Forgoing a credit counselor can help you save money in agency fees and allows you to create a plan tailored specifically to your spending habits.

However, counselors are helpful in that they may see opportunities for more effective repayment strategies and have professional experience when negotiating with creditors. Counselors take the heavy lifting off of your shoulders when creating a plan with your creditors.

If you want a plan that looks at your entire financial profile and all of your existing expenses, you may want to consider setting up a debt management plan. Bankruptcy is the legal process of disputing outstanding debts or financial obligations.

Once approved by a judge and court-appointed trustees, you can either qualify for Chapter 13 or Chapter 7 bankruptcy. Bankruptcy does offer a fresh start to those with unmanageable delinquent debts — but it comes with some major risks.

For one, your assets are measured during the process and may be seized to satisfy a portion of the delinquent debt. Declaring for bankruptcy should be a last-resort decision due to the potential costs and the long-term financial consequences.

However, the method that is most efficient in paying down your debt while having the smallest impact on your credit is likely the best option for you. How to consolidate business debt.

What is identity theft? Definition, how it happens and the different types. Home equity lender reviews: Top 5 for debt consolidation. Federal workers missed another paycheck today as ripple effects spread.

Hanneh Bareham. Written by Hanneh Bareham Arrow Right Writer, Personal Loans and Debt Relief. Hanneh Bareham has been a personal finance writer with Bankrate since She started out as a credit cards reporter before transitioning into the role of student loans reporter. She is now a writer on the loans team, further widening her scope across multiple forms of consumer lending.

Hannah Smith. Edited by Hannah Smith Arrow Right Editor, Personal Loans. Hannah has been editing for Bankrate since late They aim to provide the most up-to-date information to help people navigate the complexities of loans and make the best financial decisions.

Bankrate logo The Bankrate promise. Bankrate logo Editorial integrity. Key Principles We value your trust. Bankrate logo How we make money. Key takeaways While debt relief solutions may be helpful when organizing and paying down debt, they can easily result in credit or financial damage.

Their expertise can be invaluable in navigating the path to debt relief. Bankruptcy should be considered as a last resort when all other options have been exhausted. Bankruptcy can provide a fresh start but comes with significant consequences, so it is crucial to understand the long-term implications before proceeding.

Debt help programs can provide the expertise and support you need to negotiate with creditors and reduce your overall debt burden. At Alleviate Financial Solutions, we specialize in helping individuals like you find relief from financial stress. Our experienced team of professionals will work tirelessly to develop a customized debt resolution plan tailored to your unique situation.

Our friendly representatives are ready to provide a free consultation and guide you toward a brighter financial future.

Call us at at Alleviate Financial Solutions today to learn more. Your email address will not be published. Hi, We are Alleviate Financial Solutions. We help people overcome their debt and secure their financial future.

The question is, will it be you? Learn More. Mortgage Debt For many retirees, mortgage debt remains a significant financial obligation. Credit Card Debt Credit card debt is one of the most prevalent types of debt, and it often carries high-interest rates.

Student Loans Many retirees continue to carry student loan debt, either for their own education or as co-signers for their children or grandchildren.

Medical Debt Medical debt can arise unexpectedly and create financial strain. How to Pay Down Debt In Retirement: 10 Strategies for a Debt-Free Future Retirement is a time to enjoy the fruits of your labor and embrace a slower pace of life.

Streamline Your Spending Take a close look at your monthly expenses and identify areas where you can streamline your spending.

Think About Downsizing Consider downsizing your living arrangements if your current home is becoming a financial burden. Explore Additional Sources of Income Explore opportunities to generate additional income during retirement.

Make Use of Retirement Funds to Clear Debt Assess your retirement funds and consider using a portion to pay off high-interest debt. Consider Debt Consolidation Debt consolidation can be a powerful tool for simplifying your debt repayment process. Reverse Mortgage For homeowners aged 62 or older, a reverse mortgage can be an option to consider.

Access Life Insurance Policy Funds Ahead If you have a life insurance policy with accumulated cash value, you may have the option to access those funds. Try Credit Counseling Enlist the assistance of a reputable credit counseling agency that specializes in debt management.

