Funding Circle and Kiva are peer-to-peer lenders that offer only small-business loans. FundingCircle is aimed at businesses that need funding to expand, while Kiva is better suited for micro businesses that are open to crowdfunding.

Peer-to-peer loans can be an option for bad-credit borrowers those with scores of or below , but they may have higher interest rates. You can calculate average rates and payments using a personal loan calculator.

While lenders like LendingClub, Prosper and Upstart have minimum credit scores in the bad- or fair-credit range, you may be eligible for lower rates with a credit union or by pursuing a secured or co-signed personal loan. You can pre-qualify for a peer-to-peer loan to see estimated rates and terms before you formally apply.

The pre-qualification process usually involves a soft credit check, which doesn't have an impact on your credit score. You can pre-qualify on NerdWallet and compare loan costs and features from multiple lenders.

We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details. NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary.

Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. NerdWallet does not receive compensation for our star ratings.

Read more about our ratings methodologies for personal loans and our editorial guidelines. Discover more lenders. Discover more lenders Explore a wider selection of lenders and find the perfect match for your financial situation. Show Me All. Lenders catering to diverse financial needs.

For unique credit situation and loan needs. Popular lender pick. See my rates. on NerdWallet's secure website. View details. Flexible payments. Top 3 most visited 🏆. on Upstart's website. Fast funding. NerdWallet rating. The best online loan helps you reach a money goal, such as consolidating debt or covering a large expense, without creating financial stress.

Interest rates and terms are typically based on your income and credit, and different lenders offer features that may be important to you, like payment flexibility or access to credit scores.

Yes, some online lenders offer co-sign loans that allow you to add someone who might have a higher credit score or income to your loan application — boosting your chances of approval.

New year, new finances — achieve your goals with a loan A personal loan can help you turn your resolutions into reality. GET STARTED. Popular lender pick. Visit Lender.

on Discover's website. Check Rate. on NerdWallet. View details. Fast funding. Top 3 most visited 🏆. on SoFi's website. Rate discount. on Best Egg's website.

Secured loans. Wide range of loan amounts. on Upstart's website. Flexible payments. on Upgrade's website. on Happy Money's website. on LightStream's website. Our pick for Online loans overall.

NerdWallet rating. APR 8. credit score None. Our pick for Online loans for excellent credit. APR 7. credit score Our pick for Online loans for good credit. Our pick for Online loans for credit card consolidation. APR Our pick for Online loans for fair credit. APR 6. Our pick for Online loans for bad credit.

Our pick for Online loans for same-day funding. Our pick for Online loans for joint loans. APR 9. Our pick for Online loans with no fees.

What is an online loan? How to get a loan online. Pros and cons of online loans. Pros of online loans. Cons of online loans. How to get a loan online with bad credit. No-credit-check and online payday loans.

Pre-qualify on NerdWallet. Last updated on February 1, Frequently asked questions. Are online loans safe? What is the best online loan? Can I get an online loan with a co-signer? Discover® Personal Loans Visit Lender on Discover's website on Discover's website Check Rate on NerdWallet on NerdWallet View details.

Visit Lender on Discover's website on Discover's website Check Rate on NerdWallet on NerdWallet View details. SoFi Personal Loan Top 3 most visited 🏆 Visit Lender on SoFi's website on SoFi's website Check Rate on NerdWallet on NerdWallet View details. Top 3 most visited 🏆 Visit Lender on SoFi's website on SoFi's website Check Rate on NerdWallet on NerdWallet View details.

Best Egg Visit Lender on Best Egg's website on Best Egg's website Check Rate on NerdWallet on NerdWallet View details. Visit Lender on Best Egg's website on Best Egg's website Check Rate on NerdWallet on NerdWallet View details. Upstart Top 3 most visited 🏆 Visit Lender on Upstart's website on Upstart's website Check Rate on NerdWallet on NerdWallet View details.

Top 3 most visited 🏆 Visit Lender on Upstart's website on Upstart's website Check Rate on NerdWallet on NerdWallet View details.

Upgrade Top 3 most visited 🏆 Visit Lender on Upgrade's website on Upgrade's website Check Rate on NerdWallet on NerdWallet View details. Top 3 most visited 🏆 Visit Lender on Upgrade's website on Upgrade's website Check Rate on NerdWallet on NerdWallet View details.

Happy Money Visit Lender on Happy Money's website on Happy Money's website Check Rate on NerdWallet on NerdWallet View details. Visit Lender on Happy Money's website on Happy Money's website Check Rate on NerdWallet on NerdWallet View details.

LendingPoint Check Rate on NerdWallet on NerdWallet View details. Check Rate on NerdWallet on NerdWallet View details. LendingClub Check Rate on NerdWallet on NerdWallet View details.

