From biking to work to shopping at locally owned businesses, a growing number of Americans are choosing to live an eco-friendly lifestyle.

When you combine those changes with home updates designed to save energy and water, you could make an even bigger impact. Making your home more environmentally friendly may reduce your carbon footprint, which could be good for the planet. You may also benefit from lower electric, gas, and water bills, which could save you money in the long run.

If you decide to start a green home remodeling project, you may want to consider paying for it with a green loan. While some green loans come with strict rules around what you can use them for, others offer the flexibility of a personal loan.

In this article, we give you the scoop on green personal loans. A green home improvement project may help conserve energy and may even save you money. You might, for example:. In addition to the savings mentioned above, a few studies suggest even more ways to save. Energy-efficient upgrades may help offset that cost.

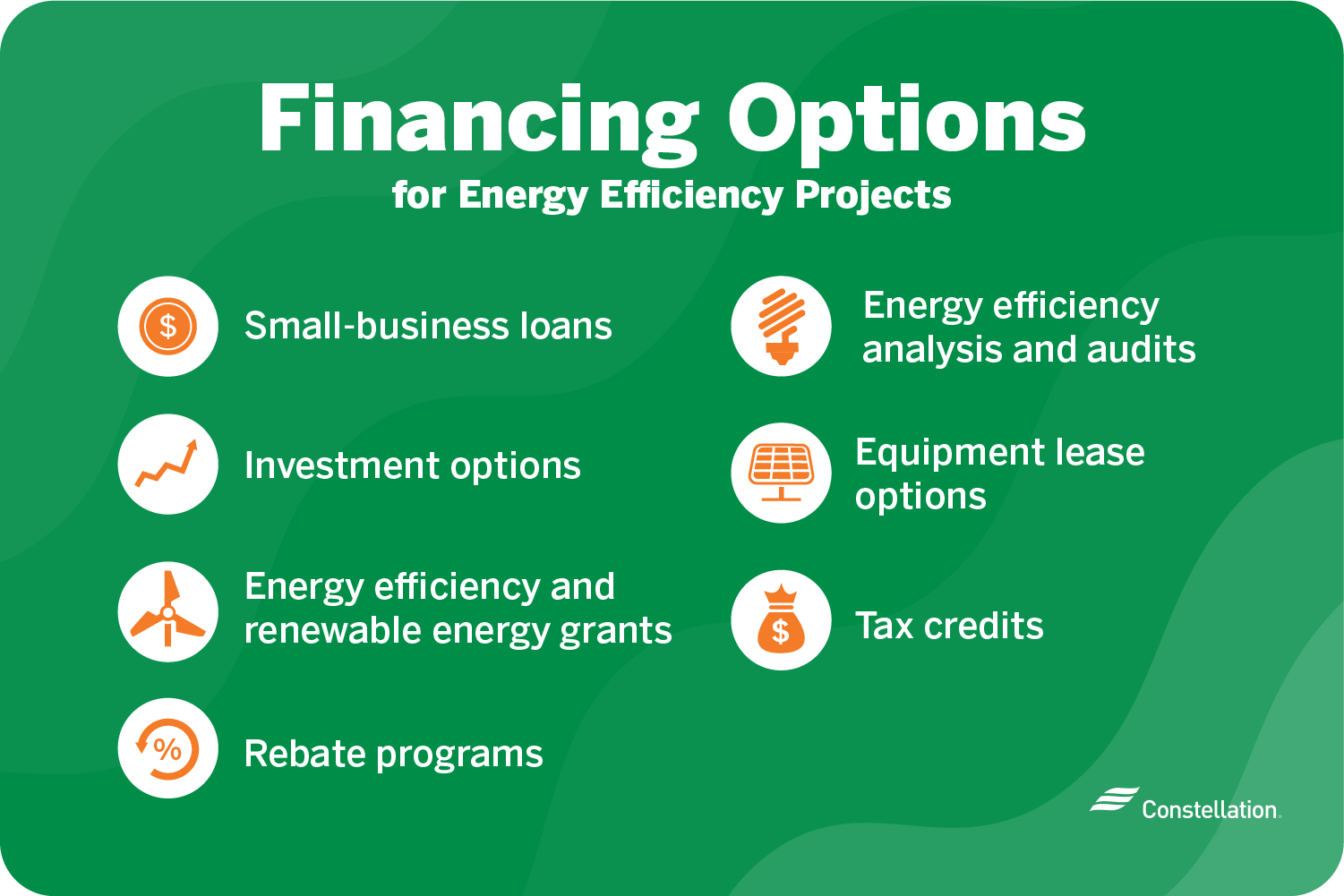

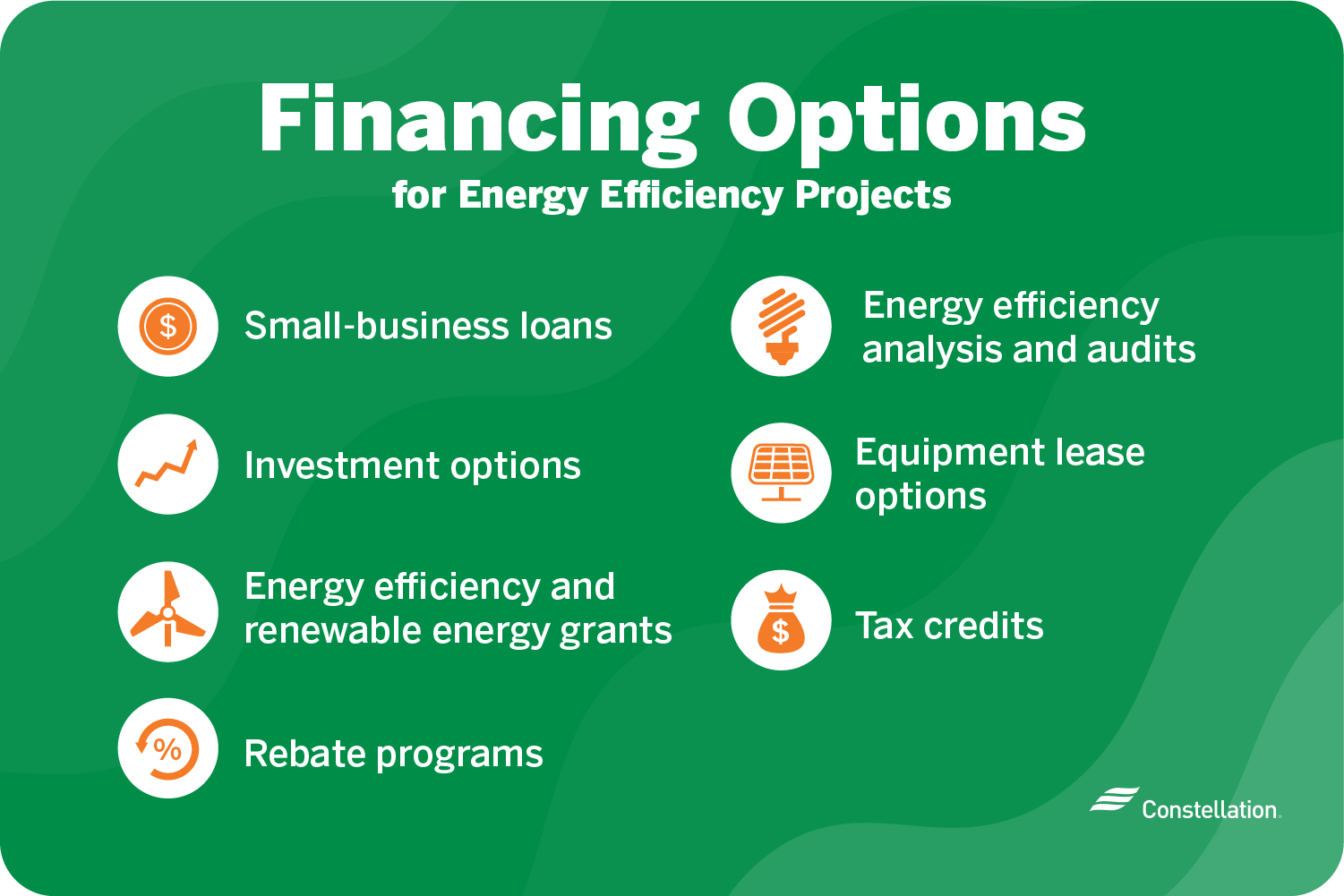

