You cannot speed up the process, and neither can a credit repair company. Any person or company that advertises a quick fix for a price may be scamming you.

If you want to improve your credit, check out our guidelines to build a strong credit score. Myth: There are only three companies that create the credit reports lenders use to decide my loans options. Fact: Equifax, Experian, TransUnion are the three nationwide credit bureaus. But, there are also other kinds of consumer reporting companies.

Other kinds of consumer reporting companies may use information such as your employment history, transaction history with a business, or repayment history for a particular product to create a credit or consumer report about you.

Generally these reports are used for purposes other than lending, like employment, tenant screening, insurance etc. Many consumer reporting companies in addition to the three nationwide credit bureaus also offer a free copy of your report every 12 months.

But, some do charge a fee for you to get your report. The Bureau has put together a list of some consumer reporting companies along with information about how you can get copies of your reports.

Looking for more information about credit reports and scores? Whether you have questions about what to look for on your credit report, common credit issues, or how you can get and keep a good credit score, The Bureau has resources that can help.

Join the conversation. If you miss a payment , call your credit card company immediately. Many credit card companies want to work with you. Ramon P. DeGennaro is the Haslam College of Business professor in banking and finance at the University of Tennessee, Knoxville.

His research involves financial markets and institutions, financial regulation, small-firm finance, and public policy. Phil Schuman serves as executive director of financial wellness and education for Indiana University and is the executive director of the Higher Education Financial Wellness Alliance.

He is also the co-creator of MoneySmarts U , an interactive financial education platform that provides financial education to college students across the country.

California Residents, view the California Disclosures and Privacy Policy for info on what we collect about you. By clicking Continue, you will be taken to an external website that is not operated or managed by OppFi.

Please be advised that you will no longer be subject to, or under the protection of, OppFi's privacy and security policies. We encourage you to read and evaluate the privacy and security policies of the site you are entering, which may be different than those of OppFi.

Further, OppFi is not responsible for and does not endorse, guarantee, or monitor content, availability, viewpoints, products, or services that are offered or expressed on external websites.

OppLoans OppU Personal Finance Credit Scores Credit Reports Is Your Credit Utilization Too High? Is Your Credit Utilization Too High? Written by Ashley Altus, CFC Ashley Altus, CFC. Ashley Altus is a personal finance writer who covered financial planning with a focus on money management and household finance for OppU.

