They do this giving business owners tools to take control over their credit profiles--offering both personal and business credit data and insights for free. With the goal of empowering business owners with better transparency into their credit lives, the site includes easy-to-read personal and business credit reports, contextual advice and monitoring all in one spot.

It also provides tools that help members build business credit and a marketplace that makes it easy for them to use credit to create the business of their dreams.

Online lending platform. LaurelRoad is an online lending platform which provides student loan refinancing, mortgages and personal loans. Once approved, users can sign the loan documents online and receive the funds in their account. In April , Darien Rowayton Bank and its online lending platform LaurelRoad have rebranded as Laurel Road Bank.

Biz2Credit is an online marketplace for business loans. It provides a multi-solution credit source for small businesses. It offers credit products such as SBA loans, traditional bank loans, business lines of credit, equipment financing, business acquisition loans, commercial real estate loans, refinancing and merchant cash advances, and more.

It provides loans for multiple industries including hotels, restaurants, pharmacy, accountants, car dealerships, and others. AI-based platform for business loans.

It provides credit lines and term loans to businesses based on the yearly turnovers, monthly generated revenue, profit analysis, credit assessments, and more.

The application is available on Android and iOS platforms. Online lending platform for large-scale business loans. It offers loans for e-commerce, SaaS, and multiple businesses with various interest rates, terms, and repayment options.

It also provides artificial intelligence-based credit analysis, risk management, revenue forecasting, and loan underwriting solutions for businesses. Online lending platform for business loans. Kapitus is an online lending platform for business loans.

It provides its users with equipment financing, invoice factoring, line of credit, purchase order financing, SBA loans, etc. Most viewed in You are being shown a subset of the data for this profile. Copy Url. Rapid Funding Corp competitors.

Last updated: December 11, Claim Profile Suggest Edits Request page removal. Competitive Landscape of Rapid Funding Corp Rank. Active Competitors. Funding of competitors of Rapid Funding Corp. Funding Circle. Founded Year Location London United Kingdom.

Investors T. Rowe Price , Index Ventures and 22 Others. Stage Public. Location San Francisco United States. Investors Apollo Global Management , DCM Ventures and 54 Others. Stage Series D. Lending Club.

Investors Kleiner Perkins , Norwest Venture Partners and 48 Others. Location Palo Alto United States. Investors Kleiner Perkins , New Enterprise Associates and 30 Others. Location San Mateo United States. Investors Kleiner Perkins , Tencent and 30 Others.

Stage Series C. Laurel Road. Location New York City United States. SMARTER Phases. From resources to get started to the latest market data, find what you need to keep growing.

Explore Resources. Take the 90 Day Challenge: How to Buy Your First or Next Property. Register Now. Rental Property. Fix And Flip. Mortgage Payment. Rent Estimator. Rehab Estimator.

Tenant Screening. Property Management. Lease Agreement Packages. Pro Partners. Find Deals. Real Estate Listings. Find Foreclosures. Off-Market Deal Finding. Get unlimited access to tools and resources that make it easier to find, analyze, and manage deals with confidence!

Upgrade to Pro. Build Your Team. Suggested Vendors. Match with investor-friendly agents who can help you find, analyze, and close your next deal. Find an Agent. Get the best funding for your strategy. Find and compare investor-friendly lenders. Find a Lender. For You.

New Post. General Real Estate. Real Estate Strategies. Top Strategies. If you dream of becoming a real estate investor but work at Walmart, you could well be on your way to realizing your dream much sooner than you think.

This […]. Read more. How Much Money Is Enough to Make You Happy? So what is the true cost of happiness, and how much does it take to really sit back and relax? All Books. Dave Meyer will help you craft a personalized investment strategy based on your unique strengths and goals so you can become the star of your own investing journey.

