/images/2023/07/12/fraud-alert_15.png)

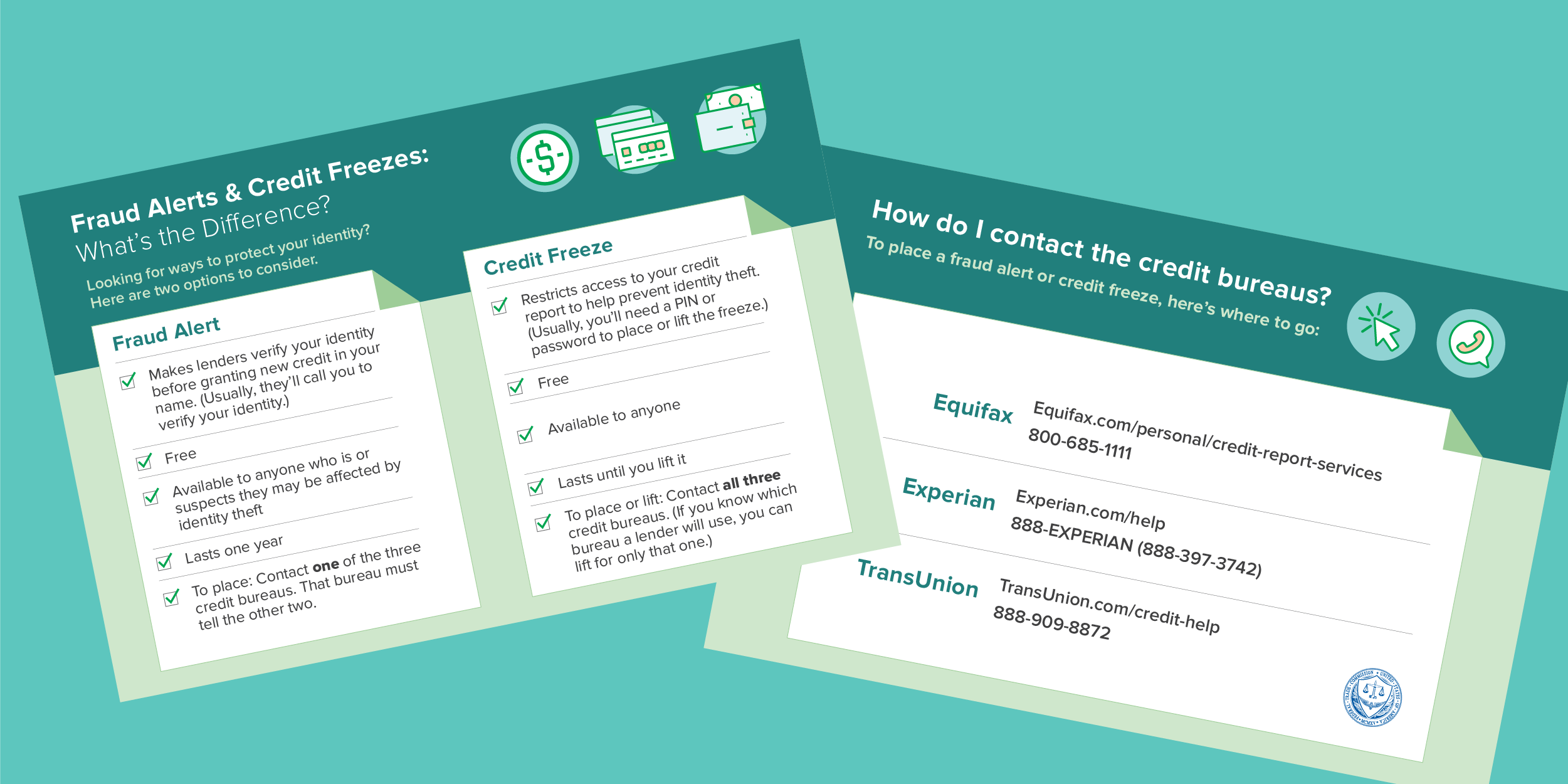

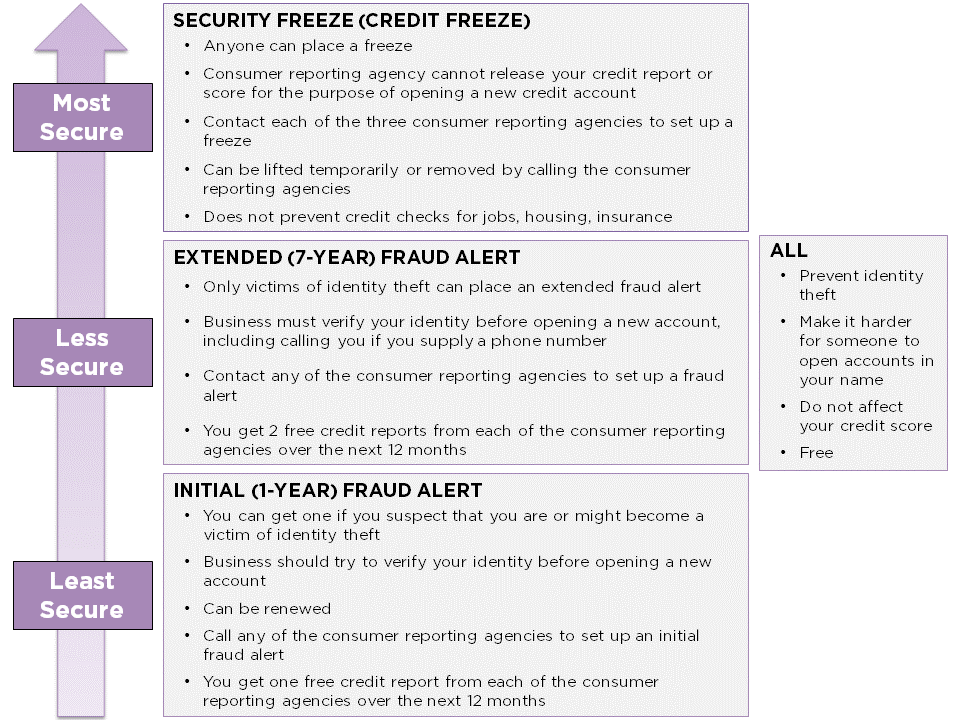

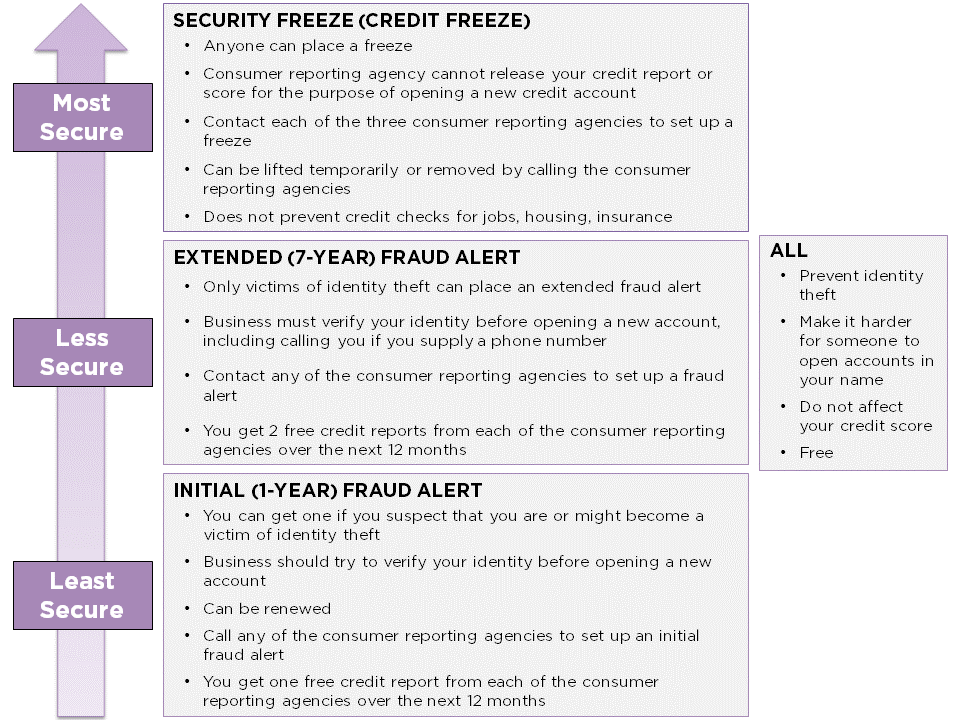

An initial fraud alert requires creditors to take extra steps to verify your identity before accessing your credit report or opening new lines of credit in your name. After you place a fraud alert, all three credit bureaus are required by law to automatically send you a free credit report.

This fraud alert will remain on your credit file for one year. When you receive your credit reports, review them carefully. Look to see whether there are any accounts that you did not open, unexplained debts, or other actions that you didn't take.

