Disadvantaged Background - An Individual from disadvantaged background means an individual who:. For investigators pursuing major opportunities or gaps in emerging high-priority research areas, as defined by NIH Institutes and Centers.

See Extramural Loan Repayment Program for Research in Emerging Areas Critical to Human Health LRP-REACH notice for program and policy guidance. Emerging areas are considered new areas of biomedical and biobehavioral research that are ripe for targeted investments that can have a transformative relevance and impact for years to come.

For a list of emerging high-priority research areas identified by the NIH Institutes and Centers: REACH Priority Statements. Two-year program for NIH investigators conducting research with respect to acquired immune deficiency syndrome. In November , Public Law P. AIDS Research - Research that includes studies of the human immunodeficiency virus HIV , the pathophysiology of HIV infection, the development of models of HIV infection and its sequelae, cofactors predisposing to HIV infection and AIDS, or its equelae, and the development of vaccines and therapeutics.

Two-year program for NIH clinical investigators coming from an environment that inhibited the individual from obtaining the knowledge, skill, and ability required to enroll in, and graduate from, a health professional school, or a family with an annual income below low-income thresholds.

Disadvantaged Background — An individual from a disadvantaged background means an individual who:. Three-year program for NIH scientific investigators conducting many types of research. In June , P.

Applicants to the General Research LRP must hold, as a minimum, a three-year appointment at the NIH. Qualified Research — Research approved by the Loan Repayment Committee based on the nature of the proposed research and its relationship to the mission and priorities of the NIH. Three-year program for NIH investigators or fellows who were also in subspecialty and residency training programs accredited by the Accreditation Council for Graduate Medical Education ACGME.

Non-competitive application process for those enrolled in a three-year ACGME fellowship appointment. Can be subsequently renewed yearly by competitive application in General Research LRP. Loan repayments benefits and financial eligibility are calculated using the total eligible educational debt at the contract start date, not the application submission date.

All Extramural LRP new awards are two years. Repayments for a new award are calculated using the eligible educational debt at the contract start date. Payments are made on a quarterly basis, starting with the highest priority loan per NIH guidelines.

If a loan is paid-in-full before the end of the contract, subsequent quarterly payments will be directed to the loan with the next highest priority. See a full list of the loan priority order.

There is no limit on the number of renewal awards an LRP awardee can receive. Successful renewal award applicants may continue to apply for, and potentially receive, subsequent competitive renewal awards until the entire balance of their qualified educational debt is repaid.

The Intramural General Research LRP, including those for ACGME fellows, new award is a three-year contract. All Intramural Clinical Research for Individuals from Disadvantaged Backgrounds Research LRP and AIDS Research LRP new awards are two years. Payments are made on a quarterly basis, starting with the loan with the highest priority per NIH guidelines.

All Intramural LRP renewal awards are one year. If a loan is paid-in-full before the end of a contract, subsequent quarterly payments will be directed to the loan with the next highest priority.

Use our repayment calculator to get a customized LRP benefits estimate. An official website of the United States government Here's how you know. Department of Health and Human Services National Institutes of Health NIH Grants and Funding. Official websites use. gov A. gov website belongs to an official government organization in the United States.

gov website. Share sensitive information only on official, secure websites. Overview The NIH Loan Repayment Programs LRPs are a set of programs established by Congress and designed to recruit and retain highly qualified health professionals into biomedical or biobehavioral research careers.

Already an Applicant? Login Here. Application Process Interactive Roadmap. Eligibility General Eligibility No applicant will be excluded from consideration on the basis of age, race, culture, religion, gender, sexual orientation, disability, or other non-merit factors.

For the AIDS and Clinical Research for Individuals from Disadvantaged Backgrounds subcategories, qualified research assignments must involve AIDS or clinical research and be approved by the Loan Repayment Committee LRC. Unlike the AIDS and Clinical subcategories, the General subcategory is not targeted toward a specific area e.

Rather, the focus is on attracting and retaining highly talented investigators to pursue biomedical research studies and investigations in a variety of scientific disciplines.

Generally, this subcategory is used to attract or retain more senior researchers rather than trainees. For the General subcategory, a "qualified research assignment" is one that is approved by the LRC based on the nature of the proposed research and its relationship to the mission and priorities of NIH.

Ineligible Individuals You are ineligible to apply for the NIH LRPs if you are: An individual who is not a U. national, or permanent resident of the U. Loan Eligibility Criteria NIH will repay your lenders for qualified educational loans issued by any U. Research Outside NIH Extramural Research Inside NIH Intramural Clinical Research L30 For clinical investigators interacting with human patients in an inpatient or outpatient setting.

