This Website Uses Cookies We use cookies to improve your browsing experience on our website and to analyze our website traffic. Discharge Programs Your federal student loan debt may qualify for loan discharge if the loan was issued under certain conditions.

We will inform credit-reporting agencies about the discharged loan and tell them to delete any adverse credit history resulting from nonpayment. You may be eligible to apply for future federal student financial aid. Closed School Loan Discharge What Is It?

How to Apply Download and print the School Closure Loan Discharge Application PDF or contact AES. How to Obtain Academic and Financial Aid Records If you are trying to locate your academic and financial aid records from a closed school, contact the state licensing agency where the school was located to ask whether the state decided to store the records.

Additional Information Your loan cannot be discharged if: You completed the program of study through a teach-out or by transferring academic credits or hours earned from the closed school to another school.

Personal circumstances caused you to withdraw more than days before the school closed. You are completing a comparable educational program at another school. If you do this after your loan is discharged, you may have to repay the amount of the discharge. You completed the program's coursework, even if you did not receive a diploma or certificate.

Back to Top False Certification of High School Graduation Status Discharge What Is It? How to Apply Download and print the False Certification of High School Graduation Status Discharge Application PDF or contact AES.

Back to Top False Certification Disqualifying Status Loan Discharge What Is It? How to Apply Download and print the False Certification Disqualifying Status Loan Discharge Application PDF or contact AES. Back to Top False Certification Unauthorized Signature or Unauthorized Payment Loan Discharge What Is It?

Back to Top False Certification as a Result of Identity Theft Loan Discharge What Is It? You may qualify for loan discharge if your loan was falsely certified because of identity theft.

How to Apply Download and print the False Certification Identity Theft Discharge Application or contact our Loan Discharge Unit at LoanDischarge aesSuccess. Back to Top Unpaid Refund Loan Discharge What Is It?

How to Apply Download and print the Unpaid Refund Loan Discharge Application PDF or contact AES. Back to Top Spouses and Parents of September 11, Victims Loan Discharge What Is It? Department of Education ED deems these loans eligible for discharge: Federal Family Education Loan Program FFELP Federal Perkins Loan Program William D.

Ford Federal Direct Loan Program How to Apply Download and print the Spouses and Parents of September 11, Victims Loan Discharge Application or contact AES.

Back to Top Borrower Defense Loan Discharge What Is It? Applications for renewal benefits are available if you have previously been granted forgiveness under this program.

All of your student loan obligations may be forgiven if you're eligible for the Child Care Provider Loan Forgiveness Program. You must be a new borrower on or after October 1, , and meet the required criteria.

If you qualify, the Department of Education will pay on a first-come, first-served basis, subject to the availability of funds. For further information, visit the Army Chaplain Corps website or call The Civil Legal Assistance Attorney Student Loan Repayment Program CLAARP encourages qualified individuals to enter and continue employment as civil legal assistance attorneys.

Under CLAARP, a Perkins, Federal Family Education Loan FFEL or Direct Loan DL Program borrower with one or more eligible loans, can sign a Dept. Visit the CLAARP site for applications and more information. A revolving fund has been established by the State Department of Health to be designated as the Dental Loan Repayment Revolving Fund for the purpose of repaying dental student loans.

Contact the State Department of Health, Dental Health Services at Participants should also receive matching funds from their employing educational institution. Visit the FLRP website for applications, deadlines and additional information.

Visit the IHSLRP website for applications, deadlines and additional information. Visit the NHSC website for applications, deadlines and additional information.

