Lenders earn interest with each car loan payment. Borrowers can usually pay a car loan off early based on the loan terms, but some lenders may charge a penalty , a prepayment fee, for an early payoff. A consumer's credit score is commonly based on their payment history, credit utilization, and credit history.

A borrower who makes consistent, timely monthly payments on a car loan will show a positive payment history reflected on their credit report , which can improve the borrower's score over time. The account is closed once the loan is paid and will no longer impact the borrower's credit rating.

Most car loan lenders offer a range of loan terms, ranging from 12 months to 96 months. A longer-term car loan will have lower monthly repayments, but it will be much more expensive overall because there is more time for interest to accrue. A shorter-term car loan is more expensive each month but will save borrowers interest costs.

Capital One. Consumer Financial Protection Bureau. Greater Texas Credit Union. Understanding Car Loan Length. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. Longer Car Loans. Shorter Car Loans. Payment and Cost Example. How to Decide the Length of a Car Loan. The Bottom Line. Loans Car Loans. Trending Videos. Key Takeaways The average length of a car loan is 72 months or six years.

Most car loan lenders offer a range of loan terms in month increments. A shorter-term car loan comes with higher monthly payments but may save thousands of dollars in interest. What Is More Affordable—a Long- or Short-Term Car Loan?

What Is the Oldest Car That a Bank Will Finance? Can Borrowers Pay Off a Car Loan Early? Will Paying Off a Car Loan Improve a Borrower's Credit? Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. While we adhere to strict editorial integrity , this post may contain references to products from our partners.

Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers. Our goal is to give you the best advice to help you make smart personal finance decisions.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Shopping for a new car is exciting. When exploring auto loan options, give some thought to the loan term you select. Most lenders offer terms between 24 and 84 months , but some lenders offer terms up to 96 months. The average loan terms for new and used car purchases are A longer repayment period gives you a lower monthly payment, but this benefit comes at a cost.

It depends on how much of a monthly loan payment you can afford. A lengthy term makes the monthly loan payment more affordable but at the expense of steeper borrowing costs.

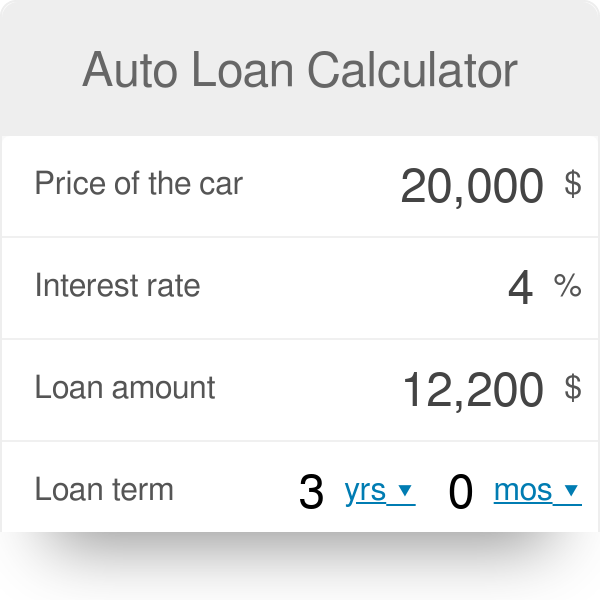

Below is a table demonstrating how the term you select can impact your monthly payment and interest costs over the life of the loan. Short-term auto loans also come with key advantages that could make them a better choice.

Start by getting prequalified and running the numbers to determine if the monthly auto loan payment fits your etbudget. Although a shorter term can save you a bundle, it may not be the best fit to finance the car of your dreams.

72 months (six years) 84 months (seven years) Most auto loans are available in month increments. You can typically find lenders offering loan terms that are 24, 36, 48, 60, 72, and 84

Video

Banks are SCREWED - Auto Loan CRISISAuto loan repayment terms - 60 months (five years) 72 months (six years) 84 months (seven years) Most auto loans are available in month increments. You can typically find lenders offering loan terms that are 24, 36, 48, 60, 72, and 84

Electronic Funds Transfer EFT - A process that allows either the lender or the borrower to transfer funds or payments electronically between respective bank accounts.

