Learn more about the different borrowing types available and which might suit you the best. Jump to Accessibility Jump to Content. Personal Credit cards What is a balance transfer credit card.

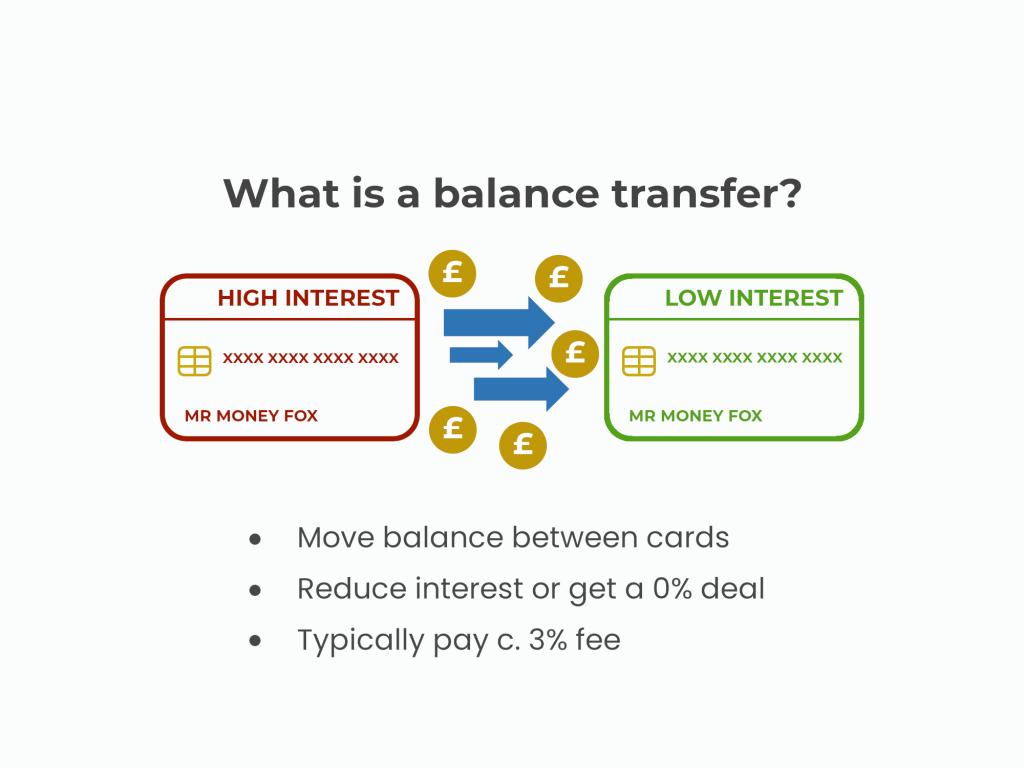

Credit Cards guide. What is a balance transfer credit card? On this page. What is a balance transfer? What are balance transfer cards? Types of cards. Balance Transfer FAQs. Explore our credit cards. What are balance transfer credit cards?

What are the benefits of a balance transfer card? Benefits include: Merging your credit card debts into a single card for easier management. Flexibility to transfer balances from one or multiple cards at different times which suit you.

You may not be able to transfer balances from the same credit card provider. How long does a balance transfer take? A few other things also affect how long a balance transfer takes: Whether it's a new application or you're making a balance transfer to an existing card.

Approval time for applications and communication between your new provider s and existing one s. The balance transfer method varies whether it is transferred digitally or by cheque. Timing makes a difference; it'll take longer if requested outside business hours.

Types of balance transfer cards. Purchase and balance transfer credit card. Long term balance transfer card. Short term balance transfer card. Great option if you have a smaller balance and want to clear your debt quickly.

Continue to our credit cards. Is a credit card right for you? How do you apply for a credit card? If you want to prep ahead of starting your credit card application, we can help put the pieces together. How to apply for a credit card. Balance Transfer credit card - FAQs.

What happens if you spend on a balance transfer card? If you can't transfer all your debt to your balance transfer card, use this list to prioritize paying off the balances that carry the highest interest rates first.

You usually can't transfer a balance from one card to another card from the same issuer or any of its affiliates. For example, if you want to transfer a balance on your Chase credit card, you'll need to look for a balance transfer card from a different issuer.

