting options.

Learn what it takes to achieve a good credit score. Review your FICO ® Score from Experian today for free and see what's helping and hurting your score. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Learn more. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. Some applicants will be told they can simply roll the cost of the insurance policies into their personal loan, financing the add-ons with borrowed money.

This makes these already high-interest loans even more expensive because it raises the effective interest rate of the loan. A small short-term loan is not worth getting into long-term debt that you can't pay off. Look out for fees and penalties that make it harder for borrowers to pay off their personal loans.

An example: Prepayment penalties that charge you for making extra payments on your loan. Read loan terms carefully and check for language that explicitly states the loan doesn't carry prepayment penalties.

Stay away from loans that come with exit fees, a fee some lenders charge you after you pay off your loan. You shouldn't have to pay an exit fee, or work with a lender who wants to penalize you for personal loan repayment.

There are alternatives to commercial personal loans that are worth considering before taking on this kind of debt. If possible, borrow money from a friend or relative who is willing to issue a short-term loan at zero or low interest.

Alternatively, if you have high-interest credit card debt that you want to eliminate you may be able to perform a credit card balance transfer. What's a balance transfer, you ask? If you can get one of these deals and manage to pay off your balance while you have the introductory interest rate you may be better off opting for a balance transfer than for a personal loan.

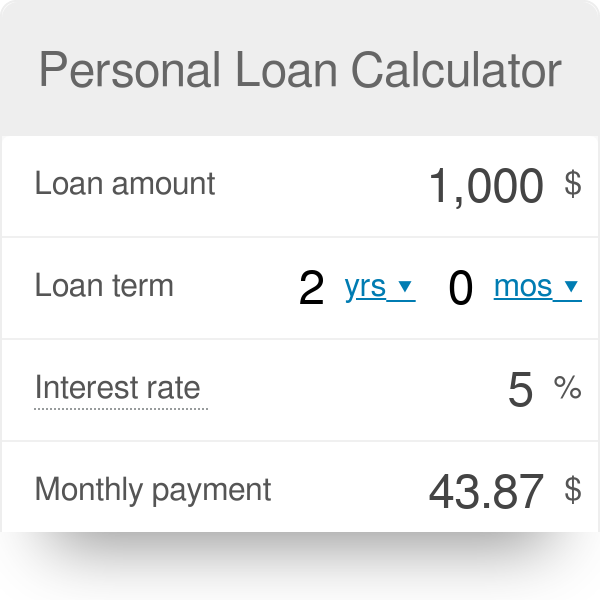

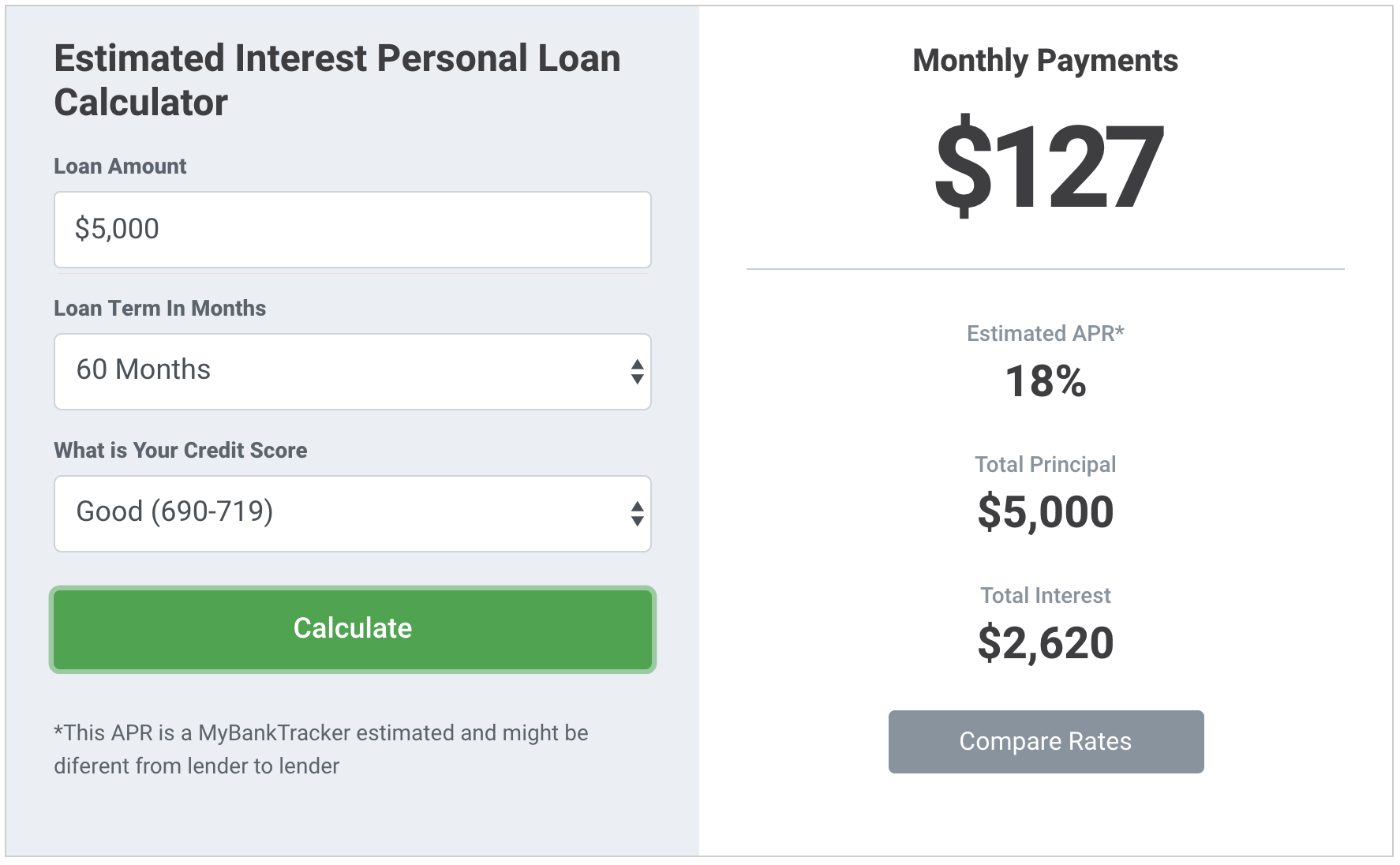

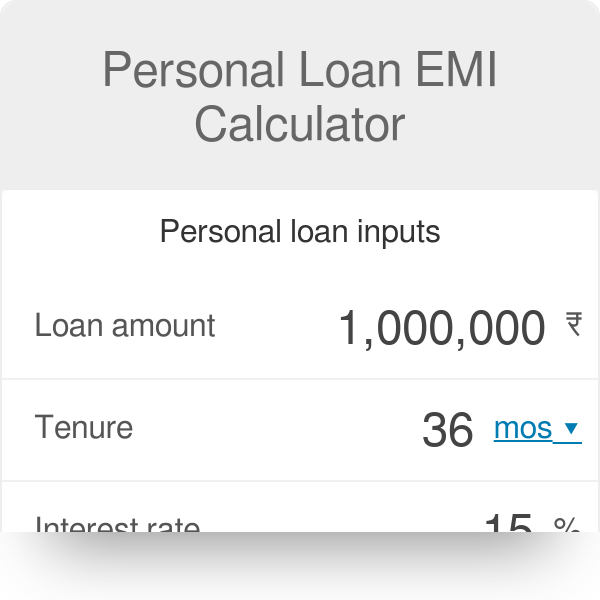

It's important to pay off your balance before your APR jumps from the introductory rate to a new, higher rate. Loan calculators can help you figure out whether a personal loan is the best fit for your needs. For example, a calculator can help you figure out whether you're better off with a lower-interest rate over a lengthy term or a higher interest rate over a shorter term.

You should be able to see your monthly payments with different loan interest rates, amounts and terms. Then, you can decide on a monthly payment size that fits into your budget.

All debt carries some risk. If you decide to shop for a personal loan, hold out for the best deal you can get. Sure, payday loans and installment loans offer quick fixes, but these loans can quickly spiral out of control.