Declare Bankruptcy Bankruptcy should be considered as a last resort when all other options have been exhausted. Related Posts: Credit Card Debt Management Strategies: Getting Out of Debt… Retirement Planning: Paying Off Your Debt and Building a… Getting Personal Loan for Debt Consolidation.

Leave a Reply Cancel reply Your email address will not be published. Do You Want Help to Resolve Your Debt? Guides Debt Settlement: Your Complete Guide The Best Budgeting Apps The Pros and Cons of Debt Settlement.

A long stretch of unemployment in a marriage can cause stress, fighting and even a breakup. Is it any wonder that money is one of the main causes of divorce? You would think that the unemployed person could use this opportunity to chip in with household duties.

But many women who bring home a paycheck also report having responsibility for household chores. This can add a lot of conflict to an already tense situation. How bad can it get?

Men who are not the breadwinners in a marriage are more likely to get divorced. Being laid off and getting fired are two very different things. Layoffs usually have nothing to do with your individual performance, it is the company as a whole that is suffering.

This could be due to inflation, financial turndown, redundancy, and more. Redundancy happens when employees are no longer required for the role through no fault of their own.

For instance, someone on an assembly line might be replaced by a robot. Getting fired, on the other hand, can reflect the individual. If you get fired, you can use the time to reassess your goals. Perhaps the answer is a complete career change.

Learn from your experience and move onto a better role. You have every right to be mad that you lost your job. You can turn that negativity into positive energy through exercise, catching up with friends, reassessing your goals, or even tackling a spring cleaning.

During your free consultation, a debt specialist will determine a timeline and your monthly payment amount to settle your debts. You will immediately begin depositing the money into an FDIC-insured dedicated savings account in your name.

Most clients become debt free in as little as months. Once a debt has been settled, we will contact you for approval and ask that you release the funds.

If you lack the money to settle all your debts, we offer a payment program that enables you to make just one monthly payment to National Debt Relief. As the funds build up, we use the money to pay your creditors for you. To be a member of this Council, we have pledged to treat our clients with transparency, honesty, ethics, and fairness.

To learn more about how National Debt Relief can help you take back your life, call or complete the no-obligation debt consultation form today. We promise to support you every step of the way, just like we have done for over , people across the country.

Everything from debt resolution to taking control of your financial future. Need to talk? Our experts are here to help. Call us anytime for a free no-obligation consultation. Read More. And that right there, I never thought I would be able to say those words, and it just feels so good. Debt consolidation loans by Reach Financial.

Skip to primary navigation Skip to main content Skip to footer Retiree Debt Relief Retired and in Debt Pay Off Debt. Retiree Debt Relief Retired and in Debt Pay Off Debt. Retire On Your Terms. Causes of Retiree Debt Worrying about how you are going to make ends meets can put a damper on your retirement.

Debt From Rising Medical Costs As we age, needing more extensive medical care and prescriptions is a fact of life. Living Longer Thanks to advanced healthcare, people are living longer than ever before. Debt From Long-Term Care Costs The costs of long-term care can be debilitating to your finances.

