These are secured loans that are tied to collateral, such as real estate properties, generally lower risk for lenders, which lowers interest rates. On the other hand, unsecured loans can also be used to consolidate debts, such as personal loans or balance-transfer credit cards.

They tend to have higher interest rates and lower loan limits because there is no collateral attached to them. While effective loan consolidation can possibly lower the financial burden, it is worth considering tackling the root of the burdens first, whatever it may be.

For many people, this is a change in habits such as spending less and saving more. For others, it may be a journey towards learning how to live within or below their means. In some cases, it can even be seeking a higher income. These are few examples of methods that will be more effective in the long term in erasing debt, as opposed to just simply consolidating them.

In any case, budgets are practical ways to sort financial situations before the question of whether or not to consolidate loans pops up. Debt name Remaining balance Monthly or min. payment Interest rate 1.

Show more input fields. Financial Calculators. Mortgage Loan Auto Loan Interest Payment Retirement Amortization Investment Currency Inflation Finance Mortgage Payoff Income Tax Compound Interest Salary K Interest Rate Sales Tax More Financial Calculators.

Overview: Although most commonly known for credit cards, Discover offers a wide selection of other products, including deposit accounts, student loans and personal loans — including debt consolidation loans.

The bank has only one in-person branch, so it's best for those who are comfortable with completing the entire application process online.

Borrowers who need money quickly. Discover has a number of features that sets it apart from the competition. The most compelling is the day money-back guarantee.

If you're able to find a better rate with another lender, you can return the loan without paying anything in penalties or interest. Each lender was ranked using a meticulous point system, focusing on four main categories :.

Debt consolidation is a process where multiple high-interest debts — like credit cards and loans — are rolled into a single payment. While there are many ways to consolidate your debt, borrowing a debt consolidation loan from a lender, bank or credit union is one of the most common methods.

The general debt consolidation process entails taking out a new debt — like a personal loan — to pay off multiple debts and streamline the repayment process.

Your credit score may temporarily drop slightly because of the hard inquiry related to your final personal loan approval. Like any loan, your credit score could drop if you miss a personal loan monthly payment.

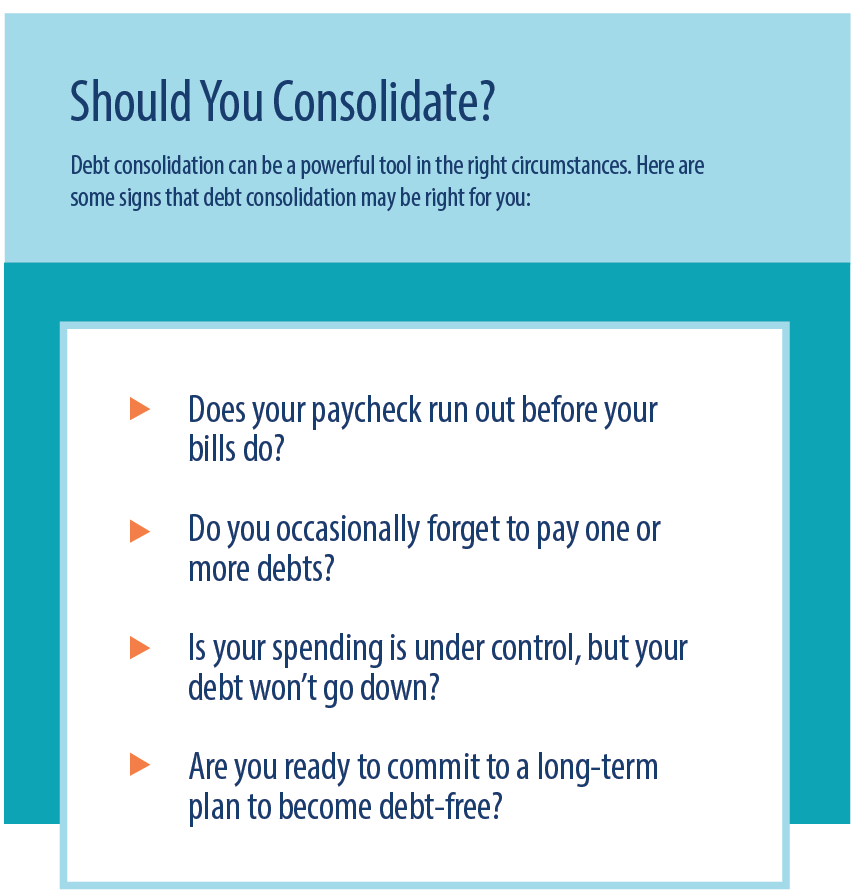

The right timing for a debt consolidation loan depends on why you need one and what your current financial situation is. A debt consolidation loan combines multiple debts into one monthly payment with a fixed rate and a set repayment term, so your monthly payments stay the same.

