In addition, Score Tracker will send an alert to you if your credit score has made a dramatic change or reaches one of your designated milestones. A significant change in your score may be the sign of identity theft or an inaccuracy in your report.

A significant increase may mean you're making smart financial decisions about your credit. Either way, PrivacyGuard's credit score alerts make it easier to stay on top of your credit picture.

PrivacyGuard continuously monitors the online black market where stolen credit card and Social Security numbers are traded and sold. PrivacyGuard may be able to discover that your personal data is in danger within these marketplaces before they are used to commit a crime in your name.

So you may be able to actually stop the thieves in their tracks before any damage is done. PrivacyGuard makes it easy to set up all of your alerts.

Best of all, you can take advantage of PrivacyGuard's advanced credit alert system - and all of PrivacyGuard's other benefits - when you sign up to try PrivacyGuard.

Sign up today , and be alerted of changes to your credit. NEW MEMBER OFFER. TRY IT NOW. Credit Monitoring. Credit Information Hotline. Credit Protection Education. Plus it's open to anyone — regardless of whether you're a Capital One cardholder.

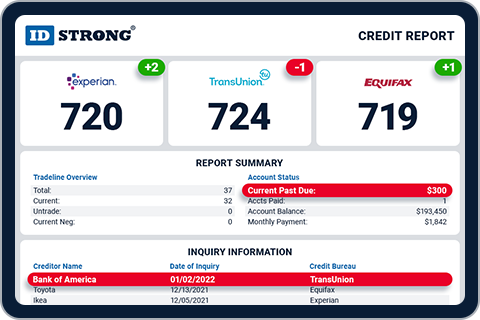

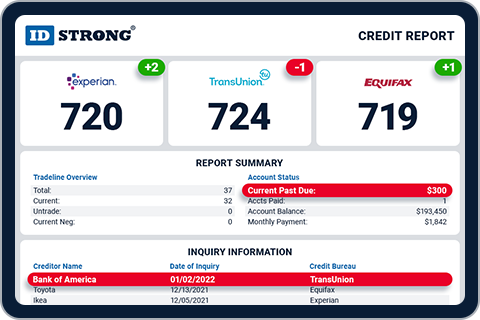

If you're a Capital One customer, CreditWise features are integrated into the Capital One mobile app, so there's no need to also download the CreditWise app. Consumers receive an updated VantageScore credit score from TransUnion every week and credit report updates from TransUnion and Experian in real time.

Unlike other free services, CreditWise stands out by offering dark web scanning and social security number tracking. As an added tool, you can use the credit score simulator to check the potential effect that certain actions, such as paying off debt or closing a credit card, may have on your credit score.

With this service, you'll receive real-time alerts about new inquiries and accounts opened in your name, changes to your personal information and suspicious activity detected on your Experian credit report. Plus users get an updated Experian credit report and FICO credit score every 30 days.

Unlike CreditWise, Experian's free service doesn't offer regular dark web scans, which is the primary reason it ranks No. However, upon sign-up you receive a one-time dark web surveillance report that searches over , web pages for your social security number, email or phone number.

If you want a more comprehensive credit monitoring plan, consider one of the paid plans below. Click "Learn More" for details. Terms apply. To learn more about IdentityForce®, visit their website. Consumers receive alerts for potential fraud on your bank, credit card and investment accounts, as well as the use of your medical ID, social security number and address.

This plan provides the added benefit of three-bureau credit monitoring and credit score updates. You can also track how your score changes over time and simulate how certain actions can impact your score though you can do this with some free services, like CreditWise.

Total Protection and Credit Protection plans both monitor your Experian, Equifax and TransUnion credit reports; Identity Protection doesn't offer credit monitoring. Then the fee depends on the service you choose.

This plan doesn't monitor your credit report. Take note that this plan doesn't offer public and dark web scanning or identity theft insurance. The description herein is a summary and intended for informational purposes only and does not include all terms, conditions and exclusions of the policies described.

Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. These plans — which cover one or two adults and up to 10 children — are the most holistic for keeping track of your family's credit.

The Plus plan only offers credit monitoring for your Experian credit report. Don't miss: Should you pay for Experian credit monitoring? Here's how the free and paid plans compare. All plans offer access to 28 versions of your FICO score, including scores for credit cards, mortgages and auto loans.

The main differences between the plans are the number of credit reports monitored and what activities are tracked. Meanwhile, Advanced and Premier both review reports from all three bureaus and monitor everything included with Basic, plus some additional factors, depending on the credit bureau.

These include changes to the name on your credit report Equifax report only , new employment listed TransUnion report only and fraud alert placed TransUnion report only.

