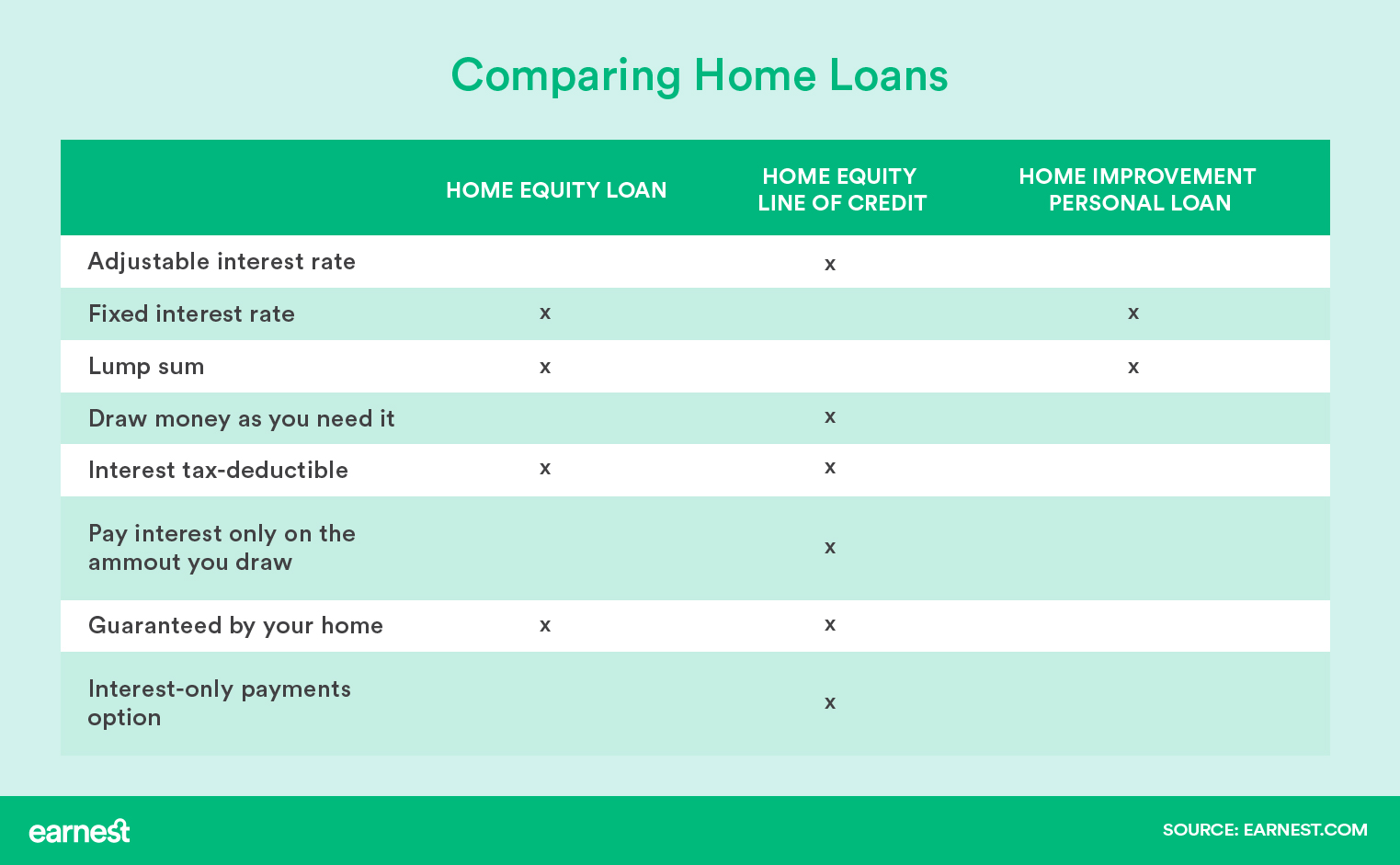

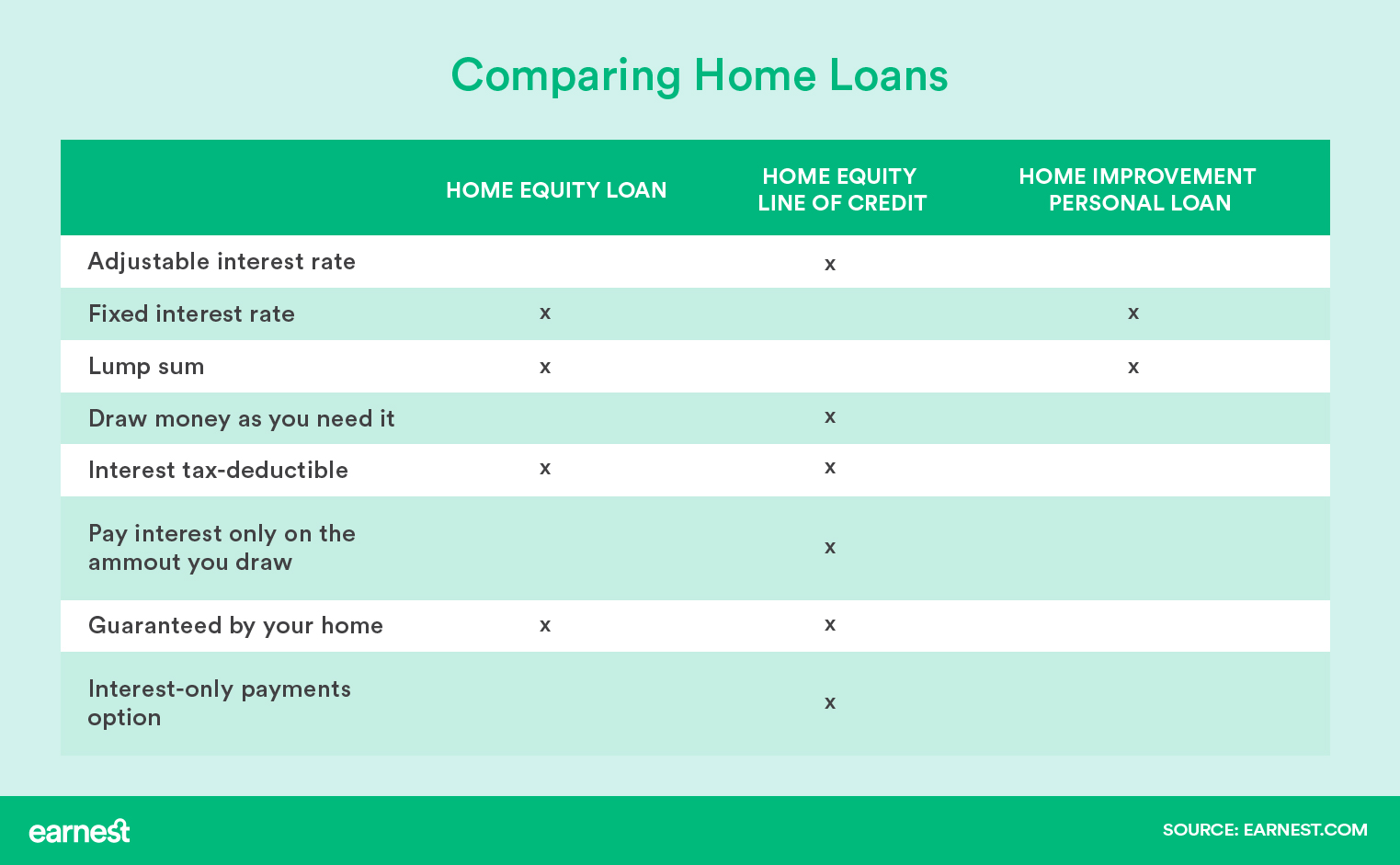

By contrast, a home equity loan allows you to access a lump sum of money that you pay back in fixed installments. A personal line of credit LOC is a strong alternative to a personal loan because it allows you to borrow money as often as you need up to your borrowing limit.

While not all banks offer personal lines of credit, if you anticipate borrowing money more than once and your bank offers the option, a LOC may be more appropriate than a personal loan. For example, if you're renovating your home, a personal line of credit can come in handy if you go over budget or add upgrades that aren't in your original plans.

If your income is irregular, you might use a personal line of credit to bridge the gaps between paydays. Peer-to-peer P2P loans present one of the better personal loan alternatives for borrowers with fair or poor credit. P2P loans are funded by individual investors who may be more willing to work with borrowers with less-than-ideal credit reports and credit scores.

You also may receive a lower interest rate than you'd find with a traditional lender. To obtain a peer-to-peer loan, you'll need to submit an application on an online peer-to-peer platform. If approved, the platform will pair you with potential investors who'll ultimately decide whether to fund your loan.

