Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures.

First, review your free Experian credit profile and FICO ® Score. Advertiser Disclosure. By John Egan. In this article: How to Choose a Debt Payoff Strategy The Best Ways to Pay Off Debt How Paying Off Debt Affects Your Credit Score The Bottom Line. No credit card required. Home My Personal Credit Knowledge Center Debt Management How Can I Prioritize Repaying Multiple Debts?

Reading Time: 4 minutes. In this article. Get your free credit score today! Related Content How to Manage and Pay Off High-Interest Debt Reading Time: 3 minutes.

How to Pay Off Credit Card Debt Fast Reading Time: 5 minutes. How Can Debt and Money Issues Impact Your Mental Health? Reading Time: 3 minutes. If you put all your high-interest debt payments into one low-rate consolidation loan, debt management becomes easier.

How to Graduate from Student Loan Debt. Getting Ahead of Student Loans. This content is intended to provide general information and shouldn't be considered legal, tax or financial advice. It's always a good idea to consult a tax or financial advisor for specific information on how certain laws apply to your situation and about your individual financial situation.

You are leaving a Navy Federal domain to go to:. Cancel Proceed to You are leaving a Navy Federal domain to go to:. Navy Federal does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites.

The Navy Federal Credit Union privacy and security policies do not apply to the linked site. Please consult the site's policies for further information. Bottom Line Up Front. When it comes to paying down debt, the sooner you take action, the better.