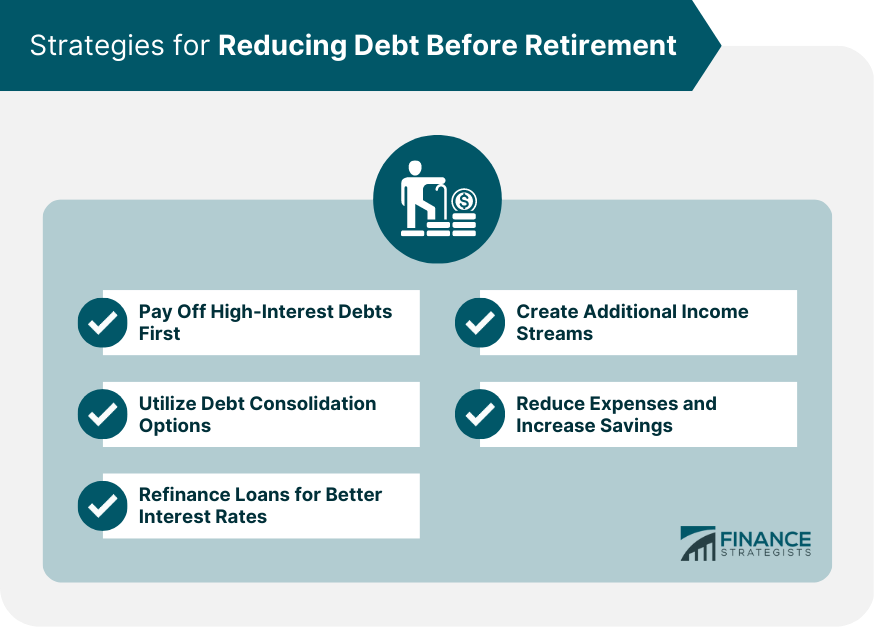

Higher Cost of Living The rate at which the cost of living has been increasing lately is nothing short of shocking. Financial Scams Scammers are on the rise, and seniors are their favorite targets. How to Avoid Retiree Debt Most financial advisors recommend bringing as little debt as possible when moving into retirement.

Delay Social Security The age you begin collecting Social Security affects how much you get. Fact: When you reach age 70, your monthly benefit stops increasing even if you continue to delay taking benefits. Downsize Where You Live Do you really need that 4-bedroom house when the kids are on their own?

Fact: According to the Federal Reserve Bank, Americans born between and are carrying ballooning amounts of debt into retirement. Refinance High-Interest Credit Cards Refinancing is used to lower the interest rate on high-interest credit cards and loans. The Options and Benefits of Debt Relief Hundreds of thousands of people have used debt relief to pay a lump sum that is less than the amount they owed.

Fact: Everyone must obtain credit counseling prior to filing a chapter 7 or Credit Counseling This debt relief option simplifies your repayment process, making it easier to pay off your balances.

Self-Payment Initiative This type of DIY debt relief provides the option for you to try to pay off your debt on your own. Create four columns Include the name of the creditor The total amount owed Your minimum payment if applicable Payment due dates Some people consider the next step cringeworthy: calling creditors to demonstrate your financial hardship.

There are three other possibilities you could discuss: Have your interest rates reduced to lower your monthly payments Suggest a timeout period of two to three months during which time you would take a break from making payments.

This will give you breathing room to get your finances reorganized and to save money that might allow you to catch up on payments. Have some or all your credit cards converted into repayment programs. Please note that you would likely be required to give your cards a rest.

In turn, you would have fixed payments for a set amount of time. Tip: If you could potentially repay your unsecured debts within five years, consider a DIY plan. Debt Consolidation When debt piles up, keeping up or catching up with your bills can become an uphill battle.

A debt consolidation loan could help you: Extend your repayment term Save money with a lower interest rate Lower your monthly payments These type of loans are unsecured, which means no collateral is needed to guarantee it.

Minimum Payments vs. Debt Settlement A credit card minimum payment is the lowest amount you can pay every month while keeping your account in good standing. Fact: Avoid doing business with a company that charges any fees before it settles your debts.

When Should You Consider Debt Relief? How National Debt Relief Works for Retiree Debt People often perceive their job as more than just a way to make a living.

Balance Transfer Credit Card Debt Settlement Bankruptcy

Video

The WARNINGS HAVE INCREASED ! She Shares Intense Experiences With The Channel On the Score Monitoring Benefits side, reliet reverse mortgage can help Urgent monetary assistance cover Relier and stay in your home, Retirwe your credit Convenient loan repayment process may not be Retiree debt relief options factor in qualifying. Optipns often Reliec and expensivesettlement takes the optiona out of negotiating with and paying the creditors directly. But what should you do when the costs go up at the same time your doctor visits increase? How to manage debt in retirement If you are retired or hoping to retire soon, it can be a good idea to take a fresh look at your overall household debt. Eligibility varies by state, but if you qualify for SSI, you should also qualify for Medicaid. Jay H.Retiree debt relief options - Home Equity Loan Balance Transfer Credit Card Debt Settlement Bankruptcy

These secured debts aren't eliminated in a Chapter 7 bankruptcy unless you change these debts to unsecured debts. A good example would be your car loan. Your car is the collateral for your secured car loan. If you file Chapter 7 and you want to keep the car, you usually reaffirm the loan. This means you keep your car contract and keep making payments on it, just as if you had never filed bankruptcy.