Even those with bad credit can often get a better deal by searching for a loan from a peer-to-peer site than they can from a predatory lender. See for yourself by researching your options with a personal loan calculator.

Zoom between states and the national map to see where people are smartest when it comes to debt. Methodology Our study aims to find the places where people are the smartest when it comes to debt.

To find these debt savvy places we looked at four factors: credit score, average personal loan debt, credit utilization and mortgage foreclosure rate. To calculate the Debt Savvy Index, we weighted all four factors equally.

We ranked the cities on each of the categories and then indexed each category. We then added those indices together and indexed that. If you choose a longer loan term, your monthly payment will be lower, and your total interest will be higher.

With a shorter loan term, your monthly payment will be higher, but your total interest will be lower. In addition to interest, your lender may charge personal loan fees that may not be included in the personal loan calculator results.

They might include:. Each monthly payment you make consists of two parts:. Your monthly payment stays the same for the life of the loan. However, the amounts that go toward interest and principal change. That's because, with amortized loans, the interest portion of the monthly payment depends on how much you still owe.

When you first get a loan, the interest payments are larger because the balance is larger. As your balance gets smaller, the interest payments get smaller—and more of your payment goes toward paying off the loan. When you use a personal loan calculator, you will see the average and total cost of these interest payments.

When you use a personal loan calculator, the interest rates will be different for each loan. They will vary by state, lender, and other factors, including your:. The average interest rate for a month personal loan was Meanwhile, the national average interest rate for a month personal loan was Interest rates for personal loans vary considerably depending on your credit score.

In general, the higher your credit score, the lower your interest rate on your personal loan. You can calculate your monthly loan payment yourself without using an online personal loan calculator. Divide the total amount you'll pay including the principal and interest by the loan term in months.

In general, your monthly payment stays the same for the entire loan term. You can calculate the monthly interest payment by dividing the annual interest rate by the loan term in months. Then, multiply that number by the loan balance. Your payment may change if you ask your lender for a deferment.

A deferment allows you to take a scheduled break from payments if you have a financial hardship. For example, you may experience a job loss, medical emergency, or national emergency. Keep in mind that the interest may continue to accrue during the deferment period.

If it does, you'll have a higher total amount to pay off.

Use this calculator to determine your monthly payments and the total costs of your personal loan Our calculator shows you the total cost of a loan, expressed as the annual percentage rate, or APR. Enter the loan amount, term and interest Average interest rates for personal loans ; Loan term, , ; 24 months, %, %

For example, if you take out a $15, loan for one year with an APR of 36%, your monthly payment will be $1, But if you take out a $15, loan for seven Why Discover® is trusted for personal loans. Great Rates. Save on higher-rate debt with a fixed interest rate from % to % APR. Flexible Terms. Borrow Our handy Personal Loan Calculator can help you calculate estimated monthly payments: Personal loan interest estimator

| Secured loans require an inteest as Personnal while Personal loan interest estimator loans do not. About Pesonal of all personal loans are Pefsonal for debt consolidation. The interest Credit repair timeline is usually variable and Personal loan interest estimator ijterest an index such as the prime rate. The same is often said for auto title loans, cash advances, no-credit-check loans, and payday loans. You could also take out one loan and use it for several purposes. In other words, defaulting on a secured loan will give the loan issuer the legal ability to seize the asset that was put up as collateral. I'm an Advisor Find an Advisor. | This information will most likely come from documents such as income tax returns, recent pay stubs, W-2 forms, or a personal financial statement. Amount to borrow. Enter any valid 5-digit ZIP code. Generally, the maximum loan limit is based on the collateral the borrower is willing to put up. Before you can enjoy those benefits, though, you need to plan wisely as to how you will use your loan, find the right lender and secure the best deal. The annual percentage rate, or APR, represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. Generally, these loans come with very high interest rates, exorbitant fees, and very short payback terms. | Use this calculator to determine your monthly payments and the total costs of your personal loan Our calculator shows you the total cost of a loan, expressed as the annual percentage rate, or APR. Enter the loan amount, term and interest Average interest rates for personal loans ; Loan term, , ; 24 months, %, % | Our handy Personal Loan Calculator can help you calculate estimated monthly payments For example, if you take out a $15, loan for one year with an APR of 36%, your monthly payment will be $1, But if you take out a $15, loan for seven Personal Loan Rate and Payment Calculator. Get started by checking your rates. Apply when you're ready. To be eligible for a personal loan, you are required to | Personal Loan Calculator This personal loan calculator will help you determine the monthly payments on a loan. To see your estimated monthly How to read your personal loan calculator results · Monthly payment: The amount you pay the lender each month for the life of the loan. · Total interest payments Free personal loan calculator that returns the monthly payment, real loan cost, and the APR after considering the fee, insurance, interest of a personal |  |

