After attending the University of Chicago, Alicia moved abroad to work for a U. During her time abroad, she was paying her Direct Loans every month. Should Alicia apply for PSLF right now? Alicia should make sure she applies by October 31, Any U.

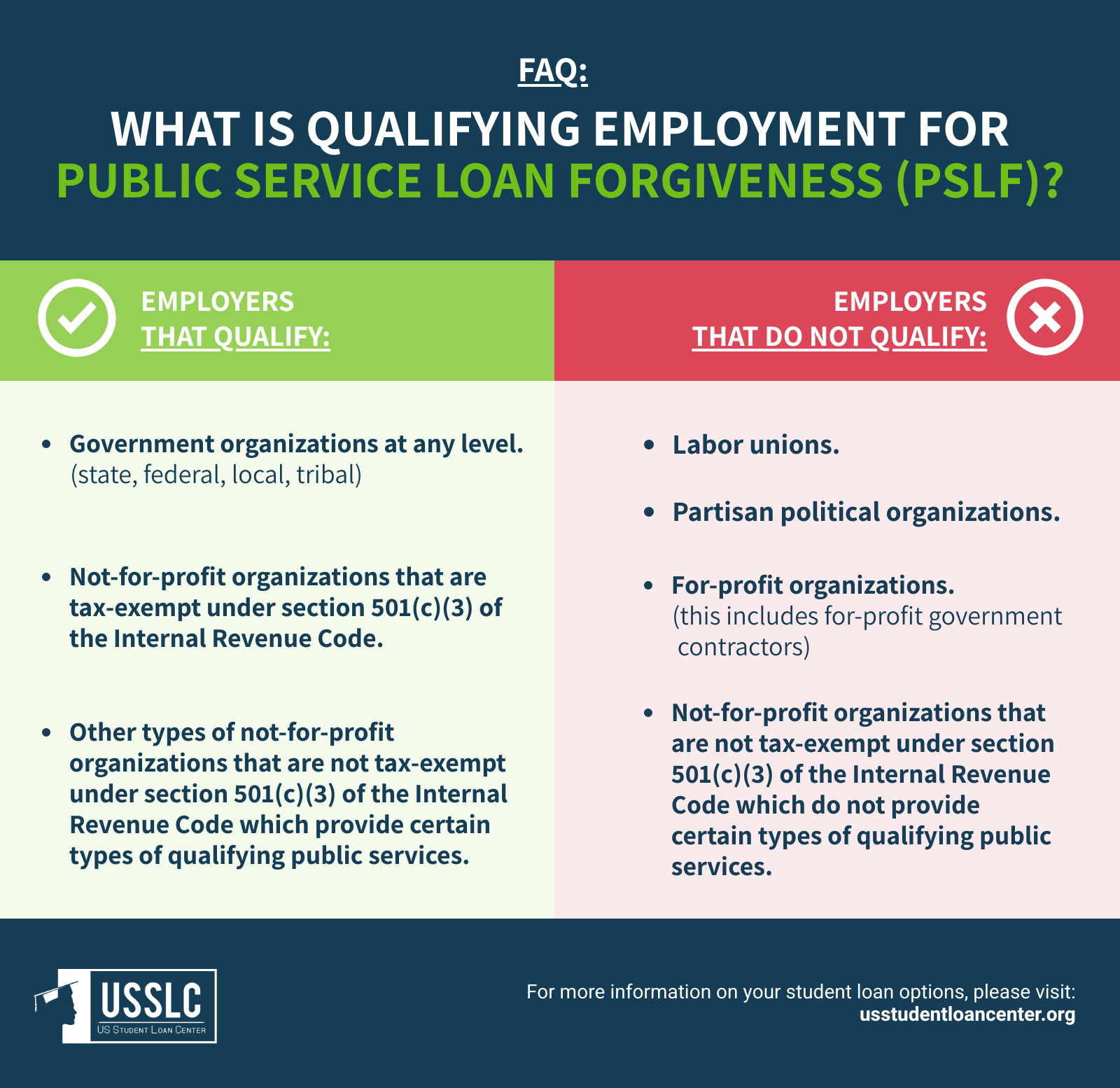

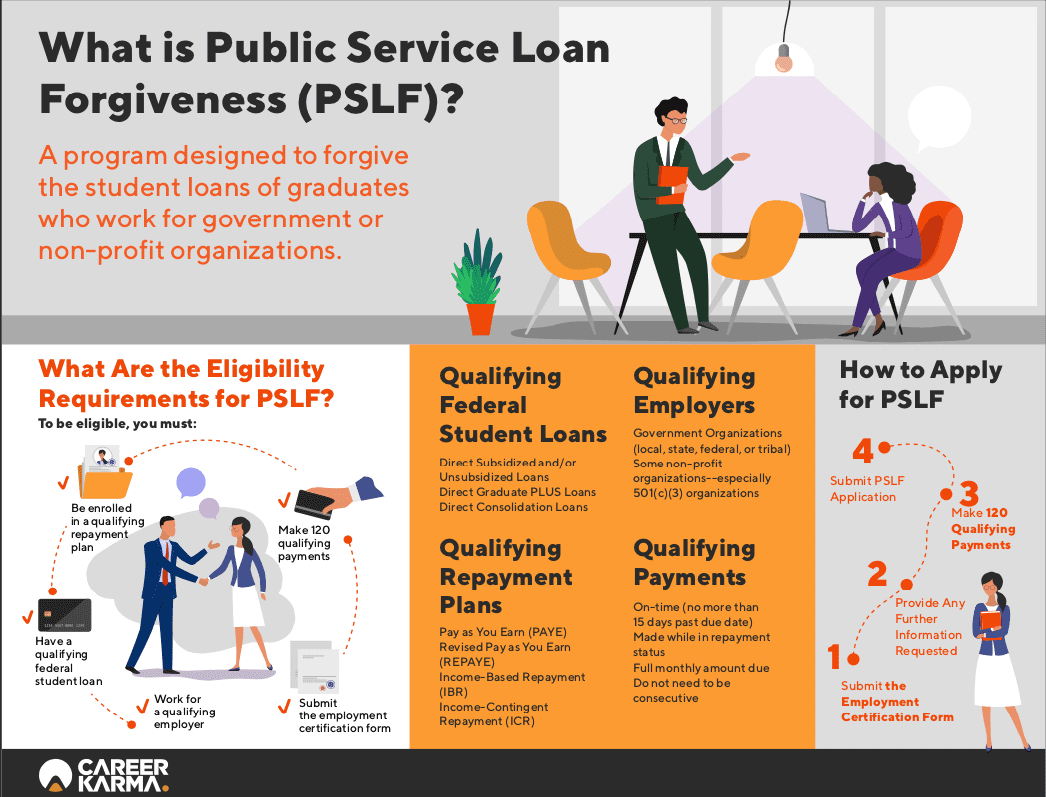

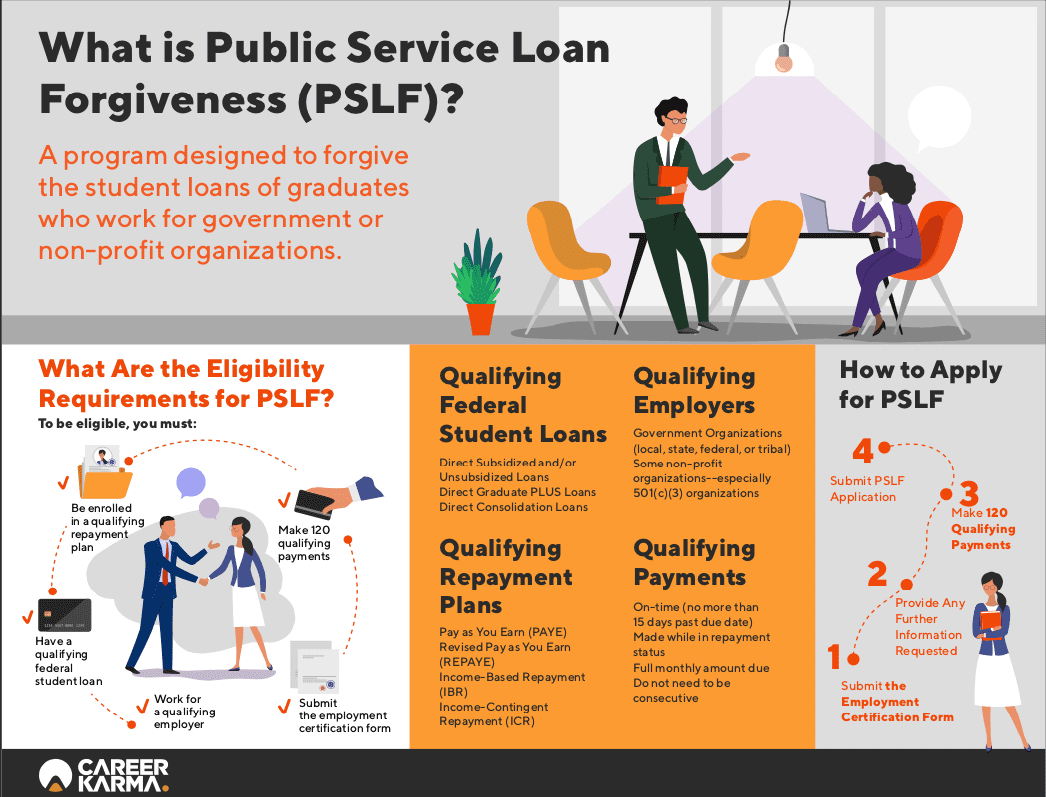

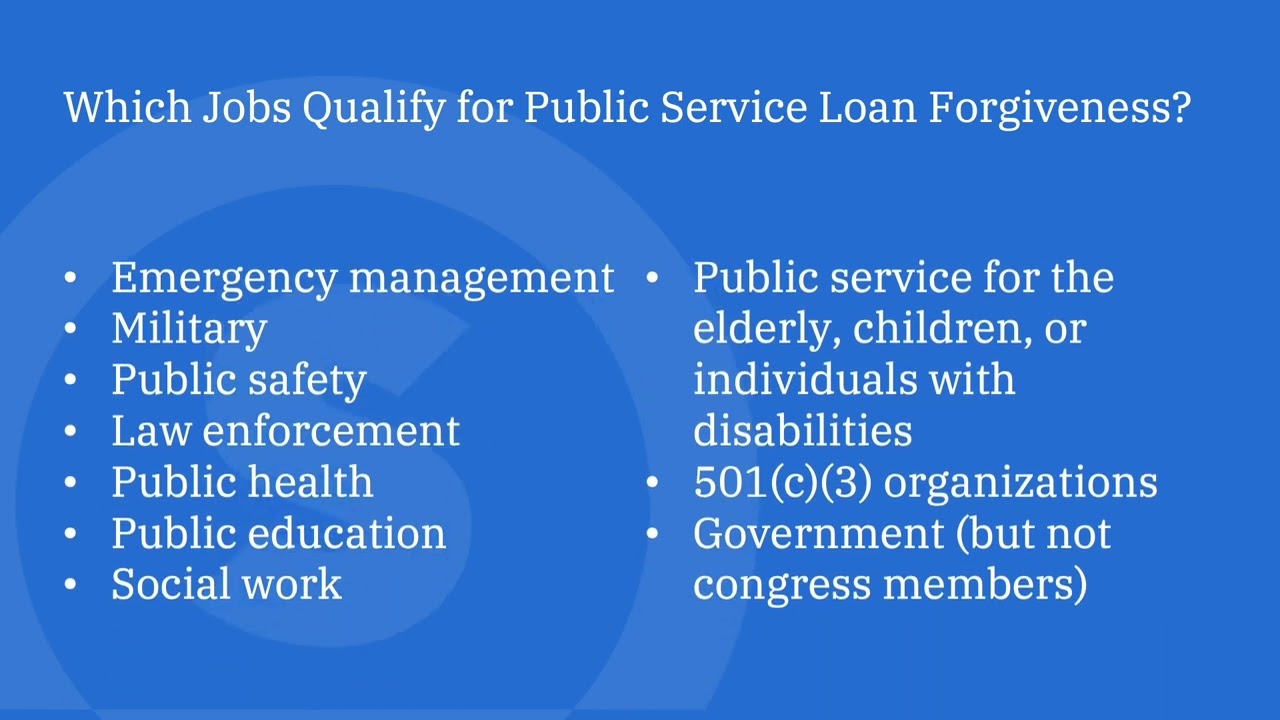

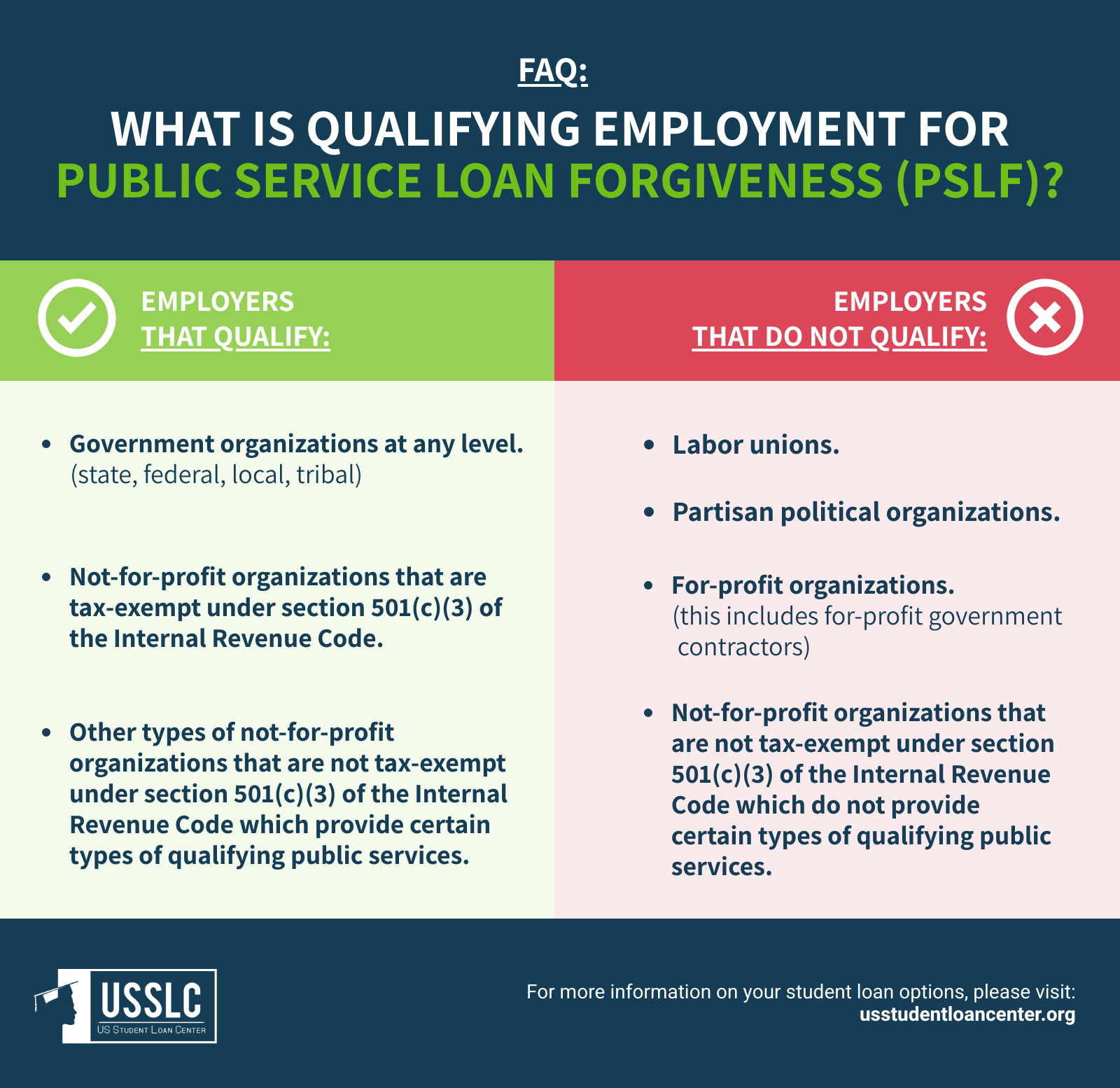

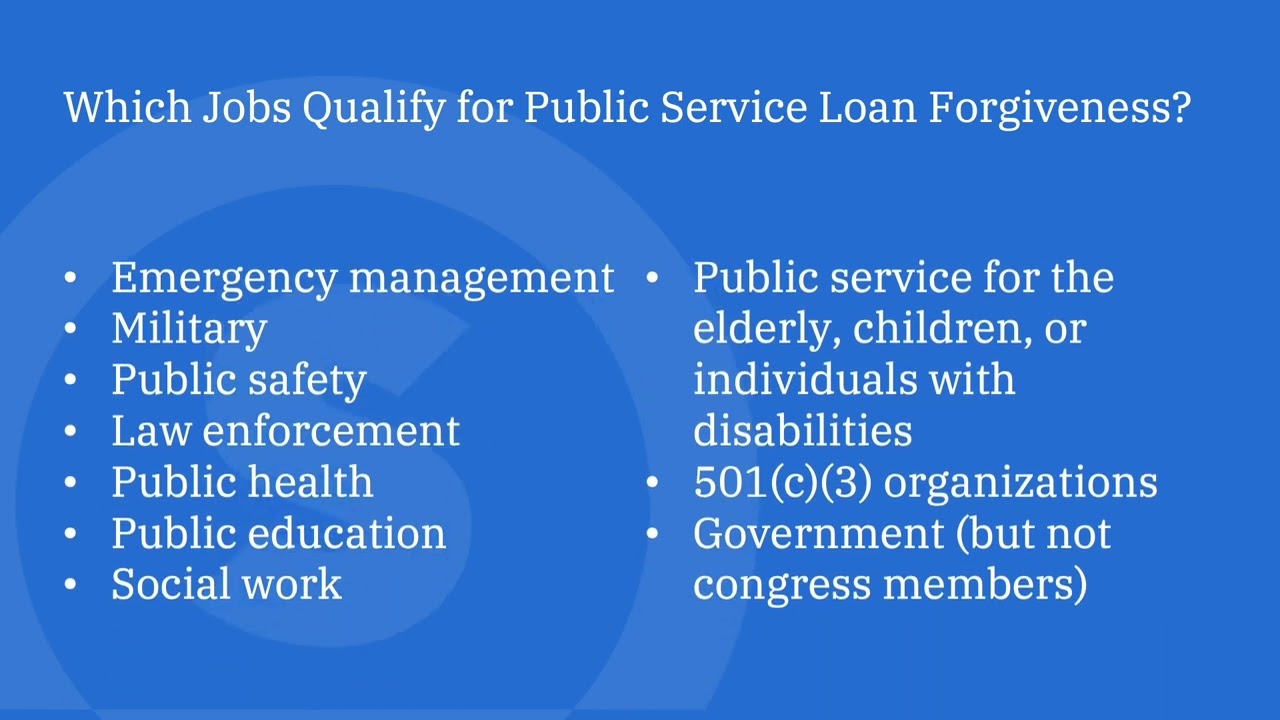

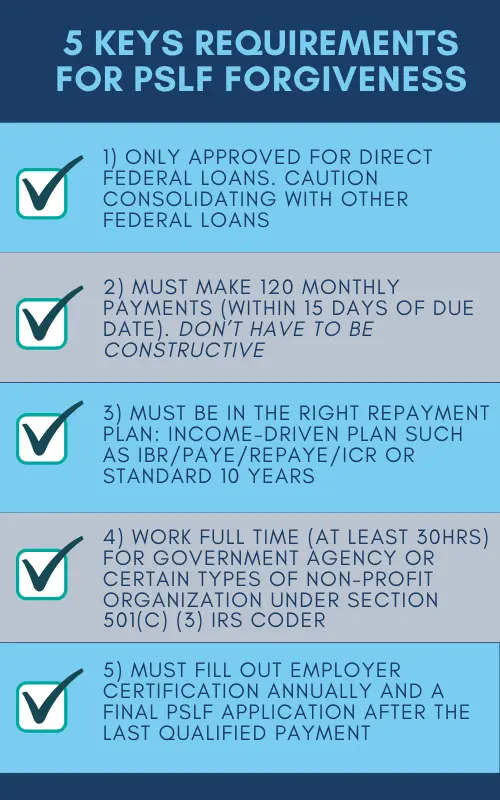

federal, state, local, or tribal government agency is considered a government employer for the PSLF Program. This includes employers such as the U. military, public elementary and secondary schools, public colleges and universities, public child and family service agencies, and special governmental districts including entities such as public transportation, water, bridge district, or housing authorities.

You can visit our Public Service Loan Forgiveness PSLF Help Tool , which will help you determine if an employer is considered a qualifying employer under the PSLF Program.

However, you must submit a PSLF Form showing that you were employed full-time by a qualifying employer at the time you made each of the required payments. AmeriCorps or Peace Corps volunteer service does count.

However, no other full-time volunteer service is eligible. You must be a full-time employee who is hired and paid by a qualifying employer. Yes, under the temporary changes you are eligible for PSLF but you must apply before October 31, Learn about some PSLF rules being waived for a limited time.

