The interest rates can be significantly lower, which will help you pay off debt faster. Once you have a plan, you may wish to use Quicken to automate your budgeting and debt management.

To rebuild your credit while managing your debt, you might look at the software program Brigit , which will help you build a positive payment history. There are some predatory debt management programs out there.

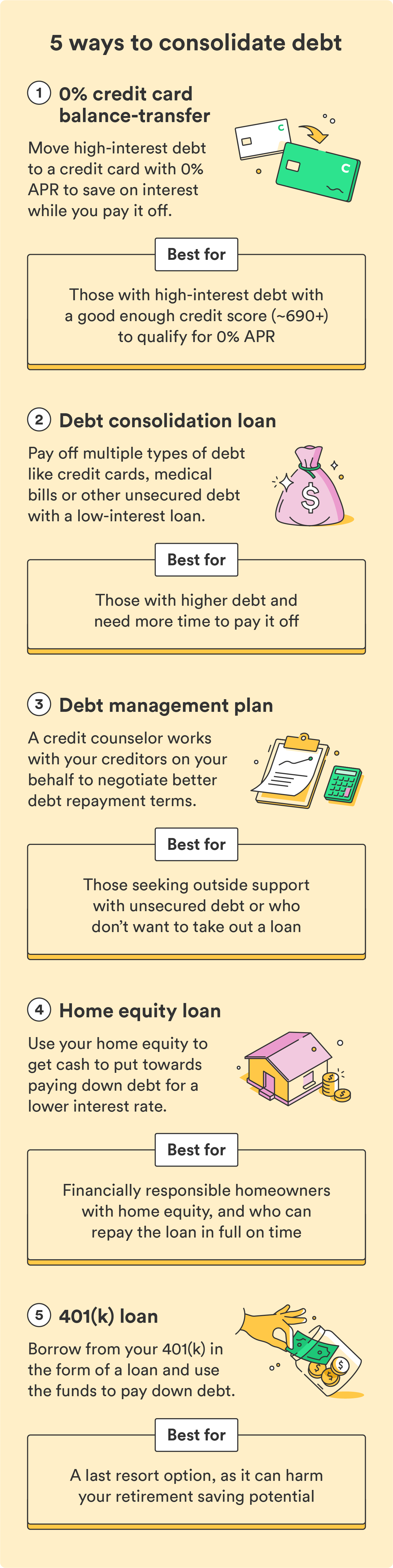

Be sure to do your research before sending any sensitive information. If you have credit card debt, consolidating it into one loan can help simplify your finances and save money on interest. Credit card consolidation can ultimately help you pay off your debt faster and more easily.

Credit card consolidation is when you take your existing credit card debt and refinance it into one new loan with a new lender, ideally with more favorable terms.

There are multiple ways to consolidate your credit card debt, and doing so can save you money and simplify your payments. Credit card consolidation can save you money on interest if you're able to qualify for a lower interest rate.

This could help you get out of debt faster, as more of your money will go toward paying off your debt instead of toward interest payments. It can also help you simplify your finances, as you will have fewer monthly payments to make after consolidating your debt.

If you're able to pay off debt, credit card consolidation can have a positive effect on your credit score in the long run. However, be aware that it can negatively affect your credit score at first because it involves a new credit inquiry and lowers the average age of your accounts.

Debt consolidation and credit card refinancing are two ways to pay off credit card debt. Debt consolidation is when you refinance multiple loans into one new loan with a new lender. The goal is to consolidate several debts into one debt in order to save money and have only one monthly payment.

Credit card refinancing often involves just one debt, with the goal of getting a lower interest rate on it. Another approach is to try to negotiate a lower rate with your current credit card company.

Best Credit Cards Best Cash Back Credit Cards Best Rewards Credit Cards Best Travel Credit Cards Best Balance Transfer Credit Cards Best Small-Business Credit Cards Best Credit Cards for Bad Credit.

The information presented here is created independently from the TIME editorial staff. To learn more, see our About page. Personal Finance Credit Cards 6 Best Ways to Consolidate Credit Card Debt.

by Jason Steele. Updated January 31, How to consolidate your credit card debt 1. Balance transfer cards A balance transfer credit card allows you to move existing balances from other credit cards onto it.

Once you hit your zero balance—whether through a debt consolidation strategy or just careful debt management—convert your mentality of credit cards. Think of credit card debt as something you must pay off in full at the end of each billing cycle.