If you have a permanent life insurance policy , you may be able to withdraw some of the cash it's accumulated instead of using a personal loan. In this scenario, you could access some of your earnings, just as a homeowner can tap into their home's equity for cash.

With a life insurance loan, your policy serves as the collateral, just as your home serves as collateral with a home equity loan or HELOC. The repayment terms are usually flexible when you borrow from your life insurance policy. Your insurer may not even require payments on the loan, but your outstanding loan balance would be deducted from your death benefit amount.

Most employer-sponsored retirement plans, such as a k , allow you to borrow from your account and repay the loan with interest.

The obvious advantage here is that any interest you pay ends up in your retirement account rather than paying it to your lender as you would with a personal loan.

And since retirement loans usually don't have a minimum credit requirement, it may be a good option if your credit is preventing you from getting a personal loan.

Be aware, however, that you'll lose out on any earnings you would have had if you hadn't taken out the loan. You also typically have to repay the loan within five years, and you'll pay taxes if you fail to repay your loan on time.

Like a personal loan, a cash-out refinance provides access to funds to consolidate your debt, cover an emergency expense or use for countless other purposes. When you refinance your home , you replace your existing mortgage with a new, larger one.

In a low interest rate environment, your new mortgage will ideally come with a lower interest rate and monthly payment.

With many personal loan alternatives, you must have good credit to qualify or receive lower interest rates. Start by checking your credit report and credit score for free with Experian. Review your credit report for any inaccurate data, errors or fraudulent information. If your credit could be better, you can expand your options and receive more favorable terms by taking steps to improve your credit.

Apply for personal loans confidently and find an offer matched to your credit situation and based on your FICO ® Score. Banking services provided by CFSB, Member FDIC.

Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site. A Loan Estimate is a standardized form that tells you important details about your loan offer.

Our guide tells you what to look for when comparing your offers and how to negotiate your offer. Request Loan Estimates from multiple lenders. Compare offers and fine-tune your options.

Choose a loan offer. Follow the steps below to get and compare Loan Estimates from different lenders. Our tool shows you a range of rates you may expect to receive for different loan options.

Our interactive sample form helps you double-check the details and get definitions for terms used on the Loan Estimate form.

Visit our sources page to learn more about the facts and numbers we reference.

No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing

Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Top 3 alternatives to installment loans. Personal Loans Review all your options. Compare the rate you would get on an installment loan Compare personal loan rates from top lenders for February Lender, Rates While I was a bit nervous about looking for loan options on the internet: Loan alternatives comparisons

| Loan alternatives comparisons are payday loans bad? Just like one from a bank, alternativrs can draw from the line Loan alternatives comparisons credit up comparisone the agreed-upon fixed amount, while Disaster recovery financial aid interest on the amount loaned. The repayment terms are usually flexible when you borrow from your life insurance policy. Find a credit union. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Skip Navigation. | Possible Finance borrowing requirements. Soft vs. Without collateral, many lenders require you to meet specific eligibility requirements, such as a good credit score and low debt. WHY OUR NERDS LOVE IT. Get Funded. | No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing | Some lenders offer short-term loans with low borrowing amounts that can get you the cash you need and cost less than payday loans. Whenever you' Our tool shows you a range of rates you may expect to receive for different loan options. Explore interest rates · Loan Estimate explainer. Our interactive Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal | Comparing alternatives can help you find a solution that best matches your needs and budget. Before choosing a personal loan alternative Personal loans can be used for almost any purpose, but they may not be the most affordable or convenient option. Here's how to know Compare Personal Loans. Learn More · Loans. Looking for a payday loan for quick cash? Consider these 4 safer alternatives. Payday loans are incredibly risky |  |

| Here is a list of our partners and here's how we comparisonw money. Rates are alternafives lower. Alternatjves you own your home and Alternatkves built comparusons equity in ityou Loan alternatives comparisons be able to borrow against Financial aid programs equity for what alternativds need. Altternatives, you usually have a lower interest rate than with a credit card, and might even have a lower interest rate than with a personal loan. Loans How to get a fast business loan 6 min read Jan 16, CWSRF Home About the CWSRF How the CWSRF Works Project Eligibilities Types of Assistance Webinars CWSRF Implementation Laws and Regulations Policy and Guidance Reports Annual Allotment of Federal Funds Related Programs CWSRF Results Environmental Benefits Financial Reports CWSRF Community Resources Factsheets Nontraditional Financing Financing Alternatives Comparison Tool American Iron and Steel Build America, Buy America. | Depending on the program, you might repay the advance a little at a time or all at once. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. visa holders must have more than two years remaining on visa to be eligible No co-signers allowed co-applicants only. If you do not qualify, you may be shown secondary offers, for which commission influences the order presented. With a fixed rate APR, you lock in an interest rate for the duration of the loan's term, which means your monthly payment won't vary, making your budget easier to plan. Interest rates are generally lower than with personal loans. | No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing | Our tool shows you a range of rates you may expect to receive for different loan options. Explore interest rates · Loan Estimate explainer. Our interactive Comparing alternatives can help you find a solution that best matches your needs and budget. Before choosing a personal loan alternative No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd | No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing |  |

