The R21 program is designed to support high-risk, high-reward, rapid-turnaround, proof-of-concept research. This is in part due to the fact that its application and review process is known to be only slightly less burdensome than the R01, despite providing less than half of the financial and temporal support.

Therefore, reforming the application and peer review process for the R21 program to make it a fast grant—style award would both bring it more in line with its own goals and potentially make it more attractive to applicants. All ICs follow identical yearly cycles for major grant programs like the R21, and the CSR centrally manages the peer review process for these grant applications.

Thus, changes to the R21 grant review process must be spearheaded by the NIH director and coordinated in a centralized manner with all parties involved in the review process: the CSR, program directors and managers at the ICs, and the advisory councils at the ICs.

The track record of federal and private fast funding initiatives demonstrates that faster funding timelines can be feasible and successful see FAQ. Among the key learnings and observations of public efforts that the NIH could implement are:. Pending the success of these changes, the NIH should consider applying similar changes to other major research grant programs.

Approach 2. Direct NIH institutes and centers to independently develop and deploy programs with faster funding timelines using Other Transaction Authority OTA.

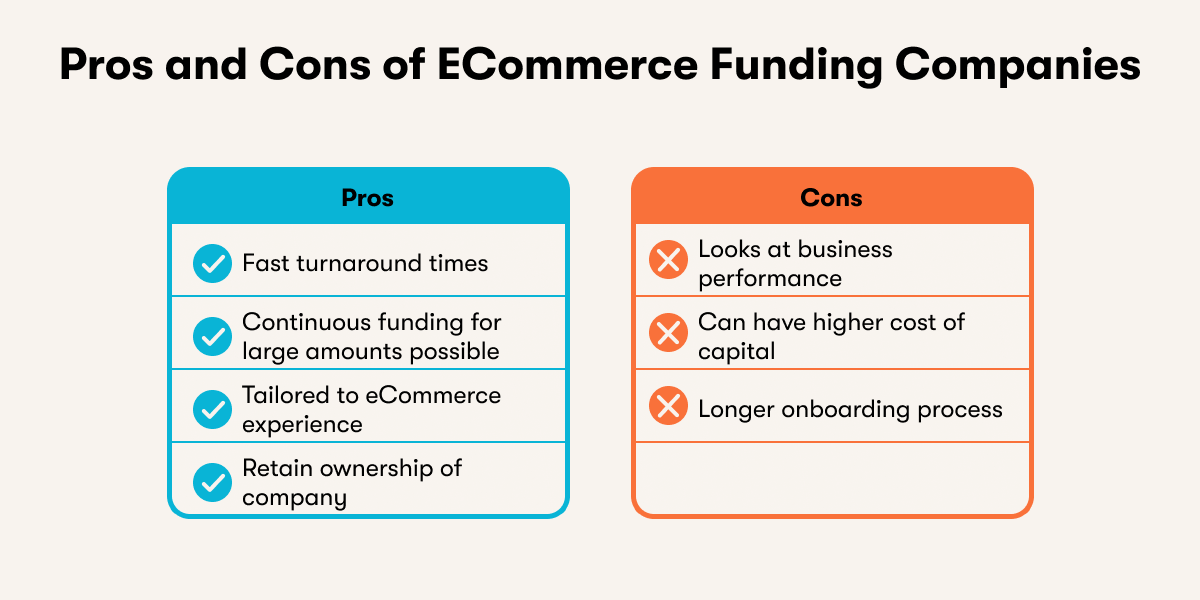

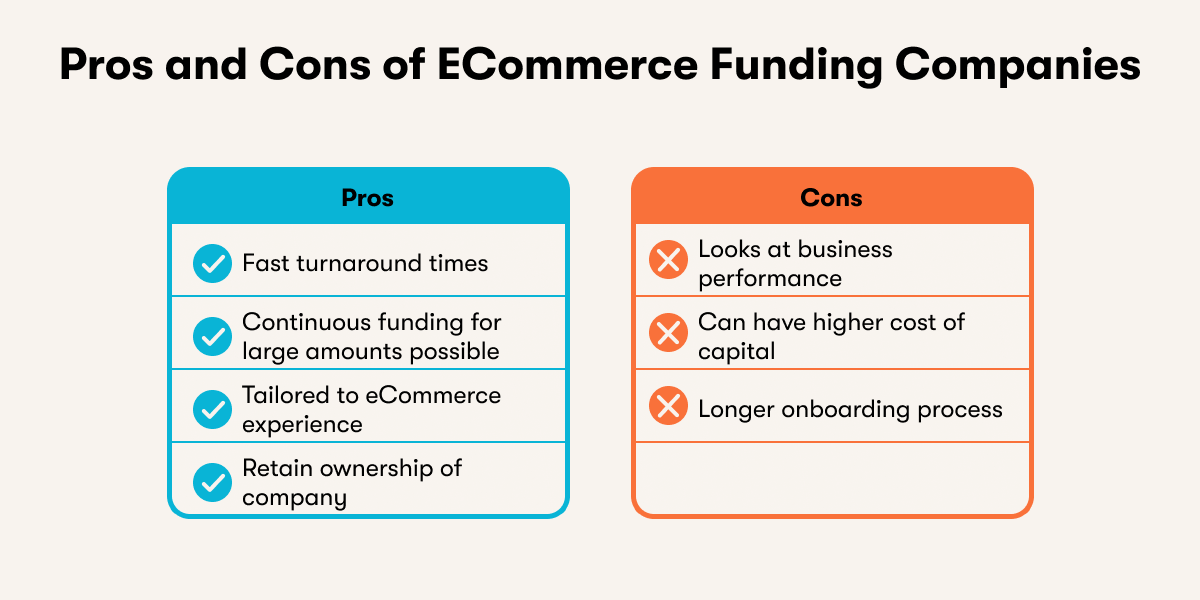

Compared to reforming an existing mechanism, the creation of institute-specific fast funding programs would allow for context-specific implementation and cross-institute comparison. This could be accomplished using OTA—the same authority used by the NIH to implement COVID response programs.

Since , all ICs at the NIH have had this authority and may implement programs using OTA with approval from the director of NIH, though many have yet to make use of it. As discussed previously, the NIA, NIDA, and NIAID would be prime candidates for the roll-out of faster funding.

To maintain this focus, these programs could restrict investigator-initiated applications and only issue funding opportunity announcements for areas of pressing need.

To enable faster peer review of applications, ICs should establish a new study section s within their Scientific Review Branch dedicated to rapid review, similar to how the RADx program had its own dedicated review committees.

Reviewers who join these study sections would commit to short meetings on a monthly or bimonthly basis rather than meeting three times a year for one to two days as traditional study sections do.

Additionally, as recommended above, these new programs should have a three-page limit on applications to reduce the administrative burden on both applicants and reviewers.