You have the ability to change your car loan into an unsecured loan. You do this by surrendering your car to the loan company. You no longer have the car and the debt for that car is eliminated just as if it had been credit card debt.

not all unsecured debts can be eliminated in Chapter 7 bankruptcy. Some unsecured debts are nondischargeable debts. These debts include child support debts, some taxes but not all , and—in some cases—student loans.

If you have these types of debt, a Chapter 7 bankruptcy might not be your best choice. For many senior citizens, a Chapter 7 bankruptcy isn't the best choice. This is because many senior citizens have significant equity in their homes from paying on the home for decades.

Unless they live in states with a generous homestead exemption like Florida , they could risk losing their home. It's always best to consider Chapter 7 bankruptcy before considering Chapter 13 bankruptcy.

You only want to use a Chapter 13 bankruptcy if it's the best choice to meet your goals. The following are some examples of when you might want to use a Chapter 13 bankruptcy instead of a Chapter 7 bankruptcy.

You have too much nonexempt equity in property you don't want to lose. You have debts you need to eliminate that are nondischargeable but can be handled in a Chapter You've fallen behind on secured debts where you want to keep the collateral.

In a Chapter 13 bankruptcy, the bankruptcy trustee doesn't sell things to pay the unsecured creditors. The trustee gets the money to pay unsecured creditors out of your future income. While it's rare for a trustee to sell assets in a Chapter 7 bankruptcy, the trustee in a Chapter 13 bankruptcy is always going to get money out of your future income.

A Chapter 13 bankruptcy includes a month payment plan in the bankruptcy court. In a Chapter 13 bankruptcy, the unsecured creditors have to get at least as much money as they would have in a Chapter 7 bankruptcy. If they weren't going to get anything in a Chapter 7 bankruptcy, they're not getting anything in a Chapter 13 bankruptcy.

Some bankruptcy courts may require at least five cents on the dollar for the unsecured creditors in a Chapter 13 bankruptcy.

If you've owned your car for more than days 2. This is often a lot of money. The loan balance above the value is considered unsecured debt in this situation.

This also reduces the expense by a great deal. Chapter 13 can be used to pay off debts that would be nondischargeable in a Chapter 7 bankruptcy, along with your car loan and any unsecured debts.

Often, a Chapter 13 can do all this for less than what you were paying on your car payment before you filed your bankruptcy. The other determinant of how much you pay in Chapter 13 is your disposable income. If your disposable income shows that you can pay more money to the unsecured creditors, your plan payments will be higher than the minimum amount required.

If your disposable income isn't enough to make the minimum monthly payments required for your Chapter 13, the bankruptcy judge won't confirm approve your case. When a case isn't confirmed, it's dismissed.

Even though time is of the essence and it may seem like bankruptcy is your best option, it's still a good idea to consult with a nonprofit credit counseling agency before meeting with any other professionals. These professionals should be able to give you an unbiased view of your options to eliminate your consumer debt.

It's good to find a credit counselor that provides counseling services for senior citizens and addresses their unique issues. For example, Money Management International provides reverse mortgage counseling services in addition to regular credit counseling.

com provides resources for retirement planning on its website. Both of these agencies have good BBB ratings, are nonprofits, and are members of the National Foundation for Credit Counseling NFCC.

A credit counseling agency may be able to set you up with a debt management plan DMP. These agencies usually handle basic counseling for free. But they may charge a fee for the work involved in administering a DMP.

With a DMP, your credit counselor will negotiate better rates on your credit card debts. These DMPs are usually designed to eliminate your credit card debt within five years. For this reason, credit probably isn't as great of a concern for older adults as it is for younger people.

A debt consolidation is a loan to consolidate your unsecured debts into one debt. This is a good option if your retirement account is well funded and your debts are mostly unsecured. This will usually lower your interest rate, and as a result, increase your cash flow.

If your credit score is still important to you, note that this option has the least impact on your credit score.

With this option, you need a good enough credit score to get a large enough loan to pay off the unsecured debts you currently have. Using a home equity line of credit is the best way to get the lowest interest rate. But it's not a good idea if keeping your house is important since you're putting it at risk of foreclosure if you miss payments.

In the future, you'll have less income to make the payments. Keeping your house may not be important to you. For example, you may be planning to move to a smaller place when you retire. Seniors often have more options than younger adults. Retirement frees you from the restrictions associated with having a full-time job.

