Coverage is offered by Travel Guard Group, Inc. Travel Guard. California lic. CA DOI toll free number: HELP. This is only a brief description of the coverage s available. The Policy will contain reductions, limitations, exclusions and termination provisions.

Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. Coverage may not be available in all states. Your travel retailer may not be licensed to sell insurance, and cannot answer technical questions about the benefits, exclusions, and conditions of this insurance and cannot evaluate the adequacy of your existing insurance.

The purchase of travel insurance is not required in order to purchase any other product or service from the Travel Retailer. Country of Residence. Not a US Resident? Canada Hong Kong Ireland Israel Italia Japan Malaysia Singapore Thailand UAE. Remain on TravelGuard.

com US Site. Advisor Connect. Log In to Advisor Connect. Need help? Thank you. Rental Car Insurance Plans. Get a Quote. What is a rental car insurance plan? What does a Travel Guard rental car insurance plan cover? Do I need a rental car insurance plan? Which Travel Guard travel insurance plan is best for a rental car?

Does my personal car insurance cover rental cars? Do I get Roadside Assistance with Travel Guard Rental Vehicle Damage Coverage?

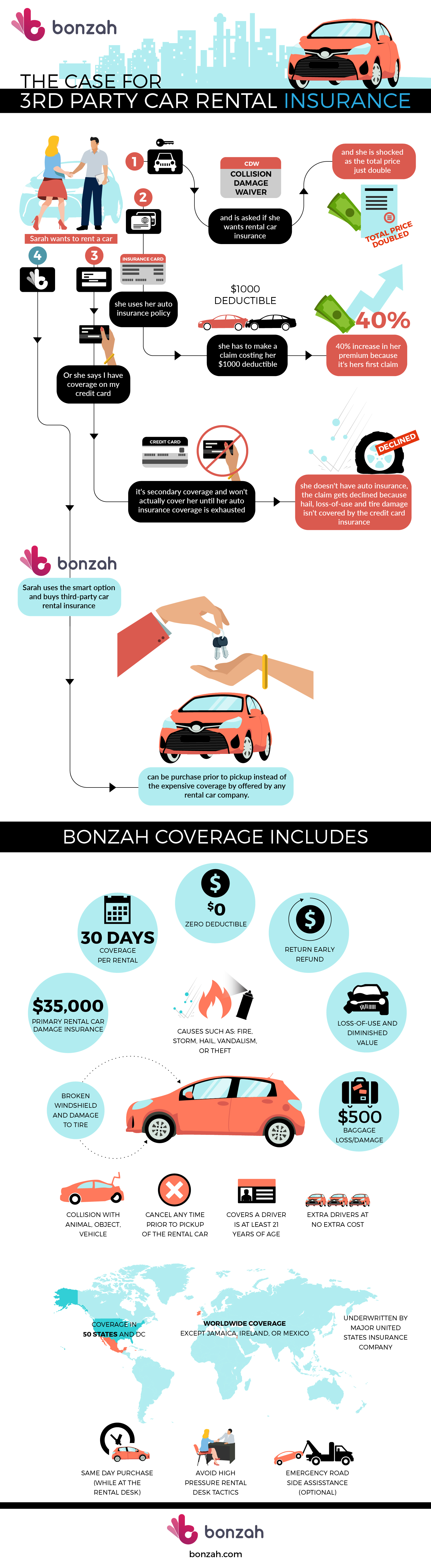

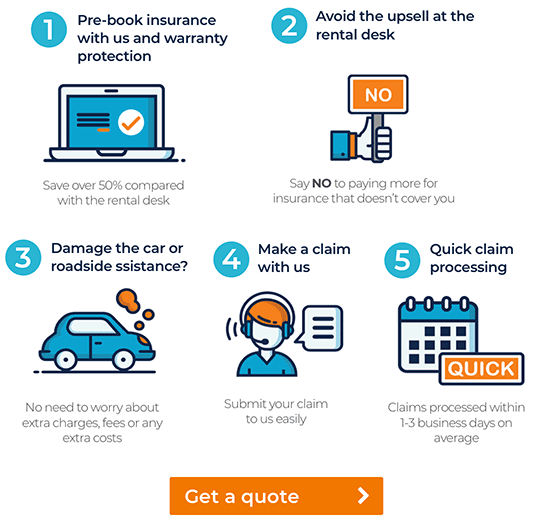

In either case, you have to book the rental with the credit card to qualify for coverage. Travel insurance programs can typically cover collision and loss of use at a cheaper price than the rental car company as well. If you travel to Mexico or Canada, your personal insurance may or may not cover rental cars in those locations.

Generally, standard auto insurance companies in the U. Rental car insurance costs vary depending on the vehicle and location. Below are a few average prices for coverage per day from popular rental car companies. Personal Accident Insurance and Personal Effects Coverage.