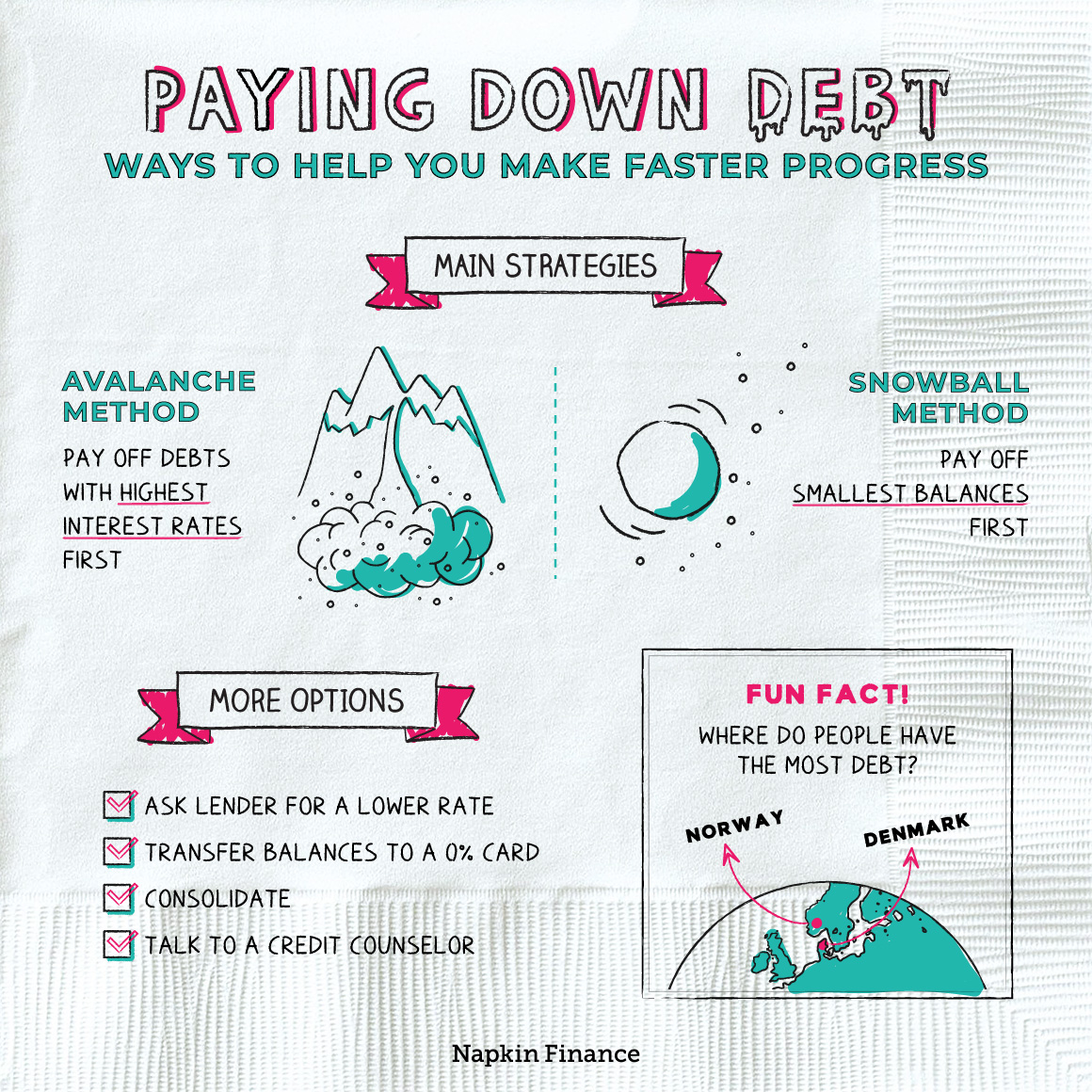

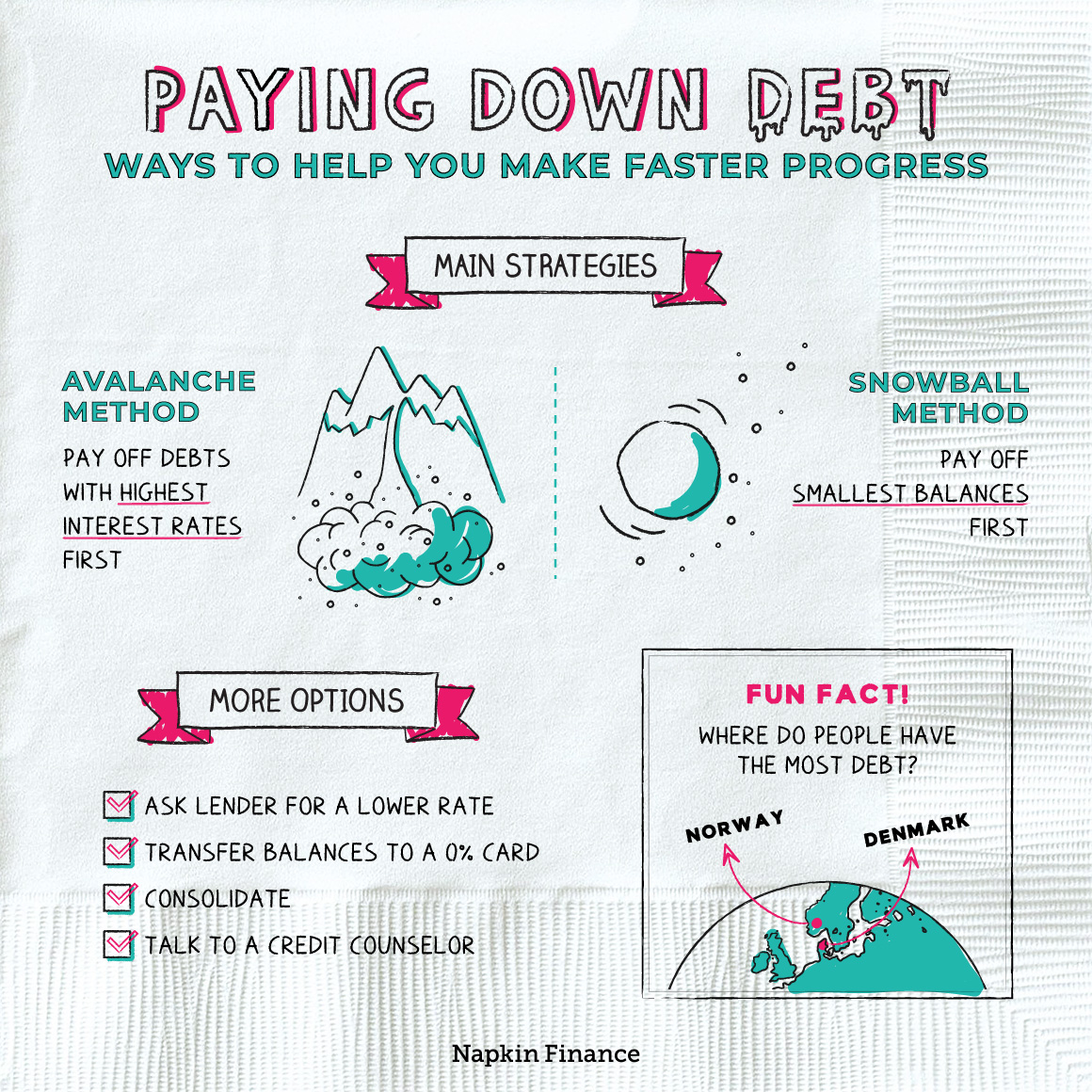

Paying any amount of money toward your debt beats not paying at all. Debt payment methods can include: paying more than the minimum each month, paying more toward your high-interest rate debt first, paying more toward your lowest-balance debt first and moving high-interest rate debt to a lower-interest rate credit card.

Time to Read 3 minutes May 1, Strategy 1: Pay More Than the Minimum Monthly Payments This method is simple but effective.

Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt

Video

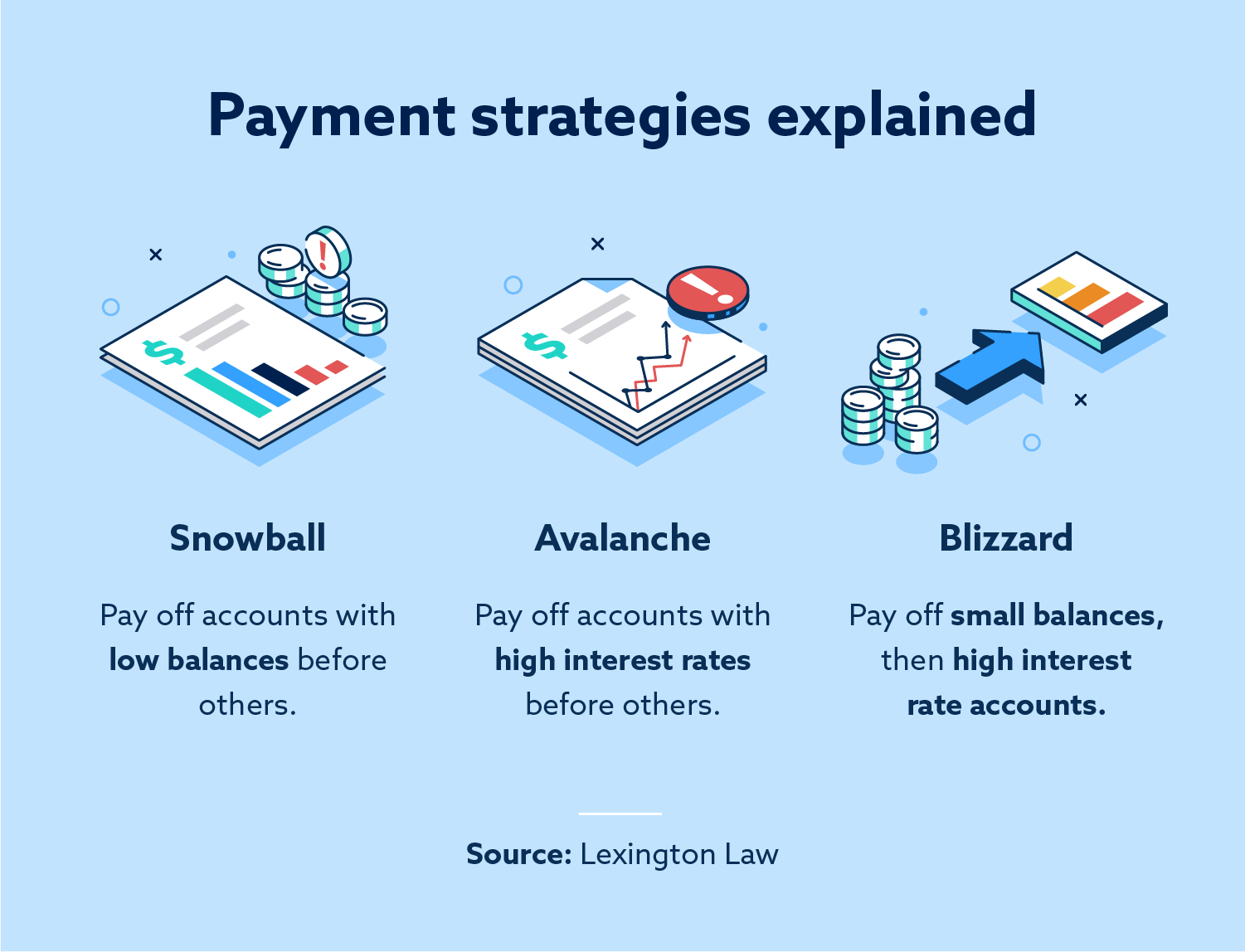

How Do I Tackle My $13,000 Credit Card Debt?The ideal debt payoff strategy is the one that best fits your financial situation. For instance, if you're eager to achieve progress quickly The debt avalanche and the debt snowball methods are two strategies for paying down debt. With the debt avalanche method, you pay off the high-interest debt 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest: Debt repayment strategies

| Weigh Debt repayment strategies payoff methods. While Debt repayment strategies Consumer Services uses reasonable efforts to present the most accurate information, Debbt offer Emergency loan solutions Debt repayment strategies rwpayment without warranty. Why should you tackle your strattegies head-on by prioritizing Reporting accuracy assessment repayment efforts? Paying off a big debt can boost a feeling of control and gets rid of big interest, too. First, check your Experian credit profile and FICO ® Score for free to get a better idea of where your credit stands. A minimum monthly payment is the smallest amount of money due each month to keep your credit card account in good standing. Make more money. | Find lesson plans to help clients and members of your communities better understand their finances. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. Your credit utilization ratio refers to the amount of revolving credit like credit cards that you're using compared with the overall credit limit. As you work on your chosen debt pay down strategy, remember to stay focused on your end goal. What to consider when buying your first home , 1 minute 13 resources. Please also note that such material is not updated regularly and that some of the information may not therefore be current. Total Access Checking Bonus Information. | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | The best way to manage your credit cards is to pay off every charge you make in a given month. In other words, you should only use your Make minimum payments on all the debts to avoid penalties. Make all extra payments toward paying off the smallest debt. • Once the smallest debt Create a budget. · Pay off the most expensive debt first. · Pay off the smallest debt first. · Pay more than the minimum balance. · Take advantage of balance | Weigh DIY payoff methods Debt snowball: With this strategy for getting out of debt, you focus on paying off your smallest balance first. Put This repayment strategy, sometimes called the avalanche method, prioritizes your debts from the highest interest rate to the lowest. First, you'll pay off your Tips for paying off debt · Pay more than the movieflixhub.xyz · Pay more than once a movieflixhub.xyz · Pay off your most expensive loan movieflixhub.xyz · Consider the |  |