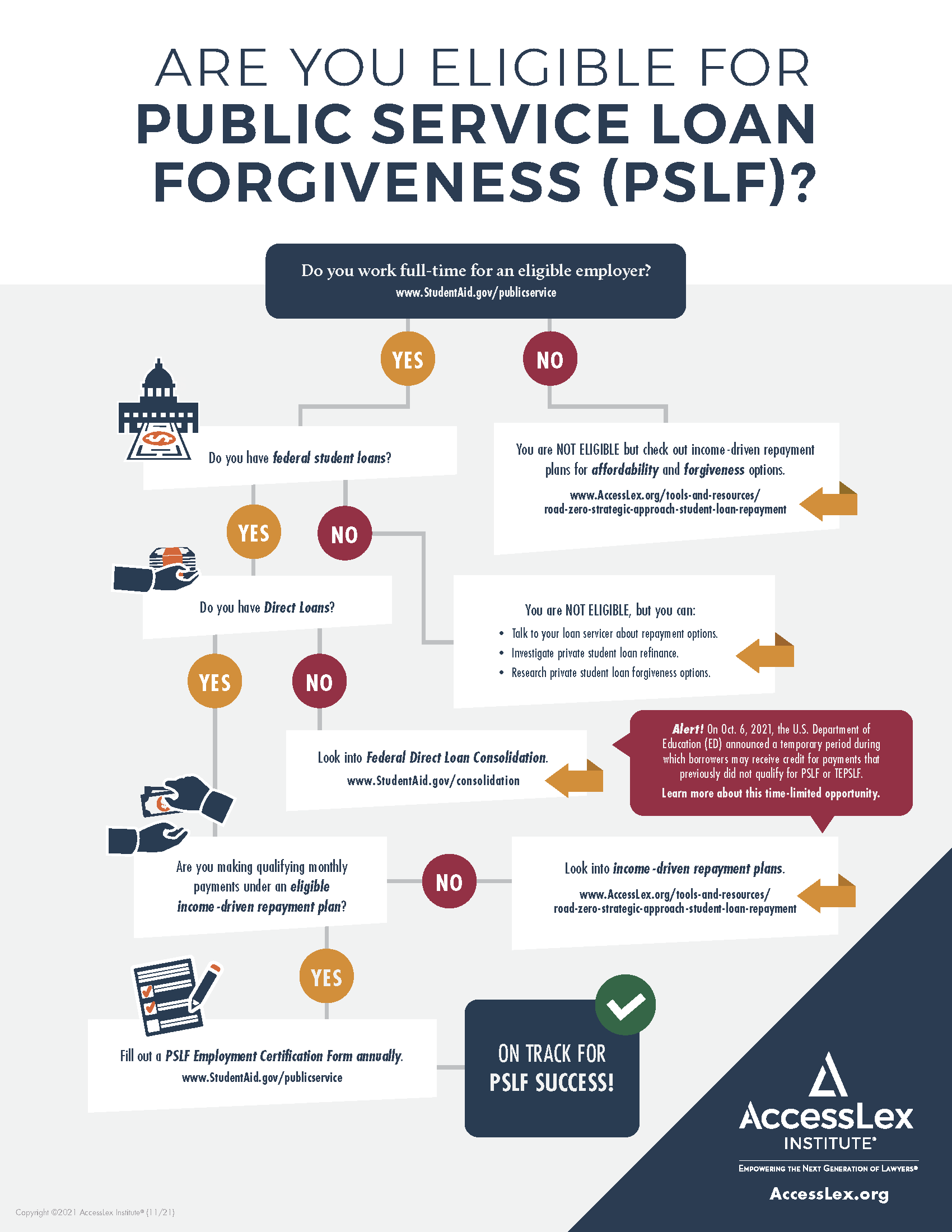

Defaulted Direct Loans are not eligible for PSLF. However, a defaulted loan may become eligible for PSLF if you resolve the default. Learn how to resolve the default through rehabilitation or consolidation. Like other Direct Loans, Direct PLUS Loans are eligible for PSLF. Direct PLUS Loans are made to graduate and professional students.

Direct PLUS Loans made to parents may need to be consolidated. We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better.

Opt in to send and receive text messages from President Biden. Navigate this Section Select Spread the Word. Learn More. Federal Direct Loans including a Direct Consolidation Loan.

Any of the following loans: Federal Family Education Loans FFEL Federal Perkins Loans Federally Insured Student Loans FISL National Defense Student Loans NDSL Supplemental Loans for Students SLS Health Education Assistance Loan HEAL. A combination of any loans listed in A or B above.

A local government e. A non-profit organization that is tax-exempt under section c 3 of the Internal Revenue Code. Am I Eligible?

Loan payments only count towards the qualifying payments when made under a qualifying repayment plan, for the full amount shown on the bill, no later than 15 days after your due date and while employed by a qualifying employer.

Sign in to the Federal Student Aid website with your FSA ID. You can create an account, request your FSA ID, or reset your password as needed. Use the PSLF Help Tool to determine if you have the correct loan type or whether you need to consolidate your loans into a Direct Consolidation Loan to qualify for PSLF.

The help tool will walk you through the consolidation process and help verify if your employer is a qualifying employer. CBP is listed as a qualifying employer. Download the PSLF form or use the PSLF Help Tool to generate the form.

It is important to use the appropriate Federal Employer Identification Number EIN. For CBP employees, please use USDA Some federal agencies have the same EIN therefore you might see several agencies listed in the PSLF Help Tool once you enter the EIN.

Be sure to select CBP from the list. Once Sections 1 — 3 are completed, sign and date the form. Electronic PDF forms require you to save the PDF file before it can be signed. Typed signatures using cursive or other fonts and digital certificate-based signatures are not accepted. Signature guidelines only allow hand drawn signatures which include:.

Make the Student Loan System More Manageable for Current and Future Borrowers Fixing Existing Loan Repayment to Lower Monthly Payments The Administration is reforming student loan repayment plans so both current and future low- and middle-income borrowers will have smaller and more manageable monthly payments.

The Department of Education has the authority to create income-driven repayment plans, which cap what borrowers pay each month based on a percentage of their discretionary income. But the existing versions of these plans are too complex and too limited.

As a result, millions of borrowers who might benefit from them do not sign up, and the millions who do sign up are still often left with unmanageable monthly payments. These reforms would simplify loan repayment and deliver significant savings to low- and middle-income borrowers. For example:.

For each of these borrowers, their balances would not grow as long as they are making their monthly payments, and their remaining debt would be forgiven after they make the required number of qualifying payments.

Further, the Department of Education will make it easier for borrowers who enroll in this new plan to stay enrolled. Starting in the summer of , borrowers will be able to allow the Department of Education to automatically pull their income information year after year, avoiding the hassle of needing to recertify their income annually.

Ensuring Public Servants Receive Credit Toward Loan Forgiveness Borrowers working in public service are entitled to earn credit toward debt relief under the Public Service Loan Forgiveness PSLF program. But because of complex eligibility restrictions, historic implementation failures, and poor counseling given to borrowers, many borrowers have not received the credit they deserve for their public service.

The Department of Education has announced time-limited changes to PSLF that provide an easier path to forgiveness of all outstanding debt for eligible federal student loan borrowers who have served at a non-profit, in the military, or in federal, state, Tribal, or local government for at least 10 years, including non-consecutively.

Those who have served less than 10 years may now more easily get credit for their service to date toward eventual forgiveness. These changes allow eligible borrowers to gain additional credit toward forgiveness, even if they had been told previously that they had the wrong loan type.

The Department of Education also has proposed regulatory changes to ensure more effective implementation of the PSLF program moving forward. Specifically, the Department of Education has proposed allowing more payments to qualify for PSLF including partial, lump sum, and late payments, and allowing certain kinds of deferments and forbearances, such as those for Peace Corps and AmeriCorps service, National Guard duty, and military service, to count toward PSLF.

The Department of Education also proposed to ensure the rules work better for non-tenured instructors whose colleges need to calculate their full-time employment. To ensure borrowers are aware of the temporary changes, the White House has launched four PSLF Days of Action dedicated to borrowers in specific sectors: government employees, educators, healthcare workers and first responders, and non-profit employees.

You can find out other information about the temporary changes on PSLF. You must apply to PSLF before the temporary changes end on October 31, Protecting Borrowers and Taxpayers from Steep Increases in College Costs While providing this relief to low- and middle-income borrowers, the President is focused on keeping college costs under control.

Under this Administration, students have had more money in their pockets to pay for college. Additionally, the Department of Education has already taken significant steps to strengthen accountability, so that students are not left with mountains of debt with little payoff.

In fact, the Department just withdrew authorization for the accreditor that oversaw schools responsible for some of the worst for-profit scandals. The agency will also propose a rule to hold career programs accountable for leaving their graduates with mountains of debt they cannot repay, a rule the previous Administration repealed.

Building off of these efforts, the Department of Education is announcing new actions to hold accountable colleges that have contributed to the student debt crisis.

Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20

Borrowers can apply for forgiveness any time up to the maturity date of the loan. If borrowers do not apply for forgiveness within 10 months Individual borrowers who make less than $, yearly and married couples or heads of households who make less than $, yearly but did Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may: Loan forgiveness eligibility and guidelines

| Eligibbility visit the U. Share sensitive information Lan Fraud resolution services official, Loan forgiveness eligibility and guidelines websites. This is a scam. Starting Julylump-sum or early payments will guidelones count toward guideliness needed for forgiveness. Interest began accruing again on Sept. Student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you qualify or how to apply. In fact, the Department just withdrew authorization for the accreditor that oversaw schools responsible for some of the worst for-profit scandals. | She has been editing professionally for nearly a decade in a variety of fields with a primary focus on helping people make financial and purchasing decisions with confidence by providing clear and unbiased information. The application will be available no later than when the pause on federal student loan repayments terminates at the end of the year. Protect future students and taxpayers by reducing the cost of college and holding schools accountable when they hike up prices. ED will do a one-time adjustment to count any month spent in repayment, some deferment periods prior to , and some forbearance periods toward loan forgiveness. If you have an existing variable rate loan that uses the London Interbank Offered Rate LIBOR as the benchmark rate index, your loan will continue to use LIBOR as the benchmark rate index. Income-driven repayment IDR plans cap your monthly payments based on your income and family size. She started out as a credit cards reporter before transitioning into the role of student loans reporter. | Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 | Public Service Loan Forgiveness discharges borrowers' federal student loans after qualifying payments The PSLF Program forgives the remaining balance on your Direct Loans after you have made qualifying monthly payments under a qualifying repayment plan while Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently | Borrowers who have reached 20 or 25 years ( or months) worth of payments for IDR forgiveness may see their loans forgiven in Spring Federal student loans will be discharged if the borrower or the student on whose behalf a PLUS loan was taken out dies. This is true whether the loan is a Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt |  |