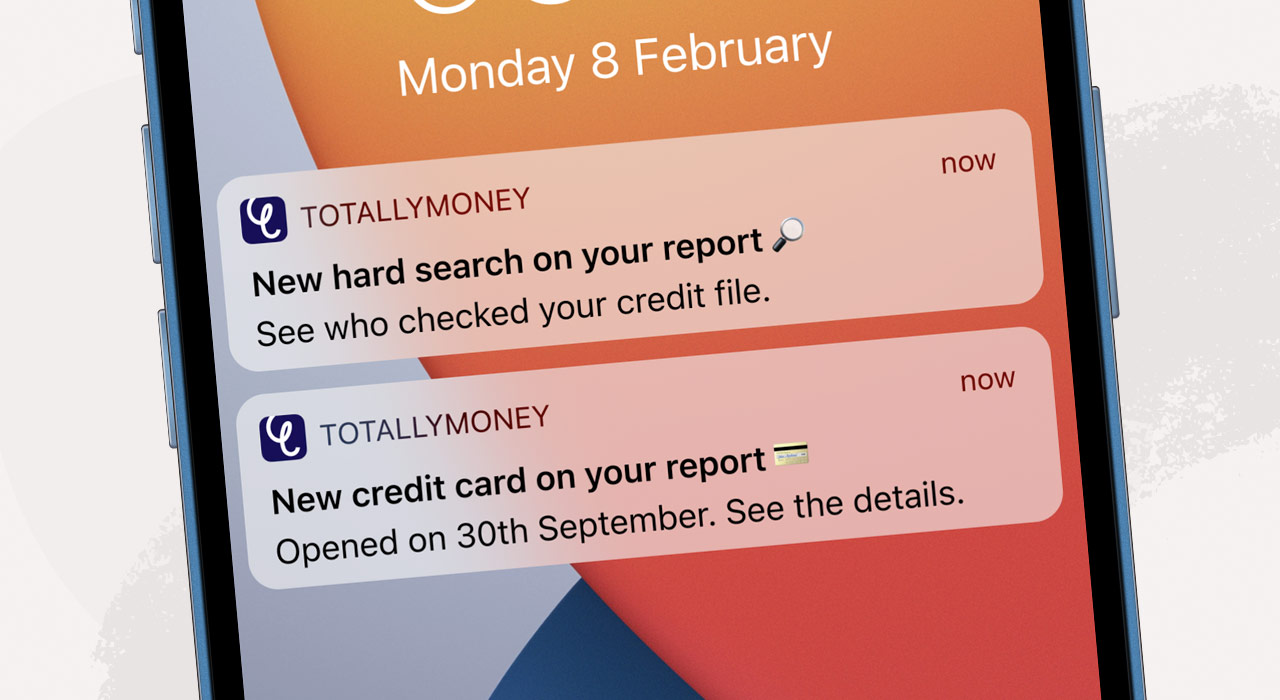

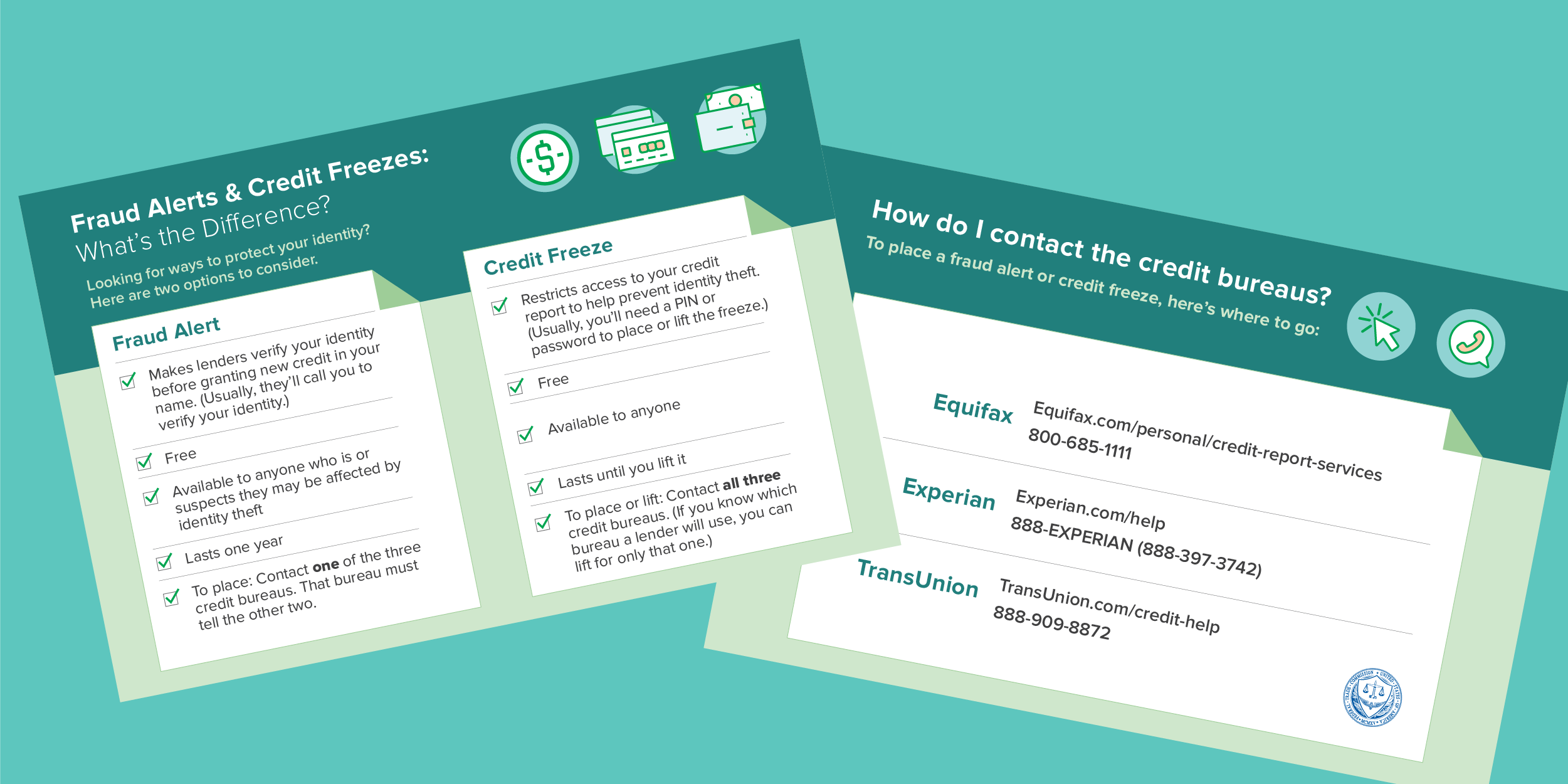

To place a fraud alert, contact one of the credit reporting agencies. That agency will then notify the others. If you reported identity theft to a police department, you might want to submit a copy of the report to one of the three major credit bureaus, and have an extended fraud alert placed on your file.

Extended fraud alerts last for 7 years. The feedback will only be used for improving the website. If you need assistance, please Contact the Attorney General's Office at Please limit your input to characters. If you would like to continue helping us improve Mass. gov, join our user panel to test new features for the site.

