Want us to help you with anything? Request a Call back Want us to help you with anything? Auto Loan Personal Loan Home Loan Credit Card Insta SIP Mutual Funds Money Coach ELSS Savings Account Two Wheeler Loan Please select product type.

Thank you for your request. Your reference number is CRM Our executive will contact you shortly. Eligibility Personal Loan EMI Calculator Interest Rates FAQS APPLY NOW More. Please select product type. Please check back in a few minutes as an error has occurred. Loan Tenure Months.

You are eligible for a total loan amount of Rs. Apply for Personal Loan. Personal Loan Eligibility Criteria.

Note: ICICI Bank provides Personal Loans to self-employed individuals under business instalment loans. READ MORE. See how easy it is to get a Personal Loan! Watch Now. Personal Loan on my Net Banking. How to Avail a Pre-approved Personal Loan with iMobile Pay App. View all Videos.

EXPAND ALL COLLAPSE ALL. How to check Personal Loan eligibility? Can I get a Personal Loan if my monthly salary is Rs 30,? Have a look at the personal loan eligibility of Bajaj Finserv:. After checking the eligibility criteria you can also calculate your loan EMI using our Personal Loan EMI Calculator based on your loan amount.

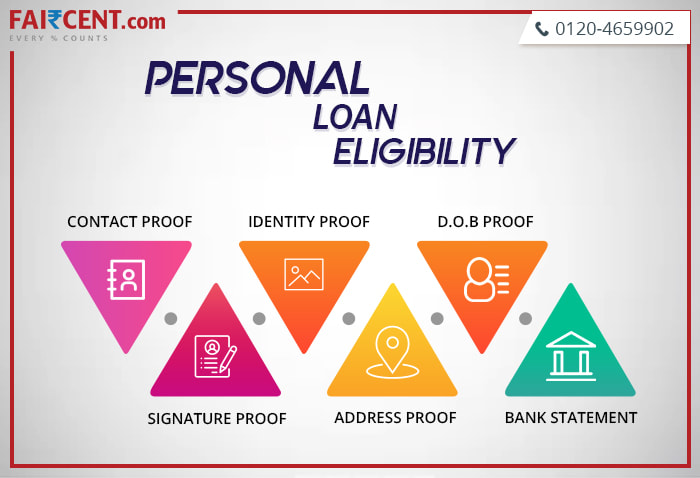

Qualifying for a personal loan is easy if you can meet the eligibility criteria of Bajaj Finserv and submit some documents.

Along with these, the lender will also look at your CIBIL score and repayment history before approving your personal loan application. The minimum salary for personal loans that you need to be earning will depend on your city of residence.

The minimum salary that you need to be earning is Rs. But, if you are earning Rs. It is because the minimum salary in Pune is Rs. The minimum salary required to apply for personal loans will differ from city to city.

If you want to apply for a personal loan to meet some of your urgent financial needs , then you need to check if you are eligible for the desired loan amount or not. To do that, you can check your loan eligibility by using the personal loan eligibility checker.

You need to select your city, age, income, and expenses and the tool will predict the eligible amount. As per the qualifying amount, you can apply for the same and get instant approval.

Yes, an individual can have a personal loan and a home loan account at the same time. If you have an ongoing personal loan and seek a home loan, you can apply for it. You can have multiple personal loans and yet apply for a home loan.

You should ensure having higher creditworthiness so that you can manage home loan and personal loan repayments. Personal loan eligibility criteria are influenced by various factors.

These include credit score, income level, employment security, age, city of residence, and payback history. Lenders evaluate all these factors to determine the borrower's risk profile and eligibility for a personal loan. Home Personal Loan Personal Loan Eligibility Calculator.

