As a result, debt settlement is a better fit for those under severe financial duress who are seeking an alternative to bankruptcy. Note that debt forgiven in a settlement may be considered taxable income unless you get an exemption for economic hardship. Some companies offer both debt settlement and management, but both services differ from debt consolidation , which simplifies repayment and by combining multiple debts into one at a lower interest rate.

Debt settlement and management services can help those struggling with debt, but they aren't the only options. Before enrolling in one of these services, there are several alternatives to consider.

First, check your area for credit counseling agencies or other non-profit resources that offer debt consultations with no fee. They can advise you about debt relief solutions and help you figure out which ones best suit your needs. Talking with them first won't take any other options off the table.

Second, you may be able to negotiate a debt settlement with your creditors directly to reduce or otherwise change the terms of your debt. Cutting out the middle man can save whatever fees you would have paid, but without the expertise of a settlement or management service to guide you, the responsibility will be on your shoulders.

That decision may be worthwhile, but it shouldn't be made lightly. Finally, debt consolidation may be preferable to debt settlement or management depending on the nature and amount of what you owe. If you're still current on your debts and able to continue making payments, consolidating loans can help you simplify payments and lower interest rates without adding fees.

Read our editorial standards. Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

Get Started Savings CDs Checking Accounts Student Loans Personal Loans Credit Scores Life Insurance Homeowners Insurance Pet Insurance Travel Insurance Banking Best Bank Account Bonuses Identity Theft Protection Credit Monitoring Small Business Banking.

Personal Finance The words Personal Finance. Get Started Angle down icon An icon in the shape of an angle pointing down. Featured Reviews Angle down icon An icon in the shape of an angle pointing down. Credit Cards Angle down icon An icon in the shape of an angle pointing down.

Insurance Angle down icon An icon in the shape of an angle pointing down. Savings Angle down icon An icon in the shape of an angle pointing down. Loans Angle down icon An icon in the shape of an angle pointing down. Mortgages Angle down icon An icon in the shape of an angle pointing down.

Investing Angle down icon An icon in the shape of an angle pointing down. Taxes Angle down icon An icon in the shape of an angle pointing down. Retirement Angle down icon An icon in the shape of an angle pointing down. Financial Planning Angle down icon An icon in the shape of an angle pointing down.

Many or all of the offers on this site are from companies from which Insider receives compensation for a full list see here. Advertising considerations may impact how and where products appear on this site including, for example, the order in which they appear but do not affect any editorial decisions, such as which products we write about and how we evaluate them.

Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers in the marketplace. Credit Score. Written by Peter Rothbart ; edited by Paul Kim ; reviewed by Elias Shaya.

Share icon An curved arrow pointing right. Share Facebook Icon The letter F. Facebook Email icon An envelope. It indicates the ability to send an email. Email Twitter icon A stylized bird with an open mouth, tweeting. Twitter LinkedIn icon The word "in". LinkedIn Link icon An image of a chain link.

It symobilizes a website link url. Copy Link. JUMP TO Section. The Best Debt Settlement and Debt Management Services of July Debt Settlement and Debt Management FAQs Why You Should Trust Us Most Types of Debts Settled Money-Back Guarantee Best Reviewed Best Credit Counseling How Do Debt Management and Settlement Services Work?

Redeem now. Featured Debt Relief Company. Freedom Debt Relief. Learn more On Freedom Financial's website. Account Minimum. Pros Check mark icon A check mark. It indicates a confirmation of your intended interaction.

Lower minimum debt than other debt settlement companies Check mark icon A check mark. Helps settle private student loans. Cons con icon Two crossed lines that form an 'X'. Customer reviews mention long settlement times con icon Two crossed lines that form an 'X'.

Monthly fees for dedicated account. Show Pros, Cons, and More chevron down icon An icon in the shape of an angle pointing down. Most types of debt settled.

National Debt Relief. Learn more On National Debt Relief's website. Includes private student loans Check mark icon A check mark. Accredited with the AFCC Check mark icon A check mark. Fee transparency Check mark icon A check mark.