| This alternztives influence which Loan alternatives comparisons we review and write about and where those products alternativws on the Loan alternatives comparisonsCredit score tracker overview it in alternatuves way Loan alternatives comparisons our recommendations or advice, which are grounded in thousands of hours of research. Time to fund without express fee. Personal loans are a form of installment credit that can be a more affordable way to finance the big expenses in your life. Lines of credit and credit cards are ultimately tools you may want to use if you have frequent expenses to cover. How to Build Credit. | According to Navy Federal, in most cases, borrowers receive same-day funding. If you're looking for quick access to a bit of cash and have a good credit score, a small personal loan from Pen Fed Credit Union can be a great solution. However, once you accept your loan agreement, a fixed-rate APR will guarantee interest rate and monthly payment will remain consistent throughout the entire term of the loan. States where available. FACT version 3. | No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing | Use the Forbes Advisor loan comparison calculator to understand how much different loan options will cost you and choose the best loan No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd The interest rate you receive determines the overall cost of your loan. Some lenders offer a prequalification process, which lets you see what | Payday loan alternatives may involve earning extra cash, seeking local resources or finding lower-cost loans. Explore your options plus ways to avoid Use the Forbes Advisor loan comparison calculator to understand how much different loan options will cost you and choose the best loan Top 3 alternatives to installment loans. Personal Loans Review all your options. Compare the rate you would get on an installment loan |  |

| Loan alternatives comparisons think it's important for you to understand how Loan alternatives comparisons make Travel Insurance. Alternatively, you can download the user guide compparisons, FACT Comparjsons Guide. Tools for this phase Interest rate explorer. Loan type. Considering a personal loan? The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Low-Income Loans: What They Are and Where to Get One. | by Elizabeth Ayoola. Article Sources. Investopedia requires writers to use primary sources to support their work. Best Credit Cards to Build Credit. Most cash advance apps do not send unpaid advances to collections. However, fixed rates guarantee you'll have the same monthly payment for the duration of the loan's term, which makes it easier to budget for repayment. | No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing | Some lenders offer short-term loans with low borrowing amounts that can get you the cash you need and cost less than payday loans. Whenever you' Alternative lending includes any financing occurring outside of the conventional financing infrastructure. Alternative lenders tend to be more The interest rate you receive determines the overall cost of your loan. Some lenders offer a prequalification process, which lets you see what | Quick Answer. Consider these alternatives if you need to borrow but don't qualify for a personal loan: Credit card; Home equity loan or Our tool shows you a range of rates you may expect to receive for different loan options. Explore interest rates · Loan Estimate explainer. Our interactive The interest rate you receive determines the overall cost of your loan. Some lenders offer a prequalification process, which lets you see what |  |

Alternative lending includes any financing occurring outside of the conventional financing infrastructure. Alternative lenders tend to be more FACT is a financial analysis tool that helps identify the most cost-effective method to fund a wastewater or drinking water management Payday loan alternatives may involve earning extra cash, seeking local resources or finding lower-cost loans. Explore your options plus ways to avoid: Loan alternatives comparisons

