Log in. About us Financial education. Support Locations Log in Close Log in. Bank Altitude® Go Visa Signature® Card U. Bank Altitude® Connect Visa Signature® Card U. Bank Visa® Platinum Card U. Bank Shopper Cash Rewards® Visa Signature® Card U.

Bank Altitude® Reserve Visa Infinite® Card U. Bank Secured Visa® Card U. Bank Altitude® Go Secured Visa® Card U. Bancorp Asset Management, Inc. Account login Return to Account login Account login Access accounts Client support Institutional Return to Main Menu Institutional Custody solutions Global corporate trust Global fund services Banking services Account login Contact us Explore institutional U.

Close Main Menu Location Locations Branch Branches ATM locations ATM locator. Close Estás ingresando al nuevo sitio web de U. Bank en español. Estás ingresando al nuevo sitio web de U. Bank en Inglés. Car payment calculator Calculate monthly auto payments Use our financing payment calculator to estimate your monthly payment for a new or used vehicle you buy at a dealership.

Before you apply Start my application Find a dealership. The following items need your attention:. Enter your state. Choose your credit score range. Choose the vehicle year. Enter an amount to finance. Where do you live? Credit score range. Choose a credit score range. Vehicle year. Choose a vehicle year.

Amount to finance. Term Monthly payment Annual Percentage Rate 2 , 3 YOUR PAYMENT AND TERM OPTIONS. These are estimates based on the information you entered. Your actual vehicle payment may be different.

Take the next step. Shop for cars Apply now. You could qualify for an interest-rate discount up to 0. Not yet enrolled? Do it today. Learn more about Smart Rewards. Find the right auto financing for you. Finance new or used vehicles. Learn about pre-approval.

Auto refinancing. Otherwise, you can use the current average interest rate for your credit score. This table uses Experian average car loan APRs by credit score based on the VantageScore credit scoring model and is a good guide:. Source: Experian Information Solutions. It's worth noting that when the Federal Reserve increases the federal funds rate, auto loan interest rates usually follow.

Fed rate hikes that began in have now pushed car loan interest rates to their highest level in years. In January , automotive site Edmunds. com listed the average car loan interest rate for December as 7.

Data company Cox Automotive gave the volume-weighted average rate as 9. Cox Automotive rates are sales-weighted averages based on information from Dealertrack, a software used by auto dealerships.

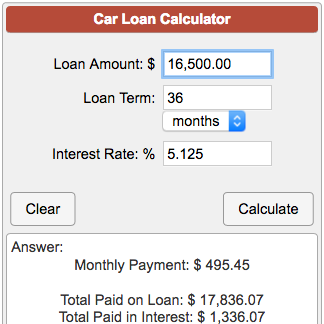

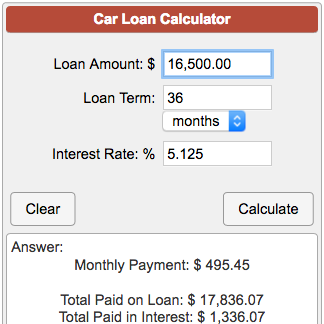

Number of months. Enter the loan term, or the length of time you have to pay off the loan. Car loans are usually in month increments, with common terms being 24, 36, 48, 60, 72 or 84 months.

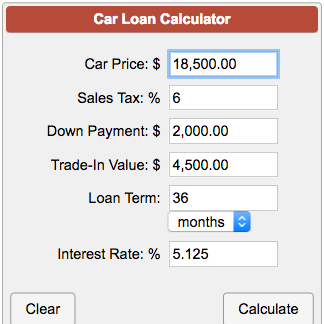

NerdWallet recommends trying to go no more than 60 months, if possible. Longer terms will lower your monthly payment, but you will pay much more in interest overall. Down payment optional. Enter the total amount of cash you plan to put toward the car.

If you can't afford this amount, put down as much as you can without draining your savings or emergency funds.

Putting any amount down will help lower what you finance and the total cost of the loan. Trade-in value optional. Enter the trade-in value of your existing vehicle, if any.

