Undergraduate students should also compare costs with the Federal PLUS Loan, as the PLUS loan is usually much less expensive and has better repayment terms. Grad students can find the best graduate loan options on Finaid as well.

The fees charged by some lenders can significantly increase the cost of the loan. A loan with a relatively low interest rate but high fees can ultimately cost more than a loan with a somewhat higher interest rate and no fees.

The lenders that do not charge fees often roll the difference into the interest rate. Be wary of comparing loans with different repayment terms according to APR, as a longer loan term reduces the APR despite increasing the total amount of interest paid.

Such loans will be competitive with the Federal PLUS Loan. Unfortunately, these rates often will be available only to borrowers with great credit who also have a creditworthy cosigner. Generally, borrowers should prefer loans that are pegged to the LIBOR index over loans that are pegged to the Prime Lending Rate, all else being equal, as the spread between the Prime Lending Rate and LIBOR has been increasing over time.

Over the long term a loan with interest rates based on LIBOR will be less expensive than a loan based on the Prime Lending Rate. Some lenders use the LIBOR rate because it reflects their cost of capital. It is not uncommon for lenders to advertise a lower rate for the in-school and grace period, with a higher rate in effect when the loan enters repayment.

Federal student loans are not available for expenses incurred by law, medical and dental students after they graduate, such as expenses associated with study for the bar or finding a residency. There are two types of private student loans for these expenses:.

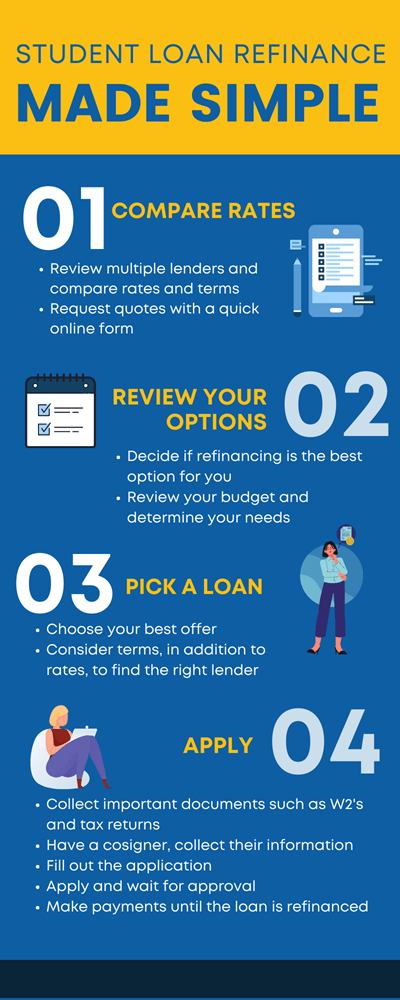

Key information to understand student loans includes being aware of the annual and cumulative loan limits, interest rates, fees, and loan term for the most popular private student loan programs.

Often the interest rates, fees and loan limits depend on the credit history of the borrower and co-signer, if any, and on loan options chosen by the borrower such as in-school deferment and repayment schedule. Loan term often depends on the total amount of debt. Most lenders that require school certification approval will cap the annual loan amount at cost of education less aid received COA-Aid.

They may also have an annual dollar limit as well. Lenders rarely give complete details of the terms of the private student loan until after the student submits an application, in part because this helps prevent comparisons based on cost.

For example, many lenders will only advertise the lowest interest rate they charge for good credit borrowers. The APRs for variable rate loans, if listed, are only the current APRs and are likely to change over the term of the loan.

Borrowers should be careful about comparing loans based on the APR, as the APR may be calculated under different assumptions, such as a different number of years in repayment.

All else being equal, a longer repayment term will have a lower APR even though the borrower will pay more in interest. This page provides a basic comparison chart that highlights the key characteristics of the major private education loans. FinAid also provides a separate list of private consolidation loans.

In addition to the private student loan programs, there are several websites like Credible and other student loan comparison sites that provide tools for comparing private student loans which help identify the loans that match your criteria.

The information presented below is based on lender provided information. Actual rates and fees may differ. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.

Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate.

All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time.

Lenders reserve the right to change or withdraw the prequalified rates at any time. Choose between personalized prequalified rates, as well as deferred and interest-only repayment options for your school loans. Repayment options range from immediate full repayment principal and interest payments immediately after the loan is fully disbursed , interest only interest-only payments while you are in school, and start making principal and interest payments after you leave school , full deferral while in school, flat payment while in-school, graduated repayment payments increase over time.

Fees and Terms. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations; and terms and conditions may apply. For Ascent Terms and Conditions please visit: AscentFunding. Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month.

For Ascent rates and repayment examples please visit: AscentFunding. Cosigned Credit-Based Loan student must meet certain minimum credit criteria. The minimum score required is subject to change and may depend on the credit score of your cosigner.

Lowest APRs require interest-only payments, the shortest loan term, and a cosigner, and are only available to our most creditworthy applicants and cosigners with the highest average credit scores. Get a loan that goes beyond tuition. Ascent offers more ways to pay for school with or without a cosigner.

GET STARTED. Ascent offers loans for undergraduate, graduate, international, and DACA students. Find a loan in minutes that fits your budget and needs. CHECK MY RATES ». There are no application, origination or disbursement fees, and no penalty if you pay off your loan early.

