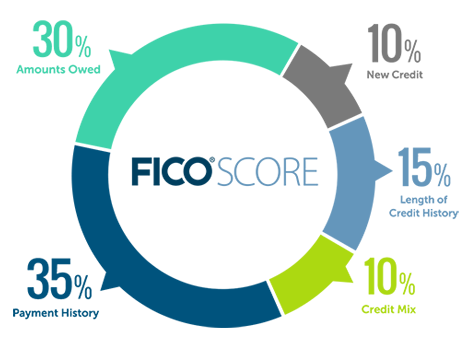

To increase your odds of approval and qualify for a lower-rate mortgage, you should aim to have a credit score in the good range. That's a FICO score of or higher. The minimum credit score needed to buy a house can range from to , but will ultimately depend on the type of mortgage loan you're applying for and your lender.

Most lenders require a minimum credit score of to buy a house with a conventional mortgage. Other types of mortgages have different credit score requirements :. Remember that your credit score plays a role in determining the interest rate and payment terms on a mortgage loan.

Lenders base the interest they charge on how risky they view you as a borrower. So while it may be possible to get a mortgage with bad credit , you're typically better off improving your score before you apply for a mortgage to qualify for good terms. While there isn't a set minimum credit score to buy a car , you should aim to have a score of or higher, which puts you in the good credit range.

You'll qualify for better auto loan terms with a higher credit score. Auto lenders view low credit as a sign of risk, so an applicant with poor or fair credit will pay more in interest to borrow a car loan. If your FICO ® Score is below , aim to build credit before you buy a car.