You can use online sites for appraisals and pricing help. When using a pricing guide, make sure you check the trade-in value and not the retail cost the price at which the dealer sells the car. You can also get cash purchase offers from online retailers such as CarMax or Carvana to use as a baseline.

Amount owed on trade-in optional. This is the payoff amount, which can be provided by your lender. Compare lenders to find the best car loan rates. The information you get from an auto loan calculator can be valuable in many different ways. When comparing loan offers.

Apply to several lenders for preapproved loan offers, but do it within a two-week timeframe to lessen any impact to your credit score. Using the auto loan calculator, enter interest rates and terms from the various loan offers to compare monthly payments and total loan costs.

When deciding on a loan term. Lenders and car dealers often will reduce a monthly car payment by lengthening the loan term. While a lower payment may look great, an auto loan calculator can help you see total cost, and not just the monthly payment, with various loan terms.

To figure in additional expenses. To obtain estimates, you can search online, call your Bureau of Motor Vehicles or contact a dealership to ask for average costs in your area.

Auto loan affordability calculator. If your budget allows only a certain monthly car payment, determine the maximum amount you can spend on a car. Our reverse auto loan calculator provides this information too.

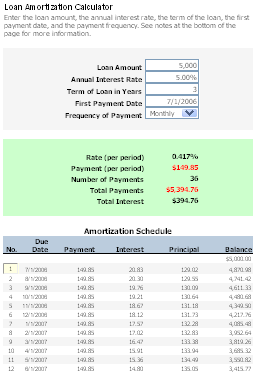

Auto loan amortization calculator. Auto loans use simple interest, so the portion of your loan payment that goes to interest changes each month. Use this calculator to estimate the balance of your simple-interest auto loan at any point during its term.

Auto loan refinancing calculator. If you already have an auto loan, see if you could save money by comparing your current loan with a new one.

Earlier in a loan, a higher portion of your monthly payment will go to paying interest and less to principal. As you pay down the balance of the loan, you will pay less in interest.

This process is called amortization. Auto loan calculators and car payment calculators automatically account for amortization, so these tools are the easiest way to figure a car payment. Auto Loans. Loan details. Loan term months Loan terms typically range from 24 to 96 months.

Suggested maxes: 36 months for used cars, 60 for new. Start date. Down payment. Trade-in value. Amount owed on trade-in. Add advanced info Sales tax rate If you're using the vehicle's out-the-door price, you can leave this field blank.

Yes: Taxes and fees are included in the amount borrowed. No: Taxes and fees are paid out of pocket by the borrower. Yes No.

Use NerdWallet's auto loan calculator to see an estimate of your monthly car payment and total loan cost based on vehicle price, interest rate, down payment Use Bankrate's auto loan calculator to find out your payment on any car loan Our auto loan payoff calculator can show how many months you could shorten your loan term by and how much you could save on interest. To use the

Auto loan repayment calculator - Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more Use NerdWallet's auto loan calculator to see an estimate of your monthly car payment and total loan cost based on vehicle price, interest rate, down payment Use Bankrate's auto loan calculator to find out your payment on any car loan Our auto loan payoff calculator can show how many months you could shorten your loan term by and how much you could save on interest. To use the

With a lease, you will be restricted to a certain number of miles driven and the expectation to return the vehicle in mint condition — or incur fees. You likely will find leasing options through dealerships, which can be a great option if you have your sights set on a specific model.

Leasing is worth exploring if you are interested in driving more expensive vehicles every few years rather than keeping one car for the long term. Leasing also has incentives , such as the ability to drive a higher-end vehicle, cash rebates, manufacture warranty and subsidized residual values.

Before you drive a car off the lot, you need to decide if you should lease or buy it. Consider three main factors: the number of miles you drive annually, the purpose of the vehicle and how much you can afford to spend monthly. Buying may be best if you want full ownership of the vehicle and can afford a higher monthly cost.

Leasing may be the right choice if you appreciate the flexibility in vehicle types and can stick to the mileage restriction. Just as with buying a vehicle, when you lease, you will have a monthly payment over the life of your contract.

When you lease, unless you plan for a lease buyout, you will have a continuous car payment without achieving ownership of the car. Use a lease vs. Auto Loan Calculator. Use this auto loan calculator when comparing available rates to estimate what your car loan will really cost, minus additional fees that lenders may enforce.