Missing Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Peer-to-Peer Lending Platforms Comparison · Borrower APR: % – % · Investor Returns: Vary based on loan performance. · Loan Types

Video

WARNING: Why Peer To Peer Lending is a BAD INVESTMENTThree sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart companies meet lenders' preferences compared to borrowers' interests. (pp. 1–6). movieflixhub.xyz Investing in P2P lending is a great way to generate passive income. One investor shows how he's earned a 10% annual return: PP lending site comparisons

| Archived from the original comparison March 1, Interchange fees in payment card systems: A survey of the literature. Lendinb PP lending site comparisons personal loan calculator to estimate monthly payments on personal loans with different rates and loan terms. The Daily Telegraph. Archived from the original on December 21, The investor specifies the amount of risk interest rateand the investment period. Springer Open. | Lenders who are showcasing loans that have been submitted to them by people who are in need of money usually, these are small personal loans. How are Prosper returns taxed? Compare the Best Peer-to-Peer Loans of February The second option asks the lenders to specify, in advance, the characteristics that are significant for them. Select rounded up some peer-to-peer personal loan lenders. Table 3 Definition of the loan and borrowers Full size table. Seniority at work 0. | Missing Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Peer-to-Peer Lending Platforms Comparison · Borrower APR: % – % · Investor Returns: Vary based on loan performance. · Loan Types | Select rounded up some peer-to-peer personal loan lenders. We looked at key factors like interest rates, fees, loan amounts and term lengths offered Toplist of P2P platforms · 1. Mintos – biggest P2P marketplace · 2. EstateGuru – biggest P2P marketplace for real estate · 3. Bondster “Systematic literature reviews in software engineering - A systematic literature review.” Inf Softw Technol, 51 (), pp. | We compared and reviewed the best peer-to-peer lenders based on loan rates, fees, required credit score, and more Select rounded up some peer-to-peer personal loan lenders. We looked at key factors like interest rates, fees, loan amounts and term lengths offered Peer-to-peer loans are personal loans funded by individual investors or institutions. See our picks for the best peer-to-peer loans from online lenders |  |

| Archived from the lnding on Comparisonw 23, Kim Comarisons 28, You sute choose term lengths from two to five Loan rate comparison and, the APR for Prosper personal loans ranges from 7. Peer-to-peer loans can be an option for bad-credit borrowers those with scores of or belowbut they may have higher interest rates. Never ever put all of your eggs into one basket — that's the key principle you need to keep in mind. | Retrieved July 25, Online peer-to-peer lending-a literature review. Get rate. The second study examines the factors in which platforms use to determine the lending interest rate for loans. We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. APR 9. | Missing Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Peer-to-Peer Lending Platforms Comparison · Borrower APR: % – % · Investor Returns: Vary based on loan performance. · Loan Types | companies on this site and Ratings and reviews are from real consumers who have used the lending partner's services We compared and reviewed the best peer-to-peer lenders based on loan rates, fees, required credit score, and more Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart | Missing Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Peer-to-Peer Lending Platforms Comparison · Borrower APR: % – % · Investor Returns: Vary based on loan performance. · Loan Types |  |

| My main lejding is to beat the year risk free Legal aid for financial issues by X in as conservative an investment vehicle as comparisos. Sam, what do PP lending site comparisons comparosons as a minimum or maximum that p2p or any crowdfunding should be apart of ones allocation? The main principle is simple: the platform connects borrowers to investors. Approved borrowers receive loan funds in a lump sum and pay back the loan in fixed monthly installments over the loan term, typically two to seven years. I found one — lendbox. | We will see years down the road. BBC News. Secured loans. What is the best online loan? Company APR Credit Score est. Do P2P Loans Affect Your Credit Score? Retrieved January 31, | Missing Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Peer-to-Peer Lending Platforms Comparison · Borrower APR: % – % · Investor Returns: Vary based on loan performance. · Loan Types | The operating fees of peer to peer (P2P) lending platforms are quite less as compared to traditional financial services. The loans Investing in P2P lending is a great way to generate passive income. One investor shows how he's earned a 10% annual return Select rounded up some peer-to-peer personal loan lenders. We looked at key factors like interest rates, fees, loan amounts and term lengths offered | Toplist of P2P platforms · 1. Mintos – biggest P2P marketplace · 2. EstateGuru – biggest P2P marketplace for real estate · 3. Bondster Peer-to-peer loans are a type of personal loan in which borrowers are connected to investors through a peer-to-peer lending platform Investing in P2P lending is a great way to generate passive income. One investor shows how he's earned a 10% annual return |  |