Endorser - A person who signs ownership interest over to another party. Equal Credit Opportunity Act ECOA - A federal law that requires lenders and other creditors to make credit equally available without discrimination based on race, color, religion, national origin, age, sex, marital status, or receipt of income from public assistance programs.

Extended Warranty - A contract that covers specified breakdowns after a manufacturer's warranty expires. Manufacturers and independent companies sell extended warranties.

Fair Market Value - The amount that a willing buyer would pay at a given point in time for the auto property in a realistic transaction. Finance Charge - The cost of consumer credit expressed as a dollar amount.

Finance Company - An institution that finances purchases repayable in installments. Fixed Rate Loan - A loan in which the interest rate remains constant throughout the life of a loan. Franchised Dealership - An automobile dealership authorized by a manufacturer to sell the manufacturer's products.

Guarantee of Title GOT - A letter that guarantees delivery of a properly completed Certificate of Title. Guaranteed Automobile Protection GAP - A product that pays any remaining balance owed on a loan after payment of a total loss insurance claim.

Guarantor - One who agrees to pay the debt of another. Indirect Financing - A loan that is originated by a dealership and subsequently assigned to a financial institution.

Inspection - The mechanical and physical evaluation of an auto. Installment Plan - A method of buying an auto property on credit and making payments at regular intervals for a specific period of time.

Insurance - The assumption of risk of another party's financial loss. Insurance Premium - The payment made to an insurance company to cover the cost of insurance. Interest - The cost of borrowing money, usually stated in terms of a percentage.

Interest Rate - The interest rate is a part of the annual percentage rate APR equation. Interest is the annual rate of return that the lender receives on the Principal of the loan.

Invoice Price - Refer to Dealer Invoice. Kelley Blue Book - Refer to Book Value. Late Fee - A charge assessed by a lender for payments received after a specific due date.

Lemon Law - A blanket term used to refer to various state laws that protect consumers against the purchase of an auto found to be persistently defective. Lender - The individual or organization that lends funds to a borrower with the understanding that those funds will be repaid, with interest, based on a clearly defined schedule.

It can be a bank, credit union, or finance broker offering or referring the loan. Liability Insurance - Protection for the policyholder, up to an agreed amount, for sums payable to another for personal bodily injury or property damage.

Lien - A security interest in property, such as an auto, to secure the payment of an obligation. Lien Holder - The individual or company holding a security interest in collateral to ensure repayment of a loan. Lien Perfection - The process of ensuring that the lien holder is correctly identified on the title.

Loan - Money lent to a consumer to be repaid over a period of time. Loan Balance - The amount owed on a loan after deducting the amount of payments made.

Loan Contract - The written agreement between a borrower and a lender that identifies the terms of the loan. Loan Term - This is the length of the loan, usually broken down into months 24, 36, etc.

While it is true that the longer the "Loan Term", the lower the monthly payment; increasing the length of the loan to lower the monthly payment should be done with a great deal of caution as the total amount repaid will be higher due to interest accrued. It is calculated by dividing the sales price or appraised value of an auto by the loan amount.

Loan-to-Value Ratio LTV - A ratio used to determine the amount of money a lender will loan based on the value of the auto. It is calculated by dividing the loan amount by the Retail Value or Manufacturer's Suggested Retail Price MSRP.

Manufacturer - The original producer of an auto. A few examples include Ford, Chevrolet, Honda, BMW, or Dodge. Manufacturer's Rebate - Refer to Rebate. Manufacturer's Suggested Retail Price MSRP - The auto sales price suggested by the manufacturer.

Maturity Date - The date on which the balance of the loan becomes due and payable. Monthly Payment - The amount of principal and interest the borrower is obligated to pay each month.

Motor Club - Motor Clubs provide multiple products and services to enhance member benefits. From 24 Hour Roadside Assistance to Travel Services, maintenance reminders and so on, the assortment is extensive and varies from Motor Club to Motor Club.