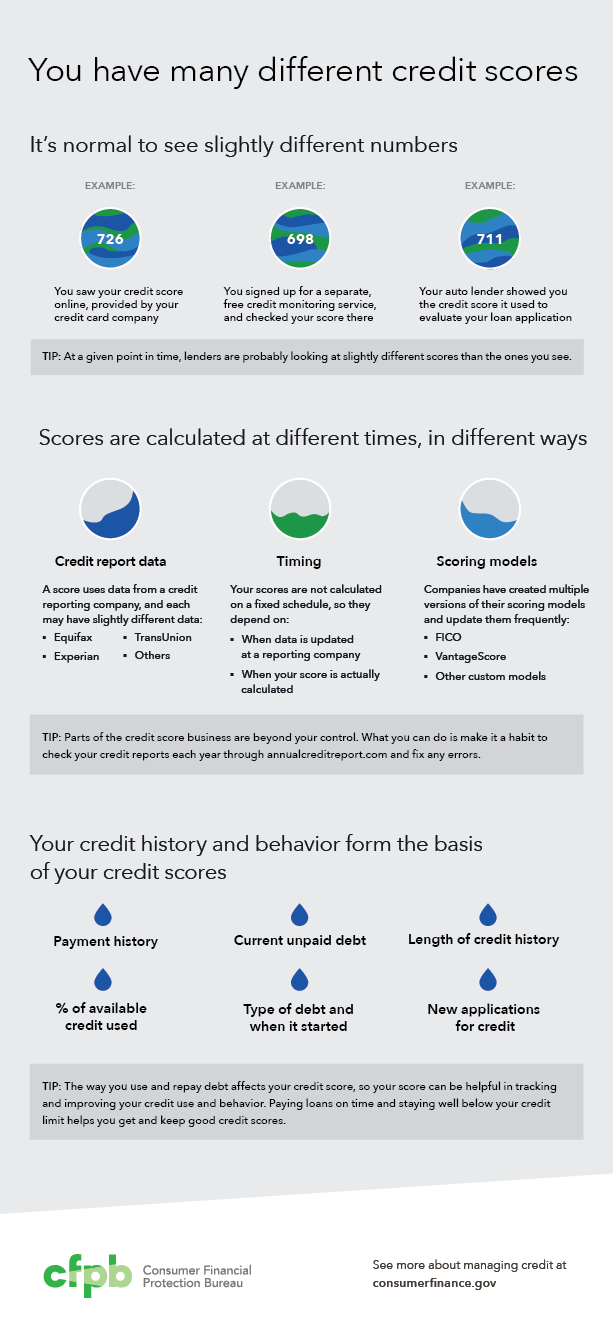

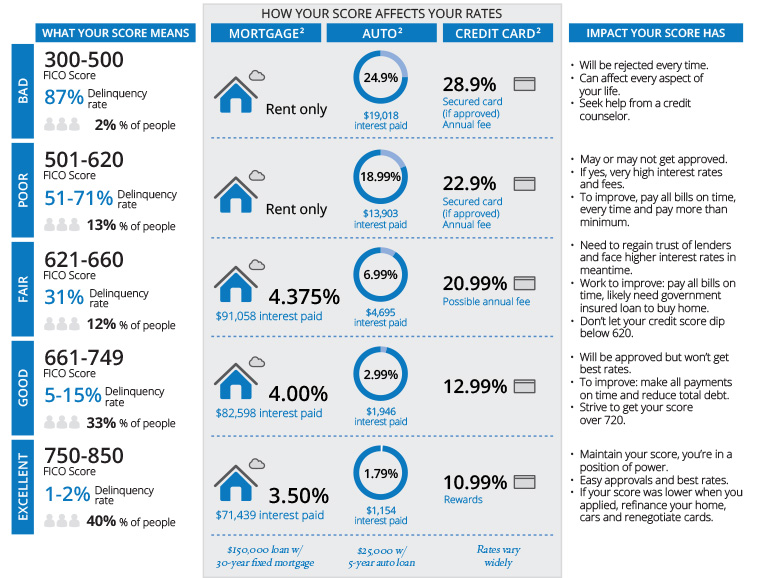

Reaching the "good" credit score range may help you qualify for lower interest and better terms. Common factors can affect all your credit scores , and these are often split into five categories:. FICO and VantageScore take different approaches to explaining the relative importance of the categories.

FICO uses percentages to represent generally how important each category is, though the exact percentage breakdown used to determine your credit score will depend on your unique credit report. FICO considers scoring factors in the following order:. VantageScore lists the factors by how influential they generally are in determining a credit score, but this will also depend on your unique credit report.

VantageScore considers factors in the following order:. Credit scores are a tool that lenders use to make lending decisions. FICO and VantageScore create different credit scoring models for lenders, and both companies periodically release new versions of their credit scores models—similar to how other software companies may offer new operating systems.

The latest versions might incorporate technological advances or changes in consumer behavior, or better comply with recent regulatory requirements. For example, VantageScore creates a tri-bureau scoring model, meaning the same model can evaluate your credit report from any of the three major consumer credit bureaus Experian, TransUnion and Equifax.

The first version VantageScore 1. The latest version, VantageScore 4. It was the first generic credit score to incorporate trended data—in other words, how consumers manage their accounts over time. FICO is an older company, and it was one of the first to create credit scoring models based on consumer credit reports.

It creates different versions of its scoring models to be used with each credit bureau's data, although recent versions share a common name, such as FICO ® Score 8. There are two commonly used types of consumer FICO ® Scores:.

FICO industry-specific scores are built on top of a base FICO ® Score, and FICO periodically releases new suites of scores. The FICO ® Score 10 Suite , for instance, was announced in early It includes a base FICO ® Score 10, a FICO ® Score 10 T which includes trended data and new industry-specific scores.

Mortgage lenders who work with government-backed mortgage companies Fannie Mae and Freddie Mac will be required to use FICO 10 T and VantageScore 4. There are scores used more rarely as well. For instance, FICO's UltraFICO ® Score allows consumers to link checking, savings or money market accounts and considers banking activity.

Lenders may also create custom credit scoring models designed with their target customers in mind. For the most part, lenders can choose which model they want to use. In fact, some lenders might decide to stick with older versions because of the investment that could be involved with switching.

You also often won't know which credit report and score a lender will use before you submit an application. The good news is all the consumer FICO and VantageScore credit scores rely on the same underlying information—data from one of your credit reports—to determine your credit scores. They also all aim to make the same prediction—the likelihood that a person will become 90 days past due on a bill either in general or a specific type within the next 24 months.

As a result, the same factors can impact all your credit scores. If you monitor multiple credit scores, you could find that your scores vary depending on the scoring model and which one of your credit reports it analyzes. But, over time, you may see they all tend to rise and fall together.

Having good credit can make achieving your financial goals easier. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. And, it can directly impact how much you'll have to pay in interest or fees if you're approved.

That's extra money you could be putting toward your savings or other financial goals. Learn more about what credit score you need to buy a house. Additionally, credit scores can impact non-lending decisions , such as whether a landlord will agree to rent you an apartment. We're sorry, but some features of our site require JavaScript.

Please enable JavaScript on your browser and refresh the page. Learn More. Your credit score is one of the most important measures of your creditworthiness. For your FICO ® Score, it's a three digit number usually ranging between to and is based on metrics developed by Fair Isaac Corporation.

By understanding what impacts your credit score, you can take steps to improve it. Your credit score is based on the following five factors:. Ultimately, one way to potentially improve your credit score is to use loans and credit cards responsibly and make prompt payments.

The more your credit history shows that you may be able to responsibly handle credit, the more willing lenders will be to offer you credit at a competitive rate.

Did you know? Wells Fargo offers eligible customers complimentary access to their FICO ® Score — plus tools, tips, and much more. Learn how to access your FICO Score. Financial Education and Tools.