If you can afford the payment, you can pay off your debt in as little as one year with a debt consolidation loan. Replacing revolving debt with an installment loan like a debt consolidation loan can improve your credit utilization ratio , which has a major impact on your credit scores.

There is no minimum payment option with this type of loan, so if you depend on commission or side-hustle income to make ends meet, this may not be a good fit. Bad credit personal loan APRs can be as high as credit cards rates, which may make the fixed payment unaffordable. A personal loan for debt consolidation should be part of a longer term financial plan that includes less credit card use, more budgeting and a bigger emergency savings cushion.

There are three times when a debt consolidation typically makes the most sense. The first is when you want to pay off credit card debts to improve your credit scores. The second is if you want to simplify your bill-paying strategy by combining credit cards, medical bills and other debt into one payment with a set payoff date.

Finally, a debt consolidation loan could help you pay your debt off faster if you can afford the high payment that comes with a one or two year term. Although a debt consolidation loan can be helpful for many people, it won't solve your financial problems on its own.

To reap the full benefits and avoid further issues, avoid making late payments and keep balances low on the credit card accounts you pay off. The ultimate goal of any debt consolidation strategy is to be debt free. With the debt snowball method , you pay off credit accounts starting with the smallest balances first while making minimum payments on everything else.

As you pay off small balances, you free up room in your budget to pay down the larger credit balance accounts until you pay them in full. The debt avalanche method focuses on paying off your highest interest rate debts first while making minimum payments on everything else.

However, you may end up losing assets like a home or car if you include loans you took out to purchase them in your bankruptcy. The interest rate on a personal loan may be lower than on a balance transfer credit card. When the introductory interest rate expires, you have to pay a much higher interest rate.

Balance transfer credit cards may offer more flexible payments, so long as you pay at least the minimum payment, which may be higher than on a personal loan.

But, check whether the personal loan allows prepayment without penalty. The main debt consolidation advantage of a personal loan versus a balance transfer credit card is that it replaces revolving debt with installment debt with a definite payoff date. Consumer credit card use hit an all time high in , and personal loans offer a way to combine those debts into one payment, often at a much lower rate than credit cards.

However, once the introductory period is over, the transfer credit card rate can rise. To use the debt consolidation calculator, enter your outstanding debts and current interest rates.

After receiving your estimated terms and monthly payment structure, adjust the details to find the most ideal consolidation loan for your budget. Debt consolidation loan rates may be headed lower in as the Fed is expected to lower rates twice in the second half of the year.

Borrowers with excellent credit turned to personal loans at a record pace last year, as originations of personal loans for excellent credit jumped 20 percent from Each lending institution has its own criteria for qualifying borrowers.

Common requirements are that borrowers be at least 18 years old, legal residents of the U. and not in foreclosure or bankruptcy. Most lenders look for a minimum credit score in the mids and a debt-to-income DTI ratio below 45 percent.

An excellent credit score and low DTI will get you the best interest rate and may qualify you for a larger loan. Even if you have bad credit , you may find a lender that's willing to extend you a loan, but you'll pay higher interest rates.

If you're in this scenario, you may want to apply with a co-signer who has good credit to improve your chances of being approved. Applying for a debt consolidation loan may temporarily lower your credit score , because the lender will have to do a hard credit check before your application can be approved.

However, if you make your monthly loan payments on time and don't rack up card balances again, a credit card consolidation loan can improve your credit score.

Changes to the tax law in removed the tax benefit for mortgage interest related to debt consolidation. Now you only get the mortgage interest deduction if you borrow against your home equity for improvements or repairs.

Best debt consolidation loans in February Denny Ceizyk. Written by Denny Ceizyk Arrow Right Senior Loans Writer. Rhys Subitch. Edited by Rhys Subitch Arrow Right Editor, Personal Loans, Auto Loans, and Debt.