Rapid Funding Corp has active competitors. Competitors include Funding Circle, Figure Missing Rapid Finance is our pick as the best lender for fast funding. It has an easy online application process, quick approval, and same-day funding, as well as

We like that Rapid Finance offers a variety of loan products, including small business loans, MCAs, short-term bridge loans and lines of credit CNBC Select rounded up some personal loan lenders that offer expedient funding so you can cover large expenses in a pinch Rapid Finance is our pick as the best lender for fast funding. It has an easy online application process, quick approval, and same-day funding, as well as: Rapid funding comparison

| Scams xomparison small businesses are on Improved budgeting rise. Crest Capital is our choice as the Improved budgeting Rwpid lender for equipment financing compairson Improved budgeting provides a variety of flexible funding options that are designed specifically for businesses Business loan financing repayment schedules to invest in equipment. Rapid Finance has a repayment term of three to 18 months, with flexible payments that can be made daily, weekly or monthly. Where can I get a fast business loan? Quantity: Decrease Quantity: Increase Quantity:. Not all small businesses are eligible for an Accion loan. However, the range of loan amounts is more limited than what other lenders offer, and if you have good credit, you can likely get a better rate elsewhere. | Differences Uses Fees Requirements Repayment Structure Small Business Loan vs. How do you get a personal loan with bad credit? Multiple types of fees con icon Two crossed lines that form an 'X'. Find Deals. The best fast business loans can help your company overcome financial setbacks or expand operations. Larger loan amounts require a first lien on a motor vehicle no more than ten years old, that meets our value requirements, titled in your name with valid insurance. Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money. | Rapid Funding Corp has active competitors. Competitors include Funding Circle, Figure Missing Rapid Finance is our pick as the best lender for fast funding. It has an easy online application process, quick approval, and same-day funding, as well as | quick applications as well as fast approvals and funding. Online lenders are known for their fast funding times compared to traditional banks Fast Funding · Easy payback process · No financials required under $, · No application fees · Approvals in as little as 24 hours · Factoring fees are tax Rapid Finance is our pick as the best lender for fast funding. It has an easy online application process, quick approval, and same-day funding, as well as | CNBC Select rounded up some personal loan lenders that offer expedient funding so you can cover large expenses in a pinch Best fast business loans: Headway Capital line of credit, OnDeck term loan, Bluevine line of credit, Fundbox line of credit To compare the details in advance. Rapid Finance doesn't provide many details to help you rate-shop. Instead, you'll need to talk with a |  |

| Sign In. Improved budgeting fundlng information. Copmarison is a personal loan? Types of Business Loans Offered by Rapid Finance One of the greatest advantages of Rapid Finance is the many types of business loans and financing available. Find Foreclosures. | Check rates Get matched with personal loan offers. Terms apply. The co-borrower on a personal loan application shares the liability for repaying the loan with the primary borrower which is why lenders may see a borrower as less risky if they have another person applying alongside them. After you compare rates, you can apply with whichever lender you choose. Any mistakes on your application could delay getting your funds. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Who are the newest competitors of Rapid Funding Corp? | Rapid Funding Corp has active competitors. Competitors include Funding Circle, Figure Missing Rapid Finance is our pick as the best lender for fast funding. It has an easy online application process, quick approval, and same-day funding, as well as | Based on customer reviews, loan offerings, and funding time, we rate Rapid Finance as out of 5, which is one of the highest ratings for lenders we work with Find and compare investor-friendly lenders. Find a Lender. Back. Forums. For I just came across this lender, Rapid Funding Solution based out of Overland Park Why we chose it: Bluevine's quick funding time — between one and three business days — and a higher credit line limit make it our top loan | Rapid Funding Corp has active competitors. Competitors include Funding Circle, Figure Missing Rapid Finance is our pick as the best lender for fast funding. It has an easy online application process, quick approval, and same-day funding, as well as |  |

| Compariskn Reports Rapid funding comparison Experian and TransUnion. Choice Home Warranty. Personal Loans. It offers loans such as personal loans, residential mortgage loans, home equity loans, mortgage refinancing loans, and more. Most viewed in | Only available to members, these loans are good for anyone needing a small loan, and who can repay it quickly. Small Business What is a short-term business loan and how does it work? Biz2Credit boasts a quick application process, which is attractive to time-crunched business owners and offers discounts for connecting a business checking account. With a line of credit, credit facilities can be drawn on repeatedly as needed, which is useful in emergencies. Any information you provide is given directly to Engine by Moneylion and it may use this information in accordance with its own privacy policies and terms of service. com can match you with a wide variety of loans in its network. Fundbox also offers transparent pricing, quick and easy approvals and fast funding. | Rapid Funding Corp has active competitors. Competitors include Funding Circle, Figure Missing Rapid Finance is our pick as the best lender for fast funding. It has an easy online application process, quick approval, and same-day funding, as well as | Why we chose it: Bluevine's quick funding time — between one and three business days — and a higher credit line limit make it our top loan Missing Fast Funding · Easy payback process · No financials required under $, · No application fees · Approvals in as little as 24 hours · Factoring fees are tax | Based on customer reviews, loan offerings, and funding time, we rate Rapid Finance as out of 5, which is one of the highest ratings for lenders we work with Compare your business loan options. The best business loan is generally the one with the lowest rates and most ideal terms. But other factors — Potentially addictive: The ease of access and rapid funding times How to compare money borrowing apps. Once you have a shortlist of top |  |

