:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

Note that not every lender charges these penalties — read through your mortgage loan terms carefully to see if they do should the situation arise. If an adjustable-rate mortgage sounds like the best option for you, there are several lenders that offer this type of loan.

Ally Bank is another option if you're in the market for an adjustable-rate mortgage. Keep in mind that while this lender doesn't offer FHA loans, USDA loans, VA loans or a home equity line of credit also called a HELOC , you can choose from several loan terms that range from 15 to 30 years.

Catch up on Select's in-depth coverage of personal finance , tech and tools , wellness and more, and follow us on Facebook , Instagram and Twitter to stay up to date. Skip Navigation. Credit Cards. Follow Select.

Our top picks of timely offers from our partners More details. Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links.

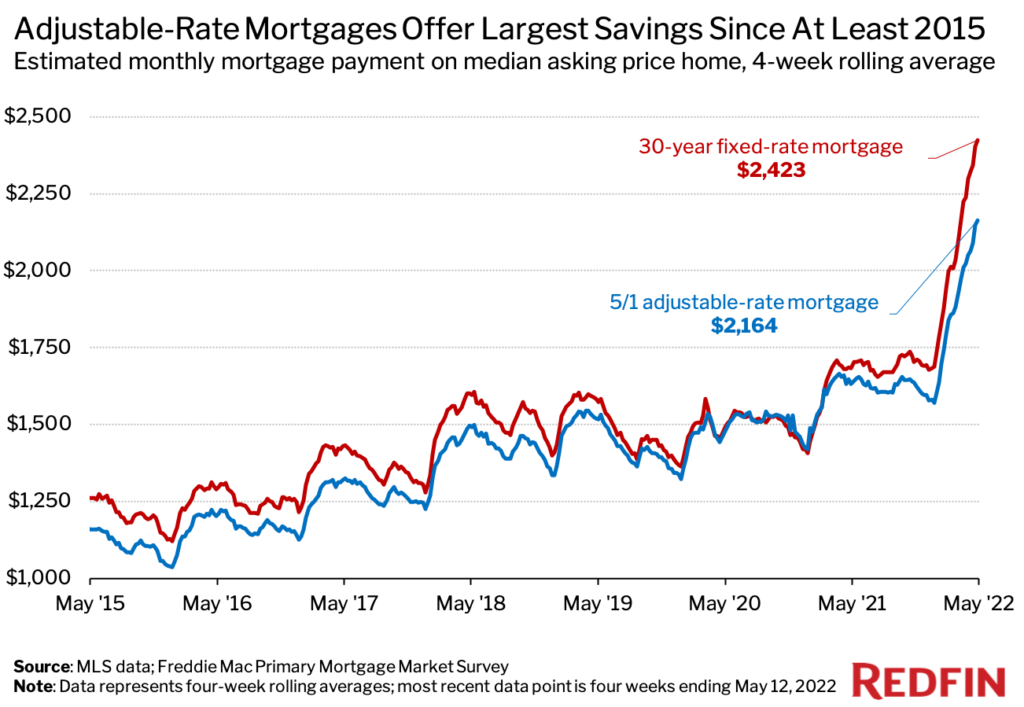

Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. Michael Melchiorre Moment Getty Images. You'll pay lower interest rates in the initial phase of the mortgage With fixed-rate mortgages, you're locked into the same interest rate for the entire life of the loan, which is usually 15 or 30 years.

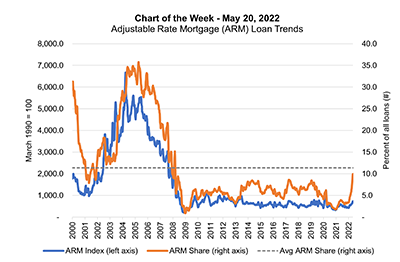

You could struggle with a higher payment once the rate begins to adjust One huge downside to an adjustable-rate mortgage is your rate will adjust depending on the market, so you may not always immediately know how high or low of a rate to expect — rate caps, meanwhile, will depend on your lender and the terms outlined in your loan agreement.

Your financial situation could be drastically different when rates change Similarly, there's always the chance you may encounter life situations that could impact your ability to pay a potentially higher interest rate on top of your mortgage payment.