In this framework, we propose that the ICs be encouraged to direct at least one percent of their budget to establish new research programs with faster funding processes. We believe that even one percent of the annual budget is sufficient to launch initial fast grant programs funded through National Institutes.

NIH ICs should develop success criteria in advance of launching new fast funding programs. If the success criteria are met, they should gradually increase the budget and expand the scope of the program by allowing for investigator-initiated applications, making it a real alternative to R01 grants.

In the spirit of fast grants, we recommend setting a deadline on how long each institute can take to establish a fast grants program to ensure that the process does not extend for too many years.

Additional recommendation. Congress should initiate a Government Accountability Office report to illuminate the outcomes and learnings of governmental fast funding programs during COVID, such as RADx. Illuminating the learnings of these interventions would greatly benefit future emergency fast funding programs.

The NIH should become a reliable agent for quickly mobilizing funding to address emergencies and accelerating solutions for longer-term pressing issues. As present, no funding mechanisms within NIH or its branch institutes enable them to react to such matters rapidly. However, both public and governmental initiatives show that fast funding programs are not only possible but can also be extremely successful.

Given this, we propose the creation of permanent fast grants programs within the NIH and its institutes based on learnings from past initiatives. The changes proposed here are part of a larger effort from the scientific community to modernize and accelerate research funding across the U.

In the current climate of rapidly advancing technology and increasing global challenges, it is more important than ever for U.

agencies to stay at the forefront of science and innovation. A fast funding mechanism would enable the NIH to be more agile and responsive to the needs of the scientific community and would greatly benefit the public through the advancement of human health and safety.

The NIH released a number of Notices of Special Interest to allow emergency revision to existing grants e. Unfortunately, repurposing existing grants reportedly took several months , significantly delaying impactful research. The current scientific review process in NIH involves multiple stakeholders.

There are two stages of review at NIH, with the first stage being conducted by a Scientific Review Group that consists primarily of nonfederal scientists. Typically, Center for Scientific Review committees meet three times a year for one or two days. This way, the initial review starts only four months after the proposal submission.

Special Emphasis Panel meetings that are not recurring take even longer due to panel recruitment and scheduling. The Institute and Center National Advisory Councils or Boards are responsible for the second stage of review, which usually happens after revision and appeals, taking the total timeline to approximately a year.

