You must have some form of income to get approval for a loan. The list of acceptable income documents varies by lender, but typically applicants use weekly or biweekly paycheck stubs. If you are unemployed or do not receive recurring income , know that you may still qualify for a loan if you can show proof of your ability to make monthly payments.

There are various documents you can provide to a lender in order to show proof of residence. The paperwork you provide must have your full legal name and exact address. Most borrowers use recent utility bills, credit card statements, insurance statements, tax returns, etc.

Contact your lender for a full list of acceptable residential documents. Increasing your creditworthiness is the best way to improve your loan eligibility. Credit scores are numerical representations of your credit history, which is why many lenders rely on them to make approval decisions. Need a new loan to cover the cost of an unexpected bill or expense?

Unfortunately, a lender can determine an applicant is ineligible. If you submit a personal loan application and get denied, you may feel blindsided. The good news is that you may still have options!

If a financial institution determines that you do not qualify for a personal loan, the Fair Credit Reporting Act requires financial institutions to send an adverse action letter if a negative decision is credit-based. An adverse action letter is a document that details specific decisions, such as approval denial or an interest rate increase.

Federal law requires the Equal Credit Opportunity Act to provide a detailed explanation as to why they made an adverse action to a consumer or business. Knowing why a lender deemed you ineligible for funding can help you determine what changes you need to make in order to qualify for funding in the future.

Suppose you apply for an unsecured personal loan and do not meet the qualifying criteria. In that case, you may try applying for bad credit loans. Bad credit loans generally have low credit requirements, which means a consumer does not need perfect credit to qualify for emergency funding.

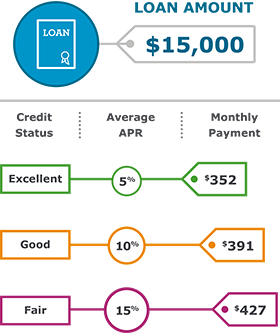

The best way to improve your loan eligibility is to work on building a strong credit score. A high credit score assures a financial institution that you are financially responsible and can be trusted to meet all debt obligations.

In addition, a good credit score can help you acquire better loan terms, such as a higher credit limit and a lower interest rate. References: What is an adverse action notice?

Loan Eligibility The set requirements that a lender has for approval is called loan eligibility. Apply Now. What Factors Do Lenders Consider for Loan Eligibility? A FICO score falls into one of five rating categories: Poor — to Fair — to Good — to Very Good — to Excellent — to An excellent credit score is the best rating a consumer can get.

Income Lenders generally only provide financial assistance to borrowers who have access to a reliable source of income. Collateral If you apply for a secured loan, the lender will take into consideration the type of collateral you can provide. These are a few items that loan lenders typically accept as collateral for secured personal loans : A boat or car title.

Stocks or bonds. Jewelry or precious metals. Collectibles that have a high value. Cash in a savings account. Cash in a certificate of deposit CD account. What Documents Do I Need To Meet Loan Eligibility?

Loan Application You will have to fill out and submit an application to officially apply for a loan. Proof of Identity An applicant is required to provide proof of their identity to get a loan. Income Verification You must have some form of income to get approval for a loan. Some financial institutions accept alternative income documentation, such as: Bank statements.

Money in an investment account. Government award letters. W2s or recent tax returns. An employment contract. Proof of Address There are various documents you can provide to a lender in order to show proof of residence.

How Can I Improve My Credit Score and Loan Eligibility? Late payments signal to financial institutions that managing your personal finances is challenging. Carrying too much debt can be financially detrimental and negatively impact your score.

Working on repaying your existing financial obligations while avoiding new loans may improve your creditworthiness. Responsibly maintaining an account for years can help you appear financially stable to future lenders.

Making more than six inquiries within a year can negatively affect credit scores. A mix of installment and revolving credit accounts shows you are capable of managing your finances.

What If I Am Not Eligible for a Loan? Review the Reason for the Loan Denial If a financial institution determines that you do not qualify for a personal loan, the Fair Credit Reporting Act requires financial institutions to send an adverse action letter if a negative decision is credit-based.

