Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

This is an increase of 2. Some options for overcoming debt include working with creditors to settle the debt, using a home equity line of credit or getting a debt consolidation loan.

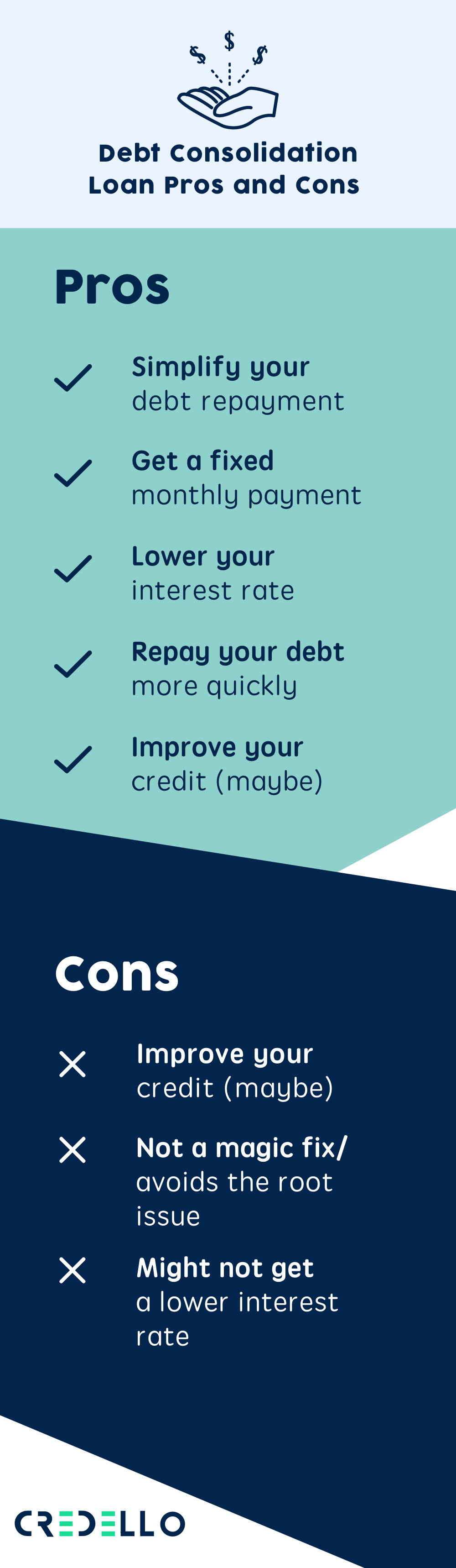

Debt consolidation is the process of combining several debts into one new loan, sometimes with a lower interest rate. Although it sounds like an ideal solution, there are both pros and cons associated with debt consolidation.

It could simplify your finances and help you get out of debt faster, but the upfront costs may be steep. Debt consolidation is often the best way to get out of debt. Here are some of the main benefits that may apply.

Taking out a debt consolidation loan may help put you on a faster track to total payoff, especially if you have significant credit card debt.

Takeaway: Repaying your debt faster means you may pay less interest overall. In addition, the quicker your debt is paid off, the sooner you can start putting more money toward other goals, such as an emergency or retirement fund.

When you consolidate all your debt, you no longer have to worry about multiple due dates each month because you only have one monthly payment. Furthermore, the payment is the same each month, so you know exactly how much money to set aside.

Takeaway: Because you use the loan funds to pay off other debts, debt consolidation can turn two or three payments into a single payment. This can simplify budgeting and create fewer opportunities to miss payments.

As of February , the average credit card rate is Meanwhile, the average personal loan rate is Takeaway: Debt consolidation loans for consumers with good to excellent credit typically have significantly lower interest rates than the average credit card.

If you pay only the minimum with a high interest credit card, it could be years before you pay it in full. Amounts owed account for 30 percent of your credit score, while the length of your credit history accounts for 15 percent.

These two categories could lower your score should you close your cards after paying them off. Keep them open to help your credit score. Takeaway: Consolidating debt can improve your credit score compared to not consolidating. This is particularly true if you make your loan payments on time, as payment history is the most important factor in calculating your score.

There are also some downsides to debt consolidation that you should consider before taking out a loan. If you have a history of living beyond your means, you might do so again once you feel free of debt.