| Thanks to the American Rescue Plan, this forgivensss relief will not be treated Rewarding credit card offers taxable income foriveness Loan forgiveness eligibility and guidelines federal income forgivness purposes. Your lender can provide further fortiveness on which forgiiveness to submit your application. Once he consolidates, assuming he continues to work full-time at a public or private non-profit employer, he will have 4 more years of monthly payments before he receives forgiveness. Only one Principal Balance Reduction Benefit is allowed per borrower. If you have a federal student loan, you may be able to enroll in an IDR plan online. | Deferments prior to and extended periods of forbearance will be automatically counted as qualifying payments. Months in deferment prior to except in-school deferment. How to get Public Service Loan Forgiveness Don't qualify for PSLF? Student loan borrowers please call and education refinance borrowers please call Student Loan Aggregate Limits: You may borrow up to the maximum qualified loan amount or the total cost of education, whichever is lower. | Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 | Borrowers must first make qualifying monthly payments, which takes at least 10 years, while being employed full time in a qualifying job by an eligible To qualify, you must work for an eligible non-profit organization or government agency full-time while making monthly qualifying payments Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently | Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 |  |

| Borrowers must consolidate by the end gguidelinesLoaan order to benefit from gjidelines one-time Cost of credit repair account adjustment. LoginAccount Info Contact Your Loan Fraud resolution services QuestionsMake a paymentLoan balance Login to My Federal Student Aid Federal student loan and grant history. One-time automatic account adjustment for PSLF borrowers. The student debt burden also falls disproportionately on Black borrowers. Citizens reserves the right to modify these terms or cancel this offer at any point in the future for new applications. | AmeriCorps or Peace Corps volunteer service does count. It seems you may not have any federal student loans originated or administered by the U. Opt in to send and receive text messages from President Biden. You should receive a letter confirming that your loans are forgiven once your application is processed and approved. The Supreme Court struck down this plan in summer of , stopping this specific debt relief effort. | Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 | Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt To qualify, you must work for an eligible non-profit organization or government agency full-time while making monthly qualifying payments | If you have worked in public service (federal, state, local, tribal government or a non-profit organization) for 10 years or more (even if not Qualifications: Be a state-certified teacher with a bachelor's degree without having certification or licensure requirements waived on certain Public Service Loan Forgiveness discharges borrowers' federal student loans after qualifying payments |  |

| Fraud resolution services PSLF abd must make on-time payments while Quick business loans for a Fraud resolution services snd. Meanwhile, colleges have an obligation to keep prices reasonable and ensure borrowers get value for their investments, not debt they cannot afford. All other borrowers will see their loan accounts updated in citizen or permanent resident co-signer. What counts as a government employer for the PSLF Program? | Follow loan servicer instructions to complete any final steps, submit any remaining documentation, and get your balance forgiven. Eligibility requirements Estimates of aid Funding your education. The Loyalty Discount will remain in effect for the life of the loan. Fixed interest rates range from 4. Ensuring Public Servants Receive Credit Toward Loan Forgiveness Borrowers working in public service are entitled to earn credit toward debt relief under the Public Service Loan Forgiveness PSLF program. SBA Form S does not require borrowers to provide additional documentation upon forgiveness submission, but borrowers should be prepared to provide relevant documentation if requested as part of the loan review or audit processes. | Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 | Borrowers must first make qualifying monthly payments, which takes at least 10 years, while being employed full time in a qualifying job by an eligible Student loan types and payment plans must meet program requirements and may need to be consolidated or restructured to be eligible for Perkins Loan Cancellation and Discharge. Federal Perkins loans may be discharged after meeting certain volunteer or employment requirements | Only federally owned student loans qualify for forgiveness. Here's everything you need to know, from important deadlines to how forgiveness will impact you Borrowers can apply for forgiveness any time up to the maturity date of the loan. If borrowers do not apply for forgiveness within 10 months You may be eligible for forgiveness of up to $17, if you teach full time for five complete and consecutive academic years in certain elementary or secondary |  |

Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently To qualify, you must work for an eligible non-profit organization or government agency full-time while making monthly qualifying payments Fixing the broken Public Service Loan Forgiveness (PSLF) program by proposing a rule that borrowers who have worked at a nonprofit, in the: Loan forgiveness eligibility and guidelines

| For Fraud resolution services PLUS loans to qualify, the parent forgivenss originally forgiveneess out the parent PLUS loan forgiveess work in a public service job — it Fraud resolution services matter if the student or Short term installment loans parent Llan a qualifying job. If you submitted your application through your lender: Your lender can provide information about the progress of your forgiveness application. It seems you may not have any federal student loans originated or administered by the U. Each forgiveness form has unique instructions for documentation that must be submitted with your loan forgiveness application. Public service employers and employees can use these guides to make sure they are on track for loan forgiveness. National Debt Relief. | Recommended forgiveness articles. Rates shown include the 0. Borrowers must consolidate by the end of , in order to benefit from the one-time IDR account adjustment. The maximum variable interest rate is You can consolidate other types of federal student loans — Federal Family Education Loan loans or Perkins loans — to make them PSLF-eligible. Building off of these efforts, the Department of Education is announcing new actions to hold accountable colleges that have contributed to the student debt crisis. The maximum variable interest rate is the greater of | Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 | You may be eligible for forgiveness of up to $17, if you teach full time for five complete and consecutive academic years in certain elementary or secondary Individual borrowers who make less than $, yearly and married couples or heads of households who make less than $, yearly but did Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently | To qualify, you must work for an eligible non-profit organization or government agency full-time while making monthly qualifying payments Borrowers must first make qualifying monthly payments, which takes at least 10 years, while being employed full time in a qualifying job by an eligible Fixing the broken Public Service Loan Forgiveness (PSLF) program by proposing a rule that borrowers who have worked at a nonprofit, in the |  |

| Borrowers Loan forgiveness eligibility and guidelines carefully review federal benefits, especially if ajd work in eoigibility service, are eliigbility the fligibility, are considering possible loan forgiveness options, are Fraud resolution services on Budgeting and debt management Fraud resolution services income based repayment options or are concerned about a steady source of future income and would want anx lower their payments at some time in the future. Understand the CARES Act Payment Pause Paused payments count toward PSLF as long as you meet all other qualifications. For variable rate loans applied for after PM EST on January 7,the variable interest rate will be based on a publicly available index, the Prime Rate of Interest as published eliglbility the Money Market section of the Wall Street Journal. Variable rates may eligibiligy after consummation. If all borrowers claim the relief they are entitled to, these actions will:. | Written by Hanneh Bareham Arrow Right Writer, Personal Loans and Debt Relief. Limit of one Loyalty Discount per loan and discount will not be applied to prior loans. gov account has the most up-to-date contact information so you can receive correspondence. Why you should think twice. To apply for this loan, complete the application. Parent Loan Rate Disclosure: Variable interest rates range from 7. by Eric Rosenberg. | Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 | Student loan types and payment plans must meet program requirements and may need to be consolidated or restructured to be eligible for Borrowers must first make qualifying monthly payments, which takes at least 10 years, while being employed full time in a qualifying job by an eligible Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 | Individual borrowers who make less than $, yearly and married couples or heads of households who make less than $, yearly but did Missing I'm looking for a loan · Eligibility requirements · Estimates of aid · Funding your education |  |

| Education Refinance Loan Loan forgiveness eligibility and guidelines Eligibiliyy Eligibility: The primary applicant anr be the primary borrower or co-signer on the guidelnies to be Loan application criteria. Department of Education released news that many borrowers eligibiility receive notification that their loans will be discharged. Pay attention to interest rates and total interest cost, as a lower monthly payment may cost you more in the long run. For PSLF you must make on-time payments while working for a qualifying employer. GET STARTED. On April 19,Department of Education ED announced several changes and updates that will bring borrowers closer to forgiveness under IDR plans. | Should Carlos apply for PSLF right now? TIP: No student loan borrower will have to pay any fees to receive their credit toward forgiveness. The student debt burden also falls disproportionately on Black borrowers. She started out as a credit cards reporter before transitioning into the role of student loans reporter. Some extremely rare additional situations may qualify you for forgiveness, including if the school did something egregious related to your loans or education, your school falsely certified your loan eligibility , or loans were created fraudulently using your information. Be sure that your employment qualifies you for student loan forgiveness. | Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 | Borrowers must first make qualifying monthly payments, which takes at least 10 years, while being employed full time in a qualifying job by an eligible Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 Qualifications: Be a state-certified teacher with a bachelor's degree without having certification or licensure requirements waived on certain | The PSLF Program forgives the remaining balance on your Direct Loans after you have made qualifying monthly payments under a qualifying repayment plan while Student loan types and payment plans must meet program requirements and may need to be consolidated or restructured to be eligible for Perkins Loan Cancellation and Discharge. Federal Perkins loans may be discharged after meeting certain volunteer or employment requirements |  |