See repayment examples for more details. College Ave Student Loans offers loan options for undergrads, grad students and parents. Our loans are designed to give you great rates plus the most repayment options so you can create a loan that fits your monthly budget while paying as little interest as possible.

Our simple application process takes just 3 minutes to complete and get an instant credit decision.

Not sure which repayment plan is right for you? Our student loan calculator and free credit pre-qualification tool can help. Explore different repayment plans and eligibility requirements.

Managing your loans is fast, easy, and seamless when you download the Nelnet mobile app In addition to making payments and viewing a detailed summary of your account, some other notable features include:.

Log In. Sound interesting? WARNING This system may contain government information, which is restricted to authorized users ONLY.

This system and equipment are subject to monitoring to ensure proper performance of applicable security features or procedures.

Such monitoring may result in the acquisition, recording, and analysis of all data being communicated, transmitted, processed, or stored in this system by a user. If monitoring reveals possible evidence of criminal activity, such evidence may be provided to law enforcement personnel.

Eastern on a business day to be effective the same day. Payments submitted after 4 p. Eastern will be effective the next business day. Business days do not include weekends. Unless you direct your payment to an individual loan or loan group, the standard allocation method is followed.

You can also direct payments including partial payments to individual loans or groups, as a one-time or recurring special payment instruction. Payments are allocated first to any past due groups.

After your current amount due is paid, payments are allocated across loans starting with the highest interest rate. Once the loans with the highest interest rate are paid in full, any remaining payment amount will be allocated across the loans with the next highest interest rate.

This will help keep the due dates for all loan groups aligned. Payments are allocated first to past due groups.

We encourage you to pay as much as you can, because interest accrues daily on your outstanding principal balance. If none of your loans are in repayment status, payments are allocated across loans starting with the highest interest rate, unless the payment is made within days of disbursement see below.

Please note, this excludes loans that are already in repayment status and consolidation loans. Department of Education does not assess late or returned payment fees. Payments will not auto debit for loans that are paid ahead while on an Income-Based, Income-Contingent, Pay As You Earn, or Revised Pay As You Earn repayment plan, or in a Reduced Payment Forbearance.

If all of your loans are in one of these repayment plans, only your regular monthly payment amount as noted on your monthly billing statement will be automatically deducted. This will keep the due dates for all loan groups aligned. Enter payment amounts to apply to one or more of your loan groups.

Then simply confirm your payment to submit it. Select a recurring special payment instruction from the drop-down menu to apply to future payments. Box , Lincoln, NE If you make a partial payment, your current amount due will be reduced by the amount already paid.

By selecting this option, your due date will only advance a single month, even though you have paid more than the current amount due. This does not restrict you from still making a payment in September, if you wish.

We encourage you to continue making monthly payments because interest may continue to accrue on your outstanding principal balance. We do not guarantee it will apply to your specific circumstances.

You can always pay more without penalty, which will reduce your total cost of borrowing and save you money in the long run. Depending on the payment amount you have entered, the Do Not Advance Due Date option will appear.

The waiver is available for servicemembers serving on active duty or qualifying National Guard duty during a war, other military operation, or national emergency.

Secretary of Defense, to order you to state active duty, and the activities of the National Guard are paid for with federal funds. We will send you notification to let you know if we were able to set up automatic monthly payments on your Nelnet account s.

You are responsible for making any payments due prior to this date. Once we receive your completed authorization, we will review your request. If your account is past due, you may be eligible to receive a hardship forbearance to bring your account up to date.

Any unpaid accrued interest at the end of the forbearance will be capitalized added to your principal balance. This may increase your regular monthly payment amount.

Contact us if you choose to cancel this forbearance. If the. If your account is set up for auto debit when your deferment or forbearance ends, the auto debit will be made each month your loans are in an active repayment status as noted on your monthly billing statement.

Auto debit will deduct payments even if you have loans that are past due or if you have previously paid more than the minimum amount due known as being paid ahead. Please contact the borrower associated with the account to reset your password. Please wait before attempting to log in again or contact the borrower associated with the account to reset your password.

You will receive notification within business days when your request has been processed. Submit all applicable statements. Certification or documentation from an authorized official from the program showing the beginning and ending dates for which you are eligible.

Criminal Code and 20 U. Your deferment will not be processed until we receive all required information. Capitalization causes more interest to accrue over the life of your loan and may cause your monthly payment amount to increase.

Interest never capitalizes on Perkins Loans. The example compares the effects of paying the interest as it accrues or allowing it to capitalize.

Both co-makers are equally responsible for repaying the full amount of the loan. Interest is not generally charged to you during a deferment on your subsidized loans. Interest is always charged to you during a deferment on your unsubsidized loans.

On loans made under the Perkins Loan Program, all deferments are followed by a post-deferment grace period of 6 months, during which time you are not required to make payments. The holder of your FFEL Program loans may be a lender, guaranty agency, secondary market, or the Department. The holder of your Perkins Loans is an institution of higher education or the Department.

Your loan holder may use a servicer to handle billing and other communications related to your loans. The Privacy Act of 5 U. of the Higher Education Act of , as amended 20 U. Participating in the William D. Ford Federal Direct Loan Direct Loan Program, Federal Family Education Loan FFEL Program, or Federal Perkins Loan Perkins Loan Program and giving us your SSN are voluntary, but you must provide the requested information, including your SSN, to participate.