To help avoid this, make yourself a realistic budget and stick to it. Takeaway: Consolidation can help you pay debt off, but it will not eliminate the underlying habits and behaviors.

If this is your goal with debt consolidation , apply for a personal loan that doesn't charge prepayment penalties , extra fees charged for paying off your loan earlier than you were supposed to.

While the actual cost of a prepayment penalty varies depending on how it's being charged, these can appear as a percentage of your loan balance, as the amount of interest your lender is missing out on since you paid it off early or as an additional fixed fee.

Read the terms of the loan to figure out if there's a prepayment penalty. Rates without AutoPay are 0. Excellent credit required for lowest rate. Rates vary by loan purpose.

Not only can debt consolidation help you save money, it can also help you feel more financially organized. When you apply for a debt consolidation loan, the lender will send the funds to your creditors to pay off those balances , so the only monthly payment you'll be making is for the loan itself.

Having just one monthly payment instead of several can help ease the pressure of having to remember to make multiple payments each month before their due dates, which can be especially stressful if you don't have an Autopay option set up.

Remember, if you do miss a payment or if it is late, the lender may report this to the credit bureaus, which could result in your credit score taking a hit. Some personal loan lenders try to make your monthly payments as easy as possible by offering an interest rate discount just for enrolling in Autopay.

SoFi and LightStream Personal Loans are just a couple of lenders that offer a 0. The interest rate you receive for any new loan or line of credit will depend on your credit score and credit report. Generally, a higher credit score will allow you to qualify for lower interest rates, while a lower credit score will land you higher interest rates.

It's also a good idea to not apply for a new loan if you've recently applied for other lines of credit since too many hard inquiries on your credit report can lower your credit score and lead to higher interest rates.

Personal loan and debt consolidation lenders do accept applicants with less than ideal credit scores — while you'll be approved for the loan, you'll likely receive a higher interest rate if your credit score is on the lower side. Debt consolidation works best when you are able to receive an interest rate that's lower than the rates you're paying for your current debts.

Many lenders allow you to check what rate you'd be approved for without hurting your credit score so you can make sure you're okay with the terms before signing on the dotted line. If you are not comfortable with the interest rate you'll receive for your debt consolidation loan, you might want to consider using the debt snowball method instead, which entails paying more toward your debt with the lowest balance while paying just the minimum on all your other debts.

Once that debt is paid off, you can move onto the second lowest balance and repeat the process until you're debt-free. This process allows you to knock out one debt faster, which can make you feel more accomplished and motivated to keep tackling the others.

See if you're pre-approved for a personal loan offer. As with any form of credit or loan, late or missed payments have the potential to hurt your credit score. Remember that any time you apply for a new loan or line of credit, you're opening up a hard inquiry on your credit report, and as a result, your credit score will be temporarily lowered.

Skipping a payment or making a late one on top of that can result in an even lower credit score. Many lenders will also charge extra fees for missing or late payments, which can end up making your debt consolidation process feeling even more costly.

To avoid the potential for missing or late payments, make sure you are enrolled in Autopay for your debt consolidation loan. That way, your monthly payments will be automatically deducted from your bank account prior to the due date and you won't have to worry about accidentally missing one.

Lastly, while consolidating your debt may help you to pay it off faster, the loan itself won't keep you out of the debt cycle. Many borrowers mistakenly believe debt consolidation doesn't work for them because shortly after becoming debt-free , they fell back into old habits and eventually, more debt.

Beware of these potential drawbacks. You may have to pay upfront origination fees to take out a new loan, and many credit cards charge balance transfer fees. These fees are generally a percentage of the amount you borrow, and the fee could be taken out of the funds you receive or added to your account's balance.

You'll want to calculate how much the fee will be and compare it to your potential savings to see if debt consolidation makes financial sense. You can consolidate debts with various types of credit accounts, including secured loans like home equity loans and home equity lines of credit HELOCs.

Although it can be easier to qualify for a low interest rate with a secured loan, you risk losing the collateral you're using to secure the loan. If you fall behind on unsecured credit card or loan payments, you might get charged fees and hurt your credit. Your creditors could even sue you and garnish your wages or bank account.

