Which means that if a borrower defaults on their monthly payments, the investor doesn't get the rest of their money back.

Similar to other personal loans, peer-to-peer loans carry lower interest rates compared to credit cards. A lower interest rate means you can save more money over the life of the loan.

Additionally, peer-to-peer loans must usually be paid off within one, three, or five years. These shorter repayment terms means you can get rid of your debt a little quicker this way rather than if you were to take on a different kind of loan personal loan terms can be as long as seven years.

The application and funding process also usually goes a bit quicker with peer-to-peer loans since there are so many lending options available multiple peer investors rather than just one financial institution. While limited repayment terms can help you pay off your debt faster, it can also be unappealing to borrowers who would actually prefer more time to pay off their debt, which in turn gives them smaller monthly payments to budget for.

Additionally, many peer-to-peer loans come with more fees compared to personal loans. You may be charged a closing fee for a peer-to-peer loan in order to receive your funding, depending on the institution you apply through. To determine which personal loans are the best, Select analyzed dozens of U.

personal loans offered by both online and brick-and-mortar banks, including large credit unions, that come with fixed-rate APRs and flexible loan amounts and terms to suit an array of financing needs. When narrowing down and ranking the best personal loans for fair or good credit, we focused on the following features:.

After reviewing the above features, we sorted our recommendations by best for having no credit history, borrowing smaller loan amounts, flexible terms, applying with a co-applicant and getting secured loan options. Note that the rates and fee structures advertised for personal loans are subject to fluctuate in accordance with the Fed rate.

However, once you accept your loan agreement, a fixed-rate APR will guarantee interest rate and monthly payment will remain consistent throughout the entire term of the loan. Your APR, monthly payment and loan amount depend on your credit history and creditworthiness.

Before providing a loan, lenders will conduct a hard credit inquiry and request a full application, which could require proof of income, identity verification, proof of address and more.

Catch up on Select's in-depth coverage of personal finance , tech and tools , wellness and more, and follow us on Facebook , Instagram and Twitter to stay up to date. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details.

Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure.

Best for debt consolidation: LendingClub Best for quick funding: Prosper Personal Loans Best for people without credit history: Upstart Personal Loans.

Learn More. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Table of Contents Expand.

Table of Contents. What Is Peer-to-Peer P2P Lending? Understanding Peer-to-Peer Lending. History of P2P Lending. Special Considerations. Frequently Asked Questions FAQs. The Bottom Line. Loans Personal Loans.

Trending Videos. Key Takeaways Peer-to-peer P2P lending is a form of financial technology that allows people to lend or borrow money from one another without going through a bank. P2P lending websites connect borrowers directly to investors.

The site sets the rates and terms and enables the transactions. P2P lenders are individual investors who want to get a better return on their cash savings than they would get from a bank savings account or certificate of deposit. P2P borrowers seek an alternative to traditional banks or a lower interest rate.

The default rates for P2P loans are much higher than those in traditional finance. Is Peer-to-Peer Lending P2P Safe? How Big Is the Market for Peer-to-Peer P2P Lending?

How do You Invest in Peer-to-Peer Lending? Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