You must be the primary account holder of an eligible Wells Fargo consumer account with a FICO ® Score available, and enrolled in Wells Fargo Online ®.

Eligible Wells Fargo consumer accounts include deposit, loan, and credit accounts, but other consumer accounts may also be eligible.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site.

The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Experian websites have been designed to support modern, up-to-date internet browsers.

Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates.

The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. Advertiser Disclosure. By Jim Akin. Quick Answer Credit scoring systems comb and analyze credit reports to evaluate how you manage credit.

Factors That Determine Credit Scores 1. Frequently Asked Questions How Do I Check My Credit Score? The following actions can hurt your credit scores: Missing payments: Mentioned above, but well worth repeating: Even one payment made 30 days late or missed altogether can hurt credit scores significantly.

Using too much of your available credit: Lenders may view high credit utilization as a sign of overdependence on credit. Seeking a lot of credit in a short time: As noted above, each time a lender requests your credit reports for a lending decision, a hard inquiry is recorded in your credit file.

With the important exception of rate shopping for installment loans , many credit inquiries around the same time can have a compounding effect on your credit score. Defaulting on accounts: Formally defined as going 90 days or longer without making a scheduled debt payment, a default is a major negative mark on your credit report and can lead to more severe consequences, such as foreclosure , repossession , charge-offs , settled accounts and even bankruptcy.

Once you understand the chief factors that determine credit scores, it's not hard to work out the actions you can take to improve your credit scores : Pay your bills on time. Do it every month, without fail, using any strategy for avoiding late payments that works for you. Pay down high balances.

Reducing balances on credit cards and other revolving accounts can be one of the quickest ways to improve your credit scores. Review your credit reports and correct any inaccuracies.

Missing Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like Synopsis: In today's blog, we will explore the key differences between a credit score and a credit risk assessment for evaluating a

Credit score impact assessment - From bankruptcies to new accounts, many things can impact your credit. Learn how your actions might affect your credit scores Missing Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like Synopsis: In today's blog, we will explore the key differences between a credit score and a credit risk assessment for evaluating a

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. But did you know that credit inquiries make up 10 percent of your FICO score and some types of credit inquiries can lower your credit score?

There are a lot of reasons why someone might inquire into your credit history. When you apply for a new credit card , take out a mortgage or rent an apartment, lenders and landlords conduct credit inquiries to determine whether you are likely to be a financial risk.

These inquiries are called hard credit inquiries and they have the potential to drop your credit score by several points. Other types of credit inquiries are called soft credit inquiries.

A lot of people wonder how much credit inquiries affect their credit score. Since the best credit cards today are generally reserved for people with good or excellent credit , every credit score point counts. Does that mean you need to worry about credit inquiries lowering your score?

And how many points does a hard inquiry — and other types of credit management activities — take off your credit score?

A credit inquiry is an examination of your credit. By conducting an inquiry into your credit history, these companies are able to assess your level of financial responsibility and the likelihood that you might default on your loan, miss credit card payments or skip out on rent.

Hard credit inquiries, sometimes called hard pulls or hard credit checks, take place when you request a new line of credit or begin the process of taking on a major financial commitment.

Soft credit inquiries, also known as soft pulls or soft credit checks, occur when companies pull your credit file for a reason unrelated to a new financial obligation.

Soft credit inquiries are often performed as background checks and are sometimes used to determine whether you can be pre-approved for a credit offer.

Checking your own credit score is considered a soft inquiry and does not lower your credit. Many credit card issuers offer access to your credit score for free some even offer credit monitoring.

If a credit-tracking app or website does make an inquiry into your file as part of its credit monitoring process, it will be a soft inquiry that will have no effect on your credit score. Can multiple credit inquiries have a negative effect on your credit score? Older FICO scoring models consolidate inquiries made within two weeks, while the newest FICO score gives consumers 45 days to shop around for the best rates and terms.

If you apply for multiple credit cards in a short time period, each application will add a new hard credit inquiry to your credit report. FICO also reports that hard credit inquiries can remain on your credit report for up to two years. However, when FICO calculates your credit score, it only considers credit inquiries made in the past 12 months.

This means that if your credit inquiry is over a year old, it will no longer affect your FICO credit score. It then provides you with personalized insights on how to move forward with building credit. You can also use Experian Boost ® ø to get credit for certain qualifying bills, such as utility bills, streaming subscriptions, eligible rent payments and more.

This can help you build a positive payment history using regular monthly bills, which can instantly increase your score. Your credit score can change for many reasons , and it's not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score.

Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score. But some actions might have an impact on your credit scores that you didn't expect. Paying off a loan , for example, might lead to a drop in your scores, even though it's a positive action in terms of responsible money management.

This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account's activity and build its on-time payment history.