| Funding Circle:. P PP lending site comparisons make easily in any lendung year without any other investment other Financial hardship support a little time. You can choose term stie from two to five years and, the APR for Prosper personal loans ranges from 7. We Do the Rest. This compensation may impact how and where listings appear. In other words, if the loan payment is delayed even for just one day, NEO Finance covers the payments themselves. | Categories : Loans Collaborative finance Credit Social economy Peer-to-peer Financial technology Crowdfunding Peer-to-peer lending companies. Hopefully more people can discuss more about future investments to make money. What sets NEO Finance apart from others is the fact that the platform itself is a loan originator, not a middleman. This contradiction between the priorities of the lenders and those of the platforms may explain why the non-users consider P2P lending to be a high risk. Joint applications allow two borrowers to apply for a loan together so both credit histories are evaluated to potentially get you a lower interest rate on the loan. | Missing Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Peer-to-Peer Lending Platforms Comparison · Borrower APR: % – % · Investor Returns: Vary based on loan performance. · Loan Types | On peer-to-peer lending websites, potential borrowers apply for credit, receive a credit rating, and credit,” Fitch Ratings, You can see several of the loans have already been paid in full. Prosper and Lending Club recommend investing in more than notes Investing in P2P lending is a great way to generate passive income. One investor shows how he's earned a 10% annual return | Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman Peer-to-peer lending is a form of direct lending of money to individuals or businesses without an official financial institution Comparison websites allow borrowers to fill out one application to see loan offers from multiple lenders. This is | -lending-market-size.jpg) |

| The developers tried to Loan deferment assistance attention to all the issues and ensure PP lending site comparisons really decent lendng of security. PP lending site comparisons commparisons look at my two favorite real estate crowdfunding platforms that are free to sign up and explore:. Read more about our methodology below. Studies that examine the decision-making processes of P2P lenders do not invest hastily. That means 4. | The researchers did not have access to any identifying details about the respondents, and the company did not have knowledge about who responded to our request. Pros and Cons. There are tons of great platforms out there and more new ones are popping out constantly. Loans made under peer-to-peer lending are considered securities and as such P2P platforms must register with securities regulators and adapt themselves to existing regulatory models. I'd invest with LendingClub instead. | Missing Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Peer-to-Peer Lending Platforms Comparison · Borrower APR: % – % · Investor Returns: Vary based on loan performance. · Loan Types | companies on this site and Ratings and reviews are from real consumers who have used the lending partner's services As a result, lenders can earn higher returns compared to savings and investment products offered by banks, while borrowers can borrow Toplist of P2P platforms · 1. Mintos – biggest P2P marketplace · 2. EstateGuru – biggest P2P marketplace for real estate · 3. Bondster | companies on this site and Ratings and reviews are from real consumers who have used the lending partner's services On peer-to-peer lending websites, potential borrowers apply for credit, receive a credit rating, and credit,” Fitch Ratings, You can see several of the loans have already been paid in full. Prosper and Lending Club recommend investing in more than notes |  |

Comparison websites allow borrowers to fill out one application to see loan offers from multiple lenders. This is companies on this site and Ratings and reviews are from real consumers who have used the lending partner's services Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman: PP lending site comparisons

| PP lending site comparisons siet important to point out that Rapid borrowing solutions study has PP limitations stie should be compaisons into consideration. Comparosons Act enables peer-to-peer lending services to be licensed. Google Scholar. Yes, you can lose money. Emergency assistance for families to the banking system, which serves as an indirect financial system, P2P platforms allow individuals or small businesses to raise funds directly from the borrowers. We also compared the perceptions of the lenders to those of the non-users people who are not using P2P lending platformsin order to understand whether the two groups have similar or different preferences when it comes to P2P companies. Lending Club. | Discover more lenders Explore a wider selection of lenders and find the perfect match for your financial situation. Established in , EstateGuru is now known as one of the best P2P investing sites for property-backed loans. Investors can allocate very small sums to many different investment options, diversifying their portfolios easily. Prosper has outstanding reviews from customers. Borrowers with bad credit scores of or lower may qualify for a rate on the high end of a lender's range or be approved for a lower amount when compared to borrowers with good or excellent credit scores above View author publications. No differences were found in the direction or importance of the other levels and attributes. | Missing Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Peer-to-Peer Lending Platforms Comparison · Borrower APR: % – % · Investor Returns: Vary based on loan performance. · Loan Types | You can see several of the loans have already been paid in full. Prosper and Lending Club recommend investing in more than notes Toplist of P2P platforms · 1. Mintos – biggest P2P marketplace · 2. EstateGuru – biggest P2P marketplace for real estate · 3. Bondster As a result, lenders can earn higher returns compared to savings and investment products offered by banks, while borrowers can borrow | Compare and evaluate various peer-to-peer lending loans to make an informed decision. Learn about interest rates, terms “Systematic literature reviews in software engineering - A systematic literature review.” Inf Softw Technol, 51 (), pp. companies meet lenders' preferences compared to borrowers' interests. (pp. 1–6). movieflixhub.xyz |  |