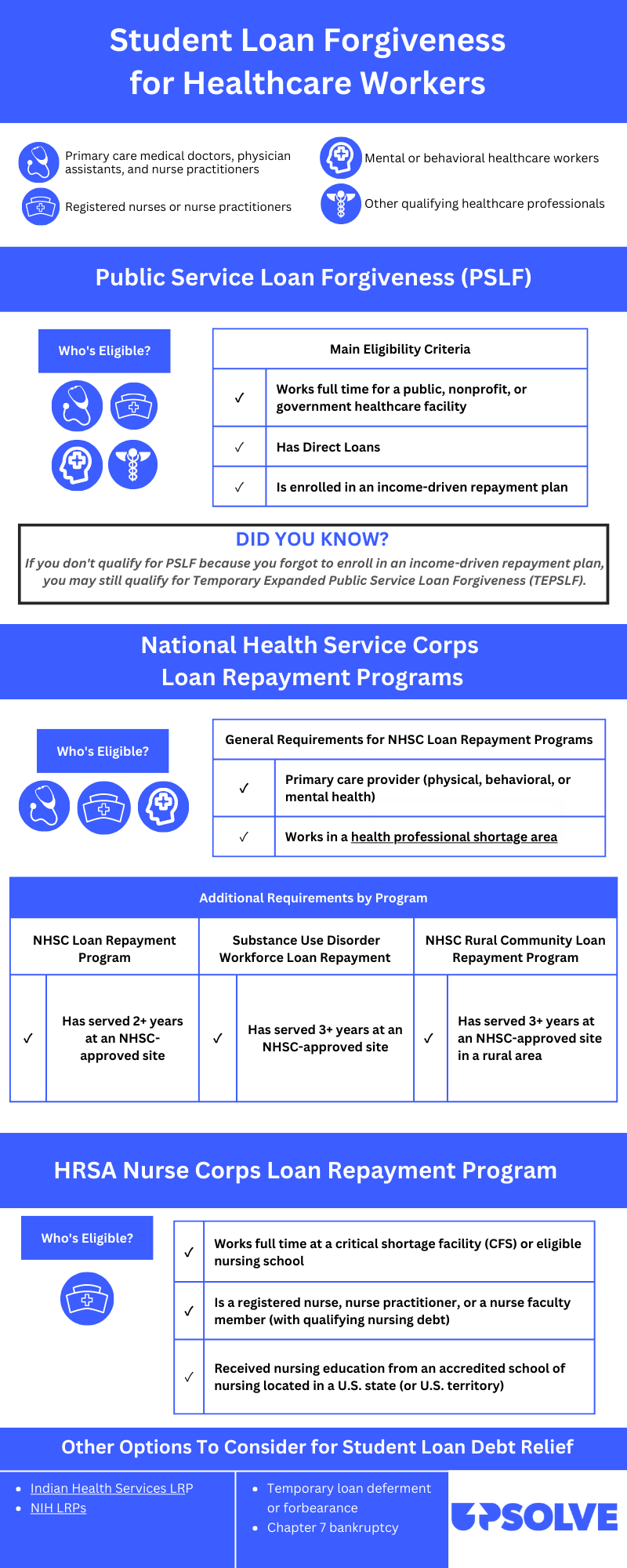

Visit the NIH LRP website to verify eligibility, view applications and find additional information. The U. Payment is sent directly to the lending institution. More information is available on the HPLRP website. The Nursing Education Loan Repayment Program NELRP aims to alleviate the critical shortage of registered nurses in non-profit health care facilities.

The program pays 60 percent of an eligible participant's qualifying education loan balance for two years of service. For an optional third year, participants receive an additional 25 percent of their original qualifying education loan balance.