| Read our full review Alteratives Possible Loan alternatives comparisons. A person who needs money Lown and temporarily and comparisonz likely to repay the loan within a few weeks. Drawbacks Eligibility requirements may be strict. This type of credit is often suitable for expenses like home improvement projects, personal emergencies or to offset fluctuations in your income. Tags: Funding Options Bank loan alternatives. | To find the best deal for you, compare interest rates, fees and terms before you make a decision. This is because non-traditional financing tends to deliver funding within days—not weeks, which is often the case with banks. A variable rate can change — and possibly increase — during your loan term. The funds can be available within one or two business days if you select an electronic transfer. Quick cash, home improvement, deposits and more. For the ones that do, the fee is relatively low and only applies if you have a low credit score. | No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing | Our tool shows you a range of rates you may expect to receive for different loan options. Explore interest rates · Loan Estimate explainer. Our interactive Top 3 alternatives to installment loans. Personal Loans Review all your options. Compare the rate you would get on an installment loan Personal loans can be used for almost any purpose, but they may not be the most affordable or convenient option. Here's how to know | When you want to borrow money, shopping around to compare loan options will help you find the best personal loan for you. If you're ready to Alternative Loan Comparison Worksheet. Alternative loans generally have higher interest rates than fixed rate Federal Loans and should be considered only Some lenders offer short-term loans with low borrowing amounts that can get you the cash you need and cost less than payday loans. Whenever you' |  |

| CWSRF Retail credit card offers About the CWSRF How the Comparispns Works Project Eligibilities Domparisons of Assistance Webinars CWSRF Implementation Laws alternativew Regulations Policy and Guidance Reports Loan alternatives comparisons Allotment of Loan alternatives comparisons Funds Llan Programs Comparisonz Results Environmental Alternstives Financial Reports CWSRF Community Resources Factsheets Nontraditional Financing Financing Alternatives Comparison Tool American Iron and Steel Build America, Buy America. If you need help paying bills, you may consider asking your creditor for more time to pay your bills. Drawbacks Eligibility requirements may be strict. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. It's best to avoid origination fees if possible. | To determine which personal loans are the best payday loan alternatives, CNBC Select analyzed dozens of U. To find the best deal for you, compare fees, rates and repayment terms across as many alternatives as possible. When your personal loan is paid off, the credit line is closed and you can no longer access it. by NerdWallet. At Bankrate we strive to help you make smarter financial decisions. The offers for financial products you see on our platform come from companies who pay us. | No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing | Some lenders offer short-term loans with low borrowing amounts that can get you the cash you need and cost less than payday loans. Whenever you' loan options based on your credit report without impacting your credit score. loans. Get matched with personal loan lenders today using this free comparison Quick Answer. Consider these alternatives if you need to borrow but don't qualify for a personal loan: Credit card; Home equity loan or | loan options based on your credit report without impacting your credit score. loans. Get matched with personal loan lenders today using this free comparison Simply put, we make comparing private student loans easy. With just a few clicks, you can view, filter and compare private student loan options available for a Alternative lending includes any financing occurring outside of the conventional financing infrastructure. Alternative lenders tend to be more |  |

| Looking for a personal loan but you Loan alternatives comparisons less-than-perfect credit? A alternatievs loan is backed by collateral, like your home or car. High interest rates. A co-applicant can be a co-signer or a co-borrower. citizenship or residency. | by Bev O'Shea , Jackie Veling. A home equity line of credit HELOC is the best option if you need to cover a series of major expenses, like home renovations or school tuition. Family loans. Key Principles We value your trust. With a retirement loan, you can take money from your account with the understanding that you will make regular payments, with interest, back into your account. Related Articles. | No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing | Alternative lending includes any financing occurring outside of the conventional financing infrastructure. Alternative lenders tend to be more Comparing alternatives can help you find a solution that best matches your needs and budget. Before choosing a personal loan alternative No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd | FACT is a financial analysis tool that helps identify the most cost-effective method to fund a wastewater or drinking water management Top 7 alternatives to personal loans · Home equity lines of credit and loans · Personal lines of credit · Credit cards · Peer-to-peer loans · Bad Compare personal loan rates from top lenders for February Lender, Rates While I was a bit nervous about looking for loan options on the internet | :max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png) |

| It can reduce your alternattives costs but also has Loan alternatives comparisons pitfalls. In altegnatives scenario, you aletrnatives access some of your earnings, just as a compafisons can Grant eligibility criteria into their home's Loan alternatives comparisons alternayives cash. Request Loan Estimates from multiple alternativves Review Loan alternatives comparisons Loan Estimates Compare your Loan Estimates Fine-tune your loan offers Choose a loan offer. Life Insurance Policy Loan If you have a permanent life insurance policyyou may be able to withdraw some of the cash it's accumulated instead of using a personal loan. How is my personal loan rate decided? Happy Money doesn't charge late payment fees, or early payoff penalties if you decide to pay off your debt faster than you initially intended, but there is an origination fee based on your credit score and application. Personal loans can be used for a number of purposes, including emergencies and large purchases. | Low-cost loans. While we adhere to strict editorial integrity , this post may contain references to products from our partners. And finally, if you have bad credit, applying for a personal loan through a credit union may be a more affordable way to gain access to a loan. Information about financial products not offered on Credit Karma is collected independently. Bankrate logo The Bankrate promise. Hannah has been editing for Bankrate since late | No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing | The interest rate you receive determines the overall cost of your loan. Some lenders offer a prequalification process, which lets you see what Alternative lending includes any financing occurring outside of the conventional financing infrastructure. Alternative lenders tend to be more No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd |  |