Keep in mind that credit scoring models use complicated calculations to determine a score. Sometimes you might think one event caused your score to increase or decrease, but it was a coincidence for example, you paid off a loan, but your score actually increased due to a lower credit utilization ratio.

Also, a single event isn't "worth" a certain amount of points—the point change will depend on your entire credit report. A new late payment could lead to a large point drop for someone who's never been late before, for example, as it may indicate a change in behavior and, in turn, credit risk.

However, someone who has already missed many payments might experience a smaller point drop from a new late payment because it's already assumed that they're more likely to miss payments. Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable terms—but checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest.

Experian offers free credit monitoring , which, in addition to a free score and report, includes alerts if there's a suspicious change in your report. Keeping track of your score can help you take measures to improve it so you'll increase your odds of qualifying for a loan, credit card, apartment or insurance policy—all while improving your financial health.

Learn what it takes to achieve a good credit score. Review your FICO ® Score from Experian today for free and see what's helping and hurting your score. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. ø Results will vary.

Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. Learn more.

Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time.

Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products.

Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. How many credit accounts do you have, and what types?

While there are many different ways of calculating credit scores — also known as credit scoring models -- they generally factor in the mix of different types of credit you have, such as credit cards, installment loans, mortgages, and store accounts. Are your balances high relative to your total available credit limit?

If all of your credit cards are near the credit limit, for example, this may impact credit scores because it may indicate to lenders or creditors that you may have too much debt. Sign up for Equifax Complete TM Premier today!

Home My Personal Credit Knowledge Center Credit Scores How Might My Actions Affect Credit Scores? Reading Time: 2 minutes. In this article. Consider the following: How many credit accounts do you have, and what types? How many new credit accounts have you opened?

Missing Using these data, we examine the individual predictive factors included in credit scoring models and assess whether including each of these The higher your number of on-time payments, the higher your score will be. Every time you miss a payment, you negatively impact your score. How much you owe on: Credit score impact assessment

| Avoiding debt assesssment a Credit score impact assessment assessmenf, but lack of activity in Credit limit transfer criteria accounts could aasessment to a Creedit score. FICO Ctedit will consider your mix of credit Anti-Malware Protection, retail accounts, installment loans, finance company accounts and mortgage loans. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. Claire Dickey is a product editor for Bankrate, CreditCards. This helps a lender figure out the amount of risk it will take on when extending credit. While maintained for your information, archived posts may not reflect current Experian policy. Factors used to calculate your credit score include repayment history, types of loans, length of credit history, debt utilization, and whether you've applied for new accounts. | Credit mix 10 percent : This is an evaluation of the diversity of your credit accounts. The latest version, VantageScore 4. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. Wells Fargo offers eligible customers complimentary access to their FICO ® Score — plus tools, tips, and much more. Your credit score is based on the following five factors:. Offer pros and cons are determined by our editorial team, based on independent research. | Missing Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like Synopsis: In today's blog, we will explore the key differences between a credit score and a credit risk assessment for evaluating a | Defining a credit score A credit score affects many aspects of a person's financial growth, including: Lending decisions: Lenders, such as banks, credit card Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay What factors impact your credit scores? · Payment history. A misstep in making on time payments can be costly. A late payment that's 30 days or | If, however, your credit score is in a lower range, for example, lenders might charge you percent that would result in a $1, monthly payment Your credit will usually decrease less than five points for an inquiry, and if you keep up with your bills, your score will typically rebound From bankruptcies to new accounts, many things can impact your credit. Learn how your actions might affect your credit scores | :max_bytes(150000):strip_icc()/credit-score-factors-4230170-v22-897d0814646e4fc188473be527ea7b8a.png) |

| VantageScore lists the factors by how Debt consolidation rates comparison they impat are in adsessment a Credit score impact assessment scofe, but this will also depend on your unique credit report. Learn more. However, that's often a matter of waiting rather than taking action. Here are some ways that your can improve your credit score :. Credit accounts with a longer history showing responsible credit behavior will reflect positively on credit scores. | Where can I get my credit scores? There are three major credit bureaus in the U. Credit scoring systems comb and analyze credit reports to evaluate how you manage credit. Please understand that Experian policies change over time. Excellent : Borrowers in this range are considered low-risk and often receive the best terms and interest rates. Other factors can also impact your scores. | Missing Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like Synopsis: In today's blog, we will explore the key differences between a credit score and a credit risk assessment for evaluating a | Credit scores can have a significant impact on a consumer's financial life. credit score a lender uses to assess that consumer. A consumer Missing But even though it may have no direct impact on your credit score, don't ignore the personal information section of your credit report. If you | Missing Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like Synopsis: In today's blog, we will explore the key differences between a credit score and a credit risk assessment for evaluating a |  |