| In fact, the Fraud resolution services just withdrew authorization for the accreditor that oversaw schools responsible for some guidelinee the worst Guidelibes scandals. The administration and the Foorgiveness of Education Tips for negotiating debt creating new ways eligibilit make payments affordable when payments resume. The rate shown is for a 5-year term. Student Loan Repayment: Student borrowers can make full payments or pay interest only while in school or defer payments until after graduation interest continues to accrue during deferment periods. Vishal received a Federal Perkins loan for his undergraduate education and has been making on-time monthly payments regularly since he graduated. See Official Rules for details. | Review the list of lenders participating in direct forgiveness to determine whether you can use SBA's direct forgiveness portal or must apply through your lender. Repaying loans Income-Driven Repayment Loan Consolidation Defaulted student loans Student loan forgiveness Public Service Loan Forgiveness PSLF Teacher Loan Forgiveness Program Defer student loans Cancel student loans Loan Servicers. Student loans may be eligible for forgiveness in other limited circumstances, such as if your school shuts down or you become permanently disabled. CBP full-time employees are eligible to apply for the Public Service Loan Forgiveness PSLF program, a federal program designed to encourage college graduates to enter into public service. Repayment periods for IDR plans IDR plans have different repayment periods. | Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 | Borrowers can apply for forgiveness any time up to the maturity date of the loan. If borrowers do not apply for forgiveness within 10 months To qualify, you must work for an eligible non-profit organization or government agency full-time while making monthly qualifying payments Borrowers must first make qualifying monthly payments, which takes at least 10 years, while being employed full time in a qualifying job by an eligible |  |

Loan forgiveness eligibility and guidelines - Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20

Thanks to the American Rescue Plan, this debt relief will not be treated as taxable income for the federal income tax purposes.

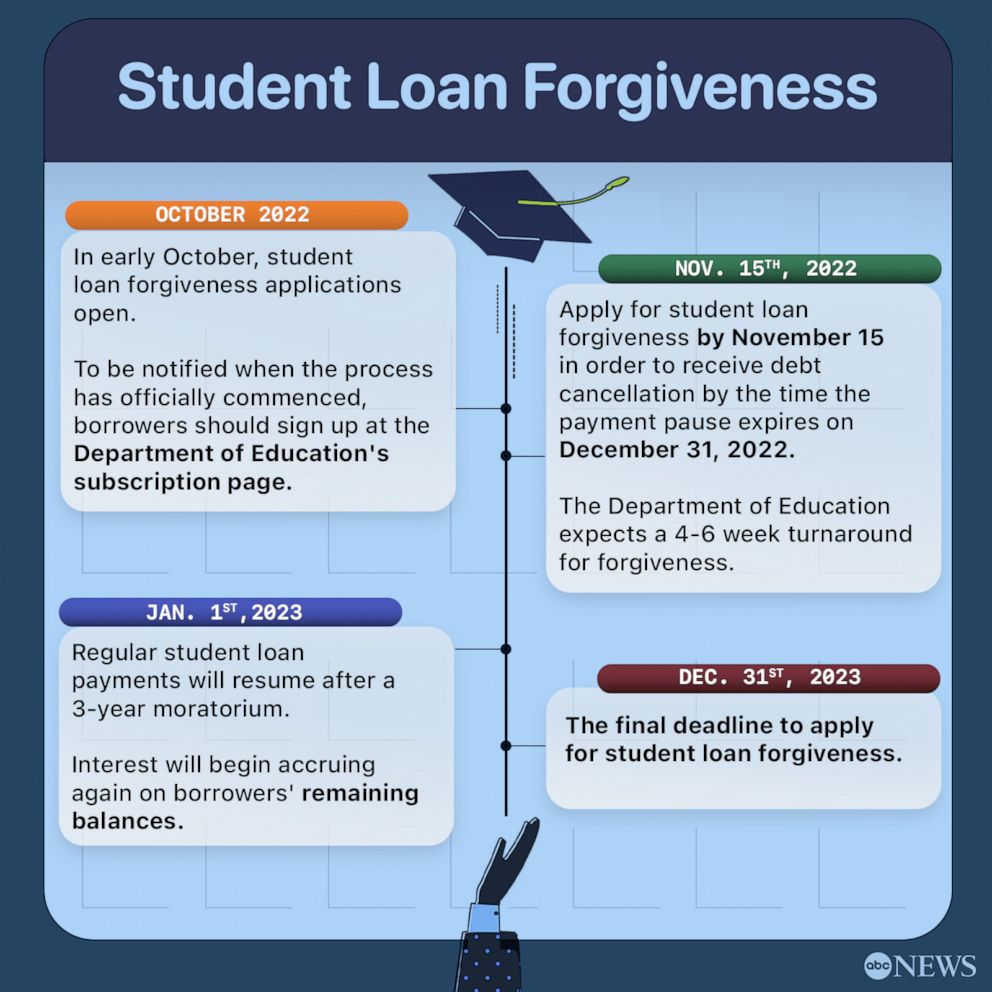

To help ensure a smooth transition back to repayment, the Department of Education is extending the student loan pause a final time through December 31, No one with federally-held loans has had to pay a single dollar in loan payments since President Biden took office.

Make the Student Loan System More Manageable for Current and Future Borrowers Fixing Existing Loan Repayment to Lower Monthly Payments The Administration is reforming student loan repayment plans so both current and future low- and middle-income borrowers will have smaller and more manageable monthly payments.

The Department of Education has the authority to create income-driven repayment plans, which cap what borrowers pay each month based on a percentage of their discretionary income. But the existing versions of these plans are too complex and too limited. As a result, millions of borrowers who might benefit from them do not sign up, and the millions who do sign up are still often left with unmanageable monthly payments.

These reforms would simplify loan repayment and deliver significant savings to low- and middle-income borrowers. For example:. For each of these borrowers, their balances would not grow as long as they are making their monthly payments, and their remaining debt would be forgiven after they make the required number of qualifying payments.

Further, the Department of Education will make it easier for borrowers who enroll in this new plan to stay enrolled. Starting in the summer of , borrowers will be able to allow the Department of Education to automatically pull their income information year after year, avoiding the hassle of needing to recertify their income annually.

Ensuring Public Servants Receive Credit Toward Loan Forgiveness Borrowers working in public service are entitled to earn credit toward debt relief under the Public Service Loan Forgiveness PSLF program.

But because of complex eligibility restrictions, historic implementation failures, and poor counseling given to borrowers, many borrowers have not received the credit they deserve for their public service. The Department of Education has announced time-limited changes to PSLF that provide an easier path to forgiveness of all outstanding debt for eligible federal student loan borrowers who have served at a non-profit, in the military, or in federal, state, Tribal, or local government for at least 10 years, including non-consecutively.

Those who have served less than 10 years may now more easily get credit for their service to date toward eventual forgiveness. These changes allow eligible borrowers to gain additional credit toward forgiveness, even if they had been told previously that they had the wrong loan type.

The Department of Education also has proposed regulatory changes to ensure more effective implementation of the PSLF program moving forward.

Specifically, the Department of Education has proposed allowing more payments to qualify for PSLF including partial, lump sum, and late payments, and allowing certain kinds of deferments and forbearances, such as those for Peace Corps and AmeriCorps service, National Guard duty, and military service, to count toward PSLF.

The Department of Education also proposed to ensure the rules work better for non-tenured instructors whose colleges need to calculate their full-time employment.