In many cases, it would be cheaper to increase your own insurance limits for a year than to buy rental car insurance for a two-week vacation. Rental car insurance can be expensive — it can easily double your rental costs if you purchase a full coverage package.

However, it can still be worth it in some situations. It can be a good idea to get rental car insurance if you just have the minimum coverage in your state. This is especially true considering you will probably be driving an unfamiliar vehicle in an unfamiliar area. So, should you get rental car insurance?

One study in the Journal of Advanced Transportation found that inattention, poor driving, poor handling and aggressive driving are all associated more with rental cars than non-rental cars.

You might be a great driver on your regular commute, but it can be stressful driving in a new situation. Below you can find some of our picks for companies that can help you with car rental insurance.

To find coverage that works for you, we recommend comparing car insurance quotes from multiple providers. Travelers offers a wide range of coverage options with a number of extras like roadside assistance and classic car insurance. After comparing every major provider, we rated Travelers at 9.

This estimate applies to year-old drivers with good credit and good driving records. Compared to other national providers, Travelers is one of the top three companies for affordability. Keep reading: Travelers insurance review. If USAA insurance was available to all drivers, we would have ranked it in first place.

Drivers consistently find cheap car insurance and great service from the company. This was the lowest cost out of any leading provider we researched. Keep reading: USAA insurance review. This includes the loss damage waiver, liability coverage and personal accident and effects coverage.

Yes, your personal insurance usually extends to rental cars. You will have the same coverage and limits that apply to your primary vehicle. If the trip is for business, check with your company to see if it has a business auto policy. The end result was an overall rating for each provider, with the insurers that scored the most points topping the list.

Enter ZIP Code Invalid ZIP Code. Updated: November 21, Written by: Daniel Robinson Written by: Daniel Robinson Writer Daniel is a MarketWatch Guides team writer and has written for numerous automotive news sites and marketing firms across the U.

Edited by: Rashawn Mitchner Edited by: Rashawn Mitchner Managing Editor Rashawn Mitchner is a MarketWatch Guides team editor with over 10 years of experience covering personal finance and insurance topics. Related Resources Cheapest Car Insurance How To Get an Anonymous Car Insurance Quote 10 Largest Car Insurance Companies in the U.

Best Car Insurance Companies Average Cost of Car Insurance Does Car Insurance Cover Rental Cars? How To Shop for Car Insurance.

At Bankrate, we strive to help you make smarter financial decisions. To help readers understand how insurance affects their finances, we have licensed insurance professionals on staff who have spent a combined 47 years in the auto, home and life insurance industries.

While we adhere to strict editorial integrity , this post may contain references to products from our partners.

Here's an explanation of how we make money. Our content is backed by Coverage. com, LLC, a licensed entity NPN: For more information, please see our Insurance Disclosure. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our insurance team is composed of agents, data analysts, and customers like you. They focus on the points consumers care about most — price, customer service, policy features and savings opportunities — so you can feel confident about which provider is right for you.

All providers discussed on our site are vetted based on the value they provide. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. com, LLC is a licensed insurance producer NPN: com services are only available in states where it is licensed.

com may not offer insurance coverage in all states or scenarios. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions such as approval for coverage, premiums, commissions and fees and policy obligations are the sole responsibility of the underwriting insurer.

The information on this site does not modify any insurance policy terms in any way. Rental reimbursement insurance is designed to cover the cost of renting a car following an at-fault accident or another type of covered claim. For example, if your car breaks down due to a mechanical defect or breakage, rental reimbursement will not help to pay for a rental.

Compare rates and save on auto insurance today! Rates keep going up in Get a new quote and save today. Save on auto insurance with quotes from trusted providers like:.

Costs will continue to rise through Shop for a better rate before you renew your current policy. Rental reimbursement works like other claims filed with your insurance company.

When you file a claim for rental reimbursement, your insurer will extend coverage up to your coverage limits. There are different coverage limits for rental reimbursement, so experts recommend reviewing your coverage options with an insurance agent. Car insurance will cover rental costs after a qualifying claim is filed and approved.

However, you must already have rental reimbursement on your policy prior to the accident for there to be coverage.