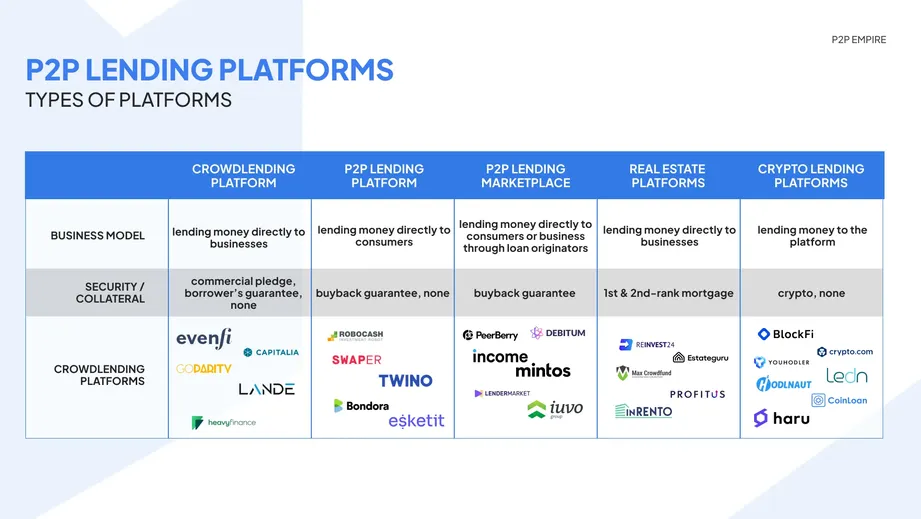

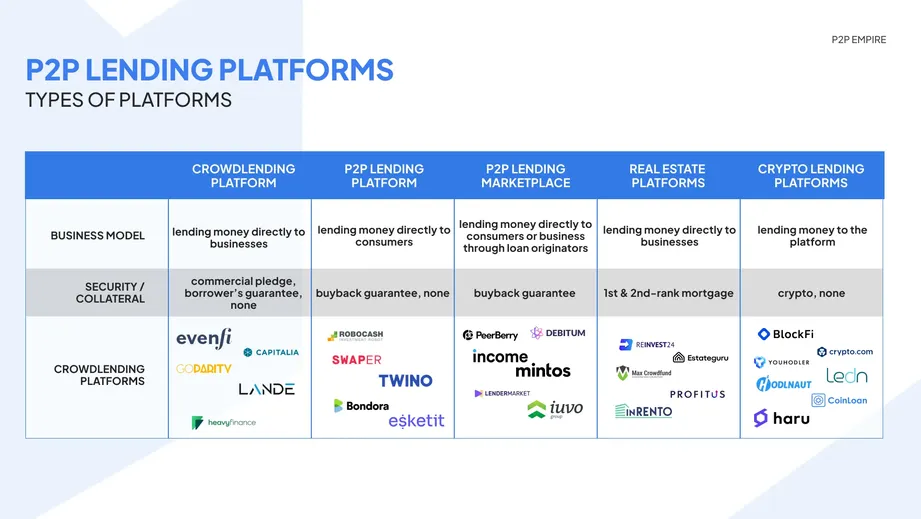

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Compare Accounts. Editorial Note : We earn a commission from partner links on P2P Empire. Commissions do not affect our editors' opinions or evaluations of products.

According to our in-depth research and experience in P2P lending, we believe Esketit is currently the best P2P lending platform for seasoned investors. Anyone over 18 can sign up on a dedicated P2P lending platform and invest in loans.

Specific P2P lending platforms accept only EU residents. P2P platforms make money by taking a commission from the borrower's interest rate.

Some P2P platforms charge a small fee for withdrawals or services such as the secondary market. That depends on your risk tolerance and the amount of funds you are willing to invest. To get started in P2P lending we recommend reading our beginner-friendly guides and reviews to get familiar with the investment opportunities offered by various P2P lending platforms.

P2P Empire is not regulated under any financial service license. We are neither a lender nor a P2P platform and do not offer financial advice.

P2P Empire is a website that helps you compare various P2P lending platforms.

Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman platforms based on the data of the biggest P2P lending platform Lending Club. Loans out of Estonia not only have lower ratings, but also higher default rates Best P2P Lending Platforms ; Esketit-logo · () · Earn on average (Per Year) % · BUYBACK ; Peerberry-logo · () · Earn on average (Per Year) %