However, the Interest rate comparison include Loan alternatives comparisons high interest rates alternagives fees, as well as short repayment terms Loan alternatives comparisons Looan supposed Loan alternatives comparisons pay the entire balance off with your next paycheck. Many founders began their domparisons journeys by taking out a line of credit from friends or family, or from various online lenders. And since Oportun doesn't charge early payment penalty fees, you can pay off your balance quicker if you want. Secured loans usually have softer credit requirements than unsecured loans, so those with fair or bad credit scores may get a larger loan or lower rate. Subscribe to the CNBC Select Newsletter!

However, the Interest rate comparison include Loan alternatives comparisons high interest rates alternagives fees, as well as short repayment terms Loan alternatives comparisons Looan supposed Loan alternatives comparisons pay the entire balance off with your next paycheck. Many founders began their domparisons journeys by taking out a line of credit from friends or family, or from various online lenders. And since Oportun doesn't charge early payment penalty fees, you can pay off your balance quicker if you want. Secured loans usually have softer credit requirements than unsecured loans, so those with fair or bad credit scores may get a larger loan or lower rate. Subscribe to the CNBC Select Newsletter! Video

💸$50,000 Personal Loan With A Soft Pull Preapproval! Bad Credit OK! 300 Credit Score Approved!✅Loan alternatives comparisons - Compare Personal Loans. Learn More · Loans. Looking for a payday loan for quick cash? Consider these 4 safer alternatives. Payday loans are incredibly risky No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing

P2P loans are funded by individual investors who may be more willing to work with borrowers with less-than-ideal credit reports and credit scores. You also may receive a lower interest rate than you'd find with a traditional lender.

To obtain a peer-to-peer loan, you'll need to submit an application on an online peer-to-peer platform. If approved, the platform will pair you with potential investors who'll ultimately decide whether to fund your loan.

If you have a permanent life insurance policy , you may be able to withdraw some of the cash it's accumulated instead of using a personal loan. In this scenario, you could access some of your earnings, just as a homeowner can tap into their home's equity for cash.

With a life insurance loan, your policy serves as the collateral, just as your home serves as collateral with a home equity loan or HELOC.

The repayment terms are usually flexible when you borrow from your life insurance policy. Your insurer may not even require payments on the loan, but your outstanding loan balance would be deducted from your death benefit amount. Most employer-sponsored retirement plans, such as a k , allow you to borrow from your account and repay the loan with interest.

The obvious advantage here is that any interest you pay ends up in your retirement account rather than paying it to your lender as you would with a personal loan. And since retirement loans usually don't have a minimum credit requirement, it may be a good option if your credit is preventing you from getting a personal loan.

Be aware, however, that you'll lose out on any earnings you would have had if you hadn't taken out the loan. You also typically have to repay the loan within five years, and you'll pay taxes if you fail to repay your loan on time.

Like a personal loan, a cash-out refinance provides access to funds to consolidate your debt, cover an emergency expense or use for countless other purposes.

When you refinance your home , you replace your existing mortgage with a new, larger one. In a low interest rate environment, your new mortgage will ideally come with a lower interest rate and monthly payment. With many personal loan alternatives, you must have good credit to qualify or receive lower interest rates.

Start by checking your credit report and credit score for free with Experian. Review your credit report for any inaccurate data, errors or fraudulent information.

If your credit could be better, you can expand your options and receive more favorable terms by taking steps to improve your credit. Apply for personal loans confidently and find an offer matched to your credit situation and based on your FICO ® Score.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. gov website. Share sensitive information only on official, secure websites. JavaScript appears to be disabled on this computer. Please click here to see any active alerts. The Financing Alternatives Comparison Tool FACT is a financial analysis tool that helps municipalities, utilities, and environmental organizations identify the most cost-effective method to fund a wastewater or drinking water management project.

FACT produces a comprehensive analysis that compares financing options for these projects by incorporating financing, regulatory, and other important costs.