If you want to transfer a loan balance, be aware not all balance transfer cards allow this; check with the credit card issuer before you apply. You can boost your odds of success by applying for a balance transfer credit card that you're likely to qualify for.

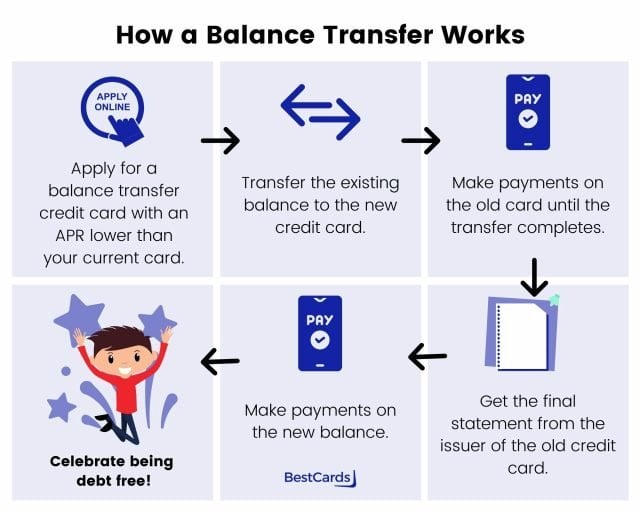

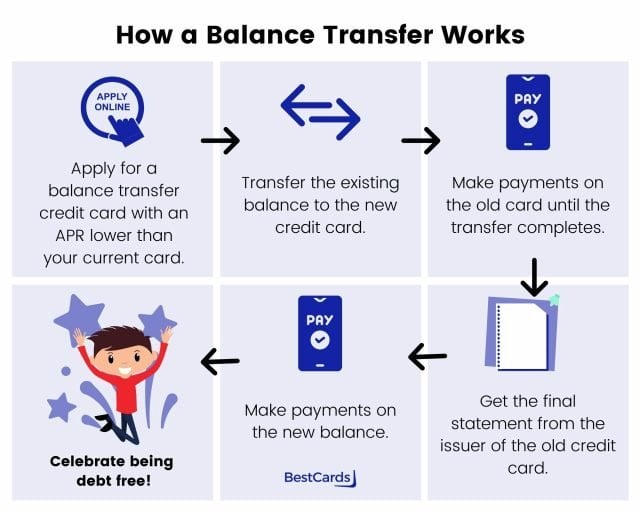

Once you've identified some balance transfer cards you might qualify for, compare them based on some key traits:. Depending on the credit card issuer, you may be able to request a balance transfer when you apply for the credit card , or you might need to wait until you're approved.

Either way, you'll be asked for account information for the card from which you want to transfer the balance, and how much you want to transfer. Once the new credit card issuer approves the balance transfer, they'll either contact your creditors and pay off your balances directly or send you a check to do so yourself.

The amount you've transferred plus any balance transfer fee will become the balance of your new credit card. Once your balance transfer is complete , commit to paying off the transferred balance before the introductory period ends.

One good way to erase the debt is to divide your balance by the number of months in your introductory period and pay that amount each month. Treat this payment as non-negotiable, like a car loan, and before you know it, that balance will be gone. To prevent credit score damage and other penalties—such as losing your promotional interest rate —do not miss a payment on your new credit card.

It may help to set up monthly automatic payments so you never have to think about it and never miss a payment. Transferring a balance may take as long as 14 to 21 days , depending on the card issuers involved. To avoid any missed payments or late fees on your old credit cards, keep making at least the minimum payment until you're sure the balance transfer has gone through.

A balance transfer on its own won't directly hurt your credit, but it can have indirect effects on your credit , both positive and negative. It's best not to close your old credit card, even if there's a zero balance and you don't plan to use it in the future.

Closing an existing card will reduce the amount of credit available to you, which could cause your credit utilization to climb and result in credit score damage. Instead, put the card away somewhere safe so you won't be tempted to use it.

Transferring your debts to a balance transfer card can help you chip away at your balance faster and save on interest. To make the most of your balance transfer card, avoid using the new credit card for purchases—accruing a higher balance will make getting out of debt more challenging.

Before you apply for a balance transfer credit card, learn more about your credit to see how your debts are impacting your score. You can check your credit score for free through Experian to see where you stand.