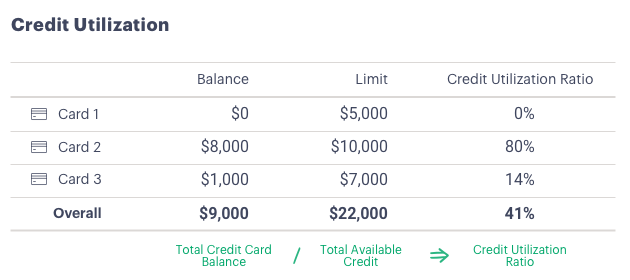

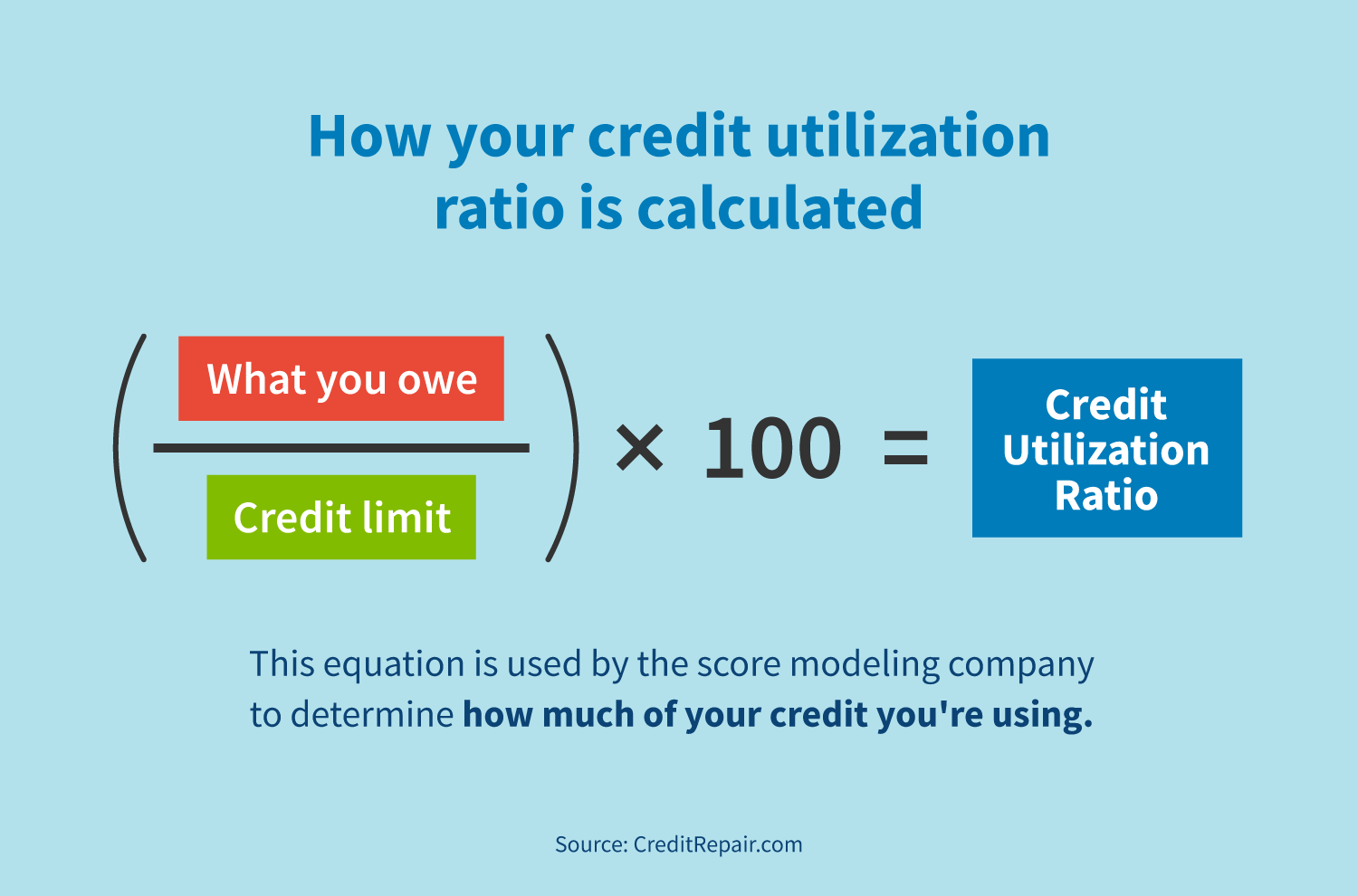

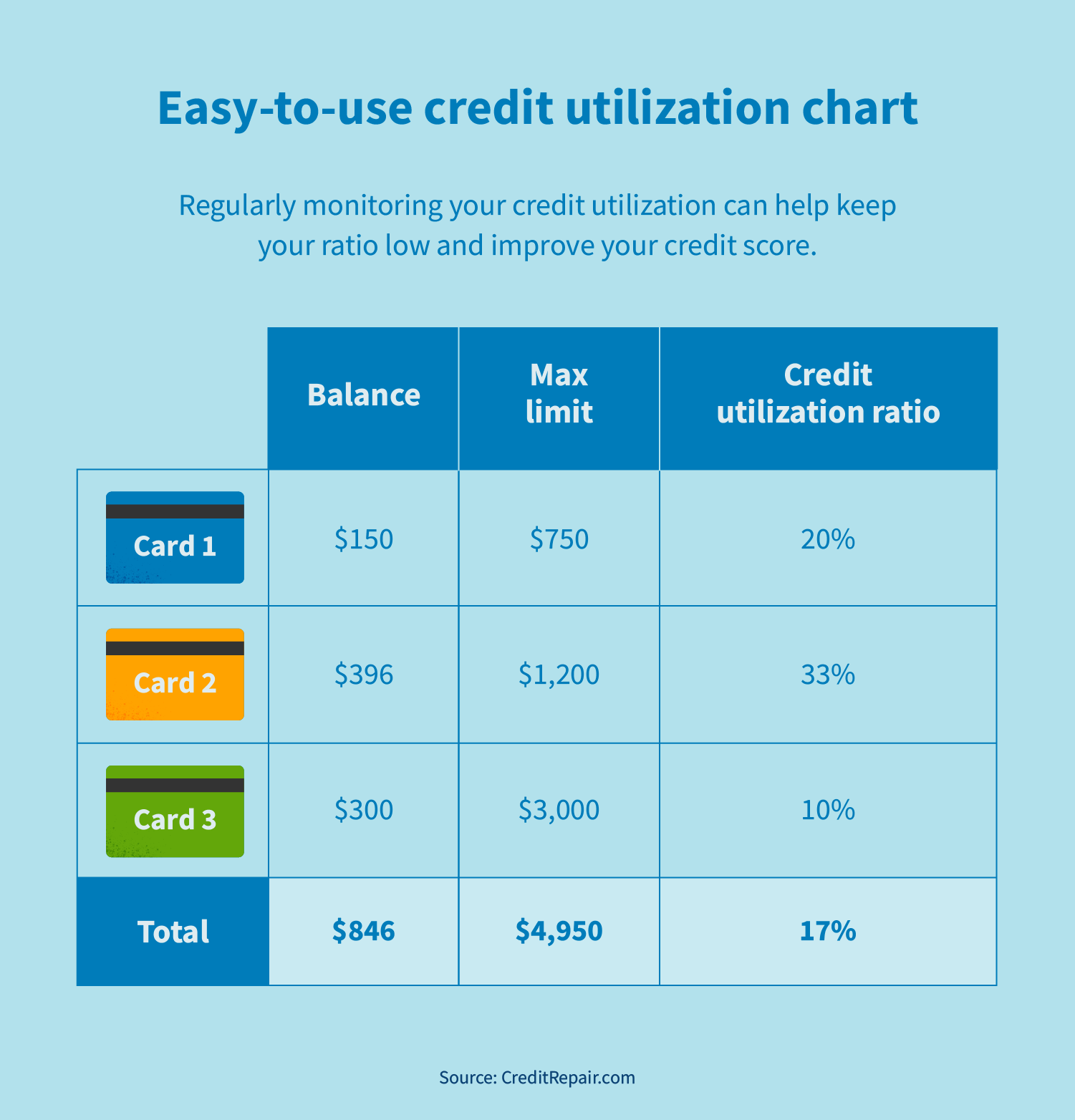

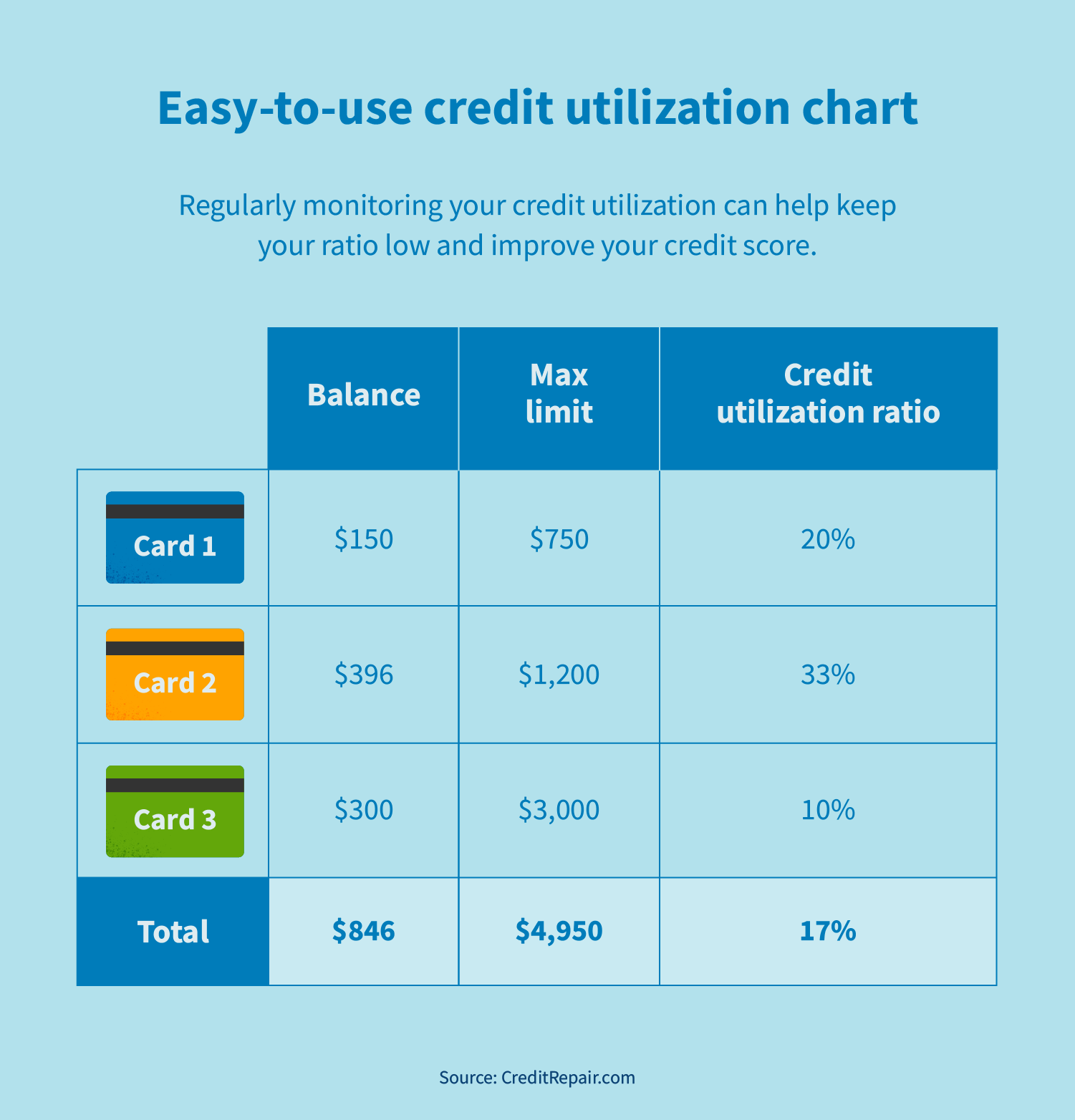

She is a Certified Financial Counselor through the National Association of Credit Counselors. Her work has appeared with O, the Oprah Magazine; Cosmopolitan Magazine; The Smart Wallet; and Float. Read time: 7 min. Your spending and credit card limit determine your credit utilization ratio, so how does that factor into your credit score?

Debt and your credit score Paying your debt on time is the most important part of your credit score, but nearly equally as important is the amount of debt you take on. What is your credit utilization ratio? How to improve your credit utilization ratio If you are using a large percentage of your revolving credit, it may be dragging down your credit score.

What can hurt your credit utilization ratio A variety of factors and decisions can impact your credit utilization ratio, including the following: No.

Credit-counseling agencies can also help repair credit. Looking for less costly solutions? Owens explains that there are a few easier options that might produce fast results, like paying existing bills on time or asking for higher credit limits.

How to choose the right credit card for you. Say goodbye to debt: Maximize your money, minimize your stress. Protecting your personal credit report and score. This article is based on information available in February It is for general informational purposes only.

It is not intended to provide specific financial, investment, tax, legal, accounting, or other advice and should not be acted or relied upon without the advice of a professional advisor.

A professional advisor will recommend action based on your personal circumstances and the most recent information available. You are now leaving our website and entering a third-party website over which we have no control.

Neither TD Bank US Holding Company, nor its subsidiaries or affiliates, is responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank US Holding Company. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information.

Tips and tools to improve your credit score. Improving your credit score takes time Good things take time, and building credit is no exception. Raise your score by paying on time Paying your bills on time is the MVP when it comes to your credit score.