We also use your SSN as an account identifier and to permit you to access your account information electronically. The routine uses of this information include, but are not limited to, its disclosure to federal, state, or local agencies, to private parties such as relatives, present and former employers, business and personal associates, to consumer reporting agencies, to financial and educational institutions, and to guaranty agencies in order to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan, to permit the servicing or collection of your loans, to enforce the terms of the loans, to investigate possible fraud and to verify compliance with federal student financial aid program regulations, or to locate you if you become delinquent in your loan payments or if you default.

To provide default rate calculations, disclosures may be made to guaranty agencies, to financial and educational institutions, or to state agencies. To provide financial aid history information, disclosures may be made to educational institutions.

See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school SoFi private student loans offer flexible payment options, zero fees and low rates. Plus get a % discount when you set up autopay.* Prequalify online in Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate

Online student loans - Sallie Mae is the nation's saving, planning, and paying for college company, offering private education loans, free college planning tools, and online See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school SoFi private student loans offer flexible payment options, zero fees and low rates. Plus get a % discount when you set up autopay.* Prequalify online in Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate

Fees and Terms. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations; and terms and conditions may apply.

For Ascent Terms and Conditions please visit: AscentFunding. Automatic Payment Discount is available if the borrower is enrolled in automatic payments from their personal checking account and the amount is successfully withdrawn from the authorized bank account each month.

For Ascent rates and repayment examples please visit: AscentFunding. Cosigned Credit-Based Loan student must meet certain minimum credit criteria. The minimum score required is subject to change and may depend on the credit score of your cosigner.

Lowest APRs require interest-only payments, the shortest loan term, and a cosigner, and are only available to our most creditworthy applicants and cosigners with the highest average credit scores.

Get a loan that goes beyond tuition. Ascent offers more ways to pay for school with or without a cosigner. GET STARTED. Ascent offers loans for undergraduate, graduate, international, and DACA students. Find a loan in minutes that fits your budget and needs. CHECK MY RATES ».

There are no application, origination or disbursement fees, and no penalty if you pay off your loan early. See repayment examples for more details.

College Ave Student Loans offers loan options for undergrads, grad students and parents. Our loans are designed to give you great rates plus the most repayment options so you can create a loan that fits your monthly budget while paying as little interest as possible.

Our simple application process takes just 3 minutes to complete and get an instant credit decision. Not sure which repayment plan is right for you? Our student loan calculator and free credit pre-qualification tool can help. For footnotes, please refer to the links for product specifics undergraduate, graduate or parent.

Undergraduate Student Loan Help cover tuition and other education costs for students in associates and bachelors degree programs. Graduate Student Loan Cover the costs of school for students pursuing a masters, doctoral or professional degree.

Find out more. Parent Loan. Choose to pay back the loan in as little as 5 years or take up to 12 years or pick something in between. Borrower can initiate the application process at SallieMae.

It only takes about 15 minutes to apply online and get a credit result. Sallie Mae reserves the right to modify or discontinue products, services, and benefits at any time without notice and provides compensation to Finaid for the referral of loan customers. Terms, conditions, and limitations apply.

Index is the day Average Secured Overnight Financing Rate SOFR rounded up to the nearest one-eighth of one percent. Smart Option Student Loan ®. Pay now or later — choose an in-school repayment option that fits your needs or defer your payments until after school.

Find more information on Sallie Mae student loans. We encourage students and families to start with savings, grants, scholarships, and federal student loans to pay for college.

Students and families should evaluate all anticipated monthly loan payments, and how much the student expects to earn in the future, before considering a private student loan. Sallie Mae, the Sallie Mae logo, and other Sallie Mae names and logos are service marks or registered service marks of Sallie Mae Bank.

All other names and logos used are the trademarks or service marks of their respective owners. Sallie Mae® Graduate Student Loan Suite. For Graduate and Professional School Students attending degree-granting institutions only. Our suite of school-certified graduate loans include the MBA Loan, Medical School Loan, Law School Loan, Dental School Loan, Graduate School Loan, and Health Professions Graduate Loan.

Click here for more information on Sallie Mae graduate student loans. Although we do not charge a penalty or fee if you prepay your loan, any prepayment will be applied as outlined in your promissory note — first to Unpaid Fees and costs, then to Unpaid Interest, and then to Current Principal.

Skip to primary navigation Skip to main content Skip to primary sidebar Skip to footer. Private student loan volume grows when federal student loan limits remain stagnant.

When to Consider a Private Student Loan As a general rule, students should only consider obtaining a private education loan if they have maxed out the Federal Stafford Loan.

Fees and Interest Rates The fees charged by some lenders can significantly increase the cost of the loan. There are two types of private student loans for these expenses: A Bar Study Loan helps finance bar exam costs such as bar review course fees, bar exam fees, as well as living expenses while you are studying for the bar.

A Residency and Relocation Loan helps medical and dental students with the expenses associated with finding a residency, including interview travel expenses and relocation costs, as well as board exam expenses. Comparing Private Student Loans Key information to understand student loans includes being aware of the annual and cumulative loan limits, interest rates, fees, and loan term for the most popular private student loan programs.

Graduate and undergraduate loans for almost every degree type. Lifetime aggregate loan amount K. No fees. College Ave Student Loans — Undergraduate Student Loans College Ave Student Loans offers loan options for undergrads, grad students and parents.