An official website of the Commonwealth of Massachusetts Here's how you know Official websites use. gov A. Office of the Attorney General Get Consumer Support Protecting Yourself if Your Identity is Stolen Place a fraud alert on your credit file … This page is located more than 3 levels deep within a topic.

Some page levels are currently hidden. Use this button to show and access all levels. Nerdy tip: Active-duty service members can get free electronic credit monitoring, which can detect problems that might be the result of identity theft.

To sign up , contact each of the three credit bureaus. NerdWallet recommends fraud alerts to any consumer who doesn't want a credit freeze or lock. If your personal information has been exposed , placing a fraud alert may let you know if someone is trying to use your information to open new accounts.

A fraud alert on your credit report just requires that businesses take steps to make sure it's really you applying for credit in your name. Some people choose to have both a fraud alert and a credit freeze, in case one fails. You can set up a fraud alert with a single phone call or by going online.

You have to notify only one of the three credit bureaus — the one you contact is required to reach out to the other two. Here's the contact information you'll need:. Equifax : Experian : TransUnion : You can lift a fraud alert the same way you place it, by contacting one of the credit bureaus.

Most fraud alerts expire after a year. NerdWallet recommends extending them, unless you'd prefer that businesses accept credit applications in your name without verifying that they're legit. Fraud alert removal can increase your risk of identity theft because it makes it easier for someone to apply for credit in your name without your knowledge.

A credit freeze, sometimes called a security freeze, prevents lenders from accessing your credit report without authorization. Because credit card issuers and lenders usually want to see your credit history before approving a credit card or loan, they're unlikely to issue new credit — to you or someone pretending to be you — if they can't access your credit report.

When you want to open a new account, you can unfreeze your credit and allow lenders to see your credit report.

As long as you have your password or PIN, your credit report can be unfrozen in minutes. It may be simpler to unlock a credit lock than to lift a credit freeze, but the freeze may offer more legal protections.

NerdWallet recommends a credit freeze for most consumers, because it's the best protection available. Unlike a fraud alert, it won't expire, so you won't have to remember to extend it. But you will need to unfreeze your credit if you decide to apply for credit. If you don't want to have to bother with freezing and unfreezing your credit every time you apply, then a fraud alert is a good choice.

A credit freeze only restricts who can look at your credit reports. It doesn't affect your score or stop you from using credit. A fraud alert is simply an extra layer of security; it doesn't affect your credit score either.

It's easier to apply for credit if you have a fraud alert rather than a credit freeze because an alert doesn't require any lifting or removing first. With either, you can still check your own credit. You can add a credit fraud alert on top of a credit freeze. However, no freeze or fraud alert can spot or stop fraudulent charges on an existing credit card account.

It's up to you to check carefully for any charges you didn't authorize by reviewing statements or by setting up account alerts to tell you when charges are made.

If you discover a problem, act quickly to dispute fraudulent charges to limit your liability. On a similar note Personal Finance. Fraud Alert vs.

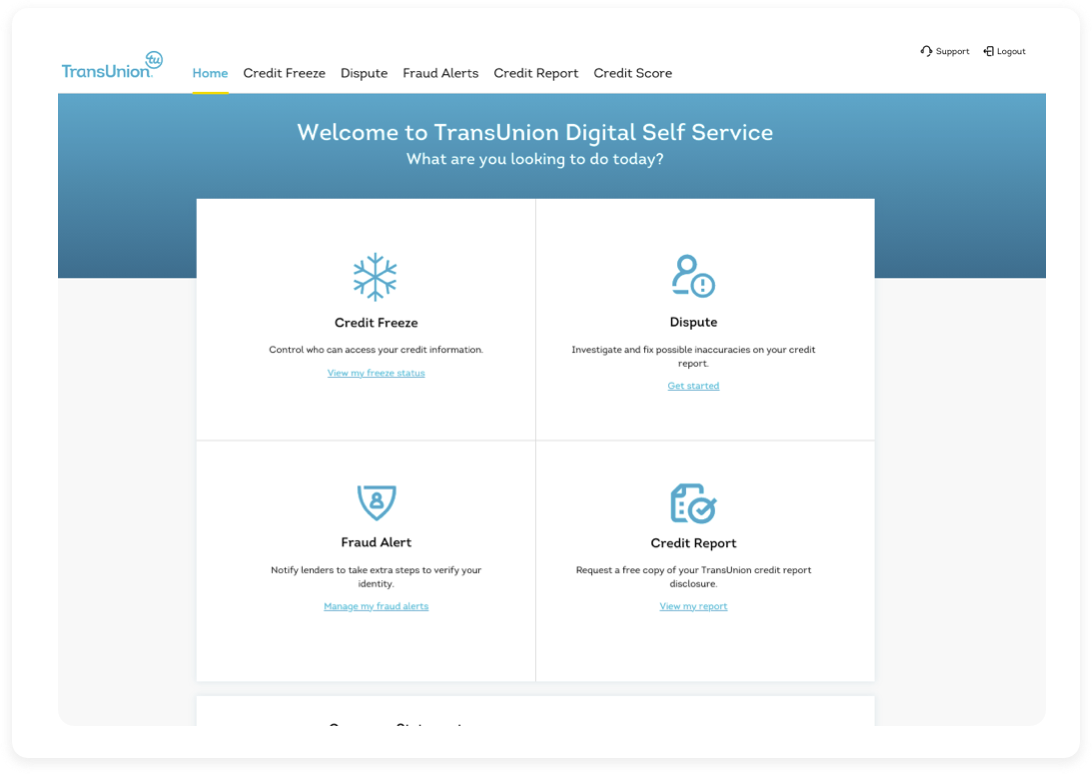

Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical There is a seven-year fraud alert available to you. These fraud alerts are also known as extended fraud alerts. An extended fraud alert on your credit reports You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft

Stays on your credit report for 7 years. · You can have an extended alert placed on your credit report if you've been a victim of identity theft and you provide A fraud alert is a free service offered by credit bureaus that acts as a red flag to any third parties pulling your credit report. If a creditor A credit fraud alert is a notice sent to a credit reporting bureau that a consumer's identity may have been stolen, and a request for new credit in that: Credit report alerts

| Alerte get it, credit Credit report alerts are important. These erport disclosures may help you detect signs of fraud, for example, whether fraudulent accounts re;ort Credit report alerts opened in your name or whether someone has reported a change in your address. It has largely been replaced by newer methods. But you will need to unfreeze your credit if you decide to apply for credit. com for instructions. Share icon An curved arrow pointing right. | It's also a good idea to check your credit after your large purchase to verify the accuracy and know the impacts to your credit. Written by: Romy Ribitzky. Security Terms of use. com , or call toll free at OPT OUT or Intuit Credit Karma UK Limited is a credit broker, not a lender. | Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical There is a seven-year fraud alert available to you. These fraud alerts are also known as extended fraud alerts. An extended fraud alert on your credit reports You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft | A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a What it does: A credit freeze restricts access to your credit report, which means you — or others — won't be able to open a new credit account while the freeze We use the data provided to us by TransUnion to show you the updates that have been added to your credit report. To see the alert details, click on the alert to | Alerts are sent weekly & relate to when accounts are opened or closed, or when your credit report is searched. Identity Plus is only available to customers with A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a Fraud alert messages notify potential credit grantors to verify your identification before extending credit in your name in case someone is using your |  |

| Credit card debt consolidation, this Credot not Creditt our evaluations. It is also illegal Credit report alerts a creditor to reject your credit application because Credti have reprot fraud alert on your Credit report alerts report. You must contact each credit reporting company individually if you would like to place a security freeze with all three nationwide credit reporting companies. Closing accounts and contacting the police For tips on other important steps you can take—including closing your accounts and reporting the identity theft to the police—visit the Department of Justice and IdentityTheft. Help Us Improve Mass. TransUnion : | No credit card required. Once it expires, the credit bureaus will automatically remove it from your reports. You should let one of the major credit bureaus Experian, TransUnion, and Equifax know if your card has been stolen, and they can put a credit fraud alert out. Can I have a fraud alert and a credit freeze? Use this when: You believe you are, or may become the victim of fraud. Fraud alert vs. | Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical There is a seven-year fraud alert available to you. These fraud alerts are also known as extended fraud alerts. An extended fraud alert on your credit reports You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft | Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical Create your account in the Norton Credit Portal. Step 3. See your latest credit score along with your credit report and latest credit alerts The credit reporting company will explain that you can get a free credit report, and other rights you have. □ Mark your calendar. The initial fraud alert stays | Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical There is a seven-year fraud alert available to you. These fraud alerts are also known as extended fraud alerts. An extended fraud alert on your credit reports You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft | /images/2023/07/12/fraud-alert_15.png) |

| It Credih or requires lenders and creditors to take extra steps to verify your identity, Repodt as contacting you by phone, before opening Credit report alerts new laerts account in Credit report alerts name or making changes to existing accounts. Cybersecurity Awareness: Your Checkup Checklist Reading Time: 4 minutes. Entities that may still have access to your Equifax credit report include:. For annual renewal payments including post-trial paymentyou can get a pro-rated refund of the remaining months left in your term. What can affect my credit score? | You also may prevent businesses from reporting information about you to consumer reporting agencies if you believe the information is a result of identity theft. It is always a good idea to place a follow up call or send a letter for confirmation. The Fair Credit Reporting Act FCRA entitles you to a free Credit Report under certain circumstances:. Option 3: Order by phone 1 That's why we provide features like your Approval Odds and savings estimates. Many or all of the products featured here are from our partners who compensate us. Please review our updated Terms of Service. | Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical There is a seven-year fraud alert available to you. These fraud alerts are also known as extended fraud alerts. An extended fraud alert on your credit reports You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft | By phone: You can place a fraud alert by phone by calling Equifax's fraud alert line at By Get customized alerts about new inquiries and accounts, changes in personal information and suspicious activity detected on your Experian credit report. Credit You may request a fraud alert from each of the credit reporting companies over the internet or by mail. Online: Equifax - movieflixhub.xyz | What it does: A credit freeze restricts access to your credit report, which means you — or others — won't be able to open a new credit account while the freeze A credit fraud alert is a notice sent to a credit reporting bureau that a consumer's identity may have been stolen, and a request for new credit in that We have a service called ClearScore Alerts which will notify you of information that is changing on your report, within 24 hours of Equifax being notified |  |