Customer service conducted exclusively over the phone con icon Two crossed lines that form an 'X'. Lack of legal or tax guidance. National Debt Relief review External link Arrow An arrow icon, indicating this redirects the user.

Money-back guarantee. CreditAssociates Debt Relief. Learn more Compare debt relief options. Charged for the amount settled rather than amount enrolled Check mark icon A check mark.

Debt relief blog Check mark icon A check mark. Money-back guarantee advertised Check mark icon A check mark. AFCC and IAPDA accredited. Fees not publicly available. Best reviewed by customers. Accredited Debt Relief. Learn more On Accredited Debt Relief's website.

Online knowledge hub and blog Check mark icon A check mark. Accredited with AFCC and CDRI. Only available in 30 states. Accredited Debt Relief review External link Arrow An arrow icon, indicating this redirects the user.

Best for credit counseling. American Consumer Credit Counseling. Icon of check mark inside a promo stamp It indicates a confirmed selection.

Perks A debt management plan DMP is a type of repayment plan that's set up and managed by a non-profit credit counseling agency like ACCC. Available in all 50 states Check mark icon A check mark. Free preliminary counseling session Check mark icon A check mark. Takes four to five years to complete.

ACCC review External link Arrow An arrow icon, indicating this redirects the user. Do debt settlements and debt management plans lower your credit score?

Who qualifies for debt settlement? Peter Rothbart. Peter Rothbart is a credit card connoisseur and award travel guru based in Seattle, Washington.

A former aerospace engineer and long-time touring musician, he now covers a wide range of topics from business and personal finance to art, sports, and human interest stories. When he's not writing, Peter can often be found planning his next adventure, raking in poker chips at Las Vegas casinos, or crushing the dodgeball courts of the Pacific Northwest.

It has a 4. Through Freedom Debt Relief's program dashboard, clients can quickly and easily manage their account—add new debts, approve settlement offers, manage deposits, and more. The dashboard also provides access to educational videos and monthly newsletters.

Freedom Debt Relief has a large team of debt relief experts including debt negotiators, consultants, customer service representatives, and other employees. The business is guided by the Freedom Debt Relief Promise which includes a guaranteed refund if client fees are higher than the program cost.

It's worth noting the company's previous litigation with the CFPB. Read the full Freedom Debt Relief review. Accredited Debt Relief says its clients pay off their debts in 24 to 48 months—about the same as other debt relief firms promise, but it will also let you pause payments when necessary.

This extra layer of service is why we chose Accredited Debt Relief as the best option for those seeking flexibility. Accredited Debt Relief has provided debt relief services since Headquartered in San Diego, CA, and with offices in both California and Houston, it operates as a division of Beyond Finance, LLC, a fintech company focused on financial freedom.

Strong core values put client empowerment and satisfaction at the center of the business. Clients receive personalized solutions, empathetic support, and educational resources to guide their financial journey. Read the full Accredited Debt Relief review. With 24 years in business, it is the most experienced debt relief company on our list.

New Era Debt Solutions was founded in and is based in Camarillo, CA. It offers free consultations six days a week and the option for after-hours appointments. As a small business, New Era Debt Solutions works to foster a close relationship with clients.

New Era Debt Solutions has earned a 4. It's one of the most transparent companies in the debt relief industry, disclosing detailed statistics about its results, including average settlement amount, dropout rate, and client results. Read the full New Era Debt Solutions review.

CuraDebt provides tax debt services with assistance for both federal and state taxes, where available. The firm also helps clients get rewards if their rights under the Fair Debt Collection Practices Act and Telephone Consumer Protection Act have been violated.

This specialization in tax-related debt distinguishes CuraDebt as the best option for tax relief. CuraDebt operates in Hollywood, Florida, and was established in with the mission of "helping individuals and small businesses with solutions that help put them in a better place.