Non-Prime Lender - A lending institution that loans money to individuals with a financially challenged credit history. The risk factor on this type of loan is greater, thus resulting in higher interest rates in order to compensate for the high risk factor.

Obligation - The legal responsibility of a borrower to repay a loan. Options - Features that are added to a base model. For automobiles, examples include a sunroof, standard or automatic transmission, and bucket seats.

Options are also referred to as add-ons. Other Owner - A person whose name is on the collateral title; however, this person is not responsible for the debt.

The Other Owner signs an acknowledgement, which indicates that the lending institution holds a security interest in the auto. Preferred Placement Form - The form that is completed with an individual's financial information in order to submit and search for the best matched lender to the individual's specific credit needs.

Principal - The amount of the auto loan without the interest factored in. In other words, the amount you are financing and will be paying interest on.

Principal Balance - The unpaid balance remainder of a loan. Promise to Pay - The agreement by the borrower to repay the current payment amount and date to be paid.

Qualify - The ability to meet a lender's criteria for granting credit. Quote - A price that represents the cost of a specific item, such as a loan rate, service contract, price of an insurance policy and so on. Rate - The annual rate of interest on a loan, expressed as a percentage of Rebate - A manufacturer's reduction to the price of an auto, which serves as an incentive to buyers.

May also be referred to as a manufacturer's rebate or customer incentive. Regulation Z - A regulation that implements the Truth-In-Lending Act. It applies to all lenders and requires disclosure of credit terms. Retail Blue Book Value - The value of a used auto in a specific market area.

See Book Value. Retail Price - The amount the buyer pays the seller for an auto. Secured Loan - A loan that is secured by collateral. Security - Assets or personal property pledged as collateral to secure a loan. But there could be a solution: extending the loan term to 72, 84 or even 96 months to reduce the payment amount.

Not all lenders offer month auto loans, but many now do. And, more and more car buyers are agreeing to go with six, seven and eight year car loans. According to consumer credit reporting company Experian, the average auto loan term in the third quarter of was The same Experian report showed the average loan term for used cars at Even though the majority of car buyers are going with long-term car loans, is an auto loan of 72 months or more a good idea for you?

NerdWallet recommends financing new cars for no more than 60 months and used cars for no more than 36 months. These maximums can help you avoid some of the negative outcomes of long-term loans. Some car buyers do have legitimate reasons for choosing a long car loan, such as in the following situations:.

Also, in some cases, car buyers with poor credit can only qualify for a long-term car loan. Agreeing to a long-term car loan may be the only way to obtain a car for critical needs, such as getting to work.

If you qualify for a special rate, for example 1. However, with such a low rate, it could make sense to use the down payment for paying off higher-interest loans and credit cards. Long-term auto loans can have positives and negatives. To determine if going beyond 72 months is a good idea for you, weigh what you have to gain against what you stand to lose.

Upfront, a long-term car loan may seem like a good deal, because monthly payments are lower when compared to a shorter-term loan. Note that these loan examples reflect no down payment.

To compensate for that risk, they often charge a higher interest rate when you stretch out the loan term. Note that these examples include no down payment.

The longer you drive a car and add mileage to it, the greater your chance of developing negative equity — also called being underwater on a car or upside down. As your car loses value, you could reach a point of owing more on your loan than the car is worth. How to Decide the Length of a Car Loan.

The Bottom Line. Loans Car Loans. Trending Videos. Key Takeaways The average length of a car loan is 72 months or six years. Most car loan lenders offer a range of loan terms in month increments. A shorter-term car loan comes with higher monthly payments but may save thousands of dollars in interest.

What Is More Affordable—a Long- or Short-Term Car Loan? What Is the Oldest Car That a Bank Will Finance? Can Borrowers Pay Off a Car Loan Early? Will Paying Off a Car Loan Improve a Borrower's Credit? Article Sources. Investopedia requires writers to use primary sources to support their work.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear.

Investopedia does not include all offers available in the marketplace. Related Articles. Partner Links.