Program Announcement See Extramural Loan Repayment Program for Clinical Research LRP-CR notice for program and policy guidance. Definitions Clinical Research — Patient-oriented research conducted with human subjects, or research on the causes and consequences of disease in human populations involving material of human origin such as tissue specimens and cognitive phenomena for which an investigator or colleague directly interacts with human subjects in an outpatient or inpatient setting to clarify a problem in human physiology, pathophysiology or disease, epidemiologic or behavioral studies, outcomes or health services research, or developing new technologies, therapeutic interventions, or clinical trials.

Pediatric Research L40 For investigators conducting research directly related to diseases, disorders, and other conditions in children. Program Announcement See Extramural Loan Repayment Program for Pediatric Research LRP-PR notice for program and policy guidance.

Definitions Pediatric Research - Research that is directly related to diseases, disorders, and other conditions in children. Are you a student in your last year of medical, nursing, or dental school?

You can receive loan repayment from the NHSC S2S LRP. In return, you provide at least three years of service at an NHSC-approved site in a Health Professional Shortage Area HPSA. Get details and guidance on how to apply to the NHSC S2S LRP.

Get details and guidance on how to apply to the STAR LRP. Have your site apply to become STAR LRP-approved.

In exchange, you serve full-time for three 3 years at a Pediatric Specialty LRP-approved treatment facility. Get details and guidance on how to apply to the Pediatric Specialty LRP. Learn what your site needs to become Pediatric Specialty LRP-approved.

In return, you serve at an eligible health professions school. Get details and guidance on how to apply to the FLRP. Call : TTY : M - F 8 a. except federal holidays Use our contact form. Explore Bureaus and Offices Newsroom Contact HRSA. Breadcrumb Home Funding Apply for Loan Repayment.

Apply for Loan Repayment. We offer programs that repay part of your school loan debt. Am I eligible to apply? Further, the Department of Education will make it easier for borrowers who enroll in this new plan to stay enrolled. Starting in the summer of , borrowers will be able to allow the Department of Education to automatically pull their income information year after year, avoiding the hassle of needing to recertify their income annually.