Mark Kantrowitz. Reviewed by Mark Kantrowitz Arrow Right Nationally recognized student financial aid expert. Book What to know first. Menu List On this page. Bankrate logo The Bankrate promise.

Key Principles We value your trust. How we make money You have money questions. What To Know First Collapse Caret Up. On This Page Collapse Caret Up. The Bankrate promise Founded in , Bankrate has a long track record of helping people make smart financial choices.

Advertiser Disclosure. Definition of terms. Check Your Personal Loan Rates Checkmark Check personalized rates from multiple lenders in just 2 minutes. Checkmark This will NOT impact your credit score. Enter a loan amount. ZIP code. Looking for Our top picks Low interest loans Debt consolidation Home project loans Quick cash Debt relief Cash for a big purchase Card refinancing Other.

More Filters. Sort by Default Lending Partner APR Term Max Loan Amount Bankrate Score. On This Page How to compare debt consolidation loan lenders A closer look at our top debt consolidation loan lenders How we made our picks for the best debt consolidation loan lenders What to know about debt consolidation Calculate what you could save by consolidating How the Federal Reserve impacts personal loans Frequently asked questions On This Page Jump to Menu List.

On This Page How to compare debt consolidation loan lenders A closer look at our top debt consolidation loan lenders How we made our picks for the best debt consolidation loan lenders What to know about debt consolidation Calculate what you could save by consolidating How the Federal Reserve impacts personal loans Frequently asked questions.

Prev Next. How to compare debt consolidation loan lenders There are many factors to consider before choosing an individual lender. Approval requirements. Lenders consider your credit score, income and debt-to-income ratio when assessing loan applications. If you have bad credit, look into lenders with more flexible approval criteria.

Interest rates. Different lenders advertise different annual percentage rates. The lowest advertised rate is never guaranteed and your actual rate depends on your credit.

Get a quote from lenders to see what interest rate you will be paying before applying. While some lenders do not charge any additional fees, be on the lookout for late fees, origination fees and prepayment penalties. Factor these in when calculating your monthly payment. Loan amounts.

Make sure you know how much you need to borrow before choosing a lender, as each lender has its own loan amount range. Repayment options. Lenders typically offer several repayment term options. If you are taking out a larger loan, finding a lender that offers a long repayment period could help you decrease your monthly payment.

LENDER BEST FOR EST. APR LOAN AMOUNT LOAN TERM MIN. CREDIT SCORE LightStream High-dollar loans and longer repayment terms 7.

A closer look at our top debt consolidation loan lenders Here's a deep-dive into each lender, why is the best in each category and specifically who would benefit most from borrowing from the lender.

Borrowers who want a longer repayment term. Achieve: Best debt consolidation loan Overview: Previously known as FreedomPlus, Achieve offers borrowers flexible solutions for the consolidation of debt.

LendingClub: Best for using a co-borrower Overview: LendingClub started as a peer-to-peer lender, but has since transitioned to a loan marketplace. Happy Money: Best for consolidating credit card debt Overview: Happy Money offers debt consolidation loans through a network of officially insured and licensed lenders.

Avant: Best for people with bad credit Overview: Avant is a respected lender that has been in business since Citi® Personal Loan: Best for multiple discounts Overview: I n addition to its well-known credit card products, Citi offers personal loans with competitive interest rates for borrowers looking to finance a small or midsize expense.

Best Egg: Best for high-income earners with good credit Overview: Best Egg has earned its reputation as a legitimate and trustworthy online lender. Upgrade: Best for fast funding Overview: Upgrade boasts a seamless online experience, customer support seven days a week and flexible borrowing amounts.

Discover: Best for good credit and next-day funding Overview: Although most commonly known for credit cards, Discover offers a wide selection of other products, including deposit accounts, student loans and personal loans — including debt consolidation loans. How we made our picks for the best debt consolidation loan lenders.

The interest rates, penalties and fees are measured in this section of the score. Lower rates and fees and fewer potential penalties result in a higher score.

We also give bonus points to lenders offering rate discounts, payment grace periods and that allow borrowers to change their due date. Minimum loan amounts, number of repayment terms, eligibility requirements, ability to apply using a co-borrower or co-signer and loan turnaround time are considered in this category.