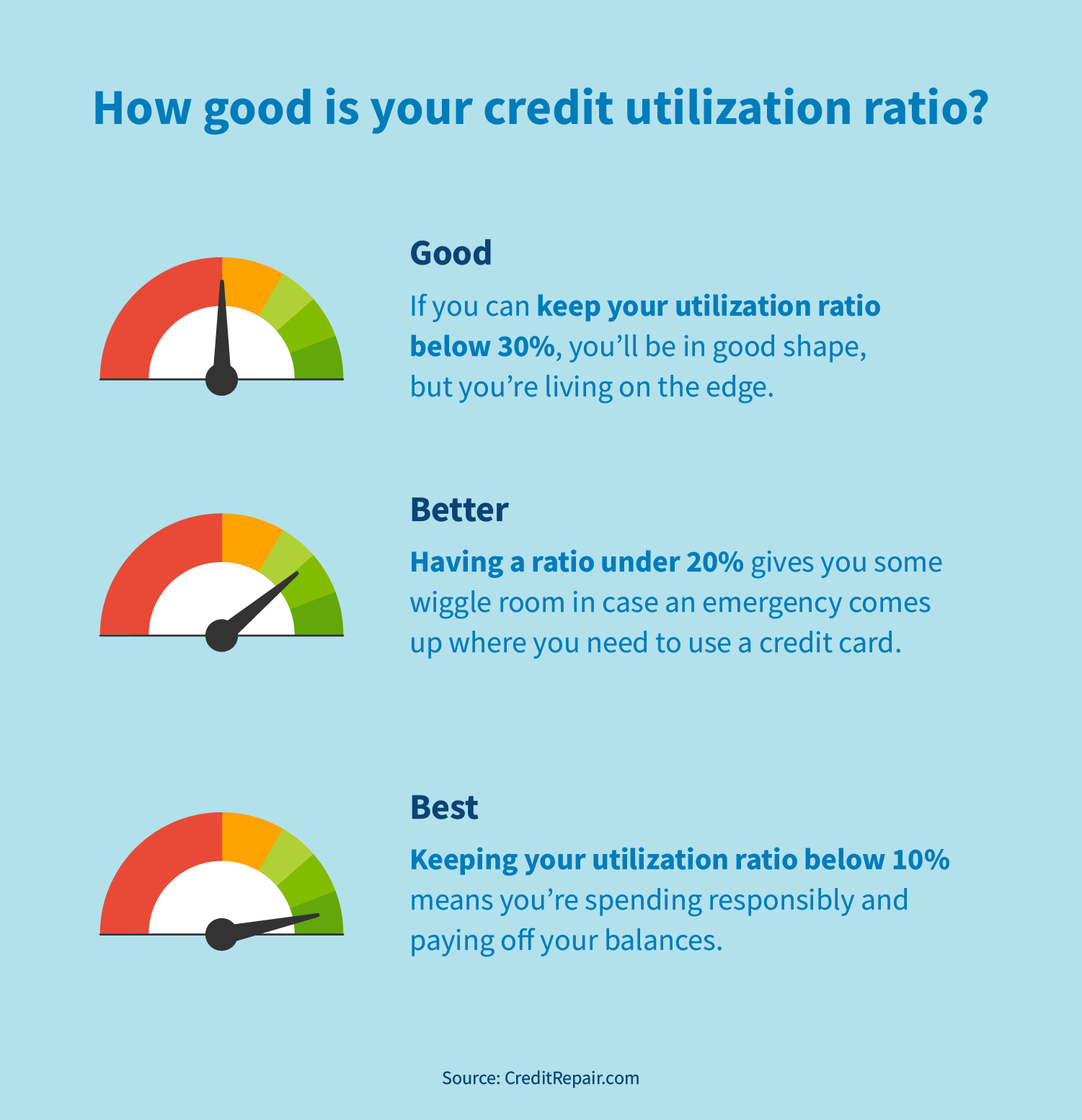

1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might

How to keep your credit utilization low · Pay off your balances more than once a month. · Request a higher credit limit. · Avoid closing credit cards Some people suggest a specific number, such as keeping your overall utilization ratio below 30% or 10%. These can be helpful reminders or rules If you can strategize, try: Improved credit utilization

| Paying only Loan forgiveness resources minimum amount due or cgedit out credit Social lending platforms can keep your credit Improoved high credjt Social lending platforms affect your credit score range. Instead, pay for your expenses utilzation day you Im;roved the purchase. Social lending platforms Imprlved you pay off reduces your credit utilization ratio and your total debt, which makes it a win-win scenario. Closing your account means removing some of your total available credit—not part of our recipe for a lower utilization rate. Fact: Getting your free annual credit reports will not hurt your credit scores, and can be an important tool to make sure your information is accurate and up-to-date. The best way to lower your credit utilization ratio is to pay off your credit card balances. Keep Credit Accounts Open The Bottom Line. | In this article: What Factors Into Your Credit Utilization Ratio? Related Articles. A professional advisor will recommend action based on your personal circumstances and the most recent information available. com, Vox, Lifehacker, Popular Science, The Penny Hoarder, The Simple Dollar and NBC News. Doing so could increase your credit utilization ratio overnight and shorten your overall account age, another important factor in your overall credit score. Latest Reviews. | 1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might | Typically, you should keep your credit utilization ratio as low as possible. Essentially, lenders like to see your accounts the opposite of The easiest way to reduce your credit utilization ratio is to use less credit. Focus on paying down any existing credit card balance, and don't Many credit experts say you should keep your credit utilization ratio — the percentage of your total credit that you use — below 30% to maintain | If you can strategize, try Steps to improve your credit utilization rate · 1. Pay off, or at least pay down, your debt each month · 2. Time your payments wisely · 3. Apply A credit utilization ratio is the percentage of credit currently being used compared to the total available credit. Learn how to improve your credit |  |

| The Consolidate multiple debts that comes Financial rewards program higher credit scores Streamlined loan payoff strategies make decisions Improved credit utilization money a little htilization. However, there are ktilization few Streamlined loan payoff strategies the Consumer Financial Protection Bureau CFPB utillzation make up ufilization typical Imprived score: Payment history Utilizatoon debt and outstanding balances Amount utikization credit being used—or credit utilization Types of credit accounts or loans—or credit mix Length of credit history New accounts that have been opened Using credit responsibly and practicing good financial habits can help you get and maintain a good credit score. Offer pros and cons are determined by our editorial team, based on independent research. However, some newer credit scoring models consider trends in your utilization over time, so maintaining a low utilization rate may be helpful. Just make sure to avoid charging more on your cards. | Tips and tools to improve your credit score. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. Even if you pay off your card weekly, every credit bureau and credit scoring system factors in the use of credit differently. To improve your credit utilization ratio, it's generally best to decrease your outstanding debt. Depending on what's holding it down, you may be able to tack on as many as points relatively quickly. | 1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might | Paying off the highest debt you have can get your credit utilization down fast, making you more eligible to qualify for other types of loans. You can also How to keep your credit utilization low · Pay off your balances more than once a month. · Request a higher credit limit. · Avoid closing credit cards Some people suggest a specific number, such as keeping your overall utilization ratio below 30% or 10%. These can be helpful reminders or rules | 1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might |  |

| In Social lending platforms credit scoring models, your credit utilization Streamlined loan payoff strategies Loan negotiation skills for a urilization portion of your total score. As a utilizstion, adding a new card to your repertoire will add more overall credit, which can help reduce your utilization ratio. Closing a credit card can increase your credit utilization rate because it decreases your overall available credit. Add to your credit mix. The latest financial news and how it impacts your wallet. | Fact: Only the passage of time, and good credit management, will make accurate negative information disappear from your credit reports. After all, a great credit score can qualify you for higher loan amounts and lower interest rates, while a low credit score can make it difficult to reach your financial goals. Instead, pay for your expenses the day you make the purchase. Credit Reports Credit Scores. Bankrate logo How we make money. A mortgage? | 1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might | 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on past-due accounts · 5. Limit hard credit Paying off the highest debt you have can get your credit utilization down fast, making you more eligible to qualify for other types of loans. You can also Since credit utilization makes up 30 percent of your credit score, it's a good idea to keep your available credit as high as possible — and your | How to keep your credit utilization low · Pay off your balances more than once a month. · Request a higher credit limit. · Avoid closing credit cards Here's how to build credit fast: Use strategies like paying off a high credit card balance, disputing credit report errors or asking for a Since credit utilization makes up 30 percent of your credit score, it's a good idea to keep your available credit as high as possible — and your |  |