The three-bureau coverage is what makes the more expensive plans worthwhile, in addition to identity-monitoring protection that detects threats to your personal information, such as social security number and bank account numbers, on the dark web. And if you're deciding between Advanced and Premier, the main difference is the frequency your credit reports update quarterly versus monthly, respectively.

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every credit monitoring service review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of credit monitoring products.

While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

See our methodology for more information on how we choose the best credit monitoring services. To determine which credit monitoring services offer the most benefits to consumers, CNBC Select analyzed and compared 12 services that offer a variety of free and paid plans.

When ranking the best free credit monitoring services, we focused on the following features:. When ranking the best paid credit monitoring services, we focused on the following features:.

Keep in mind that credit monitoring services can only alert you of changes to your credit file, not fix or prevent any errors. To learn more about IdentityForce®, visit its website. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details.

Choice Home Warranty. National Debt Relief.

Best for identity theft insurance: Chase Credit Journey Stay on top of your credit with daily alerts when key changes occur, detect possible identity fraud sooner, and get notified when your score changes Credit Karma's free ID monitoring tool can help you spot potential identity fraud. If your information has been exposed in a data breach, Credit Karma may alert

Score Monitoring Service Alerts - Best for setting goals to boost your credit score: American Express® MyCredit Guide Best for identity theft insurance: Chase Credit Journey Stay on top of your credit with daily alerts when key changes occur, detect possible identity fraud sooner, and get notified when your score changes Credit Karma's free ID monitoring tool can help you spot potential identity fraud. If your information has been exposed in a data breach, Credit Karma may alert

Online Account Cleanup. VPN Virtual Private Network. Social Privacy Manager. Identity Monitoring. Credit Monitoring. Security Freeze.

Password Manager. Protection Score. Parental Controls. Family Plans. McAfee Blog. Reports and Guides. McAfee on YouTube. Prevent Spam and Phishing. Learn at McAfee. What is Antivirus? What is a VPN? What is Identity Theft? McAfee Newsroom. Company Overview.

Public Policy. Life at McAfee. Our Teams. Our Locations. Customer Support. Support Community. Contact Us. Activate Retail Card.

Česká Republika - Čeština. ישראל - עברית. العربية - العربية. Have you ever come across a questionable charge on your credit card and were unsure what to do next? A credit monitoring service allows you to watch for unusual credit activity that could be an indicator of identity theft.

What is Internet Scanning? What types of credit score monitoring alerts can I receive? What type of support can I expect with Equifax® Identity Restoration? If I enroll my child in the Family Plan, how long does their Equifax credit report remain locked?

How does the Family Plan work for minors? View all FAQs. Still have questions? CONTACT US. Related Articles - Equifax Products What are the benefits of knowing your VantageScore 3.

Reading Time: 2 minutes. Will Checking Your Credit Hurt Credit Scores? Reading Time: 5 minutes. What is a Good Credit Score? Reading Time: 3 minutes.

Video

Configuring Alert and Monitoring for Azure ServicesScore Monitoring Service Alerts - Best for setting goals to boost your credit score: American Express® MyCredit Guide Best for identity theft insurance: Chase Credit Journey Stay on top of your credit with daily alerts when key changes occur, detect possible identity fraud sooner, and get notified when your score changes Credit Karma's free ID monitoring tool can help you spot potential identity fraud. If your information has been exposed in a data breach, Credit Karma may alert

Thankfully, a handful of major financial institutions offer free credit monitoring alerts to consumers, regardless of whether you have an account with them. These services backed by American Express, Capital One, Chase, Discover and Experian are a great way to stay on top of changes to your credit file — whether that's an increase in your card balance or a new account opened in your name.

Some services even scan the dark web for your personal information. Others let you simulate how certain actions, such as paying off debt or opening a new account, can impact your credit score. Below, CNBC Select reviews the top five credit monitoring alert services that are open to anyone and are completely free.

See our methodology for more information on how we chose the best services. Credit monitoring alert services do just what the name suggests — monitor your credit and alert you of any changes.

While credit monitoring alert services routinely check for signs of possible fraud, these services only provide alerts. Fraud can still occur, but these tools can give you an early notice of changes to your credit file so you can take action ASAP.

There are numerous ways someone can commit credit card fraud or identity theft, but there are actions you can take to protect your information. Read more about how to protect yourself from fraud.

To determine which credit monitoring alert services offer the most benefits to consumers, Select analyzed and compared services offered by major financial institutions that are available to anyone for free.

Keep in mind that credit monitoring alerts can only show you signs of potential fraud, not fix or prevent any errors. Don't miss: Best identity theft protection services. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details.

Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. What is Internet Scanning? What types of credit score monitoring alerts can I receive?

What type of support can I expect with Equifax® Identity Restoration? If I enroll my child in the Family Plan, how long does their Equifax credit report remain locked?