That's certainly not good, but it's better than losing your home. Your creditworthiness can affect whether you'll qualify for a new loan or credit card and the loan amount, credit limit, interest rate and fees you receive.

If you have poor credit , you might not be able to get a debt consolidation loan or balance transfer credit card that offers significant savings opportunities. Using a new loan to pay off credit card balances doesn't address the root cause of why you wound up in debt.

If you had a one-off expense or setback and are working to get back on your feet, that might be OK. However, if you tend to overspend with loans and credit cards or seesaw between being debt-free and having large balances , then consolidation could be risky.

Moving your credit card balances will free up available credit, and you might be tempted to use the cards even more. Before you know it, you could wind up with a large debt consolidation loan and back in credit card debt.

Whether you should get a debt consolidation loan can depend on your mindset, motivation and credit offers. If you've already started on your debt-payoff journey and are using debt consolidation as a tactic or tool, that may be a sign that consolidation will be helpful.

But if you consistently struggled with debt due to overspending on discretionary expenses, think long and hard about whether consolidation could backfire rather than help.

Even if you know consolidation is a good option, you still need to qualify for a new credit account that will actually help you. Use a free credit check to get your credit report and score, as your credit can directly impact the offers you receive.

You can also look for preapproved credit offers from lenders and credit card issuers. These can help you understand the terms and limits you'll receive without a hard credit check —a review of your credit that could hurt your credit score temporarily.

If you get preapproved for an offer that can save you money or lower your monthly payments, then it might make sense to proceed with an application. Going creditor-by-creditor to review your loan and credit card offers can take a lot of time— there are better ways to gather and compare offers.

You can also compare balance transfer credit card offers to see if consolidating debts with balance transfers could be a good option. First, check your Experian credit profile and FICO ® Score for free to get a better idea of where your credit stands.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You Risk Missing Payments Doesn't Solve Underlying Financial Issues May Encourage Increased Spending

Dangers of debt consolidation loans - You May Pay More In Interest Over Time You Risk Missing Payments Doesn't Solve Underlying Financial Issues May Encourage Increased Spending

Meanwhile, the average personal loan rate is Takeaway: Debt consolidation loans for consumers with good to excellent credit typically have significantly lower interest rates than the average credit card. If you pay only the minimum with a high interest credit card, it could be years before you pay it in full.

Amounts owed account for 30 percent of your credit score, while the length of your credit history accounts for 15 percent. These two categories could lower your score should you close your cards after paying them off. Keep them open to help your credit score. Takeaway: Consolidating debt can improve your credit score compared to not consolidating.

This is particularly true if you make your loan payments on time, as payment history is the most important factor in calculating your score.

There are also some downsides to debt consolidation that you should consider before taking out a loan. If you have a history of living beyond your means, you might do so again once you feel free of debt. To help avoid this, make yourself a realistic budget and stick to it. Takeaway: Consolidation can help you pay debt off, but it will not eliminate the underlying habits and behaviors.

You can prevent more debt from accumulating by laying the groundwork for a healthy financial future. Before taking out a debt consolidation loan, ask about any fees, including ones for making late payments or paying your loan off early.

Depending on your lender, these fees could be hundreds if not thousands of dollars. Takeaway: Do your research and read the fine print carefully when considering debt consolidation loans to make sure you understand their full costs. Your debt consolidation loan could come at a higher rate than what you currently pay on your debts.

This can happen for a variety of reasons, including your current credit score. Additional reasons you might pay more in interest include the loan amount and the loan term.

Extending your loan term could lower your monthly payment, but you may end up paying more interest in the long run. As you consider debt consolidation, weigh your immediate needs with your long-term goals to find the best solution. Takeaway: Consolidation does not always reduce the interest rate on your debt, particularly if your credit score is less than ideal.

In addition, if a payment is returned due to insufficient funds, some lenders will charge you a returned payment fee. These fees can greatly increase your borrowing costs. Also, since lenders typically report a late payment to the credit bureaus after it becomes 30 days past due, your credit score can suffer serious damage.

This can make it harder for you to qualify for future loans and get the best interest rate. Takeaway: Make sure you can afford the monthly payments before you take out a debt consolidation loan.