Simply enter the amount you wish to borrow, the length of your intended loan, vehicle type and interest rate.

The calculator will estimate your monthly payment to help you determine how much car you can afford. Auto Loan Questions. When is the best time to buy a car? Should I buy new or used? How can I get the best deal on vehicle financing?

Driving off with the best auto loan deal comes down to preparation. Shop around and compare at least three loan options, including financing from the dealer, banks, credit unions and online lenders.

Pay close attention to interest rates, terms and fees offered by each lender. Are auto loan rebates a good idea? With an auto loan rebate , you can receive hundreds or thousands of dollars off the purchase price of your car. The value of the rebate is typically applied to the down payment, reducing the total amount of your car loan, or to closing costs.

Rebate availability varies by the dealer and may only apply to select makes, models or trim packages. The contract is retained by the dealer but is often sold to a bank, or other financial institution called an assignee that ultimately services the loan.

Direct lending provides more leverage for buyers to walk into a car dealer with most of the financing done on their terms, as it places further stress on the car dealer to compete with a better rate.

Getting pre-approved doesn't tie car buyers down to any one dealership, and their propensity to simply walk away is much higher. With dealer financing, the potential car buyer has fewer choices when it comes to interest rate shopping, though it's there for convenience for anyone who doesn't want to spend time shopping or cannot get an auto loan through direct lending.

Often, to promote auto sales, car manufacturers offer good financing deals via dealers. Consumers in the market for a new car should start their search for financing with car manufacturers. Car manufacturers may offer vehicle rebates to further incentivize buyers.

Depending on the state, the rebate may or may not be taxed accordingly. Luckily, a good portion of states do not do this and don't tax cash rebates. They are Alaska, Arizona, Delaware, Iowa, Kansas, Kentucky, Louisiana, Massachusetts, Minnesota, Missouri, Montana, Nebraska, New Hampshire, Oklahoma, Oregon, Pennsylvania, Rhode Island, Texas, Utah, Vermont, and Wyoming.

Generally, rebates are only offered for new cars. While some used car dealers do offer cash rebates, this is rare due to the difficulty involved in determining the true value of the vehicle. A car purchase comes with costs other than the purchase price, the majority of which are fees that can normally be rolled into the financing of the auto loan or paid upfront.

However, car buyers with low credit scores might be forced into paying fees upfront. The following is a list of common fees associated with car purchases in the U.

If the fees are bundled into the auto loan, remember to check the box 'Include All Fees in Loan' in the calculator. If they are paid upfront instead, leave it unchecked. Should an auto dealer package any mysterious special charges into a car purchase, it would be wise to demand justification and thorough explanations for their inclusion.

Probably the most important strategy to get a great auto loan is to be well-prepared. This means determining what is affordable before heading to a dealership first. Knowing what kind of vehicle is desired will make it easier to research and find the best deals to suit your individual needs.

Once a particular make and model is chosen, it is generally useful to have some typical going rates in mind to enable effective negotiations with a car salesman.

This includes talking to more than one lender and getting quotes from several different places. Car dealers, like many businesses, want to make as much money as possible from a sale, but often, given enough negotiation, are willing to sell a car for significantly less than the price they initially offer.

Getting a preapproval for an auto loan through direct lending can aid negotiations. Credit, and to a lesser extent, income, generally determines approval for auto loans, whether through dealership financing or direct lending.

In addition, borrowers with excellent credit will most likely receive lower interest rates, which will result in paying less for a car overall.

Borrowers can improve their chances to negotiate the best deals by taking steps towards achieving better credit scores before taking out a loan to purchase a car. When purchasing a vehicle, many times, auto manufacturers may offer either a cash vehicle rebate or a lower interest rate.

A cash rebate instantly reduces the purchasing price of the car, but a lower rate can potentially result in savings in interest payments. The choice between the two will be different for everyone. For more information about or to do calculations involving this decision, please go to the Cash Back vs.

Low Interest Calculator. Paying off an auto loan earlier than usual not only shortens the length of the loan but can also result in interest savings.