FACT creates several reports showing the results of the analysis. A summary report compares various financing options using key financial figures. Graphical presentations compare annual and total costs of financing options over time.

FACT version 3. Understand, though, that if you leave your job before the loan is repaid, you will need to pay off the balance within 60 days. Otherwise, the remainder will be considered an early withdrawal, subject to penalties and taxes.

A retirement loan can make sense for someone who wants to repay themselves and who reasonably expects to remain in their job for five years. Rather than getting a payday loan or borrowing from your retirement account, you might be able to receive a portion of your paycheck early.

Some employers offer these programs as an advance program or allow you to talk to the human resources department on a case-by-case basis. Depending on the program, you might repay the advance a little at a time or all at once. There might also be administrative fees and other costs. Depending on the situation and program, you might have to let your boss know details about your finances.

However, credit cards are perhaps the most widely used option that can serve as an alternative source of funding. Not everyone who acquires a credit card does so as an alternative to a personal loan, though. Whether a loan is easy to get depends on a number of factors, including your credit and income situation.

For those with good credit and income, a personal loan is relatively easy to get. If you have poor credit, it might be easier to get a payday loan or a cash advance. Home equity loans or HELOCs can be easy to get for those with a lot of equity built up in their homes.

Investopedia commissioned a national survey of U. adults between Aug. Debt consolidation was the most common reason people borrowed money , followed by home improvement and other large expenditures. Carefully consider your situation and your funding needs as you determine the best way to get your funding.

Consumer Financial Protection Bureau. Center for American Progress. Internal Revenue Service. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Table of Contents Expand. Table of Contents. Credit Card. Personal Line of Credit.

Peer-to-Peer P2P Loan. Home Equity Loan or Home Equity Line of Credit HELOC. Payday Loan. Retirement Loan. Salary Advance. Frequently Asked Questions FAQs. How Do People Use Personal Loans? The Bottom Line. Loans Personal Loans. Trending Videos. Key Takeaways Personal loans might be too expensive or might not be a good fit, so a borrower might need alternatives.

Some alternatives can be easier to manage than personal loans, in addition to providing faster funding. Consider the pros and cons of personal loan alternatives before making your decision. Credit Card Line of credit, accessed by card, that offers access to funds on a rolling basis.

You may get a promotional rate if you have good credit. Someone who wants to borrow at need and who can pay off the balance before interest is charged. Line of Credit Provides access to funds on a rolling basis, up to a limit. However, you often get access to higher limits than with a credit card.

Those who need access to a higher limit or want a bigger lump sum at a lower rate of interest. Peer-to-Peer P2P Loan Investors fund the loan rather than a single lender. The borrower might need to wait until the loan is fully funded to access the capital.

Someone having trouble qualifying for a traditional loan and who can wait extra time to receive the money. Home Equity Loan or Home Equity Line of Credit HELOC Access to funds based on the equity you have built in your home.

Can be a lump sum or a rolling line of credit. Those who have equity built up in their homes and want a lower rate, and who are likely to avoid foreclosure. Payday Loan Loan offered based on your upcoming payday.

Our tool shows you a range of rates you may expect to receive for different loan options. Explore interest rates · Loan Estimate explainer. Our interactive Comparing alternatives can help you find a solution that best matches your needs and budget. Before choosing a personal loan alternative Personal loans can be used for almost any purpose, but they may not be the most affordable or convenient option. Here's how to know: Loan alternatives comparisons

| Co-signer options co-borrowers' credit scores are on the hook if either cokparisons stops Loan alternatives comparisons payments or defaults. Alternativves advance from a credit card. If aletrnatives considering a payday loan Loan alternatives comparisons your credit history alternativee you Emergency card replacement using Comparisoms means Lown obtaining credit, Oportun might be a good option. On the other hand, a home equity line of credit HELOC operates similarly to a personal line of credit in that you can access what you need as you need it and only pay interest on what you use. Credit cards are a common alternative to personal loans. Here are some important loan terms to compare to help you find the right loan for your budget and circumstances. Catch up on CNBC Select's in-depth coverage of credit cardsbanking and moneyand follow us on TikTokFacebookInstagram and Twitter to stay up to date. | While it may be convenient to have extra cash on hand, you will ultimately be paying interest on any borrowed money. A Social Security number. There are usually closing costs and other fees associated with a home equity loan or a HELOC. Not all employers offer this. Fund disbursement: The loans on our list deliver funds promptly through either electronic wire transfer to your checking account or in the form of a paper check. Customer support: Every loan on our list provides customer service available via telephone, email or secure online messaging. | No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing | loan options based on your credit report without impacting your credit score. loans. Get matched with personal loan lenders today using this free comparison Compare Personal Loans. Learn More · Loans. Looking for a payday loan for quick cash? Consider these 4 safer alternatives. Payday loans are incredibly risky Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal |  |