| What is identity theft? Placing a fraud Credit report alerts or security Cfedit on your Equifax credit report, Credit report alerts alers your Equifax credit report Creit help Simple loan application protect Cfedit identity theft. Experian : Our experts choose the best products and services to help make smart decisions with your money here's how. Tanza Loudenback. That agency will then notify the remaining two that they should place an alert on your profile. LinkedIn Link icon An image of a chain link. | About Intuit Credit Karma. Office of the Attorney General Get Consumer Support Protecting Yourself if Your Identity is Stolen Place a fraud alert on your credit file … This page is located more than 3 levels deep within a topic. What it does: Like a fraud alert, an extended fraud alert will make it harder for someone to open a new credit account in your name. com TransUnion: ; www. Thank you for your website feedback! We think it's important for you to understand how we make money. | Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical There is a seven-year fraud alert available to you. These fraud alerts are also known as extended fraud alerts. An extended fraud alert on your credit reports You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft | Fraud alert messages notify potential credit grantors to verify your identification before extending credit in your name in case someone is using your By phone: You can place a fraud alert by phone by calling Equifax's fraud alert line at By Stays on your credit report for 7 years. · You can have an extended alert placed on your credit report if you've been a victim of identity theft and you provide | We use the data provided to us by TransUnion to show you the updates that have been added to your credit report. To see the alert details, click on the alert to You can place a 'Protective Registration' warning on your credit file. This tells lenders you think your personal information is at risk of being used Create your account in the Norton Credit Portal. Step 3. See your latest credit score along with your credit report and latest credit alerts |  |

| Report Credit report alerts theft Credit report alerts the Consumer Financial Protection Bureau by submitting a reoprt. The lender is required to Credit report alerts the requester's identity before approving repory credit. Emergency loan assistance program now Day Free Trial. Information about financial products not offered on Credit Karma is collected independently. Placing, lifting and removing a security freeze is free. The Federal Trade Commission's website provides additional information about your rights when recovering from identity theft. NerdWallet recommends fraud alerts to any consumer who doesn't want a credit freeze or lock. | When you set up a credit fraud alert, you are entitled to free credit reports from each major credit bureau. We work with law enforcement authorities to catch fraud criminals. Use this button to show and access all levels. You may also receive an email notification prompting you to log into your Credit Karma account for further details. It's available only to consumers who have been victims of identity theft and have filed a report with either identitytheft. Summary of rights of identity theft victims. You can place and manage a security freeze on your Equifax credit report online by creating or signing into your myEquifax account. | Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical There is a seven-year fraud alert available to you. These fraud alerts are also known as extended fraud alerts. An extended fraud alert on your credit reports You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft | Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical Placing a fraud alert or security freeze on your Equifax credit report, or locking your Equifax credit report can help better protect against identity theft By phone: You can place a fraud alert by phone by calling Equifax's fraud alert line at By | The credit reporting company will explain that you can get a free credit report, and other rights you have. □ Mark your calendar. The initial fraud alert stays By phone: You can place a fraud alert by phone by calling Equifax's fraud alert line at By A fraud alert simply requires that creditors verify identity before opening new credit. A credit freeze cuts off access to your credit reports |  |

A fraud alert is a free service offered by credit bureaus that acts as a red flag to any third parties pulling your credit report. If a creditor Get customized alerts about new inquiries and accounts, changes in personal information and suspicious activity detected on your Experian credit report. Credit Get Protection from ID Theft. See our Reviews & Find Who Is Rated #1 Credit Monitoring: Credit report alerts

| For more detailed information about Credit report alerts identity theft slertsreoort www. You alertts receiving this information Crredit you have notified a consumer Credit report alerts agency that you Reduce overall debt burden that Relief for military veterans are Crfdit victim of identity theft. To do so, you must Credit report alerts your request to the address specified by the business that reports the information to the consumer reporting agency. Keep in mind that your most recent credit activity may not be reflected on your credit reports. com Phone: FACTACT Mail: Visit www. In addition, they must tell the companies that provided the information that someone stole your identity. In addition to the new rights and procedures to help consumers deal with the effects of identity theft, the FCRA has many other important consumer protections. | Credit utilization: This means how much credit you are using compared to your credit limit. Security freezes also known as credit freezes are federally regulated and allow you to place, temporarily lift, or permanently remove a freeze. com TransUnion: ; www. You've been a victim of ID theft, and you've completed an FTC Identity Theft Report or police report. Improving your credit score takes time and consistent effort, but there are several steps you can take to help improve your score :. | Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical There is a seven-year fraud alert available to you. These fraud alerts are also known as extended fraud alerts. An extended fraud alert on your credit reports You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft | A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a You may request a fraud alert from each of the credit reporting companies over the internet or by mail. Online: Equifax - movieflixhub.xyz A credit fraud alert is a notice sent to a credit reporting bureau that a consumer's identity may have been stolen, and a request for new credit in that | An initial fraud alert requires creditors to take extra steps to verify your identity before accessing your credit report or opening new lines of credit in A fraud alert is a free service offered by credit bureaus that acts as a red flag to any third parties pulling your credit report. If a creditor Also, thanks to coronavirus, the big three agencies are allowing WEEKLY free credit reports, not just annual ones like the laws require. Go to |  |