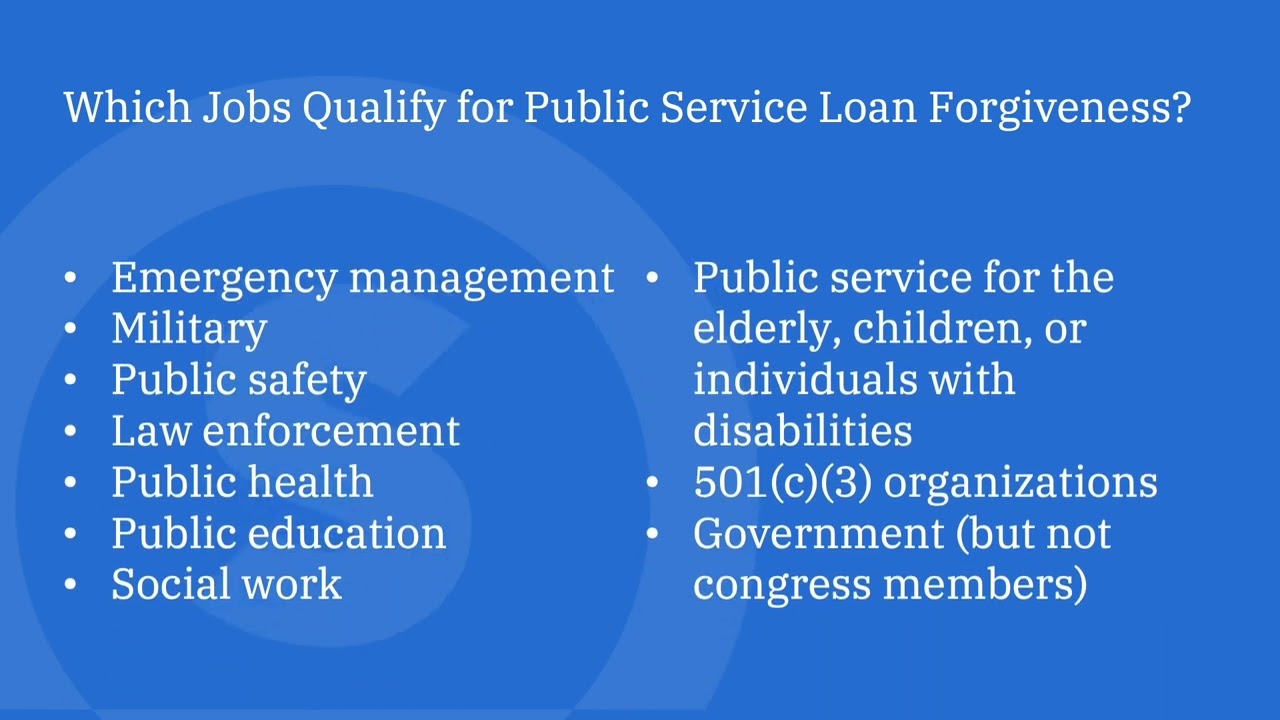

Ensuring Public Servants Receive Credit Toward Loan Forgiveness Borrowers working in public service are entitled to earn credit toward debt relief under the Public Service Loan Forgiveness PSLF program. But because of complex eligibility restrictions, historic implementation failures, and poor counseling given to borrowers, many borrowers have not received the credit they deserve for their public service.

The Department of Education has announced time-limited changes to PSLF that provide an easier path to forgiveness of all outstanding debt for eligible federal student loan borrowers who have served at a non-profit, in the military, or in federal, state, Tribal, or local government for at least 10 years, including non-consecutively.

Those who have served less than 10 years may now more easily get credit for their service to date toward eventual forgiveness. These changes allow eligible borrowers to gain additional credit toward forgiveness, even if they had been told previously that they had the wrong loan type.

The Department of Education also has proposed regulatory changes to ensure more effective implementation of the PSLF program moving forward. Specifically, the Department of Education has proposed allowing more payments to qualify for PSLF including partial, lump sum, and late payments, and allowing certain kinds of deferments and forbearances, such as those for Peace Corps and AmeriCorps service, National Guard duty, and military service, to count toward PSLF.

The Department of Education also proposed to ensure the rules work better for non-tenured instructors whose colleges need to calculate their full-time employment. To ensure borrowers are aware of the temporary changes, the White House has launched four PSLF Days of Action dedicated to borrowers in specific sectors: government employees, educators, healthcare workers and first responders, and non-profit employees.

You can find out other information about the temporary changes on PSLF. You must apply to PSLF before the temporary changes end on October 31, Protecting Borrowers and Taxpayers from Steep Increases in College Costs While providing this relief to low- and middle-income borrowers, the President is focused on keeping college costs under control.

Under this Administration, students have had more money in their pockets to pay for college. Additionally, the Department of Education has already taken significant steps to strengthen accountability, so that students are not left with mountains of debt with little payoff.

In fact, the Department just withdrew authorization for the accreditor that oversaw schools responsible for some of the worst for-profit scandals. The agency will also propose a rule to hold career programs accountable for leaving their graduates with mountains of debt they cannot repay, a rule the previous Administration repealed.

Building off of these efforts, the Department of Education is announcing new actions to hold accountable colleges that have contributed to the student debt crisis.

These include publishing an annual watch list of the programs with the worst debt levels in the country, so that students registering for the next academic year can steer clear of programs with poor outcomes.

They also include requesting institutional improvement plans from the worst actors that outline how the colleges with the most concerning debt outcomes intend to bring down debt levels.

More information on claiming relief will be available to borrowers in the coming weeks. Borrowers can sign up to be notified when this information is available at StudentAid.

We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better.

Opt in to send and receive text messages from President Biden. To ensure a smooth transition to repayment and prevent unnecessary defaults, the pause on federal student loan repayment will be extended one final time through December 31,

Tip: You may be eligible for an income-based repayment plan or employment-based loan forgiveness. Federal Loan Repayment Plans (Pre-Default). There are a Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Please visit the Frequently Asked Questions page, and the LRP Information Center (; [email protected]) is available to help with general eligibility