Credit cards are no longer used to buy things you don't yet have money for. When the amount you owe in credit is well below the limits of credit that are extended to you, you drive down your credit utilization ratio. An unfavorable credit utilization ratio could cause your credit score to go down.

Set aside one day a month to pull out your account statements, credit card statements, and credit report and take stock of your accounts. By reviewing your credit report, you make sure that if there are errors, you can address them quickly.

By looking at your accounts, you can detect and document trends that can help you build an updated budget and plan for the future. Find a credit card with a lower APR or a rewards program that matches your hobbies and cut up but don't close! your paid-off, higher-APR cards.

The true sign of great credit is when you spend less than what you earn. Yes, you can still use your credit cards after debt consolidation. It's not required that you close them.

If you plan to stop using them for a while though, be sure to monitor the accounts to ensure you're not seeing any unauthorized activity. You may see a dip in your credit score right after debt consolidation due to any loan applications that you submitted.

Over time, making steady payments on time may improve your score though. It's also fine to leave your credit card accounts open with a zero balance. Either way, the length of credit history is a factor in determining credit score, so it may be smart to keep some of them open.

Debt consolidation can be a helpful way to reduce interest rates and get your financial life back on track. If your debt is feeling overwhelming, you may find that you need help from debt counseling services. Other options include consolidation loans, balance transfers, home equity loans and even k loans.

Regardless of the options you choose, the most successful way to pay off debt is to lower your spending and remain disciplined with your monthly payments. Your purchase annual percentage rate APR could affect your credit card balance.

But what is purchase APR, when does it apply and how can you try to avoid it? Depending on your circumstances, you may find it easier to pay your credit card with cash. Learn some different ways to do this, potential pros, and more. Between streaming services and other subscriptions, recurring charges are common.

Learn about managing monthly recurring charges and more. What is the minimum payment on a credit card? How is it calculated? Learn about credit card minimum payments. Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Education center Credit cards Credit card basics.

Credit Card Marketplace. How to consolidate your credit card debt minute read. In this article, we'll cover the following topics: Should I consolidate my credit card debt? Know your current credit card debt status Ways to consolidate your credit card debt , including: Debt counseling service DIY debt consolidation Credit card balance transfer Debt consolidation loans How to build and maintain healthy credit habits Should I consolidate my credit card debt?

Know your current credit debt status The first step is to take stock of just what you owe and what your monthly take home salary is. Know your credit cards: What you owe, minimum payments, and APR Whether on paper or with a spreadsheet, collect your most recent credit card statements and document: The total amount owed on each card, The current minimum monthly payments due on each card, and The annual percentage rate APR of each card.

Know your budget: Track your income and bills Next, collect recent pay stubs to understand your typical monthly income leaving out any bonuses or tips that you can't depend on each month.

That'll likely include things like: Rent, mortgage and other housing costs Utilities, like water, gas, heating and electricity, broken down by average monthly balances Loans and insurance: Car loan and insurance, student debt payments and other personal loan or insurance costs Subscription service payments such as cable TV and cell phone bills Grocery and commuting bills Education and child-care costs And anything else that's a regular monthly payment, like gym memberships and public transport costs You can also load this information into an online budgeting tool, such as Chase's Budget , to keep on hand for future reference.

Know your balance: Can you meet your minimum payments? Ways to consolidate your credit card debt Emboldened by your knowledge of your finances, you can begin to select the debt consolidation strategy that works best for you. Credit card balance transfer Transferring your balances can be a way to help reduce your interest rates by doing a balance transfer from higher rate credit cards to a lower rate credit card.

Keep in mind that once the introductory period is over, the APR will increase. Be sure to read the terms of your balance transfer carefully so you know when your APR will change and by how much.

Once approved, the transfer of funds can take a few weeks so make sure to make payments on your card until the transfer is made.

Transferring the balances on multiple cards to a single card may feel easier to manage. Opening multiple credit cards in order to make balance transfers may reduce your credit score, which may make it more difficult to earn approval for a balance transfer credit card the next time around.

Most credit cards have a strict limit on the maximum balance you can transfer. Make sure that limit meets your debt consolidation needs before committing to a balance transfer strategy. You may be tempted to use your new available credit, leading to additional credit card debt.

Debt counseling services You may also find many options through debt counseling services, something many people turn to when they need help managing their credit card debt. Pros of debt counseling services A debt counseling service that is accredited by the National Foundation for Credit Counseling NFCC may be able to help you get fair and affordable help.