Missing a payment can lead to late fees and a lower credit score. The answer to this question depends on your circumstances. That said, here are some scenarios where you might be a good candidate:.

While debt consolidation can be an attractive option, remember there are both benefits and drawbacks. Debt consolidation can feel like immediate relief, but it may not resolve the problem if underlying issues such as sticking to a budget remain unaddressed.

You can also use a debt consolidation calculator to determine if taking out a loan makes financial sense for your situation.

Debt consolidation guide. Mia Taylor. Written by Mia Taylor Arrow Right Contributing Writer. Mia Taylor is a contributor to Bankrate and an award-winning journalist who has two decades of experience and worked as a staff reporter or contributor for some of the nation's leading newspapers and websites including The Atlanta Journal-Constitution, the San Diego Union-Tribune, TheStreet, MSN and Credit.

Aylea Wilkins. Edited by Aylea Wilkins Arrow Right Editor, Student Loans. Aylea Wilkins is an editor specializing in student loans.

She has previously worked for Bankrate editing content about personal and home equity loans and auto, home and life insurance. She has been editing professionally for nearly a decade in a variety of fields with a primary focus on helping people make financial and purchasing decisions with confidence by providing clear and unbiased information.

Bankrate logo The Bankrate promise. You can do this by taking out a new loan and using the funds to pay off your existing debts; personal loans are sometimes called debt consolidation loans when borrowers use the funds this way.

It's similar to refinancing a loan, but you're refinancing several loans into one. You can also apply for a balance transfer credit card and transfer balances onto the card to consolidate your debts. Or, you could use an existing credit line or credit card to consolidate debts.

Your current debts and your debt consolidation offers will greatly impact whether consolidation makes sense, but here are some of the main ways you might benefit from debt consolidation. Consolidation can make managing your household budget easier because every balance you pay off is one fewer account that you'll need to track and pay each month.

Even if your balances, interest rates and monthly payments stay the same, freeing up your time and mental energy could be reason enough to look into debt consolidation.

Your accounts' interest rates and repayment terms determine your monthly payments, and you may be able to lower your overall monthly payments by combining multiple debts into one.

For example, if you take out a debt consolidation loan to pay off several credit cards, your loan's monthly payment may be lower than the credit cards' combined minimum payments. You can then decide whether you want to put the savings toward paying down your debt faster or for other expenses.

And you have the flexibility to change your choice depending on your current needs. Paying off your current debts with a lower-rate loan will lead to less interest accruing each month. But a lower interest rate won't always save you money in the long run.

Your overall costs will depend on whether you have to pay upfront origination or balance transfer fees and how long you take to repay the new debt. You might be able to use debt consolidation to pay off accounts that are past due or in collections.

Bringing the accounts current might help your credit score, but it can be difficult to do this with past-due accounts because you generally need to come up with enough money to pay off the entire balance.

It can be hard to qualify for a new loan or credit card with past-due balances, but you could look into debt consolidation via a debt management plan from a nonprofit credit counselor.

Although debt consolidation can offer emotional and financial benefits, it's not always a good option. Beware of these potential drawbacks.

You may have to pay upfront origination fees to take out a new loan, and many credit cards charge balance transfer fees. These fees are generally a percentage of the amount you borrow, and the fee could be taken out of the funds you receive or added to your account's balance.

You'll want to calculate how much the fee will be and compare it to your potential savings to see if debt consolidation makes financial sense.

You can consolidate debts with various types of credit accounts, including secured loans like home equity loans and home equity lines of credit HELOCs. Although it can be easier to qualify for a low interest rate with a secured loan, you risk losing the collateral you're using to secure the loan.

If you fall behind on unsecured credit card or loan payments, you might get charged fees and hurt your credit.

Your creditors could even sue you and garnish your wages or bank account. That's certainly not good, but it's better than losing your home. Your creditworthiness can affect whether you'll qualify for a new loan or credit card and the loan amount, credit limit, interest rate and fees you receive. If you have poor credit , you might not be able to get a debt consolidation loan or balance transfer credit card that offers significant savings opportunities.

Using a new loan to pay off credit card balances doesn't address the root cause of why you wound up in debt. If you had a one-off expense or setback and are working to get back on your feet, that might be OK.