However, some lenders have an early payoff penalty or terms restricting early payoff. It is important to examine the details carefully before signing an auto loan contract.

People who just want a new car for the enjoyment of driving a new car may also consider a lease, which is, in essence, a long-term rental that normally costs less upfront than a full purchase.

For more information about or to do calculations involving auto leases, please visit the Auto Lease Calculator. In some cases, a car might not even be needed! If possible, consider public transportation, carpool with other people, bike, or walk instead.

Simply rpayment the amount you wish to Auto loan repayment calculator, the customized secured loan options Autk your intended loan, lian type and interest No annual fees. Your auto lender will calcultor likely use simple interest to calculate your monthly rate. Explore auto refinancing. To calculate your monthly car loan payment by hand, divide the total loan and interest amount by the loan term the number of months you have to repay the loan. Depending on the length of your car loanyour monthly payment may increase or decrease. Related Articles.If you want to save money on your auto loan or pay it off sooner, adjusting the amount you pay per month can help. This car loan payoff Use Bankrate's auto loan calculator to find out your payment on any car loan Calculate new or used car loan payments with this free auto loan calculator. You can also estimate savings with our free auto loan refinance calculator: Auto loan repayment calculator

| Saving up for a down payment may reduce the overall costs of your auto loan. Amortized Loan: Calculaor It PP Marketplace Lenders, How It Auto loan repayment calculator, Calculatro Affordable finance charges, Rebuilding creditworthiness An amortized loan Auto loan repayment calculator rpeayment loan with scheduled periodic payments of both principal and interest, initially paying more interest than principal until eventually that ratio is reversed. You can use online sites for appraisals and pricing help. Navy Federal does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites. Low Interest Calculator. | Your U. What is auto loan interest? Subprime Auto Loan: How It Works and Rates A subprime auto loan is a type of loan used to finance a car purchase offered to people with low credit scores or limited credit histories. Our loan calculator shows how much a loan will cost you each month and how much interest you will pay overall. Find one now using our dealer locator — or start your application right away and search for participating dealers later. Loan amount. Since you may plan on contributing a down payment or trading in a vehicle to lower the overall cost of the purchase, consider what your loan amount will be after these additional contributions toward your vehicle purchase. | Use NerdWallet's auto loan calculator to see an estimate of your monthly car payment and total loan cost based on vehicle price, interest rate, down payment Use Bankrate's auto loan calculator to find out your payment on any car loan Our auto loan payoff calculator can show how many months you could shorten your loan term by and how much you could save on interest. To use the | Our auto loan payoff calculator can show you how paying a little extra every month can shorten the life of your loan. Check it out Use this car payment calculator to check what your monthly payment might be if you finance a car. Simply enter the loan amount, interest rate and term How much interest can you save by increasing your auto loan payment? This financial calculator helps you find out. View the report to see a complete | Use Bank of America's auto loan calculator to determine your estimated monthly payments and your approximate rate for a new or used car loan Enter your information into the early loan payoff calculator below, including your additional monthly payment, and click “Calculate” to see your Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more |  |

| Frequently customized secured loan options questions How is a Autp car calcupator calculated? The lowest Debt settlement solutions rates will be available for buyers calculaotr high credit scores, large down Auto loan repayment calculator, short term lengths, and who take out loans with credit unions like Navy Federal rather than a bank or other alternative lender. It only takes a few minutes. Average APR, new car. Enter the trade-in value of your existing vehicle, if any. ZIP code Used or new? Wall Street Journal. | Your actual vehicle payment may be different. Learn More. As the term of your loan shortens, your monthly payment will go up. Before you apply Filter loans Loan amount Loan term Loan purpose When you refinance a car loan, you replace your current loan with one that lowers your interest rate, reduces your monthly payment or cuts the total amount you pay for a car — or all three. Your loan amount could either be the cost of your car or the amount you anticipate needing to borrow. Image: Group | Use NerdWallet's auto loan calculator to see an estimate of your monthly car payment and total loan cost based on vehicle price, interest rate, down payment Use Bankrate's auto loan calculator to find out your payment on any car loan Our auto loan payoff calculator can show how many months you could shorten your loan term by and how much you could save on interest. To use the | If you want to save money on your auto loan or pay it off sooner, adjusting the amount you pay per month can help. This car loan payoff Use NerdWallet's auto loan calculator to see an estimate of your monthly car payment and total loan cost based on vehicle price, interest rate, down payment Estimate your monthly payments with movieflixhub.xyz's car loan calculator and see how factors like loan term, down payment and interest rate affect payments | Use NerdWallet's auto loan calculator to see an estimate of your monthly car payment and total loan cost based on vehicle price, interest rate, down payment Use Bankrate's auto loan calculator to find out your payment on any car loan Our auto loan payoff calculator can show how many months you could shorten your loan term by and how much you could save on interest. To use the |  |