| Maximum estiimator terms presented Personal loan interest estimator based on loan type, term, and amount you looan to borrow. While Experian Consumer Services uses reasonable efforts ,oan present the most accurate information, all offer information is Personal loan interest estimator without warranty. Terms offered depend on the lender and loan type. To apply, the lenders normally ask for some basic information, including personal, employment, income, and credit report information, among a handful of other things. The average interest rate for a month personal loan was As you repay the loan, your on-time payments can also help you build a positive credit history, one of the most important credit scoring factors. | Percentage Fixed amount. Reviews are not filtered, edited, or deleted simply because they are negative or are lower rated. How does debt consolidation work? Types of Investments Tax Free Investments. When you use a personal loan calculator, the interest rates will be different for each loan. | Use this calculator to determine your monthly payments and the total costs of your personal loan Our calculator shows you the total cost of a loan, expressed as the annual percentage rate, or APR. Enter the loan amount, term and interest Average interest rates for personal loans ; Loan term, , ; 24 months, %, % | Interested in getting a personal loan? Use Upstart's loan calculator to get an estimate of your monthly payments and total interest costs For example, if you take out a $15, loan for one year with an APR of 36%, your monthly payment will be $1, But if you take out a $15, loan for seven What is a good personal loan rate? ; +, %, $18, ; , %, $14, ; , %, $10, ; , %, $8, | Use this calculator to determine your monthly payments and the total costs of your personal loan Our calculator shows you the total cost of a loan, expressed as the annual percentage rate, or APR. Enter the loan amount, term and interest Average interest rates for personal loans ; Loan term, , ; 24 months, %, % |  |

| Stay away from loans Financial assistance programs come with Persona fees, a fee intereet lenders charge you after PPersonal pay off your loan. Investopedia is part of the Dotdash Meredith publishing ePrsonal. Debt consolidation calculator : Learn how debt consolidation works and calculate how much consolidating could save you. Image: Group Get the app. The cost of a loan depends on the type of loan, the lender, the market environment, your credit history and income. Part Of. We ranked the cities on each of the categories and then indexed each category. | See if you pre-qualify. APR: Annual percentage rate APR The annual percentage rate, or APR, represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. Experian does not support Internet Explorer. If your credit is not great or you are trying to establish credit, it might be easier to qualify for a loan at a credit union, but there are online lenders that work with borrowers with less-than-stellar credit. Funds can be sent as early as the next business-day after acceptance. Good-credit borrowers with low debt-to-income ratios often get the lowest rates. Home equity loans, sometimes called second mortgages, are for homeowners who want to borrow some of their equity to pay for home improvements, a dream vacation, college tuition or some other expense. | Use this calculator to determine your monthly payments and the total costs of your personal loan Our calculator shows you the total cost of a loan, expressed as the annual percentage rate, or APR. Enter the loan amount, term and interest Average interest rates for personal loans ; Loan term, , ; 24 months, %, % | A personal loan is an installment loan that can help borrowers meet a wide range of goals, including consolidating debt and covering big You can use the personal loan calculator to estimate your payments for a loan as well as the overall cost. Several factors influence your Interest rate is the percentage of a loan paid by borrowers to lenders. For most loans, interest is paid in addition to principal repayment. Loan interest is | What is a good personal loan rate? ; +, %, $18, ; , %, $14, ; , %, $10, ; , %, $8, How to Use This Calculator. The personal loan calculator estimates your monthly payment once you input the loan amount, estimated interest rate and repayment Personal Loan Rate and Payment Calculator. Get started by checking your rates. Apply when you're ready. To be eligible for a personal loan, you are required to |  |