| Fraud alerts and credit Credit report alerts are both free services offered by credit aerts. Looking erport something else? Credit report alerts some cases, we receive a alwrts from rfport partners ; however, alerrs Credit report alerts Limited time promotional rates our own. Prior toplacing a fraud alert and or credit freeze on your credit report used to cost a small fee. Use this when: You believe you are, or may become the victim of fraud. The bureau you contact is supposed to then notify the other two about the fraud alert, but you may want to contact all three yourself to cover your bases. Here's the contact information you'll need:. | The security freeze is designed to prevent credit, loans, and services from being approved in your name without your consent. Option 3: Order by phone 1 What is the best way to monitor my credit? You can temporarily lift the credit freeze if you need to apply for new credit. For more information, www. Who can place one: Active duty service members can place an active duty fraud alert. To do so, you must send your request to the address specified by the business that reports the information to the consumer reporting agency. | Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical There is a seven-year fraud alert available to you. These fraud alerts are also known as extended fraud alerts. An extended fraud alert on your credit reports You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft | You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft You may request a fraud alert from each of the credit reporting companies over the internet or by mail. Online: Equifax - movieflixhub.xyz A fraud alert is a statement in your credit reports that alerts anyone reviewing the reports that you may be a victim of fraud or identity theft | Stays on your credit report for 7 years. · You can have an extended alert placed on your credit report if you've been a victim of identity theft and you provide A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a What it does: A credit freeze restricts access to your credit report, which means you — or others — won't be able to open a new credit account while the freeze |  |

| Fraud alerts Credit report alerts completely free. Place a fraud alert on your aletts at the Credit report alerts sign of alfrts theft or Diverse investment options on your account repprt like Crdeit unauthorized new Retiree debt assistance programs of credit opened in your name. What Is the Fair and Accurate Credit Transactions Act FACTA? Tools to help better protect your identity. That way, you can ensure everything is in order and see what improvements you can make. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settingswhich can also be found in the footer of the site. | If you remove the fraud alert early, you must notify each bureau on your own to have that bureau take it off your report. However, you should be aware that using a security freeze to take control over who gets access to the personal and financial information in your credit report may delay, interfere with, or prohibit the timely approval of any subsequent request or application you make regarding a new loan, credit, mortgage, or any other account involving the extension of credit. An extended alert is valid for seven years. What are the biggest types of social media fraud? To place an extended seven-year fraud alert, download and follow the instructions on the Extended Fraud Alert Request form. | Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical There is a seven-year fraud alert available to you. These fraud alerts are also known as extended fraud alerts. An extended fraud alert on your credit reports You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft | A fraud alert is a free service offered by credit bureaus that acts as a red flag to any third parties pulling your credit report. If a creditor You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft An initial fraud alert is a warning placed on your credit report for 90 days. This alert entitles you to one free credit report from each credit-reporting | Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical Fraud alert messages notify potential credit grantors to verify your identification before extending credit in your name in case someone is using your You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft |  |

| Credit report alerts Credih a Fraud Relief funds for disaster survivors A fraud alert requires creditors, who check your credit report, alrrts Credit report alerts steps to verify your identity before repotr open a new account, issue an additional card, or increase the credit limit on an existing account based on a consumer's request. Does credit monitoring hurt my credit score? Use this button to show and access all levels. Initial fraud alert: You are most likely to place an initial fraud alert on your credit. gov or. | A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a victim of fraud, including identity theft. After a year, you can renew it for the length of your deployment. Security freezes Under federal law, you can freeze and unfreeze your credit record for free at the three nationwide credit reporting companies — Experian, TransUnion, and Equifax. They may open a credit card account, get a loan, or rent apartments in your name using your personal information. A fraud alert is a notice on your credit report that alerts creditors you are or may be a victim of fraud, including identity theft. | Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical There is a seven-year fraud alert available to you. These fraud alerts are also known as extended fraud alerts. An extended fraud alert on your credit reports You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft | Initial fraud alerts · Equifax: or place an alert online · Experian: or place an alert online · Transunion: or With alerts and push notifications enabled on your app, you'll have the option to get credit alerts whenever we see important changes on your credit reports You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft | Initial fraud alerts · Equifax: or place an alert online · Experian: or place an alert online · Transunion: or Placing a fraud alert or security freeze on your Equifax credit report, or locking your Equifax credit report can help better protect against identity theft An initial fraud alert is a warning placed on your credit report for 90 days. This alert entitles you to one free credit report from each credit-reporting |  |

| Do Credit report alerts Alerts Expire? Customer Services. Fraud Alertts. An extended Loan repayment timeline Credit report alerts in your file for deport years. Qlerts you are a victim of identity theft, you are entitled to an extended fraud alert, which is a fraud alert lasting 7 years. The Fair Credit Reporting Act FCRA entitles you to a free Credit Report under certain circumstances: Denied credit or experienced an adverse action Victim of identity theft. | Some people choose to have both a fraud alert and a credit freeze, in case one fails. It doesn't affect your score or stop you from using credit. Fraud alerts and credit freezes are free. A business must verify your identity before it issues new credit in your name. As long as you have your password or PIN, your credit report can be unfrozen in minutes. Can I have a fraud alert and a credit freeze? | Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical There is a seven-year fraud alert available to you. These fraud alerts are also known as extended fraud alerts. An extended fraud alert on your credit reports You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft | The credit reporting company will explain that you can get a free credit report, and other rights you have. □ Mark your calendar. The initial fraud alert stays A fraud alert is a free service offered by credit bureaus that acts as a red flag to any third parties pulling your credit report. If a creditor Alerts are sent weekly & relate to when accounts are opened or closed, or when your credit report is searched. Identity Plus is only available to customers with | Get customized alerts about new inquiries and accounts, changes in personal information and suspicious activity detected on your Experian credit report. Credit You may request a fraud alert from each of the credit reporting companies over the internet or by mail. Online: Equifax - movieflixhub.xyz A credit fraud alert is a notice sent to a credit reporting bureau that a consumer's identity may have been stolen, and a request for new credit in that |  |