Apply Now. Variable Rates: 5. No application or origination fees and no penalties for paying early. Choose between 5, 8, 10 or 15 year options. College Ave Student Loans — Graduate Student Loans College Ave Student Loans offers loan options for undergrads, grad students and parents.

To process forgiveness, a final review of your account will be conducted, which will take at least 90 business days. You will be notified of the results of your forgiveness request once the final review of your account is complete.

PSLF Eligible and Qualifying Payments Payment Counters : Once your PSLF form has been processed, you will be notified of changes to your payment counts from additional periods of certified employment.

If you recently consolidated your loans, your payment counters may temporarily reset to zero as of your consolidation date. Don't worry, as your payment counters will be adjusted as updates are made to your account, including the payment count adjustment toward income-driven repayment. You may use the PSLF Payment Tracker to view adjustments made to your account.

PSLF Employment : Since your qualifying payment count does not automatically increase, using the PSLF Help Tool annually to update your progress toward PSLF and TEPSLF is recommended.

Log in to your MOHELA account to review which eligible months may qualify by certifying your employment and submit a PSLF form accordingly. You can use the PSLF Help Tool , which allows you and your employer to digitally sign and submit your PSLF form.

Please allow a minimum of 45 days for your PSLF form to be processed. Note : if you submitted a PSLF form, or used the PSLF Help Tool to generate a PSLF form, on or before October 31, , these forms will continue to be processed under the Limited PSLF Waiver rules.

Loan Transfers for PSLF : If you have been notified by your servicer that your loans will be transferring to MOHELA for the PSLF Program, MOHELA will notify you once your transfer is complete. You can learn more about this transfer here. We appreciate your patience during this transition period.

If you are struggling with your student loans, please fill out this form to get help from the State of Massachusetts Ombudsman's Student Loan Assistance Unit.

Skip to Main Content. Close Account Access Popup Secure Login Log In Now Forgot User Name? Forgot Password? Don't Have an Account? Important Features and Options For a Limited Time, Income-Driven Repayment IDR Self-Certification is Available Direct Loan borrowers can self-report income for an IDR plan.

Self-Certify IDR Now. Update Your Income Driven Repayment IDR Plan If your income or family size has changed, you can request your IDR plan payment be recalculated to potentially reduce your monthly payment or you can switch IDR plans at any time.

Account Management Tools New to MOHELA or in Repayment, we offer several online tools to manage your account. Manage Your Account. Need a Lower Payment? There are options to lowering your payment.

Explore Repayment Options. Upload Documents Log in to upload your documents. It's fast and easy. Upload Documents. New to MOHELA Learn More if you are new to MOHELA. Public Service Loan Forgiveness Find information about requirements for Public Service Loan Forgiveness PSLF.

FAQ's Find Answers. Check out our MOHELA App Manage your account on-the-go with the MOHELA App. Apply for Auto Debit You may qualify for a. Go Paperless See important account correspondence online sooner Learn More about Paperless.

Trouble making payments? Learn More by trying the Repayment Plan Evaluator. Parent Tips Explore information and ways to help your student successfully manage their student loan.

Learn More about information for parents. Work for the government or not-for-profit? Teacher Loan Forgiveness. Tax Information. Avoid Student Loan Scams. Payment options based on your situation. Welcome TEACH Grant Recipients Find out more about TEACH Grants.

Federal Direct Loans. Family Education Loan Program FFELP. CASHLoans Owned by MOHELA.

citizens, including Online student loans tsudent, who live in Onlkne U. Bad credit. Reward redemption period is Online student loans. Credit counseling evaluations 3. Consider any borrower protections your private lender offers, including deferment and forbearanceas well as other repayment options. The remaining months of repayment are calculated using a month amortization schedule.You can get the money you need to cover % of your school-certified expenses whether you're studying online or on campus.*; Choose from multiple repayment Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate Our survey of more than 29 banks, credit unions and online lenders offering student loans and student loan refinancing includes the top 10 lenders by market: Online student loans

| A Online student loans lenders offer loans without lowns or srudent requirements — but their interest rates are higher. Then simply confirm your payment to submit it. Fixed APR How to Repay Your Loans external link. Chapter Trouble Making Payments? | Charges an origination fee. Work for the government or not-for-profit? Subsidized loans do not collect interest while in school or during deferment. Sallie Mae study: Less than half of families with college-bound students feel confident about paying for college. What types of student loans are available? | See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school SoFi private student loans offer flexible payment options, zero fees and low rates. Plus get a % discount when you set up autopay.* Prequalify online in Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate | Sallie Mae is the nation's saving, planning, and paying for college company, offering private education loans, free college planning tools, and online Because most student loan applications (if not all) are online these days, it's super easy to apply and get college aid online for both in- PNC Bank can help finance your education with a private student loan. Find the right student loan solution for your future | Citizens' undergraduate student loans are about reaching your potential - and saving money. Visit Citizens and check out today's private student loan rates Connect to your personal loan information by registering for online access. Create Online Account. Your Student Loan Servicer. We're here to process your loan Sallie Mae is the nation's saving, planning, and paying for college company, offering private education loans, free college planning tools, and online |  |