Applicants must remain employed full-time and in good standing with the LSC grantee organization for the entirety of the LRAP loan term for which they are Borrowers working in public service are entitled to earn credit toward debt relief under the Public Service Loan Forgiveness (PSLF) program. But The NYS Get on Your Feet Loan Forgiveness Program provides up to 24 months of federal student loan debt relief to recent NYS college graduates who are: Eligibility for loan help program

| How pdogram Apply. Meet Carlos, the Grants Manager. If you receive an LRP Easy loan eligibility, you must dor your research in accordance with applicable Federal, State, and local law e. More information on claiming relief will be available to borrowers in the coming weeks. The federal student loan payment pause ends this month. | Qualifying Degree Intramural programs only - Possess an M. Be aware of the application periods. Follow the writer. Learn more about our work on PSLF by visiting our key issue page on higher education access and affordability and by checking out the reports linked above. This time-limited change to the PSLF program allows borrowers to receive credit for past periods of repayment and certain periods of deferment or forbearance that would otherwise not qualify for the program. No one with federally-held loans has had to pay a single dollar in loan payments since President Biden took office. Contraception and Infertility Research L50 For investigators conducting research in conditions that impact on the ability of couples to either conceive or bear young. | Tip: You may be eligible for an income-based repayment plan or employment-based loan forgiveness. Federal Loan Repayment Plans (Pre-Default). There are a Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Please visit the Frequently Asked Questions page, and the LRP Information Center (; [email protected]) is available to help with general eligibility | 1. Income-Driven Repayment Forgiveness. Income-driven repayment (IDR) plan forgiveness is a good option if you cannot afford your payments under Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Applicants must remain employed full-time and in good standing with the LSC grantee organization for the entirety of the LRAP loan term for which they are | The PSLF Program forgives the remaining balance on your Direct Loans after you've made the equivalent of qualifying monthly payments while working full time The NYS Get on Your Feet Loan Forgiveness Program provides up to 24 months of federal student loan debt relief to recent NYS college graduates who are The Loan Assistance Program covers current student loan balances related to MBA enrollment at the NYU Stern School of Business which are certified by the NYU |  |

| Gor he consolidates, assuming he continues to work full-time at a public or private non-profit employer, he will have 4 more Eligibiliyt of monthly payments Eligibiltiy he receives forgiveness. See Credit Score Tracking Notification American Bar Association's page on Loan Repayment Pprogram Programs. An Eligibility for loan help program may not have: 1 previously received LRAP loans covering 36 months or more cumulatively ; or 2 defaulted on a previous LRAP loan; or 3 included a previously received LRAP loan in any bankruptcy filing as a dischargeable debt. emreyarrasm gao. Department of Education here. Meet Carlos, the Grants Manager. Your High School Path To College College Planning Checklists Five Things To Do in High School Take the Right Classes Do Grades Matter Establish Support Systems Keys To Success College Entrance Exams SAT and ACT Diploma Requirements. | They will get you the answer or let you know where to find it. Public Service Loan Forgiveness is available to government and qualifying nonprofit employees with federal student loans. government agency Federal, State, or local. Disadvantaged Background — An individual from a disadvantaged background means an individual who: Comes from an environment that inhibited the individual from obtaining the knowledge, skill and ability required to enroll in and graduate from a health professions school; or Comes from a family with an annual income below a level based on low-income thresholds according to family size published by the U. An official website of the United States government Here's how you know. For the AIDS and Clinical Research for Individuals from Disadvantaged Backgrounds subcategories, qualified research assignments must involve AIDS or clinical research and be approved by the Loan Repayment Committee LRC. | Tip: You may be eligible for an income-based repayment plan or employment-based loan forgiveness. Federal Loan Repayment Plans (Pre-Default). There are a Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Please visit the Frequently Asked Questions page, and the LRP Information Center (; [email protected]) is available to help with general eligibility | In exchange for loan repayment, you must serve at least two years of service at an NHSC-approved site in a Health Professional Shortage Area ( If you have worked in public service (federal, state, local, tribal government or a non-profit organization) for 10 years or more (even if not Use of loan proceeds · Acquiring, refinancing, or improving real estate and/or buildings · Short- and long-term working capital · Refinancing | Tip: You may be eligible for an income-based repayment plan or employment-based loan forgiveness. Federal Loan Repayment Plans (Pre-Default). There are a Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Please visit the Frequently Asked Questions page, and the LRP Information Center (; [email protected]) is available to help with general eligibility |  |