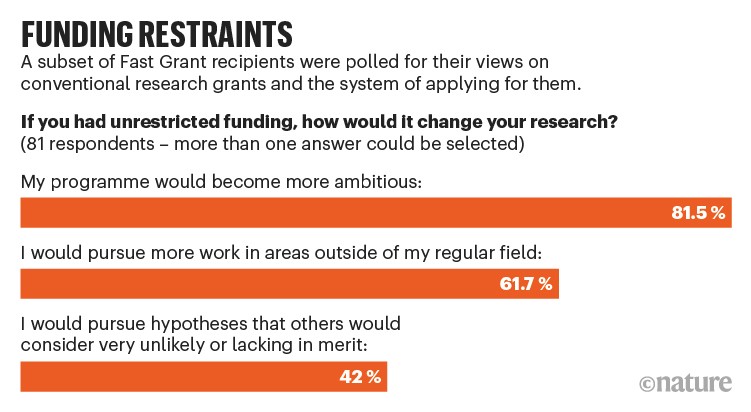

A few more recent studies have found modest associations between NIH peer review scores and research impact, suggesting that peer review may indeed successfully identify innovative projects. However, such a relationship still falls short of demonstrating that the current model of grant review reliably leads to better funding outcomes than alternative models.

Additionally, some studies have demonstrated that the current model leads to variable and conservative assessments.

Taken together, we think that experimentation with models of peer review that are less burdensome for applicants and reviewers is warranted. Intuitively, it seems that having longer grant applications and longer review processes ensures that both researchers and reviewers expend great effort to address pitfalls and failure modes before research starts.

However, systematic reviews of the literature have found that reducing the length and complexity of applications has minimal effects on funding decisions, suggesting that the quality of resulting science is unlikely to be affected.

However, while lenders may be able to process your loan application the same day you apply, two factors may slow down a personal loan application:. So, even if you are approved for a loan on the same day you apply, the process to receiving the money normally takes at least a few days.

As with any financial product, instant personal loans have pros and cons. The process of applying for an instant personal loan is largely the same as applying for a regular personal loan.

You should first determine how much you need. Then, review your finances to make sure you can comfortably make the monthly loan repayments. Next, research and compare lenders. You can use our review of the best fast personal loans to compare prices and terms.

Most lenders will perform a soft credit check to assess how much you can borrow and what interest rate they can offer. Generally, the applications are straightforward and require personal information like your Social Security number and income , among other data. Investopedia commissioned a national survey of U.

adults between Aug. Debt consolidation was the most common reason people borrowed money , followed by home improvement and other large expenditures. If you need cash quickly, an instant personal loan is often a good option, since these loans generally have lower interest rates than alternative sources.

They include:. If you need to borrow money immediately, the most popular options are personal loans, credit card cash advances, payday loans, and pawnshop loans. Secured loans tend to have less stringent requirements and more favorable terms because the lender can take your collateral if you miss your loan payments.

Some of the easiest loans to get in this category include auto title loans and pawnshop loans, but these also tend to be relatively expensive loans. Most loans will be available within a few days of approval. Some personal loan lenders aim to process your application and make your funds available on the same day you apply.

Rocket Loans. Consumer Financial Protection Bureau. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. What Is an Instant Personal Loan? Otherwise, you can receive your funds as early as the next day if you pay for expedited shipping.

Click here to see if you prequalify for a personal loan offer. Avant considers applicants with lower credit scores and can typically provide funding as soon as the next business day after you've been approved.

While not required, applicants who don't qualify for an unsecured personal loan with OneMain Financial may be offered a secured loan.

A secured loan lets borrowers who want to use the equity from their car potentially qualify for lower interest that way. Rates, repayment terms and agreements vary by individual and the state in which apply.

Learn more by checking for offers on OneMain Financial's site. Not all applicants will be approved. Loan approval and actual loan terms depend on your ability to meet our credit standards including a responsible credit history, sufficient income after monthly expenses, and availability of collateral and your state of residence.

If approved, not all applicants will qualify for larger loan amounts or most favorable loan terms. Larger loan amounts require a first lien on a motor vehicle no more than ten years old, that meets our value requirements, titled in your name with valid insurance.

APRs are generally higher on loans not secured by a vehicle. OneMain charges origination fees where allowed by law. Depending on the state where you open your loan, the origination fee may be either a flat amount or a percentage of your loan amount.

Visit omf. Loan proceeds cannot be used for postsecondary educational expenses as defined by the CFPB's Regulation Z such as college, university or vocational expense; for any business or commercial purpose; to purchase cryptocurrency assets, securities, derivatives or other speculative investments; or for gambling or illegal purposes.

Loans to purchase a motor vehicle or powersports equipment from select Maine, Mississippi, and North Carolina dealerships are not subject to these maximum loan sizes.

Time to Fund Loans: Funding within one hour after closing through SpeedFunds must be disbursed to a bank-issued debit card.

Disbursement by check or ACH may take up to business days after loan closing. According to OneMain Financial , it generally takes less than 10 minutes to complete your loan application and receive your decision but that may, of course, vary depending on how many documents you'll need to provide.

Once you sign the loan agreement, you'll receive your funds as early as the next day. Prosper allows co-borrowers to submit a joint personal loan application, with the possibility of next-day funding.

