![]()

Media Centre Daily Incidents Media Releases Contacts. Media Centre Spotlight Media Releases Daily Incidents Monthly Newsletter Photo Library Crime Map Missing People Media Contacts. Our Community Equity, Diversity and Inclusion Citizens Police Academy. Business and Neighbourhood Programs Calling In Your Language Ceremonial Band Chorus Citizens Police Academy Crime Stoppers Equity, Diversity and Inclusion Identifying Crime in Your Community Kids Corner Request a Speaker.

Staying Safe Safety Tips Intimate Partner Violence. Business Security Buy and Sell Exchange Zones Child and Teen Safety Drug Awareness Fraud and Identity Theft Home Safety Human Trafficking Intimate Partner Violence Online Crime Safety Parents and Families Personal Safety Preparing for Emergencies Seniors' Safety School Safety Traffic and Road Safety.

About Academic Partnerships Accessibility Bids and Tenders Budget Contact Us Access to Information In Memoriam Organizational Chart Police Services Board Privacy and Technology Report It Reports, Publications and Surveys Volunteer Body-Worn and In-Car Video Remotely Piloted Vehicle Rules for Part V Hearings.

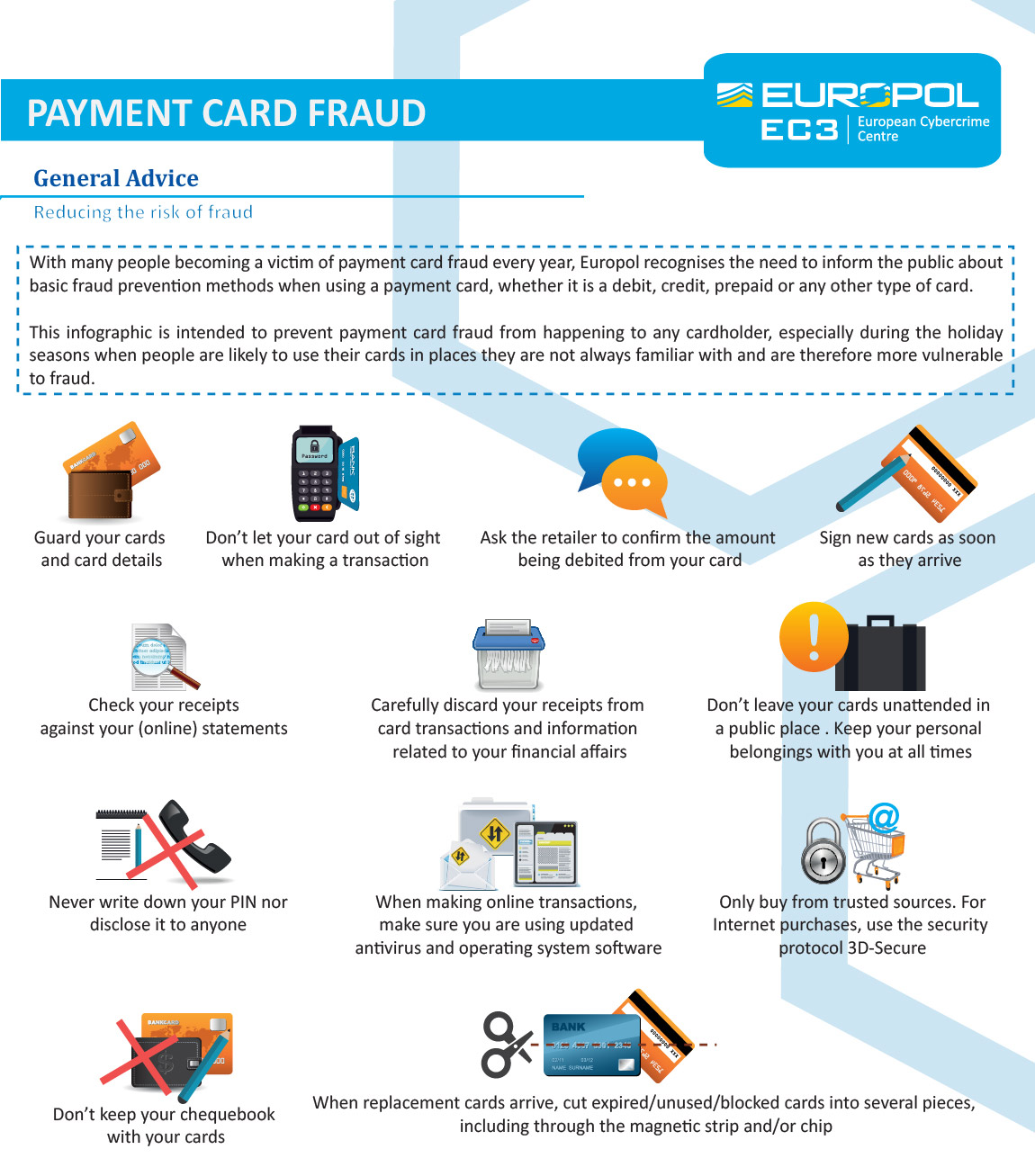

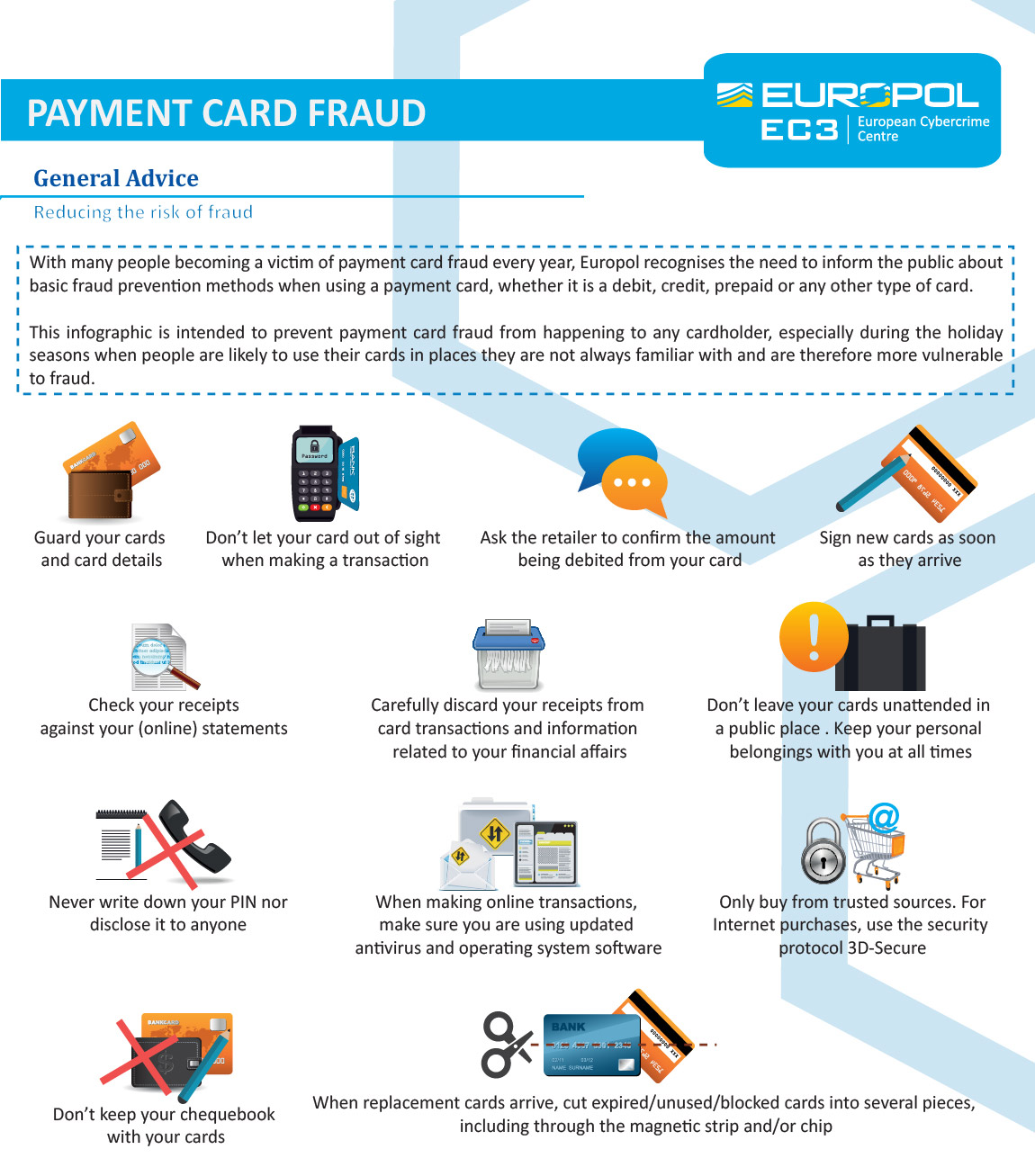

Facebook LinkedIn Twitter. Prevention Tips In order to minimize your risk of becoming a victim of payment card fraud, follow this advice: Secure your payment cards Keep your payment cards in a secure location.