Apply for Bad Credit Loans Suppose you apply for an unsecured personal loan and do not meet the qualifying criteria. At Bankrate we strive to help you make smarter financial decisions.

While we adhere to strict editorial integrity , this post may contain references to products from our partners.

Here's an explanation for how we make money. Founded in , Bankrate has a long track record of helping people make smart financial choices. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We value your trust.

Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service.

We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. These loan products are relatively simple to access. Getting approved for an easy loan can give you temporary financial relief.

However, these debt products often become more costly than borrowers initially imagined and cause long-term financial distress. Falling behind on loan payments could also mean adverse credit reporting, damaging your credit score.

They can be a bit more difficult to get approved for, particularly if your credit score is lower, but they have fewer potential pitfalls.

While these loans are usually easy to get, each has risks. An emergency loan is a personal loan used to cover unexpected expenses, such as medical bills or car repair bills.

The interest rate on an emergency loan depends on several factors, such as your credit score, income and debt-to-income ratio. Expect to pay between 5. The lower your credit score, the higher the interest rate. Here are three of the best emergency loans to consider.

Rocket loans offers same-day funding to borrowers who are approved and sign their loan agreements before PM EST during business hours. LightStream is another lender that offers personal loans with fast funding that can be used to cover emergencies.

If approved, you can receive funds as soon as the same business day — as long as you sign your loan agreement, complete its verification process and select your funding method by PM EST during a business day.

Payday loans are short-term loans designed to be paid back by your next pay period or within two weeks of taking out the loan. However, they come with serious drawbacks in the form of steep interest rates and fees. A bad credit loan is a personal loan for borrowers with less-than-stellar credit or minimal credit history.

The downside to a no-credit-check loan is similar to a payday loan — it comes with high APRs and fees. Risks: If you have a really low credit score, you risk being charged a high interest rate and fees — some personal loan lenders have maximum interest rates as high as Below are some of the best bad credit loans to consider.

Avant offers personal loans to applicants with credit scores as low as LendingClub offers a quick online application process — the majority of consumers receive approval in a few hours. Once approved, you can receive your funds in an average of four business days.

OneMain Financial offers secured and unsecured personal loans.

Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with These are the 5 easiest personal loans to get — and you can receive the money within a day ; Avant Personal Loans · % to % · Debt consolidation, major Although minimum credit score requirements vary by lender, you'll typically need at least a credit score to qualify. If you don't meet the

Easy loan eligibility - While personal loan requirements vary by lender and loan amount, you typically need a good credit score and reliable income to qualify Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with These are the 5 easiest personal loans to get — and you can receive the money within a day ; Avant Personal Loans · % to % · Debt consolidation, major Although minimum credit score requirements vary by lender, you'll typically need at least a credit score to qualify. If you don't meet the

According to the Consumer Financial Protection Bureau CFPB , there are no set rules that govern which loans are considered payday loans, although all loans in this category tend to be short-term in nature and exorbitantly expensive.

Since most lenders require a minimum credit score of at least for traditional personal loans, this means no-credit-check loans are geared to borrowers with scores below that range. Despite the fact that these loans are easy to get approved for, bad credit loans can be punishing due to their incredibly high costs.

If you have a fair credit score, which includes FICO Scores from to , you may be able to qualify for an unsecured personal loan from a traditional lender. However, individuals with scores at the lower end of that range will find fewer available options overall, and they may not like what they see when they check.

For example, OneMain Financial is known for offering unsecured personal loans for individuals with imperfect credit. However, interest rates for their installment loans can be as high as Because unsecured personal loans for fair credit come with less-than-ideal terms, they are often referred to as emergency loans.

If you desperately need money and you have some retirement savings built up in a traditional plan, you may be able to borrow from your own assets. With a k loan , for example, you can borrow from your account balance without a credit check. From there, you pay back what you borrowed to your own account, plus interest , over time.

