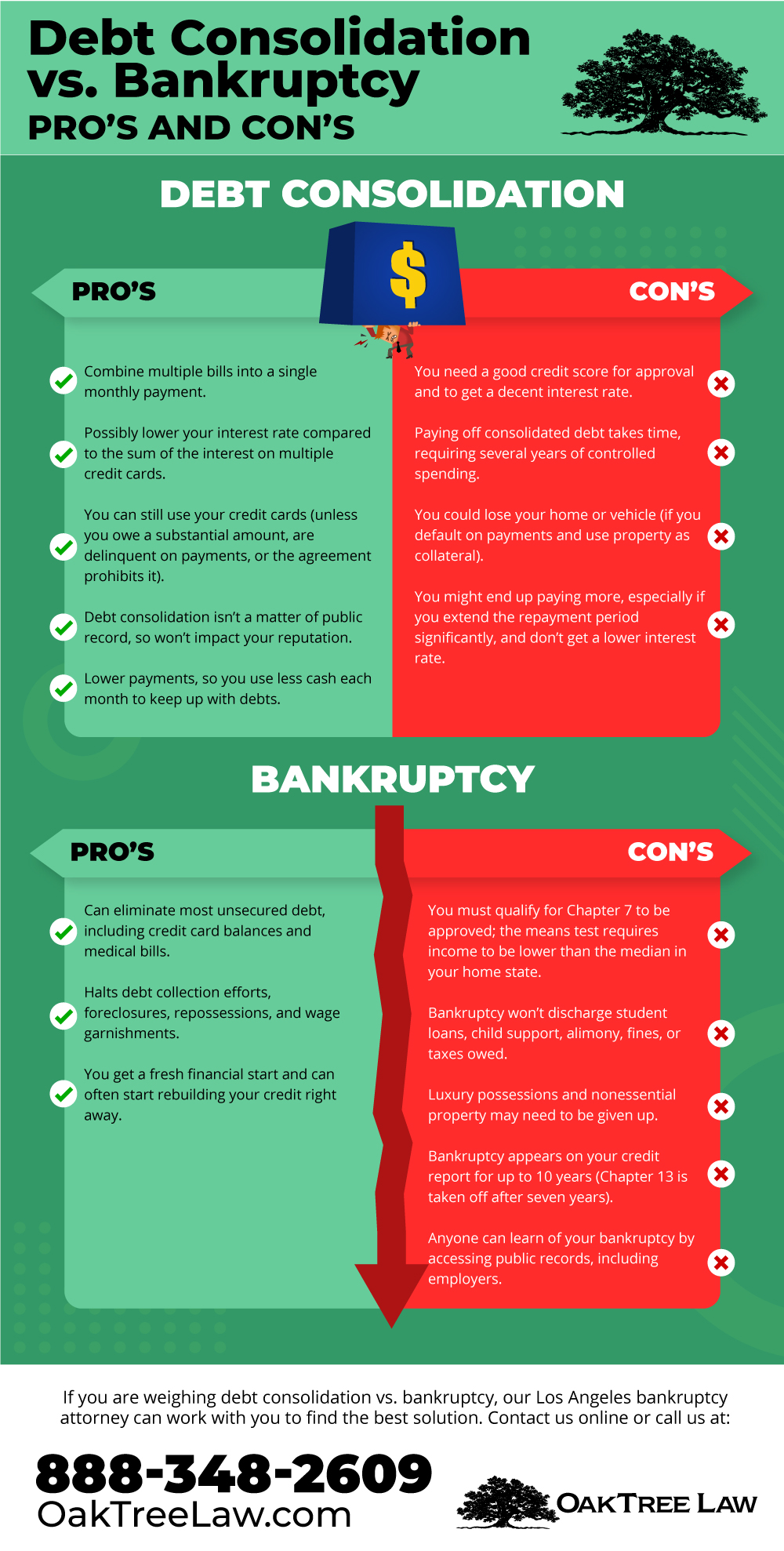

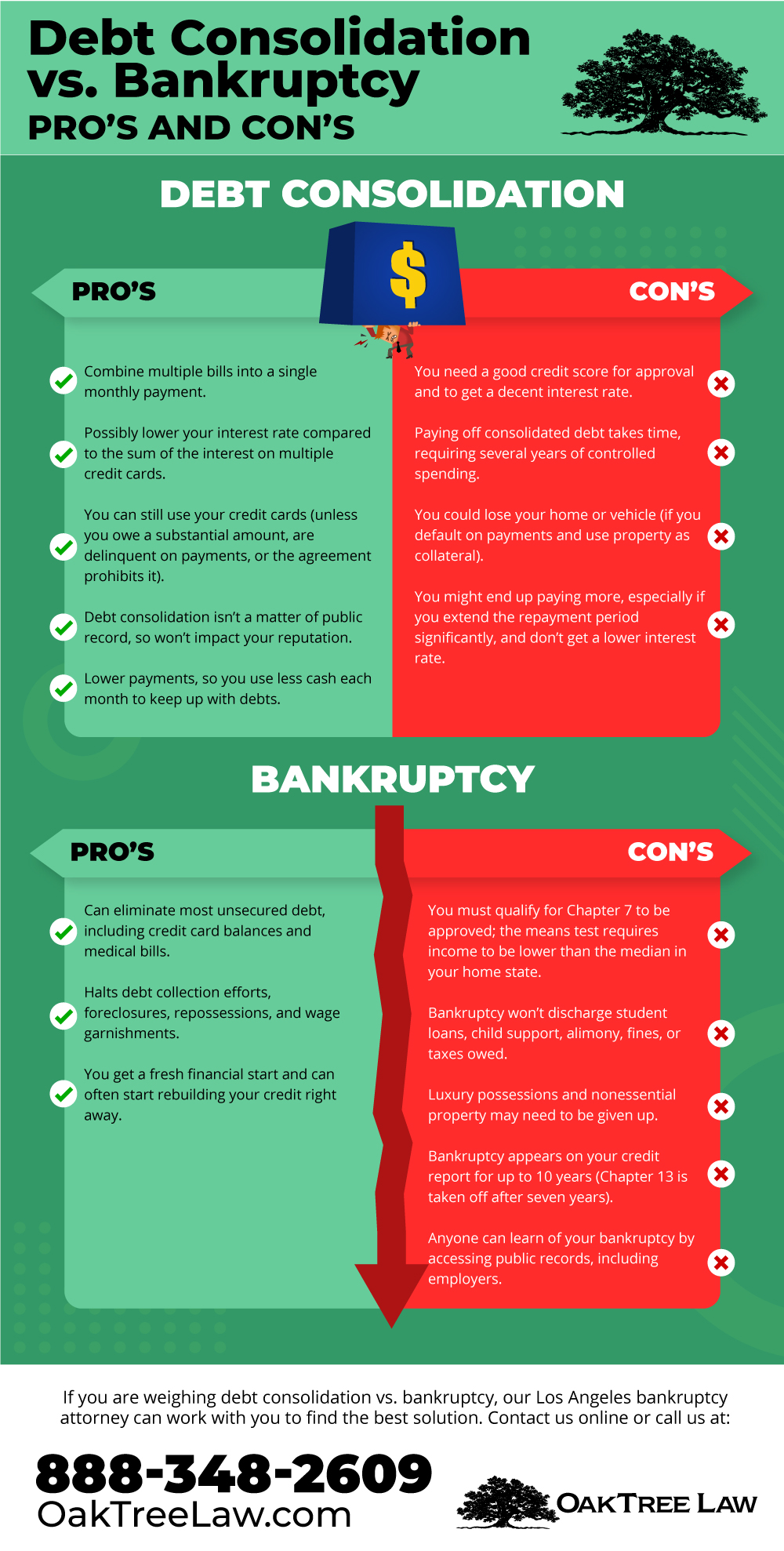

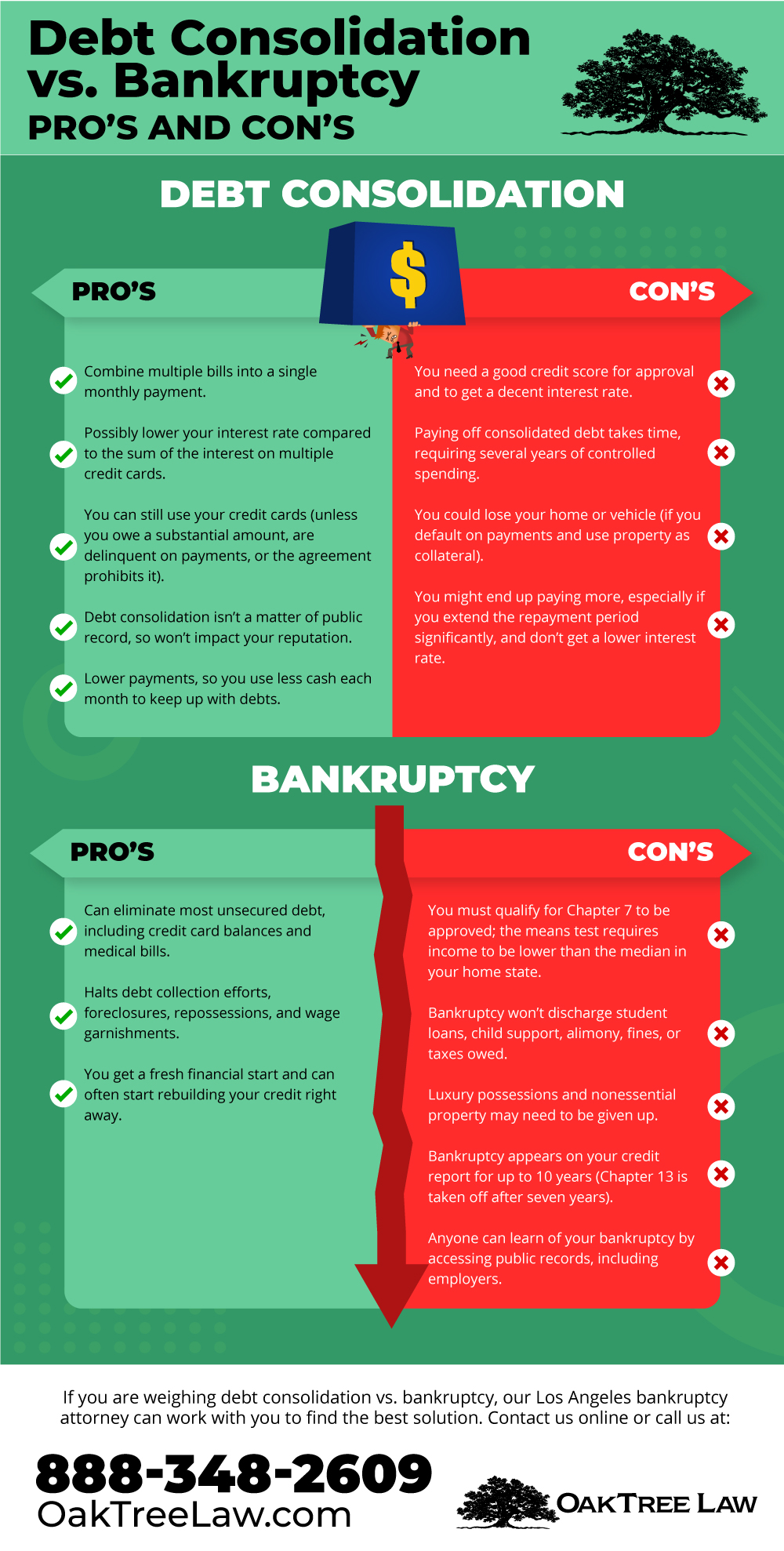

Filing bankruptcy can be a difficult and stressful process, one that causes major damage to your credit, but it may be the right choice for someone who has no means to pay off their debt within the next five years.

Bankruptcy laws were written to give people a fresh start, especially those with unpreventable financial hardships, like the loss of a job, the death of a loved one, or a chronic illness.

When comparing debt settlement to bankruptcy , the upsides include that bankruptcy can involve debt cancellation and it can halt foreclosure proceedings, wage garnishments and debt collection activity.

Note that there are many debts that cannot be included in bankruptcy, including student loans, most tax bills, child support and alimony. Tip: Bankruptcy has a major negative effect on your credit, but the damage is not permanent. Over time the impact will lessen, and with good credit habits you can recover over the course of as little as two to three years.

Given all of the different options for tackling debt, It can be difficult to make a choice. Fortunately, some of the best guidance is available from professionals, free of charge. A certified credit counselor from a nonprofit credit counseling agency can help you review all of your options, from making budget adjustments to filing bankruptcy.

They can also walk you through the ins-and-outs of a debt management plan ,. which includes working with multiple creditors to set up one affordable monthly payment. His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet.

Bill can be reached at [email protected]. org wants to help those in debt understand their finances and equip themselves with the tools to manage debt. Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up.

These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. Here is a list of our service providers.

Debt Settlement vs. Choose Your Debt Amount. Call Now: Continue Online. So which option is best for you? What Are the Differences Between Debt Settlement and Debt Consolidation? How Does Debt Settlement Work? These are the steps that are generally required: Set up an account: Each company requires different agreements to get started, but you may have to sign a power of attorney, set up a new bank account and agree to cease contact with your creditors.

Send monthly payments: The debt settlement company will collect your payments and set them aside, often for a duration of 3 years or more. In the meantime, money will not be sent to your creditors.

By withholding payment, the debt settlement company attempts to make a lump-sum settlement offer more enticing to creditors. Note that your creditors will likely continue contacting you throughout this period. Make settlement offers: You, or a representative negotiating for you, will make an offer to each of your creditors to settle the debt for less than what is owed.