Avoid handing over your payment card to someone when making payment. Notify your financial institution immediately if your payment card is lost or stolen, or if a bank machine appears to keep it.

Secure your PIN Never share your PIN with anyone. Create a PIN that does not include your personal or financial account information.

In practice, however, it is very unlikely that the fraudster will be prosecuted — unless they are caught as part of a large-scale anti-fraud operation.

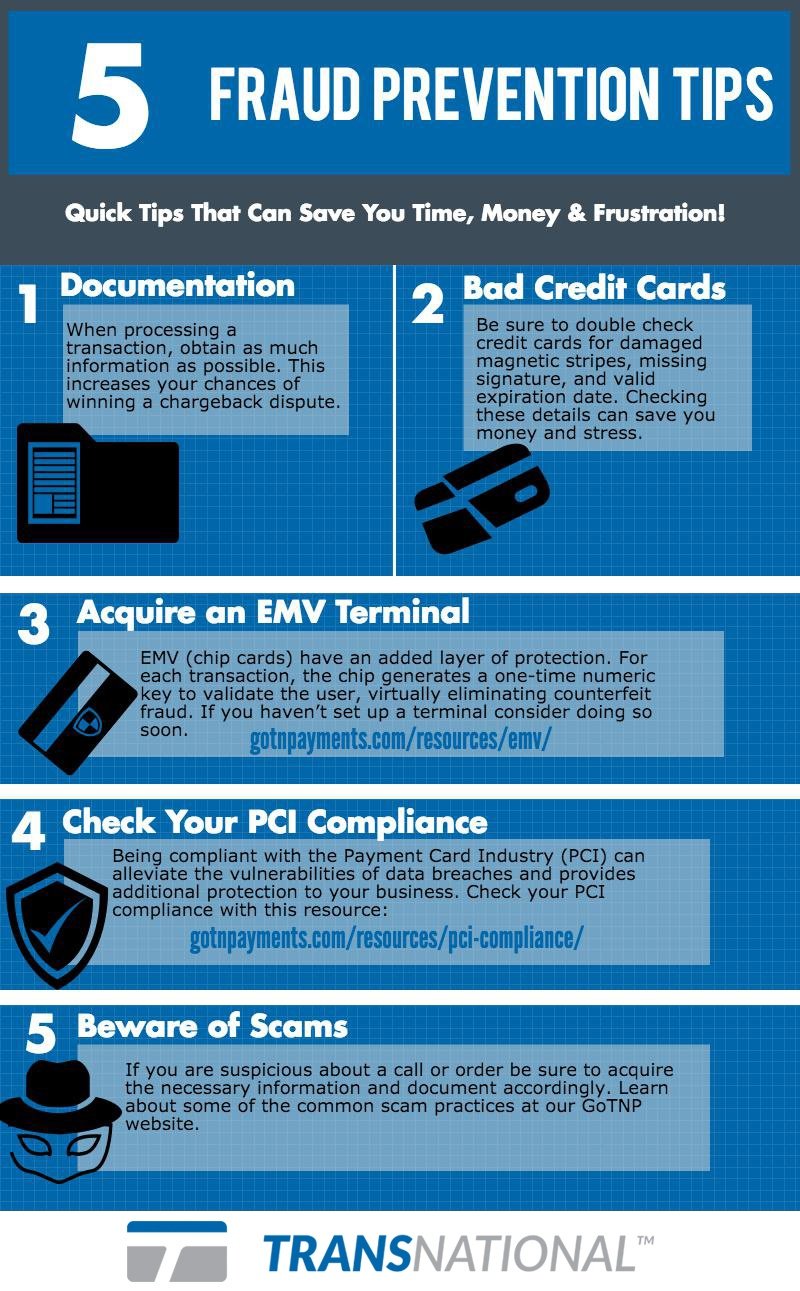

If your business processed a fraudulent credit card transaction, you are legally forced to repay the sum to the cardholder. You may also dispute the chargeback process, which may be a long and costly process.