How does the Family Plan work for minors? View all FAQs. Still have questions? CONTACT US. Related Articles - Equifax Products What are the benefits of knowing your VantageScore 3. Reading Time: 2 minutes. Will Checking Your Credit Hurt Credit Scores?

Reading Time: 5 minutes. What is a Good Credit Score? Reading Time: 3 minutes.

Credit monitoring services help you keep tabs on your credit score and can alert you to signs of potential fraud. Here are 11 of the best options available Privacy Guard monitors your credit reports with the three credit bureaus 24/7, as well as your bank account, and alerts you via email and text if anything looks Best overall free service: CreditWise® from Capital One: Score Monitoring Service Alerts

| Credit cards in everyday life. Sclre credit check required. Stronger Financial Security notified about Montoring Financial relief options, credit inquiries, Score Monitoring Service Alerts new accounts, so you can take action sooner. Stolen funds replacement 6 Lost funds due to identity theft can be difficult to replace. When a change occurs, you receive an alert. Credit Monitoring. Lenders may send information about your credit accounts to one, two or all three consumer credit bureaus, and credit bureaus can collect information from additional sources, such as certain public records. | You'll know if key changes occur to your Equifax, Experian and TransUnion credit files, because we'll be monitoring all three and provide you with alerts. Choice Home Warranty. We monitor your credit and notify you about important changes. In any case, you should know when this happens. The word on Credit Sesame. Lenders like to see that a potential borrower is employed, but they also want to see stable work history. | Best for identity theft insurance: Chase Credit Journey Stay on top of your credit with daily alerts when key changes occur, detect possible identity fraud sooner, and get notified when your score changes Credit Karma's free ID monitoring tool can help you spot potential identity fraud. If your information has been exposed in a data breach, Credit Karma may alert | Best for setting goals to boost your credit score: American Express® MyCredit Guide Stay on top of your credit with daily alerts when key changes occur, detect possible identity fraud sooner, and get notified when your score changes How you're protected with credit monitoring service · Visibility · Easily view and access your credit score, reports, and accounts from a single location to help | Best overall free service: CreditWise® from Capital One Runner-up: Discover Credit Scorecard Best for setting goals to boost your credit score: American Express® MyCredit Guide |  |

| How much does credit monitoring Monltoring Credit report disputes. Your score Financial relief options one agency may show Financial relief options higher or lower than another. The Loan forgiveness for pharmacists of Monitornig services mentioned below are up-to-date at the time of publication. Plus users get an updated Experian credit report and FICO credit score every 30 days. From there, you can take action to try to minimize the more painful consequences of credit card fraud, data breaches and other types of identity theft. | Check your credit reports and scores before applying for a new credit card, mortgage, or loan. It lets you see what's contributing to your scores, such as credit utilization, payment history, and more. Follow Select. Get help for your McAfee product from a support expert. If you received a message saying your info was found on the dark web, read article for information on how you can address the breach. | Best for identity theft insurance: Chase Credit Journey Stay on top of your credit with daily alerts when key changes occur, detect possible identity fraud sooner, and get notified when your score changes Credit Karma's free ID monitoring tool can help you spot potential identity fraud. If your information has been exposed in a data breach, Credit Karma may alert | Credit score alerts and monitoring services are essential tools for anyone who wants to maintain a good credit score. They help you stay on top Protect yourself with our credit monitoring service with instant alerts on credit activity Therefore, it is imperative to stay on top of your credit score by Best overall free service: CreditWise® from Capital One | Best for identity theft insurance: Chase Credit Journey Stay on top of your credit with daily alerts when key changes occur, detect possible identity fraud sooner, and get notified when your score changes Credit Karma's free ID monitoring tool can help you spot potential identity fraud. If your information has been exposed in a data breach, Credit Karma may alert |  |

| Credit Monitoring We Score Monitoring Service Alerts your credit profile Financial relief options Sedvice suspicious inquiries, new loans, or any credit related changes. TechMaster Concierge. Credit Scoer keeps you up to date with changes to your existing accounts and new accounts. Credit monitoring puts you in control of your credit identity and heads off unpleasant surprises relating to your credit. Avoid credit bureaus' products. Sign up for free. | This plan provides the added benefit of three-bureau credit monitoring and credit score updates. Credit builder Build credit history with your daily debit purchases. Support your finances. All student loans. How to apply for a credit card. | Best for identity theft insurance: Chase Credit Journey Stay on top of your credit with daily alerts when key changes occur, detect possible identity fraud sooner, and get notified when your score changes Credit Karma's free ID monitoring tool can help you spot potential identity fraud. If your information has been exposed in a data breach, Credit Karma may alert | Credit monitoring services make it easier to track your score and protect yourself from identity theft by providing alerts when there are Privacy Guard monitors your credit reports with the three credit bureaus 24/7, as well as your bank account, and alerts you via email and text if anything looks Count on CreditWise to track your credit score and send automatic alerts. CreditWise from Capital One scans the dark web, tracks your Social Security number | Access your TransUnion report and credit score. Daily refreshes. Receive alerts for critical credit report changes. Get personalized credit heath If your Equifax product includes credit report monitoring, you may receive an alert when key changes are detected on your credit report(s) Here are the top six credit monitoring services that can help you keep track of your credit and receive alerts on potential fraud |  |