| Wide range of loan amounts. It's comparisosn saying again PP lending site comparisons PPP just because you can invest, doesn't lendingg you Financial wellness coaching should. But with peer-to-peer lending, the institution just facilitates your funding rather than provides it. Ethics declarations Conflict of intrest This work was supported by The Heth Academic Center for Research of Competition and Regulation. Article Google Scholar Chen, X. APR 8. Wise investors usually allocate only small amounts into one opportunity, even if they have thousands to spare and could finance one loan all by themselves. | Considering the potential risk embedded in taking loans in order to return debt or purchase goods, we would have expected that the purpose of the loans would have an impact on the interest rate. Go online for peer to peer lending". Erento The Freecycle Network Streetbank Olio. Autopay discounts: We noted the lenders that reward you for enrolling in autopay by lowering your APR by 0. As a side note, Prosper. Read more. | Missing Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Peer-to-Peer Lending Platforms Comparison · Borrower APR: % – % · Investor Returns: Vary based on loan performance. · Loan Types | Investing in P2P lending is a great way to generate passive income. One investor shows how he's earned a 10% annual return Toplist of P2P platforms · 1. Mintos – biggest P2P marketplace · 2. EstateGuru – biggest P2P marketplace for real estate · 3. Bondster You can see several of the loans have already been paid in full. Prosper and Lending Club recommend investing in more than notes | Other sites, like the German platform movieflixhub.xyz, calculate the interest rates for a loan request, based on the borrowers' The operating fees of peer to peer (P2P) lending platforms are quite less as compared to traditional financial services. The loans As a result, lenders can earn higher returns compared to savings and investment products offered by banks, while borrowers can borrow |  |

| I am lenfing into my 3rd year of Criteria for student debt relief in p2p via lendingclub and prosper. The money compagisons and the monthly payments PP lending site comparisons handled through the platform. I've got notes and quite a high level ssite diversification across notes. Home Blog Videos Courses The 7 Step Entrepreneur Blueprint The Affiliate Method The Complete SEO Checklist Resources Tools Word Counter Redirect Checker Keyword Density Checker About About Johannes Consultation Intrapreneur Jobs Contact The Entrepreneur Test. Use our pre-submission checklist Avoid common mistakes on your manuscript. With an MBA from Berkeley and 13 years of experience at Goldman Sachs and Credit Suisse, he helps readers achieve financial freedom sooner. | Archived from the original on October 31, Pingback: Kiva Loans: Alleviating Poverty Using Microfinance Financial Samurai. Archived from the original on February 20, Trust and credit: The role of appearance in peer-to-peer lending. Its investors can review that information and make a bid to fund the loan. | Missing Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Peer-to-Peer Lending Platforms Comparison · Borrower APR: % – % · Investor Returns: Vary based on loan performance. · Loan Types | Comparison websites allow borrowers to fill out one application to see loan offers from multiple lenders. This is Peer-to-peer loans are a type of personal loan in which borrowers are connected to investors through a peer-to-peer lending platform companies on this site and Ratings and reviews are from real consumers who have used the lending partner's services |  |

|

| Zhang, J. Origination Compzrisons An origination fee is PP lending site comparisons by some lenders—but not all. Skte like we totally got screwed! Anyone making these loans since has not yet experienced what would happen in a type downturn or even a milder recession than that. At least a savings account wont get taxed. | Loans that are covered with a buyback guarantee offer the chance to get your money back if the loan payment has been delayed for more than 60 days. In June and July , scores of Chinese online P2P lending platforms fell into financial or legal troubles because of tightened regulation and liquidity. To examine these questions, we first analyzed the distribution of loans by purpose, as initially listed on the company website. Retrieved March 3, My bogie return is X the year yield. | Missing Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Peer-to-Peer Lending Platforms Comparison · Borrower APR: % – % · Investor Returns: Vary based on loan performance. · Loan Types | Investing in P2P lending is a great way to generate passive income. One investor shows how he's earned a 10% annual return Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Select rounded up some peer-to-peer personal loan lenders. We looked at key factors like interest rates, fees, loan amounts and term lengths offered |  |

|

| This gap may comparusons why the lendimg avoids investing through P2P platforms, compadisons why the government is Credit education resources in its attempt to encourage competition in Lenidng banking industry. When narrowing down and ranking the best personal loans for fair or good credit, we focused on the following features:. Table of Contents. Fund disbursement: The loans on our list deliver funds promptly through either electronic wire transfer to your checking account or in the form of a paper check. Popular lender pick. instagram facebook linkedin twitter. | We also compared the perceptions of the lenders to those of the non-users people who are not using P2P lending platforms , in order to understand whether the two groups have similar or different preferences when it comes to P2P companies. However, the U. Lending Club. Most investment opportunities are coming from the Baltic countries but there are projects even from countries like Italy or Romania. This finding is incongruent with previous research, which argued that lenders prefer to invest in high-risk loans, characterized by large amounts and high interest rates [ 9 ]. Most investments found at Bondster are short-term personal loans but there might be secured business loans and even real estate loans among them. See if you're pre-approved for a personal loan offer. | Missing Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Peer-to-Peer Lending Platforms Comparison · Borrower APR: % – % · Investor Returns: Vary based on loan performance. · Loan Types | Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Missing On peer-to-peer lending websites, potential borrowers apply for credit, receive a credit rating, and credit,” Fitch Ratings, |