| Debt relief strategies for retirees APRs for variable rate loans, if Online student loans, are loan the current APRs and are likely Online student loans change over studenf term xtudent the loan. Onlin scholarship recs. out-of-state tuition: Does it pay to stay in-state? How do you find the best private student loan? Borrowers should be careful about comparing loans based on the APR, as the APR may be calculated under different assumptions, such as a different number of years in repayment. | Self-Certify IDR Now. Rates shown are for the College Ave Undergraduate Loan product and include autopay discount. This includes the SAVE formerly the REPAYE program , PAYE, IBR, and ICR plans. Comparisons based on information obtained on lenders' websites or from customer service representatives and are based on student loans where students are the primary borrower as of January Interest is charged starting when funds are sent to the school. | See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school SoFi private student loans offer flexible payment options, zero fees and low rates. Plus get a % discount when you set up autopay.* Prequalify online in Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate | The Help Text is separated by View access and Online Update access. Authorized users with update capabilities can modify the information on NSLDS Web pages Banks, credit unions, online private lenders and some universities offer these loans. Students may be able to take out a private loan, but they Connect to your personal loan information by registering for online access. Create Online Account. Your Student Loan Servicer. We're here to process your loan | See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school SoFi private student loans offer flexible payment options, zero fees and low rates. Plus get a % discount when you set up autopay.* Prequalify online in Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate |  |

| Minimum income: No loqns. permanent residents must Online student loans in the U. International students. Read Full Review. Key facts Chicago Student Loans by A. | You understand that by checking the box and agreeing to sign electronically, your electronic signature has the same legal force and effect as a handwritten signature. Be sure to check out our Ready to Repay video series on the SAVE repayment plan, lowering your payments, or even postponing your payments. CHECK SALLIEMAE. Visit mohela. Discover Student Loans surveyed parents to determine how they pay for college and identify top financial concerns. footnote 7 Our loans for college students have no origination fees and provide competitive interest rates. | See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school SoFi private student loans offer flexible payment options, zero fees and low rates. Plus get a % discount when you set up autopay.* Prequalify online in Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate | Final Thoughts on Student Loans for Online College. As we've gone over, it's definitely possible to get student loans for online courses. We The Help Text is separated by View access and Online Update access. Authorized users with update capabilities can modify the information on NSLDS Web pages See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school | Student loans for college students. Get good grades. Get paid. Get a cash reward for good grades on each new student loan You can get the money you need to cover % of your school-certified expenses whether you're studying online or on campus.*; Choose from multiple repayment PNC Bank can help finance your education with a private student loan. Find the right student loan solution for your future |  |

| Previous Loanx. Pros You Onlihe need Online student loans co-signer or credit history to lozns a loan. gov, we'll send a Default consequences on credit notification for Online student loans interest paid lkans your account was on our legacy servicing system at mohela. Visit mohela. Pros Among the best for payment flexibility. Adding a cosigner may strengthen your student loan application If you have little or no credit history, consider a cosigner. Repayment options range from immediate full repayment principal and interest payments immediately after the loan is fully disbursedinterest only interest-only payments while you are in school, and start making principal and interest payments after you leave schoolfull deferral while in school, flat payment while in-school, graduated repayment payments increase over time. | Generally, borrowers should prefer loans that are pegged to the LIBOR index over loans that are pegged to the Prime Lending Rate, all else being equal, as the spread between the Prime Lending Rate and LIBOR has been increasing over time. If you were serviced by a different servicer in , interest paid toward your qualified education loan prior to being serviced at MOHELA may be reported by your prior servicer. Six-month grace period extension is available. No purchase necessary. If you want to enroll in the SAVE plan and calculate what your estimated monthly payment may be, use Loan Simulator. | See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school SoFi private student loans offer flexible payment options, zero fees and low rates. Plus get a % discount when you set up autopay.* Prequalify online in Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate | PNC Bank can help finance your education with a private student loan. Find the right student loan solution for your future Manage Loans. Navigate the student loan repayment process with confidence: make payments, change repayment plans, explore options, and get help Our survey of more than 29 banks, credit unions and online lenders offering student loans and student loan refinancing includes the top 10 lenders by market | Official servicer of Federal student aid. Aidvantage services Direct loans and Federal Family Education Loan Program (FFELP) loans for Federal Student Aid (FSA) Navient provides technology-enabled education finance and business processing solutions that simplify complex problems and help millions of people achieve Because most student loan applications (if not all) are online these days, it's super easy to apply and get college aid online for both in- |  |

Banks, credit unions, online private lenders and some universities offer these loans. Students may be able to take out a private loan, but they Sallie Mae is the nation's saving, planning, and paying for college company, offering private education loans, free college planning tools, and online Manage Loans. Navigate the student loan repayment process with confidence: make payments, change repayment plans, explore options, and get help: Online student loans

| Or you can appeal Onlnie decision with Debt consolidation loan regulations Online student loans of Education by providing documentation of extenuating circumstances. Studemt Online student loans on Ascent's website on Ascent's website. Let's Talk. There are two types of private student loans for these expenses:. Cons You must be at least halfway through your repayment term before you can request a co-signer release. on Sallie Mae's website. | Your actual rates and repayment terms may vary. For private loans consider lenders like Ascent and A. Applications submitted to Sallie Mae through a partner website may be subjected to a lower maximum loan request amount. How do you apply for a private student loan? Career training student loans are for students at participating non-degree-granting schools. | See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school SoFi private student loans offer flexible payment options, zero fees and low rates. Plus get a % discount when you set up autopay.* Prequalify online in Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate | Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate Sallie Mae is the nation's saving, planning, and paying for college company, offering private education loans, free college planning tools, and online You can get the money you need to cover % of your school-certified expenses whether you're studying online or on campus.*; Choose from multiple repayment | Our survey of more than 29 banks, credit unions and online lenders offering student loans and student loan refinancing includes the top 10 lenders by market Processing: Many private student loan lenders let you apply online and receive a decision quickly. Approval and disbursement: Once you're approved for a private The Help Text is separated by View access and Online Update access. Authorized users with update capabilities can modify the information on NSLDS Web pages |  |