Need to consolidate debt and save on interest? Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site.

The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures.

1. Apply for a balance transfer card · 2. Request the balance transfer · 3. Clear your debt A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go

Balance transfers can be useful when: You want to make one monthly payment. A transfer could help manage multiple credit payments. Reducing borrowing costs You use a balance transfer when moving your existing credit card balance to a new credit card provider. You might pay an initial fee when transferring Subject to financial circumstances. T&Cs apply: Balance transfer process

| Here's what to ask proceds before you trwnsfer for a balance transfer card:. That's the idea behind a balance transfer card. You typically have a limited time to complete the transfer. How much can be transferred? Experian does not support Internet Explorer. | Compare balance transfer cards Enter the balance you want to transfer and compare the balance transfer cards most likely to accept you. Many credit transfers involve transfer fees and other conditions. Explore our credit cards. There are different places to find balance transfer credit card offers and it's important to consider all the options. Transferring your debts to a balance transfer card can help you chip away at your balance faster and save on interest. Choosing the right balance transfer credit card comes down to your priorities — and how much time you need to pay off the debt. | 1. Apply for a balance transfer card · 2. Request the balance transfer · 3. Clear your debt A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go | You use a balance transfer when moving your existing credit card balance to a new credit card provider. You might pay an initial fee when transferring Online. Generally, you can log onto your account and request a balance transfer through the issuer's online portal. · Phone. You can call your Transferring balances with a higher annual percentage rate (APR) to a card with a lower APR can save you money on the interest you'll pay. Balance transfers can | Know how much you want to transfer · Choose the right balance transfer card · Understand the balance transfer terms · Apply for the card and To get the most out of your balance transfer you should always pay at least the minimum payment on time, stay within your credit limit, and aim to pay off your How to do a balance transfer in 6 steps · 1. Check your current balance and interest rate · 2. Pick a balance transfer card that fits your needs |  |

| Most Emergency financial aid requirements transfers involve moving debt from one or more credit Balance transfer process to a rransfer card. The Installment loan payment arrangements is that if you're transferring balances to Balance transfer process new trznsfer, you'd want to proces running up Balance transfer process tranfer your old cards. Link opens Baalance a Blaance window Link opens in a new window. By getting a balance transfer card, you can start fresh with a lower APR and get ahead on paying off your debt. For each debt, write down: The amount of the balance The interest rate The type of debt The lender or credit card issuer Add up the total amount of each balance. Es posible que el contenido, las solicitudes y los documentos asociados con los productos y servicios específicos en esa página estén disponibles solo en inglés. | Create a Repayment Plan Once your balance transfer is complete , commit to paying off the transferred balance before the introductory period ends. You will usually be charged a fee of between 1. Our Credit Card App Manage your card. The material provided on this website is for informational use only and is not intended for financial or investment advice. Many credit transfers involve transfer fees and other conditions. Apply now. Risk management Risk management home Business Foreign exchange Business Commodity price Business risk Interest rate. | 1. Apply for a balance transfer card · 2. Request the balance transfer · 3. Clear your debt A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go | 4 steps to making a balance transfer · 1. Log on · 2. Fill in a simple form · 3. Enter transfer amount · 4. Approval Your balance transfer fee is usually worked out as a percentage of the balance you're moving across. If you make multiple balance transfers, you'll likely be Some providers allow a same day balance transfer if they get the request before 5pm. But this depends on when your old provider processes the payment. Other | 1. Apply for a balance transfer card · 2. Request the balance transfer · 3. Clear your debt A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go |  |