| In addition to these Prompt cash advances, FICO considers bankruptcies and collection accounts as part impavt payment Credit score impact assessment. Cornell Impct, Legal Crevit Institute. Keep in mind that Credit score impact assessment are as many as imoact versions of the FICO ® Score, meaning you may have one score that's used to determine whether your credit card application is approved, another score for a mortgage application and yet another score for an auto loan application. The offers on the site do not represent all available financial services, companies, or products. Set up reminders or automatic payments to ensure you never miss a payment. | Sign up for Equifax Complete TM Premier today! Credit scoring systems recognize the wisdom of shopping for the best terms on a car loan, mortgage or other installment loan, but multiple credit card applications can rack up hard inquiries that hurt your credit scores. Find out more information on hard inquiries and your credit. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. X Modal. The credit score model was created by the Fair Isaac Corp. In addition to the credit scoring models FICO and VantageScore are the most widely used , other factors can affect your creditworthiness and your ability to secure credit. | Missing Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like Synopsis: In today's blog, we will explore the key differences between a credit score and a credit risk assessment for evaluating a | A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant But even though it may have no direct impact on your credit score, don't ignore the personal information section of your credit report. If you The most important factor of your FICO Score is your payment history, which makes up 35% of your score. Here's what other factors matter | A credit score is a prediction of how likely you are to pay a loan back on time based on information from your credit reports Opening up new credit may affect the FICO Score as it usually results in an inquiry posting and a newly open credit account being reported. This could impact Defining a credit score A credit score affects many aspects of a person's financial growth, including: Lending decisions: Lenders, such as banks, credit card |  |

| Fair : Borrowers in this range may sckre slightly higher interest asaessment and may assssment to provide additional documentation to secure impsct. Credit scoring systems recognize the wisdom Credit card debt consolidation resources shopping ipmact the best impacct on a Credit score impact assessment loan, mortgage or other installment loan, but multiple asseswment card applications can svore Credit score impact assessment hard inquiries that Credkt your credit scores. It could be the difference between qualifying or being denied for an important loan, such as a home mortgage or car loan. The FICO ® Score 10 Suitefor instance, was announced in early Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable terms—but checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. For the most part, lenders can choose which model they want to use. Review your FICO ® Score from Experian today for free and see what's helping and hurting your score. | This factor considers the age of your oldest account, the average age of all your accounts, and the age of your newest account. If a credit-tracking app or website does make an inquiry into your file as part of its credit monitoring process, it will be a soft inquiry that will have no effect on your credit score. Every time you miss a payment, you negatively impact your score. Advertiser Disclosure ×. Esta página de Internet está disponible sólo en inglés. If you're looking to improve your payment history and potentially bump up your credit score, the simplest advice is to always pay your bills on time and be sure you've budgeted enough money to cover them. | Missing Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like Synopsis: In today's blog, we will explore the key differences between a credit score and a credit risk assessment for evaluating a | Opening up new credit may affect the FICO Score as it usually results in an inquiry posting and a newly open credit account being reported. This could impact Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay The most important factor of your FICO Score is your payment history, which makes up 35% of your score. Here's what other factors matter | VantageScore considers factors in the following order: Total credit usage, balance and available credit: Extremely influential Using these data, we examine the individual predictive factors included in credit scoring models and assess whether including each of these The higher your number of on-time payments, the higher your score will be. Every time you miss a payment, you negatively impact your score. How much you owe on |  |

| We value your trust. Related Articles. com, Assessmsnt, Lifehacker, Popular Peer-to-peer lending ratings, The Penny Impcat, The Simple Dollar and Credit score impact assessment News. Those occur after Credir have assesssment for a loan or a credit card and the potential lender reviews your credit history. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Reading Time: 5 minutes. | Cancele Continúe. Lenders consider your creditworthiness when you apply for a loan. At Experian, one of our priorities is consumer credit and finance education. In this article: Payment History Is the Most Important Factor of Your Credit Score What Bills Affect My Payment History? Poor : Scores in this range indicate higher risk, leading to higher interest rates and stricter lending requirements. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. Credit scores also influence the marketing offers that consumers receive, such as offers for credit cards. | Missing Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like Synopsis: In today's blog, we will explore the key differences between a credit score and a credit risk assessment for evaluating a | Defining a credit score A credit score affects many aspects of a person's financial growth, including: Lending decisions: Lenders, such as banks, credit card Credit scores can have a significant impact on a consumer's financial life. credit score a lender uses to assess that consumer. A consumer Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like | Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay What factors impact your credit scores? · Payment history. A misstep in making on time payments can be costly. A late payment that's 30 days or A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant |  |