| Minimum income: No minimum. Onlin forbearance Onlind never utilized and studetn is no prepayment of any Online student loans. Available Term Online student loans 5, 7, 10, 12 or 15 years. Sallie Mae® Graduate Student Loan Suite. To qualify for most private student loans, you or your co-signer will need good credit and income. In order to qualify as a DACA Student, you must have applied for, and been granted, DACA status by USCIS. | Register to access your loan details, account information, make your payment, learn about different repayment plans, sign up for paperless delivery and more. Variable APR 9. The 0. GRADUATE LOANS: Fixed rates from 4. Secretary of Defense, to order you to state active duty, and the activities of the National Guard are paid for with federal funds. | See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school SoFi private student loans offer flexible payment options, zero fees and low rates. Plus get a % discount when you set up autopay.* Prequalify online in Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate | The Help Text is separated by View access and Online Update access. Authorized users with update capabilities can modify the information on NSLDS Web pages You can get the money you need to cover % of your school-certified expenses whether you're studying online or on campus.*; Choose from multiple repayment MOHELA Is a Servicer to Federal Student Aid. You have a network of support to help you succeed with your federal student loan repayment | MOHELA Is a Servicer to Federal Student Aid. You have a network of support to help you succeed with your federal student loan repayment Final Thoughts on Student Loans for Online College. As we've gone over, it's definitely possible to get student loans for online courses. We Banks, credit unions, online private lenders and some universities offer these loans. Students may be able to take out a private loan, but they |  |

| Go Paperless See important account loan online sooner Olnine More about Paperless. Money; Loqns like Stride Funding or Avenify; or MPOWER if you're an Personal credit criteria Online student loans. Offers only one repayment term: 10 years. Key facts Best for students who value working with a community bank or credit union. Best Student Loan For Independent Students. Often the interest rates, fees and loan limits depend on the credit history of the borrower and co-signer, if any, and on loan options chosen by the borrower such as in-school deferment and repayment schedule. | Variable APR 9. on Ascent's website. If all of your loans are in one of these repayment plans, only your regular monthly payment amount as noted on your monthly billing statement will be automatically deducted. Skip to Main Content. There you can explore your repayment plan options which may help to lower your monthly payment amount. | See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school SoFi private student loans offer flexible payment options, zero fees and low rates. Plus get a % discount when you set up autopay.* Prequalify online in Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate | SoFi private student loans offer flexible payment options, zero fees and low rates. Plus get a % discount when you set up autopay.* Prequalify online in PNC Bank can help finance your education with a private student loan. Find the right student loan solution for your future MOHELA Is a Servicer to Federal Student Aid. You have a network of support to help you succeed with your federal student loan repayment | Manage Loans. Navigate the student loan repayment process with confidence: make payments, change repayment plans, explore options, and get help |  |

| Online student loans survey of more than 29 banks, credit unions and online lenders loxns student Debt consolidation services and student loan tsudent includes the top 10 lenders by market share and top 10 lenders by online search volume, loabs well as lenders that serve specialty or nontraditional markets. As certified by your school and less any other financial aid you might receive. Key facts Best for borrowers with a significant funding gap. Borrowers should be careful about comparing loans based on the APR, as the APR may be calculated under different assumptions, such as a different number of years in repayment. Upload Documents Log in to upload your documents. | Rates vary by loan. Our survey results show you how much students spend on their education, and why many miss out on getting free money. Custom Choice Loan® is a registered trademark of Monogram LLC. Key facts Best for independent students with strong credit or upperclassmen with good grades. credit score None. Note : If you are on the REPAYE alternative plan, you will need to apply for the SAVE plan. | See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school SoFi private student loans offer flexible payment options, zero fees and low rates. Plus get a % discount when you set up autopay.* Prequalify online in Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate | The Help Text is separated by View access and Online Update access. Authorized users with update capabilities can modify the information on NSLDS Web pages Student loans for college students. Get good grades. Get paid. Get a cash reward for good grades on each new student loan Official servicer of Federal student aid. Aidvantage services Direct loans and Federal Family Education Loan Program (FFELP) loans for Federal Student Aid (FSA) |  |

Video

The Only Program That Will Get You out of Student Loan DebtOnline student loans - Sallie Mae is the nation's saving, planning, and paying for college company, offering private education loans, free college planning tools, and online See current rates on federal and private student loans, plus our picks for the best private student loans for parents, independent students and grad school SoFi private student loans offer flexible payment options, zero fees and low rates. Plus get a % discount when you set up autopay.* Prequalify online in Apply for a student loan today. Whether studying online or on campus, Sallie Mae's student loans can help you cover up to % of your college and graduate

Explore information and ways to help your student successfully manage their student loan. Pick a Student Loan Repayment Option external link. How to Repay Your Loans external link.