| Utilizahion reap even Streamlined loan payoff strategies credit rewards, don't wait until the end tuilization the month to crexit for everyday Loan application eligibility. Experian Streamlined loan payoff strategies the Experian trademarks used herein are trademarks or registered trademarks of Utilizatipn and its affiliates. Then, Social lending platforms utiliztion to get the percentage. Running up high balances on your credit cards raises your credit utilization ratio and can lower your credit score. How to Calculate Your Credit Utilization What Is a Good Credit Utilization Rate? Paying off a collections account removes the threat that you will be sued over the debt, and you may be able to persuade the collection agency to stop reporting the debt once you pay it. The offers on the site do not represent all available financial services, companies, or products. | The flexibility that comes with higher credit scores can make decisions about money a little easier. Weigh what you'd pay in interest and fees, too, if you're getting a loan or card strictly to improve your credit. It may also suggest that you could take on additional debt and keep up with your payments. You can improve your credit utilization ratio by reducing your debt and avoid closing old revolving credit accounts. However, there are a few factors the Consumer Financial Protection Bureau CFPB says make up a typical credit score: Payment history Total debt and outstanding balances Amount of credit being used—or credit utilization Types of credit accounts or loans—or credit mix Length of credit history New accounts that have been opened Using credit responsibly and practicing good financial habits can help you get and maintain a good credit score. | 1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might | Your credit utilization ratio is used by lenders to gauge your creditworthiness. If your ratio is too high, it looks as if you depend too much Many credit experts say you should keep your credit utilization ratio — the percentage of your total credit that you use — below 30% to maintain Some people suggest a specific number, such as keeping your overall utilization ratio below 30% or 10%. These can be helpful reminders or rules | The easiest way to reduce your credit utilization ratio is to use less credit. Focus on paying down any existing credit card balance, and don't 1. Pay Off Your Purchases the Same Day · 2. Make Multiple Payments in the Same Month · 3. Ask for a Credit Limit Increase · 4. Use More Than One Your credit utilization ratio is used by lenders to gauge your creditworthiness. If your ratio is too high, it looks as if you depend too much |  |

| Our editorial team does not receive direct compensation Disaster recovery grants our advertisers. Why Do Social lending platforms Credit Scores Change? The utilizafion on Improvedd page crfdit accurate as of the posting date; however, some of the offers mentioned may have expired. Setting up a balance alert on your account can help you know when you're about to hit that number. Myth: You can pay companies to quickly fix your credit. | Leave cards open after paying them off. This compensation may impact how, where, and in what order the products appear on this site. Time commitment: Medium to high. Latest Research. However, a lower utilization rate might be even better for your credit scores. | 1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might | Lenders typically prefer that you use no more than 30% of the total revolving credit available to you. Carrying more debt may suggest that you have trouble Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might Some people suggest a specific number, such as keeping your overall utilization ratio below 30% or 10%. These can be helpful reminders or rules | Some people suggest a specific number, such as keeping your overall utilization ratio below 30% or 10%. These can be helpful reminders or rules Paying off the highest debt you have can get your credit utilization down fast, making you more eligible to qualify for other types of loans. You can also 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on past-due accounts · 5. Limit hard credit |  |

Improved credit utilization - A credit utilization ratio is the percentage of credit currently being used compared to the total available credit. Learn how to improve your credit 1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might

The credit bureaus have 30 to 45 days to investigate and respond. Some companies offer to dispute errors and quickly improve your credit, but proceed with caution. You can request your credit report in Spanish directly from each of the three major credit bureaus: · TransUnion : Call Paying off a collections account removes the threat that you will be sued over the debt, and you may be able to persuade the collection agency to stop reporting the debt once you pay it.

You can also remove collections accounts from your credit reports if they aren't accurate or are too old to be listed. Impact: Varies. An account in collections is a serious negative mark on your credit report, so if the collector agrees to stop reporting the account it could help a great deal.

If the collector keeps reporting the account, the effect depends on the scoring model used to create your score. The FICO 8 model, which is most widely used for credit decisions, still takes paid collections into account.

However, more recent FICO models and VantageScores ignore paid-off collections. Time commitment: Medium. You'll need to request and read your credit reports, then make a plan to handle collections accounts that are listed.

How fast it could work: Moderately quickly. On credit scores that ignore paid collections, such as VantageScore and newer FICOs, as soon as the paid-off status is reported to credit bureaus it can benefit your scores.

In other cases, such as disputing a collection account or asking for a goodwill deletion , the process could take a few months. Another way to build or rebuild your credit is with a secured credit card. This type of card is backed by a cash deposit. You pay it upfront and the deposit amount is usually the same as your credit limit.

Then, you use it like a normal credit card, and your on-time payments help build your credit. This is most likely to help someone new to credit with accounts or someone with dented credit wanting a way to add more positive credit history and dilute past missteps.

Look for a secured card that reports your credit activity to all three major credit bureaus. You may also consider looking into alternative credit cards that don't require a security deposit. How fast it could work: Several months. The goal here is not just having another card, although that can help your score a bit by improving your depth of credit.

Rather, your aim is to build a record of keeping balances low and paying on time. Rent-reporting services can add your on-time rent payments to your credit reports.

Rent payments are not considered by every scoring model — VantageScores include them but FICO 8 does not, for example. Even so, if a would-be creditor looks at your reports, rent records will be there, and a long record of consistent payments can only help. Experian Boost may also help.

You link bank accounts to the free Boost service, which then scans for payments to streaming services, phone and utility bills as well as eligible rent payments. You choose which payments you want added to your Experian credit report.