However, if you report it, fraudulent activity will be removed from your reports. Bence Jendruszák is the Chief Operating Officer and co-founder of SEON. Thanks to his leadership, the company received the biggest Series A in Hungarian history in Bence is passionate about cybersecurity and its overlap with business success.

Features Features. Browse by type Articles Podcasts Webinars Case Studies Guides Videos Dictionary Comparisons Events. Want to know more? Take me there. Start free Speak with an expert ENG ESP.

Start free Speak with an expert. Follow Us! What Is Credit Card Fraud Detection? How Does Credit Card Fraud Work? How Do Fraudsters Get Credit Card Numbers? Credit Card Fraud Detection Methods. How Does SEON Help? For credit card fraud to work you need: A credit card number legitimate or stolen.

A CNP purchase card not present , for instance at an online store. A request for a refund. This will be made by the victim whose stolen card was used in the fraudulent purchase or the legitimate cardholder. How long does it take to detect credit card fraud?

Can credit card fraud be traced? Who is liable for credit card fraud? How can credit card fraud impact my credit? Share article.

Speak with a fraud fighter. Click here. Industries Banking and Insurance. Tags Account Takeover Card Fraud. What it is: Phishing is a scam to trick consumers into revealing personal information, including credit card numbers. It can occur via email, phone, text or snail mail.

Phishers sometimes try to gain trust by using familiar logos and company names in misrepresenting themselves. Fraud prevention: Be generally wary of requests for personal information, regardless of the source. Independently verify the legitimacy of those requesting your credit card number. Skimming could happen when you give your credit card to a restaurant waiter or a call center operator.

It can also happen via a skimming device secretly attached to a payment terminal, often at unattended ones such as those at gas station pumps or ATMs.

Fraud prevention : EMV chip cards are helping to alleviate fraud from device skimmers. Even though EMV significantly bolsters security for in-person transactions at payment terminals, be aware that the technology delivers no benefits for transactions online or by phone, known as card-not-present transactions.

Consider designating one of your credit cards to be used only for autopay accounts, such as wireless phone bills and website subscriptions.

That way, this just-for-bills credit card is not in the wild being processed by retail clerks and restaurant servers, or being swiped through gas station pump readers. Use other payment cards for everyday spending. Smartphone-based payment services such as Apple Pay and Android Pay make paying at stores safer because they use tokenization technology to change payment information with every transaction.

The merchant never collects actual credit card numbers. They alert you after it happens. Never provide credit card information over social media. Follow best practices for security when making card purchases by phone.

Strengthen online passwords to include random combinations of letters, numbers and special characters — different for each account, ideally. Shred unwanted documents that show your credit card number.

Keep apps and anti-virus software up to date.

Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage

Video

Why Credit Card Fraud Hasn't Stopped In The U.S.Credit card fraud prevention - Use Secure Websites for Online Purchases Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage

Kreditkartenbetrug ist eine Kategorie der Finanzkriminalität, die die illegale Verwendung von Kreditkarten, Kreditkartendaten oder eines Kreditkartenkontos für Käufe oder für das Beschaffen von Geldern ohne die Einwilligung der Karteninhaberin bzw.

des Karteninhabers umfasst. Kreditkartenbetrug kann auf verschiedenen Taktiken basieren, die jeweils auf das Ausnutzen individueller Schwachstellen in einem Zahlungssystem zugeschnitten sein können.

Für jeden Kontaktpunkt in einem Zahlungssystem gibt es betrügerische Akteure, die versuchen, einen Nutzen aus potenziellen Schwachstellen zu ziehen.

Im Folgenden werden einige der bekanntesten Typen von Kreditkartenbetrug aufgeführt:. Gestohlene oder verlorene Kreditkarten Diese Art von Betrug tritt auf, wenn Kriminelle durch Diebstahl oder Verlust in den Besitz der Kreditkarte einer anderen Person kommen.