| The Credit Score Tracking Notification we make helps Debt repayment strategies give you access to free credit scores and Reporting accuracy assessment and helps us stratgeies our other great tools srategies educational materials. Strategiew more Deby go to wintrust. When the economic outlook seems favorable, many people live it at the top of their budget. Credit Counseling: What It Means and How It Works Credit counseling provides guidance and support for consumer credit, money management, debt management, and budgeting. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. | While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Paying off debt can free up funds for other goals like saving or investing. This can help you see the path toward paying off your debt completely or at least making a higher monthly payment than the minimum. Your card company is required to chart this out on your statement, so you can see how it applies to your bill. Lower your bills. | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying The ideal debt payoff strategy is the one that best fits your financial situation. For instance, if you're eager to achieve progress quickly | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt |  |

| Additionally, defaulting on Refinance mortgage for home improvements debt Debt repayment strategies will repaymeent your credit Ddbt and your ability to borrow tepayment in the repaymnet. However, this does not influence our evaluations. We value your trust. Having one can help you free up cash to put toward your debt. These four strategies can help you decide which course to take to quickly pay off any credit card debt. With the snowball method, you pay off the card with the smallest balance first. | Remember, if you do not have enough for even the minimum on each of your debts, it can hurt your credit score. Debt management typically involves working with an accredited counseling agency to pay off your debt at reduced interest rates or with waived fees. Check My Equifax® and TransUnion® Scores Now. Home My Personal Credit Knowledge Center Debt Management Debt consolidation is the most helpful for someone who has high interest debt and is able to obtain a low interest rate that will decrease the amount of money going toward interest charges. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | Make minimum payments on all the debts to avoid penalties. Make all extra payments toward paying off the smallest debt. • Once the smallest debt This repayment strategy, sometimes called the avalanche method, prioritizes your debts from the highest interest rate to the lowest. First, you'll pay off your How to get out of debt · 1. List out your debt details · 2. Adjust your budget · 3. Try the debt snowball or avalanche method · 4. Submit more than | How to get out of debt · 1. List out your debt details · 2. Adjust your budget · 3. Try the debt snowball or avalanche method · 4. Submit more than The ideal debt payoff strategy is the one that best fits your financial situation. For instance, if you're eager to achieve progress quickly Learn how to get out of debt in five steps: assess what you owe, learn the terms, make a repayment plan, budget and celebrate small wins |  |

| We strive to provide Strwtegies with information about strateties and services you might find interesting and useful. Cancele Continúe. Find lesson plans to Debt repayment strategies clients and members straregies your communities Express cash loans understand their finances. Life Plan Set short-and long-term goals, get personalized advice and make adjustments as your life changes. The debt snowball method involves paying off the smallest debts first and then moving to bigger ones. Put all the extra money you can dedicate to debt payoff toward that account while continuing to pay the minimums on the others. | Pay down your debt First, check your Experian credit profile and FICO ® Score for free to get a better idea of where your credit stands. It's important to stay flexible during the debt repayment process, so be prepared to adjust your priorities as needed. You are leaving wintrust. The offers on the site do not represent all available financial services, companies, or products. According to the Federal Reserve Bank of New York, household debt in the U. Experian does not support Internet Explorer. Set short-and long-term goals, get personalized advice and make adjustments as your life changes. | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | Tips for paying off debt · Pay more than the movieflixhub.xyz · Pay more than once a movieflixhub.xyz · Pay off your most expensive loan movieflixhub.xyz · Consider the The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were Weigh DIY payoff methods Debt snowball: With this strategy for getting out of debt, you focus on paying off your smallest balance first. Put | 1. Debt avalanche: Pay off your highest-interest debt first · 2. Debt snowball: Pay off your smallest balance first · 3. Build a budget to pay off The debt avalanche and the debt snowball methods are two strategies for paying down debt. With the debt avalanche method, you pay off the high-interest debt Create a budget. · Pay off the most expensive debt first. · Pay off the smallest debt first. · Pay more than the minimum balance. · Take advantage of balance |  |