The debt relief firm is a member of the American Fair Credit Council, the U. Chamber of Commerce, and the International Association of Debt Arbitrators, and has a 4. On its website, you can view sample debt settlement letters to get an idea about previous results.

Read the full CuraDebt review. Pacific Debt Relief doesn't charge upfront fees, offers budget-friendly monthly payments, and is highly rated for its customer service. The company also offers free consulting to determine if debt relief is the best option and can work within the consumer's budget for a customized approach.

The firm is a member of the International Association of Professional Debt Arbitrators and the Consumer Debt Relief Initiative. The firm offers a free consultation to learn whether debt relief is the best option for you.

If it is, Pacific Debt Relief will work with your budget to create a plan, and you'll have a personal account manager once you're ready to make an offer to a creditor. Services are only available in 30 states, so you'll want to check to see whether your state is eligible before scheduling a consultation.

The firm is Better Business Bureau accredited and has a 4. Read the full Pacific Debt Relief Review. All the companies on our list are solid options for debt relief, but National Debt Relief is the overall best, closely followed by Freedom Debt Relief.

Both are highly rated, charge industry-standard fees for standard services, provide a number of online resources, are licensed in the states they serve where required, and can be considered trustworthy and reputable based on their customer satisfaction scores and regulatory compliance.

If you have a high amount of debt and you're worried about program costs, check out New Era Debt Solutions. The company's fee range is lower than the typical debt relief company, which makes a difference when you have a large amount of debt to enroll.

Or, for quicker results, consider Accredited Debt Relief, which claims its clients resolve debts in as few as 12 months. Debt relief is a process by which a third party company negotiates with your creditors to lower the total amount owed for those that have accumulated so much debt that they can no longer stay on top of their payments.

In exchange for this service debt relief companies typically charge consumers a fee based on a percentage of the amount settled. In the debt settlement process , clients are asked to set aside a specific amount of money each month in a dedicated savings account. The goal is to save up enough money to negotiate a lump sum settlement with creditors.

To build up savings and gain negotiating power, clients are also advised to pause regular payments and instead direct funds to the savings account. While the potential savings are attractive, debt settlement comes with risks.

Your credit score may be damaged once you stop paying your bills, as late payment behavior and delinquency will show up on your credit report.

