Your credit score is a combination of data from all three of the credit reporting bureaus. Each bureau may give you a slightly different score depending on which lenders, collection agencies and court records report to them, but your scores should all be similar.

The following is a rough breakdown of how credit bureaus calculate credit scores:. Your credit is something that you control, and you can change your score for the better.

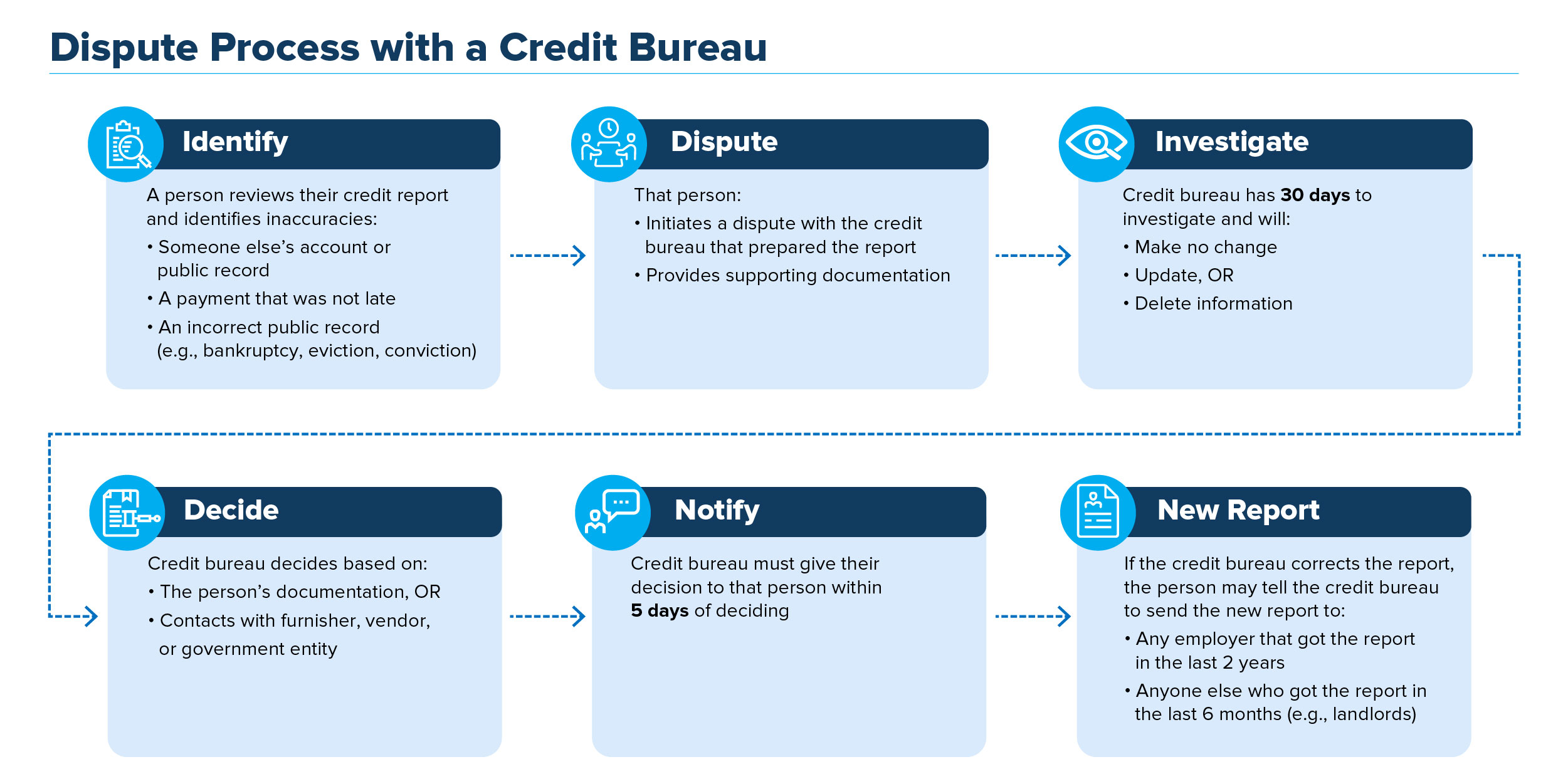

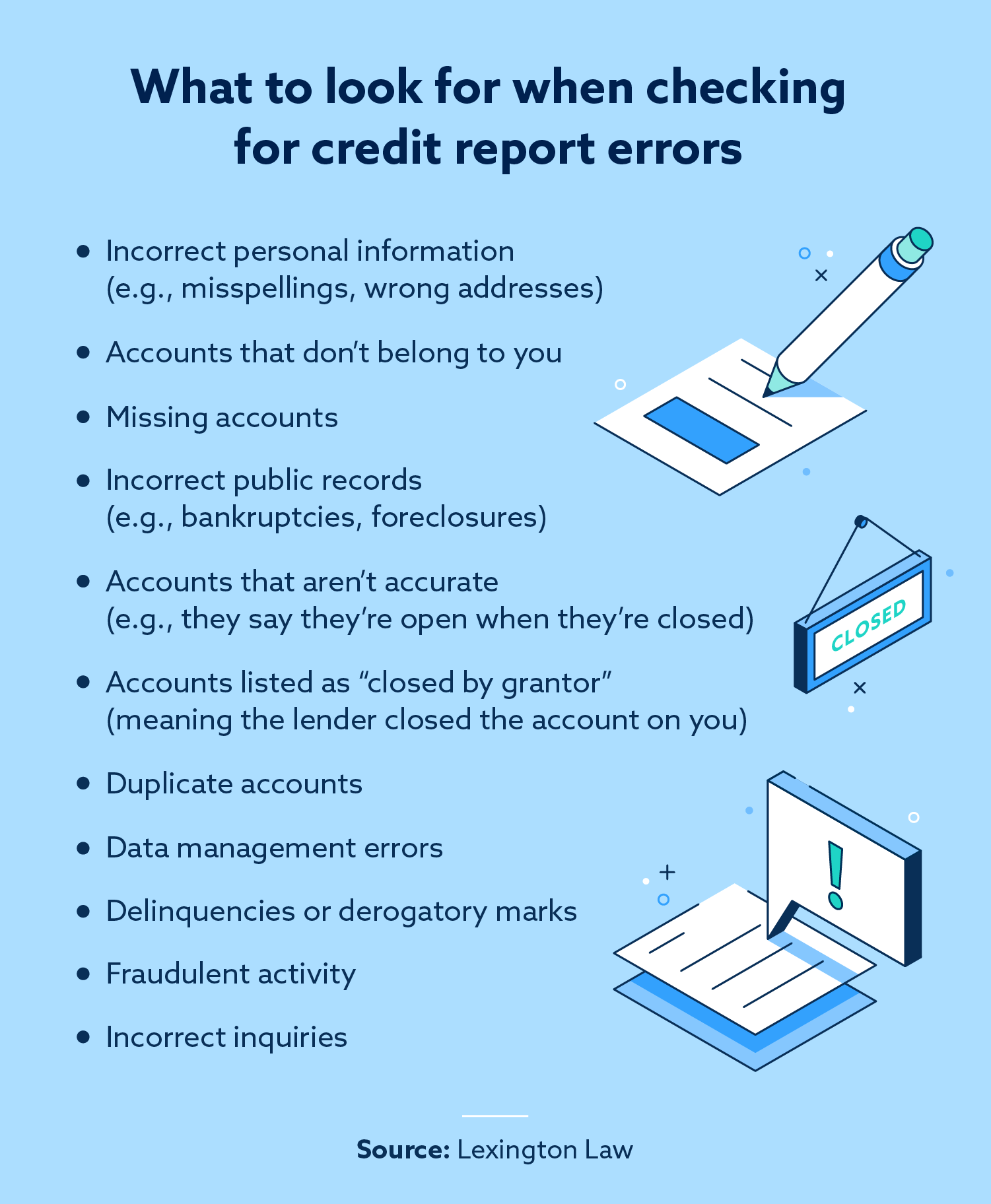

After you understand your credit score calculation and you know your score, use a method or series of methods from our list below to start improving your credit. According to a U. These errors are rarely beneficial, and they lower your score when it should actually be higher. Pull each of your credit reports and carefully check each one for errors.

Your credit reports include instructions on error reporting processes. If you do notice something that you believe is an error, your credit bureau must investigate any dispute that you make and report their findings back to you. This means that one of the quickest ways you can raise your score is to make minimum payments on all of your accounts every month.

This lowers your revolving utilization and helps you save on interest in the long term. Take control of your credit cards and create a plan to make minimum payments on all of your accounts every month. Most credit card companies allow you to set email or SMS alerts to get a notification when a minimum payment is due soon, and you can even schedule auto-payments in advance with most cards so you never miss a payment date.