The creditor may or may not accept. Negotiate your payment: Contact your creditor to negotiate a settlement amount. Start with a low offer and, if possible, avoid setting up a new payment arrangement as this can lead to new fees and more credit damage. Get it in writing: Request documentation of your agreement.

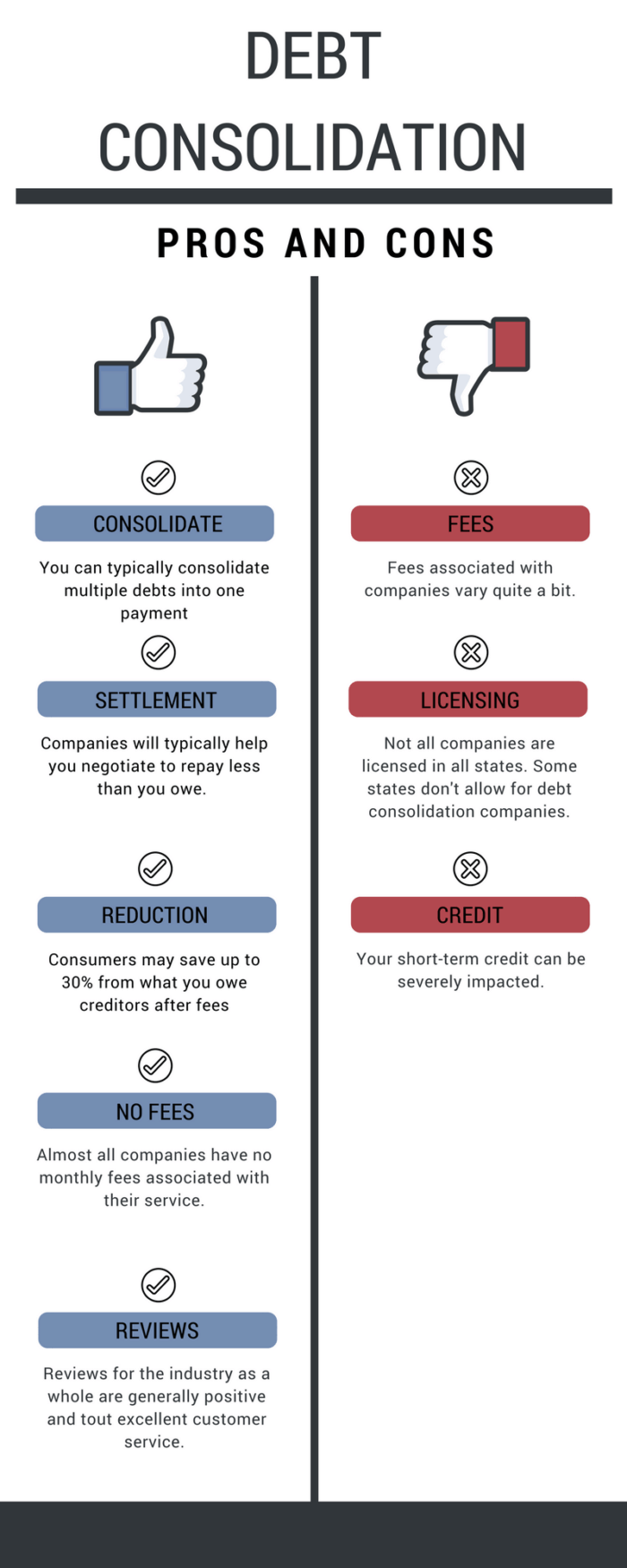

Debt Settlement: Pros and Cons The prospect of paying less than you owe — far less in some cases — makes debt settlement an enticing option.

After paying your late fees, interest charges, and the fees charged by a debt settlement agency, you may end up saving money. You may pay off debt faster: The process of debt settlement often takes three or more years to complete, but for some debtors this could be a faster path to becoming debt free than paying off their full debt balances.

Time commitment: The normal time frame for a debt settlement case is two to three years. Damaged credit: Debt settlement can damage your credit score just as much as filing bankruptcy. In fact, missing just one debt payment while negotiating a settlement can cause you to lose as much as points or more from your credit scores, and settled debts will not be automatically removed from your credit reports.

Creditors may refuse: Creditors are not obligated to accept settlement offers. In fact, some even refuse to work with debt settlement companies. Risk of scams: Financial scams and predatory loopholes are rampant in the debt settlement industry.

For example, if you enroll in-person or online, you can legally be charged fees before your debt is settled. Some companies also use false advertising, like guaranteeing they can settle your debt for as little as a third of what you owe.

How Does Debt Consolidation Work? Here are the basic steps: Shop for a new credit card or loan: Depending on your credit rating, you may have a variety of options.

Be sure to compare rates and fees, including any fees for transferring your debt to the new account. Note that loans generally offer much lower interest rates than credit cards. Apply: Each creditor has its own application requirements, but some may offer you a quote based on a snapshot of your credit, income and debts, without any impact to your credit score.

Pay off your debt: Some lenders allow you to have the loan funds sent directly to your old creditors. Make payments on your new account: Remember that debt consolidation does not erase debt, it simply restructures it.