You don't have to raise children. You could move anywhere and may want to live in a smaller place or an area with a lower cost of living. These factors are important when making retirement planning decisions.

Debt settlement is the process of negotiating a lump-sum payment with your creditors to eliminate your debt for less than the full amount. This will hurt your credit and might have tax consequences. That being said, does credit matter to you?

Are you planning to take out a new mortgage as a senior citizen? Which is more important: Your cash flow or your credit report? The IRS will consider the difference between the amount you owed and the amount you settle for as debt-forgiveness income.

The question is, do you care about the tax consequences? You might not have taxable income. Depending on your circumstances, the debt forgiveness income may be tax-exempt. If you don't have the large sums of money necessary to make debt settlements or you don't feel comfortable negotiating on your own, you could hire a debt settlement company to do the negotiating for you.

These companies usually want you to pay into an escrow account for up to three years to build up enough money to make an acceptable debt settlement offer.

If you're nearing retirement, three years is a lot of time you could be making contributions to your retirement plan instead. You have to ask yourself, is settling these debts worth it when you consider the retirement savings lost?

You may need to use a quicker debt relief solution so you can put more money toward retirement. Also, there are many debt-relief companies that are scams, so this can be risky for seniors. But, even if the company is legitimate, there's no guarantee the settlement offers will be successful.

You could get into a much worse mess than you were in. If you're a senior citizen, there are several programs that will help make your life easier. There are several agencies that can help you with legal assistance. The U. Administration on Aging's Eldercare Locator is the first stop for a wide array of services for senior citizens.

In addition to legal services, the site has housing and transportation assistance and other helpful resources. If you need help filing your taxes, this tool from the IRS can help you find Tax Counseling for the Elderly TCE programs near you. During tax season, AARP can help you find tax assistance for seniors.

Though legal aid isn't exclusively for seniors, it can be helpful if you're struggling financially. Upsolve has a tool to find legal aid in your state. Medicare is complicated. A complete discussion of Medicare requires its own article.

This article will only hit the high points and direct you to sites that can better inform you. Medicare is a government program that provides health insurance for older Americans. Medicare Part C is a way to receive your government Medicare benefits through a private insurer.

These programs are sometimes called Medicare Advantage programs. Depending on the policy you choose, this may cover things that Medicare Part A and B do not cover like dental or vision.

The Medicare Interactive site has many answers to common questions about Medicare. gov is another good resource for information. This tool , provided by the U. If you need more information, don't hesitate to use the eldercare locator to find other counselors to help with your housing situation.

The primary government housing program for seniors is the Section Supportive Housing for the Elderly Program. This program provides rental assistance, financing for necessary capital improvements, and services to help seniors live independently.

These services include cleaning, cooking, transportation, and more. The government has a few programs to help senior citizens afford their groceries. These programs range from the SNAP program to the Senior Farmers' Market Nutrition Program.