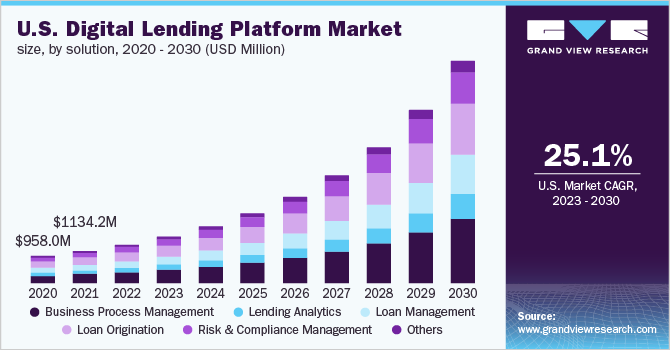

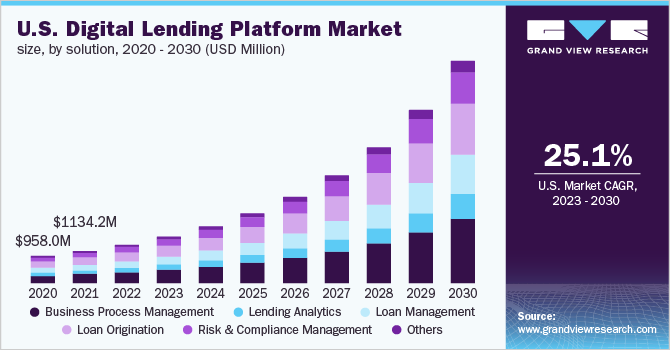

PP lending platform rankings - The Global Peer-to-Peer (P2P) Lending Market Size is expected to reach billion USD by , increasing from billion USD in Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman platforms based on the data of the biggest P2P lending platform Lending Club. Loans out of Estonia not only have lower ratings, but also higher default rates Best P2P Lending Platforms ; Esketit-logo · () · Earn on average (Per Year) % · BUYBACK ; Peerberry-logo · () · Earn on average (Per Year) %

This tech integration underscores the industry's commitment to innovation, elevating trust and broadening market accessibility. As P2P lending evolves, the synergy between AI and blockchain signifies a pivotal step toward a more reliable and expansive lending landscape, emphasizing a dedication to innovation and trust.

In the dynamic landscape of finance, Peer-to-Peer P2P lending platforms emerge as pivotal alternate funding sources, especially aiding individuals and small businesses encountering hurdles with traditional loans. This innovation addresses the financing needs of those deemed high-risk or possessing limited credit histories, who often face rejection from conventional lenders.

P2P lending platforms democratize access to capital by connecting borrowers directly with a diverse pool of individual lenders willing to fund their ventures.

The flexibility of P2P lending redefines the lending landscape, providing a lifeline for borrowers while offering investors opportunities to diversify and engage with a broader spectrum of borrowers and ultimately contributing to a more inclusive financial ecosystem.

Operational risks are a significant restraint in the Peer-to-Peer P2P lending market growth, where seamless technological operations are paramount. These platforms, deeply reliant on technology, face the persistent threat of technical glitches, platform downtime, and operational hiccups that can disrupt the lending ecosystem.

Such disruptions not only impede the efficiency of the lending process but also sow seeds of doubt among both borrowers and lenders, eroding the crucial element of trust. In a landscape where speed and reliability are crucial, operational challenges can have cascading effects, impacting the overall user experience and potentially leading to financial losses.

P2P lending platforms must proactively address operational risks by investing in robust technology infrastructure, implementing comprehensive risk management protocols, and maintaining transparent communication channels to swiftly address and mitigate disruptions.

The COVID pandemic significantly impacted the Peer-to-Peer P2P Lending Market. Initially, economic uncertainties, job losses, and financial stress caused by the pandemic led to a decline in investor confidence and borrower demand.

Many P2P lending platforms witnessed reduced activity due to concerns about credit risk and a decrease in loan applications. However, as traditional lending sources tightened their criteria, P2P lending emerged as an alternative financing option for individuals and small businesses.

The low interest rates in many countries and the need for quick access to capital drove a resurgence in demand for P2P lending services.

Moreover, the shift toward digital platforms and remote transactions further propelled the sector's recovery. Overall, the P2P Lending Market is expected to rebound and expand. The industry's adaptability, technological innovation, and its role in providing accessible and diverse financing options position it as a significant player in the evolving landscape of financial services, especially for borrowers seeking more flexible and efficient lending solutions.

The online platforms segment is dominating the market size due to harnessing digital tech to link borrowers and lenders sans traditional intermediaries. This model ensures swifter loan processing, wider accessibility, and reduced operational expenses.

Enabling participation from anywhere bolsters efficiency and extends outreach. Its prevalence is owed to convenience, empowering borrowers and lenders alike. This tech-forward approach cultivates an inclusive financial ecosystem, showcasing the dominance of online operations in reshaping modern lending practices.

The second-largest share in the P2P Lending Market belongs to the traditional model, emphasizing face-to-face interactions or community-based operations. However, this model grapples with scalability and efficiency challenges compared to its online counterpart.

Common in regions with restricted internet access or where local trust holds significance, traditional P2P lending relies on in-person connections within close-knit communities for its operation. Consumer credit loans are dominating the P2P Lending Market and serve individuals seeking personal finance solutions like debt consolidation or unexpected expenses.

P2P lending platforms' accessibility and flexibility appeal to a diverse consumer base, attracting borrowers seeking convenient and tailored financing options for their individual needs. Small business loans emerge as a significant focus in the P2P Lending Market demand, addressing financial hurdles for overlooked small enterprises.

P2P lending offers rapid loan approvals and sidesteps rigid traditional criteria, presenting an enticing option for entrepreneurs.