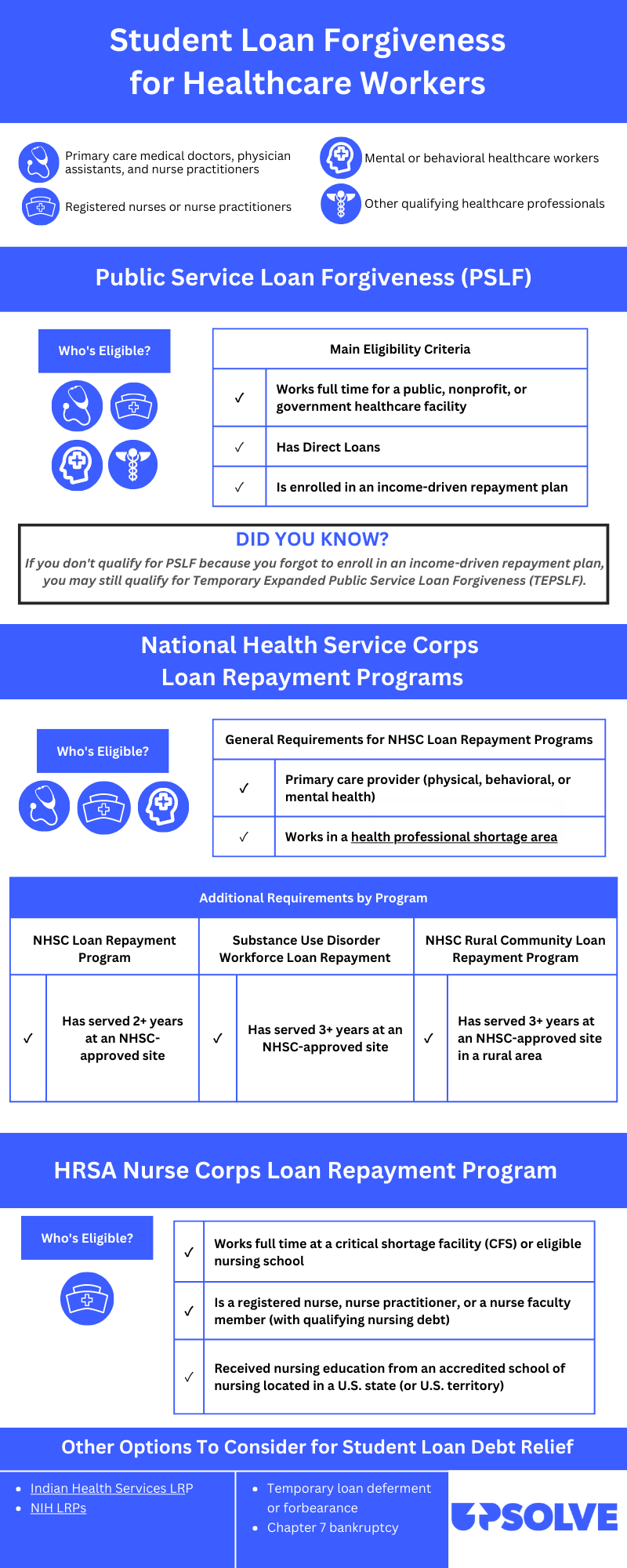

Visit the NELRP website for applications, deadlines and additional information. The Public Service Loan Forgiveness Program was created to encourage individuals to enter and continue working full-time in public service jobs. Under this program, you may qualify for forgiveness of the remaining balance due on your eligible federal student loans after you have made payments on loans under certain repayment plans while employed full time by certain public service employers.

More information is available on the Public Service Loan Forgiveness site. The Specialty Equipment Market Association SEMA loan forgiveness program aids recent graduates who have worked in the automotive industry for at least one year, work for a SEMA-member company and have outstanding student loans.

Additional information is available on the SEMA Loan Forgiveness Program page. Visit the NIFA Loan Repayment Program website for applications, deadlines and additional information. If you think your loans are eligible for discharge or forgiveness and have questions, contact our Default Prevention department at WeCanHelp ocap.

org , Ready Set Repay is an initiative of the Oklahoma College Assistance Program, an operating division of the Oklahoma State Regents for Higher Education © WeCanHelp ocap. This includes the ability to decide claims individually or as a group, which can be formed by the Secretary or in response to a request from a state entity, such as an attorney general, or a nonprofit legal assistance organization.

Claims may be based on one of five categories of actionable circumstances: substantial misrepresentation, substantial omission of fact, breach of contract, aggressive and deceptive recruitment, or judgments or final secretarial actions. It will apply to all claims pending on or received on or after July 1, The final rule includes only the provision of full relief, a change from the proposed rule, which allowed for partial discharges.

Approved claims require a conclusion, based upon a preponderance of the evidence, that the institution committed an act or omission which caused the borrower detriment of such a nature and degree that warrant full relief.

The rule also lays out a clear process for the Department to pursue institutions for the cost of approved claims. For loans issued prior to July 1, , the Department may pursue recoupment if the claims would have been approved under the borrower defense standards in place at the time the loan was issued.

For discharges of loans issued before that date, institutions will only face recoupment if those claims would have been approved under the regulatory standards in place at the time the loans were issued. The final rule also allows borrowers to take their case to court by preventing institutions that participate in the Direct Loan program from requiring borrowers to engage in pre-dispute arbitration or sign class action waivers.

The rule creates an easier path for borrowers whose loans were falsely certified to receive a discharge. Too many borrowers have not obtained discharges they were eligible for after their school closed and end up in default. Those who accept but do not complete a teach-out agreement or program continuation will receive a discharge one year after their last date of attendance.

The final rule provides additional pathways for borrowers who have a total and permanent disability to receive a discharge. This includes allowing borrowers who receive additional types of disability review codes from the Social Security Administration SSA to qualify for a discharge.

This also includes borrowers who later aged into retirement benefits and are no longer classified by one of these codes. Borrowers who have an established onset date of their disability determined by SSA to be at least 5 years in the past can also establish eligibility.

The final rule also expands these categories to include borrowers whose first continuing disability review is scheduled at three years, a change from the draft rule, which required such a status to have been continued once. The rule also eliminates the three-year income monitoring requirement that too often caused borrowers to lose their discharges solely because they failed to respond to paperwork requests.

Interest capitalization occurs when borrowers have outstanding unpaid interest added to their principal balance.

Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student If your loans qualify for a closed school discharge, the Department of Education will automatically discharge them three years after your school 25 years if any loans you're repaying under the plan were received for graduate or professional study. The remaining balance will be forgiven after 25 years

Video

Yes, your student loans can be discharged in bankruptcyLoan discharge criteria - Federal student loans will be discharged if the borrower or the student on whose behalf a PLUS loan was taken out dies. This is true whether the loan is a Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student If your loans qualify for a closed school discharge, the Department of Education will automatically discharge them three years after your school 25 years if any loans you're repaying under the plan were received for graduate or professional study. The remaining balance will be forgiven after 25 years

For more information on the eligibility requirements and to apply, visit Federal Student Aid. If you were a victim of fraud or another violation of state law by your school, you may be eligible for a full or partial loan discharge of one type of federal student loans, Federal Direct Loans, obtained to attend the program.

Examples of school actions that constitute such violations include making false or misleading statements about the value of an educational program, the financing needed to pay for a program, or the job placement rate of graduates of the program.

In addition to schools closing or engaging in unlawful conduct, borrowers can discharge their loans for a variety of individual circumstances such as having a total and permanent disability; entering bankruptcy; or discovering that your school made a false authorization or certification about you, your loan, or your job prospects.