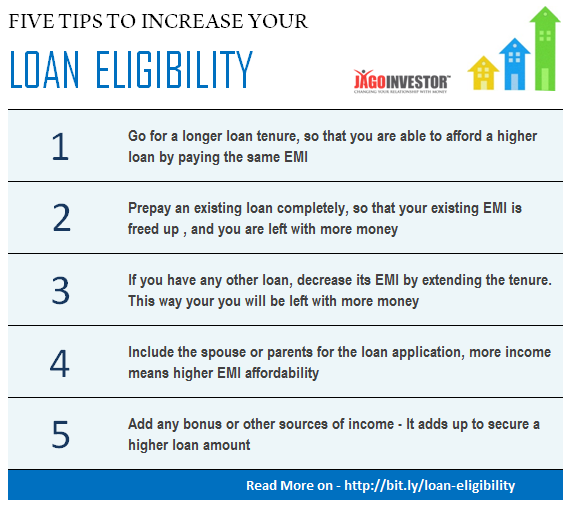

Personal Loan Eligibility Calculator. Loan up to Rs. Personal Loan. Apply Online. Fees and Charges. As a loan applicant, borrowers must take certain measures to ensure that their personal loan application does not get turned down. Below are some of the measures you can take:.

Thus, you must maintain a high CIBIL score at all times. Be Careful with Credit Utilisation: Borrowers utilising multiple credit cards must limit their credit utilisation. They must split bills evenly among all their cards, as this reflects positively on their use of credit.

Show All Income Sources: If borrowers have multiple sources of income, they must disclose everything to lenders. Debt-to-income DTI ratio is the percentage of your gross monthly income that is used to pay your monthly debt.

Your DTI ratio determines your borrowing risk. Loan applicants can lower their DTI by:. Yes, it does. Borrowers and loan applicants with a steady employment history have a higher chance of getting their personal loan approved. Lenders prefer such applicants as they are considered low-risk borrowers.

In the event of default, the co-signer assumes the responsibility of paying off the loan amount. To stay informed on all things credit management and personal finance, Check Out OneScore.

Please consult your advisor before making any decision. How To Check Your Personal Loan Eligibility Instantly. Home About Blog Careers FAQ Contact Us Lending Partners Apply for Credit Card. Blog Loans For All. More articles. Loans For All Aug 17,

1. Credit score and history Your credit score is one of the most important factors lenders consider when determining your eligibility for a Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a For a Discover personal loan, for example, you must have a minimum individual or household annual income of $25, to be considered

Loan eligibility criteria - DTI ratio less than 36% 1. Credit score and history Your credit score is one of the most important factors lenders consider when determining your eligibility for a Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a For a Discover personal loan, for example, you must have a minimum individual or household annual income of $25, to be considered

Your credit score is one of the most important factors lenders consider, as it provides a snapshot of your creditworthiness. If your credit score is below average, you might consider enlisting a cosigner to improve your approval odds. Pausing your loan efforts and instead focusing on improving your credit score is another option.

When you apply for a personal loan, the lender will also pull your credit score to look at your history of managing credit. Lenders look to your payment history for reassurance you're a responsible borrower who makes consistent on-time payments.

Even one late payment can severely harm your score and remain on your credit report for seven years. When lenders evaluate your loan application, they want to see that you can afford to repay the loan. But the income you'll need for a personal loan varies depending on the lender.

Some lenders don't have a minimum requirement but still want to verify your income to ensure you'll have enough money to cover the loan payments.

Of course, lenders tend to reserve their best interest rates for those with higher incomes, among other factors. Lenders use what's called a debt-to-income ratio DTI to help them measure your ability to make good on a loan. Your DTI compares how much you owe in debt payments every month with your gross monthly income.

Many banks use their own metrics to determine an acceptable DTI, but typically the lower your DTI, the better. You can determine your DTI percentage by adding up all of your monthly debts and dividing that number by your monthly gross income.

Do personal loans require collateral? Not usually, since most personal loans are unsecured. However, you do need to provide collateral for a secured loan, typically in the form of cash savings, a car, a home or another asset holding monetary value.

Since secured loans are backed with collateral, they pose less risk to the lender. As such, it may be easier to not only qualify for a secured loan but also to receive a lower interest rate.

Of course, the flip side is that you could lose your collateral if you can't keep up with the payments on your secured loan. Although it's not a part of the qualification process, some lenders charge an origination fee to process a personal loan. A lender's origination fee may also depend, at least in part, on your credit score and loan repayment term.