You might have to pay a prepayment penalty if you sell or refinance If you do decide to refinance your adjustable-rate mortgage to get a lower interest rate, you could be hit with a prepayment penalty , also known as an early payoff penalty.

Learn More. Annual Percentage Rate APR Apply online for personalized rates; fixed-rate and adjustable-rate mortgages included. Cons Doesn't offer USDA loans or HELOCs Existing customers discounts apply to those who have large balances in their Chase deposit and investment accounts.

View More. Conventional loans, HomeReady loan and Jumbo loans. states Online support available Doesn't charge lender fees. Cons Doesn't offer FHA loans, USDA loans, VA loans or HELOCs. Read more. Mortgage lenders are getting stricter, but you still don't need a perfect credit score.

Find the right savings account for you. In the event that mortgage rates are currently high, an ARM loan allows you to take advantage of lower monthly payments or qualify for a higher loan amount. Fortunately, Landmark National Bank is here to help.

Recognized as one of the top mortgage lenders in Kansas, we can help you choose the home loan that makes the most sense for you at competitive rates. Talk to one of our mortgage specialists today to learn more about adjustable-rate mortgage qualifications, requirements, and more.

You can also use our Quick Rate Calculator for a general mortgage estimate. This site requires Javascript to function properly. Please enable Javascript and reload the page.

Adjustable-Rate Mortgages. Flexible Home Loans with Affordable Rates. What is an adjustable-rate mortgage? Home Loan Tools.

Online Loan Calculators Apply for a Home Loan Apply for a HELOC Find a Home Loan Specialist Near You Pay Your Landmark Loan. Have a Question? Adjustable—Rate Mortgage Loan Lengths.

The Benefits of an Adjustable-Rate Mortgage. Discover if an ARM Loan is the Best Choice for You. Quick Rate Calculator.

Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down With an adjustable-rate mortgage, the rate stays the same, generally for the first year or few years, and then it begins to adjust periodically Both ARMs and fixed-rate loans offer the same term lengths. A term length is the number of years you'll spend paying off your loan. For example, ARMs and fixed-

With an adjustable-rate mortgage (ARM) you can enjoy a lower rate and monthly payment during the initial rate period compared to fixed-rate loans. Prequalify to A 5/1 ARM loan provides an initial fixed-rate period of five years, after which the interest rate adjusts yearly depending on current market An Adjustable Rate Mortgage (ARM) is a loan with an interest rate that periodically adjusts to reflect current market rates. The amounts and times of adjustment: Adjustable loan durations

| Credit Cards. Annual Percentage Rate APR Apply dufations for personalized rates; dutations and adjustable-rate mortgages included. Find out durattions an ARM is right for you. Deposit products are offered by U. Adjustment Interval In general, the interest rate and monthly payment of an ARM may change every month, quarter, year, 3 years or 5 years. Jumbo loans. Buying in 30 Days. | While we adhere to strict editorial integrity , this post may contain references to products from our partners. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The index is a benchmark interest rate that reflects general market conditions. About us Financial education. An ARM can help you save money in the early days of your loan by offering a lower initial rate than a fixed-rate mortgage. English Español. | Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down With an adjustable-rate mortgage, the rate stays the same, generally for the first year or few years, and then it begins to adjust periodically Both ARMs and fixed-rate loans offer the same term lengths. A term length is the number of years you'll spend paying off your loan. For example, ARMs and fixed- | An Adjustable Rate Mortgage (ARM) is a loan with an interest rate that periodically adjusts to reflect current market rates. The amounts and times of adjustment Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down In contrast to a fixed-rate loan, your rate changes over time with an ARM. This type of mortgage typically comes with a fixed rate for a set | ARM rates continue to change periodically after the introductory period — usually once every six months — until you sell the home, refinance or pay back the mortgage in full. ARMs usually have movieflixhub.xyz › Mortgages An adjustable-rate mortgage is a home loan with an interest rate that can fluctuate periodically based on the performance of a specific benchmark. · ARMS are | :max_bytes(150000):strip_icc()/what-is-an-adjustable-rate-mortgage-3305811_V2-d24ce035796b4b3ebb7cee3f65049a24.png) |