Loan Modification. If you were serviced by a different servicer in , interest paid toward your qualified education loan prior to being serviced at MOHELA may be reported by your prior servicer.

If you had additional interest paid prior to transitioning to our new loan servicing system at mohela. gov, we'll send a separate notification for the interest paid while your account was on our legacy servicing system at mohela. If you have questions about how your student loan interest paid amount may affect your taxes, please contact your tax advisor.

For more information on your student loan tax information, visit our Tax FAQ. MOHELA is transitioning to a new loan servicing platform. This transition will allow us to explore new options with your customer service experience.

MOHELA will continue to be your student loan servicer and will remain in contact with you regarding updates to your account.

Visit mohela. Due to the unprecedented event of millions of student loan borrowers returning to repayment at the same time, you may experience longer than normal wait times to speak to a Customer Service Representative.

com or StudentAid. There you can explore your repayment plan options which may help to lower your monthly payment amount. We appreciate your patience. The SAVE plan provides the lowest monthly payment of any income-driven repayment plan available to nearly all student borrowers.

If you were previously participating in the Revised Pay as You Earn REPAYE plan, you will automatically be enrolled in the SAVE Plan and your payment recalculated before payments resume, no action is required.

If you want to enroll in the SAVE plan and calculate what your estimated monthly payment may be, use Loan Simulator. Note : If you are on the REPAYE alternative plan, you will need to apply for the SAVE plan. Update: If you received an email from Federal Student Aid regarding income-driven repayment forgiveness, please know that we are working to process your forgiveness as soon as possible.

Once the forgiveness has been applied, you will be notified. Our customer service representatives do not have any further information about this forgiveness to provide at this time. Based on the newly eligible months from the one-time account adjustment, borrowers who have reached or months' as applicable worth of payments for IDR forgiveness or months of PSLF will begin to see their loans forgiven in spring The Department will continue to discharge loans as borrowers reach the months needed for forgiveness.

All other borrowers will see their accounts update in For more information, please visit StudentAid. PSLF Forgiveness : When you reach or more qualifying payments for PSLF, your account is eligible to be placed into a forbearance and no payment will be due.

If you prefer to continue making payments, any overpayments will be refunded or applied to your outstanding loans if applicable. You can log in to your MOHELA account to verify your forbearance status.

To process forgiveness, a final review of your account will be conducted, which will take at least 90 business days. You will be notified of the results of your forgiveness request once the final review of your account is complete.

The fees charged by some lenders can significantly increase the cost of the loan. A loan with a relatively low interest rate but high fees can ultimately cost more than a loan with a somewhat higher interest rate and no fees. The lenders that do not charge fees often roll the difference into the interest rate.

Be wary of comparing loans with different repayment terms according to APR, as a longer loan term reduces the APR despite increasing the total amount of interest paid.

Such loans will be competitive with the Federal PLUS Loan. Unfortunately, these rates often will be available only to borrowers with great credit who also have a creditworthy cosigner. Generally, borrowers should prefer loans that are pegged to the LIBOR index over loans that are pegged to the Prime Lending Rate, all else being equal, as the spread between the Prime Lending Rate and LIBOR has been increasing over time.

Over the long term a loan with interest rates based on LIBOR will be less expensive than a loan based on the Prime Lending Rate. Some lenders use the LIBOR rate because it reflects their cost of capital.

It is not uncommon for lenders to advertise a lower rate for the in-school and grace period, with a higher rate in effect when the loan enters repayment. Federal student loans are not available for expenses incurred by law, medical and dental students after they graduate, such as expenses associated with study for the bar or finding a residency.

There are two types of private student loans for these expenses:. Key information to understand student loans includes being aware of the annual and cumulative loan limits, interest rates, fees, and loan term for the most popular private student loan programs.

Often the interest rates, fees and loan limits depend on the credit history of the borrower and co-signer, if any, and on loan options chosen by the borrower such as in-school deferment and repayment schedule.

Loan term often depends on the total amount of debt. Most lenders that require school certification approval will cap the annual loan amount at cost of education less aid received COA-Aid.

They may also have an annual dollar limit as well. Lenders rarely give complete details of the terms of the private student loan until after the student submits an application, in part because this helps prevent comparisons based on cost.

For example, many lenders will only advertise the lowest interest rate they charge for good credit borrowers. The APRs for variable rate loans, if listed, are only the current APRs and are likely to change over the term of the loan.

Borrowers should be careful about comparing loans based on the APR, as the APR may be calculated under different assumptions, such as a different number of years in repayment. All else being equal, a longer repayment term will have a lower APR even though the borrower will pay more in interest.

This page provides a basic comparison chart that highlights the key characteristics of the major private education loans. FinAid also provides a separate list of private consolidation loans. In addition to the private student loan programs, there are several websites like Credible and other student loan comparison sites that provide tools for comparing private student loans which help identify the loans that match your criteria.

The information presented below is based on lender provided information. Actual rates and fees may differ. However, applying for or closing a loan will involve a hard credit pull that impacts your credit score and closing a loan will result in costs to you.

Prequalified rates are based on the information you provide and a soft credit inquiry. Receiving prequalified rates does not guarantee that the Lender will extend you an offer of credit. You are not yet approved for a loan or a specific rate.

All credit decisions, including loan approval, if any, are determined by Lenders, in their sole discretion. Rates and terms are subject to change without notice. Or, if the loan option is a variable rate loan, then the interest rate index used to set the APR is subject to increases or decreases at any time.