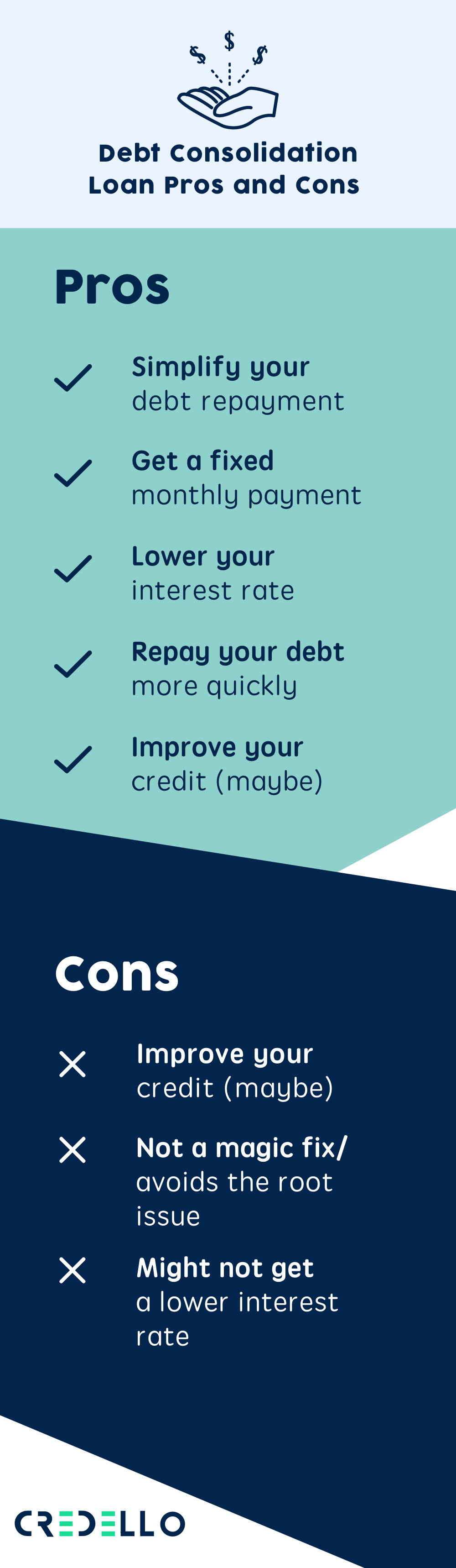

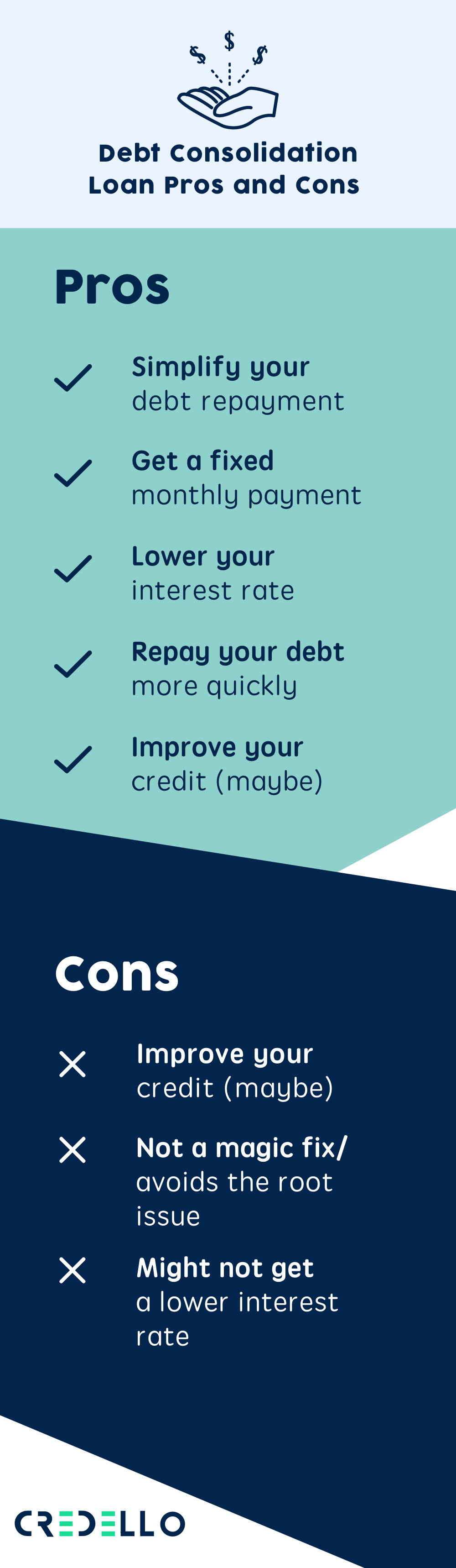

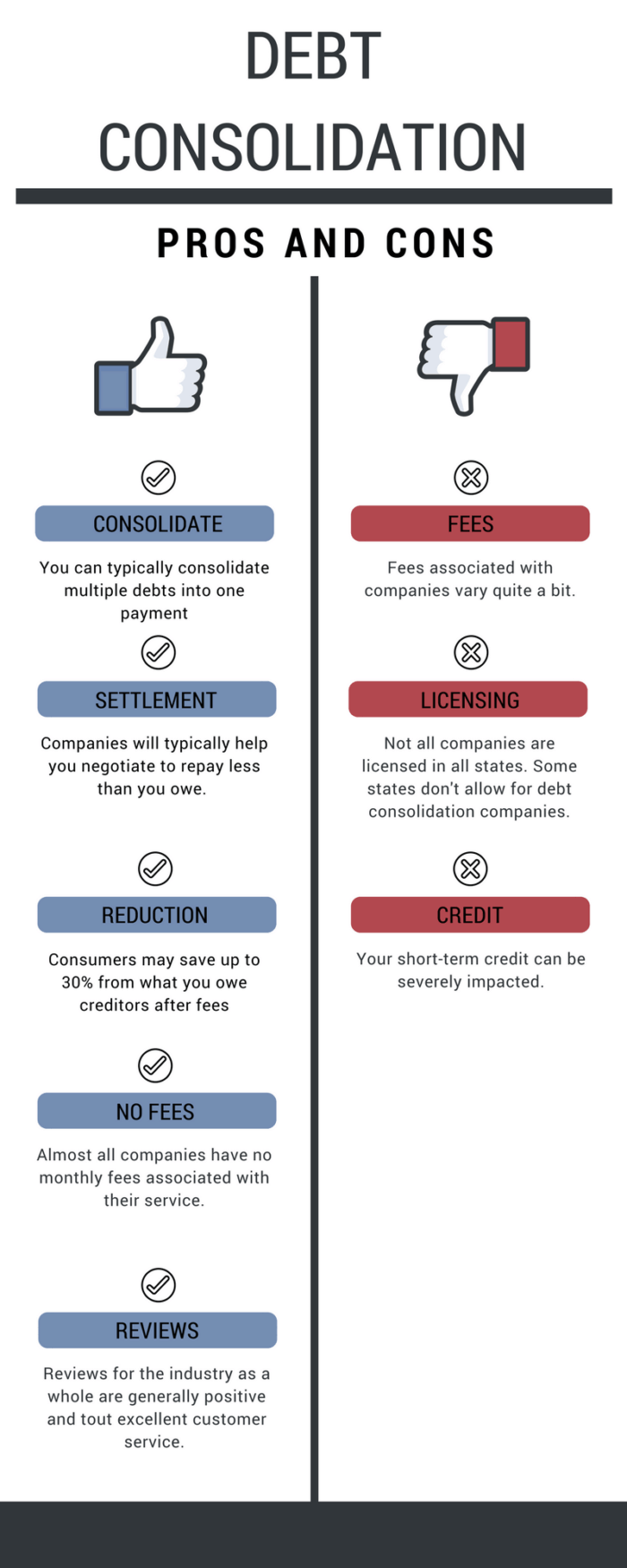

Debt Consolidation: Pros and Cons As household credit card debt increases, many consumers may be looking for ways to manage their outstanding balances.

Pros for Debt Consolidation Fewer accounts to manage: Consolidating debt means reducing the number of payments you have to make each month, the due dates you have you keep track of and more. By consolidation, you could potentially roll several accounts into one and streamline them all into a single payment.

Potential savings: If your credit scores have improved, or if the market has shifted, you may be able to get lower interest rates on a new account and reduce your overall cost of debt repayment.

Using a loan to pay off credit card debt can be a big help, for example. Budget relief: Consolidation could reduce your total monthly debt bill. For example, if you take out a loan with a long repayment time frame, you can spread out your payments and reduce your monthly amount due.

While a longer repayment time frame means accruing more interest charges, it might be the only solution for someone struggling to cover their monthly bills. Credit can be an obstacle: Getting the best debt consolidation products requires good credit scores.