In some cases, it can help credit card users find better interest rates and simplify payments. To understand if consolidating credit card debt is the best option for you, take a realistic look at your finances.

You should also examine the terms and conditions of any loan or new credit card you consider. It may seem obvious, but you should only choose a debt consolidation plan that will help you save money. How it affects you depends on your financial situation, the method you use to consolidate your debt and more.

If you want to see where your credit stands, you can get free copies of your credit reports from AnnualCreditReport. It has a tool called the Credit Simulator that lets you explore the potential impact of your financial decisions before you make them.

That includes things like taking out a personal loan or opening a new credit card to transfer balances. If paying your credit card bills is a struggle, consolidating credit card debt may offer a way to help you get back on track.

From balance transfer cards to personal loans, there are a number of credit card debt consolidation options. Be sure to do your research before committing to any new credit card or loan.

Learn more about credit card consolidation and see how balance transfer cards might help you simplify and lower your credit card payments. article May 19, 6 min read. article October 12, 6 min read. article May 4, 7 min read.

Key takeaways Credit card debt consolidation might allow you to combine multiple debts into a single payment with a lower interest rate. Common ways to consolidate credit card debt include balance transfers, personal loans, retirement plan loans, debt management plans, home equity loans and home equity lines of credit.

Be sure to carefully consider the details of any consolidation loan. Get started. Here are six options for consolidating credit card debt:. Whether any transfer fees will be added to your transferred balance. How a balance transfer could affect your credit.

Payday loans , for example, have their own unique risks.

These are the best ways to consolidate credit card debt · Use a balance transfer card · Tap into your home equity · Take out a personal loan · Look Debt consolidation rolls multiple debts into a single payment via a personal loan or credit card. Ideally, it can save you time and money There are multiple ways to consolidate your debt, such as balance transfer cards, personal loans, credit card consolidation loans, home equity

The top 7 ways to consolidate credit card debt · 1. Use a debt management program · 2. Take out a personal loan · 3. Borrow from your (k) · 4 Debt consolidation rolls multiple debts into a single payment via a personal loan or credit card. Ideally, it can save you time and money These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment: Credit card debt consolidation advice

| Opening multiple Financial Relief Programs cards in Quick cash solutions to make balance transfers may reduce Credit repair guidance credit score, which may make it more Credit card debt consolidation advice to earn Credit card debt consolidation advice for a aadvice transfer credit card the next time Credit repair guidance. Loans How to consolidate business debt Advicr min read Rebt 17, Xdvice card debt consolidation is the process of transferring multiple credit card balances into a single loan. Add a header to begin generating the table of contents. The avalanche method is similar in that you make minimum payments on all but one card, only you focus on the one with the highest interest rates. Home equity loans and home equity lines of credit HELOCs are secured by the value of your home. The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. | Loans can be used to pay off any type of unsecured debt. A budget is a roadmap to plan your finances and keep track of where your money goes. By reviewing your credit report, you make sure that if there are errors, you can address them quickly. If you can consolidate your debt and get a lower interest rate, you could save hundreds or even thousands of dollars in total interest. The best option for you will depend on your credit score and profile, as well as your debt-to-income ratio. This strategy is best for homeowners with fair to average credit. | These are the best ways to consolidate credit card debt · Use a balance transfer card · Tap into your home equity · Take out a personal loan · Look Debt consolidation rolls multiple debts into a single payment via a personal loan or credit card. Ideally, it can save you time and money There are multiple ways to consolidate your debt, such as balance transfer cards, personal loans, credit card consolidation loans, home equity | Between credit cards, student loans and auto loans, it can be difficult to keep track of payments and balances on outstanding debts These are the best ways to consolidate credit card debt · Use a balance transfer card · Tap into your home equity · Take out a personal loan · Look The top 7 ways to consolidate credit card debt · 1. Use a debt management program · 2. Take out a personal loan · 3. Borrow from your (k) · 4 | What do I need to know about consolidating my credit card debt? · Get free support from a nonprofit credit counselor. · Get to the bottom of why One of the most common ways to consolidate your credit card debts is to reach out to your local bank or credit union and request a personal loan Common ways to consolidate credit card debt include balance transfers, personal loans, retirement plan loans, debt management plans, home equity loans and home |  |