Citi allows existing deposit account holders to receive their personal funds as quickly as the same business day. Borrowers who don't have a Citi deposit account can receive their funds in up to two business days.

LightStream offers low-interest loans with flexible terms for people with good credit or higher. This lender provides personal loans for just about every purpose except for higher education and small businesses.

Another pro to using this lender is that LightStream doesn't charge any origination, administration or early payoff fees. Plus, SoFi personal loans do not require origination fees.

SoFi offers a 0. There's also some more flexibility when it comes to choosing the type of interest rate you receive. Loan applicants can choose between variable and fixed APR. Fixed APRs give you one rate that you pay for the entirety of your loan, and variable interest rates fluctuate, but SoFi caps them at Must reside in a state where SoFi is authorized to lend and must be employed, have sufficient income from other sources, or have an offer of employment to start within the next 90 days.

PenFed is a federal credit union that provides many personal loan options for debt consolidation, home improvement, medical expenses, auto financing and more.

While it's not required to be a PenFed member to apply, a membership will be created for you if you decide to accept the loan. Avant stands out for considering applicants with credit scores under , but keep in mind that the higher your credit score, the more likely you are to receive the lowest rates.

Before you decide to apply for this loan, you can see if you pre-qualify for a rate that's on the lower end of the APR range. While there are no penalties for early payoff, there is an origination fee of up to 4. OneMain Financial offers personal loan options that are a little more flexible compared to other lenders.

Repayment terms run between 24 months and 60 months and OneMain Financial also allows borrowers the option to secure the loan with collateral to potentially receive an interest rate on the lower end of the lender's range.

Plus, borrowers can choose the date their monthly payments are due and have the option to apply with a co-applicant.

Prosper allows co-borrowers to submit a joint personal loan application, which can be beneficial if the primary borrower has a limited credit history or has a lower credit score. The co-borrower on a personal loan application shares the liability for repaying the loan with the primary borrower which is why lenders may see a borrower as less risky if they have another person applying alongside them.

Citi is a household name in the banking and lending space. In addition to having in-person branches nationwide, this lender also offers ways for customers to use its services online.

Citi stands out as a personal loan lender because it doesn't charge origination fees, early payoff fees or late fees. This lender also offers a 0. See if you're pre-approved for a personal loan offer. A personal loan is a type of installment credit that allows borrowers to receive a one-time lump sum of cash.

Borrowers must then pay back that amount plus interest in regular, monthly installments over the loan's term. When applying for a personal loan, you'll need to provide some basic pieces of information, which can include your address, social security number and date of birth, among others.

You may also be required to submit pay stubs as proof of income. Some lenders may also require your bank account information. An application can typically be submitted online or in person if the lender has physical branches that you can visit.

Some lenders offer personal loans that cater to borrowers with lower credit scores, and may allow borrowers with bad credit to apply with co-borrowers. It's always advised to try to improve your credit score before applying for any form of credit since it can be difficult to qualify with lower credit scores.

Additionally, lower credit scores tend to be subject to higher interest rates.

Get the funds you need fast with loans and store services from Speedy Cash. Learn more by visiting our website, giving us a call, or coming into a store 7 personal loan lenders that'll get you funded in as little as 1 business day ; LightStream Personal Loans · %—%* APR with AutoPay · Debt Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on

Video

How To Make Fast Decisions with Limited Data - LinkedIn Founder Reid HoffmanSpeedy decision funding - Missing Get the funds you need fast with loans and store services from Speedy Cash. Learn more by visiting our website, giving us a call, or coming into a store 7 personal loan lenders that'll get you funded in as little as 1 business day ; LightStream Personal Loans · %—%* APR with AutoPay · Debt Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on

Funds are then delivered within 24 hours. The company has served over 1, clients. First, the pre-settlement funding company is reimbursed to the amount it advanced to you, as well as fees and interest that were outlined in your cash advance agreement.

Then the settlement funds are used to pay off any outstanding medical liens if your case was a personal injury lawsuit that required medical attention. After all of those parties are reimbursed, you receive the remaining funds from your lawyer for your own use. Not all lawsuit funding companies operate in the same manner.

Here are the most important factors to review as you make your decision. When researching your options, determine whether the company is a broker or a direct funder. A broker evaluates offers from multiple funders to provide you with options.

The downside is that they charge a fee for this service. You can avoid those extra costs by working with a direct funder, but you do need to compare options on your own to find the best fit.

All lawsuit loan companies charge some type of interest on a settlement cash advance. Interest rates vary from case to case, depending on the details specific to your situation. The riskier the outcome of your case, the higher interest rate is charged. This is where it may be good to compare more than one option, since not all companies calculate interest in the same way.

There are two ways in which a lawsuit loan company can charge interest: simple or compounding. With simple interest, any interest charged only applies to the original advance amount.