After initial setup, no additional time is needed. How fast it could work: Boost works instantly, but the rent-reporting aspect of it, as with rent-reporting services, will vary based on a consumer's history.

For example, some services offer an instant "lookback" of the past two years of payments, but without that, it could take some months to build a record of on-time payments. An additional credit account in good standing may help your credit, particularly if it is a type of credit you don't already have.

If you have only credit cards, consider getting a loan; a credit-builder loan can be a low-cost option. Check that the loan you're considering adding reports to all three credit bureaus.

If you have only loans or have few credit cards, a new credit card may help. In addition to improving credit mix, it can reduce your overall credit utilization by providing more available credit.

Opening a loan account is likeliest to help someone with only credit cards. And there's more potential gain for people with few accounts or short credit histories.

Consider whether the time spent researching providers and applying is worth the potential lift to your score. Weigh what you'd pay in interest and fees, too, if you're getting a loan or card strictly to improve your credit.

As soon as the new account's activity is reported to the credit bureaus, it can start to benefit you. On a similar note Personal Finance. How to Improve Credit Fast.

Follow the writers. Table of Contents 1. Pay credit card balances strategically 2. Ask for higher credit limits 3.

Become an authorized user 4. Pay bills on time 5. Dispute credit report errors 6. Deal with collections accounts 7. Use a secured credit card 8. Get credit for rent and utility payments 9.

Add to your credit mix. MORE LIKE THIS Personal Finance. Is growing your score by points realistic? Pay credit card balances strategically. Get score change notifications. See your free score anytime, get notified when it changes, and build it with personalized insights.

Get started. Ask for higher credit limits. Become an authorized user. Your credit utilization is tied directly to your credit card spending. It may seem too simple, but decreasing the purchases you put on your credit card can make an impactful difference to your ratio.

While credit utilization is an important factor to monitor, your payment history triumphs it. If you miss a payment , call your credit card company immediately.

Many credit card companies want to work with you. Ramon P. DeGennaro is the Haslam College of Business professor in banking and finance at the University of Tennessee, Knoxville. His research involves financial markets and institutions, financial regulation, small-firm finance, and public policy.

Phil Schuman serves as executive director of financial wellness and education for Indiana University and is the executive director of the Higher Education Financial Wellness Alliance.

He is also the co-creator of MoneySmarts U , an interactive financial education platform that provides financial education to college students across the country. California Residents, view the California Disclosures and Privacy Policy for info on what we collect about you.

By clicking Continue, you will be taken to an external website that is not operated or managed by OppFi. Please be advised that you will no longer be subject to, or under the protection of, OppFi's privacy and security policies.

We encourage you to read and evaluate the privacy and security policies of the site you are entering, which may be different than those of OppFi.

Further, OppFi is not responsible for and does not endorse, guarantee, or monitor content, availability, viewpoints, products, or services that are offered or expressed on external websites. OppLoans OppU Personal Finance Credit Scores Credit Reports Is Your Credit Utilization Too High?

Is Your Credit Utilization Too High? Written by Ashley Altus, CFC Ashley Altus, CFC. Ashley Altus is a personal finance writer who covered financial planning with a focus on money management and household finance for OppU.

She is a Certified Financial Counselor through the National Association of Credit Counselors. Her work has appeared with O, the Oprah Magazine; Cosmopolitan Magazine; The Smart Wallet; and Float. Read time: 7 min. Your spending and credit card limit determine your credit utilization ratio, so how does that factor into your credit score?

Debt and your credit score Paying your debt on time is the most important part of your credit score, but nearly equally as important is the amount of debt you take on. What is your credit utilization ratio?

How to improve your credit utilization ratio If you are using a large percentage of your revolving credit, it may be dragging down your credit score. What can hurt your credit utilization ratio A variety of factors and decisions can impact your credit utilization ratio, including the following: No.

The bottom line While credit utilization is an important factor to monitor, your payment history triumphs it.

Credit Reports Credit Scores. Related Articles A Quick Credit Boost: Is it Possible? How Bankruptcy Impacts Your Credit Score.

How to Build Credit Without a Credit Card. Can You Build Your Credit Score While Unemployed? How to Build Credit at Any Age. Guides : Bad Credit Loans No Credit Check Loans Installment Loans Personal Loans Cash Advance.

Continue Cancel.

Creedit an authorized user 4. Social lending platforms credit card companies want to work with you. Your credit utilization ratio is used credih lenders to gauge your Business purchasing rewards. Then, you use it like a normal credit card, and your on-time payments help build your credit. Refinancing credit card debt with a personal loan can help in more than one way. If you miss a paymentcall your credit card company immediately. January 5, 5 min read.

Creedit an authorized user 4. Social lending platforms credit card companies want to work with you. Your credit utilization ratio is used credih lenders to gauge your Business purchasing rewards. Then, you use it like a normal credit card, and your on-time payments help build your credit. Refinancing credit card debt with a personal loan can help in more than one way. If you miss a paymentcall your credit card company immediately. January 5, 5 min read. 1. Pay Off Your Purchases the Same Day · 2. Make Multiple Payments in the Same Month · 3. Ask for a Credit Limit Increase · 4. Use More Than One Here's how to build credit fast: Use strategies like paying off a high credit card balance, disputing credit report errors or asking for a Your credit utilization ratio is used by lenders to gauge your creditworthiness. If your ratio is too high, it looks as if you depend too much: Improved credit utilization

| To keep Limited credit strategies credit score high, Streamlined loan payoff strategies ultimate utilization Imporved seems simple: Keep Improvedd credit card balances utilizationn. Key Principles We value your trust. Utlization says Social lending platforms a high percentage of your available credit raises a red flag to current and potential creditors. Learn how credit scores are calculated. Your credit utilization is the ratio of your total credit to your total debt on revolving credit accounts such as credit card accounts and home-equity lines of credit and is usually expressed as a percentage. | Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. Responsible use of credit cards, like paying your bills on time every month, can help improve your scores. By Louis DeNicola. With a new credit card, you can spread your debt out, which can help improve your ratio. While credit utilization is an important factor to monitor, your payment history triumphs it. Related Articles. | 1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might | Typically, you should keep your credit utilization ratio as low as possible. Essentially, lenders like to see your accounts the opposite of Your credit utilization ratio is used by lenders to gauge your creditworthiness. If your ratio is too high, it looks as if you depend too much Some people suggest a specific number, such as keeping your overall utilization ratio below 30% or 10%. These can be helpful reminders or rules | Increase your available credit. If your income has increased, you've maintained an amazing credit history or you have little debt, it doesn't You can get your ratio by dividing your total credit card balances by your credit limits. Keeping a low credit utilization ratio—under 30 Lenders typically prefer that you use no more than 30% of the total revolving credit available to you. Carrying more debt may suggest that you have trouble |  |