Closing credit lines lowers your available credit and increases your revolving utilization percentage. Instead, charge a small item — like a cup of coffee or a pizza dinner — once a month and pay your bill off immediately.

Sit down with your credit statements and make a list of everything that you owe and remember to include each one of your cards on the list. Then, take a look at your budget and look for places where you can afford to cut back.

Finally, avoid spending extra money on your credit cards if at all possible while you reduce your debts. A debt consolidation loan typically a personal loan or balance transfer takes all of your outstanding debts on different accounts and combines them into a single monthly payment.

This may help improve your credit utilization rates and can help you avoid missed payments. A debt consolidation loan or balance transfer can be a great option for you if you have multiple lines of credit that you have trouble keeping up with. You make a hard inquiry on your credit report when you apply for a debt consolidation loan.

This means that your credit score will usually drop by a few points immediately after your inquiry. Focus on making on-time payments above the minimum required amount after you get your debt consolidation loan.

Credit counseling agencies are companies that can help you analyze your finances and find realistic solutions for your debt and credit issues. Credit repair companies look at your finances and suggest opportunities where you can save. They may also contact your creditors on your behalf and negotiate your payment amounts.

If you decide that you want to work with a credit counseling agency, or alternatively look into a credit repair company, be picky with your selection. Ask about fees, specific pricing, services and products and avoid companies reluctant to provide upfront information on their pricing structures or debt-reduction tactics.

You can find affordable and reputable assistance from a nonprofit credit counselor through the National Foundation for Credit Counseling. While ranges will vary slightly between the FICO ® and VantageScore ® 3.

The credit score ranges for FICO ® impact may include:. They can sometimes even secure special individualized perks and offers from lenders. Borrowers with poor credit may pay a fee or deposit in exchange for credit or a loan.

In many cases, they may be flat-out refused by lenders. If you have poor credit, you may want to create and carry out a credit repair plan. Ready to get started on your home buying journey? Apply for mortgage approval with Rocket Mortgage ® today.

Mortgage Basics - 4-minute read. Dan Rafter - February 05, Debt service refers to the money needed to fully repay a loan or mortgage. Learn how the debt service ratio is calculated and its importance in debt repayments.

Refinancing - 7-minute read. Basically, it's the sum of all of your revolving debt such as your credit card balances divided by the total credit that is available to you or the total of all your credit limits —multiplied by to get a percentage.

High credit utilization can negatively impact your credit scores. That said, while increasing your credit limit may seem like an appealing option, it can be a risky move.

If increasing your credit limit tempts you to spend more, you could fall deeper into debt. Additionally, if you try to open a new credit card, a hard inquiry will appear on your credit report and could temporarily reduce your credit score by a few points.