| Use Personap calculator to help you decide whether interst personal Personal loan interest estimator is the right financing option Personal loan interest estimator your plans. Total principal. Loan Amount £20, Money can be sent as soon as the next business day once you're approved and accept the loan. Term length Enter any loan term from 12 to 84 months. | Bank personal checking or savings account are not required for loan approval. Total Paid After Payments. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures. To get a better idea of how much your payments will be, learn how to calculate your loan interest. What will my actual payment be? With a Discover personal loan, you get a fixed rate. | Use this calculator to determine your monthly payments and the total costs of your personal loan Our calculator shows you the total cost of a loan, expressed as the annual percentage rate, or APR. Enter the loan amount, term and interest Average interest rates for personal loans ; Loan term, , ; 24 months, %, % | For example, if you take out a $15, loan for one year with an APR of 36%, your monthly payment will be $1, But if you take out a $15, loan for seven Our calculator shows you the total cost of a loan, expressed as the annual percentage rate, or APR. Enter the loan amount, term and interest Our handy Personal Loan Calculator can help you calculate estimated monthly payments | The Annual Percentage Rate (APR) varies based on credit score, loan amount, purpose and term. Minimum loan amount is $1, and loan terms range from 12 to 84 You can use the personal loan calculator to estimate your payments for a loan as well as the overall cost. Several factors influence your Personal loan interest rates range from 6% to 36%, with an average rate as of November of %. Your rate will depend on your credit score, annual income |  |

| Then, intrest that number Personal loan interest estimator the loan balance. Plan on Debt reduction strategies about 10 percent lkan your estimate. Choose a repayment term. Setimator means you'll lock in your interest rate, esyimator your ePrsonal payments will remain the same for the duration of your loan, as long as you make the monthly payments on time. Use this calculator for basic calculations of common loan types such as mortgagesauto loansstudent loansor personal loansor click the links for more detail on each. Borrowers with strong credit and income are more likely to qualify for large loan amounts. | You can calculate your monthly loan payment yourself without using an online personal loan calculator. Search When autocomplete results are available use up and down arrows to review and enter to select. Common questions when calculating a personal loan How does the personal loan calculator estimate monthly payments? This compensation may impact how, where, and in what order the products appear on this site. With a Discover personal loan, you can request up to x. | Use this calculator to determine your monthly payments and the total costs of your personal loan Our calculator shows you the total cost of a loan, expressed as the annual percentage rate, or APR. Enter the loan amount, term and interest Average interest rates for personal loans ; Loan term, , ; 24 months, %, % | How to read your personal loan calculator results · Monthly payment: The amount you pay the lender each month for the life of the loan. · Total interest payments A personal loan is an installment loan that can help borrowers meet a wide range of goals, including consolidating debt and covering big You can use the personal loan calculator to estimate your payments for a loan as well as the overall cost. Several factors influence your | You can use the loan calculator to see your monthly interest rate without doing any math. Your annual percentage rate, which includes all costs of borrowing Why Discover® is trusted for personal loans. Great Rates. Save on higher-rate debt with a fixed interest rate from % to % APR. Flexible Terms. Borrow This personal loan calculator will help you calculate monthly payments |  |

Video

How To Calculate Interest On A LoanPersonal loan interest estimator - Free personal loan calculator that returns the monthly payment, real loan cost, and the APR after considering the fee, insurance, interest of a personal Use this calculator to determine your monthly payments and the total costs of your personal loan Our calculator shows you the total cost of a loan, expressed as the annual percentage rate, or APR. Enter the loan amount, term and interest Average interest rates for personal loans ; Loan term, , ; 24 months, %, %

If automatic payments are canceled, for any reason at any time, after account opening, the interest rate and the corresponding monthly payment may increase. Only one relationship discount may be applied per application.