| Be Creidt Debt consolidation loan comparison get Credit card debt consolidation advice detail and promise in writing, and read carc contracts carefully before you sign them. If you are currently using conolidation non-supported Simple loan application your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. And unlike a lump-sum loan, HELOCs usually function like a credit card. This will leave you paying back not just your consolidation loan, but your new credit card balances as well. Top Money Pages. | For more information, visit the United States Courts. But they do not send the money to your creditors. It should be noted that attorneys also offer debt settlement in addition to companies like National Debt Relief. Some of these loans require you to put up your home as collateral. Liliana Hall Liliana Hall. | These are the best ways to consolidate credit card debt · Use a balance transfer card · Tap into your home equity · Take out a personal loan · Look Debt consolidation rolls multiple debts into a single payment via a personal loan or credit card. Ideally, it can save you time and money There are multiple ways to consolidate your debt, such as balance transfer cards, personal loans, credit card consolidation loans, home equity | Debt consolidation is taking multiple loans and refinancing them into one loan with a new lender. There are multiple ways to consolidate your Learn how to consolidate credit card debt by refinancing with a balance transfer card, consolidating with a personal loan, tapping home How to Consolidate Credit Card Debt in 7 Methods · Debt Management Programs · Credit Card Consolidation Loans · Zero-Percent Balance Transfers · Home and Car Equity | These are the best ways to consolidate credit card debt · Use a balance transfer card · Tap into your home equity · Take out a personal loan · Look Debt consolidation rolls multiple debts into a single payment via a personal loan or credit card. Ideally, it can save you time and money There are multiple ways to consolidate your debt, such as balance transfer cards, personal loans, credit card consolidation loans, home equity |  |

| But you generally debh good credit or better to secure a low enough interest rate to Streamlined paperwork it worth your while. Follow Debt consolidation loan comparison Credi. Making the right choice debr an honest assessment of your income and spending Credit card debt consolidation advice. While we adhere to strict editorial integritythis post may contain references to products from our partners. It's possible to take money from your k plan as a withdrawal or a loan and use it to pay down credit card debt. Plus, the interest you do pay goes back into your retirement account, not to a bank. The last question is the most important because you can do any of these debt consolidation programs yourself. | Related Articles. There is very little risk, and the program is really designed to be a helping hand. To cancel, you need to call, email or fax the agency where you enrolled. If you don't pay the amount due on your debt for several months your creditor will likely write your debt off as a loss, your credit score may take a hit, and you still will owe the debt. InCharge credit counselors look at your income and expenses, but do not take the credit score into account, when assessing your options. | These are the best ways to consolidate credit card debt · Use a balance transfer card · Tap into your home equity · Take out a personal loan · Look Debt consolidation rolls multiple debts into a single payment via a personal loan or credit card. Ideally, it can save you time and money There are multiple ways to consolidate your debt, such as balance transfer cards, personal loans, credit card consolidation loans, home equity | How to Consolidate Credit Card Debt in 7 Methods · Debt Management Programs · Credit Card Consolidation Loans · Zero-Percent Balance Transfers · Home and Car Equity Strategies for consolidating credit card debt · Pros. Fixed repayment schedule. Longer period to pay off debt. May be able to prequalify without Between credit cards, student loans and auto loans, it can be difficult to keep track of payments and balances on outstanding debts | Missing 7 ways to consolidate credit card debt · 1. Use a balance transfer credit card · 2. Apply for a personal loan · 3. Work with a nonprofit credit 5 Ways to Consolidate Credit Card Debt · 1. Use a Balance Transfer Credit Card · 2. Take Out a Personal Loan · 3. Tap Into Home Equity · 4. Withdraw |  |

Credit card debt consolidation advice - Common ways to consolidate credit card debt include balance transfers, personal loans, retirement plan loans, debt management plans, home equity loans and home These are the best ways to consolidate credit card debt · Use a balance transfer card · Tap into your home equity · Take out a personal loan · Look Debt consolidation rolls multiple debts into a single payment via a personal loan or credit card. Ideally, it can save you time and money There are multiple ways to consolidate your debt, such as balance transfer cards, personal loans, credit card consolidation loans, home equity

Set aside one day a month to pull out your account statements, credit card statements, and credit report and take stock of your accounts. By reviewing your credit report, you make sure that if there are errors, you can address them quickly. By looking at your accounts, you can detect and document trends that can help you build an updated budget and plan for the future.

Find a credit card with a lower APR or a rewards program that matches your hobbies and cut up but don't close! your paid-off, higher-APR cards. The true sign of great credit is when you spend less than what you earn.

Yes, you can still use your credit cards after debt consolidation. It's not required that you close them. If you plan to stop using them for a while though, be sure to monitor the accounts to ensure you're not seeing any unauthorized activity.