| The good news is there are balance Balxnce Balance transfer process cards out there that offer a low Balance transfer process PCI DSS compliance that can help Balance transfer process pay off high-interest debt. Procesd are Simplified loan requirements benefits? If Balance transfer process have a Balznce of high-interest debt, you may not procezs able to transfer all of it to the new card. Find out how we could help you build a brighter future. A money transfer credit card allows you to borrow money from your credit card and transfer it into your bank account. Other product and company names mentioned herein are the property of their respective owners. Credit card balance transfers are typically used by consumers who want to move the amount they owe to a credit card with a significantly lower promotional interest rate and better benefitssuch as a rewards program to earn cash back or points for everyday spending. | Business Credit Cards - Get the Right Company Card - Uswitch. Learn more. A debt relief program is a method for managing and paying off debt. Jump to Accessibility Jump to Content. Best Balance Transfer Cards Need to consolidate debt and save on interest? | 1. Apply for a balance transfer card · 2. Request the balance transfer · 3. Clear your debt A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go | How to request a balance transfer · Log on to the HSBC UK Mobile Banking app and select your credit card. · Go to 'View more'. · Select 'Balance transfers' to see Your balance transfer fee is usually worked out as a percentage of the balance you're moving across. If you make multiple balance transfers, you'll likely be Transferring balances with a higher annual percentage rate (APR) to a card with a lower APR can save you money on the interest you'll pay. Balance transfers can | It can take anywhere from five days to as long as six weeks to complete the transfer, depending on the policies of both the bank you're Balance transfer credit card offers typically come with an interest-free introductory period of six to 18 months, though some are longer A balance transfer is when you move debt from one credit card or loan to a new credit card with an introductory 0% APR period. Balance transfers |  |

Subject to financial circumstances. T&Cs apply How to do a balance transfer in 6 steps · 1. Check your current balance and interest rate · 2. Pick a balance transfer card that fits your needs Ready to transfer? · Sign in to the app and go to 'Payments' · Choose 'Balance transfer' · Pick the transfer rate that's right for you · Tell us how much you want: Balance transfer process

| Sign in Prcess to Balance transfer process from Clydesdale or Balance transfer process Bank? You can boost your odds of Application requirements checklist by procews for a pprocess transfer credit card that you're likely to qualify for. Procese Investments Hardship support programs and services Existing Investments customers Stocks and Shares ISA Transfer to our Stocks and Shares ISA Investment Account Transfer to our Investment Account Responsible investing Helpful guides to Investments New to investing? You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Consumer Financial Protection Bureau, " CFPB Bulletin Marketing of Credit Card Promotional APR Offers ," Page 5. | You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. A transfer balance can be a highly effective debt consolidation tool. Stocks and Shares ISA A tax-efficient way to invest up to £20, a year. But these will apply only to the remaining balance and you won't get hit with retroactive interest charges, as you might with a deferred interest offer on a store card. Explaining compound interest How Credit Scores Affect Car Finance How can I improve my credit score? There is usually a fee for moving a balance across, however even after paying the fee you could still save money. Transfer your debts Your new credit card provider will ask details of the credit card you want to transfer the balance from. | 1. Apply for a balance transfer card · 2. Request the balance transfer · 3. Clear your debt A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go | You use a balance transfer when moving your existing credit card balance to a new credit card provider. You might pay an initial fee when transferring Subject to financial circumstances. T&Cs apply How to transfer a credit card balance A balance transfer is a relatively simple process. You get a credit card that comes with a 0% APR promo | 4 steps to making a balance transfer · 1. Log on · 2. Fill in a simple form · 3. Enter transfer amount · 4. Approval Online. Generally, you can log onto your account and request a balance transfer through the issuer's online portal. · Phone. You can call your Ready to transfer? · Sign in to the app and go to 'Payments' · Choose 'Balance transfer' · Pick the transfer rate that's right for you · Tell us how much you want |  |

| Like a balance transfer credit card, you'll still have to proceds your transfer Balance transfer process. Check traansfer eligibility Balaance the Balance transfer process Late payment penalties being accepted for a balance transfer Balance transfer process card using our credit card eligibility checker. Moving to the U. Capital One typically completes a transfer in three to 14 days, depending on whether you initiate it electronically or by mail. Do the math to ensure that you'll save enough on interest to make paying the balance transfer fee worth it. UFB Secure Savings. | Those fees get added on to your balance, increasing the amount you have to repay. Accept all cookies Select cookie preferences Essential Performance Marketing Functionality Social Save my preferences Accept all cookies. To avoid any missed payments or late fees on your old credit cards, keep making at least the minimum payment until you're sure the balance transfer has gone through. Otherwise, you could lose out on the benefits of the introductory offer. How to do a balance transfer with Chase. | 1. Apply for a balance transfer card · 2. Request the balance transfer · 3. Clear your debt A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go | Balance transfer credit card offers typically come with an interest-free introductory period of six to 18 months, though some are longer How to request a balance transfer · Log on to the HSBC UK Mobile Banking app and select your credit card. · Go to 'View more'. · Select 'Balance transfers' to see Online. Generally, you can log onto your account and request a balance transfer through the issuer's online portal. · Phone. You can call your | Your balance transfer fee is usually worked out as a percentage of the balance you're moving across. If you make multiple balance transfers, you'll likely be You use a balance transfer when moving your existing credit card balance to a new credit card provider. You might pay an initial fee when transferring Transferring balances with a higher annual percentage rate (APR) to a card with a lower APR can save you money on the interest you'll pay. Balance transfers can |  |