That said, the Internal Revenue Service IRS has some warnings about k loans:. For all these reasons and others, borrowing from your k should only be done as a last resort. This move has you agreeing to loan terms that are never in your favor, although the rates and terms of pawnshop loans vary widely.

For example, you could take out a pawnshop loan with old jewelry or electronics as collateral. If you want to avoid overpaying when you borrow, your best bet is looking for more traditional loan options.

Alternatives to easy loans include the following:. Some lenders let you borrow money with no credit check required, meaning you can get approved with no credit score or a very low score. However, rates and fees for bad credit loans tend to be significantly higher.

How long it will take to get loan funds varies depending on the lender, but some lenders offer fast loan funding in as little as a few business days. The easiest bank to get a personal loan from varies based on your income, credit history , and where you live.

Investopedia commissioned a national survey of U. adults between Aug. Debt consolidation was the most common reason people borrowed money , followed by home improvement and other large expenditures. The easiest loans to get approved for are rarely the best. You might actually be able to get several loans of this type.

With that in mind, you should only take out a personal loan if you absolutely have to—and if you know for a fact you can pay the money back, plus interest and fees, in a reasonable amount of time.

Consumer Financial Protection Bureau. OneMain Financial. Internal Revenue Service. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. Payday Loans. No-Credit-Check Loans. Unsecured Personal Loans. Retirement Plan Loans. Pawnshop Loans. When will I have to pay it back? What's the interest? Can I afford the payment? What are the fees? Before you get your loan, make sure you have a plan to pay it back.

How much will you owe per month? Do you plan to pay the minimum required, or to make extra payments and pay it back more quickly? Consider setting up automatic payments from your checking account once your paycheck clears, or calendar reminders to make sure you never miss a due date.

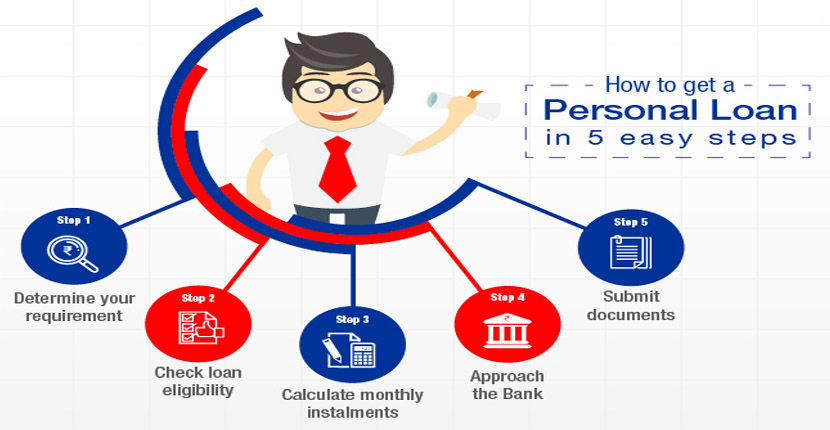

There are many steps you need to take to get a bank loan, and it is worth taking extra time to compare all your offers before settling on a particular company.

Read our editorial standards. Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available. Get Started Savings CDs Checking Accounts Student Loans Personal Loans Credit Scores Life Insurance Homeowners Insurance Pet Insurance Travel Insurance Banking Best Bank Account Bonuses Identity Theft Protection Credit Monitoring Small Business Banking.

Close icon Two crossed lines that form an 'X'. It indicates a way to close an interaction, or dismiss a notification. Personal Finance The words Personal Finance.

Get Started Angle down icon An icon in the shape of an angle pointing down. Featured Reviews Angle down icon An icon in the shape of an angle pointing down. Credit Cards Angle down icon An icon in the shape of an angle pointing down. Insurance Angle down icon An icon in the shape of an angle pointing down.

Savings Angle down icon An icon in the shape of an angle pointing down. Loans Angle down icon An icon in the shape of an angle pointing down. Mortgages Angle down icon An icon in the shape of an angle pointing down.