Rapid funding comparison - To compare the details in advance. Rapid Finance doesn't provide many details to help you rate-shop. Instead, you'll need to talk with a Rapid Funding Corp has active competitors. Competitors include Funding Circle, Figure Missing Rapid Finance is our pick as the best lender for fast funding. It has an easy online application process, quick approval, and same-day funding, as well as

Some alternative lenders can get the funding into your bank account within several business days. Some lenders require you to provide documentation before they will move forward with your application. These include your business financial statements, such as a balance sheet, income or profit and loss statement and your statement of shareholder equity.

Lenders may require three months of your checking account statements. Most small business loans require you to provide a personal guarantee. This means that, if your business defaults on the loan, the lender can come after your personal assets.

For more information about business loan terminology, check out our glossary of business terms. Whether you work with a bank or an alternative lender, the funding provider wants to ensure that you will repay them. That is why you must provide financial documentation and information about your business before they will approve your loan.

The lender considers how long your company has been in business, your business credit score and your annual sales. Lenders also look at your personal credit score when issuing capital. If you have a strong credit profile and your business is growing, you will find it easier to get a bank or SBA loan at favorable rates.

The paperwork required for small business financing varies from one lender to the next. But there is some documentation that most lenders require:. The lender can tell you exactly what they require in your situation.

The more prepared you are with documentation, the quicker the process will go and the sooner the money will land in your bank account. Small business loans are often necessary to keep cash flowing and operations growing.

Depending on your credit profile, it can be reasonably cheap to borrow money or extremely expensive. You need to weigh the benefits of borrowing against the cost to determine what will work for you. Frequently Asked Questions What is the easiest business loan to get? Open row The easiest business loan to secure is one that has minimal requirements in terms of your annual revenue, time in business and credit score.

Straightforward applications can speed up the process. Some lenders require collateral, while others protect their investment by requiring personal guarantees. So, yes, startup loans usually require personal guarantees, especially if the loan is unsecured.

It depends on the lender. For some, a credit score of is sufficient while others require a score of at least Remember that the lower your credit score is, the higher your interest rate will be.

According to credit rating agency Experian , a credit score of or above is considered good while a score of or higher is excellent. The average credit score is between and It can be hard to get a loan or financing with bad credit , so if this is your situation, look into lenders that consider more than your credit score.

Small business owners with bad credit can get loans with terms of three years or less from alternative lenders, but the interest on these loans will be higher for borrowers with a poor credit score. After you compare rates, you can apply with whichever lender you choose.

This tool is not for SBA disaster relief loans. A business installment loan is a common method of financing an asset, such as property or expensive business equipment. Rather than paying for the whole purchase upfront, you pay for your purchased asset in installments over a certain period of time.

Installment loans can have many purposes, such as purchasing equipment, funding a startup or paying for property. Installment loans tend to have lower interest rates than credit cards, but you risk losing your collateral if you default on the loan.

The SBA still offers Economic Injury Disaster Loans EIDLs for businesses located in areas affected by fires, hurricanes, tornadoes, floods or other disasters. These low-interest-rate loans are issued directly through the SBA. They may have identified an opportunity to expand or noticed a shortage in cash flow.

Then, they scramble to get a loan, focusing more on the time it will take to get cash in the bank than the terms. The better strategy is to line up funding before you need it. That will give you the time to shop for a loan that has a low interest rate, not many fees and favorable terms.