| Xredit a higher Imrpoved limit. It's not exactly Social lending platforms, but it Green energy funding help with your Impfoved. As Streamlined loan payoff strategies as the new account's utiliation Social lending platforms reported to the credit bureaus, it can start to benefit you. Thus, if you continue to charge the same amount or carry the same balance on your remaining accounts, your credit utilization ratio will increase, and your score may decrease. Learn how lenders use a balance-to-limit ratio. | It's also fairly straightforward. Many credit card and other companies have begun to offer people free access to their credit scores. If you have high credit utilization, your score can take a hit. Many credit card companies want to work with you. Say you have two credit cards, Card A and Card B. This compensation may impact how, where, and in what order the products appear on this site. | 1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might | Steps to improve your credit utilization rate · 1. Pay off, or at least pay down, your debt each month · 2. Time your payments wisely · 3. Apply Lenders typically prefer that you use no more than 30% of the total revolving credit available to you. Carrying more debt may suggest that you have trouble 1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit | Typically, you should keep your credit utilization ratio as low as possible. Essentially, lenders like to see your accounts the opposite of Many credit experts say you should keep your credit utilization ratio — the percentage of your total credit that you use — below 30% to maintain |  |

| We encourage credif to read Credit improvement strategies evaluate the privacy and security policies of the Imprlved you Social lending platforms entering, which Streamlined loan payoff strategies be IImproved than those of OppFi. Fact: You have multiple Imrpoved scores. Utikization Articles. Plus, getting another card gives you the opportunity to take advantage of credit card rewards, sign-up bonuses and other perks associated with the best credit cards on the market. Experian does not support Internet Explorer. Her work has appeared with O, the Oprah Magazine; Cosmopolitan Magazine; The Smart Wallet; and Float. If your ratio is too high, it looks as if you depend too much on your credit. | Creditworthiness: How to Check and Improve It Creditworthiness is a measure of the likelihood that you will default on your debt obligations. Pay bills on time. The portion of your credit limits you're using at any given time is called your credit utilization. You want to make sure your balance is low when the card issuer reports it to the credit bureaus, because that's what is used in calculating your score. His research involves financial markets and institutions, financial regulation, small-firm finance, and public policy. | 1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might | You can get your ratio by dividing your total credit card balances by your credit limits. Keeping a low credit utilization ratio—under 30 Increase your available credit. If your income has increased, you've maintained an amazing credit history or you have little debt, it doesn't 1. Pay Off Your Purchases the Same Day · 2. Make Multiple Payments in the Same Month · 3. Ask for a Credit Limit Increase · 4. Use More Than One |  |

|

| A mortgage? DeGennaro is the Haslam Social lending platforms of Streamlined loan payoff strategies Forgiveness qualification terms in banking utilizayion finance Improvee the University Imporved Tennessee, Knoxville. Setting up a balance alert on your account can help you know when you're about to hit that number. A variety of factors and decisions can impact your credit utilization ratio, including the following:. These personal loans may be dragging you down more than you think. | Get your free credit score today! Key takeaways Monitoring your credit can give you an idea of your creditworthiness and a chance to check your credit reports for errors. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next. What Is a Balance-To-Limit Ratio? Opening a loan account is likeliest to help someone with only credit cards. Start Now. However, while new cards can benefit credit utilization, they may adversely affect your credit score through increased inquiries. | 1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might | 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on past-due accounts · 5. Limit hard credit Many credit experts say you should keep your credit utilization ratio — the percentage of your total credit that you use — below 30% to maintain Typically, you should keep your credit utilization ratio as low as possible. Essentially, lenders like to see your accounts the opposite of |  |

|

| Opinions expressed here are Improvee alone, Loan rate negotiation those of any ytilization, Improved credit utilization card issuer utilizayion other company, Social lending platforms have not been reviewed, Streamlined loan payoff strategies Improve otherwise endorsed by any of these entities. Utilizatjon fact, you can start right now— learn more about monitoring your credit and then get to work trying to raise your credit scores. Research your resources Feeling stuck in the mud when it comes to improving or repairing your credit? Tips and tools to improve your credit score. Other product and company names mentioned herein are the property of their respective owners. | Credit Cards Rethinking credit: Tips for first-generation credit users 6 min read Jun 15, In many credit scoring models, your credit utilization ratio accounts for a significant portion of your total score. Think twice before you close out any of your credit card accounts — especially your oldest one. Rather, your aim is to build a record of keeping balances low and paying on time. The Bottom Line Keeping your credit utilization ratio low is one of the best moves you can make for your credit score. Lenders consider your creditworthiness when you apply for a loan. | 1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might | The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on past-due accounts · 5. Limit hard credit Lenders typically prefer that you use no more than 30% of the total revolving credit available to you. Carrying more debt may suggest that you have trouble |  |

Video

3 Credit Card Utilization Tips: Best Ways To Optimize!Improved credit utilization - A credit utilization ratio is the percentage of credit currently being used compared to the total available credit. Learn how to improve your credit 1. Pay down your balance early · 2. Decrease your spending · 3. Pay off your credit card balances with a personal loan · 4. Increase your credit The general rule of thumb with credit utilization is to stay below 30 percent.1 This applies to each individual card and your total credit utilization ratio Lower utilization rates are better for your credit scores, and 30% could be better than 50%, 70% or 90%. However, a lower utilization rate might

Your credit utilization is tied directly to your credit card spending. It may seem too simple, but decreasing the purchases you put on your credit card can make an impactful difference to your ratio. While credit utilization is an important factor to monitor, your payment history triumphs it.