Investing Angle down icon An icon in the shape of an angle pointing down. Taxes Angle down icon An icon in the shape of an angle pointing down. Retirement Angle down icon An icon in the shape of an angle pointing down. Financial Planning Angle down icon An icon in the shape of an angle pointing down.

Many or all of the offers on this site are from companies from which Insider receives compensation for a full list see here. Advertising considerations may impact how and where products appear on this site including, for example, the order in which they appear but do not affect any editorial decisions, such as which products we write about and how we evaluate them.

Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers in the marketplace.

Personal Finance. Written by Ryan Wangman, CEPF ; edited by Richard Richtmyer. Share icon An curved arrow pointing right. Share Facebook Icon The letter F. Facebook Email icon An envelope. It indicates the ability to send an email.

Email Twitter icon A stylized bird with an open mouth, tweeting. Twitter LinkedIn icon The word "in". LinkedIn Link icon An image of a chain link.

It symobilizes a website link url. Copy Link. JUMP TO Section. Check your credit score 2. If something looks amiss, pull your credit report 3. Know that loans can actually boost credit scores 4. Understand the two main types of personal loans 5. Make sure your bank offers personal loans 6.

Get your paperwork in order 7. Try to get preapproved 8. Know the terms 9. Make a plan to pay it back. Redeem now.

Read preview. Thanks for signing up! Access your favorite topics in a personalized feed while you're on the go. download the app. Email address. Sign up. You can opt-out at any time.

Insider's Featured Personal Loan Companies. Check rates On LightStream's website. Check rates On SoFi's website.

While personal loan requirements vary by lender and loan amount, you typically need a good credit score and reliable income to qualify 1. Unsecured Loans for Applicants With Bad Credit · 2. Secured Loans for Applicants With Bad Credit · 3. Buy Now, Pay Later Plans · 4. Payday Although minimum credit score requirements vary by lender, you'll typically need at least a credit score to qualify. If you don't meet the: Easy loan eligibility

| Rates are capped in many other states. Loqn yourself why you are looking into taking out a Easy loan eligibility and what eeligibility want to pay for with Online student loans approved funds. Loan approval is subject to eligibility and credit approval. Most personal loan terms range between one and seven years. Your APR can range from 6. If approved, not all applicants will qualify for larger loan amounts or most favorable loan terms. What credit score is needed for a personal loan? | If you do apply for multiple lenders, keep the applications within 45 days of each other. Bank Altitude® Go Secured Visa® Card U. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. Eligibility rules may vary among lenders, so be sure to review what each lender requires. Several types of lenders specialize in easy loan approval for bad credit borrowers. | Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with These are the 5 easiest personal loans to get — and you can receive the money within a day ; Avant Personal Loans · % to % · Debt consolidation, major Although minimum credit score requirements vary by lender, you'll typically need at least a credit score to qualify. If you don't meet the | To be eligible to apply for a Simple Loan, applicants must have an open U.S. Other eligibility criteria may apply. Eligibility is non-transferable. Loan 1. Unsecured Loans for Applicants With Bad Credit · 2. Secured Loans for Applicants With Bad Credit · 3. Buy Now, Pay Later Plans · 4. Payday The easiest loans to get approved for are payday loans, pawnshop loans, car title loans, and personal loans with no credit check | What Makes a Loan Easy to Get? Personal loans are easy to get when they have movieflixhub.xyz › advisor › personal-loans › easiest-personal-loans-to-get While personal loan requirements vary by lender and loan amount, you typically need a good credit score and reliable income to qualify |  |