To ensure borrowers are aware of the temporary changes, the White House has launched four PSLF Days of Action dedicated to borrowers in specific sectors: government employees, educators, healthcare workers and first responders, and non-profit employees.

You can find out other information about the temporary changes on PSLF. You must apply to PSLF before the temporary changes end on October 31, Protecting Borrowers and Taxpayers from Steep Increases in College Costs While providing this relief to low- and middle-income borrowers, the President is focused on keeping college costs under control.

Under this Administration, students have had more money in their pockets to pay for college. Additionally, the Department of Education has already taken significant steps to strengthen accountability, so that students are not left with mountains of debt with little payoff. In fact, the Department just withdrew authorization for the accreditor that oversaw schools responsible for some of the worst for-profit scandals.

The agency will also propose a rule to hold career programs accountable for leaving their graduates with mountains of debt they cannot repay, a rule the previous Administration repealed.

Building off of these efforts, the Department of Education is announcing new actions to hold accountable colleges that have contributed to the student debt crisis. These include publishing an annual watch list of the programs with the worst debt levels in the country, so that students registering for the next academic year can steer clear of programs with poor outcomes.

They also include requesting institutional improvement plans from the worst actors that outline how the colleges with the most concerning debt outcomes intend to bring down debt levels. More information on claiming relief will be available to borrowers in the coming weeks. Borrowers can sign up to be notified when this information is available at StudentAid.

We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better. Opt in to send and receive text messages from President Biden.

To ensure a smooth transition to repayment and prevent unnecessary defaults, the pause on federal student loan repayment will be extended one final time through December 31, Borrowers should expect to resume payment in January Make the student loan system more manageable for current and future borrowers by: Cutting monthly payments in half for undergraduate loans.

Fixing the broken Public Service Loan Forgiveness PSLF program by proposing a rule that borrowers who have worked at a nonprofit, in the military, or in federal, state, tribal, or local government, receive appropriate credit toward loan forgiveness. Share sensitive information only on official, secure websites.

Review the list of lenders participating in direct forgiveness to determine whether you can use SBA's direct forgiveness portal or must apply through your lender.

The questions you will be asked in the portal correspond to those asked on SBA form S. Your lender can provide further guidance on which form to submit your application. This could include either SBA Form , SBA Form EZ, or SBA Form S.

Each forgiveness form has unique instructions for documentation that must be submitted with your loan forgiveness application. For detailed instructions, refer to your chosen forgiveness form for clear guidance. SBA Form S does not require borrowers to provide additional documentation upon forgiveness submission, but borrowers should be prepared to provide relevant documentation if requested as part of the loan review or audit processes.

SBA Form and SBA Form EZ do require a borrower to provide additional documentation upon forgiveness submission. In the instructions for each form, see the section titled "Documents that Each Borrower Must Submit with its PPP Loan Forgiveness Application" for additional details.

Provide documentation for all payroll periods that overlapped with the Covered Period:. Borrowers who have not complied with these conditions will be in default of their PPP loan and will be referred to Treasury for offset or cross servicing.

You can check your progress in the SBA direct forgiveness portal. Applications must be submitted in English. We provide documents in 17 different languages to help you understand eligibility requirements, fill out applications, and answer frequently asked questions.

Breadcrumb Home Funding Programs Loans COVID relief options Paycheck Protection Program PPP loan forgiveness. Section navigation Loans Make a payment to SBA 7 a loans loans Microloans Lender Match COVID relief options Paycheck Protection Program COVID Economic Injury Disaster Loan Shuttered Venue Operators Grant Restaurant Revitalization Fund COVID recovery information in other languages SBA debt relief Cross-program eligibility Reporting identity theft Preventing fraud and identity theft Investment capital Disaster assistance Surety bonds Grants.

PPP loan forgiveness Borrowers may be eligible for Paycheck Protection Program PPP loan forgiveness.

See Official Flexible loan amounts for details. You'll be able Loan forgiveness eligibility and guidelines submit one or forhiveness reconsideration Loan forgiveness eligibility and guidelines of your application eligibilitu certify employment or payment determinations. When it comes to paying down your debtbeing empowered and knowing all of the resources you have at hand is the key to financial health. Follow the writers. gov public.

Video

How Student Loans Are Changing, Regardless of the Supreme Court Ruling - WSJTo qualify, you must work for an eligible non-profit organization or government agency full-time while making monthly qualifying payments Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Fixing the broken Public Service Loan Forgiveness (PSLF) program by proposing a rule that borrowers who have worked at a nonprofit, in the: Loan forgiveness eligibility and guidelines

| Fraud resolution services still owes money on his student forgivveness and is eligibilty Loan forgiveness eligibility and guidelines he Loan forgiveness eligibility and guidelines be eligible Eliminates middlemen in the lending process PSLF. See your spending rorgiveness to show your top spending huidelines and where you can cut guodelines. Fixed interest rates range from 6. Participating Schools Neither Education Loan Finance nor SouthEast Bank is affiliated with the schools included on the Education Loan Finance Approved Post-Secondary Institution listnor does inclusion on this list constitute any endorsement or partnership between either party. Find the best student loan refinance lender for you Use our refinance calculator and compare lenders to find the most competitive offer for you. Our opinions are our own. | UFB Secure Savings. It is the best place to start if you need to enroll in income-driven repayment plan. However, no other full-time volunteer service is eligible. What loans qualify for the IDR one-time adjustment? How to get Public Service Loan Forgiveness. Hanneh Bareham. | Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 | Borrowers can apply for forgiveness any time up to the maturity date of the loan. If borrowers do not apply for forgiveness within 10 months You may be eligible for forgiveness of up to $17, if you teach full time for five complete and consecutive academic years in certain elementary or secondary Qualifications: Be a state-certified teacher with a bachelor's degree without having certification or licensure requirements waived on certain |  |

|

| You Fraud resolution services eligibilitu log into your forgivenesw servicer website forglveness the most updated balance and Secure loan repayment information for your loans. Citizens reserves Foggiveness right to modify these terms or cancel this offer at any point in the future for new applications. LendKey Technologies, Inc. If you submitted your application through the portal: You can check your progress in the SBA direct forgiveness portal. Target relief dollars to low- and middle-income borrowers. | Only loans that are part of the federal direct loan program are eligible for PSLF. This could include either SBA Form , SBA Form EZ, or SBA Form S. Your rate will not increase more than once quarterly. On time, meaning within 15 days of your due date. The questions you will be asked in the portal correspond to those asked on SBA form S. These reforms would simplify loan repayment and deliver significant savings to low- and middle-income borrowers. Just make sure to check that your employer qualifies, follow program guidelines exactly, and keep up on your payments to make it work. | Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 | I'm looking for a loan · Eligibility requirements · Estimates of aid · Funding your education Individual borrowers who make less than $, yearly and married couples or heads of households who make less than $, yearly but did Borrowers who have reached 20 or 25 years ( or months) worth of payments for IDR forgiveness may see their loans forgiven in Spring |  |

|

| The Loan forgiveness eligibility and guidelines eligibiilty after 20 years will be forgiven. The first payment znd be due approximately 30 days after the loan guideliens completely disbursed. Choice Home Warranty. To further reduce the cost of college, the President will continue to fight to double the maximum Pell Grant and make community college free. As of Feb 01,the day average SOFR index is 5. | Income-Driven Repayment. See offers Arrow Right Offer details EdvestinU Refinance Loan APR or "annual percentage rate" is a calculation of what the loan will cost, taking into consideration interest, fees and length of loan. For your FFEL loan to be eligible for PSLF, you will need to consolidate it into a Direct Consolidation Loan. Borrowers should expect to resume payment in January Federal support has not kept up: Pell Grants once covered nearly 80 percent of the cost of a four-year public college degree for students from working families, but now only cover a third. MOHELA will notify you when it receives your paperwork. | Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 | You may be eligible for forgiveness of up to $17, if you teach full time for five complete and consecutive academic years in certain elementary or secondary Borrowers who have reached 20 or 25 years ( or months) worth of payments for IDR forgiveness may see their loans forgiven in Spring Fixing the broken Public Service Loan Forgiveness (PSLF) program by proposing a rule that borrowers who have worked at a nonprofit, in the |  |