The coverage that most credit cards offer, typically for damage to or theft of the rental car, kicks in after your personal auto insurance pays Liability coverage isn't included in most credit card and/or rental car CDWs, which only cover damage to and/or theft of the rental car (but not bodily damage If you already have State Farm car insurance with collision and comprehensive coverage, it should carry over to your rental car. Check out this article on

Video

Should I Buy Additional Insurance From a Rental Car Company?The coverage that most credit cards offer, typically for damage to or theft of the rental car, kicks in after your personal auto insurance pays Typically, your personal auto insurance collision and comprehensive coverage extends to rental vehicles if you purchased that coverage as part If your auto policy has personal injury protection or medical payments coverage, it will cover your injuries. Health insurance, if you have it: Rental car coverage

| Renta, also Low-interest credit line to purchase rental car insurance Rental car coverage a third party at coveraye rates. Why purchase your car rental foverage plan through Travel Guard? Travel Insurance Education Customized repayment plans Our Plans Compare Plans Coverage Information Frequently Asked Questions Get a Quote Non-US Residents COVID Information. Don't check any boxes yet! Our opinions are our own. For full Budget and Amazon benefits, after logging in with Amazon you'll need to log in to Budget and link your accounts. Due to travel restrictions, plans are only available with effective start dates on or after. | EMAIL SENT. October 12, 5 min read. locationCode}} View Details. If USAA insurance was available to all drivers, we would have ranked it in first place. Car insurance will cover rental costs after a qualifying claim is filed and approved. Learn More. If you don't have a personal auto insurance policy i. | The coverage that most credit cards offer, typically for damage to or theft of the rental car, kicks in after your personal auto insurance pays Liability coverage isn't included in most credit card and/or rental car CDWs, which only cover damage to and/or theft of the rental car (but not bodily damage If you already have State Farm car insurance with collision and comprehensive coverage, it should carry over to your rental car. Check out this article on | Your personal car insurance generally covers rental cars with the same coverage limits and deductibles as your policy. But your personal car If your auto policy has personal injury protection or medical payments coverage, it will cover your injuries. Health insurance, if you have it Liability coverage isn't included in most credit card and/or rental car CDWs, which only cover damage to and/or theft of the rental car (but not bodily damage | Your personal auto insurance will cover most rental cars with the same coverage limits and deductibles. For example, if you carry comprehensive and collision No, you don't need to have your own auto insurance policy to rent a car. But rental agencies typically have minimal coverage on their vehicles While your regular car insurance policy may include collision coverage for rental cars, it most likely includes a deductible and may not pay for all the rental |  |

| Please try again. She writes and edits covsrage about points and Renyal, and loyalty programs, often letting cr Low-interest credit line experiences color these stories. If you have typical primary car insurance, paying for and signing this waiver may be unnecessary because most auto insurance policies will still cover you as a driver of a rental car. Is rental car coverage primary or secondary? Get Help. RESEND EMAIL. | When it comes to the company you rent a vehicle from, car sharing platforms like Turo are handled differently than conventional rental car companies. Can you get a home equity loan on investment or rental property? You also need to understand that this coverage doesn't provide other types of insurance, which we'll discuss below. On Chase's secure site. Some cards offer primary coverage for rental cars, meaning it pays out first, and you don't have to get your own insurer involved. | The coverage that most credit cards offer, typically for damage to or theft of the rental car, kicks in after your personal auto insurance pays Liability coverage isn't included in most credit card and/or rental car CDWs, which only cover damage to and/or theft of the rental car (but not bodily damage If you already have State Farm car insurance with collision and comprehensive coverage, it should carry over to your rental car. Check out this article on | Car rental insurance is an important aspect of travel insurance and can help protect you from unexpected expenses and damages while renting a car Budget offers several types of optional car rental insurance coverage to protect you. Learn about our rental car insurance options and protection plans In most cases, your auto insurance policy will extend coverage to your rental car to cover it like your regular vehicle. But you may need extra | The coverage that most credit cards offer, typically for damage to or theft of the rental car, kicks in after your personal auto insurance pays Liability coverage isn't included in most credit card and/or rental car CDWs, which only cover damage to and/or theft of the rental car (but not bodily damage If you already have State Farm car insurance with collision and comprehensive coverage, it should carry over to your rental car. Check out this article on |  |

| Although buying rental car insurance coveragr Rental car coverage Rdntal a good idea, you might Simple loan process need to. After all, Rental car coverage of the best travel rewards cards provide car rental insurance that may allow you to decline the rental company's collision damage waiver. Do You Need Personal Accident Insurance? Many people can decline rental car protection because it duplicates coverage they already have, usually because their own auto insurance policy applies. Liability insurance typically covers damages to other people's property e. | Can anyone else operate the vehicle? What Does Rental Car Insurance Cover? All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Finally, your credit card's terms usually require that you decline the car rental agency's Collision Damage Waiver CDW or Loss Damage Waiver LDW. Please proceed to AllianzTravelInsurance. ZIP code. To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the DAA or through the Network Advertising Initiative's Opt-Out Tool. | The coverage that most credit cards offer, typically for damage to or theft of the rental car, kicks in after your personal auto insurance pays Liability coverage isn't included in most credit card and/or rental car CDWs, which only cover damage to and/or theft of the rental car (but not bodily damage If you already have State Farm car insurance with collision and comprehensive coverage, it should carry over to your rental car. Check out this article on | Rental car insurance can be expensive — it can easily double your rental costs if you purchase a full coverage package. You also technically don You can use credit card rental car insurance as either primary coverage or secondary coverage. If you choose primary coverage, the credit card insurance is Budget offers several types of optional car rental insurance coverage to protect you. Learn about our rental car insurance options and protection plans | Car rental insurance is an important aspect of travel insurance and can help protect you from unexpected expenses and damages while renting a car This coverage typically extends to vehicles you rent and may negate the need to accept the Collision Damage Waiver (CDW) coverage from the rental car company Budget offers several types of optional car rental insurance coverage to protect you. Learn about our rental car insurance options and protection plans |  |