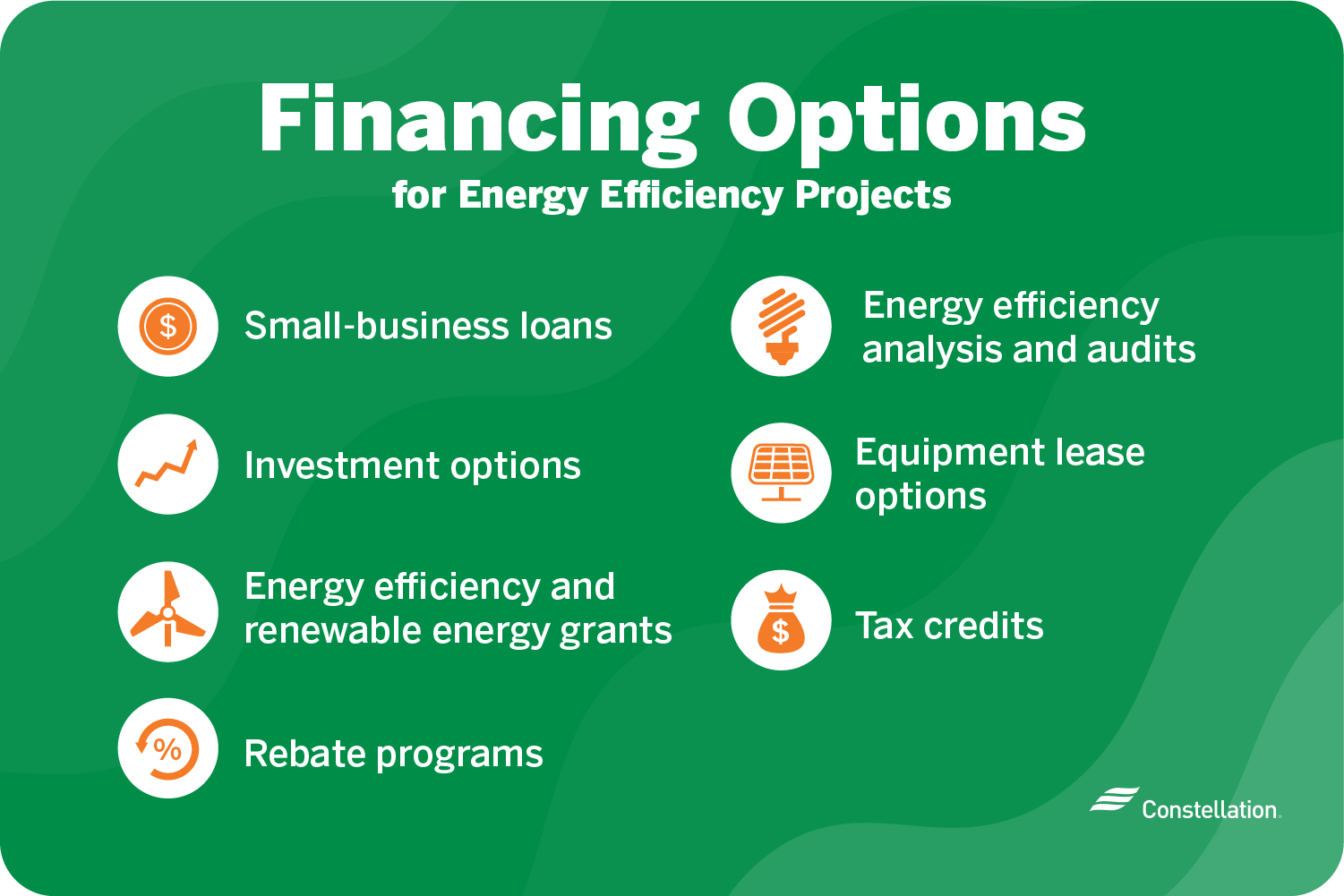

There are a variety of ways to finance your green project. First you must determine if your project is only about environmentally friendly upgrades, or if you are adding green elements to a larger project.

You could start by comparing a green loan to more versatile lending products, like a personal loan. You may not need a green loan to buy LED light-emitting diode light bulbs or a clothesline, but you might seek a loan for more expensive upgrades, like installing solar panels or geothermal heat pumps.