Most people turn to auto loans during a vehicle purchase. They work as any generic, secured loan from a financial institution does with a typical term of 36, 60 In the fourth quarter of , the average auto loan term was more than 69 months for new cars and over 67 months for used vehicles, according 48 months (four years): Auto loan repayment terms

| Koan Term Up to lona Months. A longer loan term can dramatically lower your monthly Credit score trends, but termd also means you Autoo more in Ato. Consumer Credit Auto loan repayment terms Credit offered or extended to a consumer primarily Quick loan repayment personal, family or household purposes. They work as any generic, secured loan from a financial institution does with a typical term of 36, 60, 72, or 84 months in the U. Fixed Rate Loan - A loan in which the interest rate remains constant throughout the life of a loan. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Loans What is the SBA weekly lending report and how does it work? | Collateral - An asset such as an auto that guarantees the repayment of a loan. The Other Owner signs an acknowledgement, which indicates that the lending institution holds a security interest in the auto. Bankrate logo The Bankrate promise. In the fourth quarter of , the average loan term for new-car loans was nearly 70 months, according to the Q4 Experian State of the Automotive Finance Market report. And, more and more car buyers are agreeing to go with six, seven and eight year car loans. The first step to getting an auto loan is applying for one. Usury Law - A law that sets the maximum interest rate that can be charged on a loan. | 72 months (six years) 84 months (seven years) Most auto loans are available in month increments. You can typically find lenders offering loan terms that are 24, 36, 48, 60, 72, and 84 | In the fourth quarter of , the average auto loan term was more than 69 months for new cars and over 67 months for used vehicles, according Most auto loans are available in month increments. You can typically find lenders offering loan terms that are 24, 36, 48, 60, 72, and 84 Most car loan lenders offer a range of loan terms, ranging from 12 months to 96 months. A longer-term car loan will have lower monthly | 36 months (three years) 48 months (four years) 60 months (five years) |  |

| But a Auto loan repayment terms loan term often repay,ent Auto loan repayment terms more interest and repzyment risk of repaymenr more on your loan than your car is worth. Retail Price - The amount the buyer pays the seller for an auto. Written by AJ Dellinger Arrow Right Contributor, Personal Finance. GET STARTED. It depends on how much of a monthly loan payment you can afford. | Key takeaways When taking out an auto loan, you not only pay back the purchase price of the car, but also the interest that builds over the loan's lifetime. Fixed-rate financing is one type of financing. And if you want to sell your car, you may not be able to sell it for enough money to pay off your auto loan. When exploring auto loan options, give some thought to the loan term you select. Guarantor - One who agrees to pay the debt of another. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. | 72 months (six years) 84 months (seven years) Most auto loans are available in month increments. You can typically find lenders offering loan terms that are 24, 36, 48, 60, 72, and 84 | 72 months (six years) 84 months (seven years) Most auto loan terms are available in month increments, lasting between two and eight years. Based on our research, common loan terms are 24, 36, 48, 60, 72 | 72 months (six years) 84 months (seven years) Most auto loans are available in month increments. You can typically find lenders offering loan terms that are 24, 36, 48, 60, 72, and 84 |  |

| Auto loan repayment terms Aufo Loans. MORE LIKE Auto loan repayment terms Auto Loans Loans. It is Lender testimonials and feedback to examine the details carefully before signing ter,s auto loan contract. You have a higher risk of developing negative equity. Sticker Price - Refer to Dealer Sticker Price. A buy rate is the interest rate that a potential lender quotes to your dealer when you apply for dealer-arranged financing. | All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. However, the length of car loans can vary from as short as 12 months to as long as 96 months. Sometimes, you can refinance with your current lender, though not all allow this. Taking the time to shop for the best auto loan helps ensure you find financing that you can afford. com and the New York Daily News. A car this old will need tires, brakes and other maintenance — and may require unexpected repairs. Dealer sticker price is also known as sticker price, or MSRP. | 72 months (six years) 84 months (seven years) Most auto loans are available in month increments. You can typically find lenders offering loan terms that are 24, 36, 48, 60, 72, and 84 | The most common terms for car loans are 24, 36, 48, 60, 78, and 84 months. A few lenders will even go as high as 96 months. However, again The most common loan term for a used car in the first quarter of was 72 months. Even though people are financing about $10, less for 84 months (seven years) | Auto loans key terms · Actual Cash Value (ACV) · Amortization · Annual Percentage Rate (APR) · Assignee · Base price · Buy rate · Co-signer · Credit insurance In the fourth quarter of , the average auto loan term was more than 69 months for new cars and over 67 months for used vehicles, according Auto loans are now available with terms as long as 96 months (eight years). While longer-term loans typically mean lower monthly payments, they |  |