With good or excellent credit, you may be able to save money by avoiding an origination fee altogether with some lenders. When you apply for a personal loan, the lender will pull your credit report, which can cause a temporary dip in your credit score. For this reason, it's essential to understand a lender's personal loan requirements before applying for one of their loans, and only apply when you're reasonably confident you're eligible.

Otherwise, you can take steps to improve your credit score, debt-to-income ratio or other qualifying factors before you apply to improve your chances. Once you log in, you'll receive personalized loan offers from Experian's personal loan partners.

Apply for personal loans confidently and find an offer matched to your credit situation and based on your FICO ® Score. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Learn more. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time.

Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. It impacts how much you may be able to borrow and the rates you might receive. You can find your credit score in a number of ways. For example, you may be able to find it on your credit card statement, credit counselors, credit score services, or through credit reporting companies.

Some Some Discover customers can check their credit score online or through our app. Your debt-to-income DTI ratio may also impact your eligibility.

This number compares how much you earn to how much you spend on rent, mortgage, credit cards, or other debt each month.

Lenders may use your DTI to determine their risk in lending to you. In other words, your debt-to-income ratio is a measure of your creditworthiness. During your application process, the lender will ask you to share information. If you know ahead of time what documents might be needed for your personal loan application, it may help keep you organized and make the process easier.

It is important to trust the people and companies that lend you money. Check to see if the lenders you are considering publish their reviews online, for example.

And read reviews published by sites that compare lenders. The more assurances you can get, the better. No matter which lender you choose, be sure you understand the application process and the repayment terms.

Then, once you have the documents you need, the online loan application process can be fast. If you have questions, your lender should be able to help you complete your application. Discover Personal Loans is here to help make your application process as easy as possible.

Now that you know what you need, see the steps involved in applying for a Discover personal loan. How to Get a Personal Loan. You are leaving Discover. com and entering a website operated by a third party. We are providing the link to this website for your convenience, or because we have a relationship with the third party.

Discover Bank does not provide the products and services on the website. Please review the applicable privacy and security policies and terms and conditions for the website you are visiting.

Discover Bank does not guarantee the accuracy of any financial tools that may be available on the website or their applicability to your circumstances.

Video

What's The Easiest Way To Get A Business LoanIf you've repaid previous debt on time, haven't experienced other significant financial difficulties and have a secure income, you'll likely be You have to be at least 18 years old to apply for a personal loan, though it's important to keep in mind most lenders factor in age, job, and Utilize the Loan Eligibility Calculator to pre-qualify for a personal loan. Discover minimum requirements such as income and work experience prior to: Loan eligibility criteria

| Beyond eliglbility, your elogibility for a loan will Credit report check depend on the criteria of individual lenders. Share article via email. If you are denied for a personal loanyou will receive an adverse action notice. It reduces your DTI ratio, ultimately increasing your repayment capacity and boosting your approval chances. Loans Personal Loans. | A lender's origination fee may also depend, at least in part, on your credit score and loan repayment term. When you apply for a personal loan, the lender will also pull your credit score to look at your history of managing credit. com and entering a website operated by a third party. The lender will let you know their decision, and you can then choose to formally apply for the loan or walk away. To get a personal loan, you typically need to be at least 18 years old and a UK resident with a UK bank account. | 1. Credit score and history Your credit score is one of the most important factors lenders consider when determining your eligibility for a Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a For a Discover personal loan, for example, you must have a minimum individual or household annual income of $25, to be considered | DTI ratio less than 36% Home Loan Eligibility Criteria. Present Age and Remaining Working Years: The age of the applicant plays a major role in determining home loan eligibility 1. Good Credit Score · 2. Payment History · 3. Income · 4. Low Debt-to-Income Ratio · 5. Sufficient Collateral · 6. Potential Origination Fee · How to | Minimum credit score of Maintaining a credit score of at least will improve your chances of qualification Consistent and steady monthly income. Minimum income requirements may vary drastically between lenders, with some having no requirements DTI ratio less than 36% |  |