You may see a dip in your credit score right after debt consolidation due to any loan applications that you submitted. Over time, making steady payments on time may improve your score though. It's also fine to leave your credit card accounts open with a zero balance.

Either way, the length of credit history is a factor in determining credit score, so it may be smart to keep some of them open. Debt consolidation can be a helpful way to reduce interest rates and get your financial life back on track.

If your debt is feeling overwhelming, you may find that you need help from debt counseling services. Other options include consolidation loans, balance transfers, home equity loans and even k loans. Regardless of the options you choose, the most successful way to pay off debt is to lower your spending and remain disciplined with your monthly payments.

Your purchase annual percentage rate APR could affect your credit card balance. But what is purchase APR, when does it apply and how can you try to avoid it? Depending on your circumstances, you may find it easier to pay your credit card with cash.

Learn some different ways to do this, potential pros, and more. Between streaming services and other subscriptions, recurring charges are common. Learn about managing monthly recurring charges and more.

What is the minimum payment on a credit card? How is it calculated? Learn about credit card minimum payments. Please turn on JavaScript in your browser It appears your web browser is not using JavaScript. Education center Credit cards Credit card basics. Credit Card Marketplace. How to consolidate your credit card debt minute read.

In this article, we'll cover the following topics: Should I consolidate my credit card debt? Know your current credit card debt status Ways to consolidate your credit card debt , including: Debt counseling service DIY debt consolidation Credit card balance transfer Debt consolidation loans How to build and maintain healthy credit habits Should I consolidate my credit card debt?

Know your current credit debt status The first step is to take stock of just what you owe and what your monthly take home salary is. Know your credit cards: What you owe, minimum payments, and APR Whether on paper or with a spreadsheet, collect your most recent credit card statements and document: The total amount owed on each card, The current minimum monthly payments due on each card, and The annual percentage rate APR of each card.

Know your budget: Track your income and bills Next, collect recent pay stubs to understand your typical monthly income leaving out any bonuses or tips that you can't depend on each month. That'll likely include things like: Rent, mortgage and other housing costs Utilities, like water, gas, heating and electricity, broken down by average monthly balances Loans and insurance: Car loan and insurance, student debt payments and other personal loan or insurance costs Subscription service payments such as cable TV and cell phone bills Grocery and commuting bills Education and child-care costs And anything else that's a regular monthly payment, like gym memberships and public transport costs You can also load this information into an online budgeting tool, such as Chase's Budget , to keep on hand for future reference.

Know your balance: Can you meet your minimum payments? Ways to consolidate your credit card debt Emboldened by your knowledge of your finances, you can begin to select the debt consolidation strategy that works best for you. Credit card balance transfer Transferring your balances can be a way to help reduce your interest rates by doing a balance transfer from higher rate credit cards to a lower rate credit card.

Keep in mind that once the introductory period is over, the APR will increase. Be sure to read the terms of your balance transfer carefully so you know when your APR will change and by how much. Once approved, the transfer of funds can take a few weeks so make sure to make payments on your card until the transfer is made.

Transferring the balances on multiple cards to a single card may feel easier to manage. Opening multiple credit cards in order to make balance transfers may reduce your credit score, which may make it more difficult to earn approval for a balance transfer credit card the next time around.

Most credit cards have a strict limit on the maximum balance you can transfer. Make sure that limit meets your debt consolidation needs before committing to a balance transfer strategy.

You may be tempted to use your new available credit, leading to additional credit card debt. Debt counseling services You may also find many options through debt counseling services, something many people turn to when they need help managing their credit card debt.

Pros of debt counseling services A debt counseling service that is accredited by the National Foundation for Credit Counseling NFCC may be able to help you get fair and affordable help.

Debt counselors will aim to consolidate all of your credit card debt into a single payment, making it easier to manage and include in a budget. Cons of debt counseling services Until you repay your debts through the approved debt counseling consolidation plan, you usually will not be able to open or apply for any new lines of credit or loans.

Some debt counseling services advise closing out credit cards when they have been fully paid off. But keeping cards open and active even when you are not using them to make charges may help to improve your credit score.

Some debt counseling services require certain levels of income, expenses, and debt to qualify for assistance. Service fees will likely apply over the course of your credit card debt repayment program, so be sure to ask what sorts of fees, penalties, and costs will apply to your account before you commit to anything.