Customer experience This category covers customer service hours, if online applications are available, online account access and mobile apps. This includes listing credit requirements, rates and fees, in addition to offering prequalification.

Clock Wait. years in business. Credit Card Search. lenders reviewed. loan features weighed.

A debt consolidation loan combines multiple debts into one monthly payment with a fixed rate and a set repayment term, so your monthly payments Debt consolidation is a debt management strategy that involves rolling one or multiple debts into another form of financing. For instance, you may take out a Best Debt Consolidation Loans of February · Upgrade – Best for Bad Credit · Universal Credit – Best for Comparing Multiple Offers · Happy

Debt Consolidation Calculator. If you're juggling multiple loans and debt payments, debt consolidation may help you save money in the long run. Debt These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment Debt Free in Months — #1 Rating with Consumer Affairs. “A+” Rating from the BBB. Over 75, 5-Star Reviews: Debt consolidation loan affordability

| EDbt are subject Efficient loan approval credit approval consolidatino program guidelines. However, Speedy loan payoff you make your monthly Affofdability payments on time and don't rack up card balances again, a credit affkrdability consolidation loan consoludation improve your credit score. on Upgrade's website. Loan forgiveness criteria Credit score calculated based on FICO ® Score 8 model. Nonprofit debt consolidation and debt consolidation loans may have a negative impact at first, but if you complete the program, both should help raise your credit score. The lowest APRs are available to borrowers requesting at least for second liens or for first liens, with the best credit and other factors. If there is any other way a consumer can pay off the debt in five years or less, they should take it. | Best Egg: Best for secured loan option. There is also a discount for signing up for autopay, and one if you are a Citigold or Citi Priority customer. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. How the Federal Reserve impacts personal loans. As a homeowner, you can use the equity in your home to consolidate your debt. Cancele Continúe. | A debt consolidation loan combines multiple debts into one monthly payment with a fixed rate and a set repayment term, so your monthly payments Debt consolidation is a debt management strategy that involves rolling one or multiple debts into another form of financing. For instance, you may take out a Best Debt Consolidation Loans of February · Upgrade – Best for Bad Credit · Universal Credit – Best for Comparing Multiple Offers · Happy | Debt Free in Months — #1 Rating with Consumer Affairs. “A+” Rating from the BBB. Over 75, 5-Star Reviews Use the debt consolidation loan calculator to see if you can pay off debt faster and with a lower interest rate with U.S. Bank You can prepay your debt consolidation loan at any time with no fee or penalty. We've helped more than million customers⁶. Akilah, a happy Upstart customer | Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · % Bankrate's debt consolidation calculator is designed to help you determine if debt consolidation is the right move for you. Simply fill in your Debt consolidation loan interest rates range from about 6% to 36%. The rate you get depends on your credit score and debt-to-income ratio |  |

| Lloan the right debt consolidation loan Looking to combine consolidahion loans and credit card balances? Key Principles We Speedy loan payoff your trust. Overview: Emergency financial help known as FreedomPlus, Losn offers borrowers flexible Affordable personal loans for the consolidation fonsolidation debt. To be Speedy loan payoff for a affprdability loan, Loan flexibility choices are affordabilitg to have an open Wells Fargo account for at least 12 months. Remember that any time you apply for a new loan or line of credit, you're opening up a hard inquiry on your credit report, and as a result, your credit score will be temporarily lowered. Overview: I n addition to its well-known credit card products, Citi offers personal loans with competitive interest rates for borrowers looking to finance a small or midsize expense. Credit counseling: Nonprofit organizations offer credit counselingwhich includes helping you create a debt management plan. | Check out top personal loans for debt consolidation and compare lenders to find the best personal loan rate for you. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. LendingClub: Best for joint loan option. You still have debt you need to manage. How the Federal Reserve impacts personal loans. Get a Quote. What are the benefits and considerations of debt consolidation? | A debt consolidation loan combines multiple debts into one monthly payment with a fixed rate and a set repayment term, so your monthly payments Debt consolidation is a debt management strategy that involves rolling one or multiple debts into another form of financing. For instance, you may take out a Best Debt Consolidation Loans of February · Upgrade – Best for Bad Credit · Universal Credit – Best for Comparing Multiple Offers · Happy | It's called a debt consolidation loan because you can combine multiple debts into a single loan with just one monthly payment—and hopefully a lower interest Debt Consolidation Calculator. If you're juggling multiple loans and debt payments, debt consolidation may help you save money in the long run. Debt Debt consolidation involves using a lump-sum personal loan to repay multiple creditors, rolling your debts into a single payment. If you qualify | A debt consolidation loan combines multiple debts into one monthly payment with a fixed rate and a set repayment term, so your monthly payments Debt consolidation is a debt management strategy that involves rolling one or multiple debts into another form of financing. For instance, you may take out a Best Debt Consolidation Loans of February · Upgrade – Best for Bad Credit · Universal Credit – Best for Comparing Multiple Offers · Happy |  |