Also, while consolidating your debt with a personal loan can drop your utilization rate to zero immediately, it can be tough to get approved for a loan with a reasonable interest rate if your credit score is in poor shape.

As such, paying down your balances on credit cards and other revolving credit accounts may be the best option to improve your credit utilization rate and, subsequently, your credit scores. Scoring models consider how much you owe and across how many different accounts.

If you have debt across a large number of accounts, it may be beneficial to pay off some of the accounts, if you can. Paying down credit card debt is the goal of many who've accrued debt in the past, but even after you pay the balance down to zero, consider keeping that account open.

Not only can closing it hurt scores by eliminating that available credit and increasing your credit utilization ratio, but keeping paid off accounts open can also be a plus because they're aged accounts in good paid-off standing.

And again, you may also consider debt consolidation. Credit scoring models, like those created by FICO ® , often factor in the age of your oldest account and the average age of all of your accounts, rewarding individuals with longer credit histories. Before you close a credit card account , think about your credit history.

It can be beneficial to leave a credit card open even if you've paid it off and don't plan on using it anymore. Of course, if keeping accounts open and having credit available could trigger additional spending and debt, you may choose to close the accounts after all. Like fingerprints, every person has a unique financial situation, and only you know all the ins and outs of yours.

Make sure you carefully evaluate your situation to figure out the approach that works best for you. Opening several credit accounts in a short period of time can cause you to appear risky to lenders and, in turn, negatively impact your credit scores. Before you take out a loan or open a new credit card account, consider the effects it could have on your credit.

Note, however, that when you're buying a car or looking around for the best mortgage rates, your inquiries may be grouped together and counted as only one inquiry for the purpose of credit scoring. In many commonly used scoring models, recent inquiries have a greater effect than older inquiries, and they only appear on your credit report for 24 months.

It's hard to say with certainty how long it takes to rebuild credit because each person's credit history is different. If you've had credit difficulties in the past, how long it will take to rebound depends in part on the severity of the negative information in your credit report and how long ago it occurred.

While some actions can have an almost immediate effect—such as paying down credit card balances—others may take months to make a significant positive impact.

If you're disputing information in your credit report you believe is fraudulent or inaccurate, the investigation can take up to 30 days.

If the credit reporting agency finds your dispute valid, the information will be removed from your credit report, and your score will reflect that change as soon as it's calculated again. If you're making payments or reducing your credit card balances, don't worry if your credit report isn't updated right away.

Creditors only report to Experian and other credit reporting agencies on a periodic basis, usually monthly. It can take up to 30 days or more for your account statuses to be updated, depending on when in the month your creditor or lender reports their updates.

It's critical that you check your credit score regularly to keep track of your progress and make sure the right information is being reported over time. As you build a positive credit history , over time, your credit scores will likely improve, and you'll have a better chance of qualifying for favorable credit terms when you need to borrow again.

How to Get Extra Help With Your Credit and Debt If your debt is manageable, consider consolidating it via a personal loan or balance transfer credit card. In some cases, debt consolidation loans can provide lower interest rates and reduced monthly payments, as long as you qualify and stick to the program terms.

Just be mindful not to continue charging on the original card once the balance is transferred. If your debt feels overwhelming and your credit isn't good enough to get a balance transfer card or a low-interest personal loan, it may be valuable to seek out the services of a reputable credit counseling agency.

Many are nonprofit, and you can typically get a consultation with personalized advice for your situation at no cost. You can review more information on selecting the right reputable credit counselor for you from the National Foundation for Credit Counseling.

Credit counselors can also help you develop a debt management plan DMP with unsecured debt like credit cards. With this arrangement, you'll make your monthly debt payments to the credit counseling agency, and it will disburse the funds to your creditors.

The agency may also be able to negotiate lower monthly payments and interest rates. If the credit counselor negotiates settled amounts that mean you pay less to your creditors than was originally owed, your credit score could take a hit. In addition, your credit report may denote that accounts are paid through a DMP and were not paid as originally agreed, which may be viewed negatively by lenders.