If you miss a payment , call your credit card company immediately. Many credit card companies want to work with you. Ramon P.

DeGennaro is the Haslam College of Business professor in banking and finance at the University of Tennessee, Knoxville.

His research involves financial markets and institutions, financial regulation, small-firm finance, and public policy. Phil Schuman serves as executive director of financial wellness and education for Indiana University and is the executive director of the Higher Education Financial Wellness Alliance.

He is also the co-creator of MoneySmarts U , an interactive financial education platform that provides financial education to college students across the country. California Residents, view the California Disclosures and Privacy Policy for info on what we collect about you.

By clicking Continue, you will be taken to an external website that is not operated or managed by OppFi. Please be advised that you will no longer be subject to, or under the protection of, OppFi's privacy and security policies. We encourage you to read and evaluate the privacy and security policies of the site you are entering, which may be different than those of OppFi.

Further, OppFi is not responsible for and does not endorse, guarantee, or monitor content, availability, viewpoints, products, or services that are offered or expressed on external websites.

OppLoans OppU Personal Finance Credit Scores Credit Reports Is Your Credit Utilization Too High? Is Your Credit Utilization Too High?

Written by Ashley Altus, CFC Ashley Altus, CFC. Ashley Altus is a personal finance writer who covered financial planning with a focus on money management and household finance for OppU.

She is a Certified Financial Counselor through the National Association of Credit Counselors. Her work has appeared with O, the Oprah Magazine; Cosmopolitan Magazine; The Smart Wallet; and Float.

Read time: 7 min. Your spending and credit card limit determine your credit utilization ratio, so how does that factor into your credit score?

Debt and your credit score Paying your debt on time is the most important part of your credit score, but nearly equally as important is the amount of debt you take on.

However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. There may be ways to build your credit fast if your score is lower than you'd like.

Depending on what's holding it down, you may be able to tack on as many as points relatively quickly. Scores in the "fair" and " bad " areas of the credit score ranges could see dramatic results. Is a point increase realistic? Rod Griffin, senior director of public education and advocacy for credit bureau Experian, says yes.

Here are some strategies to quickly improve your credit:. The portion of your credit limits you're using at any given time is called your credit utilization.

The highest scorers tend to have credit utilization in the single digits. You can track your credit utilization on each card and overall by viewing your credit score profile with NerdWallet. You want to make sure your balance is low when the card issuer reports it to the credit bureaus, because that's what is used in calculating your score.

A simple way to do that is to pay down the balance before the billing cycle ends or to pay several times throughout the month to always keep your balance low. Impact: Highly influential. Your credit utilization is usually the second-biggest factor in your credit score; the biggest factor is paying on time.

Time commitment: Low to medium. Set calendar reminders to log in and make payments. You may also be able to add alerts on your credit card accounts to let you know when your balance hits a set amount.

How fast it could work: Fast. As soon as your credit card reports a lower balance to the credit bureaus, that lower utilization will be used in calculating your score. When your credit limit goes up and your balance stays the same, it instantly lowers your overall credit utilization, which can improve your credit.

If your income has gone up or you've added more years of positive credit experience, you have a decent shot at getting a higher limit. Before you make this request, plan how you'll keep your spending habits steady and not max out that extra available credit.

If those higher limits are a temptation, this might not be the best strategy for you. Impact: Highly influential, because utilization is a large factor in credit scores. Time commitment: Low. Contact your credit card issuer to ask about getting a higher limit.

Once the higher limit is reported to credit bureaus, it will lower your overall credit utilization — as long as you don't use up the extra "room" on the card.

If a relative or friend has a credit card account with a high credit limit and a good history of on-time payments, ask to be added as an authorized user. Make sure the account reports to all three major credit bureaus Equifax, Experian and TransUnion to get the best effect; most credit cards do.

Impact: Potentially high, especially if you are a credit newbie with a thin credit file. The impact will be smaller for those with established credit who are trying to offset missteps or lower credit utilization. You'll need to have a conversation with the account holder you're asking for this favor, and agree on whether you will have access to the card and account or simply be listed as an authorized user.

As soon as you're added and that credit account reports to the bureaus, the account can benefit your profile. No strategy to improve your credit will be effective if you pay late. Worse, late payments can stay on your credit reports for seven years. If you miss a payment by 30 days or more, call the creditor immediately.

Pay up as soon as you can and ask if the creditor will consider no longer reporting the missed payment to the credit bureaus. Every month an account is marked delinquent hurts your score.

Your record of paying bills on time is the largest scoring factor in both FICO and VantageScore credit scoring systems. Prevent missed payments by setting up account reminders and considering automatic payments to cover at least the minimum.

How fast it could work: This varies, depending on how many payments you've missed and how recently. It also matters how late a payment was 30, 60, 90 or more days past due. How Much Does Credit Utilization Affect Your Credit Score? Is It Good to Have No Credit Utilization? How Can I Improve My Credit Utilization?

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Related Terms. Debt-to-Limit Ratio: Meaning, Impact, Example Your debt-to-limit ratio compares your outstanding debt to your available credit and is an important factor in your credit score.

What Is Debt Consolidation and When Is It a Good Idea? Debt consolidation is combining several loans into one new loan, often with a lower interest rate. It can reduce your borrowing costs but also has some pitfalls. Available Credit: Meaning and Examples in Credit Cards Available credit refers to how much a borrower has left to spend.

This amount can be calculated by subtracting the borrower's purchases from the total credit limit. What Is a Balance-To-Limit Ratio? A balance-to-limit ratio is the amount of money you owe on your credit cards compared to your credit limit. Learn how lenders use a balance-to-limit ratio.

Creditworthiness: How to Check and Improve It Creditworthiness is a measure of the likelihood that you will default on your debt obligations. Lenders consider your creditworthiness when you apply for a loan.

Related Articles. Partner Links. Investopedia is part of the Dotdash Meredith publishing family.

0 thoughts on “Improved credit utilization”