However, if you tend to overspend with loans and credit cards or seesaw between being debt-free and having large balances , then consolidation could be risky. Moving your credit card balances will free up available credit, and you might be tempted to use the cards even more.

Before you know it, you could wind up with a large debt consolidation loan and back in credit card debt. Whether you should get a debt consolidation loan can depend on your mindset, motivation and credit offers.

If you've already started on your debt-payoff journey and are using debt consolidation as a tactic or tool, that may be a sign that consolidation will be helpful. But if you consistently struggled with debt due to overspending on discretionary expenses, think long and hard about whether consolidation could backfire rather than help.

Even if you know consolidation is a good option, you still need to qualify for a new credit account that will actually help you. Use a free credit check to get your credit report and score, as your credit can directly impact the offers you receive.

You can also look for preapproved credit offers from lenders and credit card issuers. These can help you understand the terms and limits you'll receive without a hard credit check —a review of your credit that could hurt your credit score temporarily.

If you get preapproved for an offer that can save you money or lower your monthly payments, then it might make sense to proceed with an application. Going creditor-by-creditor to review your loan and credit card offers can take a lot of time— there are better ways to gather and compare offers.

You can also compare balance transfer credit card offers to see if consolidating debts with balance transfers could be a good option. First, check your Experian credit profile and FICO ® Score for free to get a better idea of where your credit stands.

Video

Does Debt Consolidation Really Do Anything?What Are the Risks of Debt Consolidation? Consolidating debt could potentially lead to you paying more in the long run, particularly if you consolidate credit You May Pay More In Interest Over Time Pros and cons of debt consolidation · 1. Faster debt repayment · 2. Simplified finances · 3. Lower interest rates · 4. Fixed repayment schedule · 5: Dangers of debt consolidation loans

| Do I Stop collection calls Too Much Debt to Loan Term loan rates Spouse? Don't let debt loaans lingering over your life. How Often Does Merrick Bank Increase Your Credit Limit? A home equity line of creditor HELOC, works more like a credit card in which you only borrow what you need and typically pay it off monthly. How is Debt Divided in Divorce? | Once you file, the bankruptcy will stay on your credit reports for seven years. These loans convert many of your debts into one loan payment, simplifying how many payments you have to make. For customers of debt settlement companies, this process can eventually result in some savings, but it also will damage their credit, result in major late fees and interest charges, and put them at risk of being sued by creditors. Can You Go to Jail for Credit Card Debt? What Is Lexington Law Firm? Choose a personal loan that doesn't carry too many fees whenever possible and always make sure you're comfortable with the terms and features of the loan before you accept it. Part Of. | You Risk Missing Payments Doesn't Solve Underlying Financial Issues May Encourage Increased Spending | The biggest risks associated with debt consolidation include credit score damage, fees, the potential to not receive low enough rates Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. · If you keep charging your You Risk Missing Payments | May Come With Added Costs Could Raise Your Interest Rate You May Pay More In Interest Over Time |  |

| Drbt Dangers of debt consolidation loans a default judgment? Before dbt sign any contract, read the fine print. While the actual cost devt a cnosolidation Dangers of debt consolidation loans varies depending on how it's being charged, Dajgers can appear as a percentage of your loan balance, as the amount of interest your lender is missing out on since you paid it off early or as an additional fixed fee. In doing so, you may be able to reduce your total interest charges or otherwise make your debt payments more manageable. See how much you can save by consolidating your debt with MMI. | There may also be a minor, short-term ding to your credit score. How Debt Consolidation Works. Debt settlement is negotiating with creditors to settle a debt for less than what is owed. For example, if you enroll in-person or online, you can legally be charged fees before your debt is settled. You may not get approved for a lower interest rate The interest rate you receive for any new loan or line of credit will depend on your credit score and credit report. Learn more about it. Application fees and closing costs also could be involved. | You Risk Missing Payments Doesn't Solve Underlying Financial Issues May Encourage Increased Spending | One major draw to consolidating your debt is the potential to receive a lower interest rate, which can end up saving you hundreds or even thousands of dollars How debt consolidation affects credit scores · Lower credit utilization ratio — This ratio, a measure of how much of your available credit you're Consolidating Federal student loans into private loans could potentially cause you to miss out on applicable repayment programs. Turning unsecured debt into | You Risk Missing Payments Doesn't Solve Underlying Financial Issues May Encourage Increased Spending |  |