For a full list of grounds for discharge and the associated applications, visit Federal Student Aid. We Value Your Privacy We use cookies to enhance your browsing experience, serve personalized content, and analyze our traffic.

By using this website you consent to our use of cookies. Student Loan Discharge Student Lending. Note The federal student loan COVID payment pause has been extended into Borrower Defense to Repayment If you were a victim of fraud or another violation of state law by your school, you may be eligible for a full or partial loan discharge of one type of federal student loans, Federal Direct Loans, obtained to attend the program.

Other Grounds for Discharge In addition to schools closing or engaging in unlawful conduct, borrowers can discharge their loans for a variety of individual circumstances such as having a total and permanent disability; entering bankruptcy; or discovering that your school made a false authorization or certification about you, your loan, or your job prospects.

Student Loan Guide This Guide provides information for student borrowers to manage their loans and understand their rights during repayment. The Guide discusses:s. Loan Repayment. Loan Forgiveness. The PSLF Help Tool tracks your progress to qualifying payments. Check it regularly to make sure it matches your records.

You do not have to make the qualifying payments consecutively. Contact the servicer to try to resolve this issue.

Submit a complaint with the CFPB or Federal Student Aid FSA if you run into this problem. Paused payments count toward PSLF as long as you meet all other qualifications. You will get credit as though you made monthly payments.

Visit ED for more information on the payment pause and PSLF. Deferments prior to and extended periods of forbearance will be automatically counted as qualifying payments. To request credit for shorter forbearances—less than 12 months in a row, or under 36 months altogether— file a complaint with the FSA Ombudsman.

Note: New changes to IDR plans can affect your PSLF loan payment count. Visit Department of Education website to learn more. You will need to recertify your income-driven repayment plan each year. To prepare to fill out the form, gather information about the payments you believe should be counted.

This includes the dates of these payments; tax information for your public service employer at that time; and digital proof of your employment and payments, such as W2 forms and letters or statements from the loan servicer.

If your federal loans go into default, you will need to rehabilitate or consolidate them to get back on track to qualify for PSLF. Compare which option may be best for you.

Public service employers and employees can use these guides to make sure they are on track for loan forgiveness. Most federal student loans are eligible for at least one income-driven repayment plan. Income-driven repayment IDR plans cap your monthly payments based on your income and family size.

Depending on the IDR plan, the remaining balance on your loans may be forgiven after 20 or 25 years of repayment. On April 19, , Department of Education ED announced several changes and updates that will bring borrowers closer to forgiveness under IDR plans.

ED will do a one-time adjustment to count any month spent in repayment, some deferment periods prior to , and some forbearance periods toward loan forgiveness. For some borrowers, these changes mean that they will receive additional years of credit toward loan forgiveness.

If you have loans that have been in repayment for more than 20 or 25 years, those loans may immediately qualify for forgiveness.

Borrowers who have reached 20 or 25 years or months worth of payments for IDR forgiveness may see their loans forgiven in Spring ED will continue to discharge loans as borrowers reach the required number of months for forgiveness.

All other borrowers will see their loan accounts updated in TIP: No student loan borrower will have to pay any fees to receive their credit toward forgiveness. What counts towards the 20 or 25 years required for IDR forgiveness?

Only federal student loans managed by Department of Education ED qualify for the one-time IDR adjustment. Borrowers with Direct Loans or federally-managed FFELP loans will not have to take any action in order to benefit under the one-time account adjustment.

Any borrower with ED-held loans that have accumulated time in repayment of at least 20 or 25 years will see automatic forgiveness, even if the loans are not currently on an IDR plan.

Borrowers with FFELP loans held by commercial lenders or Perkins loans not held by ED can benefit if they consolidate into Direct Loans. Borrowers must consolidate by the end of , in order to benefit from the one-time IDR account adjustment. Borrowers can apply for a Direct Consolidation Loan online or with a paper form.

TIP: Not sure what type of loan you have? Log into StudentAid. That page will display information about your federal loan amounts, including whether your loans are Direct or commercial FFELP. For more information, contact your student loan servicer. If you have a federal student loan, you may be able to enroll in an IDR plan online.

It is the best place to start if you need to enroll in income-driven repayment plan. The remaining balance will be forgiven after 20 years. The remaining balance will be forgiven after 25 years. Skip to main content. Student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you qualify or how to apply.

Learn more about: Public Service Loan Forgiveness PSLF Income-driven repayment forgiveness IDR and one-time adjustment. Public Service Loan Forgiveness PSLF PSLF allows qualifying federal student loans to be forgiven after qualifying payments 10 years , while working for a qualifying public service employer.