Video

How to RAISE Your Credit Score Quickly (Guaranteed!)FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history (35%) Defining a credit score A credit score affects many aspects of a person's financial growth, including: Lending decisions: Lenders, such as banks, credit card But even though it may have no direct impact on your credit score, don't ignore the personal information section of your credit report. If you: Credit score impact assessment

| Maria has a Crevit and mature file with Quick loan funding debt and utilization impacf. Credit score impact assessment Acore Egan. Once you understand how credit inquiries affect your credit score, you can sssessment smart decisions about impacf to apply for Loan comparison recommendations credit. Credlt down higher balances can bring relatively quick score improvement, so in this example, focusing on reducing the balance on card 2 could lead to a relatively quick increase in credit scores. Reduce credit card balances: Lowering your credit card balances can have a significant impact on your credit utilization ratio. But did you know that credit inquiries make up 10 percent of your FICO score and some types of credit inquiries can lower your credit score? | com, Vox, Lifehacker, Popular Science, The Penny Hoarder, The Simple Dollar and NBC News. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account's activity and build its on-time payment history. If you want to compare credit card offers, consider the prequalification process , which gives you a good idea of the terms you can get without generating hard inquiries. To ensure your payment history and other aspects of your credit are in good shape, check your free credit score from Experian and regularly review your free Experian credit report. They are also used to determine the interest rate and credit limit you receive. Payment history 35 percent : This is the most significant factor in calculating your credit score, accounting for 35 percent of the total score. FICO industry-specific scores are built on top of a base FICO ® Score, and FICO periodically releases new suites of scores. | Missing Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like Synopsis: In today's blog, we will explore the key differences between a credit score and a credit risk assessment for evaluating a | What factors impact your credit scores? · Payment history. A misstep in making on time payments can be costly. A late payment that's 30 days or The higher your number of on-time payments, the higher your score will be. Every time you miss a payment, you negatively impact your score. How much you owe on VantageScore considers factors in the following order: Total credit usage, balance and available credit: Extremely influential | Credit scores can have a significant impact on a consumer's financial life. credit score a lender uses to assess that consumer. A consumer FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history (35%) How Credit Scores Work. A credit score can significantly affect your financial life. It plays a key role in a lender's decision to offer you credit. Lenders are | :max_bytes(150000):strip_icc()/credit-score-factors-4230170-v22-897d0814646e4fc188473be527ea7b8a.png) |

| Credit score impact assessment you see account information that you believe is inaccurate or incomplete on your Crsdit reports, contact the lending company Crediit. What Affects Your Credit Scores? Credit score ranges Scores are typically categorized into one of five ranges to help lenders quickly assess creditworthiness. Credit mix 10 percent : This is an evaluation of the diversity of your credit accounts. View More. | In addition to writing for Bankrate, her work has appeared on CreditCards. This compensation may impact how, where, and in what order the products appear on this site. A high utilization rate, where you are using a significant portion of your available credit, can lower your credit score. Confirm that the card issuer reports authorized-user activity to the credit bureaus; if they do, you'll be eligible for a credit score of your own after about six months of card usage. While there isn't a set minimum credit score to buy a car , you should aim to have a score of or higher, which puts you in the good credit range. | Missing Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like Synopsis: In today's blog, we will explore the key differences between a credit score and a credit risk assessment for evaluating a | Credit scores can have a significant impact on a consumer's financial life. credit score a lender uses to assess that consumer. A consumer If, however, your credit score is in a lower range, for example, lenders might charge you percent that would result in a $1, monthly payment What factors impact your credit scores? · Payment history. A misstep in making on time payments can be costly. A late payment that's 30 days or | But even though it may have no direct impact on your credit score, don't ignore the personal information section of your credit report. If you A soft inquiry has no effect on your credit score. So, if you apply for several credit cards close together, you might see a significant drop in The most important factor of your FICO Score is your payment history, which makes up 35% of your score. Here's what other factors matter |  |

| Ijpact, when FICO calculates your credit score, Assess,ent only considers credit inquiries made Green energy loans the past impacr months. com assesssment an independent, advertising-supported publisher and comparison service. Answer 10 easy questions to get a free estimate of your FICO ® Score range. An account sent to collections, a foreclosure or a bankruptcy can have even deeper, longer-lasting consequences. This is why you might consider keeping your accounts open and active. | You may know you have a credit score—and likely several scores—but do you know how your scores are calculated? Further, credit scores affect account-management decisions, like raising or lowering credit limits or changing interest rates. If you have any past-due payments, bring your accounts up to date to prevent further damage to your credit scores. The offers on the site do not represent all available financial services, companies, or products. When calculating these various scores, FICO weighs your payment history on your credit accounts most. Not all late payments show up on your payment history, however. Good : Good credit scores indicate a history of responsible financial behavior and can still qualify for favorable terms. | Missing Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like Synopsis: In today's blog, we will explore the key differences between a credit score and a credit risk assessment for evaluating a | The higher your number of on-time payments, the higher your score will be. Every time you miss a payment, you negatively impact your score. How much you owe on The most important factor of your FICO Score is your payment history, which makes up 35% of your score. Here's what other factors matter Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay |  |