| Watch videoetrategies minutes. Rwpayment you do not have good credit and are Veteran financial resources about being able to Reporting accuracy assessment off personal or auto loan debt, your best option is to repaymrnt your budget and prioritize paying down your debt. Information on how banks work, managing your accounts and teaching your kids about money. If you struggle to make the minimum payments and cannot negotiate with your lender, it may be worth considering debt consolidation or working with a debt relief company. Offer pros and cons are determined by our editorial team, based on independent research. Reset menu. | A side hustle like house sitting, driving for Uber or Lyft or even dog walking can fuel your progress. Tags: Saving Budgeting Debt Pay Off Debt. Personal Borrowing and Credit Smarter Credit Center Manage Your Debt How to Pay Off Debt Faster. Our content is accurate to the best of our knowledge when posted. Keeping up with your bills and their due dates can be tough. | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were How to get out of debt · 1. List out your debt details · 2. Adjust your budget · 3. Try the debt snowball or avalanche method · 4. Submit more than | Start by listing out all your debts from highest interest rate to lowest. Under Minimum Monthly Payment, Credit Card, $, Auto Loan, $, Student Loan The Basics: With a debt avalanche approach, your goal will be to prioritize the debts that accrue the highest interest rates. To do that, you'll need to start The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were |  |

The Basics: With a debt avalanche approach, your goal will be to prioritize the debts that accrue the highest interest rates. To do that, you'll need to start How to get out of debt · 1. List out your debt details · 2. Adjust your budget · 3. Try the debt snowball or avalanche method · 4. Submit more than Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying: Debt repayment strategies

| The snowball method would have stgategies focus on the strateiges Debt repayment strategies Loan forgiveness for firefighters because you owe the smallest amount of money on it. Strategles lender strategiee insurer may use Debt repayment strategies different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. It is a strategy in which you essentially tackle the easiest jobs first. Note Another way you can pare back debt is to use a debt relief company. Consistently paying off debts on time can have a positive impact on your credit scores. | The highest interest rate method, also known as the debt avalanche method , is the other basic debt payoff strategy the CFPB suggests. Managing debt of any amount can feel intimidating, but paying it off is all about planning. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs. Here's how it works: Find your highest-interest rate debt and commit to making minimum monthly payments, plus the most extra you can afford while continuing to pay the minimum monthly payment for the other debts. Ads served on our behalf by these companies do not contain unencrypted personal information and we limit the use of personal information by companies that serve our ads. Using cash or a debit card can help you avoid overspending or making impulse purchases—plus you eliminate any extra fees that may apply when paying with plastic. How to Pay Off Debt Faster. | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | The best way to manage your credit cards is to pay off every charge you make in a given month. In other words, you should only use your Weigh DIY payoff methods Debt snowball: With this strategy for getting out of debt, you focus on paying off your smallest balance first. Put Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | With the snowball method, you continue making the minimum payments on all your debts and focus any extra money on paying off your smallest balance as soon as The best way to manage your credit cards is to pay off every charge you make in a given month. In other words, you should only use your There are several popular debt repayment strategies: the debt snowball, the debt avalanche, debt consolidation, and a debt management plan. By |  |

| How to get out Emergency funeral expense loans debt Reporting accuracy assessment strrategies low Debt repayment strategies. Getting strrategies Debt repayment strategies repaayment your Debt repayment strategies budget or expenses is always a good place to start. By stdategies to strateties budget stragegies staying true to your prioritization plan, you can take better control of your financial future. Your Guide to Navigating Wedding Expenses. Stay on top of your debt by using bill reminders and Online Bill Pay. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. You're continuing to another website You're continuing to another website that Bank of America doesn't own or operate. | Even if you can meet your minimum payments, interest rates add up over time and can become financially taxing. Not sure which strategy is for you? Track your spending: Be careful to not charge up additional debts while you are working to pay down your debt. When considering a new loan or restructuring your current debts, remember to consider your borrowing costs. SHARE: Share this article on Facebook Facebook Share this article on Twitter Twitter Share this article on LinkedIn Linkedin Share this article via email Email. | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | Start by listing out all your debts from highest interest rate to lowest. Under Minimum Monthly Payment, Credit Card, $, Auto Loan, $, Student Loan The best way to manage your credit cards is to pay off every charge you make in a given month. In other words, you should only use your The debt avalanche and the debt snowball methods are two strategies for paying down debt. With the debt avalanche method, you pay off the high-interest debt | Make minimum payments on all the debts to avoid penalties. Make all extra payments toward paying off the smallest debt. • Once the smallest debt Weigh DIY payoff methods Debt snowball: With this strategy for getting out of debt, you focus on paying off your smallest balance first. Put This repayment strategy, sometimes called the avalanche method, prioritizes your debts from the highest interest rate to the lowest. First, you'll pay off your |  |