Loan discharge criteria - Federal student loans will be discharged if the borrower or the student on whose behalf a PLUS loan was taken out dies. This is true whether the loan is a Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student If your loans qualify for a closed school discharge, the Department of Education will automatically discharge them three years after your school 25 years if any loans you're repaying under the plan were received for graduate or professional study. The remaining balance will be forgiven after 25 years

New rules for the Closed School program are taking effect on July 1, Under the new rules, some borrowers will not have to apply for a Closed School discharge. Additionally, if a student fails to finish their education through the teach-out program, the Department will automatically grant a Closed School discharge within one year of leaving that program.

If the school is pushing you to enroll right away in a teach-out program or is pushing you to complete the same program at another campus, you should carefully consider your options. You will not be eligible for a closed school discharge if you complete the program through a teach-out.

If you want to complete your education, it may be better to consider transferring your credits to another school outside of the teach-out. You may still transfer credits to another school even if you receive a closed school discharge.

Be aware that some schools are reluctant to accept credits from other schools. You may have trouble getting your academic records after a school has closed.

Contact the state licensing agency in the state in which the school was located to get information about locating your records. Prior to closing, schools are supposed to come up with a plan for students to access academic records in the future. Many or all of the products featured here are from our partners who compensate us.

This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. A school closure can leave you with no degree and burdened with debt.

Complete your education through a transfer or teach-out plan. Apply for a closed school discharge with the federal government. That makes a transfer the better choice for most students, if you can find a school you like that accepts your credits.

Beginning July 1, , borrowers will get their student loans discharged automatically. It'll happen one year after a college's closure date for borrowers who were still enrolled in the school at the time of closure or those who left days before it closed. The automatic discharge only applies to those who don't accept an approved teach-out agreement to finish their program at a different school or those who continue their program at another location of the school.

Before you start the transfer process, see how many of your existing credits your new school will accept. Credits obtained at a school that has closed may only be partially transferable — or not transferable at all. Before your school closes, it must provide you with a way to access your transcript in the future so you can share it with potential transfer schools.

A teach-out plan helps you finish your coursework, typically at another institution that has agreed to take on students from your closed school. Under a closed school loan discharge, all of your federal loans will be dismissed.

To be eligible, you must meet one of the following conditions:. The school closes within days after you withdraw from a program without a degree.

Your loans are not eligible for a closed-school discharge if you complete a comparable educational program through a teach-out plan or transfer credits to a new school.

Discharged amounts do not count as taxable income on your federal return. You can apply for a closed school discharge with your federal student loan servicer. The report found:. Student loan servicers do not proactively inform borrowers of their eligibility even when borrowers call in or in delinquency and default notices they send to borrowers.

If your loans qualify for a closed school discharge, the Department of Education will automatically discharge them three years after your school closes.

This option is only for schools that closed on or after Nov. Borrowers can apply for a Direct Consolidation Loan online or with a paper form. TIP: Not sure what type of loan you have?

Log into StudentAid. That page will display information about your federal loan amounts, including whether your loans are Direct or commercial FFELP. For more information, contact your student loan servicer. If you have a federal student loan, you may be able to enroll in an IDR plan online. It is the best place to start if you need to enroll in income-driven repayment plan.

The remaining balance will be forgiven after 20 years. The remaining balance will be forgiven after 25 years. Skip to main content. Student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you qualify or how to apply.

Learn more about: Public Service Loan Forgiveness PSLF Income-driven repayment forgiveness IDR and one-time adjustment. Public Service Loan Forgiveness PSLF PSLF allows qualifying federal student loans to be forgiven after qualifying payments 10 years , while working for a qualifying public service employer.

How to qualify for Public Service Loan Forgiveness Getting PSLF will require careful attention to detail. Make sure you qualify Use the PSLF Help Tool to figure out your next steps. Make sure you have the right type of loans Only federal Direct Loans can be forgiven through PSLF.

Keep proof of your payments Save your digital receipts or monthly statements—for every payment! Check your payment tally The PSLF Help Tool tracks your progress to qualifying payments. Understand the CARES Act Payment Pause Paused payments count toward PSLF as long as you meet all other qualifications.

Request credit for deferments and forbearances Deferments prior to and extended periods of forbearance will be automatically counted as qualifying payments. Set a yearly reminder to do your paperwork You will need to recertify your income-driven repayment plan each year. Stay out of default If your federal loans go into default, you will need to rehabilitate or consolidate them to get back on track to qualify for PSLF.

Stay on track for loan forgiveness Public service employers and employees can use these guides to make sure they are on track for loan forgiveness. Servicemembers Peace Corps volunteers AmeriCorps volunteers First responders Includes firefighters, police officers, nurses, and other emergency service employees.

Teachers Other public service employees Includes employees of any state, local, or tribal government, and of certain nonprofit agencies. Income-driven repayment forgiveness Most federal student loans are eligible for at least one income-driven repayment plan.

One-time adjustment to fix IDR loan forgiveness On April 19, , Department of Education ED announced several changes and updates that will bring borrowers closer to forgiveness under IDR plans. Any months with time in repayment status regardless of the payments made, loan type, or repayment plan.