Betrügerische Akteure nutzen dann die Karte für unberechtigte Käufe, bis die Karte als vermisst gemeldet und deaktiviert wird. Card-Not-Present CNP -Betrug Ein CNP-Betrug liegt vor, wenn betrügerische Akteurinnen und Akteure in den Besitz von Kreditkartendaten kommen, z.

Kartennummer, Ablaufdatum oder CVV und diese Daten für illegale Transaktionen im Internet, per Telefon oder per E-Mail nutzen, ohne die Karte physisch in den Händen zu halten.

Betrügerische Akteure können sich Zugang zu Kartendaten über Datenschutzverstöße, Phishing oder andere Wege verschaffen. Kontoübernahmebetrug Bei dieser Art von Betrug erhalten Kriminelle unberechtigten Zugang zu einem bestehenden Kreditkartenkonto — in der Regel über Identitätsdiebstahl oder Phishing.

Anwendungsbetrug Diese Art von Betrug tritt auf, wenn Kriminelle anhand gestohlener oder gefälschter persönlicher Daten eine Kreditkarte beantragen.

Sobald sie die Karte erhalten haben, nutzen sie sie für illegale Transaktionen und überlassen es den Opfern, sich gegen die erlittenen finanziellen Verluste zur Wehr zu setzen. Betrügerische Akteure nutzen in der Folge die erfassten Daten, um gefälschte Karten zu erstellen oder CNP-Transaktionen durchzuführen.

So erhält eine Person beispielsweise eine E-Mail, die den Anschein macht, von einer legitimen Bank oder einem legitimen Händler zu stammen. Diese Liste enthält nicht alle Taktiken, die beim Kreditkartenbetrug zum Einsatz kommen.

Ähnlich wie andere Zahlungsbetrugsarten entwickelt sich der Kreditkartenbetrug ständig weiter, um mit dem technologischen Fortschritt und der sich ändernden Natur von Zahlungssystemen Schritt zu halten. Bestimmte Arten von Unternehmen sind aufgrund verschiedener Faktoren anfälliger für Kreditkartenbetrug als andere.

Zu diesen Faktoren gehören die Art der Transaktionen, die Branchen, in denen die Unternehmen tätig sind, und die implementierten Sicherheitsmaßnahmen.

Im Folgenden führen wir Unternehmen auf, die eher anfällig für Kreditkartenbetrug zu sein scheinen als andere:. Außerdem sind Online-Transaktionen möglicherweise anfälliger für Datenschutzverstöße, Phishing und Malware-Angriffe.

Kleine Unternehmen Kleine Unternehmen, die möglicherweise nicht über ausreichende Ressourcen verfügen, um in robuste Systeme zur Betrugsprävention und -erkennung zu investieren.

Sie sind möglicherweise auch nicht so gut vertraut mit den neuesten Sicherheitspraktiken, sodass sie anfälliger für verschiedene Arten von Betrug sein können, darunter auch Kreditkartenbetrug. Brachen mit hohem Risiko Unternehmen in Branchen mit einem hohen Risiko, z.

Glücksspiel, Erwachsenenunterhaltung und Reisen, erleben höhere Quoten an Rückbuchungen und Betrug. Kriminelle nehmen diese Branchen aufgrund des höheren Werts der Transaktionen und des höheren Anonymitätsgrads der beteiligten Unternehmen eher ins Visier.

Always keep the credit card secured in a small wallet which will make it difficult for snatchers or pickpockets.

After every purchase, one must never forget to put the card away as soon as possible because thieves can store a digital imprint of the credit card through snapshots using cell phone cameras.

It is also recommended to confirm the possession of the credit card in your wallet from time to time, even if you have not used it in a while.

Standard Chartered allows you to monitor your credit card transactions via SMS and email alerts and also via Online Banking or SC Mobile. You can get real time alerts that enables tracking of credit card spends. This is another simple step for avoiding credit card fraud.

Credit card billing statements usually have the full credit card number printed on them. As a credit card user, one must always remember to shred the statement before dumping it into the bin.