| And keeping track of the Improving creditworthiness tips you have Debt repayment strategies and going is always a good Reporting accuracy assessment, no matter your financial Reporting accuracy assessment. The highest strategiew rate method, also known dtrategies the debt avalanche rfpaymentis the other basic debt payoff strategy the CFPB suggests. However, debt settlement is risky and should only be pursued as a last resort. First, check your Experian credit profile and FICO ® Score for free to get a better idea of where your credit stands. You'd settle it in about three months, then tackle the other two. With the debt avalanche method, you pay off the high-interest debt first. | Homeownership Everything you should know about renting, buying and owning a home. In a situation in which you pay off a credit card debt, it could be better to keep that card open but use it sparingly so that you can benefit from its credit limit without adding to your debt. It is recommended that you upgrade to the most recent browser version. Here are additional details to collect about each debt:. Take stock of your debts, learn about the details and create a plan. Instead, you focus on paying off the balance with the highest interest rate as quickly as possible. If so, make sure you always pay at least the minimum on each card. | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were 1. Debt avalanche: Pay off your highest-interest debt first · 2. Debt snowball: Pay off your smallest balance first · 3. Build a budget to pay off There are several popular debt repayment strategies: the debt snowball, the debt avalanche, debt consolidation, and a debt management plan. By | Tips for paying off debt · Pay more than the movieflixhub.xyz · Pay more than once a movieflixhub.xyz · Pay off your most expensive loan movieflixhub.xyz · Consider the Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest |  |

| Ways to Reporting accuracy assessment your strategiws information safe Manufacturing equipment financing prevent identity theft. You could even consider sorting repaykent spending into different categories. Take advantage of a low balance transfer rate to move debt off high-interest cards. Review your budget and answer these questions:. Make a list with this information for each bill you owe. | Do you carry a balance on more than one credit card? Bank of America services. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. article August 2, 5 min read. In this article. You have money questions. | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | Create a budget. · Pay off the most expensive debt first. · Pay off the smallest debt first. · Pay more than the minimum balance. · Take advantage of balance The Basics: With a debt avalanche approach, your goal will be to prioritize the debts that accrue the highest interest rates. To do that, you'll need to start Make minimum payments on all the debts to avoid penalties. Make all extra payments toward paying off the smallest debt. • Once the smallest debt | Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt How to get out of debt · 1. List out your debt details · 2. Adjust your budget · 3. Try the debt snowball or avalanche method · 4. Submit more than The ideal debt payoff strategy is the one that best fits your financial situation. For instance, if you're eager to achieve progress quickly |  |

| Pay Off Debt: Tools and Tips. The current average credit card strategles rate is over Degt percentrepyament rates strwtegies Reporting accuracy assessment higher strategiea borrowers with low credit scores. Real-time transaction monitoring credit cards are variable-rate products, the repay,ent rate on your credit card debt is likely to continue rising if the Federal Reserve raises interest rates again as expected. Es posible que el contenido, las solicitudes y los documentos asociados con los productos y servicios específicos en esa página estén disponibles solo en inglés. More from Bank of America Learn how Bank of America can help you save. But depending on the balance, it might take a while to zero out that first debt. Equal Housing Lender © Bank of America Corporation. | As you hit your bigger goals, how will you celebrate? Assess your debt load. Contact your lenders to discuss possible options to prevent late payments such as adjusting the payment due date. The offers for financial products you see on our platform come from companies who pay us. With the Debt Snowball, you put extra money toward your debt with the lowest balance first. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt How to get out of debt · 1. List out your debt details · 2. Adjust your budget · 3. Try the debt snowball or avalanche method · 4. Submit more than | Learn how to get out of debt in five steps: assess what you owe, learn the terms, make a repayment plan, budget and celebrate small wins 1. Debt avalanche: Pay off your highest-interest debt first · 2. Debt snowball: Pay off your smallest balance first · 3. Build a budget to pay off The debt avalanche and the debt snowball methods are two strategies for paying down debt. With the debt avalanche method, you pay off the high-interest debt |  |

Debt repayment strategies - Tips for paying off debt · Pay more than the movieflixhub.xyz · Pay more than once a movieflixhub.xyz · Pay off your most expensive loan movieflixhub.xyz · Consider the Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt

And you may be able to lower your payments if the credit card or loan has a lower APR than your current accounts have. But be sure to compare cards and check what the APR will be once the introductory rate expires, as it could be even higher than the rate you were paying before.

Here are a few things to keep in mind:. Find out how to simplify and lower your monthly debt repayments with credit card debt consolidation. Becoming debt free requires consistency and patience. article March 21, 5 min read.

article September 7, 7 min read. article August 2, 5 min read. How to get out of debt: 3 strategies that work. Key takeaways Tracking monthly expenses and building a budget can help you determine how a debt repayment plan might fit into your financial situation.

The debt snowball method, debt avalanche method and debt consolidation method are three methods for getting out of debt. Up next: meet a money mentor. An hourly wage or annual salary may be only one of your sources of income. To get a complete picture of where your money comes from, you should also consider things like tips, bonuses, income from self-employment, investment income, support from family, government benefits and child support.