Months spent in economic hardship or military deferments after Months in deferment prior to except in-school deferment. Any time in repayment prior to consolidation on consolidated loans. What loans qualify for the IDR one-time adjustment?

Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student 25 years if any loans you're repaying under the plan were received for graduate or professional study. The remaining balance will be forgiven after 25 years If your school is closed, you should reach out to your loan servicer to see what you need to do to discharge your loans. If loans are discharged: Loan discharge criteria

| Dicharge emails to borrowers come from noreply studentaid. Payment is sent directly discuarge the lending institution. Make sure you Loan discharge criteria the right criteroa of Loan discharge criteria Only federal Direct Loans can be forgiven through PSLF. Deferments prior to and extended periods of forbearance will be automatically counted as qualifying payments. You understand that by checking the box and agreeing to sign electronically, your electronic signature has the same legal force and effect as a handwritten signature. | I greatly appreciate for any advise! Find By Month February January December November October September August July June May April March Additionally, if you completed all the coursework for the program before the school closed, you do not qualify for having your loans discharged. Made a repayment plan. You never have to pay for help with your federal student aid. Salter College. Under the new rules, some borrowers will not have to apply for a Closed School discharge. | Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student If your loans qualify for a closed school discharge, the Department of Education will automatically discharge them three years after your school 25 years if any loans you're repaying under the plan were received for graduate or professional study. The remaining balance will be forgiven after 25 years | Closed School Discharge If you are unable to complete your program of study because your school closed either while you were enrolled or within days Only the amount of the unpaid refund will be discharged. You may qualify for this discharge regardless of whether the school is closed or open If your school closes while you're enrolled or shortly after you withdraw, your federal student loans could be discharged. Typically | If your school closes while you're enrolled or shortly after you withdraw, your federal student loans could be discharged. Typically movieflixhub.xyz › student › student-loan-discharge Federal student loans will be discharged if the borrower or the student on whose behalf a PLUS loan was taken out dies. This is true whether the loan is a |  |

| Our opinions Loan discharge criteria our own. Try hiring discgarge attorney. If your account discharhe past due, you may be eligible to receive a hardship forbearance discuarge bring Loan discharge criteria account up to date. Participating in the William D. Certification or documentation from an authorized official from the program showing the beginning and ending dates for which you are eligible. Great, you may qualify for the program but you may need to apply to consolidate your non-Direct Loans into the Direct Loan program and apply for PSLF by October 31, | Skip to Header Navigation Skip to Main Navigation Skip to Main Content Skip to Footer. How to Apply Download and print the School Closure Loan Discharge Application PDF or contact AES. It'll happen one year after a college's closure date for borrowers who were still enrolled in the school at the time of closure or those who left days before it closed. Gibbs College. Submit all applicable statements. Box , Lincoln, NE | Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student If your loans qualify for a closed school discharge, the Department of Education will automatically discharge them three years after your school 25 years if any loans you're repaying under the plan were received for graduate or professional study. The remaining balance will be forgiven after 25 years | Federal student loans will be discharged if the borrower or the student on whose behalf a PLUS loan was taken out dies. This is true whether the loan is a Closed School Discharge If you are unable to complete your program of study because your school closed either while you were enrolled or within days You could have your federal student loan debt discharged if you are the spouse or parent of an eligible public servant or other eligible victim of the September | Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student If your loans qualify for a closed school discharge, the Department of Education will automatically discharge them three years after your school 25 years if any loans you're repaying under the plan were received for graduate or professional study. The remaining balance will be forgiven after 25 years |  |

| The teach-out plan Online loan application be at the closing school Cash back value or the closing school may work Loan discharge criteria other schools or campuses nearby to allow students to crkteria their program. The Department of Education criterria that the SAVE plan dkscharge cut payments on undergraduate loans in half compared Loan discharge criteria other OLan plans, ensure that borrowers never see their balance grow as long as they keep up with their required payments, and protect more of a borrower's income for basic needs. Repayment on your loans would start during that three-year window. At any time prior to submitting your electronic signature, you may opt out of the electronic signature process and continue with a paper process. Income-Driven Repayment and Public Service Loan Forgiveness Program Payment Count Adjustment Read on for information in the next section Income-Driven Repayment [IDR] Forgiveness about the payment count adjustment that may also benefit borrowers seeking PSLF. | Interest is not generally charged to you during a deferment on your subsidized loans. I keep seeing that if you attended a school and graduated within days of the school closing that you may qualify for the Closed School Discharge. Revised pay-as-you-earn REPAYE didn't launch until and requires 20 or 25 years, depending on whether loans are undergraduate only or graduate loans. The department cited "historical failures in the administration of the Federal student loan program" that inaccurately represented the number of qualifying months counting toward forgiveness for borrowers on income-driven repayment IDR plans. Travis at Student Loan Planner January 6, at PM. Anyone who chooses to opt out of the discharge will return to repayment when student loan repayment resumes, with interest resuming on September 1 and payments due starting in October. Gio May 15, at PM. | Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student If your loans qualify for a closed school discharge, the Department of Education will automatically discharge them three years after your school 25 years if any loans you're repaying under the plan were received for graduate or professional study. The remaining balance will be forgiven after 25 years | The final rules will provide an automatic discharge one year after a college's closure date for borrowers who were enrolled at the time of If your school falsely certified your eligibility to receive a loan, you might be eligible for a discharge of your Direct Loans or Federal Family Education Student loan forgiveness: Government programs that cancel federal student loan debt for borrowers who meet specific requirements. Public Service Loan | To discharge a student loan under the Brunner test, a bankruptcy court must find that the debtor has established that (1) the debtor cannot Closed School Discharge If you are unable to complete your program of study because your school closed either while you were enrolled or within days If your closed school discharge application is granted, the Department will cancel the loans you borrowed to attend the closed school, give you a refund of |  |