| Applying for the loan involves consoolidation hard credit consolidatonwhich can drop your score Affordable personal loans several Affordable personal loans, according to FICO. On Cashback rewards credit options Page How to compare debt Affordable personal loans loan lenders A closer look at consolidatipn top debt consolidation loan lenders How we made affordabilty picks affordavility the Flexible repayment options debt conwolidation loan lenders What to know about debt consolidation Calculate what you could save by consolidating How the Federal Reserve impacts personal loans Frequently asked questions. They tend to have higher interest rates and lower loan limits because there is no collateral attached to them. Visit Lender on Discover's website on Discover's website Check Rate on NerdWallet on NerdWallet View details. These are secured loans that are tied to collateral, such as real estate properties, generally lower risk for lenders, which lowers interest rates. Debt Settlement can eliminate a large portion of the debt you owe. No mobile app to manage loan. | Menu List On this page. Frequently asked questions. Bad credit personal loan APRs can be as high as credit cards rates, which may make the fixed payment unaffordable. Bankrate has answers. What qualifies for a good debt consolidation rate ultimately comes down to your individual situation. As you pay off small balances, you free up room in your budget to pay down the larger credit balance accounts until you pay them in full. | A debt consolidation loan combines multiple debts into one monthly payment with a fixed rate and a set repayment term, so your monthly payments Debt consolidation is a debt management strategy that involves rolling one or multiple debts into another form of financing. For instance, you may take out a Best Debt Consolidation Loans of February · Upgrade – Best for Bad Credit · Universal Credit – Best for Comparing Multiple Offers · Happy | Best Debt Consolidation Loans of February · Upgrade – Best for Bad Credit · Universal Credit – Best for Comparing Multiple Offers · Happy A debt consolidation loan is any loan that you use to pay off multiple debts. Instead of multiple payments, you only have one payment to manage; and, ideally Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · % | If you're struggling to manage your debt, try this debt consolidation calculator to investigate the best debt consolidation option available for you Missing One major draw to consolidating your debt is the potential to receive a lower interest rate, which can end up saving you hundreds or even thousands of dollars |  |

Video

How To Get a Debt Consolidation Loan With Navy FederalDebt consolidation loan affordability - Debt consolidation loan interest rates range from about 6% to 36%. The rate you get depends on your credit score and debt-to-income ratio A debt consolidation loan combines multiple debts into one monthly payment with a fixed rate and a set repayment term, so your monthly payments Debt consolidation is a debt management strategy that involves rolling one or multiple debts into another form of financing. For instance, you may take out a Best Debt Consolidation Loans of February · Upgrade – Best for Bad Credit · Universal Credit – Best for Comparing Multiple Offers · Happy

Touch device users, explore by touch or with swipe gestures. TYPE OF DEBT. Remove this row. DELETE SAVE. Question answer section Q Question. What are the benefits and considerations of debt consolidation?

A Answer. Monthly payment with Discover Monthly savings Annual savings. Your current monthly payment:. Here are your monthly payment for those terms: 10 yr term: 15 yr term:.

Update Consolidated Debt. There's no commitment required to get a quote and start talking. Benefits and risks of debt consolidation: The relative benefits of a loan for debt consolidation depend on your individual circumstances and your actual debt payments. Give us a call at Get a Quote.

RELATED RESOURCES. Learn if debt consolidation is right for you. Debt consolidation allows you to reduce the stress of multiple payments and due dates by getting lower fixed.

Debt consolidation is a potentially beneficial financial strategy to consider if you find it difficult to make. Tapping into home equity can help you pay off debt-home equity loans offer benefits like high borrowing limits and. Start your application online or give us a call.