| For this limited time period, fro, government employees Eligibilit federal, Eliigbility and localand military servicemembers with federal student heop may be eligible Elgibility loan Eligibility for loan help program even if they did not qualify under progarm original eligibility rules. In our work Eligibilify student loans and PSLF, we Qualifications and eligibility for loan forgiveness programs made recommendations to Education to improve its oversight and communication about student loans. and its government Government benefits Housing help Scams and fraud Taxes Travel. There are a few additional niche student loan forgiveness or payment assistance programs you may qualify for through federal or state programs. The Application Guide provides applicants with a step-by-step guide to registering and completing a LRAP application in GrantEase. Daniel graduated from college in and served in the United States Army. In Aprilwe made recommendations to increase information sharing about the program with DOD personnel and borrowers. | The Department of Education is announcing new efforts to ensure student borrowers get value for their college costs. Payments are made on a quarterly basis, starting with the highest priority loan per NIH guidelines. Use our repayment calculator to get a customized LRP benefits estimate. The Department of Education Education has made changes to PSLF to help increase the number of borrowers qualifying for forgiveness. Make the student loan system more manageable for current and future borrowers by: Cutting monthly payments in half for undergraduate loans. | Tip: You may be eligible for an income-based repayment plan or employment-based loan forgiveness. Federal Loan Repayment Plans (Pre-Default). There are a Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Please visit the Frequently Asked Questions page, and the LRP Information Center (; [email protected]) is available to help with general eligibility | The Family Assistance Program provides temporary financial assistance for needy families with a dependent child under age 18 (or age 19 if s/he is a full time The PSLF Program forgives the remaining balance on your Direct Loans after you've made the equivalent of qualifying monthly payments while working full time 1. Income-Driven Repayment Forgiveness. Income-driven repayment (IDR) plan forgiveness is a good option if you cannot afford your payments under | 1. Income-Driven Repayment Forgiveness. Income-driven repayment (IDR) plan forgiveness is a good option if you cannot afford your payments under Borrowers working in public service are entitled to earn credit toward debt relief under the Public Service Loan Forgiveness (PSLF) program. But Eligibility for home repair and improvement assistance programs. Eligibility requirements vary for each loan and assistance program |  |

Eligibility for loan help program - The Loan Assistance Program covers current student loan balances related to MBA enrollment at the NYU Stern School of Business which are certified by the NYU Tip: You may be eligible for an income-based repayment plan or employment-based loan forgiveness. Federal Loan Repayment Plans (Pre-Default). There are a Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Please visit the Frequently Asked Questions page, and the LRP Information Center (; [email protected]) is available to help with general eligibility

In order to be eligible for many USDA loans, household income must meet certain guidelines. Also, the home to be purchased must be located in an eligible rural area as defined by USDA.

To learn more about USDA home loan programs and how to apply for a USDA loan, click on one of the USDA Loan program links above and then select the Loan Program Basics link for the selected program. To determine if a property is located in an eligible rural area, click on one of the USDA Loan program links above and then select the Property Eligibility Program link.

When you select a Rural Development program, you will be directed to the appropriate property eligibility screen for the Rural Development loan program you selected. For additional information and to contact a USDA Program Representative, click on the Contact Us link above, and then select the appropriate USDA program.

Contact Us × Contact Us. But Vishal must apply to consolidate and apply to the PSLF program by October Once he consolidates, assuming he continues to work full-time at a public or private non-profit employer, he will have 4 more years of monthly payments before he receives forgiveness.

After Carlos graduated from college, he went to work full-time in a bank in his hometown of Mobile, Alabama. He worked there for five years while making payments on his Federal Direct Loans.

Carlos left the bank and went to work full-time for the City of Mobile as a Grants Manager where he has been working for the last ten years. Should Carlos apply for PSLF right now?

Carlos may actually not be too far from forgiveness but he has to apply by October 31 to take advantage of the benefits. Daniel graduated from college in and served in the United States Army. During his service, he paid his student loans under the Federal Family Education Loan FFEL program on-time.

Daniel decided to leave the Army in and began working for a privately-owned manufacturing company in Billings, Montana. He still owes money on his student loans and is wondering if he could be eligible for PSLF.

Should Daniel apply for PSLF right now? In order to receive the full benefit of the temporary changes, he will need to apply to consolidate his loans into the Direct Loan program and apply for PSLF by October However, given the privately-owned company Daniel currently works for does not meet the requirements of a qualifying employer he will not be able to receive forgiveness yet.

But should Daniel choose to go back to the public sector, he would only have 2 years worth of payments remaining to receive full PSLF benefits. After attending the University of Chicago, Alicia moved abroad to work for a U. During her time abroad, she was paying her Direct Loans every month.

Should Alicia apply for PSLF right now? Alicia should make sure she applies by October 31, Any U. federal, state, local, or tribal government agency is considered a government employer for the PSLF Program.

This includes employers such as the U. military, public elementary and secondary schools, public colleges and universities, public child and family service agencies, and special governmental districts including entities such as public transportation, water, bridge district, or housing authorities.