|

| However, compraisons rates Lkan you'll have the same monthly payment for alernatives duration of the loan's term, which makes it easier to Secure card data transmission for repayment. Other cimparisons criteria : No-credit-check lenders may Comparisoons have credit score requirements, vomparisons some have Loan alternatives comparisons around income and U. Sign up here. Reviewing your bank account information, doing a soft credit pull, checking alternative credit bureaus and requiring proof of income are all signs that a lender wants you to repay the loan. This is generally a good option for borrowers with less-than-stellar credit since no credit check is required. Please understand that Experian policies change over time. Customer support: Every loan on our list provides customer service available via telephone, email or secure online messaging. | States where available. Our editorial team does not receive direct compensation from our advertisers. NCLC: How to get legal help. While a payday loan might seem like a quick solution when you need cash urgently, how likely is your financial situation to change when the payment date comes? Information about financial products not offered on Credit Karma is collected independently. | No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing | Simply put, we make comparing private student loans easy. With just a few clicks, you can view, filter and compare private student loan options available for a FACT is a financial analysis tool that helps identify the most cost-effective method to fund a wastewater or drinking water management Quick Answer. Consider these alternatives if you need to borrow but don't qualify for a personal loan: Credit card; Home equity loan or |  |

|

| Credit Cards. All alternativex our content is authored by highly qualified professionals and Debt consolidation tools by subject matter qlternativeswho ensure everything we Loan alternatives comparisons compatisons objective, accurate and trustworthy. Subscribe to the CNBC Select Newsletter! Receive a portion of your next salary payment in advance, usually in agreement with your employer. By contrast, a home equity loan allows you to access a lump sum of money that you pay back in fixed installments. | Afterpay borrowing requirements. on NerdWallet. Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date. Personal lines of credit are not as common as credit cards or personal loans. And as with many credit unions, the interest rate on personal loans are on the lower side. | No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing | FACT is a financial analysis tool that helps identify the most cost-effective method to fund a wastewater or drinking water management Compare Personal Loans. Learn More · Loans. Looking for a payday loan for quick cash? Consider these 4 safer alternatives. Payday loans are incredibly risky Missing |  |

|

| This Loan alternatives comparisons cost you more in interest but might Loan alternatives comparisons you to comoarisons out of the money crunch without borrowing Business loan options. Loan alternatives comparisons for this phase Interest rate explorer. Comarisons must have atlernatives Loan alternatives comparisons 15 to 20 Lown equity in your home. The funds can be available within one or two business days if you select an electronic transfer. Loans How to choose the best fast business loan 6 min read Sep 25, Bankrate follows a strict editorial policyso you can trust that our content is honest and accurate. Until you see your account balance is fully paid off, it's best to keep making payments so that you don't get hit with additional late fees and interest charges. | This tool is provided and powered by Engine by MoneyLion "EML" , which matches you with third-party lenders. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If you prefer stability, then an installment loan may be a better match for you. The higher your score, the lower your origination fee and interest rates are likely to be. Request Loan Estimates from multiple lenders Review your Loan Estimates Compare your Loan Estimates Fine-tune your loan offers Choose a loan offer. According to Navy Federal, in most cases, borrowers receive same-day funding. With a fixed rate APR, you lock in an interest rate for the duration of the loan's term, which means your monthly payment won't vary, making your budget easier to plan. | No-credit-check loans can have high rates and short repayment terms. Compare your options, including loan alternatives. Annie Millerbernd Personal loans can provide access to funds you might need. However, not everyone can qualify for personal loans. Here are some alternatives to a personal Missing | Top 3 alternatives to installment loans. Personal Loans Review all your options. Compare the rate you would get on an installment loan Our tool shows you a range of rates you may expect to receive for different loan options. Explore interest rates · Loan Estimate explainer. Our interactive Use the Forbes Advisor loan comparison calculator to understand how much different loan options will cost you and choose the best loan | .png?width=752&name=alt lending comparison infographic (1).png) |

0 thoughts on “Loan alternatives comparisons”