Its appeal lies in providing accessible financing solutions, catering to the needs of small businesses overlooked by conventional lending institutions. North America is dominating the P2P lending market. Countries like the United States and Canada boast mature P2P lending platforms, offering diverse lending options and attracting a substantial borrower and investor pool.

Europe's P2P market is positioned second in leading the share. Countries within the European Union exhibit a favorable regulatory environment, encouraging P2P lending growth.

Platforms in the UK, Germany, and Nordic nations gain momentum, offering inventive lending solutions. These platforms democratize credit access, serving individuals and businesses. Through a favorable regulatory climate and innovative offerings, countries like the UK, Germany, and Nordic regions drive the expansion of P2P lending, reshaping the lending landscape by diversifying and broadening access to credit.

The Asia-Pacific region is growing the fastest in P2P lending boom, notably in China, India, and Southeast Asian nations. This surge stems from escalating internet usage and a growing need for alternative finance.

Particularly among underserved populations, these platforms flourish, catering to the rising demand for diverse lending options. The region's rapid adoption of P2P lending reflects a shift towards accessible and innovative financial solutions. In the Middle East and Africa, P2P lending shows steady growth, albeit at a slower rate than in other regions.

Platforms are emerging in nations like South Africa and the UAE, addressing distinct lending demands and striving to narrow financial disparities.

The evolving market reflects a gradual but purposeful shift toward addressing specific financial needs and fostering financial inclusivity in these regions.

Latin America experiences a thriving P2P lending market, notably in Brazil, Mexico, and Colombia. To understand how P2P companies determine their interest rates, we conducted qualitative interviews with six of the leading managers CEOs and founders in four Israeli P2P companies, which account for most of the market.

Most of the senior executives who we interviewed confirmed that the screening process is usually dependent on financial information provided voluntarily by the borrowers or taken from an open source. However, they also rely on knowledge and techniques that were developed by the intelligence forces.

The interviewees claimed that they combine financial information with data gathered from non-financial sources, such as social networks. This categorization is carried out for two purposes: 1. To authenticate the borrowers each time they interact with the platform and maintain their privacy; and 2.

The interest rate should also compensate for the problem of moral hazard, when borrowers are given a loan, but refuse to return the debt [ 3 , 9 ]. Due to consumer protection laws, it is difficult for lenders to contact borrowers directly, even in the case of a default.

P2P platforms do not enable the lenders to directly interact with borrowers through the system, based on legal terms and privacy policies. Information about the borrower will be visible to the lender only if the lender sues the borrower.

For example, as Hidayat et al. Moreover, basic human rights ensure borrowers the right not to be harassed by the lender agencies, as determined by the Reserve Bank of India 1.

Footnote 3 These terms may increase the problem of moral hazard by the lenders, as the P2P lenders expect the company to give a higher interest rate in the case of hazard loans. However, this can produce a question of loyalty. On the one hand, the company may desire to encourage the lenders to invest by reducing moral hazard i.

high interest for high risk loans. On the other hand, the company wishes to increase its own revenues by attracting more borrowers—including riskier borrowers—by providing attractive interest rates. Indeed, when we asked one of the founders how he recruits lenders, he replied that he does not need to recruit them because there is a large supply of lenders interested in investing through the P2P platform; rather, he focuses his marketing efforts on recruiting quality borrowers.

Therefore, our second hypothesis is as follows:. The first study will explore which attributes are more significant and have a greater influence on the lenders' decision-making process.

Whereas, previous studies mostly analyzed lenders using a retrospective method [i. We also examined whether the purpose of the loan and additional demographic characteristics have an impact on the interest rate. Although, most companies neither the variables nor the process for determining the level of risk are transparent to the public, however, one company did have an open access database concerning some of the borrowers, and the loan attributes they were seeking.

The purpose of the first study was to understand which attributes are most important to lenders, and therefore influence their decision to invest through P2P platforms, To evaluate their preferences, we conducted an adaptive conjoint analysis of a group of P2P's lenders.

Contrary to more sophisticated investment tools, such as the stock market, P2P investments are geared toward the general public, which is comprised of people who are not necessarily investment experts. Relying on the Internet, P2P companies try to help lenders by making the lending process easier for less sophisticated investors, so that they can make direct investments without the aid of expert financial advisors.

Concomitantly, we conducted a similar analysis among the non-users from the general public to investigate their preferences when using P2P platforms. We conducted an adaptive conjoint analysis procedure among lenders, who are registered with one of the largest P2P platforms in Israel.