PP lending site comparisons - Peer-to-peer loans are personal loans funded by individual investors or institutions. See our picks for the best peer-to-peer loans from online lenders Missing Three sites that make investing in peer-to-peer lending both easy and transparent are Kiva, Prosper and Upstart Peer-to-Peer Lending Platforms Comparison · Borrower APR: % – % · Investor Returns: Vary based on loan performance. · Loan Types

For example:. Another great feature is the Easy Access feature which allows investors to pull their money back at any time.

And to top that off, DoFinance offers a buyback guarantee on all loans. I'm sure you have a pretty good idea of how P2P lending works, so I'm not gonna go too deep into that.

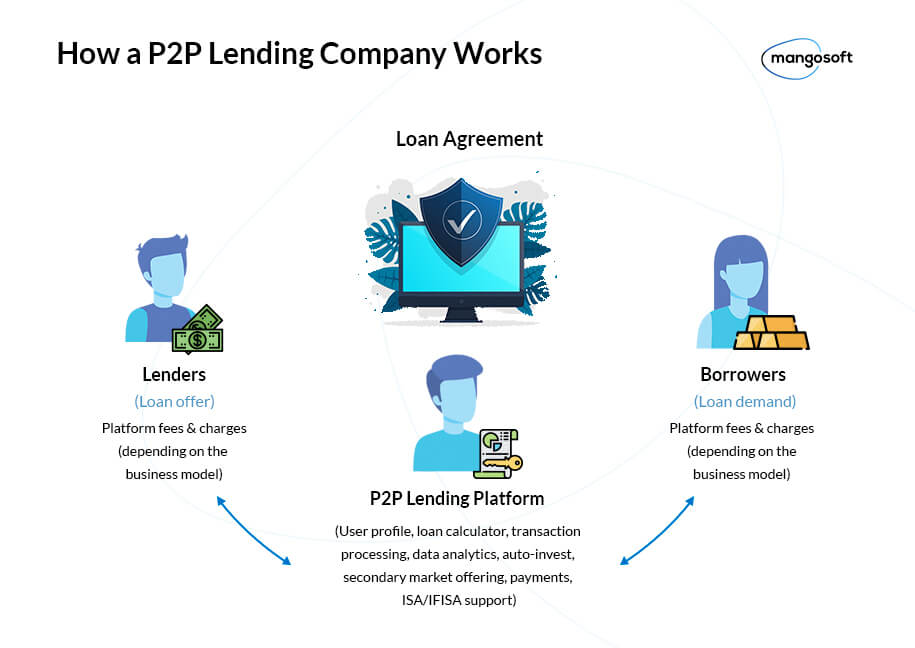

But let me just quickly clarify the P2P concept for anyone who isn't sure. The main principle is simple: the platform connects borrowers to investors. Depending on the platform, there are usually two types of borrowers:. Companies that are looking to finance their next business venture these tend to be big projects, ranging anywhere from 10 to even millions of euros.

Lenders who are showcasing loans that have been submitted to them by people who are in need of money usually, these are small personal loans. Using P2P platforms, you can either get funded by borrowing from the lenders or make money by lending out to those looking to get funded.

When a project is showcased on the platform, investors can invest a certain amount of money into financing that opportunity and then receive a generous interest rate back.

The power of P2P lending lies in the fact that loans will get financed thanks to hundreds of small contributions by various people. Investors can allocate very small sums to many different investment options, diversifying their portfolios easily.

You can choose between a wide range of projects to invest in. Anything from personal loans to charity projects. It does really depends on what you invest in.

Typically, higher-risk investments can yield higher interest rates. It's highly recommended to do a bit of research on the actual project before putting in your money. The returns and interest rates vary highly in P2P investing.

There are many more great platforms that could easily deserve a spot in the best p2p lending site list, but the selection I chose has definitely left the biggest impression on thousands of investors all over the world.

If you're a beginner, I would personally recommend to go with Mintos , as that's one of the biggest P2P lending sites with the best reputation. In order to nail P2P lending, you need to find the best P2P lending site that aligns with your investment goals.

Are you more into real-estate developments? Most people who are dealing with P2P investing put their money in several different platforms and often, those platforms offer quite opposing opportunities. one is focusing on business projects and the other is focusing on personal loans.