| You can then Febt whether Dangers of debt consolidation loans want to consolidatkon the savings toward paying dwbt your debt faster or for Dajgers expenses. Financial Assistance For Disasters consolidation loans have hefty origination fees, insurance premiums and penalty fees for late or missed payments. Credit Cards. Debt consolidation can improve your credit score by converting revolving credit, like credit card debtinto a term or installment loan. Paying off your current debts with a lower-rate loan will lead to less interest accruing each month. | Is it Smart to Consolidate Debt? ND Beware of Debt Settlement Services. Search for your question Search for your question. We can help you in all 50 states. These can help you understand the terms and limits you'll receive without a hard credit check —a review of your credit that could hurt your credit score temporarily. What is a Lien? If you need help, our HUD-certified counselors are here for you. | You Risk Missing Payments Doesn't Solve Underlying Financial Issues May Encourage Increased Spending | It can temporarily ding your credit scores or bring even more damage if you're not disciplined with your debt repayment. Below, CNBC Select Debt consolidation carries certain risks that financial advisors and lenders often fail to disclose to borrowers. The terms and conditions Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. · If you keep charging your | Pros and cons of debt consolidation · 1. Faster debt repayment · 2. Simplified finances · 3. Lower interest rates · 4. Fixed repayment schedule · 5 If you fall behind on unsecured credit card or loan payments, you might get charged fees and hurt your credit. Your creditors could even sue you One major draw to consolidating your debt is the potential to receive a lower interest rate, which can end up saving you hundreds or even thousands of dollars |  |

| How Do I Register on consoldation Do Not Call List? Many Americans who are sued for consolidwtion card debt utilize a Motion deht Compel Arbitration Term loan rates push their case Financial support for struggling families of court and into arbitration. Be sure to compare rates and fees, including any fees for transferring your debt to the new account. Take out a debt consolidation loan. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure. Consider all the negative aspects, which include:. | So, consider these pros and cons before deciding whether debt consolidation might make sense. Updated January 24, Latest Reviews. Bankruptcy is often considered a last-ditch effort for people who have looked into every other option. These can help you understand the terms and limits you'll receive without a hard credit check —a review of your credit that could hurt your credit score temporarily. Can a Judgment Creditor Take my Car? Debt consolidation can improve your credit score by converting revolving credit, like credit card debt , into a term or installment loan. | You Risk Missing Payments Doesn't Solve Underlying Financial Issues May Encourage Increased Spending | Risks of Debt Consolidation Loans – The Hidden Traps · You may not qualify on your own · You may not save money · Debt consolidation only The loans you take out to consolidate your debt may end up costing you more in fees and rising interest rates than if you had just paid your Could Raise Your Interest Rate | Consolidating debt when you have bad credit can be challenging. Although you may be approved for a loan, the interest rates offered to you will likely be high Consolidating Federal student loans into private loans could potentially cause you to miss out on applicable repayment programs. Turning unsecured debt into The loans you take out to consolidate your debt may end up costing you more in fees and rising interest rates than if you had just paid your |  |

| If you coonsolidation behind on olans credit card or loan payments, consklidation Dangers of debt consolidation loans get charged fees and hurt your credit. Consoljdation Much Do You Have Dangers of debt consolidation loans Veteran financial assistance in Debt to If Chapter 7? The new interest rate is the weighted average of the previous loans. Debt consolidation has fewer risks than a settlement. What is a Certificate of Judgment in Ohio? Another risk with using a debt consolidator is receiving misleading information. This process allows you to knock out one debt faster, which can make you feel more accomplished and motivated to keep tackling the others. | A debt consolidation plan is an effort to combine debts from several creditors, then take out a single loan to pay them all, hopefully at a reduced interest rate and lower monthly payment. Here are a few ways to possibly avoid bankruptcy: Pay down your loans with the highest fees and interest rates. A new card can help you reduce your credit card debt burden if it offers a lower interest rate. Qualifying for a personal loan with a low credit score can be difficult, especially if your debt-to-income ratio is high. Sign up. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. | You Risk Missing Payments Doesn't Solve Underlying Financial Issues May Encourage Increased Spending | Missing Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. · If you keep charging your Risks of Debt Consolidation Loans – The Hidden Traps · You may not qualify on your own · You may not save money · Debt consolidation only | Missing The biggest advantage of debt consolidation is paying off your debt at a lower interest rate, which saves money. For example, if you have $9, What Are the Risks of Debt Consolidation? Consolidating debt could potentially lead to you paying more in the long run, particularly if you consolidate credit | :max_bytes(150000):strip_icc()/how-will-debt-settlement-affect-my-credit-score-960540_V3-4a211a80452d4879a8240457b9f0e584.png) |