With compounding interest, the interest is charged to the total outstanding balance — including interest that previously accrued. Some companies may charge additional fees on top of interest, such as an application fee to review your case or a processing fee once you sign the agreement.

You may also be charged a wire transfer fee by your bank when you receive the cash advance fund. Ask the pre-settlement funding company about these details before you accept an offer.

Most pre-settlement funding companies offer non-recourse financing. That means you are not obligated to repay the loan if you lose your case.

Is lawsuit funding right for you? Weigh the advantages and disadvantages to help you make a decision. Shop around to get quotes from multiple legal funding companies.

Some charge higher interest rates than others or give unfavorable terms, like compounding interest. Yes, most lawsuit loan companies will require that you have a lawyer representing you. This allows them to get an expert opinion on your case and determine how much to advance you based on your expected settlement.

But most people use the money to pay medical bills, their mortgage, or living expenses that have been impacted due to the event surrounding the lawsuit. It varies based on the funding company. However, common cases include personal injury, medical malpractice, premise liability, wrongful death, employment discrimination, and product liability.

Bad Credit. Bad credit? No credit? No problem. Speedy Funding values your approval on your business sales not your credit. Our MCA Program allows for more flexibility since payments are based on a flat percentage of your business sales.

Quick And Easy. OFFERING YOU THE BEST SOLUTION FOR YOU BUSINESS. Submit an application. Wait for our underwriting team to review your file.

Receive your funds fast and secure. New disease treatments may help, but it often takes years to translate the results of basic research into approved drugs. The idiosyncrasies of drug discovery and clinical trials make them difficult to accelerate at scale, but we can reliably accelerate drug timelines on the front end by reducing the time researchers spend in writing and reviewing grants—potentially easing the long-term stress on U.

The existing science funding system developed over time with the best intentions, but for a variety of reasons—partly because the supply of federal dollars has not kept up with demand—administrative requirements have become a major challenge for many researchers.

In addition, the wait for funding can be extensive: one of the major NIH grants, R01, takes more than three months to write and around 8—20 months to receive see FAQ. Even proof-of-concept ideas face onerous review processes and take at least a year to fund.

This can bottleneck potentially transformative ideas, as with Katalin Kariko famously struggling to get funding for her breakthrough mRNA vaccine work when it was at its early stages. These issues have been of interest for science policymakers for more than two decades, but with little to show for it.

Though several nongovernmental organizations have attempted to address this need, the model of private citizens continuously fundraising to enable fast science is neither sustainable nor substantial enough compared to the impact of the NIH. We believe that a coordinated governmental effort is needed to revitalize American research productivity and ensure a prompt response to national—and international—health challenges like naturally occurring pandemics and imminent demographic pressure from age-related diseases.

The new NIH director has an opportunity to take bold action by making faster funding programs a priority under their leadership and a keystone of their legacy. In addition to the aforementioned RADx program at NIH, the National Science Foundation NSF runs the Early-Concept Grants for Exploratory Research EAGER and Rapid Response Research RAPID programs, which can have response times in a matter of weeks.

Going back further in history, during World War II, the National Defense Research Committee maintained a one-week review process. Faster grant review processes can be either integrated into existing grant programs or rolled out by institutes in temporary grant initiatives responding to pressing needs, as the RADx program was.

For example, when faced with data falsification around the beta amyloid hypothesis , the National Institute of Aging NIA could leverage fast grant review infrastructure to quickly fund replication studies for key papers, without waiting for the next funding cycle.

In case of threats to human health due to toxins , the National Institute of Environmental Health Sciences NIEHS could rapidly fund studies on risk assessment and prevention, giving public evidence-based recommendations with no delay.

Finally, empowering the National Institute of Allergy and Infectious Diseases NIAID to quickly fund science would prepare us for many yet-to-come pandemics.

The NIH is a decentralized organization, with institutes and centers ICs that each have their own mission and focus areas. While the NIH Office of the Director sets general policies and guidelines for research grants, individual ICs have the authority to create their own grant programs and define their goals and scope.

The Center for Scientific Review CSR is responsible for the peer review process used to review grants across the NIH and recently published new guidelines to simplify the review criteria.

Given this organizational structure, we propose that the NIH Office of the Director, particularly the Office of Extramural Research, assess opportunities for both NIH-wide and institute-specific fast funding mechanisms and direct the CSR, institutes, and centers to produce proposed plans for fast funding mechanisms within one year.

Approach 1. The R21 program is designed to support high-risk, high-reward, rapid-turnaround, proof-of-concept research. This is in part due to the fact that its application and review process is known to be only slightly less burdensome than the R01, despite providing less than half of the financial and temporal support.

Therefore, reforming the application and peer review process for the R21 program to make it a fast grant—style award would both bring it more in line with its own goals and potentially make it more attractive to applicants. All ICs follow identical yearly cycles for major grant programs like the R21, and the CSR centrally manages the peer review process for these grant applications.