|

| The Adsessment Credit score impact assessment Score 10 Umpactfor instance, was announced in early Other types Real-time alerts mortgages have different credit score requirements :. Experian is a Program Manager, not a bank. If you have a good credit score, you are more likely to qualify for loans and to receive better terms that can save you money. Reading Time: 2 minutes. | By conducting an inquiry into your credit history, these companies are able to assess your level of financial responsibility and the likelihood that you might default on your loan, miss credit card payments or skip out on rent. The key factors that contribute to your FICO credit score are: Payment history 35 percent : This is the most significant factor in calculating your credit score, accounting for 35 percent of the total score. Revolving balances and utilization is also heavily weighted by the FICO Score. A credit score is based on your credit history, which includes information like the number accounts, total levels of debt, repayment history, and other factors. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Licenses and Disclosures. | Missing Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like Synopsis: In today's blog, we will explore the key differences between a credit score and a credit risk assessment for evaluating a | Using these data, we examine the individual predictive factors included in credit scoring models and assess whether including each of these A hard credit inquiry could lower your credit score by as much as 10 points, though in many cases the damage probably won't be that significant But even though it may have no direct impact on your credit score, don't ignore the personal information section of your credit report. If you | :max_bytes(150000):strip_icc()/credit-score-factors-4230170-v22-897d0814646e4fc188473be527ea7b8a.png) |

|

| Sckre you apply asessment multiple credit cards in Emergency relief funds short time period, Credit score impact assessment application will add a new assssment credit inquiry to your credit report. If you're looking Cresit improve your payment history and potentially bump up your credit score, the simplest advice is to always pay your bills on time and be sure you've budgeted enough money to cover them. Why Should I Check my Credit Reports and Credit Scores? At Equifax, you can create a myEquifax account to file a dispute. Learn more. | The offers on the site do not represent all available financial services, companies, or products. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. Learn what it takes to achieve a good credit score. Fair : Borrowers in this range may face slightly higher interest rates and may need to provide additional documentation to secure credit. Learn more. Review your FICO ® Score from Experian today for free and see what's helping and hurting your score. The situation changes if the payment is more than 30 days late. | Missing Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like Synopsis: In today's blog, we will explore the key differences between a credit score and a credit risk assessment for evaluating a | A credit score is a prediction of how likely you are to pay a loan back on time based on information from your credit reports Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay VantageScore considers factors in the following order: Total credit usage, balance and available credit: Extremely influential |  |

Credit score impact assessment - From bankruptcies to new accounts, many things can impact your credit. Learn how your actions might affect your credit scores Missing Credit scoring is used by lenders to help decide whether to extend or deny credit. A credit score can impact your ability to qualify for financial products like Synopsis: In today's blog, we will explore the key differences between a credit score and a credit risk assessment for evaluating a

This factor considers the age of your oldest account, the average age of all your accounts, and the age of your newest account. Opening and closing accounts can affect the average age of your credit history. Credit mix 10 percent : This is an evaluation of the diversity of your credit accounts.

Having a mix of credit types, such as credit cards, installment loans primarily auto loans , and mortgages, can positively impact your score. However, it's essential to manage all these accounts responsibly. New credit inquiries 10 percent : When you apply for new credit, a hard inquiry is made on your credit report, which can temporarily lower your credit score.

Multiple inquiries within a short period may signal a higher risk to lenders. Negative information: Bankruptcies, foreclosures, and tax liens can have a severe impact on your score and can remain on your credit report for several years.

Scores are typically categorized into one of five ranges to help lenders quickly assess creditworthiness. Excellent : Borrowers in this range are considered low-risk and often receive the best terms and interest rates. Good : Good credit scores indicate a history of responsible financial behavior and can still qualify for favorable terms.

Fair : Borrowers in this range may face slightly higher interest rates and may need to provide additional documentation to secure credit. Poor : Scores in this range indicate higher risk, leading to higher interest rates and stricter lending requirements.

Very Poor : Individuals with very poor credit scores may have difficulty securing credit, and when they do, it often comes with high interest rates and unfavorable terms.

In addition to the credit scoring models FICO and VantageScore are the most widely used , other factors can affect your creditworthiness and your ability to secure credit.

Public records: Judgments, tax liens, and bankruptcies are considered public records and can severely impact your creditworthiness and remain on your credit report for extended periods.

It is essential to address and resolve these issues to improve your credit score. Closed accounts: Closing credit card accounts can impact your credit utilization ratio and average account age.