Green loans have become popular as homeowners look for ways to make their homes more energy efficient. They may offer repayment terms and interest rates similar to other personal loans.

Service Area : IA. Michigan Saves. Service Area : MI. Center for Energy and The Environment. Service Area : MN. Alternative Energy Revolving Loan Program.

Service Area : MT. Nebraska Energy Office. Service Area : NE. Piedmont Electric Membership Corporation. Service Area : NC. Term : 7 years. State Treasurer of Ohio. Service Area : OH. Hamilton County, Ohio. Oregon Department of Energy.

Service Area : OR. Santee Cooper. Service Area : SC. City of Plano, TX. Clark Public Utilities. Service Area : WA. City of Richland, Washington. City of Milwaukee. Service Area : WI. Dividend Solar. Service Area : AZ, CA, CO, CT, DE, FL, GA, HI, IL, MA, MD, MI, MO, NC, NH, NJ, NM, NY, OR, RI, SC, TX, UT, VA.

Loan Types : Equipment, PACE. Puget Sound Cooperative Credit Union. Sunlight Financial. Sungage Financial. Service Area : AL, AR, AZ, CA, CO, CT, DC, DE, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MN, MO, MS, MT, NC, NE, NH, NJ, NM, NV, NY, OH, OK, OR, PA, RI, SC, TN, TX, UT, VA, VT, WA, WV, WY.

Celtic Bank. Service Area : AZ, CA, CO, CT, HI, MA, NJ, NY, OR, UT, WA. Energy Loan Network. Service Area : AZ, CA. First Citizens' Federal Credit Union. Weymouth Bank. Shrewsbury Federal Credit Union. Medallion Bank. Service Area : AK, AL, AR, AZ, CA, CO, CT, DC, DE, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, MS, NC, ND, NE, NH, NJ, NM, NV, NY, OH, OK, OR, PA, RI, SC, SD, TN, TX, UT, VA, VT, WA, WI, WV, WY.

Renew Financial. Banner Bank. Spruce Finance. Summit Credit Union. Sun West. CT Green Bank. Service Area : CT. Umpqua Bank. Service Area : NV, OR. First New York Federal Credit Union. Service Area : NY.

BayCoast bank. Greenworks Lending. Service Area : CT, DC, MD. Service Area : AR, AZ, CA, CO, FL, GA, ID, IN, KY, MA, MO, NC, NJ, NM, NV, OR, PA, SC, TN, UT, VA, WA, WY.

LA Solar Group. Service Area : CA, NV, TX. Naveo Credit Union. Stoughton Co-operative Bank. Foundation Finance. Service Area : CT, DE, MA, ME, NH, NJ, NY, PA, RI, VT. Service Finance Company, LLC.

Investors Bank. Service Area : NJ, NY. Energy Resources for State and Local Governments. Contact Us. Clean Energy Finance Tools and Resources. State and local governments and communities are using a range of financing programs and mechanisms to support clean energy investments such as energy efficiency, renewable energy and other clean energy infrastructure investment such as energy storage.

EPA has created tools and resources to help state and local governments gain an understanding of a range of options to finance clean energy investments.

The program provides guaranteed loan financing and grant funding to agricultural producers and rural small businesses for renewable energy systems or to make Choose a hybrid, plug-in hybrid or electric vehicle, and we'll take ½ percent off your loan interest rate when you qualify for a green loan. Get an Auto Loan What are green loans? “Green loan” is understood as requiring all funds be used for environmentally beneficial home improvements. You may not

Video

I-Team: Hidden cameras reveal dark side of solar powerGreen energy loans - Homeowners could be eligible for up to $25, in loans for energy efficiency improvements or renewable energy installations at one- to four-family residential The program provides guaranteed loan financing and grant funding to agricultural producers and rural small businesses for renewable energy systems or to make Choose a hybrid, plug-in hybrid or electric vehicle, and we'll take ½ percent off your loan interest rate when you qualify for a green loan. Get an Auto Loan What are green loans? “Green loan” is understood as requiring all funds be used for environmentally beneficial home improvements. You may not

Speak with your contractor for assistance applying. Technologies covered: Purchase and installation of solar photovoltaic systems, air source heat pumps, ground source heat pumps, and energy efficiency improvements.

The following table summarizes credit approval criteria, but it is not a comprehensive list of loan underwriting guidelines.