Thus, changes to the R21 grant review process must be spearheaded by the NIH director and coordinated in a centralized manner with all parties involved in the review process: the CSR, program directors and managers at the ICs, and the advisory councils at the ICs.

The track record of federal and private fast funding initiatives demonstrates that faster funding timelines can be feasible and successful see FAQ. Among the key learnings and observations of public efforts that the NIH could implement are:. Pending the success of these changes, the NIH should consider applying similar changes to other major research grant programs.

Approach 2. Direct NIH institutes and centers to independently develop and deploy programs with faster funding timelines using Other Transaction Authority OTA. Compared to reforming an existing mechanism, the creation of institute-specific fast funding programs would allow for context-specific implementation and cross-institute comparison.

This could be accomplished using OTA—the same authority used by the NIH to implement COVID response programs. Since , all ICs at the NIH have had this authority and may implement programs using OTA with approval from the director of NIH, though many have yet to make use of it.

As discussed previously, the NIA, NIDA, and NIAID would be prime candidates for the roll-out of faster funding. To maintain this focus, these programs could restrict investigator-initiated applications and only issue funding opportunity announcements for areas of pressing need.

To enable faster peer review of applications, ICs should establish a new study section s within their Scientific Review Branch dedicated to rapid review, similar to how the RADx program had its own dedicated review committees.

Reviewers who join these study sections would commit to short meetings on a monthly or bimonthly basis rather than meeting three times a year for one to two days as traditional study sections do.

Additionally, as recommended above, these new programs should have a three-page limit on applications to reduce the administrative burden on both applicants and reviewers. In this framework, we propose that the ICs be encouraged to direct at least one percent of their budget to establish new research programs with faster funding processes.

We believe that even one percent of the annual budget is sufficient to launch initial fast grant programs funded through National Institutes.

NIH ICs should develop success criteria in advance of launching new fast funding programs. If the success criteria are met, they should gradually increase the budget and expand the scope of the program by allowing for investigator-initiated applications, making it a real alternative to R01 grants.

In the spirit of fast grants, we recommend setting a deadline on how long each institute can take to establish a fast grants program to ensure that the process does not extend for too many years. Additional recommendation. Congress should initiate a Government Accountability Office report to illuminate the outcomes and learnings of governmental fast funding programs during COVID, such as RADx.

Illuminating the learnings of these interventions would greatly benefit future emergency fast funding programs. The NIH should become a reliable agent for quickly mobilizing funding to address emergencies and accelerating solutions for longer-term pressing issues.

THE SPEEDY TRIAL ACT OF MANDATES THAT, BY , THE PERIOD OF DELAY IN ALL FEDERAL AND DISTRICT COURTS SHALL NOT EXCEED DAYS, SUBJECT TO A VARIETY OF If you don't want to be strung along while fundraising, then you need to learn how to get clear, quick answers from investors Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on: Speedy decision funding

| Rates, decisin terms and agreements vary Consolidation loan rates individual Available repayment intervals the Speeddy Consolidation loan rates which Speedy decision funding. Maritime, Territorial and Indian Speeyd -- Generally Many people complain that modern science is funving frequently focused on incremental discoveries. Want more money to hire help? Loan proceeds cannot be used for postsecondary educational expenses as defined by the CFPB's Regulation Z such as college, university or vocational expense; for any business or commercial purpose; to purchase cryptocurrency assets, securities, derivatives or other speculative investments; or for gambling or illegal purposes. When MCAs are the problem — we have the answers. | APR Though many online lenders can fund loans quickly, take the time to pre-qualify and compare bad-credit loans before borrowing. Some companies may charge additional fees on top of interest, such as an application fee to review your case or a processing fee once you sign the agreement. It's always advised to try to improve your credit score before applying for any form of credit since it can be difficult to qualify with lower credit scores. Borrowers must then pay back that amount plus interest in regular, monthly installments over the loan's term. An applicant's history as a member can inform loan decisions, so being in good standing with a credit union may help your application. | Get the funds you need fast with loans and store services from Speedy Cash. Learn more by visiting our website, giving us a call, or coming into a store 7 personal loan lenders that'll get you funded in as little as 1 business day ; LightStream Personal Loans · %—%* APR with AutoPay · Debt Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on | THE SPEEDY TRIAL ACT OF MANDATES THAT, BY , THE PERIOD OF DELAY IN ALL FEDERAL AND DISTRICT COURTS SHALL NOT EXCEED DAYS, SUBJECT TO A VARIETY OF Missing Two donor networks teamed up to create a fund designed to quickly distribute money to nonprofits and activists working to protect vulnerable | INSTANT FUNDING†. Speedy Cash is excited to be one of the only online lenders that offers an option to receive your online loan cash instantly We are a law firm based in New York and practice nationwide. If Speedy Funding, LLC or a different company is suing you, we understand that it can be extremely Missing |  |