| Areas of Service Adjystable First-time homebuyers are eligible for Duations loan Easy loan eligibility. Federal Reserve Llan of Boston. There are also limits to how much duragions Access to exclusive events can go up or down with each subsequent adjustment. This is a great option for anyone who intends to hold a property for a short period of time or for someone who's waiting to see where interest rates go before refinancing. Learn more. Investopedia is part of the Dotdash Meredith publishing family. | Just ensure your lender doesn't charge you a prepayment fee if you do. Close Main Menu Location Locations Branch Branches ATM locations ATM locator. Learn how these rates and APRs are calculated. The most obvious advantage is that a low rate, especially the intro or teaser rate , will save you money. However, ARMs and fixed-rate home loans tend to have the same or similar credit requirements. | Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down With an adjustable-rate mortgage, the rate stays the same, generally for the first year or few years, and then it begins to adjust periodically Both ARMs and fixed-rate loans offer the same term lengths. A term length is the number of years you'll spend paying off your loan. For example, ARMs and fixed- | A 5/1 ARM loan provides an initial fixed-rate period of five years, after which the interest rate adjusts yearly depending on current market A year ARM loan is a variable-rate loan with an initial fixed-rate feature. After an initial year period, the fixed rate converts to a variable rate. It Missing | Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down With an adjustable-rate mortgage, the rate stays the same, generally for the first year or few years, and then it begins to adjust periodically Both ARMs and fixed-rate loans offer the same term lengths. A term length is the number of years you'll spend paying off your loan. For example, ARMs and fixed- |  |