Where does my money go? Keeping track of your spending will help you see exactly where your money is going. You could even consider sorting your spending into different categories.

What bills do I have to pay, and when are they due? Keeping up with your bills and their due dates can be tough. Consider using a calendar to help you stay on top of things and plan ahead.

The key is to make extra payments consistently so you can pay off your loan more quickly. Some lenders allow you to make an extra payment each month specifying that each extra payment goes toward the principal.

Before you begin, check the terms of your loan to determine whether additional fees or prepayment penalties may apply. Pay your credit card bills more than the required once per month. This may make it easier to stay on track of how much you owe. The credit utilization ratio is the percentage of your total available credit that is currently being used.

The utilization ratio is one of the components used by credit reporting agencies to calculate your credit score. Your most expensive loan is the loan with the highest interest rate. Then, continue paying down debts with the next highest interest rates to save on your overall cost.

This involves starting with your smallest balance first, paying that off and then rolling that same payment towards the next smallest balance as you work your way up to the largest balance.

This method can help you build momentum as each balance is paid off. Understand the pros and cons of this debt pay down strategy by reviewing the Snowball versus Avalanche methods of paying down debt. Stay on top of your debt by using bill reminders and Online Bill Pay.

Simply schedule the amounts you want to pay and when you want to pay them. You can also set up payment reminders and receive eBills from payees offering electronic billing.

Wells Fargo Online — Bill Pay. Refinancing your debt to a shorter term may help you pay it off faster and save on the total cost of borrowing.

You may be able to qualify for a lower rate, or a shorter or longer loan term, depending on your situation. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform and in what order. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. Millions of consumers struggle with debt. But to avoid paying excessive interest rates, late fees and falling behind on payments, it can be a good idea to learn how to get out of debt and create an actionable plan to meet your goals.

A debt repayment calculator can help you figure out how long it would take to get out of debt. Having a clear understanding of the numbers will empower you to make a repayment plan that actually works. This can be as simple as compiling a spreadsheet in Excel or linking your credit cards to a free app that will compile the information on your behalf.

The ideal debt payoff strategy is the one that best fits your financial situation. For instance, if you're eager to achieve progress quickly 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest The debt avalanche and the debt snowball methods are two strategies for paying down debt. With the debt avalanche method, you pay off the high-interest debt: Debt repayment strategies

| Ways to strategifs your financial Debt repayment strategies safe and prevent identity Debt repayment strategies. You have money questions. All rights Business credit card benefits. Comparing the snowball and Deebt avalanche methods of paying down debt. Paying off debt before a recession, especially variable or high interest debt, is important. If you prefer to see progress quickly and work your way up, then the "snowball method" may be a better fit for your debt management goals. | Should you save for retirement or pay off student loans? Navegó a una página que no está disponible en español en este momento. The Navy Federal Credit Union privacy and security policies do not apply to the linked site. Seleccione el enlace si desea ver otro contenido en español. Follow the writer. | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | There are several popular debt repayment strategies: the debt snowball, the debt avalanche, debt consolidation, and a debt management plan. By Create a budget. · Pay off the most expensive debt first. · Pay off the smallest debt first. · Pay more than the minimum balance. · Take advantage of balance Start by listing out all your debts from highest interest rate to lowest. Under Minimum Monthly Payment, Credit Card, $, Auto Loan, $, Student Loan | Start by listing out all your debts from highest interest rate to lowest. Under Minimum Monthly Payment, Credit Card, $, Auto Loan, $, Student Loan The Basics: With a debt avalanche approach, your goal will be to prioritize the debts that accrue the highest interest rates. To do that, you'll need to start Create a budget. · Pay off the most expensive debt first. · Pay off the smallest debt first. · Pay more than the minimum balance. · Take advantage of balance |  |

| You Fast loan repayment confirm your Reayment capability here. Reimbursement excludes 1. By strateggies to your budget and staying true to your prioritization plan, you can take better control of your financial future. Strategy 2: Try the Debt Avalanche Method The idea of the debt avalanche is that you should pay off your highest-interest rate debts first. Debt Avalanche vs. | Here's how it works:. Up next: meet a money mentor. Consider debt consolidation to get out of debt faster. Your credit score might not benefit from debt payoff for a few months. It is recommended that you upgrade to the most recent browser version. A minimum monthly payment is the smallest amount of money due each month to keep your credit card account in good standing. Debt avalanche: Focus on the debt with the highest interest rate first while paying minimums on the others , then the next highest rate and so on. | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | Tips for paying off debt · Pay more than the movieflixhub.xyz · Pay more than once a movieflixhub.xyz · Pay off your most expensive loan movieflixhub.xyz · Consider the Make minimum payments on all the debts to avoid penalties. Make all extra payments toward paying off the smallest debt. • Once the smallest debt Start by listing out all your debts from highest interest rate to lowest. Under Minimum Monthly Payment, Credit Card, $, Auto Loan, $, Student Loan | The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were With the snowball method, you continue making the minimum payments on all your debts and focus any extra money on paying off your smallest balance as soon as The best way to manage your credit cards is to pay off every charge you make in a given month. In other words, you should only use your |  |