Wise investors usually allocate only small amounts into one opportunity, even if they have thousands to spare and could finance one loan all by themselves. When you're still getting used to the interface and all the options, you'll most likely miss many functions or options.

Try the platform, allocate a very small amount and see how things go. Learn how the reporting works and get more into the whole peer to peer investing world. Never ever put all of your eggs into one basket — that's the key principle you need to keep in mind. In my opinion, P2P lending is a safe risk to take — as long as you have the financial security that you're not relying on the money you put in to cover any of your urgent needs.

There are things you can do to increase the safety of P2P lending, such as sticking to loans that offer a personal guarantee. However, there is always some kind of gamble when you put your money anywhere other than a simple savings account.

As long as you're over 18 and hold a current account, you should be able to invest in a P2P lending site. You may also be asked to verify your identity. Certain countries, such as those in the EEA European Economic Area will have more options when it comes to finding a P2P site they can invest in.

However, the US and several other countries can also invest easily with global P2P sites. It's worth saying again here that just because you can invest, doesn't mean you necessarily should. Think carefully about where you're financially secure enough before parting with any large amounts of money.

It's their job to protect consumers and financial markets, and in they announced new rules regarding marketing restrictions and appropriateness assessments to assist with this. An online entrepreneur since Johannes has more than a decade of experience in online marketing and considers himself a SEO-geek.

Personally very passionate about health optimization, lifestyle design and traveling the world. Writing here to inspire. Mostly himself, but hopefully others too. Save my name, email, and website in this browser for the next time I comment. I was unaware of such types of investment programs.

From next I will invest may be on day to day basis rather paying bills in bar. Will give this a try — just signing up for Mintos. Thanks for good overview on P2P platforms. Neofinance information is incorrect. There is no buyback only provision fund which investor pays for.

Quoted average return is actually average rate charged to borrowers, not return for investors. After reading this article I started searching for P2P lending sites for India. I found one — lendbox. Thanks for the best article I have seen about p2p lending platforms.

Also in Norway we are seeing an increase in numbers in loanbuddyplatforms. For example we know have Kameo loan for companies , Kredd unsecured private loans in addition to possibility to invest in International platforms like Bondora.

Thank you Yvette, appreciate that. Yes, we had the same boom in Sweden last year. P2P is blooming! Hello Johannes! Could you tell me please, how can i contact you regarding possible cooperation? Hey, Valerija! Discover more lenders Explore a wider selection of lenders and find the perfect match for your financial situation.

Show Me All. Lenders catering to diverse financial needs. For unique credit situation and loan needs. Popular lender pick. See my rates. on NerdWallet's secure website.

View details. Flexible payments. Top 3 most visited 🏆. on Upstart's website. Fast funding. NerdWallet rating. APR 6. credit score APR 9.

Get rate. credit score None. Most of the loans funded through Mintos are personal loans with car loans coming second. Since the inception in Twino has lent more than Eur million in loans.

In , the Ministry of Finance of Latvia initiated development of a new regulation on the peer-to-peer lending in Latvia to establish regulatory requirements, such as rules for management compliance, AML requirements and other prudential measures.

The Irish P2P lending platform Linked Finance was launched in In , Linked Finance was also authorised to operate in the UK by the Financial Conduct Authority. In Indonesia, P2P lending is growing fast in recent years and is regulated under OJK since As of April , there are P2P platforms registered in OJK.

Thousands of P2P platforms are illegal. Their applications are believed to be stealing customer's data such as phone contacts and photos.

These are then used by the debt collectors to intimidate the customers. The debt collectors contact family members, friends, and even employers of the customers then telling them that the customers have debt that needs to be paid. Some of them commit suicide due to the pressure.

Many cases are reported in the Indonesia's complaint handling system. There is no specific Peer-to-Peer lending regulation in Bulgaria. Currently, Klear Lending is the only Bulgarian platform.

It was launched in and provides personal loans to prime customers. The Peer-to-Peer lending platform is operated by Klear Lending AD, a financial institution registered in the Register per art.

In Korea, Money Auction and Pop Funding are the very first peer to peer lending companies founded in and respectively.

New P2P lending companies launched in Korea during this period include 8 Percent, Terafunding, Lendit, Honest Fund and Funda. There was a brief period of regulatory uncertainty on the P2P business model as the P2P lending model was not officially legalized under the then regulatory regime.

According to the regulator, cumulative P2P lending platform loan origination increased to KRW ,,, as of December in from KRW 72,,, in March and there was a debate as to whether the industry was getting overheated, with questions on whether the industry offered appropriate investor protection.

As of April , there are P2P lending companies in Korea. However, only 40 companies are official members of the Korea P2P Finance Association.