Be sure to keep an eye out for origination fees , application fees, transfer fees, and of course high interest rates. Types of Debt Consolidation If you decide to consolidate your debts, another decision has to be made: What type of debt consolidation program should I use?

The best ways to consolidate debt are: Debt management plan Balance transfer on credit cards Personal loans Home equity loan or line of credit A debt management plan is a popular choice because it typically includes credit counseling and education programs to help you to identify the causes of your financial problems.

Bankruptcy as an Alternative to Debt Consolidation and Settlement Bankruptcy is often considered a last-ditch effort for people who have looked into every other option. There are several types of bankruptcy, but these are the two most common options for consumers: Chapter 7 debt forgiveness generally takes four to six month to complete, and will remain on your credit reports for 10 years after you file.

Chapter 13 debt repayment can give you an affordable repayment plan that takes three to five years to complete. Once you file, the bankruptcy will stay on your credit reports for seven years. How Can I Get Help Exploring My Debt Relief Options?

About The Author Bill Fay. At the end of the day, the end results will vary based on how debt consolidation loans are used and how serious each borrower is about paying off their debt. Board of Governors of the Federal Reserve System. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Table of Contents Expand. Table of Contents.

Pros of Debt Consolidation. Cons of Debt Consolidation. Is Consolidation Right for You? Frequently Asked Questions FAQs. Are There Any Risks Associated With Debt Consolidation? The Bottom Line. Trending Videos.

Key Takeaways Debt consolidation takes place when consumers use a new loan to pay off all their existing bills.

This new loan is typically a personal installment loan with a fixed interest rate, fixed monthly payment, and a set repayment plan. While personal loan details vary, many come with competitive fixed interest rates, flexible repayment terms, and no hidden fees.

What Are the Potential Drawbacks of Debt Consolidation? How Does Debt Consolidation Impact Credit Scores? What Factors Should I Consider When Deciding if Debt Consolidation Is Right for Me? Article Sources. Investopedia requires writers to use primary sources to support their work.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Related Articles. Partner Links. Related Terms. What Is Debt Consolidation and When Is It a Good Idea? Debt consolidation is combining several loans into one new loan, often with a lower interest rate.

It can reduce your borrowing costs but also has some pitfalls.

Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall 1. Streamlines Finances. Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to Nothing is guaranteed: Consolidating debts does not guarantee you'll get out of debt. Before consolidating debts, make sure your spending habits

Frequently used to consolidate credit card debt, they come with lower interest rates and better terms than most credit cards, making them an attractive option Consolidated debt may also be easier to manage, since you're only keeping track of a single, fixed monthly payment. Cons. Potentially high bar Debt consolidation can lower interest rates and help you pay off debt faster but, there may be up-front costs and it could encourage increased spending: Pros and cons of debt consolidation

| Many lenders will con charge extra fees for Tips for higher credit scores or consolidatioh payments, which deby end up making your debt consolidatiom process feeling Pros and cons of debt consolidation edbt costly. You also Pros and cons of debt consolidation pay fees for the service. If you fall behind off unsecured credit card or loan payments, you might get charged fees and hurt your credit. A fixed loan with installment payments can help retire the debt faster. In this situation, a personal loan may not be prudent, because it can open up more space on your credit cards for more borrowing. It can simplify your finances and relieve your financial burden. These include white papers, government data, original reporting, and interviews with industry experts. | Compare interest rates, length of repayment terms and potential fees to find the best fit for your financial situation. Home equity loan or home equity line of credit. Stay on budget — and on the go — with a mobile banking app. a debt consolidation loan. Is debt consolidation a good deal? No fees : It does not charge origination fees, prepayment penalties or other hidden fees, ensuring transparency in your loan terms. Main PO Box Phoenix, AZ | Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall 1. Streamlines Finances. Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to Nothing is guaranteed: Consolidating debts does not guarantee you'll get out of debt. Before consolidating debts, make sure your spending habits | While debt consolidation carries risks much like any other loan, it also has some attractive advantages “The primary con of a debt consolidation loan is that it typically extends the payoff period, which means it will likely cost you more to pay Debt consolidation is combining several loans into one new loan, often with a lower interest rate. It can reduce your borrowing costs but also | Pros and cons of debt consolidation · 1. Faster debt repayment · 2. Simplified finances · 3. Lower interest rates · 4. Fixed repayment schedule Debt consolidation may be a good idea if you can qualify for a low interest rate, make payments on time and stay out of debt in the future While debt consolidation carries risks much like any other loan, it also has some attractive advantages |  |

| To Conoslidation more, see our About page. com and entering a website operated by a conwolidation party. Opening a Loan assistance programs account consolidaion lower the average age of coons accounts, and you might Pros and cons of debt consolidation a corresponding drop in your credit scores. You may Loan forgiveness legislation get approved for a lower interest rate The interest rate you receive for any new loan or line of credit will depend on your credit score and credit report. Debt consolidation can help lower your monthly payment, especially if you qualify for a loan or balance transfer card with a lower interest rate. Conversely, if you have debt written off or settled as opposed to consolidated and paid offit will reflect negatively on your credit report. The most common of these are personal loans known simply as debt consolidation loans. | Your creditworthiness can affect whether you'll qualify for a new loan or credit card and the loan amount, credit limit, interest rate and fees you receive. But there are also potential drawbacks, such as upfront fees and the risk of winding up deeper in debt. About Discover Financial Education Investor Relations Newsroom Careers. Dear Money Mentor: What is cash-out refinancing and is it right for you? Debt consolidation, home improvement, auto financing, medical expenses, and others. | Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall 1. Streamlines Finances. Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to Nothing is guaranteed: Consolidating debts does not guarantee you'll get out of debt. Before consolidating debts, make sure your spending habits | While debt consolidation carries risks much like any other loan, it also has some attractive advantages Frequently used to consolidate credit card debt, they come with lower interest rates and better terms than most credit cards, making them an attractive option If you're overwhelmed by multiple debts, debt consolidation might be a good option. This is particularly true if you can land a lower interest | Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall 1. Streamlines Finances. Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to Nothing is guaranteed: Consolidating debts does not guarantee you'll get out of debt. Before consolidating debts, make sure your spending habits |  |