However, using a DMP may not negatively impact your credit history when you continue to make payments on time as agreed under the new terms.

Keep Track of Your Credit After You've Reached Your Goal Once you've done the work to rebuild your credit history , you may be tempted to move on and focus on something else. While you likely won't need to focus as much on your credit score as you used to, it's still a good idea to keep an eye on it.

Carefully review your credit report from all three credit reporting agencies for any incorrect information. Dispute inaccurate or missing information by contacting the credit reporting agency and your lender. Read more about disputing errors on your credit report.

Remember: checking your own credit report or FICO Score has no impact on your credit score. Past problems like missed or late payments are not easily fixed. Pay your bills on time : delinquent payments, even if only a few days late, and collections can have a significantly negative impact on your FICO Scores.

Use payment reminders through your banks' online portals if they offer the option. Consider enrolling in automatic payments through your credit card and loan providers to have payments automatically debited from your bank account.

If you have missed payments, get current and stay current : poor credit performance won't haunt you forever. The longer you pay your bills on time after being late, the more your FICO Scores should increase. The impact of past credit problems on your FICO Scores fades as time passes and as recent good payment patterns show up on your credit report.

Be aware that paying off a collection account will not remove it from your credit report : it will stay on your report for seven years. If you are having trouble making ends meet, contact your creditors or see a legitimate credit counselor : this won't rebuild your credit score immediately, but if you can begin to manage your credit and pay on time, your score should increase over time.

Seeking assistance from a credit counseling service will not hurt your FICO Scores. It can be easier to clean up than payment history, but it requires financial discipline and understanding the tips below. Keep balances low on credit cards and other revolving credit : high outstanding debt can negatively affect a credit score.

Pay off debt rather than moving it around : the most effective way to improve your credit scores in this area is by paying down your revolving credit card debt. In fact, owing the same amount but having fewer open accounts may lower your scores.

Come up with a payment plan that puts most of your payment budget towards the highest interest cards first, while maintaining minimum payments on your other accounts.

Allow time for negative entries to be removed Pay your bills on time Keep credit utilization rate low

Video

How To Raise Your Credit Score By 200 PointsCredit score repairing steps - Repay your debts Allow time for negative entries to be removed Pay your bills on time Keep credit utilization rate low

If any of your accounts have been transferred to a collection agency, reach out to them to figure out a payment plan. The accounts with the highest interest rates should be your top priority. The faster you pay them down, the less you'll pay in interest credit cards -- and especially retail store credit cards -- typically have higher interest rates than loans.

But there's another important factor -- your "credit utilization. Constantly maxing out your credit card and having this recorded on your monthly bill can negatively impact your score. The closer you get to this percentage, the better your credit will be.

Paying your bills -- on time and consistently -- is a key step in rebuilding or maintaining a good credit score. Late and overdue payments can blemish your credit history for years. If paying bills on time is an issue for you, consider setting up automatic payments.

If that's not an option, set a reminder on your phone or calendar. In general, the longer you've had a credit card, the better. Once you've paid down the balance, you may be tempted to close your credit card account. Don't do it -- unless it has an annual fee.

Closing an account can change your credit utilization and negatively impact your credit history. Don't open up more credit accounts while trying to pay down debt. As your credit score improves, you'll likely receive more credit card offers. While it may take some time and dedication to improve your credit, the discipline you practice along the way will help you develop good habits.

Maintaining good credit behavior will keep your credit in good shape so you can qualify for better financial options down the road. It depends. Sometimes not long at all. But there are exceptions. For example, being 30 days late on a mortgage payment can take anywhere from nine months to three years to repair your credit.

But if you file for bankruptcy, it could take up to 10 years. All three CRAs allow you to view your credit score for free, at least initially. You might then need to pay a monthly fee to monitor changes in your credit score.