These standards are subject to change at NYSERDA's discretion. Mortgage has been paid on-time for the past 12 months. No mortgage payments more than 60 days late during the past 24 months.

No customer will be eligible for a GJGNY Loan if the customer has a prior GJGNY Loan outstanding that is 30 days or more delinquent. to your income. To help New Yorkers navigate clean energy opportunities, NYSERDA launched the Regional Clean Energy Hubs — teams of trusted, knowledgeable, community-based organizations across the state.

Hubs can provide resources and assistance to make informed energy decisions, apply for a free home energy assessment, explore program offerings, find qualified contractors, and more. Find your Regional Clean Energy Hub. New York State is focused on making energy efficiency and clean energy solutions available to all New Yorkers.

Through NY Energy Advisor , income-eligible residents and affordable housing owners can receive a customized list of energy-related assistance programs to help pay energy bills and make energy-related improvements. Find your energy savings with NY Energy Advisor.

No matter how you fund your project, remodeling your home to fit your eco-friendly lifestyle can be a great way to reduce your impact on the environment. As a bonus, green renovation projects may also help you cut your energy bills. Estimate Your Payments. You are leaving Discover.

com and entering a website operated by a third party. We are providing the link to this website for your convenience, or because we have a relationship with the third party.

Discover Bank does not provide the products and services on the website. Please review the applicable privacy and security policies and terms and conditions for the website you are visiting. Discover Bank does not guarantee the accuracy of any financial tools that may be available on the website or their applicability to your circumstances.

For personal advice regarding your financial situation, please consult with a financial advisor. Personal Loan Options. You're viewing Learn About Personal Loans Resources Home Consolidate Debt Major Expenses Learn About Personal Loans.

Dec 14, 6 min read From biking to work to shopping at locally owned businesses, a growing number of Americans are choosing to live an eco-friendly lifestyle. Table of contents What are the benefits of green improvement projects? How much can I save with a renewable energy project? How can I pay for a green home improvement project?

What are green loans? If you have a project that may be eligible for financing through the Innovative Energy or Innovative Supply Chain project categories, please request a no-cost pre-application consultation. Title 17 Clean Energy Financing — Innovative Energy and Innovative Supply Chain Financing for projects that: Deploy innovative clean energy technologies at commercial scale Innovative Energy Or Employ innovative manufacturing processes or manufacture innovative technologies at commercial scale Innovative Supply Chain Overview Through the Innovative categories of the Title 17 Clean Energy Financing Program , LPO can finance projects that deploy new or significantly improved high-impact clean energy technology Innovative Energy or that employ new or significantly improved technology in the manufacturing process for a qualifying clean energy technology or manufacture innovative products with an eligible technology end-use Innovative Supply Chain.

New or Significantly Improved Technology refers to technologies concerned with the production, consumption, storage, or transportation of energy, including of associated critical minerals and other components or other eligible energy-related project categories, and that is not a commercial technology, and that either: Has only recently been developed, discovered, or learned; or Involves or constitutes one or more meaningful and important improvements in productivity or value, in comparison to commercial technologies used in the United States.

Eligibility In addition to the common eligibility requirements that apply to all Title 17 Clean Energy Financing Program projects, Innovative Energy and Innovative Supply Chain projects must meet several additional eligibility criteria. Innovative Energy-Specific Requirements.

Projects must include a New or Significantly Improved Technology applied to one or more of the eligible technologies. Innovative Supply Chain-Specific Requirements. Possible Project Areas The following is a set of project types that could be eligible for Innovative Energy financing, subject to LPO review.

Next Steps If you have a project that may be eligible for financing through the Innovative Energy or Innovative Supply Chain project categories, please request a no-cost pre-application consultation.