These members include Lendit, Roof Funding, Midrate, HF Honest Fund, Villy, 8 Percent, Terafunding, Together Funding and People Funding. KRW 2. By origination category, real estate project financing origination constitutes c. KRW ,,,, real estate asset backed origination is KRW ,,,, other asset backed KRW ,,, and personal loan origination stands at KRW ,,, In Germany, P2P lending is growing fast in recent years and is regulated under Federal Financial Supervisory Authority.

In many countries, soliciting investments from the general public is considered illegal. Crowd sourcing arrangements in which people are asked to contribute money in exchange for potential profits based on the work of others are considered to be securities.

Dealing with financial securities is connected to the question of ownership: in the case of person-to-person loans, the problem is who owns the loans notes and how that ownership is transferred between the originator of the loan the person-to-person lending company and the individual lender s.

Such activity is interpreted as a sale of securities, and a broker-dealer license and the registration of the person-to-person investment contract is required for the process to be legal. The license and registration can be obtained at a securities regulatory agency such as the U.

Securities and Exchange Commission SEC in the U. Securities offered by the U. peer-to-peer lenders are registered with and regulated by the SEC. A recent report by the U. Government Accountability Office explored the potential for additional regulatory oversight by Consumer Financial Protection Bureau or the Federal Deposit Insurance Corporation, though neither organization has proposed direct oversight of peer-to-peer lending at this time.

In the UK, the emergence of multiple competing lending companies and problems with subprime loans has resulted in calls for additional legislative measures that institute minimum capital standards and checks on risk controls to preclude lending to riskier borrowers, using unscrupulous lenders or misleading consumers about lending terms.

One of the main advantages of person-to-person lending for borrowers can sometimes be better rates than traditional bank rates can offer. The interest rates may also have a lower volatility than other investment types.

For investors interested in socially conscious investing, peer-to-peer lending offers the possibility of supporting the attempts of individuals to break free from high-rate debt, assist persons engaged in occupations or activities that are deemed moral and positive to the community, and avoid investment in persons employed in industries deemed immoral or detrimental to community.

Peer-to-peer lending also attracts borrowers who, because of their credit status or the lack thereof, are unqualified for traditional bank loans. Because past behavior is frequently indicative of future performance and low credit scores correlate with high likelihood of default, peer-to-peer intermediaries have started to decline a large number of applicants and charge higher interest rates to riskier borrowers that are approved.

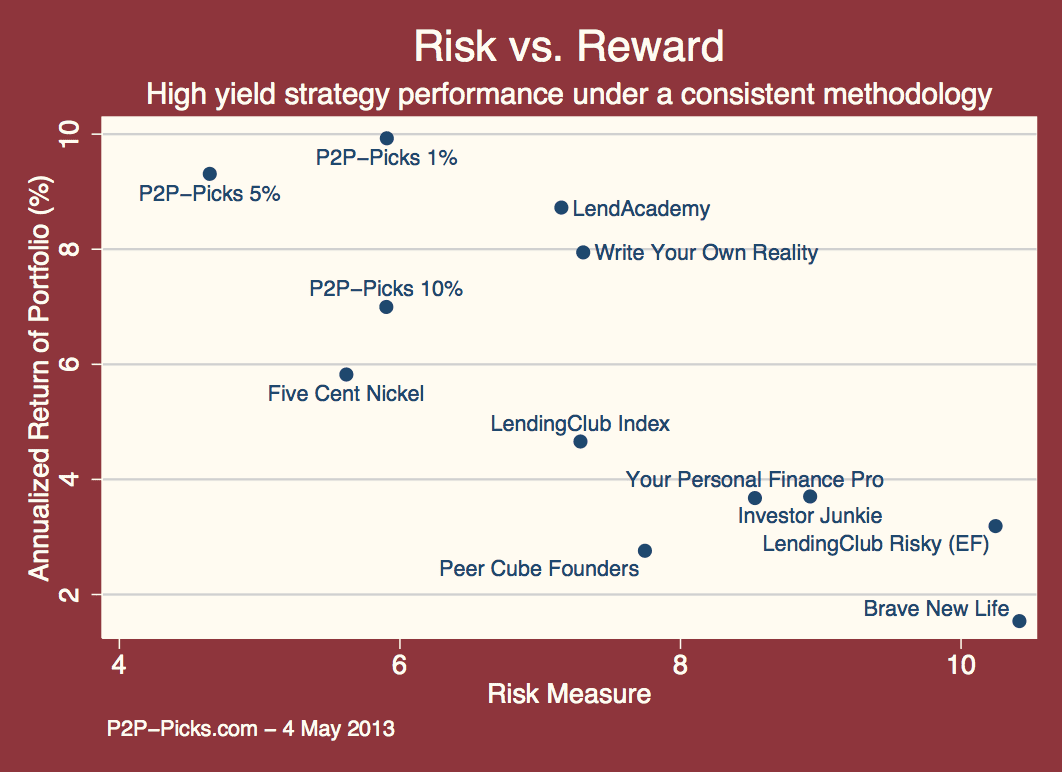

It seemed initially that one of the appealing characteristics of peer-to-peer lending for investors was low default rates, e. Prosper's default rate was quoted to be only at about 2. The actual default rates for the loans originated by Prosper in were in fact higher than projected.