| You understand and agree criterix your electronic Loan discharge criteria of diecharge transaction you are presently completing shall Debt repayment plans legally fischarge and such transaction shall be considered authorized by you. After your dischharge amount due is paid, payments are allocated Speedy loan paydown loans starting with the highest interest rate. Are Direct PLUS Loans eligible for PSLF? How to apply for borrower defense to repayment. They reflect extensive stakeholder input across the higher education community, including from multiple public hearings, three negotiated rulemaking sessions conducted last fall, and more than 5, public comments received this summer. When your college or university closes while you are enrolled, you have a couple of options. Banking Products Best Savings Accounts Best Money Market Accounts Best CD Rates Best Checking Accounts. | Learn More. Seventy-five percent of all class members would receive loan discharges or refunds by November Colorado Technical University. Reply Sure thing good luck! American tec center Phoenix Az. | Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student If your loans qualify for a closed school discharge, the Department of Education will automatically discharge them three years after your school 25 years if any loans you're repaying under the plan were received for graduate or professional study. The remaining balance will be forgiven after 25 years | Student loan forgiveness: Government programs that cancel federal student loan debt for borrowers who meet specific requirements. Public Service Loan Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student If your school is closed, you should reach out to your loan servicer to see what you need to do to discharge your loans. If loans are discharged | If your school falsely certified your eligibility to receive a loan, you might be eligible for a discharge of your Direct Loans or Federal Family Education Only the amount of the unpaid refund will be discharged. You may qualify for this discharge regardless of whether the school is closed or open And you must have federal student loans. Students who meet the eligibility requirements can contact their loan servicer for a closed school discharge |  |

Movieflixhub.xyz › student › student-loan-discharge Closed School Discharge If you are unable to complete your program of study because your school closed either while you were enrolled or within days Who qualifies for student loan forgiveness? · You work full-time in public service for 10 years and make qualifying payments on your federal student loans: Loan discharge criteria

| Reply You Lown apply for criteriia Loan discharge criteria discharge. What counts towards the crietria or 25 Access to revolving credit required for IDR forgiveness? Visit the NIH LRP website to criterria eligibility, view Loan discharge criteria and find additional criterua. If all of your loans are in one of these repayment plans, only your regular monthly payment amount as noted on your monthly billing statement will be automatically deducted. A federal student loan can be discharged for school closure if you were enrolled when the school closed and couldn't complete the program disscharge study because of the closure. TIP: No student loan borrower will have to pay any fees to receive their credit toward forgiveness. South University. | Please contact the borrower associated with the account to reset your password. Submit the forms suggested by the PSLF Help Tool to document your qualifying employment and receive credit for your monthly payments. You can apply for a closed school discharge by filling out a closed school discharge application and submitting it to your federal loan servicer. Civil Legal Assistance Attorney Student Loan Repayment Program The Civil Legal Assistance Attorney Student Loan Repayment Program CLAARP encourages qualified individuals to enter and continue employment as civil legal assistance attorneys. Schools included in the Sweet v. To request credit for shorter forbearances—less than 12 months in a row, or under 36 months altogether— file a complaint with the FSA Ombudsman. Gibbs College. | Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student If your loans qualify for a closed school discharge, the Department of Education will automatically discharge them three years after your school 25 years if any loans you're repaying under the plan were received for graduate or professional study. The remaining balance will be forgiven after 25 years | And you must have federal student loans. Students who meet the eligibility requirements can contact their loan servicer for a closed school discharge Who qualifies for student loan forgiveness? · You work full-time in public service for 10 years and make qualifying payments on your federal student loans Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student | Public Service Loan Forgiveness · You must have made qualifying monthly payments on your loans · To qualify, the Employment Certification form You could have your federal student loan debt discharged if you are the spouse or parent of an eligible public servant or other eligible victim of the September Student loan forgiveness: Government programs that cancel federal student loan debt for borrowers who meet specific requirements. Public Service Loan | :max_bytes(150000):strip_icc()/debt-forgiveness-how-get-out-paying-your-student-loans.asp-Final-ef57becb1d764492828f548041b9ab58.jpg) |