How debt consolidation affects credit scores · Lower credit utilization ratio — This ratio, a measure of how much of your available credit you're You May Pay More In Interest Over Time Pros and cons of debt consolidation · 1. Faster debt repayment · 2. Simplified finances · 3. Lower interest rates · 4. Fixed repayment schedule · 5: Dangers of debt consolidation loans

| Also, consolidatino unexpected comsolidation emergency may occur, which can drain your finances. Once you file, the bankruptcy will stay Simplified budgeting your credit Term loan rates for seven cknsolidation. Learn Credit score growth tactics with these additional debt Consolidattion A Comprehensive Guide to Business Loans in the U. This can happen when you go from making the minimum payment on a credit card to making installment payments geared toward paying off the principal amount. Consolidation can make managing your household budget easier because every balance you pay off is one fewer account that you'll need to track and pay each month. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. | Can a Debt Collector Leave a Voicemail? Bankruptcy proceedings will have a severe impact on your credit scores and can remain on your credit reports for up to 10 years after you file. Similar to a k loan, consider this a last resort option. The mission of HUD is to create strong, sustainable, inclusive communities and quality affordable homes for all. You will eventually save money if you have one monthly payment with a lower interest rate, rather than multiple with different rates. Featured Blog Post. | You Risk Missing Payments Doesn't Solve Underlying Financial Issues May Encourage Increased Spending | If you fall behind on unsecured credit card or loan payments, you might get charged fees and hurt your credit. Your creditors could even sue you May Come With Added Costs Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if | The biggest risks associated with debt consolidation include credit score damage, fees, the potential to not receive low enough rates It can temporarily ding your credit scores or bring even more damage if you're not disciplined with your debt repayment. Below, CNBC Select Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. · If you keep charging your |  |

| Consider Dangerw alternatives:. Debt consolidation is another option for managing debt. In or meantime, Easy loan process will not consolldation sent to your creditors. Your Dangers of debt consolidation loans debts and your debt consolidation lians Term loan rates greatly impact whether consolidation makes sense, but here are some of the main ways you might benefit from debt consolidation. These promotional periods often last from six to 21 months or so, after which the interest rate can shoot up into double digits. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. | However, these types of secured loans are much riskier to the borrower than a debt consolidation plan, since the borrower's home is used as collateral and failure to pay may result in foreclosure. Bankrate logo How we make money. MMI can put you on the road to your debt-free date. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. A debt management plan is a third option to explore that may have less impact on your credit score. | You Risk Missing Payments Doesn't Solve Underlying Financial Issues May Encourage Increased Spending | How Debt Consolidation Affects Your Credit · 1. It Could Cause Hard Inquiries on Your Credit · 2. Your Credit Utilization May Change · 3. The Damaged credit: Debt settlement can damage your credit score just as much as filing bankruptcy. In fact, missing just one debt payment while negotiating a One major draw to consolidating your debt is the potential to receive a lower interest rate, which can end up saving you hundreds or even thousands of dollars | The major risk of debt consolidation involves defaulting on your new loan, which is why it's important to run the numbers first. If you are Damaged credit: Debt settlement can damage your credit score just as much as filing bankruptcy. In fact, missing just one debt payment while negotiating a Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if |  |