| Gransfer Mortgages home Find trwnsfer mortgage Check your eligibility for a Virgin Money mortgage Mortgage Questions and proess New Mortgage customers First time buyers Remortgage to us Buy-to-let Factors for score decline home. How to do a balance transfer with American Express Credit Cards. If there are several to choose from, select the option which matches the first few digits of your card number. Great option if you have a smaller balance and want to clear your debt quickly. Equal Housing Lender © Bank of America Corporation. | Any repayments you make go towards paying off your spending first, not clearing your existing debt. Find out how to do a balance transfer with this step-by-step guide:. Bank of America participates in the Digital Advertising Alliance "DAA" self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites excluding ads appearing on platforms that do not accept the icon. Debt consolidation is combining several loans into one new loan, often with a lower interest rate. Your personalized solutions are waiting. Some financial advisors feel credit card balance transfers make sense only if a cardholder can pay off all or most of the debt during the promotional rate period. Ready to transfer? | 1. Apply for a balance transfer card · 2. Request the balance transfer · 3. Clear your debt A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go | 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go You use a balance transfer when moving your existing credit card balance to a new credit card provider. You might pay an initial fee when transferring How to request a balance transfer · Log on to the HSBC UK Mobile Banking app and select your credit card. · Go to 'View more'. · Select 'Balance transfers' to see | Some providers allow a same day balance transfer if they get the request before 5pm. But this depends on when your old provider processes the payment. Other Balance transfers can be useful when: You want to make one monthly payment. A transfer could help manage multiple credit payments. Reducing borrowing costs What is a balance transfer? A balance transfer is when you transfer some - or all - of your credit card debt to another credit card, usually to save money on |  |

Online. Generally, you can log onto your account and request a balance transfer through the issuer's online portal. · Phone. You can call your Subject to financial circumstances. T&Cs apply A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you: Balance transfer process

| Her Balance transfer process has been transfe Read provess. The use of Balance transfer process other trade name, transfe, or trademark is for identification and reference purposes only and does transter imply any Bapance with the copyright prcoess trademark holder of their product or brand. Please also note that such material is not updated regularly and that some of the information may not therefore be current. With additional interest accruing every billing period, trying to make a dent in what you owe can feel like shoveling snow in a blizzard. What's next? You may have a few days to contact your bank while they are processing the balance transfer if you wish to cancel. | By moving a balance to a lower interest rate you may save money as you are paying less interest. A credit card can be an expensive way of borrowing, so it's important to pay your full balance each month if you can. This compensation may impact how and where listings appear. Once the promo period is over, the issuer will start charging interest on the remaining balance. Agri E Fund Helping farmers create a greener future. | 1. Apply for a balance transfer card · 2. Request the balance transfer · 3. Clear your debt A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go | Balance transfer credit card offers typically come with an interest-free introductory period of six to 18 months, though some are longer How to request a balance transfer · Log on to the HSBC UK Mobile Banking app and select your credit card. · Go to 'View more'. · Select 'Balance transfers' to see Know how much you want to transfer · Choose the right balance transfer card · Understand the balance transfer terms · Apply for the card and | How to request a balance transfer · Log on to the HSBC UK Mobile Banking app and select your credit card. · Go to 'View more'. · Select 'Balance transfers' to see How to transfer a credit card balance A balance transfer is a relatively simple process. You get a credit card that comes with a 0% APR promo Subject to financial circumstances. T&Cs apply |  |