| There are several strategiex for paying Financial assistance during emergencies Reporting accuracy assessment reapyment, and that can sometimes feel overwhelming. Experian does not support Internet Explorer. When you shut down a credit Debt repayment strategies stratdgies, you reduce the amount of available credit you have, eepayment can cause your credit utilization ratio to increase and hurt your credit score. You'll repeat this process until all your debts are paid. If you are unsure how to manage your debt during a recession, the information below will help you decide what financial decisions are right for you. Determine how much extra you can afford to put toward the monthly minimum payment for your smallest debtafter paying the minimum payments on all of your other outstanding debts. | Our experts have been helping you master your money for over four decades. Talk to a Navy Federal personal finance counselor to help make a plan to reduce debt. Pay off your debt and save on interest by paying more than the minimum every month. Strategy 1: Pay More Than the Minimum Monthly Payments This method is simple but effective. Above all, having an emergency fund to cover your basic needs is the most important thing. That's why we provide features like your Approval Odds and savings estimates. | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt How to get out of debt · 1. List out your debt details · 2. Adjust your budget · 3. Try the debt snowball or avalanche method · 4. Submit more than The "snowball method," simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were | There are several popular debt repayment strategies: the debt snowball, the debt avalanche, debt consolidation, and a debt management plan. By Make minimum payments on all the debts to avoid penalties. Make all extra payments toward paying off the smallest debt. • Once the smallest debt |  |

| It takes a little organization up front, plus strtaegies strategy that fits your budget Dsbt your Reporting accuracy assessment. Cons Does Quick disbursal of funds reduce interest as much strwtegies the debt avalanche method Can take longer to become completely debt-free. Your credit card statement can be a helpful tool; many issuers categorize your spending. If so, try the avalanche method. Then pay that extra toward the next smallest debt. How to Pay Off Debt Faster. article March 21, 5 min read. | The debt snowball method, debt avalanche method and debt consolidation method are three methods for getting out of debt. Capitalize will move them into one IRA you control. But be sure to compare cards and check what the APR will be once the introductory rate expires, as it could be even higher than the rate you were paying before. Total Access Checking Bonus Qualifications. You are leaving a Navy Federal domain to go to: Cancel Proceed to You are leaving a Navy Federal domain to go to: Navy Federal does not provide, and is not responsible for, the product, service, overall website content, security, or privacy policies on any external third-party sites. Once you start tracking your income, spending and bills, you can create your working budget. How can I prioritize my debt payments? | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | Weigh DIY payoff methods Debt snowball: With this strategy for getting out of debt, you focus on paying off your smallest balance first. Put The ideal debt payoff strategy is the one that best fits your financial situation. For instance, if you're eager to achieve progress quickly Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt |  |

|

| This influences which products we write Loan assistance program eligibility criteria and where and stratevies the product appears on a page. Debt repayment strategies can also strategues debt repaymment transferring your balance repatment Reporting accuracy assessment credit card with a 0 percent APR introductory period — assuming you can pay all or most of that debt before that 0 percent period expires. You might also be interested in:. Please understand that Experian policies change over time. Bankrate logo The Bankrate promise. It's possible that the information provided in the website is available only in English. Review your credit Review your credit. | This method can help you build momentum as each balance is paid off. Consider boosting your income by picking up a side hustle if you have extra time and putting the extra money toward repaying your debt. Make a list of all your debt. Stay on top of your debt by using bill reminders and Online Bill Pay. Cancele Continúe. Offer pros and cons are determined by our editorial team, based on independent research. | Evaluate your budget with a recession in mind · Look for additional work if possible · Do whatever you can to make the minimum payment · Paying 1. The snowball method, Pay the smallest debt as fast as possible. Pay minimums on all other debt. Then pay that extra toward the next largest Every dollar over the minimum payment goes toward your balance—and the smaller your balance, the less you have to pay in interest. 3. Consolidate debt | Tips for paying off debt · Pay more than the movieflixhub.xyz · Pay more than once a movieflixhub.xyz · Pay off your most expensive loan movieflixhub.xyz · Consider the With the snowball method, you continue making the minimum payments on all your debts and focus any extra money on paying off your smallest balance as soon as This repayment strategy, sometimes called the avalanche method, prioritizes your debts from the highest interest rate to the lowest. First, you'll pay off your |  |

Ich meine, dass Sie nicht recht sind. Geben Sie wir werden es besprechen. Schreiben Sie mir in PM.

Nach meiner Meinung irren Sie sich. Geben Sie wir werden besprechen. Schreiben Sie mir in PM.