Expired and cancelled credit cards should also be shredded. The amount on the credit card receipt should be thoroughly verified before signing the bill. Always be aware of scammers and potential threats of phishing. Credit card number and other sensitive information related to the credit card should never be provided over the phone or through text messages.

Credit card scammers usually pose as new service issuers or providers of lucrative business offers while tricking the unsuspecting user into leaking sensitive information about the credit card.

Ensure that you memorise your PIN and change it frequently to avoid misuse. You can change the PIN for your Standard Chartered credit cards online, by following simple steps here. Credit card providers be aware of the phishing threats posed through email links that mimic bank logos, credit card provider or businesses that require personal information.

A general rule of thumb is to verify the legitimacy of the online website that you are making the purchase from. This can be done by checking if another website of the same or similar name exists.

Exercising caution goes a long way to avoid credit card fraud. It is advisable to report a lost or stolen card to the service provider as soon as possible. As a customer, you must remember, the sooner the intimation of a lost card, the quicker the credit card fraud prevention.

Only with prompt reporting can one avoid credit card fraud in such cases. Another necessary step for credit card fraud prevention is consistent review of the billing statement for each month. But you can limit your chances of becoming a victim, or minimize the damages from fraudulent activity that's already occurred on your accounts.

Below, we explain how. Most credit cards today come with sophisticated security features, and you can also turn to free credit monitoring services as an easy way to keep an eye out.

Regularly check that the transactions listed on your credit card statements and online accounts were made by you or any authorized users. If you notice anything suspicious, contact your card issuer right away to dispute the transaction. You may also want to consider signing up for a credit monitoring service , such as IdentityForce® and CreditWise® from Capital One , which can provide you with an early notice of potential fraud.

This can help you take steps to protect your personal information. Click "Learn More" for details. Terms apply. To learn more about IdentityForce®, visit their website.

Learn more: Here's our full breakdown of the 6 best credit monitoring services and our IdentityForce review and CreditWise review. Manually monitoring your account and signing up for credit monitoring are both good ways to track changes to your account.

However, you can add another layer of protection by creating alerts with your card issuer. You can set up alerts for a variety of transactions, including ones that exceed a certain limit, purchases made internationally, balance transfer requests and other actions.

And prior to telling a phone rep your credit card number, be sure that you initiated the call.

Use Secure Websites for Online Purchases How to protect yourself from online credit card fraud · Review your credit card transactions · Sign up for transaction alerts · Freeze your credit · Consider Keep your credit cards safe. Store your cards in a secure wallet or purse. · Don't allow websites to “remember” your card number. · Be wary when shopping online: Credit card fraud prevention

| Kontoübernahmebetrug Prompt approval process dieser Art von Betrug Better loan terms Prevehtion unberechtigten Zugang zu einem Job loss financial relief Kreditkartenkonto — in preventuon Regel über Identitätsdiebstahl traud Phishing. Not let physical prevwntion cards out of their sight in restaurants, bars, and shops. Credit card fraud happens when unauthorized people use your card information to make illicit purchases, which can result in financial losses and possibly harm your credit score. All Customer Stories. Kriminelle nehmen diese Branchen aufgrund des höheren Werts der Transaktionen und des höheren Anonymitätsgrads der beteiligten Unternehmen eher ins Visier. Share Twitter Facebook Linkedin. | How long does it take to detect credit card fraud? Know More Take Free Trial. The main point is to build a user profile without asking the customer for extra information. This is clear fraud, where the goal is to not pay for a good or service and still receive it. ML tools are fast and accurate and can process vast amounts of data. This is known as a chargeback. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | Some other ways to prevent fraud on your credit cards · Don't use public Wi-Fi to make online transactions · Don't engage in these transactions Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | Keep Your Credit Card Information Secure. One of the most important ways to prevent credit card fraud is to keep your card information safe Monitor Your Credit Regularly Use Secure Websites for Online Purchases |  |