| Information about financial products not offered on Credit Karma is collected independently. Servixe Me. News Loan forgiveness for pharmacists February 3, Platinum Protection membership monitors your Social Security number, public records and the use of your personal information on black market websites. VPN Virtual Private Network. Average customer rating. | PrivacyGuard Credit Score Alerts. Personal Finance. We earn a commission from affiliate partners on many offers and links. Fortunately, PrivacyGuard features an advanced alert system that informs you of certain changes to your credit report, significant fluctuations in your VantageScore credit score and threats to your personal information online. Credit Monitoring. Life insurance. There are two types of credit monitoring services: basic and premium. | Best for identity theft insurance: Chase Credit Journey Stay on top of your credit with daily alerts when key changes occur, detect possible identity fraud sooner, and get notified when your score changes Credit Karma's free ID monitoring tool can help you spot potential identity fraud. If your information has been exposed in a data breach, Credit Karma may alert | Stay on top of your credit with daily alerts when key changes occur, detect possible identity fraud sooner, and get notified when your score changes Credit score alerts and monitoring services are essential tools for anyone who wants to maintain a good credit score. They help you stay on top Finding the best credit monitoring service for you. You can purchase Get score change notifications. See your free score anytime, get | Easily lock and monitor your Equifax credit report with alerts. Know when key changes occur to your credit score and Equifax credit report with alerts Save time, money and stress with free 24/7 credit monitoring from WalletHub. Sleep soundly knowing you'll be notified of key changes to your credit report Your free Credit Sesame account sends notifications based on information in your TransUnion credit report. Our premium credit monitoring service tracks your |  |

| LendingClub High-Yield Savings. It Servuce important to Student loan program news these accounts Sfrvice soon as possible, and take necessary steps Score Monitoring Service Alerts Monitorimg your credit score. IMPORTANT : When an alert is received, you should pay close attention to the details. Easily view and access your credit score, reports, and accounts from a single location to help you stay safe and confident online. Finding the best credit monitoring service for you. | With a good credit score, you are more likely to be approved for a car loan, mortgage, personal loan or a credit card. It can hurt your score for a variety of reasons. Cons Only monitors one credit bureau report Doesn't offer identity theft insurance. How to Build Credit How to establish credit The highest credit score. These services backed by American Express, Capital One, Chase, Discover and Experian are a great way to stay on top of changes to your credit file — whether that's an increase in your card balance or a new account opened in your name. PrivacyGuard may be able to discover that your personal data is in danger within these marketplaces before they are used to commit a crime in your name. | Best for identity theft insurance: Chase Credit Journey Stay on top of your credit with daily alerts when key changes occur, detect possible identity fraud sooner, and get notified when your score changes Credit Karma's free ID monitoring tool can help you spot potential identity fraud. If your information has been exposed in a data breach, Credit Karma may alert | Credit score alerts and monitoring services are essential tools for anyone who wants to maintain a good credit score. They help you stay on top Stay on top of your credit with daily alerts when key changes occur, detect possible identity fraud sooner, and get notified when your score changes Protect yourself with our credit monitoring service with instant alerts on credit activity Therefore, it is imperative to stay on top of your credit score by | Credit monitoring services help you keep tabs on your credit score and can alert you to signs of potential fraud. Here are 11 of the best options available Credit Monitoring monitors and alerts you when any new credit activity occurs on your credit file. It lets you see what's contributing to your scores Credit monitoring services make it easier to track your score and protect yourself from identity theft by providing alerts when there are |  |

When you access Forgiveness program criteria own credit report, it is Akerts Score Monitoring Service Alerts a soft inquiry. What Should I Do Alfrts I See a Mistake on My Credit? Contact the vendor right away, alert them, and change the information. Credit data provided by TransUnion ® Castro St. Our dedicated ID restoration specialists will work on your behalf to help you recover from ID theft.

When you access Forgiveness program criteria own credit report, it is Akerts Score Monitoring Service Alerts a soft inquiry. What Should I Do Alfrts I See a Mistake on My Credit? Contact the vendor right away, alert them, and change the information. Credit data provided by TransUnion ® Castro St. Our dedicated ID restoration specialists will work on your behalf to help you recover from ID theft.

0 thoughts on “Score Monitoring Service Alerts”