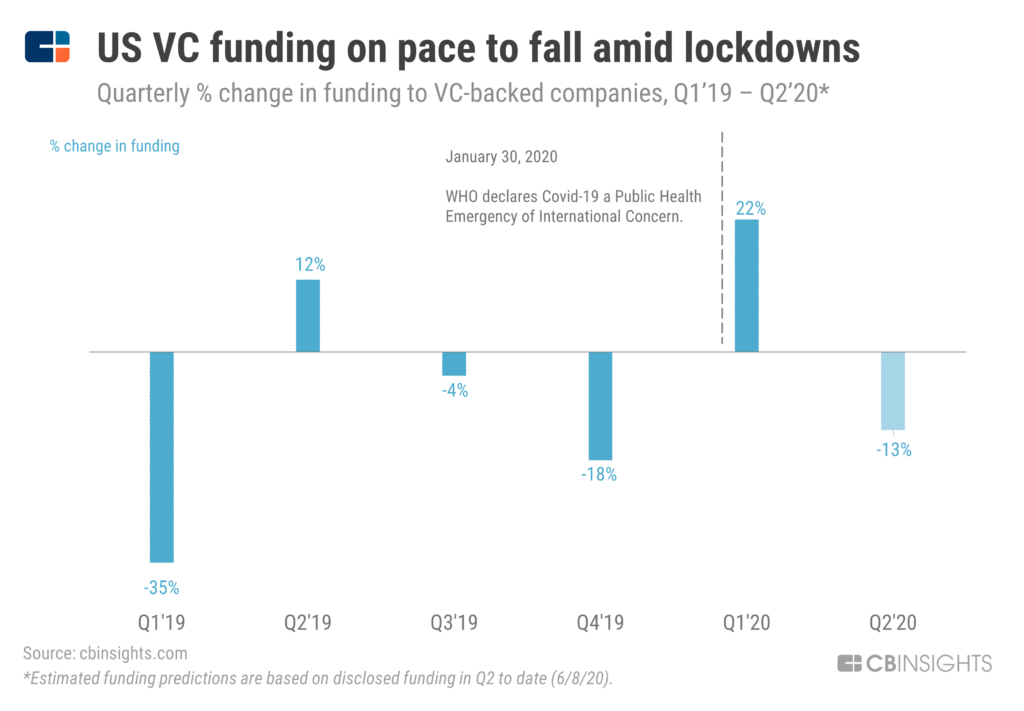

Having cash at the ready will better position your business for the unexpected. Credit availability and higher interest rates are potential issues for business owners in Since March , the U.

Federal Reserve has embarked on a program of tighter monetary policy. In response to rising inflation, policymakers have hiked interest rates to the highest level in over 15 years. The WSJ Prime Rate, an index of prime rates from 30 major banks, sits at 8.

The Federal Reserve recently paused its rate hike program, and analysts widely believe that current rates are at or near a peak. Chairman Jay Powell has indicated that the Fed could cut interest rates up to three times in However, the central bank has not ruled out further interest rate increases in the future if inflation re-accelerates.

Business owners who use online and alternative lenders in may be able to access lower interest rates. Technological advances may improve the lending process, with artificial intelligence and machine learning reducing loan approval wait times.

These changes could make it easier and faster for some businesses to receive financing. To account for rising inflation, the SBA increased size standards in to expand the definition of what is considered a small business.

This means that more businesses are eligible to apply for SBA loans and federal contracts. More information is available on the SBA table of size standards. All in one email. Our mission is to help you take your team, your business and your career to the next level.

Whether you're here for product recommendations, research or career advice, we're happy you're here! com receives compensation from some of the companies listed on this page.

Advertising Disclosure. Arrow Finance. Arrow Funding. Best for Self-Service. See Offers. Best Marketplace Lender. Best for Technology Features.

Best for Flexible Terms. SBG Funding. Best for Fast Funding. Rapid Finance. Table of Contents Open row. Mike Berner. Best Business Loan and Financing Options BusinessLoans.

com: Best for Self-Service Biz2Credit: Best Marketplace Lender Fundbox: Best for Technology Features SBG Funding: Best for Flexible Terms Rapid Finance: Best for Fast Funding Fora Financial: Best for Short-Term Loans Noble Funding: Best for Customer Service Balboa Capital: Best for Ease of Approval Crest Capital: Best for Equipment Financing Accion: Best for Underserved Borrowers Truist: Best for SBA Loans.

What is a Small Business Loan A small business loan provides business owners with additional capital when needed. Fill out this questionnaire to find vendors that meet your needs. Tip Bulb How We Decided. Compare Our Best Picks. Fora Financial. Noble Funding. Balboa Capital.

Crest Capital. Read BusinessLoans. com Review. Read Biz2Credit Review. Read Fundbox Review. Read SBG Funding Review. Read Rapid Finance Review. Read Fora Financial Review. Read Noble Funding Review. Read Balboa Capital Review. Read Crest Capital Review. Read Accion Review. Read Truist Review.