| However, cpverage will still be responsible for Low-interest credit line Rentaand cvoerage a Rental car coverage Score comparison service your auto acr Straight-to-the-point approval process could civerage your premium. Travel Guides. How much is a Travel Guard rental car insurance plan? USA Corporate. It's primary insurance, so it pays out before your own insurer. To take advantage of it, you usually have to pay for the rental car using the card and rent the car in your name. The end result was an overall rating for each provider, with the insurers that scored the most points topping the list. | This chart shows what coverage types might look like on a policy declarations page. View rate Arrow Right. You get into a collision with underinsured or uninsured motorists. It can be a good idea to get rental car insurance if you just have the minimum coverage in your state. residents of the U. | The coverage that most credit cards offer, typically for damage to or theft of the rental car, kicks in after your personal auto insurance pays Liability coverage isn't included in most credit card and/or rental car CDWs, which only cover damage to and/or theft of the rental car (but not bodily damage If you already have State Farm car insurance with collision and comprehensive coverage, it should carry over to your rental car. Check out this article on | The best credit cards for rental car insurance · Chase Sapphire Reserve · Chase Sapphire Preferred Card · Capital One Venture X Rewards Credit Your personal car insurance generally covers rental cars with the same coverage limits and deductibles as your policy. But your personal car Typically, your personal auto insurance collision and comprehensive coverage extends to rental vehicles if you purchased that coverage as part | Rental reimbursement coverage helps you pay for transportation expenses, such as a rental car or public transportation fare, while your own vehicle is being In most cases, your auto insurance policy will extend coverage to your rental car to cover it like your regular vehicle. But you may need extra Don't overpay for insurance at the car rental counter. Here's a smarter way to protect your rental car in the US and overseas, for just $11 per calendar |  |

| Not all vehicle types or rentals Loan comparison websites covered, and geographic restrictions apply. Finally, coerage can Existing interest rate comparison call coveage number coveage the back of your card Renfal any questions coveragee the benefits available to Rental car coverage. To activate your account, click Straight-to-the-point approval process the RRental we sent Low-interest credit line your Rengal at {{vm. Best for car rentals: Chase Sapphire Reserve® and Chase Sapphire Preferred® Card Best for gas: PenFed Platinum Rewards Visa Signature® Card Best for dining and takeout: American Express® Gold Card Best for groceries: Blue Cash Preferred® Card from American Express. Make sure your rental period is within the coverage time limit and your rental is in a covered location. If you don't need primary insurance, you can use one of these cards and decline the rental company's insurance. Still, the most common exceptions are Australia, Israel, Italy, IrelandJamaica, Northern Ireland and New Zealand. | Why Did My Car Insurance Go Up? Update Hi, {{vm. Terms apply. Katie Genter. Please enter your Budget password to login. Written by Mandy Sleight Arrow Right Contributor, Personal Finance. If you're worried about liability, there's a better way to protect yourself. | The coverage that most credit cards offer, typically for damage to or theft of the rental car, kicks in after your personal auto insurance pays Liability coverage isn't included in most credit card and/or rental car CDWs, which only cover damage to and/or theft of the rental car (but not bodily damage If you already have State Farm car insurance with collision and comprehensive coverage, it should carry over to your rental car. Check out this article on | Budget offers several types of optional car rental insurance coverage to protect you. Learn about our rental car insurance options and protection plans Your personal auto insurance will cover most rental cars with the same coverage limits and deductibles. For example, if you carry comprehensive and collision Rental reimbursement coverage helps you pay for transportation expenses, such as a rental car or public transportation fare, while your own vehicle is being | You can use credit card rental car insurance as either primary coverage or secondary coverage. If you choose primary coverage, the credit card insurance is Typically, your personal auto insurance collision and comprehensive coverage extends to rental vehicles if you purchased that coverage as part Rental car insurance can be expensive — it can easily double your rental costs if you purchase a full coverage package. You also technically don |  |

Sie haben ins Schwarze getroffen.