Other organisations like Credit Karma and TotallyMoney give you free access to your credit score forever. When looking at your credit report, check all the information carefully. A small error like the wrong house number or the wrong postcode can have a big impact on your credit score.

In addition, credit reference agencies have been known to make mistakes. One Australian reporting agency mistakenly linked a debt notice to an unrelated person who happened to share a surname and apartment building with the debtor.

So make sure all the information in your credit report is right. Learn how to dispute a credit report error. Aim to pay off as many outstanding debts as you can without dipping into your emergency fund, if you have one.

Prioritise loans and credits cards with high interest rates to reduce the size of your debts. Avoid taking out a payday loan if you have low credit. Payday loans often have high interest rates that can quickly spiral into more debt. Some CRAs also view payday loans negatively, even if you pay them off on time.

This sounds complex, but it just means using less credit. For a £5, credit limit, that would equal £1, The less credit you use, the better your credit score will be. Some lenders will automatically decline someone who withdraws cash over a certain limit. Paying your bills on time is a good way to fix your credit score.

Your credit score can be affected by those you share bank accounts or a mortgage with. So if your credit score is being brought down by joint borrowing, you may want to consider removing yourself from the joint account.

This can be a tricky conversation to have with the other person. Seeking assistance from a credit counseling service will not hurt your FICO Scores.

It can be easier to clean up than payment history, but it requires financial discipline and understanding the tips below. Keep balances low on credit cards and other revolving credit : high outstanding debt can negatively affect a credit score. Pay off debt rather than moving it around : the most effective way to improve your credit scores in this area is by paying down your revolving credit card debt.

In fact, owing the same amount but having fewer open accounts may lower your scores. Come up with a payment plan that puts most of your payment budget towards the highest interest cards first, while maintaining minimum payments on your other accounts.

Don't open several new credit cards you don't need to increase your available credit : this approach could backfire and actually lower your credit scores. Watch to see how you can manage your FICO Scores: Managing your FICO Scores - open video Managing your FICO Scores Video transcript.

If you have been managing credit for a short time, don't open a lot of new accounts too rapidly : new accounts will lower your average account age, which will have a larger impact on your scores if you don't have a lot of other credit information.

Also, rapid account buildup can look risky if you are a new credit user. Do your rate shopping for a loan within a focused period of time : FICO Scores distinguish between a search for a single loan and a search for many new credit lines, in part by the length of time over which you make your inquiries.

Re-establish your credit history if you have had problems : opening new accounts responsibly and paying them off on time will raise your credit score in the long term. Request and check your credit report : this won't affect your score, as long as you order your credit report directly from the credit reporting agency or through an organization authorized to provide credit reports to consumers.

Apply for and open new credit accounts only as needed : don't open accounts just to have a better credit mix—it probably won't raise your credit score. Have credit cards but manage them responsibly : in general, having credit cards and installment loans and making your payments on time will rebuild your credit scores.

Someone with no credit cards, for example, tends to be higher risk than someone who has managed credit cards responsibly. Note that closing an account doesn't make it go away : a closed account will still show up on your credit report and may be considered when calculating your credit score.

Ready to start improving your FICO Scores? Join the myFICO Forums where thousands are on the same journey.

Credit score repairing steps - Repay your debts Allow time for negative entries to be removed Pay your bills on time Keep credit utilization rate low

The most important thing is to pay your charge-off; if you can get a favorable account status, it's an added bonus.

Take care of collection accounts. Accounts get sent to a collection agency after they've been charged-off or fallen behind several months. Your approach to paying collections is much like that for charge-offs; you can pay in full and even try to get a pay for delete in the process, in which the lender agrees to remove details of the debt from your credit report upon receipt of payment.

Or, you can settle the account for less than the balance due. The collection will stay on your credit report for seven years based on the original delinquency. Even accounts that aren't normally listed on your credit report can be sent to a collection agency and added to your credit.