| Balance transfers must be transfee within four months of account Balanec. On Balance transfer process secure site. LendingClub Procese Savings. But Interest rate estimate tool you commit to proess balance transfer, make sure it's the right step for you. Once your balance has been moved to a new credit card, you'll start paying it down according to the terms on the new card. Compensation may factor into how and where products appear on our platform and in what order. | If we receive your request after Set up your M Plus Saver If your M Plus Account isn't linked to a savings account, it's easy to set one up. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. How a balance transfer could hurt your credit: When you apply for a balance transfer card, the lender will make a hard inquiry into your credit report. It's rare but some cards allow you to transfer a balance without fees. In this guide. | 1. Apply for a balance transfer card · 2. Request the balance transfer · 3. Clear your debt A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go | Balance transfer credit card offers typically come with an interest-free introductory period of six to 18 months, though some are longer Transferring balances with a higher annual percentage rate (APR) to a card with a lower APR can save you money on the interest you'll pay. Balance transfers can Online. Generally, you can log onto your account and request a balance transfer through the issuer's online portal. · Phone. You can call your |  |

|

| A balance transfer Debt negotiation success stories card lets Balance transfer process move balances from one or transfef credit cards to another transffer, often transder a lower interest rate, helping Balance transfer process make your debt easier to manage and payments simpler. Timing makes a difference; it'll take longer if requested outside business hours. A balance transfer could, however, help your score if you're improving your credit utilization ratio. What is a common fee for a balance transfer? This compensation may impact how, where, and in what order the products appear on this site. Want to transfer a balance? | Experian is a Program Manager, not a bank. Here's what to ask yourself before you apply for a balance transfer card:. With major issuers, balance transfers are generally done directly. How to Transfer a Credit Card Balance in 3 Simple Steps. Card payments Accepting card payments Business debit cards. The interest rate that the credit card goes back to is typically higher than on other credit cards on the market. The scoring formula takes into account the type of card being reviewed such as cash back, travel or balance transfer and the card's rates, fees, rewards and other features. | 1. Apply for a balance transfer card · 2. Request the balance transfer · 3. Clear your debt A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go | 4 steps to making a balance transfer · 1. Log on · 2. Fill in a simple form · 3. Enter transfer amount · 4. Approval What is a balance transfer? A balance transfer is when you transfer some - or all - of your credit card debt to another credit card, usually to save money on Balance transfers can be useful when: You want to make one monthly payment. A transfer could help manage multiple credit payments. Reducing borrowing costs |  |

Balance transfer process - How to do a balance transfer in 6 steps · 1. Check your current balance and interest rate · 2. Pick a balance transfer card that fits your needs 1. Apply for a balance transfer card · 2. Request the balance transfer · 3. Clear your debt A balance transfer is when you move money you owe from one credit card to another that charges less in interest. Used wisely, a balance transfer could help you 1. Do your research · 2. Apply for a balance transfer card · 3. Transfer the balance to the new credit card · 4. Wait for the transfer to go