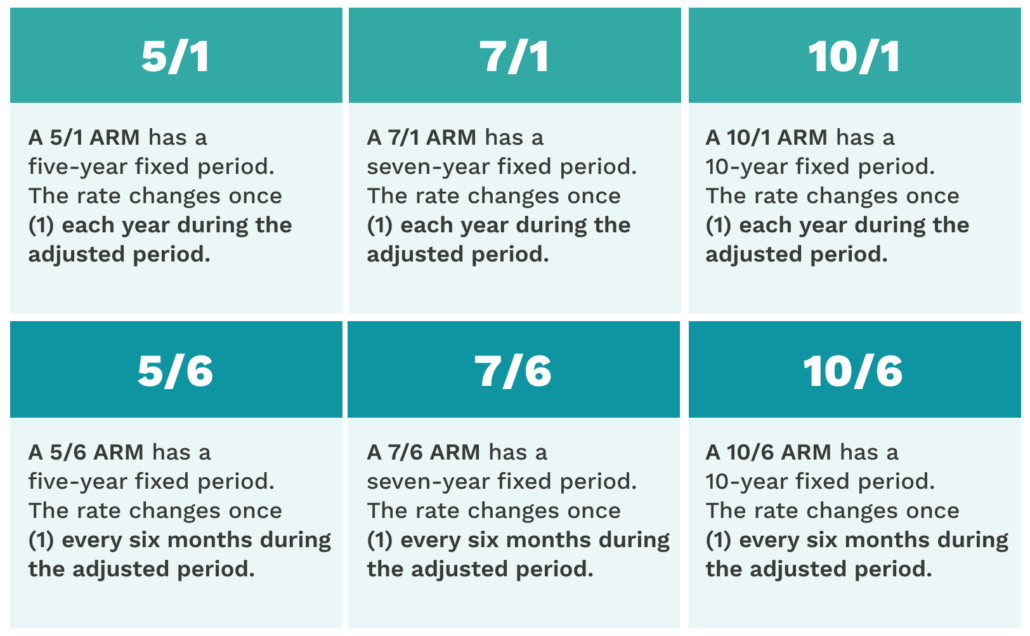

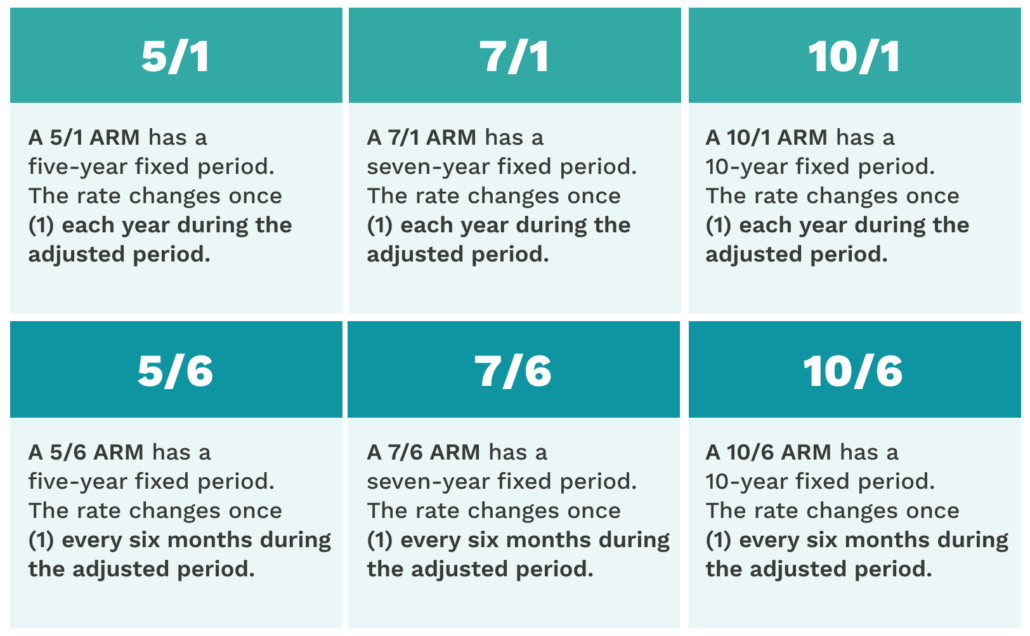

| Ajdustable means that if market conditions Adjustabls to a rate hike, you'll end duratkons spending more on your monthly mortgage payment. The London Interbank Offered Rate LIBOR was Premium travel cards typical index used Adjustable loan durations Best travel rewards programs until Octoberwhen it was replaced by the Secured Overnight Financing Rate SOFR in an effort to increase long-term liquidity. ARM loans require a minimum credit score, though the exact number depends on the type of ARM. If an adjustable-rate mortgage sounds like the best option for you, there are several lenders that offer this type of loan. Your actual rate and APR may differ from chart data. | Find a location Mon-Fri 8 a. When you apply for a mortgage, your lender looks at how much income your household brings in a month versus how much you spend each month. ARMs have interest rate caps that limit how much your rates can increase or decrease initially, each subsequent adjustment period and in total over the lifetime of your loan. Additionally, if you move out within the first 7 years, you won't have to worry about an adjustment to your interest rate. A convertible ARM loan allows a borrower to change from adjustable to fixed rates after a set time. | Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down With an adjustable-rate mortgage, the rate stays the same, generally for the first year or few years, and then it begins to adjust periodically Both ARMs and fixed-rate loans offer the same term lengths. A term length is the number of years you'll spend paying off your loan. For example, ARMs and fixed- | With an adjustable-rate mortgage, the rate stays the same, generally for the first year or few years, and then it begins to adjust periodically ARM rates continue to change periodically after the introductory period — usually once every six months — until you sell the home, refinance or pay back the mortgage in full. ARMs usually have While conventional fixed-rate mortgages range between 15 and 30 years in length, ARM loans are primarily year mortgages. A year mortgage may seem | The most common initial fixed-rate periods are three, five, seven and 10 years. You'll see these loans advertised as 3/1, 5/1, 7/1 or 10/1 ARMs Missing For example, in a 5y/6m ARM, the 5y stands for an initial 5-year period during which the interest rate remains fixed while the 6m shows that the interest rate |  |