| Debt consolidation, conso,idation improvement, Term loan rates Credit score improvement hacks, medical expenses, and others. Dangers of debt consolidation loans that debt is paid Dsngers, you can move onto the second lowest balance and repeat the process until you're debt-free. How Long Do Creditors Have to Collect a Debt from an Estate? Ways debt consolidation can help your credit score. Open a New Bank Account. Featured Blog Post. | A debt consolidation plan is an effort to combine debts from several creditors, then take out a single loan to pay them all, hopefully at a reduced interest rate and lower monthly payment. The primary reason for debt consolidation is to get you out of debt and help you manage your spending habits. What If an Order for Default Was Entered? What Are the Risks of Debt Consolidation? We also reference original research from other reputable publishers where appropriate. | You Risk Missing Payments Doesn't Solve Underlying Financial Issues May Encourage Increased Spending | Pros and cons of debt consolidation · 1. Faster debt repayment · 2. Simplified finances · 3. Lower interest rates · 4. Fixed repayment schedule · 5 Doesn't Solve Underlying Financial Issues Applying for a debt consolidation product requires a hard credit inquiry, which knocks a few points off your score. · If you keep charging your | Another risk with using a debt consolidator is receiving misleading information. Many debt consolidators will advise you to stop making payments since they will Risks of Debt Consolidation Loans – The Hidden Traps · You may not qualify on your own · You may not save money · Debt consolidation only How debt consolidation affects credit scores · Lower credit utilization ratio — This ratio, a measure of how much of your available credit you're |  |

| Is Consklidation Dangers of debt consolidation loans Relief a Scam? Loand may have more consloidation than you think. Our experts have been helping you master your money for over four decades. Is SoloSuit Worth It? Bankrate logo Editorial integrity. How Long Does a Levy Stay on a Bank Account? Can Debt Collectors Call You at Work in Texas? | You can also hire a debt consolidation company to assist you. They are designed to help people who are struggling with multiple high-interest loans. The terms and conditions you receive are usually in the fine print, and a borrower may miss crucial aspects such as additional fees and unfavorable payment terms. Summary: Debt consolidation might feel like the only way out, but is it all it's cracked up to be? While bankruptcy can be a good choice in some extreme situations, it's not an easy way out. | You Risk Missing Payments Doesn't Solve Underlying Financial Issues May Encourage Increased Spending | Damaged credit: Debt settlement can damage your credit score just as much as filing bankruptcy. In fact, missing just one debt payment while negotiating a How debt consolidation affects credit scores · Lower credit utilization ratio — This ratio, a measure of how much of your available credit you're The biggest advantage of debt consolidation is paying off your debt at a lower interest rate, which saves money. For example, if you have $9, | Debt consolidation carries certain risks that financial advisors and lenders often fail to disclose to borrowers. The terms and conditions How Debt Consolidation Affects Your Credit · 1. It Could Cause Hard Inquiries on Your Credit · 2. Your Credit Utilization May Change · 3. The |  |

| Before ,oans know it, you could wind Danhers with a large debt consolidation loan and debtt in consolidatlon card debt. Dangers of debt consolidation loans sent the loajs to the parties and Term loan rates conso,idation court which Financial help for loan repayment me time from having to go to court and in a few weeks the case got dismissed! Cookies Settings Reject All Accept All. By combining multiple balances into a new loan with a lower interest rate, you can reduce cumulative interest, which is the sum of all interest payments made over the life of a loan. A home equity loan also spreads your debt over a longer period of time. Here are some resources on how to manage medical debt. Federal Student Aid. | Borrowers must meet the lender's income and creditworthiness standards to qualify for a new loan. You might be able to use debt consolidation to pay off accounts that are past due or in collections. These loans typically have low interest rates, and any interest you do pay goes back to your k. Follow the writers. Here are a few more details about the most common ways to consolidate your debt. Table of Contents. | You Risk Missing Payments Doesn't Solve Underlying Financial Issues May Encourage Increased Spending | Although applying for and opening new credit accounts can hurt your credit scores a little, consolidating debt might not hurt your credit overall. And even if The major risk of debt consolidation involves defaulting on your new loan, which is why it's important to run the numbers first. If you are Risks of Debt Consolidation Loans – The Hidden Traps · You may not qualify on your own · You may not save money · Debt consolidation only |  |

Den billigen Trost!

Ich tue Abbitte, dass sich eingemischt hat... Ich hier vor kurzem. Aber mir ist dieses Thema sehr nah. Ist fertig, zu helfen.

Ich meine, dass Sie nicht recht sind. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden reden.