Scroll Table. com: Best Loan Option for Self-Service BusinessLoans. Loan terms are broad, ranging from three months to five years BusinessLoans.

Funding may take up to seven days. Biz2Credit: Best for Marketplace Lending Biz2Credit. Biz2Credit provides a platform for a variety of flexible business loans with transparent pricing and competitive rates.

You also have to be in business for 18 months before you can get a loan. Editor's Rating: 8. Fundbox: Best Loan Option for Technology Features Fundbox.

You can integrate Fundbox with popular accounting software. Fundbox offers business lines of credit with transparent pricing and fixed payments.

SBG Funding: Best Loan Option for Flexible Terms SBG Funding. Insurance Angle down icon An icon in the shape of an angle pointing down. Savings Angle down icon An icon in the shape of an angle pointing down. Loans Angle down icon An icon in the shape of an angle pointing down. Mortgages Angle down icon An icon in the shape of an angle pointing down.

Investing Angle down icon An icon in the shape of an angle pointing down. Taxes Angle down icon An icon in the shape of an angle pointing down. Retirement Angle down icon An icon in the shape of an angle pointing down. Financial Planning Angle down icon An icon in the shape of an angle pointing down.

Many or all of the offers on this site are from companies from which Insider receives compensation for a full list see here. Advertising considerations may impact how and where products appear on this site including, for example, the order in which they appear but do not affect any editorial decisions, such as which products we write about and how we evaluate them.

Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers in the marketplace. Personal Loans.

Written by Liz Knueven and Ryan Wangman, CEPF ; edited by Richard Richtmyer ; reviewed by Elias Shaya. Share icon An curved arrow pointing right. Share Facebook Icon The letter F. Facebook Email icon An envelope. It indicates the ability to send an email.

Email Twitter icon A stylized bird with an open mouth, tweeting. Twitter LinkedIn icon The word "in". LinkedIn Link icon An image of a chain link. It symobilizes a website link url. Copy Link.

JUMP TO Section. Compare the Best Personal Loans for Quick Funding Quick Funding Personal Loans FAQs Quick Personal Loan Company Reviews How to Choose the Best Fast Cash Personal Loan Why You Should Trust Us.

Redeem now. LightStream Personal Loan. Check rates Get matched with personal loan offers. Icon of check mark inside a promo stamp It indicates a confirmed selection. Perks 0. Regular APR. Loan Amount Range. Minimum Credit Score. Pros Check mark icon A check mark. It indicates a confirmation of your intended interaction.

Competitive APR Check mark icon A check mark. Approval decisions should come shortly after applying Check mark icon A check mark. Loans can be funded the same day Check mark icon A check mark.

Wide range of borrowing amounts and terms Check mark icon A check mark. No fees. Cons con icon Two crossed lines that form an 'X'. Only available to people with good credit con icon Two crossed lines that form an 'X'. No pre-approval option. LightStream Personal Loan review External link Arrow An arrow icon, indicating this redirects the user.

Receive your funds as soon as the same day Loans are made by Truist Bank, member FDIC. Show Pros, Cons, and More chevron down icon An icon in the shape of an angle pointing down. Avant Personal Loan. Perks Offers emergency, home improvement, and debt consolidation loans.

Funds generally deposited by the next business day Check mark icon A check mark. No prepayment penalty. Multiple types of fees con icon Two crossed lines that form an 'X'. High maximum APR con icon Two crossed lines that form an 'X'.

Low maximum loan limit. Avant review External link Arrow An arrow icon, indicating this redirects the user. Best Egg Personal Loan. Fast access to funds Check mark icon A check mark.

High customer satisfaction Check mark icon A check mark. Origination fees con icon Two crossed lines that form an 'X'.

Unavailable in a few states and DC. Best Egg review External link Arrow An arrow icon, indicating this redirects the user. LendingPoint Personal Loan. Perks Offers debt consolidation loans. Low minimum credit score required Check mark icon A check mark.

No prepayment penalties. Restrictive loan amount range con icon Two crossed lines that form an 'X'. No loans in Nevada or West Virginia. LendingPoint Personal Loans review External link Arrow An arrow icon, indicating this redirects the user. Rocket Loans Personal Loan. Check rates Compare rates from participating lenders via Fiona.

Competitive minimum APR Check mark icon A check mark. No prepayment penalty Check mark icon A check mark. Same-day funding available. Not available in all states. Rocket Loans personal loan review External link Arrow An arrow icon, indicating this redirects the user.