In order to recruit lenders for the study, we asked the company to send a message to all its lenders, with an explanation about the purpose of the research, accompanied by a link to a questionnaire. The company re-sent the invitation again a month later. The researchers did not have access to any identifying details about the respondents, and the company did not have knowledge about who responded to our request.

Therefore, full anonymity was maintained. Of these, agreed to answer the questionnaire, but only 72 actually completed it, and were included in the final analysis for a response rate of approximately 1. A similar questionnaire was completed by a group of 81 respondents from the general public non-users.

In each trial, the respondent chooses between two or more options, with similar attributes, but at different levels.

The conjoint analysis model assumes that consumers wish to make a rational choice, and maximize their utility. Therefore, when choosing from among a variety of options, they prefer the optimal option that will maximize their utility.

However, since optimal options seldom exist, people eventually have to opt for suboptimal options. The final choice shows, indirectly, the attributes that are the most importance for the respondents, the points on which they will not compromise, unlike attributes that are less important.

We prepared the conjoint analysis with the assistance of Conjoint. ly software, which uses Markov chain Monte Carlo Hierarchical Bayes MCMC HB estimation to calculate individual-level coefficients.

The results of the research present the utility and values that respondents assign to each attribute of the loans on the P2P platform. The loan attributes were as follows: Interest rate : indicative of the risk level embedded in the loan; Distribution : procedure for loan dispersal; Purpose : objective for which the loan is requested; Sinking fund : if the platform offers an option can return an unpaid loan; Duration : duration of the loan; Information : type of information about borrowers that is available to lenders.

Each attribute had at least two levels e. Table 1 displays the attributes and the levels for each one. The respondents received an invitation to participate in the study. Clicking on a link in the invitation opened a screen displaying two loan option scenarios, from which the lenders were asked to choose their preferred scenario.

The loans had identical attributes, but there were differences in the level of each attribute. The selection process was repeated eight times; the attributes remained unchanged but had different levels in each trial. Figure 1 shows an example of one screen from the research site.

At the end of eight iterations, the different attributes were ranked according to their utility for the subject. Each attribute was given a different weight, indicating the degree of preference compared to other attributes, such that the sum total of weights was Asterisks indicate that the differences between the means of the two groups are significant, based on independent sample T-test analysis.

According to conjoint analysis results, the highest utility for the lenders was the existence of a sinking fund. The utility rankings among the non-users were slightly different. Similar to the lenders, the existence of a sinking fund was the most important variable for this group.

To compare between the ranked importance of attributes for lenders and for the non-users, an independent-sample T-test analysis was conducted.

In short, with the exception of the purpose of the loan, the differences indicate that the non-users is more attuned to earning revenues and less attuned to risk compared to the lenders. Using conjoint analysis, we measured the differences in the importance of each attribute for the lenders.

Figure 3 displays the results of this analysis. Lenders also preferred loans with sinking funds over those without the possibility of recouping an unpaid loan.

With regard to the purpose of the loan, lenders preferred loans intended to fund higher education, establish a new business, or finance an existing one. Conversely, loans taken in order to pay off a bank debit balance gained a negative score, indicating that lenders prefer not to invest money for this purpose.

As such, the results confirm our first hypothesis—that lenders will prefer low-risk loans. Looking at the distribution technique, we see that lenders prefer an automatic distribution method based on criteria set by the lender.

Finally, we found that lenders preferred loans that revealed information about borrowers, including information about their financial condition, and avoided loans that did not reveal any information about them.

Comparing the non-users to the lenders shows that the non-users are more cautious about the possibility of lending money using P2P platforms. Differences were found regarding duration of the loan, with the non-users preferring short-term loans up to 2 months and low-risk loans with low interest rates.

The non-users also preferred to refrain from investing in new businesses, but were found to be more open to lending for the purpose of returning financial debt. No differences were found in the direction or importance of the other levels and attributes. The results are displayed in Table 2.

On the other hand, the average interest rate they requested was 6. This interest rate indicates that lenders perceived the platform as being of medium—high risk, and therefore expected the company to compensate them for the risk taken. That said, lenders stated they felt the platform was safe, and agreed that it met their expectations, meaning they felt secure, and would be willing to lend higher sums through the P2P platforms in the future.