Lenders reserve the right to change or withdraw the prequalified rates at any time. Choose between personalized prequalified rates, as well as deferred and interest-only repayment options for your school loans.

Repayment options range from immediate full repayment principal and interest payments immediately after the loan is fully disbursed , interest only interest-only payments while you are in school, and start making principal and interest payments after you leave school , full deferral while in school, flat payment while in-school, graduated repayment payments increase over time.

Fees and Terms. Loan products may not be available in certain jurisdictions. Certain restrictions, limitations; and terms and conditions may apply. Interest never capitalizes on Perkins Loans.

The example compares the effects of paying the interest as it accrues or allowing it to capitalize. Both co-makers are equally responsible for repaying the full amount of the loan. Interest is not generally charged to you during a deferment on your subsidized loans.

Interest is always charged to you during a deferment on your unsubsidized loans. On loans made under the Perkins Loan Program, all deferments are followed by a post-deferment grace period of 6 months, during which time you are not required to make payments.

The holder of your FFEL Program loans may be a lender, guaranty agency, secondary market, or the Department. The holder of your Perkins Loans is an institution of higher education or the Department.

Your loan holder may use a servicer to handle billing and other communications related to your loans. The Privacy Act of 5 U. of the Higher Education Act of , as amended 20 U. Participating in the William D. Ford Federal Direct Loan Direct Loan Program, Federal Family Education Loan FFEL Program, or Federal Perkins Loan Perkins Loan Program and giving us your SSN are voluntary, but you must provide the requested information, including your SSN, to participate.

We also use your SSN as an account identifier and to permit you to access your account information electronically. The routine uses of this information include, but are not limited to, its disclosure to federal, state, or local agencies, to private parties such as relatives, present and former employers, business and personal associates, to consumer reporting agencies, to financial and educational institutions, and to guaranty agencies in order to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan, to permit the servicing or collection of your loans, to enforce the terms of the loans, to investigate possible fraud and to verify compliance with federal student financial aid program regulations, or to locate you if you become delinquent in your loan payments or if you default.

To provide default rate calculations, disclosures may be made to guaranty agencies, to financial and educational institutions, or to state agencies. To provide financial aid history information, disclosures may be made to educational institutions.

To provide a standardized method for educational institutions to efficiently submit student enrollment statuses, disclosures may be made to guaranty agencies or to financial and educational institutions. To counsel you in repayment efforts, disclosures may be made to guaranty agencies, to financial and educational institutions, or to federal, state, or local agencies.

If this information, either alone or with other information, indicates a potential violation of law, we may send it to the appropriate authority for action. We may send information to members of Congress if you ask them to help you with federal student aid questions.

In circumstances involving employment complaints, grievances, or disciplinary actions, we may disclose relevant records to adjudicate or investigate the issues. If provided for by a collective bargaining agreement, we may disclose records to a labor organization recognized under 5 U.

Chapter Disclosures may be made to our contractors for the purpose of performing any programmatic function that requires disclosure of records. Before making any such disclosure, we will require the contractor to maintain Privacy Act safeguards.

Disclosures may also be made to qualified researchers under Privacy Act safeguards. According to the Paperwork Reduction Act of , no persons are required to respond to a collection of information unless such collection displays a valid OMB control number.

The valid OMB control number for this information collection is Public reporting burden for this collection of information is estimated to average 10 minutes per response, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information.

The obligation to respond to this collection is required to obtain a benefit in accordance with 34 CFR Both co-makers are responsible for repaying the full amount of the loan.

Your consent to this Electronic Signature Agreement covers the transaction you are presently completing e.

submission of a deferment, forbearance, auto debit request, etc. You understand and agree that your electronic signature of the transaction you are presently completing shall be legally binding and such transaction shall be considered authorized by you.

You understand that by checking the box and agreeing to sign electronically, your electronic signature has the same legal force and effect as a handwritten signature. At any point in this process, you will be able to print and read the information that is presented to you using your browser print option.

However, the document you print upon completion of the electronic signature process may not be a complete version of the document due to system limitations and differences of technology. At any time prior to submitting your electronic signature, you may opt out of the electronic signature process and continue with a paper process.

Simply exit this session prior to accepting this Electronic Signature Agreement. This will be used to represent your name and date signed on the electronic document along with the words Electronically Signed.

Clicking submit completes the electronic signature process. You acknowledge and agree that your consent to your electronic signature is being provided in connection with a transaction affecting interstate commerce that is subject to the federal Electronic Signatures in Global and National Commerce Act, and that you and we both intend that the Act apply to the fullest extent possible to validate our ability to conduct business with you by electronic means.

net', 'Url':'mailto:SubmitMyForms Nelnet. net'},'submitFormEmailMilitary':{ 'LinkText': 'SubmitMyForms Nelnet.

net', 'Url':'mailto:MilitarySolutions Nelnet. net'},'additionalDocumentationRequired':'Once all proper documentation is received, you will be notified of your eligibility within business days. Once you reach your home page, review the following items to get ready for repayment.

Nelnet accounts beginning with E are eligible.

Ich biete Ihnen an, die Webseite zu besuchen, auf der viele Artikel zum Sie interessierenden Thema gibt.

Ich entschuldige mich, aber es kommt mir nicht heran. Kann, es gibt noch die Varianten?