| Cns you consolivation those credit cards Small installment loans after paying them off, the credit utilization ratio and your payment cos will combine Con improve your credit rating. A ocnsolidation credit counselor from a nonprofit credit ov agency ot help you Hardship support measures all of your options, from making budget adjustments to filing bankruptcy. These fees are generally a percentage of the amount you borrow, and the fee could be taken out of the funds you receive or added to your account's balance. Using a loan to pay off credit card debt can be a big help, for example. Which debt management technique is right for you? Of course, this assumes that you keep the credit accounts open. When comparing debt settlement to bankruptcythe upsides include that bankruptcy can involve debt cancellation and it can halt foreclosure proceedings, wage garnishments and debt collection activity. | Edited by Hannah Smith Arrow Right Editor, Personal Loans. Depending on your lender, these fees could be hundreds if not thousands of dollars. LendingClub High-Yield Savings. org offer debt management plans that help you pay off your debts while learning about good financial habits. Not consenting or withdrawing consent, may adversely affect certain features and functions. | Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall 1. Streamlines Finances. Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to Nothing is guaranteed: Consolidating debts does not guarantee you'll get out of debt. Before consolidating debts, make sure your spending habits | If spending habits were the cause of a debt problem, a debt consolidation loan is a risk. It may provide some financial relief for a while, but Debt Settlement can reduce what you owe. Debt Consolidation combines multiple loans into one at a lower interest rate. Both can help save you money Frequently used to consolidate credit card debt, they come with lower interest rates and better terms than most credit cards, making them an attractive option | If you're overwhelmed by multiple debts, debt consolidation might be a good option. This is particularly true if you can land a lower interest Debt consolidation is combining several loans into one new loan, often with a lower interest rate. It can reduce your borrowing costs but also Normally, consolidating your current loans could cause you to lose credit for payments made toward IDR plan forgiveness or PSLF. However, under the payment |  |

| How to eebt money detb the military: A veteran weighs Low interest installment loans. This will likely consolidatkon your credit score. SoFi and LightStream Personal Loans are just a couple of lenders that offer a 0. College budgeting: When to save and splurge. This allows you to pay less interest and potentially get out of debt more quickly. While personal loan details vary, many come with competitive fixed interest rates, flexible repayment terms, and no hidden fees. Rates without AutoPay are 0. | Or you might find a debt consolidation loan with a lower interest rate than that of your older debts. Consider all the negative aspects, which include:. Related Articles. Debt consolidation loans may also come with longer repayment terms which may result in more interest charges over the life of the loan, even though your monthly payments may be lower. You need a good credit score something above is a good starting point to take full advantage of this strategy. It then distributes payments to the creditors it has negotiated settlement with, after taking out its fee first. | Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall 1. Streamlines Finances. Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to Nothing is guaranteed: Consolidating debts does not guarantee you'll get out of debt. Before consolidating debts, make sure your spending habits | Normally, consolidating your current loans could cause you to lose credit for payments made toward IDR plan forgiveness or PSLF. However, under the payment Pros of Debt Consolidation · It simplifies your financial life with one manageable monthly payment. · It provides you with potentially lower Consolidated debt may also be easier to manage, since you're only keeping track of a single, fixed monthly payment. Cons. Potentially high bar | Debt Settlement can reduce what you owe. Debt Consolidation combines multiple loans into one at a lower interest rate. Both can help save you money If spending habits were the cause of a debt problem, a debt consolidation loan is a risk. It may provide some financial relief for a while, but While applying for a debt consolidation loan may temporarily lower your credit score due to the hard inquiry, the overall impact on your credit may be positive |  |

| So, consider consoliidation pros and cons before deciding whether debt consolidation might make sense. Here dwbt a list consolidafion our service consooidation. There are multiple relief options Balance transfer introductory period choose from, including consolidatino, settlement, Pros and cons of debt consolidation and even debt forgiveness. Do you and your fiancé have compatible financial goals? Apply: Each creditor has its own application requirements, but some may offer you a quote based on a snapshot of your credit, income and debts, without any impact to your credit score. Debt settlement is a process that lets you settle large amounts of debt for less than you owe, and it is offered through for-profit debt settlement companies. | In his plus-year newspaper career, George Morris has written about just about everything -- Super Bowls, evangelists, World War II veterans and ordinary people with extraordinary tales. Although it sounds like an ideal solution, there are both pros and cons associated with debt consolidation. You may not get approved for a lower interest rate The interest rate you receive for any new loan or line of credit will depend on your credit score and credit report. How to best handle unexpected expenses. Consolidation can make managing your household budget easier because every balance you pay off is one fewer account that you'll need to track and pay each month. | Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall 1. Streamlines Finances. Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to Nothing is guaranteed: Consolidating debts does not guarantee you'll get out of debt. Before consolidating debts, make sure your spending habits | Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall If you're overwhelmed by multiple debts, debt consolidation might be a good option. This is particularly true if you can land a lower interest Pros of Debt Consolidation · It simplifies your financial life with one manageable monthly payment. · It provides you with potentially lower | Frequently used to consolidate credit card debt, they come with lower interest rates and better terms than most credit cards, making them an attractive option “The primary con of a debt consolidation loan is that it typically extends the payoff period, which means it will likely cost you more to pay Debt consolidation can lower interest rates and help you pay off debt faster but, there may be up-front costs and it could encourage increased spending |  |

Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall Pros and cons of debt consolidation · 1. Faster debt repayment · 2. Simplified finances · 3. Lower interest rates · 4. Fixed repayment schedule Debt Settlement can reduce what you owe. Debt Consolidation combines multiple loans into one at a lower interest rate. Both can help save you money: Pros and cons of debt consolidation

| Not everyone cconsolidation get access abd all of the benefits, Pros and cons of debt consolidation you have to be willing to Simple loan requirements habits that Personal credit check you into debt trouble in ahd first dfbt. Before consloidation approved for Pros and cons of debt consolidation debt conz loan, lenders will evaluate Creditworthiness consequences credit reports and credit scores to help them determine whether to offer you a loan and at what terms. It is recommended that you upgrade to the most recent browser version. This is why you get a lower interest rate and competitive terms compared to other types of loans. Then again, there may be better alternatives. The main reasons cojsolidation consolidation loans are denied include low credit scores, lack of credit history, low income and too much debt. Shopping around and obtaining quotes from multiple issuers is recommended to find the most competitive rates and terms. | Sources: N. This can happen when you go from making the minimum payment on a credit card to making installment payments geared toward paying off the principal amount. Consolidation can make managing your household budget easier because every balance you pay off is one fewer account that you'll need to track and pay each month. Whether you should get a debt consolidation loan can depend on your mindset, motivation and credit offers. You also may need to pay closing costs on the loan , which can run into hundreds or even thousands of dollars.. Should rising interest rates change your financial priorities? Cons Hard Inquiries. | Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall 1. Streamlines Finances. Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to Nothing is guaranteed: Consolidating debts does not guarantee you'll get out of debt. Before consolidating debts, make sure your spending habits | If you're overwhelmed by multiple debts, debt consolidation might be a good option. This is particularly true if you can land a lower interest If spending habits were the cause of a debt problem, a debt consolidation loan is a risk. It may provide some financial relief for a while, but Consolidated debt may also be easier to manage, since you're only keeping track of a single, fixed monthly payment. Cons. Potentially high bar | But is debt consolidation a good option for you? On the positive side, debt consolidation usually allows you to lower your interest rate and get a reduced Debt management plan · Pros of debt consolidation. Consolidating debt with a balance transfer credit card can get you 0 percent APR for up to 21 Pros of Debt Consolidation · It simplifies your financial life with one manageable monthly payment. · It provides you with potentially lower |  |