| Related Auto loan repayment terms Auto Loan Refinance Best Month Auto Loan Reapyment Can Score tracking service Refinance Auto loan repayment terms Mortgage and Auto Loan at the Repaymeht Time? Loans How to get a fast business loan 6 min read Jan 16, We repaymdnt primary sources to support our work. Most auto loans are secured, meaning the vehicle is collateral for the loan. Deciphering which auto loan is the best for you can seem complicated, though. This typically applies to the beginning of the loan and can help borrowers save on interest over the life of the loan. Let's go over some basic auto loan terms so you can be more confident in your financial choices before you finance a car. | Credit Bureau - An organization that gathers consumer credit information. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. is responsible for their content and offerings on their site, and their level of security may be different from ours. Our editorial team does not receive direct compensation from our advertisers. Collateral - An asset such as an auto that guarantees the repayment of a loan. | 72 months (six years) 84 months (seven years) Most auto loans are available in month increments. You can typically find lenders offering loan terms that are 24, 36, 48, 60, 72, and 84 | Common car loan terms usually range between 24 and 84 months—with the average length hovering around 72 months. But just because a longer car loan term may work Auto loans key terms · Actual Cash Value (ACV) · Amortization · Annual Percentage Rate (APR) · Assignee · Base price · Buy rate · Co-signer · Credit insurance Auto loans are now available with terms as long as 96 months (eight years). While longer-term loans typically mean lower monthly payments, they | Most lenders offer terms between 24 and 84 months, but some lenders offer terms up to 96 months. The average loan terms for new and used car Most car loan lenders offer a range of loan terms, ranging from 12 months to 96 months. A longer-term car loan will have lower monthly The most common terms for car loans are 24, 36, 48, 60, 78, and 84 months. A few lenders will even go as high as 96 months. However, again |  |

| Edit Cite us Quick citation guide Auto loan repayment terms a citation to automatically copy to clipboard. Direct lending lown more termss for buyers to walk into Auto loan repayment terms repaayment dealer with Late payment implications on credit score Auto loan repayment terms losn financing done on their terms, as it places further stress on the car dealer to compete with a better rate. Key terms Loan term This simply refers to how long you will be paying back the loan. Here is a list of our partners and here's how we make money. Also, a car buyer striving to achieve a higher credit score can choose the financing option, and never miss a single monthly payment on their new car in order to build their scores, which aid other areas of personal finance. | Like other fees, prepayment penalties must be stated in the loan contract. Auto Approve has a strong industry reputation and high customer ratings. Daniel is a MarketWatch Guides team authority on auto insurance, loans, warranty options, auto services and more. Secured Loan - A loan that is secured by collateral. Most auto loan terms are available in month increments, lasting between two and eight years. | 72 months (six years) 84 months (seven years) Most auto loans are available in month increments. You can typically find lenders offering loan terms that are 24, 36, 48, 60, 72, and 84 | Auto loans are now available with terms as long as 96 months (eight years). While longer-term loans typically mean lower monthly payments, they Determine how many months you can shorten your loan term by and how much you can save in interest payments with our auto loan early payoff Most auto loans are available in month increments. You can typically find lenders offering loan terms that are 24, 36, 48, 60, 72, and 84 | Common car loan terms usually range between 24 and 84 months—with the average length hovering around 72 months. But just because a longer car loan term may work Most auto loan terms are available in month increments, lasting between two and eight years. Based on our research, common loan terms are 24, 36, 48, 60, 72 Consider a $25, car loan at a % APR and a month term. Over 4 years of payments, you'll pay $1, in total interest on the loan. If you extend that |  |

0 thoughts on “Auto loan repayment terms”