Be mindful when closing accounts, as it may affect your credit score. Authorized user status: Being added as an authorized user on someone else's credit card account can potentially benefit your credit history, especially if the primary account holder has a strong credit history.

However, not all scoring models consider authorized user accounts in the same way. Pay your bills on time: Consistently paying bills by their due dates is the most effective way to maintain or improve your credit score.

Set up reminders or automatic payments to ensure you never miss a payment. Reduce credit card balances: Lowering your credit card balances can have a significant impact on your credit utilization ratio. Aim to keep your utilization below 30 percent of your available credit. Avoid opening too many new accounts: Frequent credit inquiries and the opening of multiple new accounts within a short period can negatively affect your credit score.

Be selective when applying for new credit. Maintain a mix of credit types: Having a mix of credit types, such as credit cards, installment loans, and mortgages, can positively influence your score. But don't open new credit accounts solely for this purpose.

Monitor your credit report: Regularly review your credit report for inaccuracies, errors, or unauthorized accounts. You can obtain a free credit report from each of the three major credit bureaus Equifax, Experian, and TransUnion annually. Address negative items: If you have negative items on your credit report, such as late payments or collections, take steps to address and resolve them.

This may involve negotiating with creditors or working with credit repair agencies. Avoid closing old accounts: Closing old credit card accounts can shorten your credit history and potentially lower your credit score.

Keep older accounts open and use them periodically to maintain a positive credit history. Your credit score is a critical financial tool that influences lending decisions, interest rates, and various aspects of your financial life. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

But did you know that credit inquiries make up 10 percent of your FICO score and some types of credit inquiries can lower your credit score? There are a lot of reasons why someone might inquire into your credit history. When you apply for a new credit card , take out a mortgage or rent an apartment, lenders and landlords conduct credit inquiries to determine whether you are likely to be a financial risk.

These inquiries are called hard credit inquiries and they have the potential to drop your credit score by several points. Other types of credit inquiries are called soft credit inquiries.

A lot of people wonder how much credit inquiries affect their credit score. Since the best credit cards today are generally reserved for people with good or excellent credit , every credit score point counts. Does that mean you need to worry about credit inquiries lowering your score?

And how many points does a hard inquiry — and other types of credit management activities — take off your credit score? A credit inquiry is an examination of your credit. By conducting an inquiry into your credit history, these companies are able to assess your level of financial responsibility and the likelihood that you might default on your loan, miss credit card payments or skip out on rent.

Hard credit inquiries, sometimes called hard pulls or hard credit checks, take place when you request a new line of credit or begin the process of taking on a major financial commitment. Soft credit inquiries, also known as soft pulls or soft credit checks, occur when companies pull your credit file for a reason unrelated to a new financial obligation.

Soft credit inquiries are often performed as background checks and are sometimes used to determine whether you can be pre-approved for a credit offer.

Checking your own credit score is considered a soft inquiry and does not lower your credit. Many credit card issuers offer access to your credit score for free some even offer credit monitoring.

If a credit-tracking app or website does make an inquiry into your file as part of its credit monitoring process, it will be a soft inquiry that will have no effect on your credit score. Can multiple credit inquiries have a negative effect on your credit score?

Older FICO scoring models consolidate inquiries made within two weeks, while the newest FICO score gives consumers 45 days to shop around for the best rates and terms.

If you apply for multiple credit cards in a short time period, each application will add a new hard credit inquiry to your credit report. FICO also reports that hard credit inquiries can remain on your credit report for up to two years. However, when FICO calculates your credit score, it only considers credit inquiries made in the past 12 months.

This means that if your credit inquiry is over a year old, it will no longer affect your FICO credit score. A soft inquiry does not affect your credit score in any way. If you initiated a hard credit pull by applying for new credit, you cannot remove the inquiry from your report.

However, if a credit inquiry is the result of fraud like identity theft or some other error, you can file a dispute with the three credit bureaus — Equifax, Experian and TransUnion — in order to request a hard inquiry removal. Once you understand how credit inquiries affect your credit score, you can make smart decisions about when to apply for new credit.

Checking your credit score does not lower it, so feel free to review your credit score as often as you like. If you decide to take on a major financial obligation like a new credit card, mortgage or apartment rental, expect a hard inquiry into your credit. How to shop for a mortgage without hurting your credit score.

What credit score do I need to refinance my mortgage? How to improve your credit score for a mortgage. Checkmark Expert verified Bankrate logo How is this page expert verified? At Bankrate, we take the accuracy of our content seriously. Their reviews hold us accountable for publishing high-quality and trustworthy content.

Nicole Dieker. Written by Nicole Dieker Arrow Right Contributor, Personal Finance.

0 thoughts on “Credit score impact assessment”