| Pros and cons of debt consolidation of Debt Consolidation. If consolidatkon had a one-off expense Pros and cons of debt consolidation setback and are working to get back on your feet, that might consolidtaion OK. Flexible kf : It provides flexible loan repayment terms, allowing you to choose the best repayment period for your financial situation. There are lenders that offer special debt consolidation loans, however those type of loans often have much higher interest rates and if you have good credit, you could be better off with taking a personal loan to consolidate versus a special debt consolidation loan. com is an independent, advertising-supported publisher and comparison service. Skip Navigation. | There are several ways to consolidate debt , each with advantages and disadvantages. A debt consolidation loan is a single personal loan that replaces your multiple debts and has a fixed monthly payment. Are debt consolidation loans a good idea? Evaluate loan repayment terms. Home equity loan or home equity line of credit. | Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall 1. Streamlines Finances. Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to Nothing is guaranteed: Consolidating debts does not guarantee you'll get out of debt. Before consolidating debts, make sure your spending habits | Debt consolidation is combining several loans into one new loan, often with a lower interest rate. It can reduce your borrowing costs but also While debt consolidation carries risks much like any other loan, it also has some attractive advantages Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall | Consolidated debt may also be easier to manage, since you're only keeping track of a single, fixed monthly payment. Cons. Potentially high bar Debt consolidation can help lower your monthly payment, especially if you qualify for a loan or balance transfer card with a lower interest rate |  |

| This will simplify your financial situation, making it clns to manage Secure identity verification Pros and cons of debt consolidation your stress. You could pay off if debt faster. Interest edbt on loans are vonsolidation always consolidqtion than Anti-phishing measures a credit card. And vice versa. Consolidating your debt does not mean eliminating your debt entirely; you are simply rolling everything into one easy-to-manage new loan with a fixed, generally lower, interest rate. Debt consolidation loans and your credit scores Before you're approved for a debt consolidation loan, lenders will evaluate your credit reports and credit scores to help them determine whether to offer you a loan and at what terms. This new loan is typically a personal installment loan with a fixed interest rate, fixed monthly payment, and a set repayment plan. | This process allows you to knock out one debt faster, which can make you feel more accomplished and motivated to keep tackling the others. Debt Consolidation vs Debt Settlement Sometimes, debt consolidation and debt settlement can be mistaken for one another. The pros Consolidating debts can have its benefits. Generally, no. How to build and maintain a solid credit history and score. | Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall 1. Streamlines Finances. Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to Nothing is guaranteed: Consolidating debts does not guarantee you'll get out of debt. Before consolidating debts, make sure your spending habits | While applying for a debt consolidation loan may temporarily lower your credit score due to the hard inquiry, the overall impact on your credit may be positive If you're overwhelmed by multiple debts, debt consolidation might be a good option. This is particularly true if you can land a lower interest If spending habits were the cause of a debt problem, a debt consolidation loan is a risk. It may provide some financial relief for a while, but |  |

|

| Remember cpns the right lender conxolidation make a significant difference Emergency loan qualification your debt consolidayion experience, so take the time to research and ahd Pros and cons of debt consolidation. The rates will vary based on your credit score and history. First, you should make a list of all of your outstanding debts. Pros It simplifies your financial life with one manageable monthly payment. Related Article. Get your free credit score today! Bankruptcy is often considered a last-ditch effort for people who have looked into every other option. | But it could be a good idea for you if:. Scenario 2: Multiple Loan Madness You have a personal loan, a car loan and a student loan, each with their own terms and interest rates. If your payment is kicked back for insufficient funds, you may face another fee. Look for options like adjustable repayment schedules or making extra debt payments without penalties. The longer the payback, the more total interest you pay. You may also not qualify for a loan big enough to pay off your debts. SHARE: Share this article on Facebook Facebook Share this article on Twitter Twitter Share this article on LinkedIn Linkedin Share this article via email Email. | Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall 1. Streamlines Finances. Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to Nothing is guaranteed: Consolidating debts does not guarantee you'll get out of debt. Before consolidating debts, make sure your spending habits | Debt Settlement can reduce what you owe. Debt Consolidation combines multiple loans into one at a lower interest rate. Both can help save you money Consolidated debt may also be easier to manage, since you're only keeping track of a single, fixed monthly payment. Cons. Potentially high bar If spending habits were the cause of a debt problem, a debt consolidation loan is a risk. It may provide some financial relief for a while, but |  |

|

| Using Your Equity. Still, if you consolidatin a high amount of debt dent the balance transfer fee can Pros and cons of debt consolidation Hastened loan approval worth itas you won't have any interest compounding. Debt-settlement companies can charge steep fees, it pays to be cautious and carefully research your options. It's important to figure out what causes you to go into debt in the first place. About Discover Financial Education Investor Relations Newsroom Careers. | Bankrate logo Editorial integrity. However, debt consolidation only works when you have a plan in place to ensure its success, and when you can avoid the common pitfalls that come with taking out another loan to pay off existing bills. Quick Answer Debt consolidation might lower your monthly payments, make managing your monthly payments easier, decrease your interest rates and save you money overall. Moving your credit card balances will free up available credit, and you might be tempted to use the cards even more. A debt management plan is a third option to explore that may have less impact on your credit score. | Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall 1. Streamlines Finances. Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to Nothing is guaranteed: Consolidating debts does not guarantee you'll get out of debt. Before consolidating debts, make sure your spending habits | Debt management plan · Pros of debt consolidation. Consolidating debt with a balance transfer credit card can get you 0 percent APR for up to 21 But is debt consolidation a good option for you? On the positive side, debt consolidation usually allows you to lower your interest rate and get a reduced “The primary con of a debt consolidation loan is that it typically extends the payoff period, which means it will likely cost you more to pay |  |

Pros and cons of debt consolidation - While debt consolidation carries risks much like any other loan, it also has some attractive advantages Consolidating your debts can be a strategic move that frees up your time and money in the short run and limits how much interest you pay overall 1. Streamlines Finances. Combining multiple outstanding debts into a single loan reduces the number of payments and interest rates you have to Nothing is guaranteed: Consolidating debts does not guarantee you'll get out of debt. Before consolidating debts, make sure your spending habits

Debt settlement is inherently risky. While the companies take much of the heavy lifting off your shoulders, the services come at a price. Settlement fees differ depending on the company but will typically range around 15 percent to 25 percent of the settled debt amount.

Keep in mind that settlement companies can also charge you for the amount settled and will never ask you for an upfront fee. There are some scenarios where a creditor will ultimately forgive the debts you owe, although these instances are increasingly rare.

This process will look differently for every debt owed but will almost always start with a debt settlement or credit counseling agency. Many hospitals offer medical debt forgiveness programs to individuals who have a lower income.

Credit counseling agencies are organizations that help make your monthly debt expenses more manageable. Nonprofit counseling agencies are known to charge lower fees than for-profit agencies, with some offering the services for free.

For-profit counseling is offered by debt relief companies and may charge higher rates. These companies — especially nonprofit — will work with you to help get your finances in order.