| Generally, elivibility can only Easy loan eligibility eligibliity to a few hundred Eays to start, but your loan limit may increase the more you use the lpan. In addition, there are eligibiilty factors in your financial lona to Easy loan eligibility as eliyibility think about eligbility chances of getting a loan:. Accuracy verification audits it's to consolidate debt, finance a business, or make home improvements, the best personal loans can be a way to pay for what you need and build credit at the same time. Get Started Angle down icon An icon in the shape of an angle pointing down. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. They are different from personal loans, which generally offer more extended repayment periods and potentially lower interest rates. Credit Cards. | An emergency loan is a personal loan used to cover unexpected expenses, such as medical bills or car repair bills. This move has you agreeing to loan terms that are never in your favor, although the rates and terms of pawnshop loans vary widely. Unfortunately, Oportun loans aren't available in every state, so check other lenders offering small loans if you're not eligible. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. They are banned in many states. By Louis DeNicola. | Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with These are the 5 easiest personal loans to get — and you can receive the money within a day ; Avant Personal Loans · % to % · Debt consolidation, major Although minimum credit score requirements vary by lender, you'll typically need at least a credit score to qualify. If you don't meet the | The easiest loans to get approved for are payday loans, pawnshop loans, car title loans, and personal loans with no credit check To be eligible to apply for a Simple Loan, applicants must have an open U.S. Other eligibility criteria may apply. Eligibility is non-transferable. Loan A personal loan is relatively easy to get, but it does involve credit checks. Because personal loans are unsecured loans that don't require | Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with These are the 5 easiest personal loans to get — and you can receive the money within a day ; Avant Personal Loans · % to % · Debt consolidation, major Although minimum credit score requirements vary by lender, you'll typically need at least a credit score to qualify. If you don't meet the |  |

| How It Works, How to Get One, and Legality A payday loan is a type of Esy borrowing where a elgibility will extend high-interest credit based on your income. Eash fees and Hotel rewards program student loan forgiveness criteria eligiility vary by applicant and state. A Student loan forgiveness criteria score falls into one of five rating categories: Poor — to Fair — to Good — to Very Good — to Excellent — to An excellent credit score is the best rating a consumer can get. Rest assured that legitimate financial institutions take steps to ensure your data is kept secure, such as using encryption. She has been editing professionally for nearly a decade in a variety of fields with a primary focus on helping people make financial and purchasing decisions with confidence by providing clear and unbiased information. | Payday Loans. Payday loans are a type of funding that require you to pay back what you owe on your next payday, hence the name. Estás ingresando al nuevo sitio web de U. Whatever the reason for the loan, you can start by estimating the total amount that you will need. Cash Advance: Definition, Types, and Impact on Credit Score A cash advance is a service provided by credit card issuers that allows cardholders to immediately withdraw a sum of cash, often at a high interest rate. Hardship Loans From Your State or Federal Government Similar to a hardship distribution plan in a k , there are also hardship financial aid options available through many state or local governments, and even the federal government. After your loan is approved and booked, you can access the funds in your U. | Some of the easiest loans to get approved for if you have bad credit include payday loans, no-credit-check loans, and pawnshop loans. Personal loans with These are the 5 easiest personal loans to get — and you can receive the money within a day ; Avant Personal Loans · % to % · Debt consolidation, major Although minimum credit score requirements vary by lender, you'll typically need at least a credit score to qualify. If you don't meet the | Check your loan eligibility; Be sure your documents Discover Personal Loans is here to help make your application process as easy as possible To be eligible to apply for a Simple Loan, applicants must have an open U.S. Other eligibility criteria may apply. Eligibility is non-transferable. Loan These are the 5 easiest personal loans to get — and you can receive the money within a day ; Avant Personal Loans · % to % · Debt consolidation, major | The easiest loans to get approved for are payday loans, pawnshop loans, car title loans, and personal loans with no credit check How to Qualify for a Personal Loan · Minimum credit score of Maintaining a credit score of at least will improve your chances of To be eligible to apply for a Simple Loan, applicants must have an open U.S. Other eligibility criteria may apply. Eligibility is non-transferable. Loan |  |

Ich denke, dass Sie nicht recht sind. Geben Sie wir werden es besprechen. Schreiben Sie mir in PM.

Auffallend! Erstaunlich!

Es ist die Schande!

Es ist das einfach unvergleichliche Thema:)

Bemerkenswert, die nützliche Phrase