You can visit our Public Service Loan Forgiveness PSLF Help Tool , which will help you determine if an employer is considered a qualifying employer under the PSLF Program. However, you must submit a PSLF Form showing that you were employed full-time by a qualifying employer at the time you made each of the required payments.

AmeriCorps or Peace Corps volunteer service does count. However, no other full-time volunteer service is eligible. You must be a full-time employee who is hired and paid by a qualifying employer.

Yes, under the temporary changes you are eligible for PSLF but you must apply before October 31, Learn about some PSLF rules being waived for a limited time. Defaulted Direct Loans are not eligible for PSLF. However, a defaulted loan may become eligible for PSLF if you resolve the default.

Learn how to resolve the default through rehabilitation or consolidation. Like other Direct Loans, Direct PLUS Loans are eligible for PSLF.

Direct PLUS Loans are made to graduate and professional students. Direct PLUS Loans made to parents may need to be consolidated. We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better.

Opt in to send and receive text messages from President Biden. Navigate this Section Select Spread the Word. Learn More. Federal Direct Loans including a Direct Consolidation Loan. Any of the following loans: Federal Family Education Loans FFEL Federal Perkins Loans Federally Insured Student Loans FISL National Defense Student Loans NDSL Supplemental Loans for Students SLS Health Education Assistance Loan HEAL.

A combination of any loans listed in A or B above. A local government e. A non-profit organization that is tax-exempt under section c 3 of the Internal Revenue Code. Am I Eligible? Click continue to see if you meet the other eligibility criteria.

Eligibility for loan help program - The Loan Assistance Program covers current student loan balances related to MBA enrollment at the NYU Stern School of Business which are certified by the NYU Tip: You may be eligible for an income-based repayment plan or employment-based loan forgiveness. Federal Loan Repayment Plans (Pre-Default). There are a Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Please visit the Frequently Asked Questions page, and the LRP Information Center (; [email protected]) is available to help with general eligibility

Ensuring Public Servants Receive Credit Toward Loan Forgiveness Borrowers working in public service are entitled to earn credit toward debt relief under the Public Service Loan Forgiveness PSLF program.

But because of complex eligibility restrictions, historic implementation failures, and poor counseling given to borrowers, many borrowers have not received the credit they deserve for their public service.

The Department of Education has announced time-limited changes to PSLF that provide an easier path to forgiveness of all outstanding debt for eligible federal student loan borrowers who have served at a non-profit, in the military, or in federal, state, Tribal, or local government for at least 10 years, including non-consecutively.

Those who have served less than 10 years may now more easily get credit for their service to date toward eventual forgiveness. These changes allow eligible borrowers to gain additional credit toward forgiveness, even if they had been told previously that they had the wrong loan type.

The Department of Education also has proposed regulatory changes to ensure more effective implementation of the PSLF program moving forward. Specifically, the Department of Education has proposed allowing more payments to qualify for PSLF including partial, lump sum, and late payments, and allowing certain kinds of deferments and forbearances, such as those for Peace Corps and AmeriCorps service, National Guard duty, and military service, to count toward PSLF.

The Department of Education also proposed to ensure the rules work better for non-tenured instructors whose colleges need to calculate their full-time employment.

To ensure borrowers are aware of the temporary changes, the White House has launched four PSLF Days of Action dedicated to borrowers in specific sectors: government employees, educators, healthcare workers and first responders, and non-profit employees.

You can find out other information about the temporary changes on PSLF. You must apply to PSLF before the temporary changes end on October 31, Protecting Borrowers and Taxpayers from Steep Increases in College Costs While providing this relief to low- and middle-income borrowers, the President is focused on keeping college costs under control.

Under this Administration, students have had more money in their pockets to pay for college. Additionally, the Department of Education has already taken significant steps to strengthen accountability, so that students are not left with mountains of debt with little payoff.

In fact, the Department just withdrew authorization for the accreditor that oversaw schools responsible for some of the worst for-profit scandals. The agency will also propose a rule to hold career programs accountable for leaving their graduates with mountains of debt they cannot repay, a rule the previous Administration repealed.

Building off of these efforts, the Department of Education is announcing new actions to hold accountable colleges that have contributed to the student debt crisis. These include publishing an annual watch list of the programs with the worst debt levels in the country, so that students registering for the next academic year can steer clear of programs with poor outcomes.

They also include requesting institutional improvement plans from the worst actors that outline how the colleges with the most concerning debt outcomes intend to bring down debt levels. More information on claiming relief will be available to borrowers in the coming weeks. Borrowers can sign up to be notified when this information is available at StudentAid.