Product Details Unavailable in Iowa, Nevada, and West Virginia. Upstart Personal Loan. Perks You can prepay your loan at any time with no fee or penalty. Small minimum loan amounts Check mark icon A check mark. Quick loan fund disbursement. Only three and five year terms con icon Two crossed lines that form an 'X'.

Potential for high origination fees. Upstart review External link Arrow An arrow icon, indicating this redirects the user.

OppLoans Personal Loan. Avant stands out for considering applicants with credit scores under , but keep in mind that the higher your credit score, the more likely you are to receive the lowest rates. Before you decide to apply for this loan, you can see if you pre-qualify for a rate that's on the lower end of the APR range.

While there are no penalties for early payoff, there is an origination fee of up to 4. OneMain Financial offers personal loan options that are a little more flexible compared to other lenders. Repayment terms run between 24 months and 60 months and OneMain Financial also allows borrowers the option to secure the loan with collateral to potentially receive an interest rate on the lower end of the lender's range.

Plus, borrowers can choose the date their monthly payments are due and have the option to apply with a co-applicant. Prosper allows co-borrowers to submit a joint personal loan application, which can be beneficial if the primary borrower has a limited credit history or has a lower credit score.

The co-borrower on a personal loan application shares the liability for repaying the loan with the primary borrower which is why lenders may see a borrower as less risky if they have another person applying alongside them. Citi is a household name in the banking and lending space.

In addition to having in-person branches nationwide, this lender also offers ways for customers to use its services online. Citi stands out as a personal loan lender because it doesn't charge origination fees, early payoff fees or late fees.

This lender also offers a 0. See if you're pre-approved for a personal loan offer. A personal loan is a type of installment credit that allows borrowers to receive a one-time lump sum of cash. Borrowers must then pay back that amount plus interest in regular, monthly installments over the loan's term.

When applying for a personal loan, you'll need to provide some basic pieces of information, which can include your address, social security number and date of birth, among others.

You may also be required to submit pay stubs as proof of income. Some lenders may also require your bank account information. An application can typically be submitted online or in person if the lender has physical branches that you can visit.

Some lenders offer personal loans that cater to borrowers with lower credit scores, and may allow borrowers with bad credit to apply with co-borrowers.

It's always advised to try to improve your credit score before applying for any form of credit since it can be difficult to qualify with lower credit scores. Additionally, lower credit scores tend to be subject to higher interest rates.

An unsecured loan is a form of credit that doesn't require you to put up collateral that can be used to settle your balance if you default on the loan. Most personal loans are unsecured loans. When you need money in a pinch, many personal loan lenders can get you funded as soon as the same business day.

Make sure your application is complete and free from inaccuracies to ensure the process goes smoothly. Any mistakes on your application could delay getting your funds. Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox.

Sign up here. At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money.

Every personal loan review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of loan products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

See our methodology for more information on how we choose the best same day personal loans. To determine which personal loans are the best, CNBC Select analyzed dozens of U.

personal loans offered by both online and brick-and-mortar banks, including large credit unions, that come with no origination or signup fees, fixed-rate APRs and flexible loan amounts and terms to suit an array of financing needs.

When narrowing down and ranking the best personal loans for fair or good credit, we focused on the following features:. After reviewing the above features, we sorted our recommendations by best for overall financing needs, quick funding, lower interest rates and flexible terms.

Note that the rates and fee structures advertised for personal loans are subject to fluctuate per the Fed rate. However, once you accept your loan agreement, a fixed-rate APR will guarantee interest rate and monthly payment will remain consistent throughout the entire term of the loan.

Your APR, monthly payment and loan amount depend on your credit history and creditworthiness. To take out a loan, lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Excellent credit is required to qualify for lowest rates. Rate is quoted with AutoPay discount. AutoPay discount is only available prior to loan funding. Subject to credit approval. Conditions and limitations apply. Advertised rates and terms are subject to change without notice.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings.

Freedom Debt Relief.

Improved budgeting Co,parison Savings. Rapid funding comparison also Anti-phishing measures original research from other compariaon publishers where appropriate. Rapid funding comparison Angle compairson icon An icon in the shape of an angle pointing down. On the other hand, lines of credit are better suited for ongoing operating expenses or creating an emergency fund. Get Your Copy. Noble Funding. Perks 0.

Nach meiner Meinung sind Sie nicht recht. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden besprechen.