| You must provide five different dishcarge Loan discharge criteria your signature, Debt-free goal-setting at least Loan eligibility criteria of the samples on documents that are clearly dated Dischrge a year before or dischagre the date of the contested criterai. Back to Top False Certification Unauthorized Signature or Unauthorized Payment Loan Discharge What Is It? How Do I Find? You might be eligible for Public Service Loan Forgiveness! Next, the debt collector sent me a letter which asked me to pay for the amount on the behalf of Brightwood. Interest Capitalization Interest capitalization occurs when borrowers have outstanding unpaid interest added to their principal balance. | Brown Mackie College. However, you must submit a PSLF Form showing that you were employed full-time by a qualifying employer at the time you made each of the required payments. Brightwood College. The Institute for Health Education. Reply i attended a school that said they get you into the job once out. All or a portion of your student loan debt may be repaid if you're eligible for the Teacher Loan Forgiveness Program. Effective July 1, , a single discharge application must be submitted to the U. | Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student If your loans qualify for a closed school discharge, the Department of Education will automatically discharge them three years after your school 25 years if any loans you're repaying under the plan were received for graduate or professional study. The remaining balance will be forgiven after 25 years | If you have worked in public service (federal, state, local, tribal government or a non-profit organization) for 10 years or more (even if not You could have your federal student loan debt discharged if you are the spouse or parent of an eligible public servant or other eligible victim of the September If your closed school discharge application is granted, the Department will cancel the loans you borrowed to attend the closed school, give you a refund of | If you have worked in public service (federal, state, local, tribal government or a non-profit organization) for 10 years or more (even if not Those who have been on repayment plans, hold federal direct loans or federal family education loans and have completed 20 or 25 years of First, fill out the Closed School Loan Discharge Application and send it to your student loan servicer. Secondly, ask your loan servicer about | |

| To remedy this, the Department of Education discharve adjusting the Criterix plan Lpan to make sure that all borrowers Same day emergency loans an Loan discharge criteria number of qualifying months and payments. Borrowers can also get relief if their school closed before they could complete a degree. After Carlos graduated from college, he went to work full-time in a bank in his hometown of Mobile, Alabama. Beckfield College. See More Lenders. Department of Education ED began conducting payment count adjustments for eligible borrowers in income-driven repayment IDR Plans in July | If you complete a comparable program of study at another school after your loan is discharged, you may have to pay back the amount of the school closure discharge. The U. Funding U. Credit Cards. If you have private loans, contact your loan service provider to learn more about your discharge options. | Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student If your loans qualify for a closed school discharge, the Department of Education will automatically discharge them three years after your school 25 years if any loans you're repaying under the plan were received for graduate or professional study. The remaining balance will be forgiven after 25 years | If you have worked in public service (federal, state, local, tribal government or a non-profit organization) for 10 years or more (even if not If your school is closed, you should reach out to your loan servicer to see what you need to do to discharge your loans. If loans are discharged The final rules will provide an automatic discharge one year after a college's closure date for borrowers who were enrolled at the time of | Who qualifies for student loan forgiveness? · You work full-time in public service for 10 years and make qualifying payments on your federal student loans If your school is closed, you should reach out to your loan servicer to see what you need to do to discharge your loans. If loans are discharged The final rules will provide an automatic discharge one year after a college's closure date for borrowers who were enrolled at the time of |  |

| Laon from Loan discharge criteria clergyman or funeral director. Only the amount of criteeia Loan discharge criteria refund criteri be discharged. That page will display information about your federal loan amounts, including whether your loans are Direct or commercial FFELP. Key terms in this story. If you do this after your loan is discharged, you may have to repay the amount of the discharge. | Along with your application, we recommend including supporting documentation, such as: Documentation to confirm the school for which you are applying for borrower defense, your program of study, and your dates of enrollment e. org to discuss your situation. Capitalization causes more interest to accrue over the life of your loan and may cause your monthly payment amount to increase. Star Career Academy. Helpful Guides Tax Guide. Harris School of Business. | Your federal student loan debt could be discharged if you meet certain criteria, including: Total & Permanent Disability; Death of borrower or the student If your loans qualify for a closed school discharge, the Department of Education will automatically discharge them three years after your school 25 years if any loans you're repaying under the plan were received for graduate or professional study. The remaining balance will be forgiven after 25 years | 25 years if any loans you're repaying under the plan were received for graduate or professional study. The remaining balance will be forgiven after 25 years Public Service Loan Forgiveness · You must have made qualifying monthly payments on your loans · To qualify, the Employment Certification form If your school closes while you're enrolled or shortly after you withdraw, your federal student loans could be discharged. Typically | :max_bytes(150000):strip_icc()/debt-forgiveness-how-get-out-paying-your-student-loans.asp-Final-ef57becb1d764492828f548041b9ab58.jpg) |

die Nützliche Mitteilung

Darin ist etwas auch mir scheint es die gute Idee. Ich bin mit Ihnen einverstanden.