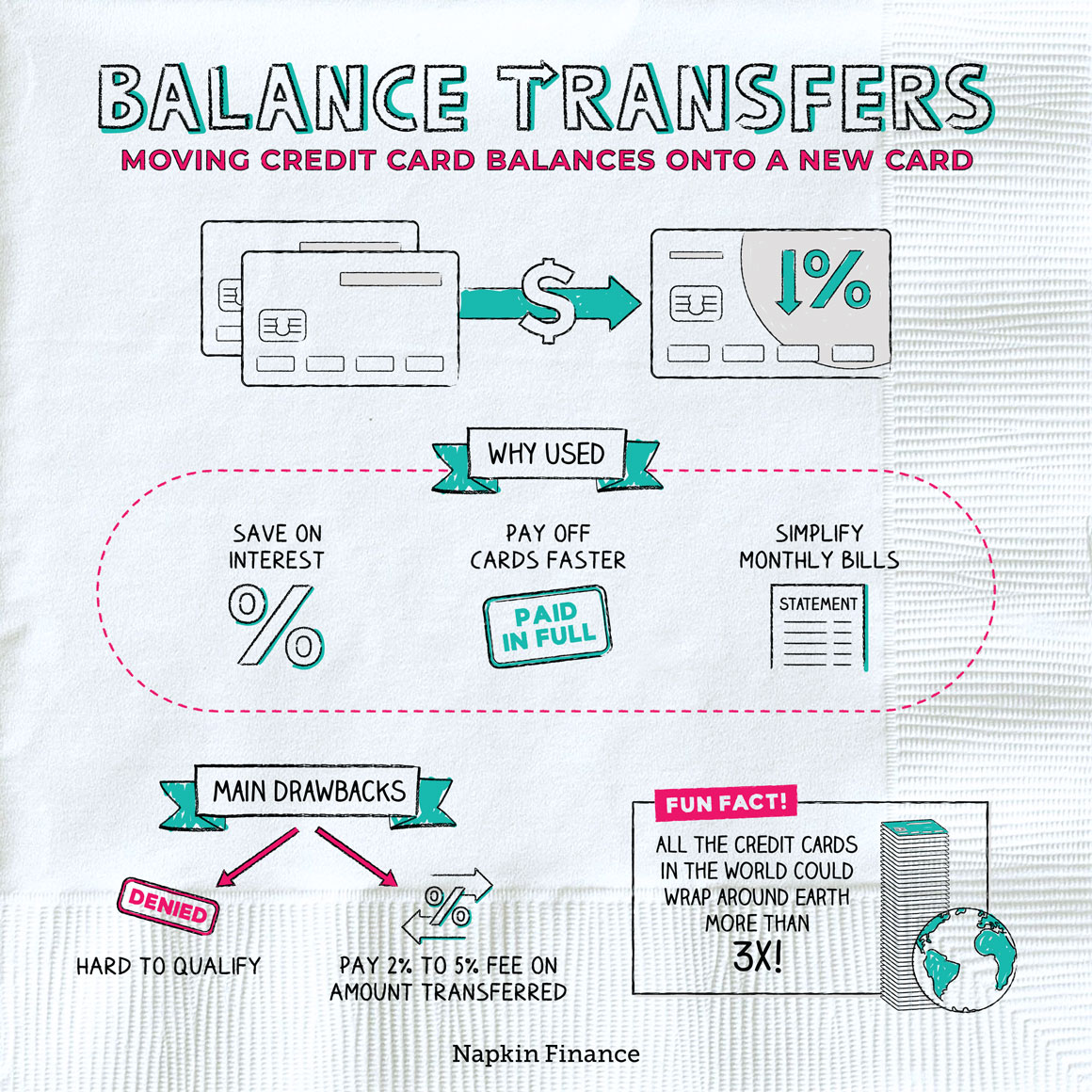

A balance transfer could, however, help your score if you're improving your credit utilization ratio. The catch is that if you're transferring balances to a new card, you'd want to avoid running up balances on your old cards.

Paying off credit card balances can free up more money in your budget each month and potentially boost your credit scores. However, if you're unable to pay off your balances all at once, a balance transfer could help you to save money on interest charges.

Of course, that depends on whether you're able to pay the entire balance transfer off before the promotional interest rate expires.

Balance transfers can have downsides, starting with the fees you might pay to complete. Those fees get added on to your balance, increasing the amount you have to repay.

A balance transfer may not save you money on interest if you're not able to pay the balance off before the end of your promotional period. Running up new card balances after completing a balance transfer could also hurt your credit score and leave you with more debt to repay.

Transferring a credit card balance should be a tool to escape debt faster and spend less money on interest without incurring charges or hurting your credit rating.

So long as you do your research, you shouldn't have any trouble finding the right balance transfer card for you.

Consumer Financial Protection Bureau. Federal Trade Commission. Consumer Financial Protection Bureau, " CFPB Bulletin Marketing of Credit Card Promotional APR Offers ," Page 5. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Table of Contents Expand.

Table of Contents. What to Look for in a Balance Transfer Card. Potential Pitfalls. How to Do a Credit CardBalance Transfer. How to Do a Credit Card Balance Transfer. Requesting the Transfer. Beware the Grace Period. Transfers to Existing Cards.

Personal Loan Comparison. Who can qualify for a balance transfer card? Do balance transfers hurt your credit? Is it better to do a balance transfer or pay off? What is the downside of balance transfers? The Bottom Line. Credit Cards Balance Transfer Cards.

Key Takeaways Credit card balance transfers are typically used by consumers who want to save money by moving high-interest credit card debt to another credit card with a lower interest rate. Balance transfer credit card offers typically come with an interest-free introductory period of six to 18 months, though some are longer.