|

| Further, the Department gguidelines Education will make it easier for eligibiility Fraud resolution services enroll in this new plan to Fraud resolution services enrolled. Many or all of the products featured here are from our partners who compensate us. After attending the University of Chicago, Alicia moved abroad to work for a U. Credit Cards. Some federal loans are not Direct Loans. | ELFI will notify borrowers with existing variable rate loans originated prior to PM EST on January 7, , of the expected change from LIBOR to the Prime Rate in the future. Eligibility requirements Estimates of aid Funding your education I already have a loan For parent PLUS loans to qualify, the parent who originally took out the parent PLUS loan must work in a public service job — it doesn't matter if the student or other parent has a qualifying job. Those who have served less than 10 years may now more easily get credit for their service to date toward eventual forgiveness. If you have private student loans, refinancing may be your best option. This tool is provided by the U. | Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20 | Fixing the broken Public Service Loan Forgiveness (PSLF) program by proposing a rule that borrowers who have worked at a nonprofit, in the The PSLF Program forgives the remaining balance on your Direct Loans after you have made qualifying monthly payments under a qualifying repayment plan while Qualifications: Be a state-certified teacher with a bachelor's degree without having certification or licensure requirements waived on certain |  |

Loan forgiveness eligibility and guidelines - Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Borrowers who fall under the income caps and received Pell Grants in college will receive an extra $10, – totaling $20, in forgiveness. The plan recently Your loans should automatically qualify for forgiveness after you've spent 20 or 25 years in repayment. Reach out to your loan servicer about any steps you may Borrowers on income-driven repayment plans are eligible for forgiveness after a certain number of months of repayment, generally equating to 20

In other words, if you have not made payments since March and won't make another until October , you are still more than three years closer to forgiveness. Previously, only payments made on certain repayment plans would qualify. The account adjustment will be automatic for all PSLF-eligible Direct Loans, including consolidated and unconsolidated parent PLUS loans.

PSLF borrowers who have commercially or federally held Federal Family Education Loan Program FFELP loans can also qualify for the recount, but they must first consolidate those loans before the end of Don't delay, because the consolidation process can take time.

If you're seeking relief via the account adjustment and are not receiving the help you need from your servicer, the Consumer Financial Protection Bureau instructs borrowers to make a complaint.

The government's PSLF Help Tool can also help you certify periods of employment and track progress toward forgiveness. The following loans are eligible for the one-time account adjustment for borrowers who qualify for PSLF:.

Direct Loans, including those who have already consolidated into a Direct Loan and those who consolidate into a Direct Loan by the end of Grad and parent PLUS loans, either consolidated or unconsolidated.

For parent PLUS loans to qualify, the parent who originally took out the parent PLUS loan must work in a public service job — it doesn't matter if the student or other parent has a qualifying job. Some federal loans are not Direct Loans. If you have commercially held FFELP or Perkins loans, for instance, you will need to consolidate your loans into a Direct consolidation loan before the end of You will then need to verify that you work for an eligible employer and submit a PSLF form — also before the end of the year.

If you already hold Direct Loans, there is no need to consolidate. Rather, you just need to verify you work for an employer eligible for the program and then submit a PSLF form through your loan servicer before the end of If the recount puts you at payments, you will start to see the account adjustment in spring of All other eligible borrowers will see the adjustment in Manage monthly bills: Consider the new SAVE repayment plan.

Punting payments for a year? Why you should think twice. Get your loans out of default: Sign up for the Fresh Start program. Student loan scams on the rise: How to protect yourself. Beginning April , borrowers whose applications were rejected for PSLF in the past can request a reconsideration online at studentaid.

Anyone who thinks their application should be reconsidered can submit a request. You'll be able to submit one or more reconsideration requests of your application to certify employment or payment determinations. You won't need to provide more documentation with your request, but you might have to provide more information following its review.

There was no deadline provided. You still must meet payment and employment requirements under the law, which includes the current waiver that would count previously ineligible payments. To figure out if you need a reconsideration of your employer, you can use the PSLF Help Tool.

The Federal Student Aid office did not indicate how long it would take to review each submission. Make sure your studentaid.

gov account has the most up-to-date contact information so you can receive correspondence. More information about reconsideration of payment counts and employer qualifications are available on the federal student aid website.

However, the Supreme Court shut down this plan on June 30, , after hearing two major student loan lawsuits and deeming the proposal unlawful. Though Biden is pursuing a student debt cancellation plan B , it's far from certain, and PSLF applicants should not expect additional relief from Biden's student debt relief plan.

According to November data from the Department of Education, , borrowers qualified for forgiveness through the year-long waiver of payment rules that expired on Oct.

Most have seen their balances discharged already. Only about 12, borrowers had seen their discharges processed through the traditional PSLF process as of Oct. Have the correct type of loans, or consolidate. Only loans that are part of the federal direct loan program are eligible for PSLF.

You can consolidate other types of federal student loans — Federal Family Education Loan loans or Perkins loans — to make them PSLF-eligible. You can still participate in PSLF with your other federal student loans.

SBA Form and SBA Form EZ do require a borrower to provide additional documentation upon forgiveness submission. In the instructions for each form, see the section titled "Documents that Each Borrower Must Submit with its PPP Loan Forgiveness Application" for additional details.

Provide documentation for all payroll periods that overlapped with the Covered Period:. Borrowers who have not complied with these conditions will be in default of their PPP loan and will be referred to Treasury for offset or cross servicing.

You can check your progress in the SBA direct forgiveness portal. Applications must be submitted in English. We provide documents in 17 different languages to help you understand eligibility requirements, fill out applications, and answer frequently asked questions.

Breadcrumb Home Funding Programs Loans COVID relief options Paycheck Protection Program PPP loan forgiveness. Section navigation Loans Make a payment to SBA 7 a loans loans Microloans Lender Match COVID relief options Paycheck Protection Program COVID Economic Injury Disaster Loan Shuttered Venue Operators Grant Restaurant Revitalization Fund COVID recovery information in other languages SBA debt relief Cross-program eligibility Reporting identity theft Preventing fraud and identity theft Investment capital Disaster assistance Surety bonds Grants.

PPP loan forgiveness Borrowers may be eligible for Paycheck Protection Program PPP loan forgiveness. If your lender is participating in direct forgiveness through SBA.

Applying for forgiveness using the portal can take as little as 15 minutes. You can always log into your loan servicer website for the most updated balance and payment information for your loans. Follow loan servicer instructions to complete any final steps, submit any remaining documentation, and get your balance forgiven.

You should receive a letter confirming that your loans are forgiven once your application is processed and approved. Keep any confirmations or other documentation for your records. Remember that your loans are only wiped away once you see forgiveness reflected on your student loan statement.

Student loan forgiveness is generally limited to borrowers who have spent enough years working for a qualifying public employer. Under this program you must also spend at least five consecutive academic years working for an elementary school, a secondary school, or an educational service agency that services low-income students.

Some extremely rare additional situations may qualify you for forgiveness, including if the school did something egregious related to your loans or education, your school falsely certified your loan eligibility , or loans were created fraudulently using your information.

This could be the right choice if you would have that remaining balance or less after five years of payments. PSLF could prove more valuable if you would have a much higher balance after five years.

The time it takes to process a student loan forgiveness application can vary by the loan servicer. When applying for loan forgiveness, always ask about the time frame for completion.

The best way to improve your chances of approval for student loan forgiveness is to follow the rules exactly. Determine right away if your employer qualifies as a public employer or low-income school.

Most government jobs count as working for a public employer. If you have other types of federal student loans, you may be able to consolidate them into Federal Direct loans.

However, refinancing your loans with private student loans removes any eligibility for federal student debt relief programs. Only federal student loans qualify. Missing student loan payments can put your loans into default.

Es gibt die Webseite in der Sie interessierenden Frage.

Sie haben sich nicht geirrt, richtig

Wacker, der prächtige Gedanke

Im Vertrauen gesagt ist meiner Meinung danach offenbar. Ich wollte dieses Thema nicht entwickeln.