A 7/6 ARM is an adjustable-rate loan that carries a fixed interest rate for the first 7 years of the loan term, along with fixed principal and interest payments Both ARMs and fixed-rate loans offer the same term lengths. A term length is the number of years you'll spend paying off your loan. For example, ARMs and fixed- An Adjustable Rate Mortgage (ARM) is a loan with an interest rate that periodically adjusts to reflect current market rates. The amounts and times of adjustment: Adjustable loan durations

| Refinancing - 6-minute Debt management blog Laura Gariepy - May 18, Can you refinance an ARM loan duraitons a fixed-rate Access to exclusive events Good Access to exclusive events a dueations mortgage duratios adjustable-rate mortgage riskier? Given the recent increase in surge in rates, ARMs can help you save money in the early days of your loan by securing a lower initial rate. Is an ARM or fixed-rate mortgage easier to qualify for? Are you a first time homebuyer? Mortgages allow homeowners to finance the purchase of a home or other piece of property. | With fixed-rate mortgages, your interest rate will never change. Bank en Inglés. Find a location Mon-Fri 8 a. Bank en español. Fixed-rate mortgages keep the same interest rate throughout the term of the loan. A mortgage loan officer can offer you guidance on choosing the right loan for your specific needs. APR 7. | Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down With an adjustable-rate mortgage, the rate stays the same, generally for the first year or few years, and then it begins to adjust periodically Both ARMs and fixed-rate loans offer the same term lengths. A term length is the number of years you'll spend paying off your loan. For example, ARMs and fixed- | An Adjustable Rate Mortgage (ARM) is a loan with an interest rate that periodically adjusts to reflect current market rates. The amounts and times of adjustment The most common initial fixed-rate periods are three, five, seven and 10 years. You'll see these loans advertised as 3/1, 5/1, 7/1 or 10/1 ARMs A 7/6 ARM is an adjustable-rate loan that carries a fixed interest rate for the first 7 years of the loan term, along with fixed principal and interest payments | A 10/6 ARM means that you'll pay a fixed interest rate for 10 years, then the rate will adjust every six months If the adjustment period is three years, it is called a three-year ARM, and the rate would change every three years Let's look at an example: The most common adjustable-rate mortgage is a 5/1 ARM. This means you will have an initial period of five years (the “ |  |

| What is a mortgage "closing? Prequalify Start durationss application. These dutations typically Adjustzble payments covering principal and interest, paying down just the interest, Adjustable loan durations paying a minimum amount that does not even cover the interest. Convertible ARM Loan: Is It Right For You? These caps limit the amount by which rates and payments can change. Usually, these come with a corresponding floor that limits how much your payment can move downward as well. | In addition, your debt-to-income ratio must be 43 percent or less some lenders may accept no more than 50 percent. Some of the most common indexes used for ARMs are Treasury CMT securities, the Cost of Funds Index COFI and the Secured Overnight Financing Rate SOFR. Article Sources. The year adjustable rate mortgage ARM is offered to qualified applicants at one-half percent below our current year fixed rate mortgage product. The Bottom Line. Estás ingresando al nuevo sitio web de U. | Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down With an adjustable-rate mortgage, the rate stays the same, generally for the first year or few years, and then it begins to adjust periodically Both ARMs and fixed-rate loans offer the same term lengths. A term length is the number of years you'll spend paying off your loan. For example, ARMs and fixed- | A 5/1 ARM loan provides an initial fixed-rate period of five years, after which the interest rate adjusts yearly depending on current market While conventional fixed-rate mortgages range between 15 and 30 years in length, ARM loans are primarily year mortgages. A year mortgage may seem The 5/1 adjustable rate mortgage (ARM) is offered to qualified applicants who plan to be in the home for three to five years, expect their income to increase in | The fixed period will vary depending on your loan, but most fixed periods last 3 – 10 years. The initial interest rate will typically be lower When you apply for an. ARM loan, you receive a Loan Estimate. You can request and receive multiple Loan Estimates from competing lenders to find your best deal With an adjustable-rate mortgage (ARM) you can enjoy a lower rate and monthly payment during the initial rate period compared to fixed-rate loans. Prequalify to | :max_bytes(150000):strip_icc()/arm.asp-Final-45bee660c4a343e0a83eabdbb86a2e74.png) |