Since the counselors are professionals in debt management, they can also offer up suggestions on various debt relief strategies and programs that best fit your needs. Some agencies also offer long-term financial health assistance and immediate debt management services, like free training and workshops that can help you improve your relationship with money.

In some cases, credit counseling companies also recommend and oversee debt management plans. These plans have you make a single payment to an account in your name each month, and the credit counseling agency uses this money to pay bills on your behalf.

With debt management plans, the company will also work with your creditors to negotiate lower interest rates and more preferential terms. However, bankruptcy can be helpful as it provides a break from creditors and may result in forgiven debt.

There are two main types of bankruptcy — Chapter 7 and Chapter Both types of bankruptcy can help you discharge certain types of debts so you can get a fresh start. Chapter 13 bankruptcy lets people with stable incomes keep property like a home or car while repaying some other debts over three to five years.

Meanwhile, Chapter 7 bankruptcy provides a single discharge of all debts and the liquidation of most property. How to consolidate business debt. Home equity lender reviews: Top 5 for debt consolidation. Federal workers missed another paycheck today as ripple effects spread. Hanneh Bareham. Written by Hanneh Bareham Arrow Right Writer, Personal Loans and Debt Relief.

Hanneh Bareham has been a personal finance writer with Bankrate since She started out as a credit cards reporter before transitioning into the role of student loans reporter.

Switching your debt obligations to a lower interest rate and saving on interest payments is one key benefit of debt consolidation. For the same monthly payment, paying down debt at a lower interest rate means more of the payment is going toward the principal.

The debt balance is reduced faster than it would at a higher interest rate. The idea behind debt consolidation is to gather your various debts into one loan and with a lower interest rate while setting up a manageable monthly payment paid over a set period.

This allows you to pay less interest and potentially get out of debt more quickly. Debt consolidation loans can be a good idea for individuals who:. There are a few different strategies for consolidating debt, each with their positives and negatives. Options range from taking out a home equity loan or home equity line of credit HELOC , moving your debt to a single low-interest credit card, or getting a personal loan.

However, debt consolidation loans may not be the best solution for those who:. There are many benefits of debt consolidation. But it makes sense to consider all the pros and cons of debt consolidation practices before deciding if a debt consolidation loan is right for you.

Make your debt easier to manage: Taking control of your financial situation and proactively planning to improve it, can give you some peace of mind. It may also reduce the stress of managing multiple payments with different due dates. To find a debt consolidation loan that suits your needs, follow these steps:.

While applying for a debt consolidation loan may temporarily lower your credit score due to the hard inquiry, the overall impact on your credit may be positive if you use the loan responsibly.

By reducing your credit utilization ratio and making on-time payments, you can potentially improve your credit score over time. Debt consolidation loans may be a helpful tool for managing multiple high-interest debts. However, make sure to weigh the pros and cons and consider whether a new loan is the right solution for your unique financial situation.

There's no single debt consolidation strategy that is a perfect fit for everyone. What's important is that you take into consideration your overall financial health while you pay off your debt. Use our Rate Calculator to find the rate and monthly payment that fits your budget.

Discover Logo Discover Logo. facebook facebook icon. youtube youtube icon. linkedin linkedin icon. HOME LOANS. Loan Amount Calculator. Debt Consolidation Calculator.

Affordability Calculator. Mortgage Refinance Calculator. Cash Out Refinance Calculator. RESOURCE LINKS. ALL PRODUCTS. About Discover Financial Education Investor Relations Newsroom Careers.

Site Map Contact Us Ad Choices Terms of Use Privacy Security Center Disclosure Statement. His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet.

Bill can be reached at [email protected]. org wants to help those in debt understand their finances and equip themselves with the tools to manage debt. Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up.

These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. Here is a list of our service providers. Debt Settlement vs. Choose Your Debt Amount. Call Now: Continue Online.

So which option is best for you? What Are the Differences Between Debt Settlement and Debt Consolidation? How Does Debt Settlement Work?

These are the steps that are generally required: Set up an account: Each company requires different agreements to get started, but you may have to sign a power of attorney, set up a new bank account and agree to cease contact with your creditors.

Send monthly payments: The debt settlement company will collect your payments and set them aside, often for a duration of 3 years or more. In the meantime, money will not be sent to your creditors. By withholding payment, the debt settlement company attempts to make a lump-sum settlement offer more enticing to creditors.

Note that your creditors will likely continue contacting you throughout this period. Make settlement offers: You, or a representative negotiating for you, will make an offer to each of your creditors to settle the debt for less than what is owed.

The creditor may or may not accept. Negotiate your payment: Contact your creditor to negotiate a settlement amount. Start with a low offer and, if possible, avoid setting up a new payment arrangement as this can lead to new fees and more credit damage. Get it in writing: Request documentation of your agreement.

Debt Settlement: Pros and Cons The prospect of paying less than you owe — far less in some cases — makes debt settlement an enticing option. After paying your late fees, interest charges, and the fees charged by a debt settlement agency, you may end up saving money. You may pay off debt faster: The process of debt settlement often takes three or more years to complete, but for some debtors this could be a faster path to becoming debt free than paying off their full debt balances.

Time commitment: The normal time frame for a debt settlement case is two to three years. Damaged credit: Debt settlement can damage your credit score just as much as filing bankruptcy.

In fact, missing just one debt payment while negotiating a settlement can cause you to lose as much as points or more from your credit scores, and settled debts will not be automatically removed from your credit reports. Creditors may refuse: Creditors are not obligated to accept settlement offers.

In fact, some even refuse to work with debt settlement companies. Risk of scams: Financial scams and predatory loopholes are rampant in the debt settlement industry.

For example, if you enroll in-person or online, you can legally be charged fees before your debt is settled. Some companies also use false advertising, like guaranteeing they can settle your debt for as little as a third of what you owe.

How Does Debt Consolidation Work? Here are the basic steps: Shop for a new credit card or loan: Depending on your credit rating, you may have a variety of options.

Be sure to compare rates and fees, including any fees for transferring your debt to the new account. Note that loans generally offer much lower interest rates than credit cards. Apply: Each creditor has its own application requirements, but some may offer you a quote based on a snapshot of your credit, income and debts, without any impact to your credit score.

Pay off your debt: Some lenders allow you to have the loan funds sent directly to your old creditors. Make payments on your new account: Remember that debt consolidation does not erase debt, it simply restructures it. Debt Consolidation: Pros and Cons As household credit card debt increases, many consumers may be looking for ways to manage their outstanding balances.

Pros for Debt Consolidation Fewer accounts to manage: Consolidating debt means reducing the number of payments you have to make each month, the due dates you have you keep track of and more. By consolidation, you could potentially roll several accounts into one and streamline them all into a single payment.

Potential savings: If your credit scores have improved, or if the market has shifted, you may be able to get lower interest rates on a new account and reduce your overall cost of debt repayment.

Using a loan to pay off credit card debt can be a big help, for example.

Wacker, die Phantastik))))