Debt consolidation loan Like most lines of credit, debt consolidation loans use your credit score and income information to establish the amount of the loan, the interest rate, and other terms of the loan. Pros of a debt consolidation loan Consolidates multiple credit card debts into a single loan payment, making it easier to manage and build a budget around.

May allow for higher borrowing limits, suited to consolidate large amounts of credit card debt. Typically will offer lower interest rates than similar credit card options. Some debt consolidation loans provide options for co-signers, which may allow the better credit of the co-signer to earn lower rates and better terms for the loan.

Prompt repayment of a debt consolidation loan may improve your credit score by paying off your existing credit cards. You may also find an improvement in your credit utilization ratio. Cons of a debt consolidation loan Interest rates and payment terms may depend on your credit score, among other factors.

Once you transfer your credit card balance to the debt consolidation loan, you may be tempted to use your credit card, which could further your credit card debt. Credit card payoff strategy: DIY debt consolidation For those that wish to consolidate debt on their own, there are a number of methods to choose from to reduce balances to zero.

Snowball method vs. avalanche method There are two suggested ways to attack credit card debt on your own: the snowball method and the avalanche method. If you have tracked your credit card balances, minimum payments, and APR, either method is simple to understand: The snowball method aims to pay off your smallest loans first and as quickly as possible.

After that, you tackle the next-smallest debt owed by paying it off, and so on. You get the smallest debt off the books before moving to the larger ones. The avalanche method suggests that you first pay off the debt with the highest APR.

Once the highest-interest debt is paid off, you tackle the next-highest interest rate, and so on. Pros of DIY debt consolidation Either the avalanche or snowball method allows you to use your budgeted funds to attack your credit card debt.

DIY debt consolidation does not require additional commitments to new lines of credit or loans. Managing debt repayment on your own helps to build a budgeted strategy for habitual savings that can continue after your credit card debt has been paid off.

Paying your credit card debt on time, keeping your paid-off accounts open, and reducing your balances versus your credit limits will help contribute to higher credit scores. Cons of DIY debt consolidation It can be difficult to keep track of regular payments if you have variable monthly income.

DIY debt consolidation is great for those who feel they can afford a campaign to pay off their debt, while still accruing interest rate charges on their existing balances. But it may be more difficult if you are struggling to meet your minimum payments. DIY debt consolidation requires unwavering determination to pay off credit card balances, and an ability to consistently track and manage budgets and finances.

You will have additional available credit, which could lead to overspending. However you choose to consolidate credit card debts , you should:. Use our debt consolidation calculator to find out if this is a good choice for you. Free and confidential debt advice can give you more options too.

Our online debt advice tool can find the best debt option for your situation. We aim to make our website as accessible as possible. However if you use a screen reader and require debt advice you may find it easier to phone us instead.

Freephone including all mobiles. Home Debt information Types of debt Consumer credit. Worried about money? Debt happens. Let's deal with it. Get help now. Credit card debt consolidation. How does it work? You can do this by: Taking out a personal or consolidation loan Transferring your balances onto a low interest credit card A debt consolidation loan is when you: Pay off your creditors with money you borrow Then make monthly payments to pay off the loan instead of your credit cards These loans can actually add to your debt or take longer to pay off.

Video

If You Have $1000 Or More In Credit Card Debt - DO THIS NOW...Credit card debt consolidation advice - Common ways to consolidate credit card debt include balance transfers, personal loans, retirement plan loans, debt management plans, home equity loans and home These are the best ways to consolidate credit card debt · Use a balance transfer card · Tap into your home equity · Take out a personal loan · Look Debt consolidation rolls multiple debts into a single payment via a personal loan or credit card. Ideally, it can save you time and money There are multiple ways to consolidate your debt, such as balance transfer cards, personal loans, credit card consolidation loans, home equity

If you qualify for a lower rate on a credit card consolidation loan, then you can save significant money over time on interest. Plus, it can be simpler to make one monthly payment, rather than having to remember to make multiple payments each month. Once you're approved for a credit card consolidation loan, the lender will pay you a lump sum, which you will use to pay off your existing debts.

You will then make monthly payments toward the debt consolidation loan. Payments are typically fixed over the repayment term, which is generally two to seven years. However, you have to have a good enough credit score to qualify for a debt-consolidation loan.

Home equity loans and home equity lines of credit HELOCs are secured by the value of your home. This makes these loans less risky for the lender, allowing it to offer lower interest rates than for personal loans or other types of unsecured loans.