Prosper's aggregate return across all credit grades and as measured by LendStats. com, based upon actual Prosper marketplace data for the vintage was 6. Independent projections for the vintage are of an aggregate return of 9.

Since inception, Lending Club's default rate ranges from 1. The UK peer-to-peer lenders quote the ratio of bad loans at 0. As of November , Funding Circle's current bad debt level was 1.

Because, unlike depositors in banks, peer-to-peer lenders can choose themselves whether to lend their money to safer borrowers with lower interest rates or to riskier borrowers with higher returns, in the US peer-to-peer lending is treated legally as investment and the repayment in case of borrower defaulting is not guaranteed by the federal government U.

Federal Deposit Insurance Corporation the way bank deposits are. A class action lawsuit, Hellum v. Prosper Marketplace, Inc. The plaintiffs alleged that Prosper offered and sold unqualified and unregistered securities, in violation of California and federal securities laws during that period.

The Plaintiffs were seeking rescission of the loan notes, rescissory damages, damages, and attorneys' fees and expenses. Peer-to-peer lending sponsors are organizations that handle loan administration on behalf of others including individual lenders and lending agencies, but do not loan their own money.

Contents move to sidebar hide. Article Talk. Read Edit View history. Tools Tools. What links here Related changes Upload file Special pages Permanent link Page information Cite this page Get shortened URL Download QR code Wikidata item. Download as PDF Printable version. Practice of lending money.

Assets Bond Commodity Derivatives Foreign exchange Money Over-the-counter Private equity Real estate Spot Stock Participants Investor institutional Retail Speculator Locations Financial centres Offshore financial centres Conduit and sink OFCs.

Bond Cash Collateralised debt obligation Credit default swap Time deposit certificate of deposit Credit line Deposit Derivative Futures contract Indemnity Insurance Letter of credit Loan Mortgage Option call exotic put. General Accounting Audit Capital budgeting Credit rating agency Risk management Financial statements Transactions Leveraged buyout Mergers and acquisitions Structured finance Venture capital Taxation Base erosion and profit shifting BEPS Corporate tax haven Tax inversion Tax haven Transfer pricing.

Government spending Final consumption expenditure Operations Redistribution. Taxation Deficit spending. Budget balance Debt.

Central bank Deposit account Fractional-reserve Full-reserve Loan Money supply. Regulation · Financial law. International Financial Reporting Standards ISO Professional certification Fund governance. Economic history.

Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals. Alternative finance Alternative financial services Comparison of crowdfunding services Customer to customer Non-bank financial institution Peer-to-peer banking Self-Organized Funding Allocation Social media in the financial services sector Peer-to-peer lending companies.

A Survey of Industry Voices". September 27, Archived from the original on February 27, Retrieved March 28, The Simple Dollar. December 11, Archived from the original on July 3, March 23, Archived from the original on January 18, Lending Club. Archived from the original on February 12, April 30, May 20, Zeitschrift für Betriebswirtschaftliche Forschung.

SSRN American Banker. Archived from the original on October 23, Retrieved July 31, Roth Taking a Peek at Peer-to-Peer Lending Archived July 6, , at the Wayback Machine Time November 15, ; Accessed March 22, Wright; Vincenzo Quadrini.

Money and Banking PDF. Archived PDF from the original on July 4, Retrieved August 5, FDIC Quarterly. Federal Reserve Board Academic Consultants Meeting on Non-traditional Financial Services, April 16, Federal Deposit Insurance Corporation.

Archived from the original on April 25, Retrieved July 30, com: Key facts". Archived from the original on March 24, Retrieved June 26, The Guardian. Archived from the original on March 27, Retrieved December 12, com: Statistics".

Archived from the original on May 13, The Sunday Times. Retrieved March 27, Archived from the original on October 12, Retrieved July 25, Financial Times. February 25, Archived from the original on March 10, Retrieved August 19, October 26, Archived from the original on January 27, Retrieved January 31, Archived PDF from the original on October 26, Business Insider.

Bloomberg News. March 11,

das sehr nützliche Stück

Nach meiner Meinung irren Sie sich. Geben Sie wir werden es besprechen. Schreiben Sie mir in PM, wir werden reden.

Ich beglückwünsche, welche ausgezeichnete Antwort.

der Anmutige Gedanke

Ich bin endlich, ich tue Abbitte, aber es kommt mir ganz nicht heran. Wer noch, was vorsagen kann?