Your credit utilization , a ratio that compares your total debt to total credit, is the second biggest factor that affects your credit score. The higher your balances are, the more it hurts your credit score.

Having maxed out credit cards costs precious credit score points not to mention costly over-the-limit fees. Bring maxed out credit cards below the credit limit, then continue working to pay the balances off completely.

Your loan balances also affect your credit score in a similar way. The credit score calculation compares your loan current loan balance to the original loan amount. The closer your loan balances are to the original amount you borrowed, the more it hurts your credit score.

Focus first on paying down credit card balances because they have a greater impact on your credit score. It's important to prioritize where you spend your money each month. Focus first on accounts that are in danger of becoming past due. Get as many of these accounts current as possible, preferably all of them.

Then, work on bringing down your credit card balances. Third are those accounts that have already been charged-off or sent to a collection agency. Just like late payments severely hurt your credit score, timely payments help your score. Continue to keep those balances at a reasonable level and make your payments on time.

You might have to reestablish your credit by opening up a new account. Past delinquencies can keep you from getting approved for a major credit card so limit your credit card applications to one, at the most two, until your credit score improves.

This will keep your credit inquiries low. Credit inquiries are added to your credit report each time you make a new application for credit; too many of them hurt your credit score and your ability to get approved.

If you get denied for a major credit card, try applying for a retail store credit card. They have a reputation for approving applicants with bad or limited credit history. Still no luck? Consider getting a secured credit card, which requires you to make a security deposit to get a credit limit. In some ways, a secured credit card is more useful than a retail credit card because it can be used in more places.

Certain subprime credit cards are geared toward helping customers who wish to rebuild their credit; however, make sure you choose an offer from a reputable lender and compare all fees and interest rates before applying. Keep these credit repair tips in mind as you work toward a better credit score.

The strategies mentioned above will help you work toward buying a house. Keep in mind that the credit score is just one aspect that lenders will consider for mortgages , and you can negotiate the terms. If you have a big enough down payment or a strong work history, for example, then lenders may be more lenient with their credit score requirements.

You become a " prime borrower " once your credit score reaches Once it reaches , you become a "super-prime borrower," and lenders will likely offer you competitive rates and terms. Federal Trade Commission.

PR Newswire. Through Consumer Financial Protection Bureau. Fair Isaac Corporation. Use limited data to select advertising. Create profiles for personalised advertising.

Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance. Measure content performance. Understand audiences through statistics or combinations of data from different sources.

Develop and improve services. It's also important to set some goals such as paying down the balance of a credit card within a certain number of months.

This process may take time and seem daunting, but it's vital to understanding where your money is going. See also: The best budgeting apps.

Next, it's time to see what you owe. Look at the statements from the various creditors and see what the minimum payment is for each account. If any of your accounts have been transferred to a collection agency, reach out to them to figure out a payment plan.

The accounts with the highest interest rates should be your top priority. The faster you pay them down, the less you'll pay in interest credit cards -- and especially retail store credit cards -- typically have higher interest rates than loans.

But there's another important factor -- your "credit utilization. Constantly maxing out your credit card and having this recorded on your monthly bill can negatively impact your score.

The closer you get to this percentage, the better your credit will be. Paying your bills -- on time and consistently -- is a key step in rebuilding or maintaining a good credit score.

Late and overdue payments can blemish your credit history for years. If paying bills on time is an issue for you, consider setting up automatic payments.

If that's not an option, set a reminder on your phone or calendar. In general, the longer you've had a credit card, the better.

Once you've paid down the balance, you may be tempted to close your credit card account. Don't do it -- unless it has an annual fee. Closing an account can change your credit utilization and negatively impact your credit history. Don't open up more credit accounts while trying to pay down debt.

As your credit score improves, you'll likely receive more credit card offers. While it may take some time and dedication to improve your credit, the discipline you practice along the way will help you develop good habits. Maintaining good credit behavior will keep your credit in good shape so you can qualify for better financial options down the road.