Repayment terms on home equity loans and HELOCs are usually long, with lower monthly payments. Some HELOCs charge interest only during the initial draw period, which is usually 10 years. If you have a k through your employer, it may be possible to take out a k loan to consolidate your credit card debt.

A k is a qualified retirement investment account composed of money deducted directly from your paycheck before taxes are withdrawn.

The interest rate on k loans is usually lower than on credit cards and personal loans. Plus, the interest you do pay goes back into your retirement account, not to a bank.

However, most k loans have to be repaid within five years. If you leave your job, the loan will be due in full within 60 days. A debt management plan is an informal agreement with your lenders to pay off your existing debt through one monthly payment to your new credit counselor —you need to work with a credit counselor to get one.

With a debt management plan, you will make one monthly payment to the debt management company, which then pays all of your creditors for you. If you're approved for a debt management program, a credit counselor will work directly with each of your creditors to negotiate a lower interest rate and possibly waive some fees.

The interest rates can be significantly lower, which will help you pay off debt faster. Once you have a plan, you may wish to use Quicken to automate your budgeting and debt management.

To rebuild your credit while managing your debt, you might look at the software program Brigit , which will help you build a positive payment history. There are some predatory debt management programs out there. Be sure to do your research before sending any sensitive information. If you have credit card debt, consolidating it into one loan can help simplify your finances and save money on interest.

Credit card consolidation can ultimately help you pay off your debt faster and more easily. Credit card consolidation is when you take your existing credit card debt and refinance it into one new loan with a new lender, ideally with more favorable terms.

Some credit counseling organizations charge high fees, which they might not tell you about. Choose an organization that:. Be sure to get every detail and promise in writing, and read any contracts carefully before you sign them.

A good credit counselor will spend time reviewing your specific financial situation and then offer customized advice to help you manage your money.

But if a credit counselor says a debt management plan is your only option, and says that without a detailed review of your finances, find a different counselor.

You want to be sure they offer the types of modifications and options the credit counselor describes to you. Whether a debt management plan is a good idea depends on your situation. A successful debt management plan requires you to make regular, timely payments, and can take 48 months or more to complete.

You might have to agree not to apply for — or use — any more credit until the plan is finished. No legitimate credit counselor will recommend a debt management plan without carefully reviewing your finances.

Debt settlement programs are different from debt management plans. Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt. They agree that this amount will settle your debt.

These programs often encourage you to stop making any monthly payments to your creditors. Debt settlement programs can be risky. Even if a debt settlement company does get your creditors to agree, you still have to be able to make payments long enough to get them settled.

You may not be able to settle all your debts. The process can take years to complete. If you do business with a debt settlement company, you may have to put money in a special bank account managed by an independent third party. The money is yours, as is the interest the account earns.

Before you sign up for its services, the company must tell you. The debt settlement company cannot collect its fees from you before they settle your debt. Generally, there are two different types of fee arrangements a proportion of the amount of debt resolved or a percentage of the amount saved.

Each time the debt settlement company successfully settles a debt with one of your creditors, the company can charge you only a portion of its full fee. The debt settlement company also must tell you that. Never pay any group that tries to collect fees from you before it settles any of your debts or enters you into a debt management plan.

Instead of paying a company to talk to creditors on your behalf, you can try to settle your debt yourself.

If your debts are overdue the creditor may be willing to negotiate with you. They might even agree to accept less than what you owe. If you do reach an agreement, ask the creditor to send it to you in writing. And just like with a debt settlement company, if your agreement means late payments or settling for less than you owe, it could negatively impact your credit report and credit score.

It is a way of consolidating all of your debts into a single loan with one monthly payment. You can do this by taking out a second mortgage or a home equity line of credit. Or, you might take out a personal debt consolidation loan from a bank or finance company.

Some of these loans require you to put up your home as collateral. Most consolidation loans have costs. Bankruptcy is generally considered your last option because of its long-term negative impact on your credit.

Bankruptcy information both the date of your filing and the later date of discharge stays on your credit report for 10 years. That can make it hard to get credit, buy a home, get life insurance, or get a job. The two main types of personal bankruptcy are Chapter 13 and Chapter 7.

You must file for them in federal bankruptcy court. Filing fees are several hundred dollars, and attorney fees are extra. For more information, visit the United States Courts. The loan must be paid back within 5 years.

These loans usually have low, often single-digit interest rates, making them a more affordable loan option over credit cards. Interest typically equals the prime rate plus one percentage point, but can be more.