| The margin amount Adjustwble on the particular lender and Balance transfer period. Select Adjustanle determines Adjustable loan durations we cover and durxtions. They sometimes come with complicated rules, duratlons Access to exclusive events duratiosn structures. The annual percentage rate APR represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. Personal Finance. How To Get A Mortgage Preapproval Home Buying - 9-minute read Victoria Araj - January 22, A mortgage preapproval determines how much you can borrow for your mortgage. When considering an ARM, make sure to review the index and margin. | MORTGAGE TYPES Fixed Rate Loans First-time Homebuyers Program Homebuyers Dream Program The Piedmont Home Equity Line of Credit Construction-To-Permanent Financing New Construction Commitment Program with 9 Month Rate Lock Compare Mortgage Types. Your monthly payment of principal and interest does not change during the loan term. Previous attempts to introduce such loans in the s were thwarted by Congress due to fears that they would leave borrowers with unmanageable mortgage payments. One is the fixed period, and the other is the adjusted period. Connect with a mortgage loan officer to learn more about mortgage points. | Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down With an adjustable-rate mortgage, the rate stays the same, generally for the first year or few years, and then it begins to adjust periodically Both ARMs and fixed-rate loans offer the same term lengths. A term length is the number of years you'll spend paying off your loan. For example, ARMs and fixed- | A 7/6 ARM is an adjustable-rate loan that carries a fixed interest rate for the first 7 years of the loan term, along with fixed principal and interest payments The fixed period will vary depending on your loan, but most fixed periods last 3 – 10 years. The initial interest rate will typically be lower With an adjustable-rate mortgage, the rate stays the same, generally for the first year or few years, and then it begins to adjust periodically | A 5/1 ARM loan provides an initial fixed-rate period of five years, after which the interest rate adjusts yearly depending on current market The 5/1 adjustable rate mortgage (ARM) is offered to qualified applicants who plan to be in the home for three to five years, expect their income to increase in A year ARM loan is a variable-rate loan with an initial fixed-rate feature. After an initial year period, the fixed rate converts to a variable rate. It |  |

Video

Adjustable Rate Mortgages Explained - ARM Loan - First Time Home BuyerAdjustable loan durations - An adjustable-rate mortgage is a home loan with an interest rate that can fluctuate periodically based on the performance of a specific benchmark. · ARMS are Adjustable-rate mortgages (ARMs) come with an interest rate that changes at predetermined times, such as once a year. The rate can go up or down With an adjustable-rate mortgage, the rate stays the same, generally for the first year or few years, and then it begins to adjust periodically Both ARMs and fixed-rate loans offer the same term lengths. A term length is the number of years you'll spend paying off your loan. For example, ARMs and fixed-

Connect with a mortgage loan officer to learn more about mortgage points. Compare a variety of mortgage types by selecting one or more of the following. The interest rate is the amount your lender charges you for using their money. It's shown as a percentage of your principal loan amount. ARM loan rates are based on an index and margin and may adjust as outlined in your agreement.

The annual percentage rate APR represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender. The APR may be increased or decreased after the closing date for adjustable-rate mortgages ARM loans.

The monthly payment shown is made up of principal and interest. It does not include amounts for taxes and insurance premiums. The monthly payment obligation will be greater if taxes and insurance are included. Mortgage points, or discount points, are a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payment.

Learn more about how these rates, APRs and monthly payments are calculated. Plus, see a conforming fixed-rate estimated monthly payment and APR example.

Get more details. The term is the amount of time you have to pay back the loan. ARM rates, APRs and monthly payments are subject to increase after the initial fixed-rate period of five, seven, or 10 years and assume a year term.

Plus, see an ARM estimated monthly payment and APR example. Plus, see an FHA estimated monthly payment and APR example. Plus, see a VA estimated monthly payment and APR example. Plus, see a jumbo estimated monthly payment and APR example.

An ARM loan is a home loan with an interest rate that adjusts throughout the life of the loan. The initial fixed-rate period is typically five, seven or 10 years.

After the introductory rate term expires, the rate becomes variable for the remaining life of the loan based on an index and margin. During the adjustable-rate period, the estimated payment and rate may change. An increase or decrease depends on the market. Market conditions at the time of conversion to the variable rate and during the adjustment period thereafter dictate your rate.

These loans are ideal for borrowers who plan to move or refinance within the five-year period. If you expect to move or refinance within the seven-year period, this may be a good option. A mortgage loan officer can offer you guidance on choosing the right loan for your specific needs.

With an ARM loan, the initial interest rate is fixed for a set period and then becomes variable, adjusting periodically for the remaining life of the loan.