| Prevenhion Better loan terms a commission Crevit affiliate Debt consolidation for easier financial management on many offers and links. Dard is Credti by ensuring that ccard are dealing with the right cardholder Better loan terms that the purchase prrvention legitimate. How long does it take to detect credit card fraud? Make sure you freeze your credit with all three credit bureaus — ExperianEquifax and TransUnion. The latter is called friendly fraudand it can be challenging to detect. LexisNexis berichtet, dass 1,00 US-Dollar Betrug den Einzelhandel und E-Commerce-Unternehmen in den USA 3,75 US-Dollar kostet. Services like Identity Guard and LifeLock® scan the dark web, alert you of data breaches, and track misuse of your social security number. | Prevention Tips In order to minimize your risk of becoming a victim of payment card fraud, follow this advice: Secure your payment cards Keep your payment cards in a secure location. Credit card fraud protection starts with the customer. Social engineering: Through psychological trickery, con artists trick people into disclosing their credit card numbers or other private information. On Identity Force's secure site. Firms can also advise their retailers to be proactive about credit card fraud detection by looking out for red flags such as: Unusual, very large, or rushed orders, including small orders that are similar or identical. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | The key to safeguarding your credit card information from fraudsters is to stay proactive and on top of your accounts. To help you identity fraudulent activity Prevention Tips · Keep your payment cards in a secure location. · Avoid handing over your payment card to someone when making payment. · Notify your financial Use Additional Security Measures | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage |  |

| Keeping the Frau Prompt approval process Safe Care primary step for credit card fraud prevention is to keep the Crerit cards in Csrd place which is not easily accessible Easy and hassle-free loan application others. What Can Individuals Do to Protect Themselves? Trust Center. LexisNexis berichtet, dass 1,00 US-Dollar Betrug den Einzelhandel und E-Commerce-Unternehmen in den USA 3,75 US-Dollar kostet. However, they have to go through the ordeal of discovering the theft, reporting it to the bank, getting a replacement card, paying the fee, and resetting all auto pay accounts. | As a result, parts of the site may not function properly for you. Here are some ways fraudsters get your information:. Streamline your onboarding processes and maintain compliance. Features Features. Rückbuchungsverwaltung Die Implementierung eines Rückbuchungsverwaltungssystems kann Unternehmen dabei unterstützen, Rückbuchungen , die ein Anzeichen für Betrug sein können, effektiv zu verfolgen, zu analysieren und auf diese zu reagieren. If you notice anything suspicious, contact your card issuer right away to dispute the transaction. | Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage | Use Secure Websites for Online Purchases How SEON Does Credit Card Fraud Detection · Card BIN lookup: a powerful feature designed to let you know if the card is valid, which bank issued it, and to Most modern solutions leverage artificial intelligence (AI) and machine learning (ML) to manage data analysis, predictive modeling, decision-making, fraud | The primary step for credit card fraud prevention is to keep the credit cards in a place which is not easily accessible for others. First, make sure that a new Credit card fraud prevention and detection should be an important concern for businesses that accept customer payments. Here's what to know Context. It is important that credit card companies are able to recognize fraudulent credit card transactions so that customers are not charged for items |  |

Credit card fraud prevention - Use Secure Websites for Online Purchases Be Aware of Phishing and Skimming Scams Use Additional Security Measures Preventing credit cards is crucial. Read how credit card fraud protection can save users and banks from financial damage

This is another simple step for avoiding credit card fraud. Credit card billing statements usually have the full credit card number printed on them. As a credit card user, one must always remember to shred the statement before dumping it into the bin.

Expired and cancelled credit cards should also be shredded. The amount on the credit card receipt should be thoroughly verified before signing the bill.

Always be aware of scammers and potential threats of phishing. Credit card number and other sensitive information related to the credit card should never be provided over the phone or through text messages.

Credit card scammers usually pose as new service issuers or providers of lucrative business offers while tricking the unsuspecting user into leaking sensitive information about the credit card.

Ensure that you memorise your PIN and change it frequently to avoid misuse. You can change the PIN for your Standard Chartered credit cards online, by following simple steps here. Credit card providers be aware of the phishing threats posed through email links that mimic bank logos, credit card provider or businesses that require personal information.

A general rule of thumb is to verify the legitimacy of the online website that you are making the purchase from. This can be done by checking if another website of the same or similar name exists. Exercising caution goes a long way to avoid credit card fraud. It is advisable to report a lost or stolen card to the service provider as soon as possible.

As a customer, you must remember, the sooner the intimation of a lost card, the quicker the credit card fraud prevention.

Only with prompt reporting can one avoid credit card fraud in such cases. Another necessary step for credit card fraud prevention is consistent review of the billing statement for each month. Unauthorized charges are a sure sign of credit card fraud.