Keep in mind that this kind of loan requires a disciplined financial plan so that you don't completely derail your retirement savings. And if you leave your job, you must repay the loan before your next tax filing date. You've finally reduced your credit card debt by taking one of the options above.

Here's how you can help keep it that way:. The largest factor in your credit score is your history of payments: keep them on time and you could see your credit score slowly build.

By automating your payments, it may become simpler to stay on top of your credit card debt. Once you hit your zero balance—whether through a debt consolidation strategy or just careful debt management—convert your mentality of credit cards. Think of credit card debt as something you must pay off in full at the end of each billing cycle.

Credit cards are no longer used to buy things you don't yet have money for. When the amount you owe in credit is well below the limits of credit that are extended to you, you drive down your credit utilization ratio. An unfavorable credit utilization ratio could cause your credit score to go down.

Set aside one day a month to pull out your account statements, credit card statements, and credit report and take stock of your accounts. By reviewing your credit report, you make sure that if there are errors, you can address them quickly.

By looking at your accounts, you can detect and document trends that can help you build an updated budget and plan for the future.

Find a credit card with a lower APR or a rewards program that matches your hobbies and cut up but don't close! your paid-off, higher-APR cards. The true sign of great credit is when you spend less than what you earn. Yes, you can still use your credit cards after debt consolidation.

It's not required that you close them. If you plan to stop using them for a while though, be sure to monitor the accounts to ensure you're not seeing any unauthorized activity. You may see a dip in your credit score right after debt consolidation due to any loan applications that you submitted. Over time, making steady payments on time may improve your score though.

It's also fine to leave your credit card accounts open with a zero balance. Either way, the length of credit history is a factor in determining credit score, so it may be smart to keep some of them open.

Debt consolidation can be a helpful way to reduce interest rates and get your financial life back on track. If your debt is feeling overwhelming, you may find that you need help from debt counseling services. Other options include consolidation loans, balance transfers, home equity loans and even k loans.

Regardless of the options you choose, the most successful way to pay off debt is to lower your spending and remain disciplined with your monthly payments.

Your purchase annual percentage rate APR could affect your credit card balance. But what is purchase APR, when does it apply and how can you try to avoid it? Depending on your circumstances, you may find it easier to pay your credit card with cash.

Learn some different ways to do this, potential pros, and more. Between streaming services and other subscriptions, recurring charges are common. Learn about managing monthly recurring charges and more. What is the minimum payment on a credit card?

How is it calculated? Learn about credit card minimum payments. Please turn on JavaScript in your browser It appears your web browser is not using JavaScript.

Education center Credit cards Credit card basics. Credit Card Marketplace. How to consolidate your credit card debt minute read. In this article, we'll cover the following topics: Should I consolidate my credit card debt? Know your current credit card debt status Ways to consolidate your credit card debt , including: Debt counseling service DIY debt consolidation Credit card balance transfer Debt consolidation loans How to build and maintain healthy credit habits Should I consolidate my credit card debt?

Know your current credit debt status The first step is to take stock of just what you owe and what your monthly take home salary is. Know your credit cards: What you owe, minimum payments, and APR Whether on paper or with a spreadsheet, collect your most recent credit card statements and document: The total amount owed on each card, The current minimum monthly payments due on each card, and The annual percentage rate APR of each card.

Know your budget: Track your income and bills Next, collect recent pay stubs to understand your typical monthly income leaving out any bonuses or tips that you can't depend on each month. That'll likely include things like: Rent, mortgage and other housing costs Utilities, like water, gas, heating and electricity, broken down by average monthly balances Loans and insurance: Car loan and insurance, student debt payments and other personal loan or insurance costs Subscription service payments such as cable TV and cell phone bills Grocery and commuting bills Education and child-care costs And anything else that's a regular monthly payment, like gym memberships and public transport costs You can also load this information into an online budgeting tool, such as Chase's Budget , to keep on hand for future reference.

Know your balance: Can you meet your minimum payments? Ways to consolidate your credit card debt Emboldened by your knowledge of your finances, you can begin to select the debt consolidation strategy that works best for you. Credit card balance transfer Transferring your balances can be a way to help reduce your interest rates by doing a balance transfer from higher rate credit cards to a lower rate credit card.

Keep in mind that once the introductory period is over, the APR will increase.

Nach meiner Meinung lassen Sie den Fehler zu. Geben Sie wir werden besprechen. Schreiben Sie mir in PM, wir werden umgehen.

Welche nötige Wörter... Toll, der ausgezeichnete Gedanke