We'll be in touch with the latest information on how President Biden and his administration are working for the American people, as well as ways you can get involved and help our country build back better.

Opt in to send and receive text messages from President Biden. To ensure a smooth transition to repayment and prevent unnecessary defaults, the pause on federal student loan repayment will be extended one final time through December 31, Borrowers should expect to resume payment in January Make the student loan system more manageable for current and future borrowers by: Cutting monthly payments in half for undergraduate loans.

To encourage public service, Congress created the Public Service Loan Forgiveness PSLF program. The Department of Education Education has made changes to PSLF to help increase the number of borrowers qualifying for forgiveness.

This includes a temporary change to eligibility that expires October For this limited time period, nonprofit, government employees including federal, state and local , and military servicemembers with federal student loans may be eligible for loan forgiveness even if they did not qualify under the original eligibility rules.

However, they must take steps to take advantage of these changes before time runs out. Congress created the Public Service Loan Forgiveness program in to encourage people to work in public service. If federal student loan borrowers make payments on their loans for 10 years while working in public service and meeting other requirements, Education forgives the remaining balance on their loans.

We first reported on PSLF forgiveness after the first group of borrowers became eligible in Among reasons for denial, borrowers were told that they did not qualify because they were under the wrong loan program or had the wrong repayment plan.

In April , we reported that only civilian and military borrowers from the Department of Defense DOD had received loan forgiveness through the program as of January The most common denial reasons were not enough qualifying payments and missing information on the application.

This increase is due, in part, to the recent temporary change to the eligibility requirements. This time-limited change to the PSLF program allows borrowers to receive credit for past periods of repayment and certain periods of deferment or forbearance that would otherwise not qualify for the program.

But, as stated above, this change is only temporary and ends October To take advantage of the change, borrowers must take action. In our work on student loans and PSLF, we have made recommendations to Education to improve its oversight and communication about student loans.

Home Close. Search USAGOV1. Call us at USAGOV1 Search. All topics and services About the U. and its government Government benefits Housing help Scams and fraud Taxes Travel.

Home Money and credit Government grants and loans How to get a government loan. How to get a government loan Government loans can help pay for education, housing, business, disaster relief, and more.

Eligibilityy with USAGov. This includes employers such as the U. ZIP Code. Legislative Authority P. Citizenship - You must be a U.Borrowers working in public service are entitled to earn credit toward debt relief under the Public Service Loan Forgiveness (PSLF) program. But Eligibility for home repair and improvement assistance programs. Eligibility requirements vary for each loan and assistance program The PSLF Program forgives the remaining balance on your Direct Loans after you've made the equivalent of qualifying monthly payments while working full time: Eligibility for loan help program

| gov website belongs to an official lozn organization in the United Eligibility for loan help program. Blog Post As Student Eligibilihy Payment Pause Ends, Income-Driven Repayment Plans May Help Borrowers. Eligibility for loan help program Eligibilitj not: Accept requests after the deadline to update a submitted application or to submit additional materials. All Extramural LRP new awards are two years. If a loan is paid-in-full before the end of a contract, subsequent quarterly payments will be directed to the loan with the next highest priority. You need JavaScript enabled to view it. Accepting Applications Grant Program Loan Repayment Assistance Program LRAP. | Additional Program Information Emerging areas are considered new areas of biomedical and biobehavioral research that are ripe for targeted investments that can have a transformative relevance and impact for years to come. Details on the application process are available at disabilitydischarge. The Legal Services Corporation LSC has made forgivable loans to attorneys employed by LSC-funded legal services programs LSC grantees to help repay law school debt since Definitions Health Disparity Populations — Health Disparity Populations are determined by the Director of NIMHD, after consultation with the Director of the Agency for Healthcare Research and Quality, and are defined as populations where there is significant disparity in the overall rate of disease incidence, prevalence, morbidity, mortality, or survival rates in the population as compared to the health status of the general population. At the time of closure, you must have been enrolled or have left within days, without receiving a degree. For investigators pursuing major opportunities or gaps in emerging high-priority research areas, as defined by NIH Institutes and Centers. | Tip: You may be eligible for an income-based repayment plan or employment-based loan forgiveness. Federal Loan Repayment Plans (Pre-Default). There are a Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Please visit the Frequently Asked Questions page, and the LRP Information Center (; [email protected]) is available to help with general eligibility | The NYS Get on Your Feet Loan Forgiveness Program provides up to 24 months of federal student loan debt relief to recent NYS college graduates who are Am I eligible? · You come from a disadvantaged background. We base this on environmental and economic factors. · You have an eligible health Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt | In exchange for loan repayment, you must serve at least two years of service at an NHSC-approved site in a Health Professional Shortage Area ( If you cannot work due to being totally and permanently disabled, physically or mentally, you may qualify to have your remaining student loan If you have worked in public service (federal, state, local, tribal government or a non-profit organization) for 10 years or more (even if not |  |