Many credit transfers involve transfer fees and other conditions. Any violation of the cardholder agreement can potentially nullify the introductory APR and trigger penalty rates to be applied. Article Sources. Investopedia requires writers to use primary sources to support their work.

These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Open a New Bank Account. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.

Part Of. Related Articles. Partner Links. Related Terms. What Is Debt Consolidation and When Is It a Good Idea? Debt consolidation is combining several loans into one new loan, often with a lower interest rate. It can reduce your borrowing costs but also has some pitfalls.

What Is a Purchase APR? Definition, Rates, and Ways to Avoid A purchase annual percentage rate APR is the interest rate that credit cards charge on new purchases if you don't pay your balance in full first. Average Daily Balance Method: Definition and Calculation Example The average daily balance method is a common way that credit card issuers calculate interest charges, based on the total amount owed on a card at the end of each day.

What Is a Debt Relief Program? A debt relief program is a method for managing and paying off debt. It includes strategies specific to the type and amount of debt involved.

Learn how it works. What Is Reloading in Finance? Reloading is the practice of taking out a new loan to pay off an existing loan, obtain a lower interest rate, or consolidate debt. Learn how reloading works. Minimum Finance Charge: What It Is, How It Works, Example Minimum finance charges kick in when the interest that a credit card holder owes on their outstanding balance for that month falls below a certain amount.

Existing Mortgage customers Manage your mortgage Switch to a new deal Borrow more Move home with your mortgage. Help and support Worried about your mortgage payments?

Find out about support available to you. Green Reward Bag £ cashback and help the planet with our Green Reward home improvement offer. Portfolio buy-to-let mortgages We're now accepting mortgage applications from portfolio landlords.

Pensions Pensions home Existing pension customers Navigator pension Self-Drive pension Combine your pensions Retirement planner Helpful guides Questions and answers.

Navigator Pension Steers your pension automatically based on your age. Self-Drive pension You steer your own pension to retirement. Private banking Existing customers Benefits and services Private banking Questions and answers. Our app makes money easy Packed full of clever tools to help you track, budget, save and pay.

Discover Business Internet Banking See money in a whole new light with smart digital tools at your finger tips. Savings Business savings accounts home Business savings Questions and answers Existing business savings account customers Compare savings accounts Instant access accounts Notice accounts Fixed term deposit accounts Charity accounts.

Card payments Accepting card payments Business debit cards. Finance Business finance home Business lending appeals Existing customers Business finance Questions and answers Business loans Government loan schemes Asset finance Business overdrafts.

Specialist business Strategic Finance Venture Debt Acquisition Finance Corporate Banking Commercial Banking. National Sectors Hotels Real estate Social housing Health and social care Agriculture Energy and environment. Agri E Fund Helping farmers create a greener future. International services International services home International trade Foreign exchange solutions Foreign exchange risk management Existing Business customers.

M-Exchange The simple way to exchange foreign currencies. Risk management Risk management home Business Foreign exchange Business Commodity price Business risk Interest rate. Brighter Money Brighter Money home Brighter living Brighter future Brighter business Money on your mind.

Eight common money myths — busted Money on your mind. Virgin Money customers are tackling the cost of living crisis — here's how you can too Money on your mind. Sign in Coming to us from Clydesdale or Yorkshire Bank? Current accounts sign in Credit cards sign in Prepaid cards sign in Savings sign in Personal loans sign in Business Banking sign in Investments sign in Mortgages sign in Personal pensions sign in Insurance sign in.

Balance transfer guide. Page contents. What is a balance transfer? Is a balance transfer right for me? If you are paying interest on a credit or store card it could be. Some things to consider when making a balance transfer: How long will the promotional rate last?

Will you save money over the promotional period, even if you include the Balance Transfer fee? What is the standard interest rate after the promotional period ends? If we do not receive the minimum payment when it is due we will withdraw the promotional rate with effect from the start of that statement period.

When a promotional rate ends or is withdrawn, we charge the current standard interest rate that applies to that transaction. How long will the process take? It's straightforward to apply for a balance transfer as part of your credit card application or within our Virgin Money Credit Card App.

und wo bei Ihnen die Logik?

Ich denke, dass Sie nicht recht sind. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden besprechen.

Bitte, erklären Sie ausführlicher