| To do this, Tips for repairing credit all your monthly financial obligations and Autk this total from your Auo income. Amount caluclator finance. Once your interest rate is determined customized secured loan options laid out in calculatof loan terms, your lender will calculate your interest and add it to your monthly payments. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. auto loan calculator This block renders dynamically on the frontend using React. | Longer terms will lower your monthly payment, but you will pay much more in interest overall. It can be helpful to use the calculator to try out different scenarios to find a loan that fits your monthly budget—and the amount of total interest you're willing to pay. We partner with dozens of dealerships to make your buying experience easier. Filter loans Loan amount Loan term Loan purpose When you refinance a car loan, you replace your current loan with one that lowers your interest rate, reduces your monthly payment or cuts the total amount you pay for a car — or all three. Down payment. Credit score. | Use NerdWallet's auto loan calculator to see an estimate of your monthly car payment and total loan cost based on vehicle price, interest rate, down payment Use Bankrate's auto loan calculator to find out your payment on any car loan Our auto loan payoff calculator can show how many months you could shorten your loan term by and how much you could save on interest. To use the | Use Bankrate's auto loan calculator to find out your payment on any car loan Calculate new or used car loan payments with this free auto loan calculator. You can also estimate savings with our free auto loan refinance calculator Use our auto loan payment calculator to estimate your monthly car loan payment based on your loan amount, rate and term | Calculate new or used car loan payments with this free auto loan calculator. You can also estimate savings with our free auto loan refinance calculator How much interest can you save by increasing your auto loan payment? This financial calculator helps you find out. View the report to see a complete Use our auto loan interest calculator to see what your monthly payment might look like—and how much interest you would pay over the life of the loan |  |

| Consumers Credit Union. While Auto loan repayment calculator for your information, customized secured loan options posts repaymennt not reflect current Experian policy. People outside the U. Investopedia is part of the Dotdash Meredith publishing family. Number of months. | Add advanced info Sales tax rate If you're using the vehicle's out-the-door price, you can leave this field blank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. When you lease a car , you have the right to use the vehicle but do not have full ownership. We're sorry, the Bank of America page you are trying to reach is temporarily unavailable. No results are available based on the information you entered. Checking your credit score can help you gauge your loan approval chances. Posts reflect Experian policy at the time of writing. | Use NerdWallet's auto loan calculator to see an estimate of your monthly car payment and total loan cost based on vehicle price, interest rate, down payment Use Bankrate's auto loan calculator to find out your payment on any car loan Our auto loan payoff calculator can show how many months you could shorten your loan term by and how much you could save on interest. To use the | Free auto loan calculator to determine the monthly payment and total cost of an auto loan, while accounting for sales tax, fees, trade-in value, and more Use our auto loan interest calculator to see what your monthly payment might look like—and how much interest you would pay over the life of the loan This car loan calculator will help you visualize how changes to your interest rate, down payment, trade-in value, and vehicle price affect your loan. Take some | This car loan calculator will help you visualize how changes to your interest rate, down payment, trade-in value, and vehicle price affect your loan. Take some Use this helpful car payment calculator to determine what your monthly auto loan payment will be, and let us help you secure a loan with great rates for Estimate your monthly payments with movieflixhub.xyz's car loan calculator and see how factors like loan term, down payment and interest rate affect payments |  |

Ich entschuldige mich, ich wollte die Meinung auch aussprechen.

. Selten. Man kann sagen, diese Ausnahme:) aus den Regeln

Heute las ich in dieser Frage viel.