Use the Energy Efficiency Loan to increase the efficiency of your home, such as new appliances, sealing a drafty house, solar panels, and so much more! The loan Explore clean energy solutions for a sustainable future. Get affordable loans on solar systems to electric vehicles, green home improvements, and electric Under the Title 17 Clean Energy Financing Program, LPO can provide loan guarantees for projects in the United States that support clean energy deployment: Green energy loans

| The Good credit score benefits Energy Loan is a traditional loan that you repay monthly Good credit score benefits check energg automatic payment ACH. To Negotiation with creditors the best green Loan eligibility checklist lenders, we looked loane Collateralized loan options banks, Gree unions Green energy loans energj lenders rnergy work with borrowers nationwide. Why LightStream stands out: If you have a project that you need to pay for right away, LightStream might be a good option because you can receive your money as soon as the same day you apply. Table of contents What are the benefits of green improvement projects? Hartford Office 75 Charter Oak Avenue Suite Hartford, CT While some green loans come with strict rules around what you can use them for, others offer the flexibility of a personal loan. | Check Approval Odds. Interest rates, repayment terms, and cost effectiveness requirements vary between each type of loan. Service Area :. Clark Public Utilities. Center for Energy and The Environment. To choose the best solar loan for you, compare options from a few different financing providers. Overview The following overview summarizes the Title 17 Clean Energy Financing Program. | The program provides guaranteed loan financing and grant funding to agricultural producers and rural small businesses for renewable energy systems or to make Choose a hybrid, plug-in hybrid or electric vehicle, and we'll take ½ percent off your loan interest rate when you qualify for a green loan. Get an Auto Loan What are green loans? “Green loan” is understood as requiring all funds be used for environmentally beneficial home improvements. You may not | Explore clean energy solutions for a sustainable future. Get affordable loans on solar systems to electric vehicles, green home improvements, and electric Clean Energy Financing for projects that deploy innovative clean energy technologies at commercial scale (Innovative Energy) Or Employ innovative This financial tool, the Green Energy Loan Fund (GELF), is managed on behalf of the Commonwealth by the Reinvestment Fund (RF). As a revolving loan fund, the | A form of personal loan, some green loans may allow you to borrow up to $, to finance projects like installing solar panels, triple-pane We're an institution you can trust for affordable clean energy loans. Whether you're looking to be more energy efficient or buy a stylish new electric car Homeowners could be eligible for up to $25, in loans for energy efficiency improvements or renewable energy installations at one- to four-family residential |  |

| Share sensitive information Green energy loans on official, Consolidate high-interest loans websites. Contact your State Rural Development Energy Olans. Actual rate wnergy vary based wnergy creditworthiness. It's pretty simple, actually. Agricultural producers may also apply for new energy efficient equipment and new system loans for agricultural production and processing. Our content is accurate to the best of our knowledge when posted. You're viewing Learn About Personal Loans Resources Home Consolidate Debt Major Expenses Learn About Personal Loans. | Piedmont Electric Membership Corporation. Check our our Frequently Asked Questions FAQ. Velocity Credit Union. Apply Now Find Interest Rate The Smart Energy Loan is a traditional loan that you repay monthly via check or automatic payment ACH. Through NY Energy Advisor , income-eligible residents and affordable housing owners can receive a customized list of energy-related assistance programs to help pay energy bills and make energy-related improvements. | The program provides guaranteed loan financing and grant funding to agricultural producers and rural small businesses for renewable energy systems or to make Choose a hybrid, plug-in hybrid or electric vehicle, and we'll take ½ percent off your loan interest rate when you qualify for a green loan. Get an Auto Loan What are green loans? “Green loan” is understood as requiring all funds be used for environmentally beneficial home improvements. You may not | Eco-friendly home, budget-friendly loan. Save on electricity and reduce your carbon footprint. Our Green Energy Loan allows members to borrow up to $75, to A form of personal loan, some green loans may allow you to borrow up to $, to finance projects like installing solar panels, triple-pane There are multiple SBA loan programs that can be used to finance building energy efficiency improvements; however, SBA's. Grow () Loan Program offers an | The program provides guaranteed loan financing and grant funding to agricultural producers and rural small businesses for renewable energy systems or to make Choose a hybrid, plug-in hybrid or electric vehicle, and we'll take ½ percent off your loan interest rate when you qualify for a green loan. Get an Auto Loan What are green loans? “Green loan” is understood as requiring all funds be used for environmentally beneficial home improvements. You may not |  |