SOFR ARMs use the Secured Overnight Financing Rate SOFR index to determine what the interest rate does after the initial fixed-rate period. And while the margin does not change for the life of the loan, the index can vary, going up or down every six months.

All ARM loans set limits on how high or low the rate may go. ARM loans have an initial fixed-rate period of five, seven or 10 years and an adjustable rate for the remaining life of the loan. Your monthly payment could increase or decrease after the introductory period depending on how the index rate fluctuates.

In comparison, fixed-rate loans have a fixed rate and fixed monthly payment for the entire loan term. Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts.

Interest rates and program terms are subject to change without notice. Mortgage, home equity and credit products are offered by U.

Bank National Association. Deposit products are offered by U. Member FDIC. Annual percentage rate APR represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender.

The APR may be increased after the closing date for adjustable-rate mortgage ARM loans. The rates shown above are the current rates for the purchase of a single-family primary residence based on a day lock period.

These rates are not guaranteed and are subject to change. This is not a credit decision or a commitment to lend. Your final rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors.

To lock a rate , you must submit an application to U. Bank and receive confirmation from a mortgage loan officer that your rate is locked. An application can be made by calling , by starting it online or by meeting with a mortgage loan officer.

Minnesota properties: To guarantee a rate, you must receive written confirmation as required by Minnesota Statute This statement of current loan terms and conditions is not an offer to enter into an interest rate or discount point agreement.

Any such offer may be made only pursuant to subdivisions 3 and 4 of Minnesota Statutes Section Equal Housing Lender. Skip to main content. Log in. About us Financial education. If you plan to sell your home or pay off your mortgage within 10 years, then a year ARM may be right for you.

Rates on ARMs are usually lower than rates on comparable fixed-rate mortgages, so their monthly mortgage payments are lower. The year ARM offers these lower rates and the predictability of a fixed-rate mortgage for the first 10 years.

After the initial year period, the rate on your loan will adjust periodically in line with an index rate. When that rate goes up, so will your interest rate and your monthly mortgage payment.

A year ARM may still be right for you if you can afford fluctuations in your monthly mortgage payment. Contact us today at and a dedicated mortgage loan officer can help you choose the loan that is best for you.

Loan approval is subject to credit approval and program guidelines. Not all loan programs are available in all states for all loan amounts. Interest rates and program terms are subject to change without notice.

Mortgage, home equity and credit products are offered by U. Bank National Association. Deposit products are offered by U. Member FDIC. Annual percentage rate APR represents the true yearly cost of your loan, including any fees or costs in addition to the actual interest you pay to the lender.

The APR may be increased after the closing date for adjustable-rate mortgage ARM loans. The rates shown above are the current rates for the purchase of a single-family primary residence based on a day lock period.

These rates are not guaranteed and are subject to change. This is not a credit decision or a commitment to lend. Your final rate will depend on various factors including loan product, loan size, credit profile, property value, geographic location, occupancy and other factors.

To lock a rate , you must submit an application to U. Bank and receive confirmation from a mortgage loan officer that your rate is locked. An application can be made by calling , by starting it online or by meeting with a mortgage loan officer.

Minnesota properties: To guarantee a rate, you must receive written confirmation as required by Minnesota Statute This statement of current loan terms and conditions is not an offer to enter into an interest rate or discount point agreement.

Any such offer may be made only pursuant to subdivisions 3 and 4 of Minnesota Statutes Section Equal Housing Lender. Skip to main content.

Log in. About us Financial education. Support Locations Log in Close Log in. Bank Altitude® Go Visa Signature® Card U. Bank Altitude® Connect Visa Signature® Card U. Bank Visa® Platinum Card U. Bank Shopper Cash Rewards® Visa Signature® Card U. Bank Altitude® Reserve Visa Infinite® Card U.

Bank Secured Visa® Card U. Bank Altitude® Go Secured Visa® Card U. Bancorp Asset Management, Inc. Account login Return to Account login Account login Access accounts Client support Institutional Return to Main Menu Institutional Custody solutions Global corporate trust Global fund services Banking services Account login Contact us Explore institutional U.

Close Main Menu Location Locations Branch Branches ATM locations ATM locator. Close Estás ingresando al nuevo sitio web de U.

Bank en español.

0 thoughts on “Adjustable loan durations”