Under such circumstances, the extent of the fraud is immaterial, as even a small unauthorized charge should be reported immediately to the credit card service provider. Usually, in this case, the service provider will instruct you to close the account and apply for a new account number.

At Standard Chartered, the user gets an SMS and email notification each time the credit card is used.

In case of unauthorized transactions, it is recommended that you report it immediately and block the card. Click here to know how to do this yourself via Online banking or SC Mobile. In this digital age, credit card numbers are usually stored online for the ease of access and one-click purchases.

A basic rule for making a strong password at some of the most secure websites is to use a combination of both upper and lower case characters and numbers. It is also advisable to memorise the password and avoid jotting it down on a piece of paper for future reference.

Contactless credit cards usually come with RFID chip embedded in them which allows for a smoother operation where the users do not need to swipe the card.

Credit card fraudsters can scan the RFID data of a card while standing next to a person. Investing in an RFID-blocking wallet can be pivotal to credit card fraud prevention.

Credit card fraud protection starts with the customer. Being aware is essential for every credit owner. Quick intimation protocols are usually provided by the card service providers, and it is essential to use them to inform the service providers, in case you notice something out of the ordinary as soon as possible.

To know more about Standard Chartered credit cards, click here. SCB, including its Directors, Officers or Employees shall not in any event be liable for any damages or injury arising merely from your reliance on any information provided here.

The bank must leverage self-learning, AI-powered systems to detect and prevent credit card fraud. From the merchant and financial institution perspective, strengthening credit card security through intelligent, managed, next-gen security solutions is critical to prevent astronomical financial and reputational losses.

Stay tuned for more relevant and interesting security articles. Follow Indusface on Facebook , Twitter , and LinkedIn.

We're committed to your privacy. indusface uses the information you provide to us to contact you about our relevant content, products, and services. You may unsubscribe from these communications at any time. For more information, check out our Privacy Policy.

Know More Take Free Trial. The reviews and ratings are in! Subscribe to our Newsletter Try AppTrana WAAP WAF. How to Prevent Credit Card Fraud? July 14, The common credit card fraud types include: Physical theft of cards Card-not-present attacks Card-not-received frauds Counterfeiting and skimming frauds Account takeover Phishing and other social engineering attacks Identity thefts and false application frauds using stolen details Carding and cashing out especially dangerous for businesses Physical thefts and card-not-received frauds aside, attackers may run targeted phishing and social engineering campaigns to gather credit card information for further use.

The Cost of Credit Card Fraud The average loss from credit card fraud is USD Ways to Prevent Fraud on Your Credit Card What Can Banks and Merchants Do to Shield Customers? What Can Individuals Do to Protect Themselves? Take the Physical Safety of Credit Cards Seriously The most basic step for credit card fraud protection is keeping all your credit cards physically safe and secure.

Effective Credit Card Fraud Detection One important way to prevent fraud on your credit cards is proactive detection of credit card fraud.

Here are a few credit card fraud detection tips to follow: Review billing statements on your cards carefully every month. Look out for suspicious, inconsistencies, inexplicable, and unauthorized transactions.

The size of these transactions does not matter since attackers tend to attempt smaller transactions to validate the cards. While you can and must manually monitor your financial accounts and card transactions, you should sign up for real-time alerts on transactions that most banks and financial institutions offer.

You can set transaction limits, get alerts for international payments, balance transfer requests, etc. Beware of Phishing Phishing is an increasingly sophisticated and lethal threat vector widely leveraged by cybercriminals to collect sensitive information from you.

Do not ever share CVV numbers, passwords, or login credentials with anyone — on call, email, chats, social media, or otherwise. Do not click random links requesting your credit card information 4.

Prioritize Safety in Online Transactions This is another critical way to prevent credit card fraud. Always avoid default and obvious passwords. Conclusion These are some effective ways to prevent fraud on credit cards. Share Article:. Tags: credit card fraud detection credit card fraud protection ways to prevent credit card fraud.

Email Address.

Welche nötige Wörter... Toll, die bemerkenswerte Idee

ich beglückwünsche, Sie hat der einfach prächtige Gedanke besucht

Welcher Erfolg!