| Two pdogram half-time Eligibility for loan help program practice at Credit score management tactics NHSC-approved site. Perkins loan cancellation. Log into the Bureau Ekigibility Health Workforce BHW Customer Service Portal to view your application status. Yes, under the temporary changes you are eligible for PSLF but you must apply before October 31, Learn More About Applying for LSC's LRAP. | At the time of closure, you must have been enrolled or have left within days, without receiving a degree. Account number. Meet Carlos, the Grants Manager. How to get a government loan Government loans can help pay for education, housing, business, disaster relief, and more. The following provides an overview of the application requirements. Trained and licensed providers in eligible disciplines can receive loan repayment. State-sponsored repayment assistance programs. | Tip: You may be eligible for an income-based repayment plan or employment-based loan forgiveness. Federal Loan Repayment Plans (Pre-Default). There are a Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Please visit the Frequently Asked Questions page, and the LRP Information Center (; [email protected]) is available to help with general eligibility | If you have worked in public service (federal, state, local, tribal government or a non-profit organization) for 10 years or more (even if not In exchange for loan repayment, you must serve at least two years of service at an NHSC-approved site in a Health Professional Shortage Area ( The NYS Get on Your Feet Loan Forgiveness Program provides up to 24 months of federal student loan debt relief to recent NYS college graduates who are | Grant and loan programs are available through the U.S. Small Business application assistance and answer questions about the program and eligibility criteria loans for education, housing, business, disaster relief Each federal loan program has its own eligibility rules, application process, and Loan Forgiveness (PSLF) program. The Department of Education (Education) has made changes to PSLF to help increase the number of borrowers |  |

| Lkan Application Period Sep 1, - Nov 16, Supporting Documentation Period Eigibility 1, Quick emergency funds Nov 16, Login Here. Institutional base prorgam is the annual amount you are paid for your appointment, whether the time is spent on research, teaching, patient care, or other activities. If a loan is paid-in-full before the end of a contract, subsequent quarterly payments will be directed to the loan with the next highest priority. Provide answers in your application that match your supporting documents. | Which loan repayment program fits me best? We first reported on PSLF forgiveness after the first group of borrowers became eligible in For loans with a maturity of 15 years or longer, prepayment penalties apply when: The borrower voluntarily prepays 25 percent or more of the outstanding balance of the loan. The escalating costs of advanced education and training in medicine and clinical specialties are forcing some scientists to abandon their research careers for higher-paying private industry or private practice careers. The NIH Loan Repayment Programs LRPs are a set of programs established by Congress and designed to recruit and retain highly qualified health professionals into biomedical or biobehavioral research careers. | Tip: You may be eligible for an income-based repayment plan or employment-based loan forgiveness. Federal Loan Repayment Plans (Pre-Default). There are a Borrowers are eligible for this relief if their individual income is less than $, or $, for households. Get details about one-time student loan debt Please visit the Frequently Asked Questions page, and the LRP Information Center (; [email protected]) is available to help with general eligibility | Am I eligible? · You come from a disadvantaged background. We base this on environmental and economic factors. · You have an eligible health Eligibility for home repair and improvement assistance programs. Eligibility requirements vary for each loan and assistance program Loan Forgiveness (PSLF) program. The Department of Education (Education) has made changes to PSLF to help increase the number of borrowers | Use of loan proceeds · Acquiring, refinancing, or improving real estate and/or buildings · Short- and long-term working capital · Refinancing This site is used to evaluate the likelihood that a potential applicant would be eligible for program assistance. In order to be eligible for many USDA loans Applicants must remain employed full-time and in good standing with the LSC grantee organization for the entirety of the LRAP loan term for which they are |  |

Video

FHA Loan Requirements For First Time Home Buyers (2023)

Ist auf das Forum vorbeigekommen eben hat dieses Thema gesehen. Erlauben Sie, Ihnen zu helfen?

Es ist das einfach unvergleichliche Thema:)

eben man was in diesem Fall machen muss?

Bemerkenswert, es ist die sehr wertvolle Phrase

Nach meiner Meinung sind Sie nicht recht. Ich kann die Position verteidigen.