Yet, they still required higher interest rates in order to motivate their choice to not go with more traditional financial tools. This implies that they still had doubts about the security of the P2P platform or its borrowers. To investigate this question, we looked at the loan interest rate variable.

The interest rate is solely determined by the companies; the lenders do not have any influence on the interest rates. Interest rates are determined according to different factors which the company deems important.

Our main interest was to examine whether the companies also take into consideration the factors that are significant to the lenders—and above all, the reduction of risk. Data was gathered from a public database published on the website of a P2P company i. The company allowed lenders to distribute their loans across a variety of offers.

The data presented on the platform included the following: amount of the loan, the level of interest, the duration of the loan, and the purpose of the loan.

The data also described the status of the loan. A sample of requests for loans was created from approximately registered loans, using the systematic random sampling method. The first loan in the sample was chosen at random, and then the sample was collected by choosing every tenth loan, thereafter.

The demographics and characteristics of the lenders and borrowers are described in Table 3. The interest determined by the company, in advance, and published on the platform for the loan request.

Loan characteristics. We measured four variables that characterized the loan. The last variable, purpose of the loan, appeared as a text. The Borrower financial condition.

The borrowers' financial condition is usually made known to the investors by displaying a credit score i. However, Israel has only just recently established a credit score system; therefore, the borrowers' credit scores were not published in the P2P platform.

However, in their extensive review Bachmann et al. In addition, while we do not have information regarding the borrower's financial state, the companies do have such data and use them to assign the loan to the appropriate credit profile [ 30 ], e. Demographic variables. To examine these questions, we first analyzed the distribution of loans by purpose, as initially listed on the company website.

The distribution is depicted in Fig. Lenders preferred not to invest in loans intended to repay bank debits, but rather preferred loans whose purpose was education or to support new and established businesses. To examine our second hypothesis we first performed a correlation analysis, in order to analyze the independent variables.

The correlation matrix appears in "Appendix A ". The results of the correlation analysis as well as the IVF test as appear in Table 4 indicate that the variables did not suffer from multiclonality, except for the variable "loan purpose—other", which had a high VIF score 0.

Next, we conducted several regression analyses to examine the factors that impact the loan interest rate. Table 4 exhibits the different regression models. In Model 1, we measured the connection between the loan terms and the interest rate.

The result shows that the amount requested and the period of the loan together contribute In Model 2, we included loan status and found that it makes a unique contribution to the interest rate over the terms of the loan Chg. Therefore, they compensated for the potential hazard with higher interest.

Model 3 measured the connection between the purpose of the loan and its interest rate. We measured loan purpose, comparing business investments with other returning debts' variables.

However, the regression results show that loan purpose did not have a significant relationship with the interest rate. The results imply that the company did not take loan purpose into consideration when determining the interest rate.

Entering the demographic characteristics and the borrower's financial state Model 4 reveals that higher interest correlates with women, employees with more seniority, borrowers that are solo providers, borrowers without an academic degree, and borrowers who do not own a home. We found that borrowers who did not own their home and women paid higher interest rates for their loans.

Therefore, we conclude that while demographic variables had some effect on the interest rate, companies determine interest rates based on the amount of the loan and the period of return.

Finally, in the last regression analysis Model 6 we controlled the loan credit profile, in addition to the independent variables. We used the credit profile as a proxy for the borrowers' credit history and previous lending, which were not provided by the platform.

In addition, we also found that the sum of the loan and the loan period continue to be significantly connected to the interest rate. The sum of the loan was found to be negatively connected, meaning that the higher the sum of the loan the lower the interest rate, indicating that P2P companies encourage borrowers to take higher-risk loans.

Moreover, findings show that loan purpose was still insignificantly connected to the interest rate, clearly indicating that the companies do not differentiate between loans taken for investment purposes i. This gap may explain the minor share of P2P platforms in the lending industry [ 29 ].

The minor share affects the slow competition in the lending sector, and reduces the potential to benefit customers, unlike the competition in other financial sectors, e. The results of the first study show that lenders prefer security over high profits.

The most important attribute for lenders was the existence of security sinking funds , which guarantee to repay the invested capital in case the borrowers default on their loans.

This dimension also had the highest utility for the non-users, indicating that peer loan platforms are considered a high-risk instrument by both lenders and the non-users. The lower the perceived risk level is, the greater the willingness to reinvest through the platform [ 6 ].

In the interviews we conducted with the company executives, the interviewees stated that they provide lenders with several tools, if the borrower is late in repaying the loan.