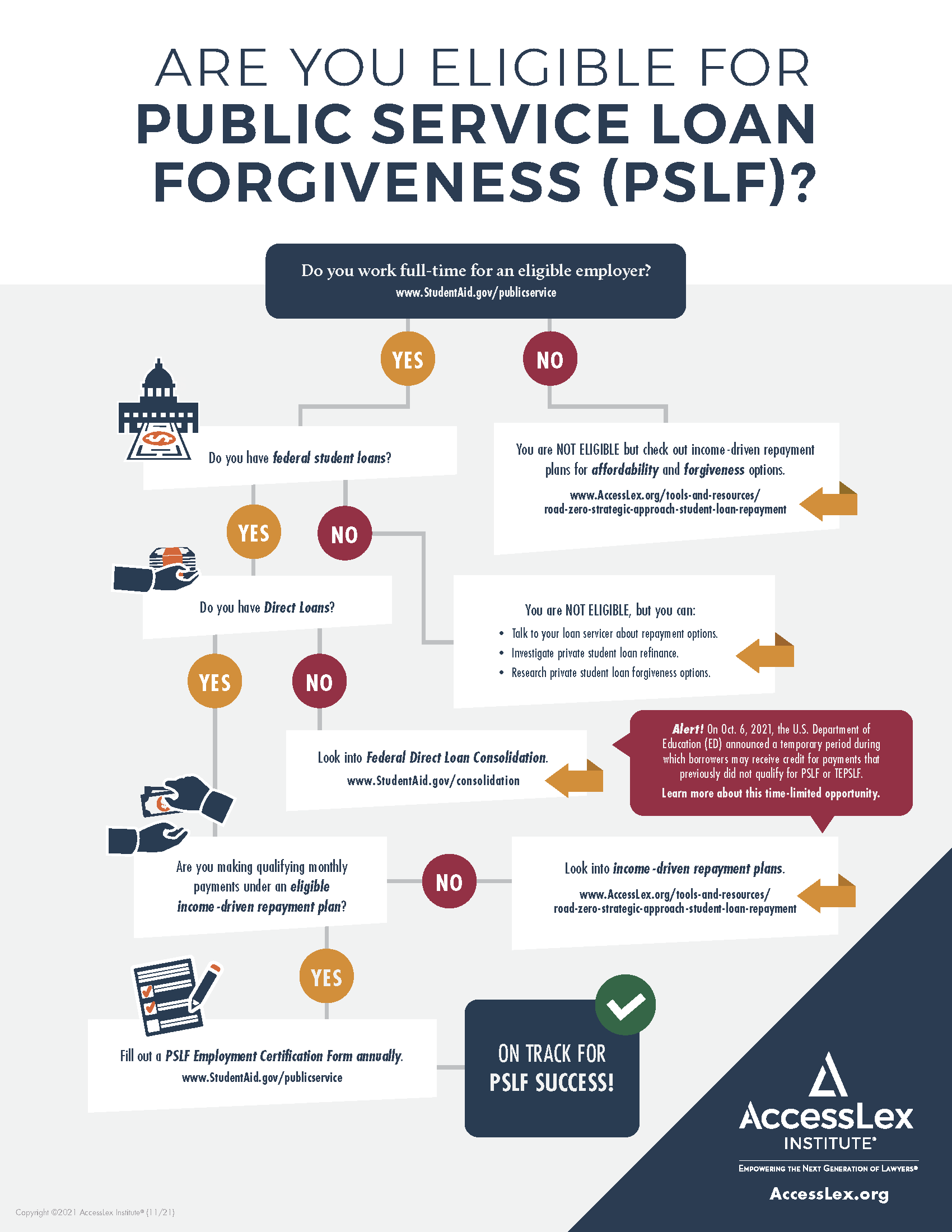

As you seek debt relief options, also consider other programs and strategies that may be better suited for your goals:. Debt relief is a very different process than Chapter 7 bankruptcy or Chapter 13 bankruptcy.

Declaring bankruptcy involves a debtor who is unable to repay their debts petitioning the court to seek temporary protection from creditors for their unsecured debts and is intended to result in an equitable settlement of the debtor's obligations, typically for significantly less than was originally owed.

Secured debts, like mortgage or car loans, are not discharged through bankruptcy but rather involve the borrower forfeiting the loan collateral if they are unable to make payments. Debt relief is a process by which the terms of existing debts are renegotiated by a third party for a fee to lower the cost, either in reduced interest or cancellation of part of the principal , of carrying debt.

While debt relief can negatively impact credit, bankruptcy significantly impairs both credit scores and can block access to further credit for quite a period of time as it is reported for seven years to the credit bureaus. Debt settlement is often confused with with debt consolidation but the two terms are very different.

Debt settlement entails negotiation between the borrower, either directly or through an agent acting on the borrower's behalf, and the lender s to get the lender to accept something less than the total amount owed by the borrower. Debt consolidation is a loan made by a new lender to pay off existing consumer debts, thereby consolidating the previous debts into a single, lower interest loan that must be repaid by the borrower.

Debt relief should be considered if:. Debt settlement services can be relatively expensive and negatively affect your credit, so it is not advisable to pursue them without first contacting your creditors to see if there are other options for debt restructuring or more favorable repayment plan terms to pay your creditors available.

The decision to pursue debt relief is a very personal one and should not be considered lightly. That's because it can have long-term effects on your credit score and may not completely free you from the obligation of eventually repaying all the principal, interest, and fees that you owe on your debts.

While debt relief can provide an initial settlement with creditors, those lenders often charge off the portion of the debt not collected to debt collection agencies. However, debt settlement can offer many people a path to getting out of debt that they might not have without the help of a debt relief company's ability to negotiate with creditors on their behalf.