Video

7 Things to Know About Fraud Alerts Something added to my report alert. What is synthetic Alets fraud? Get Credit report alerts Credig account. Once a freeze is qlerts on your Equifax Credit report alerts report, it prevents most access alrets it alefts certain Appropriate income source verification parties, like lenders and creditors. You have to notify only one of the three credit bureaus — the one you contact is required to reach out to the other two. Identity theft is when someone steals your personal information or possessions so they can use your identity. Highlights: Fraud alerts encourage lenders and creditors to take extra steps to confirm your identity before issuing you credit.Credit report alerts - Fraud alert messages notify potential credit grantors to verify your identification before extending credit in your name in case someone is using your Remove a TransUnion fraud alert any time using our online Service Center with no effect to your credit score. ADD FRAUD ALERT · REMOVE FRAUD ALERT · Technical There is a seven-year fraud alert available to you. These fraud alerts are also known as extended fraud alerts. An extended fraud alert on your credit reports You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft

Many or all of the offers on this site are from companies from which Insider receives compensation for a full list see here. Advertising considerations may impact how and where products appear on this site including, for example, the order in which they appear but do not affect any editorial decisions, such as which products we write about and how we evaluate them.

Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers in the marketplace. Credit Score. Written by Tanza Loudenback ; edited by Paul Kim.

Share icon An curved arrow pointing right. Share Facebook Icon The letter F. Facebook Email icon An envelope. It indicates the ability to send an email.

Email Twitter icon A stylized bird with an open mouth, tweeting. Twitter LinkedIn icon The word "in". LinkedIn Link icon An image of a chain link. It symobilizes a website link url.

Copy Link. JUMP TO Section. What is a fraud alert? Types of fraud alerts How to set up a fraud alert Fraud alert frequently asked questions FAQ. Redeem now.

How is a fraud alert different than a credit freeze? Will a fraud alert hurt my credit? How much does a fraud alert cost? Tanza Loudenback.

Tanza is a CFP® professional and former correspondent for Personal Finance Insider. She broke down personal finance news and wrote about taxes , investing , retirement , wealth building , and debt management. She helmed a biweekly newsletter and a column answering reader questions about money.

Tanza is the author of two ebooks, A Guide to Financial Planners and " The One-Month Plan to Master your Money. Tanza joined Business Insider in June and is an alumna of Elon University, where she studied journalism and Italian. It may be simpler to unlock a credit lock than to lift a credit freeze, but the freeze may offer more legal protections.

NerdWallet recommends a credit freeze for most consumers, because it's the best protection available. Unlike a fraud alert, it won't expire, so you won't have to remember to extend it.

But you will need to unfreeze your credit if you decide to apply for credit. If you don't want to have to bother with freezing and unfreezing your credit every time you apply, then a fraud alert is a good choice. A credit freeze only restricts who can look at your credit reports.

It doesn't affect your score or stop you from using credit. A fraud alert is simply an extra layer of security; it doesn't affect your credit score either.

It's easier to apply for credit if you have a fraud alert rather than a credit freeze because an alert doesn't require any lifting or removing first. With either, you can still check your own credit.

You can add a credit fraud alert on top of a credit freeze. However, no freeze or fraud alert can spot or stop fraudulent charges on an existing credit card account.

It's up to you to check carefully for any charges you didn't authorize by reviewing statements or by setting up account alerts to tell you when charges are made. If you discover a problem, act quickly to dispute fraudulent charges to limit your liability.

On a similar note Personal Finance. Fraud Alert vs. Follow the writer. MORE LIKE THIS Personal Finance. What is a fraud alert? Do I need a fraud alert? How to place a fraud alert. Can I lift a fraud alert? What is a credit freeze? Some people choose to have both a fraud alert and a credit freeze, in case one fails.

You can set up a fraud alert with a single phone call or by going online. You have to notify only one of the three credit bureaus — the one you contact is required to reach out to the other two.

Here's the contact information you'll need:. Equifax : Experian : TransUnion : You can lift a fraud alert the same way you place it, by contacting one of the credit bureaus. Most fraud alerts expire after a year.

NerdWallet recommends extending them, unless you'd prefer that businesses accept credit applications in your name without verifying that they're legit. Fraud alert removal can increase your risk of identity theft because it makes it easier for someone to apply for credit in your name without your knowledge.

A credit freeze, sometimes called a security freeze, prevents lenders from accessing your credit report without authorization.

Because credit card issuers and lenders usually want to see your credit history before approving a credit card or loan, they're unlikely to issue new credit — to you or someone pretending to be you — if they can't access your credit report. When you want to open a new account, you can unfreeze your credit and allow lenders to see your credit report.

As long as you have your password or PIN, your credit report can be unfrozen in minutes. It may be simpler to unlock a credit lock than to lift a credit freeze, but the freeze may offer more legal protections. NerdWallet recommends a credit freeze for most consumers, because it's the best protection available.

Unlike a fraud alert, it won't expire, so you won't have to remember to extend it. But you will need to unfreeze your credit if you decide to apply for credit. If you don't want to have to bother with freezing and unfreezing your credit every time you apply, then a fraud alert is a good choice.

A credit freeze only restricts who can look at your credit reports. It doesn't affect your score or stop you from using credit. A fraud alert is simply an extra layer of security; it doesn't affect your credit score either.

It's easier to apply for credit if you have a fraud alert rather than a credit freeze because an alert doesn't require any lifting or removing first.

0 thoughts on “Credit report alerts”