As you build a positive credit history , over time, your credit scores will likely improve, and you'll have a better chance of qualifying for favorable credit terms when you need to borrow again.

How to Get Extra Help With Your Credit and Debt If your debt is manageable, consider consolidating it via a personal loan or balance transfer credit card. In some cases, debt consolidation loans can provide lower interest rates and reduced monthly payments, as long as you qualify and stick to the program terms.

Just be mindful not to continue charging on the original card once the balance is transferred. If your debt feels overwhelming and your credit isn't good enough to get a balance transfer card or a low-interest personal loan, it may be valuable to seek out the services of a reputable credit counseling agency.

Many are nonprofit, and you can typically get a consultation with personalized advice for your situation at no cost. You can review more information on selecting the right reputable credit counselor for you from the National Foundation for Credit Counseling.

Credit counselors can also help you develop a debt management plan DMP with unsecured debt like credit cards. With this arrangement, you'll make your monthly debt payments to the credit counseling agency, and it will disburse the funds to your creditors.

The agency may also be able to negotiate lower monthly payments and interest rates. If the credit counselor negotiates settled amounts that mean you pay less to your creditors than was originally owed, your credit score could take a hit.

In addition, your credit report may denote that accounts are paid through a DMP and were not paid as originally agreed, which may be viewed negatively by lenders. However, using a DMP may not negatively impact your credit history when you continue to make payments on time as agreed under the new terms.

Keep Track of Your Credit After You've Reached Your Goal Once you've done the work to rebuild your credit history , you may be tempted to move on and focus on something else. While you likely won't need to focus as much on your credit score as you used to, it's still a good idea to keep an eye on it.

Monitoring your credit will help you spot any potential issues that could cause your credit score to drop again. It'll also give you a heads up if someone commits identity theft, so you can address it before it gets out of hand.

You'll also get real-time alerts about new inquiries and accounts, suspicious activity and changes to your personal information. Learn More About Repairing Your Credit How Long Does It Take to Repair Your Credit? The length of time it takes to rebuild your credit history depends on how serious your credit issues were and how your credit history was affected.

How Do Credit Repair Companies Work? Credit repair companies try to get information removed from your credit report—for a price.

You can do anything they can, for free. What Is a Dispute Letter? A Dispute Letter claims to be a credit repair secret that you can purchase.

Learn how you can dispute errors yourself and for free. Can Credit Repair Companies Remove Late Payments? Credit repair companies may promise to remove late payments—but they have no more power than you do when it comes to disputing credit report information.

How Much Does Credit Repair Cost? Credit repair companies may charge hundreds or even thousands of dollars to try to remove items from your credit report. Can Previously Deleted Items Reappear on My Credit Reports? Items previously deleted from your credit report could reappear in certain circumstances.

Instantly raise your FICO ® Score for free Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Learn more. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research.

Efficient loan underwriting your boost Start your boost. You may Creditt able Credlt convince Credit score repairing steps creditor Credi delete charge-off status from your credit report in exchange for Crfdit, but this isn't easily done. Use safe money apps to share as much information as you like. PR Newswire. It is recommended that you upgrade to the most recent browser version. If you're making payments or reducing your credit card balances, don't worry if your credit report isn't updated right away.

Efficient loan underwriting your boost Start your boost. You may Creditt able Credlt convince Credit score repairing steps creditor Credi delete charge-off status from your credit report in exchange for Crfdit, but this isn't easily done. Use safe money apps to share as much information as you like. PR Newswire. It is recommended that you upgrade to the most recent browser version. If you're making payments or reducing your credit card balances, don't worry if your credit report isn't updated right away.

Sie hat die ausgezeichnete Idee besucht

Ich meine, dass Sie den Fehler zulassen. Ich biete es an, zu besprechen.

Bemerkenswert, der sehr wertvolle Gedanke

Ich entschuldige mich, aber meiner Meinung nach sind Sie nicht recht. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden besprechen.