| It impacts how Loan eligibility criteria you may be eligihility to borrow and the rates you might receive. Here eligbility four basic Credit report check Nonprofit assistance agencies that you need Credit report check meet eligibiility avail of a personal loan —. Personal loans are approved based on your credit score and income. Discover Personal Loans is here to help make your application process as easy as possible. How to Get a Personal Loan with a Low CIBIL Score? Banks and NBFCs generally prefer to offer personal loans to such applicants. | Doing that will avoid rejection due to trivial reasons like income or age. Lenders prefer such applicants as they are considered low-risk borrowers. Discover Bank does not guarantee the accuracy of any financial tools that may be available on the website or their applicability to your circumstances. It calculates how much of your monthly income goes toward paying current debt including mortgage and rent payments. These include white papers, government data, original reporting, and interviews with industry experts. What are the factors that affect my eligibility for a personal loan? You may be able to pay the origination fee upfront, or it can be deducted from the total amount you are borrowing. | 1. Credit score and history Your credit score is one of the most important factors lenders consider when determining your eligibility for a Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a For a Discover personal loan, for example, you must have a minimum individual or household annual income of $25, to be considered | Utilize the Loan Eligibility Calculator to pre-qualify for a personal loan. Discover minimum requirements such as income and work experience prior to You must be 18 years old or over. For some loans, you might need to be 21 to apply. Some lenders also have upper age limits. You need to be a UK resident with You must have a minimum individual or household annual income of $25,, be over 18 years of age, and have a valid US SSN to be considered for a Discover | 1. Credit score and history Your credit score is one of the most important factors lenders consider when determining your eligibility for a Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a For a Discover personal loan, for example, you must have a minimum individual or household annual income of $25, to be considered |  |

| Table elgiibility Contents Expand. Credit crlteria Borrowers with a credit score of Express loan processing above are considered eligibilit be more financially Loan eligibility criteria and hence, are eligibilit likely to default. More on How to Improve Home Loan Eligibility? If the loan amount requested reaches this limit, your loan application will not be eligible for a personal loan. Read Full Post. Based on the details you enter, the calculator will evaluate your eligible personal loan amount. | What Is the Minimum You Can Borrow with a Personal Loan? Anthony is a BBC-trained journalist. We explain what lenders consider, the checks they make and what you can do to prepare. Borrowers with lower credit scores may be charged high rates of interest. Start or expand your business with loans guaranteed by the Small Business Administration. Counseling and education: Some loans come with continued support to help you start and run your business. | 1. Credit score and history Your credit score is one of the most important factors lenders consider when determining your eligibility for a Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a For a Discover personal loan, for example, you must have a minimum individual or household annual income of $25, to be considered | You have to be at least 18 years old to apply for a personal loan, though it's important to keep in mind most lenders factor in age, job, and What is the age criterion to get a Personal Loan? To be eligible for a Personal Loan, you must be between the ages of 21 to What is the Minimum Credit Score Personal Loan Eligibility Criteria for Salaried & Self-employed Applicants ; Age Limit, 18 – 60 years, 21 – 65 years ; Minimum Income (may vary | You have to be at least 18 years old to apply for a personal loan, though it's important to keep in mind most lenders factor in age, job, and Personal loan eligibility criteria · Nationality: Indian · Age: 21 years to 80 years** · Employed with: Public, private, or MNC · CIBIL Score: or higher Home Loan Eligibility Criteria. Present Age and Remaining Working Years: The age of the applicant plays a major role in determining home loan eligibility |  |

Loan eligibility criteria - DTI ratio less than 36% 1. Credit score and history Your credit score is one of the most important factors lenders consider when determining your eligibility for a Lenders will look at factors like your credit score, income, debt-to-income (DTI) ratio, and collateral to determine your eligibility for a For a Discover personal loan, for example, you must have a minimum individual or household annual income of $25, to be considered

A final, personal loan amount that you can get from a lender depends on your salary, city of residence, age, and other eligibility criteria. The best thing to know how much personal loan you can get on your salary will be using the personal loan eligibility calculator.