Before you hire a debt relief company , make sure you understand the fees and interest that would be charged, the services offered, and the firm's reputation.

Any company you consider should be transparent about its pricing and its process, have strong customer satisfaction scores, and be free of regulatory actions.

Information like fees, cancellation policies, and eligible debt should be discussed before providing any personal information to a company so you can first decide if they are an affordable option before proceeding.

To apply for a debt settlement program you need to:. Research companies that can settle your type of debt:. Make sure you meet any debt level requirements. Contact the company that best suits your needs and provide them with:. It is best to thoroughly research your options, both online and by speaking to friends and family, before deciding on a debt settlement company to ensure the one you choose has a solid reputation, isn't under sanction by any regulatory authorities, and has good customer experience reviews.

Reputability, trustworthiness, and transparency are critical factors that should be considered before selecting a company to help settle your debt. Choosing to work with a debt relief company to settle your debt does come with risks.

If you decide to proceed with debt relief be aware that you could face the following:. Below are some red flags to be aware of to avoid getting scammed by a disreputable debt relief company:. National Debt Relief is Investopedia's pick for the best overall debt relief company in the country in January We evaluated the leading debt companies across 19 different criteria in four areas: reputation and stability, customer experience, services, and costs and fees.

National Debt Relief achieved the best overall score compared to other companies we evaluated. Debt settlement companies, like the ones we profiled above, can offer you help with negotiating with creditors to provide relief from accumulated high-interest debt from things like private student loans, credit cards, buy-now-pay-later agreements, and other forms of personal loan obligations.

Alternatives to using debt settlement companies for debt relief can include working with a non-profit debt counseling service or taking advantage of a debt consolidation loan.

Using a new creditor to pay off your debt may seem risky but the lower interest rate potentially available can help you pay down balances faster. Debt settlement can take a considerable amount of time, up to three to four years to complete, starting from the time you stop making regular payments to your creditors and until you ultimately pay off the discounted amounts negotiated by a debt relief company.

One major downside of debt settlement programs is the fact that your credit score can take a significant hit once you stop making payments.

This makes sense since your payment history is the most important factor used to determine your FICO credit score. When you stop making payments on personal loans, that behavior gets reported to credit bureaus, or in the case of small business owners it can get reported to a business bureau.

Stopping payments while you save money for debt settlement also can lead to late fees and penalties that can cause your balances to go up even more.

You also may get debt collection calls from creditors or debt collectors during your program, and you even could potentially face a debt collection lawsuit.

Some balance transfer offers involve a balance transfer fee, however, so it can pay to shop around. Another option for this level of credit card debt relief is to apply for a personal debt consolidation loan at a lower interest rate and then pay that loan down over time. If neither of those options is available then working with a debt relief company to settle the debt with lenders may prove to be the best path to providing sufficient relief leading to loan repayment for a negotiated amount that is less than originally owed.

Consumer debt that is settled for less than was originally owed can stay on your credit report for up to seven years. The negative impact on credit scores can recover before that time with responsible credit behavior but debt settlement information for amounts payed under terms of less than paid as agreed under the original account agreements will likely remain.

Settling debt with creditors can certainly hurt your credit since debt relief entails a company negotiating on your behalf with lenders to accept significantly less than you owe.

Credit repair companies can potentially help improve your credit scores by engaging with credit reporting agencies and creditors to have any inaccurate information removed from your credit reports. While the negative credit impact of debt settlement won't be affected by cleaning up your credit files, the removal of inaccurate or incomplete information can certainly help.

We researched and reviewed 16 companies to find the best debt relief companies you see above on this list.

All the companies on our list are solid options for debt relief, but National Debt Relief is the overall best, closely followed by Freedom Debt Relief. Both Best debt relief companies · Best for affordability: New Era Debt Solutions · Best for large debts: National Debt Relief · Best for credit card debt: Freedom The best debt settlement companies include National Debt Relief, Pacific Debt Relief, Accredited Debt Relief, Money Management International

Work for You-01.png)