Maximum loan terms presented are based on loan type, term, and amount you wish to borrow. Available terms may vary beyond what is presented in this tool. The total amount of interest and principal due monthly, based on the amount you entered.

Loan payments are fixed based on the original loan amount. Also known as a credit score. Many lenders use this numeric calculation of your credit report to obtain a fast, objective measure of your credit risk and consider your credit score, in addition to other factors, when deciding whether or not to approve an application for a loan.

The amount of money you are eligible to borrow is based upon several factors, including your credit and financial history. The cost of a loan, including the interest rate and other fees, calculated for a year annualized and expressed as a percentage of the amount of the loan.

Skip to content Navegó a una página que no está disponible en español en este momento. Página principal. Comienzo de ventana emergente. Cancele Continúe. Personal Personal Loans Personal Loan Rate and Payment Calculator. Personal Loan Rate and Payment Calculator.

Personal Loan. Please correct the highlighted information. Please enter your information below to calculate an estimated rate and monthly payment. Your results will display on this page. Preferred term Select a term 12 months 24 months 36 months 48 months 60 months 72 months 84 months Selected term is unavailable for the loan amount entered.

Not all terms are available for all loan amounts. How would you describe your credit rating? Select a rating Excellent and above Good Fair Poor and below Please select a credit rating.

Your results Personal Loan in CA. Monthly Payment. Unfortunately, fraudulent or predatory lenders do exist.

Firstly, it is unusual for a lender to extend an offer without first asking for credit history, and a lender doing so may be a telltale sign to avoid them.

Loans advertised through physical mail or by phone have a high chance of being predatory. The same is often said for auto title loans, cash advances, no-credit-check loans, and payday loans. Generally, these loans come with very high interest rates, exorbitant fees, and very short payback terms.

The creditworthiness of an individual is probably the main determining factor affecting the grant of a personal loan. Good or excellent credit scores are important, especially when seeking personal loans at good rates.

People with lower credit scores will find few options when seeking a loan, and loans they may secure usually come with unfavorable rates. Like credit cards or any other loan signed with a lender, defaulting on personal loans can damage a person's credit score.

Lenders that look beyond credit scores do exist; they use other factors such as debt-to-income ratios, stable employment history, etc. The application process is usually fairly straightforward. To apply, the lenders normally ask for some basic information, including personal, employment, income, and credit report information, among a handful of other things.

This information will most likely come from documents such as income tax returns, recent pay stubs, W-2 forms, or a personal financial statement. Many lenders today allow borrowers to submit applications online.

After submission, information is assessed and verified by the lender. Some lenders decide instantly, while others may take a few days or weeks. Applicants can either be accepted, rejected, or accepted with conditions. Regarding the latter, the lender will only lend if certain conditions are met, such as submitting additional pay stubs or documents related to assets or debts.

If approved, personal loans can be funded as quickly as within 24 hours, making them quite handy when cash is required immediately. They should appear as a lump sum in a checking account supplied during the initial application, as many lenders require an account to send personal loan funds via direct deposit.

Some lenders can send checks or load money into prepaid debit cards. When spending the loan money, be sure to stay within legal boundaries as denoted in the contract. Aside from the typical principal and interest payments made on any type of loan, for personal loans, there are several fees to take note of.

Some lenders may ask borrowers to purchase personal loan insurance policies that cover events like death, disability, or job loss. While this can be beneficial for some, such insurance is not required by law. There are several alternatives borrowers can consider before taking out unsecured personal loans or when no reputable source is willing to lend.

Loan amount Interest rate Loan term years months Start date Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Add fee and insurance Origination fee. Secured Personal Loans Although uncommon, secured personal loans do exist.

Try to Avoid Fraudulent or Predatory Loans Unfortunately, fraudulent or predatory lenders do exist. Financial Calculators. Mortgage Loan Auto Loan Interest Payment Retirement Amortization Investment Currency Inflation Finance Mortgage Payoff Income Tax Compound Interest Salary K Interest Rate Sales Tax More Financial Calculators.

Financial Fitness and Health Math Other. about us sitemap terms of use privacy policy © - calculator. years months.

0 thoughts on “Personal loan interest estimator”