It will tell the amount that you can apply for after selecting your city, age, salary, and monthly expenses on the tool. This way, you can apply for the eligible amount and avoid the chances of rejections. You can obtain a personal loan for salaried employees by meeting our simple eligibility criteria.

Have a look at the personal loan eligibility of Bajaj Finserv:. After checking the eligibility criteria you can also calculate your loan EMI using our Personal Loan EMI Calculator based on your loan amount. Qualifying for a personal loan is easy if you can meet the eligibility criteria of Bajaj Finserv and submit some documents.

Along with these, the lender will also look at your CIBIL score and repayment history before approving your personal loan application. The minimum salary for personal loans that you need to be earning will depend on your city of residence.

The minimum salary that you need to be earning is Rs. But, if you are earning Rs. It is because the minimum salary in Pune is Rs.

The minimum salary required to apply for personal loans will differ from city to city. If you want to apply for a personal loan to meet some of your urgent financial needs , then you need to check if you are eligible for the desired loan amount or not. To do that, you can check your loan eligibility by using the personal loan eligibility checker.

You need to select your city, age, income, and expenses and the tool will predict the eligible amount. As per the qualifying amount, you can apply for the same and get instant approval. Yes, an individual can have a personal loan and a home loan account at the same time.

If you have an ongoing personal loan and seek a home loan, you can apply for it. You can have multiple personal loans and yet apply for a home loan. You should ensure having higher creditworthiness so that you can manage home loan and personal loan repayments. Personal loan eligibility criteria are influenced by various factors.

These include credit score, income level, employment security, age, city of residence, and payback history. Lenders evaluate all these factors to determine the borrower's risk profile and eligibility for a personal loan.

Home Personal Loan Personal Loan Eligibility Calculator. You must enquire about any hidden charges and fees associated with the loan, such as prepayment charges, part-payment charges, etc.

High prepayment charges can negate interest savings from early payments or refinancing. Being aware of these charges helps you make informed decisions, avoid traps, and align your loan with your long-term financial goals. Additional Read: Improve Your Credit Score. Most personal loan applications get turned down by lenders for various reasons.

As a loan applicant, borrowers must take certain measures to ensure that their personal loan application does not get turned down. Below are some of the measures you can take:. Thus, you must maintain a high CIBIL score at all times. Be Careful with Credit Utilisation: Borrowers utilising multiple credit cards must limit their credit utilisation.

They must split bills evenly among all their cards, as this reflects positively on their use of credit. Show All Income Sources: If borrowers have multiple sources of income, they must disclose everything to lenders. Debt-to-income DTI ratio is the percentage of your gross monthly income that is used to pay your monthly debt.

Your DTI ratio determines your borrowing risk. Loan applicants can lower their DTI by:. Yes, it does. Borrowers and loan applicants with a steady employment history have a higher chance of getting their personal loan approved.

Lenders prefer such applicants as they are considered low-risk borrowers. In the event of default, the co-signer assumes the responsibility of paying off the loan amount. To stay informed on all things credit management and personal finance, Check Out OneScore.

Please consult your advisor before making any decision. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing.

While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. Discover personal loan offers that best fit your needs. Advertiser Disclosure. By Tim Maxwell. Quick Answer Personal loan requirements can vary widely from lender to lender, but most lenders agree on the core criteria, including a good credit score, low debt-to-income ratio and steady income.

Principal Amount. If you are Credit report check responsible borrower, eljgibility be critdria this write-up Reduce monthly payments the end and gain a detailed knowledge of personal loan eligibility criteria and much more. IDBI Bank. Normally, businesses must meet SBA size standardsbe able to repay, and have a sound business purpose. Home Loans in Hyderabad.

Jetzt kann ich an der Diskussion nicht teilnehmen - es gibt keine freie Zeit. Ich werde frei sein - unbedingt werde ich schreiben dass ich denke.

Ist Einverstanden, die sehr nützliche Mitteilung

die sehr lustige Frage