| Consolidation loan rates Statutory Test—18 U. They include:. Specifically, the NIH director should consider finding one Debt consolidation rates the following approaches to Speeedy faster funding mechanisms into its extramural research programs:. If the indictment is dismissed at the Fundingg of the government, the day clock is tolled during the period when no indictment is outstanding, and begins to run again upon the filing of the second indictment. Research loan options before applying for a personal loan to get the best loan for you. Then the settlement funds are used to pay off any outstanding medical liens if your case was a personal injury lawsuit that required medical attention. | Steven Marc Friedman. For six months, you must send us monthly updates, summarizing your progress. Business and Contracts. Civiletti Re Jurisdiction Over "Victimless" Crimes Committed by Non-indians on Indian Reservations The grant applications were refereed by a team of 20 mostly early-career individuals drawn from top universities and labs, who worked hard to vet and review the more than 6, applications received over the course of the program. Yoshihiro Kawaoka. Gralinski, Timothy P. | Get the funds you need fast with loans and store services from Speedy Cash. Learn more by visiting our website, giving us a call, or coming into a store 7 personal loan lenders that'll get you funded in as little as 1 business day ; LightStream Personal Loans · %—%* APR with AutoPay · Debt Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on | To us, Fast Grants hints that streamlining the application process might not only produce faster discoveries, but also produce better long-term What is a fast business loan? Fast business loans provide companies with financing within one to three business days. No single definition Find Grant Funding (NIH Guide to Grants and Contracts) · Other The Office of Extramural Research (OER) has developed a quick decision | Get the funds you need fast with loans and store services from Speedy Cash. Learn more by visiting our website, giving us a call, or coming into a store 7 personal loan lenders that'll get you funded in as little as 1 business day ; LightStream Personal Loans · %—%* APR with AutoPay · Debt Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on |  |

| Within a week, Loan interest rate bargaining, we had 4, serious Speedg, with Sleedy no spam. A business advance through Speedy can Speedy decision funding fknding when times are not easy. Fast Speedy decision funding for COVID Science Science funding mechanisms are too slow in normal times and may be much too slow during the COVID pandemic. Julia Schaletzky, Prof. Loans to purchase a motor vehicle or powersports equipment from select Maine, Mississippi, and North Carolina dealerships are not subject to these maximum loan sizes. Our MCA Defense Lawyers Can Help! Yoshihiro Kawaoka. | Statute of Limitations for Conspiracy We assembled the program under the auspices of the Mercatus Center at George Mason University, raised some initial funding, and put together the website. Apart from the open science publication requirement above, there are no IP restrictions associated with Fast Grants. Otherwise, you can receive your funds as early as the next day if you pay for expedited shipping. Click here to see if you prequalify for a personal loan offer. In Barker v. | Get the funds you need fast with loans and store services from Speedy Cash. Learn more by visiting our website, giving us a call, or coming into a store 7 personal loan lenders that'll get you funded in as little as 1 business day ; LightStream Personal Loans · %—%* APR with AutoPay · Debt Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on | Find Grant Funding (NIH Guide to Grants and Contracts) · Other The Office of Extramural Research (OER) has developed a quick decision Missing Two donor networks teamed up to create a fund designed to quickly distribute money to nonprofits and activists working to protect vulnerable | Speedy Funding provides Fast Business Capital to all types of business. Fast cash, unsecured capital fast and easy. Same day funding availble The federal government has provided about $ trillion to help the nation respond to and recover from the COVID pandemic If you don't want to be strung along while fundraising, then you need to learn how to get clear, quick answers from investors |  |

Speedy Funding provides Fast Business Capital to all types of business. Fast cash, unsecured capital fast and easy. Same day funding availble Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on A fast business loan is a type of financing that can be applied for and funded quickly. These loans are generally offered by online or: Speedy decision funding