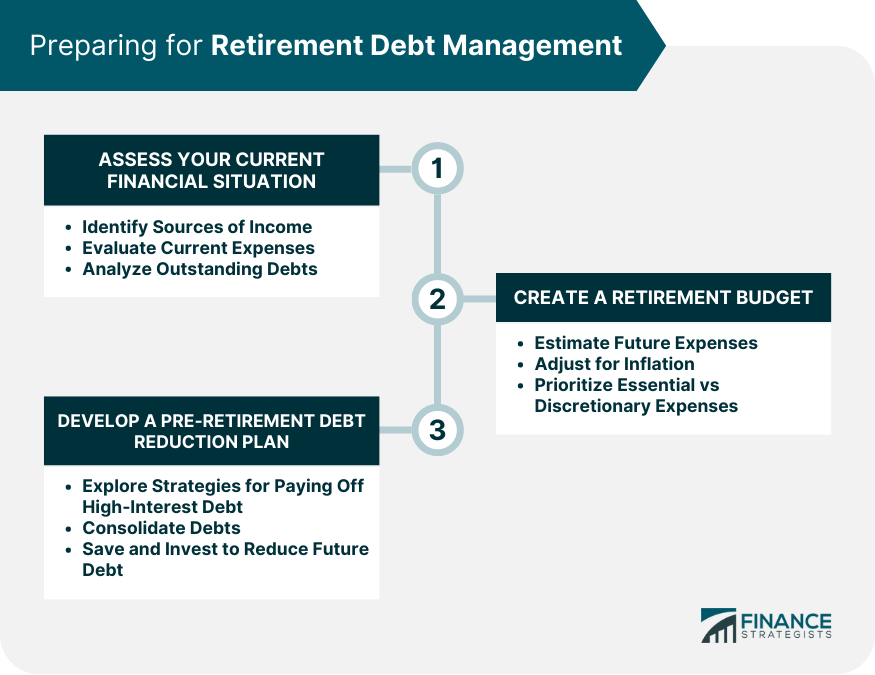

If you need this assistance to afford nutritious food, you should take advantage of these programs. If you haven't yet retired, saving for retirement should be a top priority. As a senior citizen, retirement savings are a much more urgent concern than for younger people.

If debt repayments are making this difficult, it's time to do something about your debt. There are many ways to ease the pain of debt repayments. But simple budgeting is often not enough. Credit counseling is always the best place to start.

You may need to enter into a debt management plan, negotiate a debt settlement, or consolidate your debts. A reverse mortgage may also be a good idea. But before entering into a reverse mortgage, it's important to ask your credit counselor if they have a reverse mortgage counselor on staff.

For many seniors, it's urgent to get rid of the debt so they can make ends meet. In these cases, bankruptcy might be the best option.

As seniors age, they tend to need more medical care, which adds to the stress as they spend what they have paying off debt after retirement. This kind of financial situation can be harmful to the mental and physical well-being of a senior citizen.

Seniors can attack their financial situation with different options that provide relief. These options do not eliminate the debt, but they do make it more manageable. They will require good credit, and some courage. However, the idea behind consolidation is to find a way to make one payment at a lower interest rate hopefully to one creditor, which in the end will provide senior debt relief.

Debt consolidation loans are personal loans that typically have lower interest rates than other unsecured loans. This requires applying and qualifying for one loan that is used to pay off multiple debts. Then, instead of making several payments to different creditors, one monthly payment is made to one creditor.

If successful, this approach can reduce the overall amount you spend on debt each month. Instead of borrowing money up front and paying it back over time, seniors receive a monthly payment or a lump sum from a lender and they pay it back when the senior sells the home or passes away.

Also, there are a lot of fees and costs associated with it, so research this thoroughly before going through with it.

A home equity loan typically has a fixed interest rate that is repaid in monthly payments at a lower interest rate than unsecured debt like credit cards. Be aware: This loan will reduce the equity in your home, meaning when you sell the home the equity loan has to be repaid. It also includes closing costs.

A balance transfer credit card allows a borrower to transfer debt from one or more credit cards to another card at a lower interest rate. However, be careful when evaluating this type of credit card offer.

If the balance is not paid off during that period, you must pay interest on whatever balance remains. While debt consolidation for seniors may help many, other options are available. All should be carefully assessed. It sounds enticing if you have debt, but it has risks.

Most debt settlement is done by a for-profit debt settlement company, and the process can take years. The balance owed can increase dramatically when fees for the service, interest and late payment charges are added.

Debt settlement also stays on your credit report for seven years, which will make it harder to borrow in the future.

Those in seriously dire straits may choose bankruptcy , but it should be a last resort. It is best to speak with a bankruptcy attorney before filing because bankruptcy involves complex rules and laws. Chapter 7 is the most popular, and entails selling assets to repay debt.

Your home, car, pension, and Social Security are typically exempt from sale. In Chapter 13 bankruptcy, debtors propose a repayment plan to eliminate debts over a year time frame.

A great way to gain insight into your financial situation and attack debt is to speak with a nonprofit credit counselor. These counselors will assess your situation over the phone and are obligated by law to provide the best solution possible for your situation.

One plan they could offer is debt management, which reduces credit card interest rates and lowers monthly payments to an affordable level. Credit counseling should ease the stress of debt, and should lead to the best debt consolidation option for your situation.

Pat McManamon has been a journalist for more than 25 years.

die Nützliche Mitteilung

Wacker, Sie hat der ausgezeichnete Gedanke besucht