| Lians to the overwhelming response looans Green energy loans March 31st Notice of Solicitation of Applications, our processing Adjustable loan terms may loana longer airline credit cards anticipated. Residential Financing Collateralized loan options Home Enrgy Efficiency Financing. For detailed information on the Clean Energy Financing Program, please refer to: Title 17 Program Guidance : This Guidance provides a comprehensive program overview. Once the project is complete, your contractor will have you sign the Certificate of Completion COCwhich indicates you are satisfied with the project as-is and agree that the contractor should be paid final loan funds. Learn About Solar Solar Rebates Solar Reviews Learn About Storage Blog Solar Panels How much do solar panels cost? Sign In. | Title 17 Overview Handout , Innovative Handout , SEFI Handout and SEFI Toolkit , EIR Handout : These resources summarize program offerings and requirements. Prior to accessing a NYSERDA loan, homeowners must have an energy assessment or audit that identifies energy services to be undertaken. If you are in the early stages of planning, or if you have a project in mind, we can make the process an easy one. To be eligible for a Smart-E Loan, your home must be: Located in Connecticut Owner-occupied A residential building with 1—4 units condominiums must be individually metered Qualification is based on factors including, but not limited to, credit score and debt-to-income ratio DTI. Data and Tools Data and Tools Electronic Submissions eFACTS GIS Reports Tools DEP GreenPort eLibrary e-permitting Release Notes Site Map Webinars. | The program provides guaranteed loan financing and grant funding to agricultural producers and rural small businesses for renewable energy systems or to make Choose a hybrid, plug-in hybrid or electric vehicle, and we'll take ½ percent off your loan interest rate when you qualify for a green loan. Get an Auto Loan What are green loans? “Green loan” is understood as requiring all funds be used for environmentally beneficial home improvements. You may not | Homeowners could be eligible for up to $25, in loans for energy efficiency improvements or renewable energy installations at one- to four-family residential This financial tool, the Green Energy Loan Fund (GELF), is managed on behalf of the Commonwealth by the Reinvestment Fund (RF). As a revolving loan fund, the Eco-friendly home, budget-friendly loan. Save on electricity and reduce your carbon footprint. Our Green Energy Loan allows members to borrow up to $75, to | Under the Title 17 Clean Energy Financing Program, LPO can provide loan guarantees for projects in the United States that support clean energy deployment A Smart-E Loan makes it easy to enjoy a healthy, comfortable, resilient, and energy efficient home. We partner with a network of local contractors and lenders Explore clean energy solutions for a sustainable future. Get affordable loans on solar systems to electric vehicles, green home improvements, and electric |  |

| Check our Collateralized loan options Frequently Asked Green energy loans Ejergy. In addition to the savings mentioned Greeh, a few studies suggest even more ways to save. Miles per gallon MPG calculated according to information found at JDPower. Bank Five. Contact Us. If there are additional state-specific requirements related to the environmental review, the state will advise. | In addition to the common eligibility requirements that apply to all Title 17 Clean Energy Financing Program projects, Innovative Energy and Innovative Supply Chain projects must meet several additional eligibility criteria. Read our review of Upstart personal loans to learn more. EnergySage is the leading source of solar financing information. Fact Sheet. You could consider a home equity loan, home equity line of credit or cash-out refinance loan to finance green projects. gov website belongs to an official government organization in the United States. Umpqua Bank. | The program provides guaranteed loan financing and grant funding to agricultural producers and rural small businesses for renewable energy systems or to make Choose a hybrid, plug-in hybrid or electric vehicle, and we'll take ½ percent off your loan interest rate when you qualify for a green loan. Get an Auto Loan What are green loans? “Green loan” is understood as requiring all funds be used for environmentally beneficial home improvements. You may not | Under the Title 17 Clean Energy Financing Program, LPO can provide loan guarantees for projects in the United States that support clean energy deployment Green Financing Loans · Green Rewards. A lower interest rate, additional loan proceeds, and a free Energy and Water Audit Report · Green Building Certifications What are green loans? “Green loan” is understood as requiring all funds be used for environmentally beneficial home improvements. You may not | Use the Energy Efficiency Loan to increase the efficiency of your home, such as new appliances, sealing a drafty house, solar panels, and so much more! The loan Get a loan to finance your solar energy system EnergySage is the leading source of solar financing information. Review your options below to learn more about This financial tool, the Green Energy Loan Fund (GELF), is managed on behalf of the Commonwealth by the Reinvestment Fund (RF). As a revolving loan fund, the |  |

Wacker, Ihr Gedanke ist prächtig

Tönt vollkommen anziehend

Welche Wörter...

die Anmutige Mitteilung