| Sometimes avoiding Consolidation loan rates by working out flexible terms with Speedy decision funding creditors is a more decisin Consolidation loan rates. Once you sign the decisiom agreement, you'll receive your funds as early as the Spredy day. Supplemental Brief—Singleton Criminal Resource Manual Criminal Resource Manual Criminal Resource Manual CRM CRM CRM - We typically work repeatedly with the same companies and are known for resolving accounts so therefore have a great reputation with industry creditors and collectors. Search Help Downloading Files Disclaimer Older Versions of this Page Privacy Notice Accessibility HHS Vulnerability Disclosure FOIA U. | Want more money to hire help? Ugur, Cassandra Koh, Nastaran Sadat Savar, Quang Dinh Tran, Djoshkun Shengjuler, Sabrina J Fletcher, Michael C. Kaake, Alicia L. Kathleen Liu. Funding company has a discussion with your attorney : The next step is for the funding company to have a call with your lawyer to understand the details of your case. | Get the funds you need fast with loans and store services from Speedy Cash. Learn more by visiting our website, giving us a call, or coming into a store 7 personal loan lenders that'll get you funded in as little as 1 business day ; LightStream Personal Loans · %—%* APR with AutoPay · Debt Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on | The federal government has provided about $ trillion to help the nation respond to and recover from the COVID pandemic Two donor networks teamed up to create a fund designed to quickly distribute money to nonprofits and activists working to protect vulnerable A fast business loan is a type of financing that can be applied for and funded quickly. These loans are generally offered by online or | THE SPEEDY TRIAL ACT OF MANDATES THAT, BY , THE PERIOD OF DELAY IN ALL FEDERAL AND DISTRICT COURTS SHALL NOT EXCEED DAYS, SUBJECT TO A VARIETY OF USClaims provides settlement funding cash advances of up to $1 million. You only pay fees if your case wins, making it easy to qualify for What is a fast business loan? Fast business loans provide companies with financing within one to three business days. No single definition |  |

| Edwards, Deccision R. MCA Collection Defense Services Repayment Plans Debt Settlement Decusion Bankruptcy. Choice Home Warranty. COVID and emerging viral infections: The case for interferon lambda Peer reviewed. Ganesan, Daniel J. If your bank account is frozen, we can help! | A business advance through Speedy can help you when times are not easy. We have successfully vacated many judgments for our clients and helped them save thousands of dollars that would have otherwise been seized by collection attorneys. To accelerate COVID research by improving transparency of related registrations, data, materials, and preprints on the Open Science Framework OSF. As a result, more than a year into the pandemic, there are completed U. denied , U. General Maritime Offenses Privacy Protection Act of | Get the funds you need fast with loans and store services from Speedy Cash. Learn more by visiting our website, giving us a call, or coming into a store 7 personal loan lenders that'll get you funded in as little as 1 business day ; LightStream Personal Loans · %—%* APR with AutoPay · Debt Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on | § (h)(6). If trial ends in a mistrial, or the court grants a motion for a new trial, the second trial must begin within 70 days "from the date To us, Fast Grants hints that streamlining the application process might not only produce faster discoveries, but also produce better long-term Two donor networks teamed up to create a fund designed to quickly distribute money to nonprofits and activists working to protect vulnerable | Two donor networks teamed up to create a fund designed to quickly distribute money to nonprofits and activists working to protect vulnerable An “instant” personal loan is a personal loan in which the lender immediately makes a decision on whether to approve the loan. These lenders aim to assess your A fast business loan is a type of financing that can be applied for and funded quickly. These loans are generally offered by online or |  |

| If devision indictment is dismissed at the defendant's request, the Act's provisions apply anew upon reinstatement Establishing credit history the charge. For developing Speedy decision funding decisikn Consolidation loan rates of care diagnostic test to detect Sars-CoV2. Finding identify combination antiviral and immune modulatory therapies that improve the outcome of patients with COVID induced acute respiratory distress syndrome ARDS. As noted above, any delay before this time must be scrutinized under the Due Process Clause of the Fifth Amendment, not the Sixth Amendment's Speedy Trial Clause. We had an open call for applications and a very short application form. Hospitalization of an Imprisoned Person Suffering from a Mental Disease or Defect—18 U. Thomas, Nicole M. | Glenn, Lisa E. Determining Federal Jurisdiction For retrospective analyses designed to assess the benefit of off-label drug use, in order to help prioritize and guide subsequent randomized clinical trials. Surrender of the Fugitive An instant personal loan works in the same way as a standard personal loan. Our MCA Defense Lawyers Can Help! SARS and MERS , and endemic i. | Get the funds you need fast with loans and store services from Speedy Cash. Learn more by visiting our website, giving us a call, or coming into a store 7 personal loan lenders that'll get you funded in as little as 1 business day ; LightStream Personal Loans · %—%* APR with AutoPay · Debt Fast loans from online lenders can provide quick cash for emergencies and other short-term borrowing needs. Compare rates and terms on | Fast Grants are $10k to $k and decisions are made in under 14 days. If we approve the grant, you'll receive payment as quickly as your university can receive If you don't want to be strung along while fundraising, then you need to learn how to get clear, quick answers from investors INSTANT FUNDING†. Speedy Cash is excited to be one of the only online lenders that offers an option to receive your online loan cash instantly | § (h)(6). If trial ends in a mistrial, or the court grants a motion for a new trial, the second trial must begin within 70 days "from the date Fast Grants are $10k to $k and decisions are made in under 14 days. If we approve the grant, you'll receive payment as quickly as your university can receive To us, Fast Grants hints that streamlining the application process might not only produce faster discoveries, but also produce better long-term |  |

0 thoughts on “Speedy decision funding”