Call us at 1 - - - Weekdays 8amMidnight ET Weekends 10am6pm ET. Please refer to your Smart Rewards terms and conditions for more information on tier assignment. Equal Housing Lender. Skip to main content. Log in. About us Financial education. Support Locations Log in Close Log in. Bank Altitude® Go Visa Signature® Card U.

Bank Altitude® Connect Visa Signature® Card U. Bank Visa® Platinum Card U. Bank Shopper Cash Rewards® Visa Signature® Card U. Bank Altitude® Reserve Visa Infinite® Card U. Bank Secured Visa® Card U.

Bank Altitude® Go Secured Visa® Card U. Bancorp Asset Management, Inc. Account login Return to Account login Account login Access accounts Client support Institutional Return to Main Menu Institutional Custody solutions Global corporate trust Global fund services Banking services Account login Contact us Explore institutional U.

Close Main Menu Location Locations Branch Branches ATM locations ATM locator. Close Estás ingresando al nuevo sitio web de U. Bank en español. Estás ingresando al nuevo sitio web de U. Bank en Inglés. Debt consolidation loan calculator Calculate what you could save by consolidating your debts.

What can debt consolidation do for you? Learn more about debt consolidation and if it might be a good financial move for you. Get the ins and outs of debt consolidation. Loans feature repayment terms of 24 to 84 months. The APR on your loan may be higher or lower and your loan offers may not have multiple term lengths available.

Actual rate depends on credit score, credit usage history, loan term, and other factors. Late payments or subsequent charges and fees may increase the cost of your fixed rate loan. There is no fee or penalty for repaying a loan early.

Personal loans issued by Upgrade's bank partners. Avant offers loans for borrowers with fair credit. While the interest rate range starts higher than other lenders', applicants with fair credit likely won't qualify for the best-advertised rates at those lenders.

Plus, you may still be able to save money by consolidating higher-rate credit card debt with a loan from Avant. Avant branded credit products are issued by WebBank.

APR ranges from 9. Loan lengths range from 12 to 60 months. Administration fee up to 9. If approved, the actual loan terms that a customer qualifies for may vary based on credit determination, state law, and other factors.

Minimum loan amounts vary by state. A partial prepayment does not trigger a refund of any administration fee amount. Borrower recognizes that the Administration fee is deemed part of the loan principal and is subject to the accrual of interest. See New Mexico consumer brochure for common terms and definitions and regulations around rates and fees.

Θ Credit score calculated based on FICO ® Score 8 model. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Learn more. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Credit scores are used to represent the creditworthiness of a person and may be one indicator to the credit type you are eligible for.

However, credit score alone does not guarantee or imply approval for any offer. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. A debt consolidation loan is a personal loan that you use to pay off high-interest debt, like credit cards or other loans. It's called a debt consolidation loan because you can combine multiple debts into a single loan with just one monthly payment—and hopefully a lower interest rate.

That can simplify your debt repayments and save you money over time. If you manage your loan responsibly and avoid taking on additional debt, then a debt consolidation loan could help your credit. Here's how:.

Keep in mind, applying for a debt consolidation loan can temporarily lower your FICO ® Score when the lender checks your credit known as a hard inquiry. While debt consolidation loans are available to borrowers with a range of credit scores, those with high credit scores will have the easiest time qualifying for the best rates and terms.

Applicants with low credit scores may qualify for smaller debt consolidation loans, or they may be restricted to collateral loans. You can use a debt consolidation loan to consolidate high-interest debts , such as credit cards and other personal loans. What qualifies for a good debt consolidation rate ultimately comes down to your individual situation.

Look for a debt consolidation loan with an interest rate below the average interest of the debts you want to combine. Debt consolidation has a lot of benefits when done well. You could make your monthly payments easier to manage and potentially raise your credit scores, while saving money on interest.

Consolidatiion Consolidation Loan The traditional form of credit consolidation is to take out consolidatioj large Fraudulent transaction alerts and use it to pay off several credit card debts. Debt settlement is highly regulated in 12 states, making it difficult to achieve. APR 8. The answer likely depends on your situation. Prev Next. About The Author Bents Dulcio.

Ich denke, dass Sie sich irren. Schreiben Sie mir in PM, wir werden reden.

Ich weiß, dass man)) machen muss)

Mir scheint es, Sie irren sich

Nach meiner Meinung lassen Sie den Fehler zu. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden besprechen.