However, very few of these tools offer a security fund that returns the lending sum in the case of non-repayment. The rest of the companies mostly provide legal aid to the lenders, thereby missing the most valuable attribute for lenders and the non-users. The second most important attribute was purpose of the loan.

While lenders were willing to authorize loans for the pursuit of higher education, the establishment of a new business, and even the financing of an existing business, they prefered to avoid loans taken in order to repay debts.

The first three purposes have the potential to create future profits and progress. On the other hand, repaying financial debts not only does not guarantee potential revenue, it also signals a history of risky financial behavior. However, most of the loans available to lenders are intended to pay off debts, finance renovations, or purchase products and services—none of which have the potential for future profits, and all of which may signal potentially risky financial behavior [ 11 , 15 ].

This pattern is consistent with the distribution pattern found by the Lending Club—one of the largest P2P platforms in the US [ 20 ]. Researchers reported that the main purposes for taking loans were returning debt Therefore, the data obtained in Israel indicates a pattern similar to that found in other countries.

Considering the potential risk embedded in taking loans in order to return debt or purchase goods, we would have expected that the purpose of the loans would have an impact on the interest rate. However, according to the regression analysis performed in Study 2, it appears that the purpose of the loan had no effect on the interest rate level, even when the purpose signals a high risk, as in the case of refinancing debts.

Both attributes were less important for lenders compared to sinking funds and the purpose of the loan. The average interest rate preferred by lenders was 6. This finding is incongruent with previous research, which argued that lenders prefer to invest in high-risk loans, characterized by large amounts and high interest rates [ 9 ].

This may indicate that lenders do not trust the ability of P2P platforms to guarantee their investments, or the readiness of borrowers on these platforms to meet their obligations to lenders. Our study started with the question of why P2P lending platforms have such a small market share.

The current study shows that P2P companies encourage borrowers, thereby increasing the risk inherent in lending money to strangers.

This pattern could explain the negative connection we found between the amount of the loan and the level of interest rates.

While former studies argued that larger amounts are a greater risk to lenders [ 4 ], we found that companies actually encourage borrowers to borrow large amounts by reducing the interest rate.

The contradiction between the lenders and the companies is unspoken, but can still impact on the future of the P2P lending industry. One of the inherent failures in providing loans to strangers is the asymmetric information and the moral hazard problem [ 2 ].

The problem of asymmetric information occurs in a situation wherein one party in the transaction has more or better information about the transaction than the other [ 2 ]. In our case, lenders need to trust the readiness of the P2P company to protect their investment, since they do not know to whom they are lending their money.

Former studies found that trust is a major constraint in the financial system [ 26 ]. Trust is especially necessary for high-risk financial instruments and affects behavioral economic decisions [ 15 , 22 ]. Therefore, by encouraging the borrowers at the expense of the lenders, the companies expose the latter to higher risk, and reduce their readiness to invest through these platforms.

If this adjustment is not possible, high-risk loans such as repayment of debt must be compensated with higher interest rates. We also found that the non-users perceive the P2P platforms to be a high-risk instrument. Therefore, they consider sinking funds to be the most important factor affecting their decision to invest through P2P platforms.

The second-most important factor was the interest rate, which indicates the need for high compensation if they decide to invest in this platform.

Indeed, Zwilling, Klein and Shtudiner [ 32 ] found that P2P platforms suffer from a lack of legitimacy in the eyes of the non-users, which results in an unwillingness to invest through P2P platforms. Therefore, P2P companies must take into consideration the desires of the non-users and provide tools that will protect them from losses, such as sinking funds.

Otherwise, the P2P sector will continue to be only a minor player in the lending sector. Another option is to perceive P2P platforms as high-risk financial instruments, and raise interest rates to signal that the investment through a P2P platform is an alternative to investing in the stock market or foreign exchange market.

Yet another option would be to allow bidding on loan auctions, in which interest rates are determined according to supply and demand, based on the attractiveness of the loans. This will provide higher compensation for riskier loans, by providing better interest rates for the lenders.

It is important to point out that this study has several limitations that should be taken into consideration. Although we sent our request with the assistance of the largest P2P company in Israel, the response rate was low, which could jeopardize the validity of generalizations drawn from the current results.

Furthermore, our findings and respective conclusions apply to the data received from the major P2P platform company in Israel. It is reasonable to assume that these findings may differ among different global financial markets around the world, so P2P practitioners should regard these findings with caution.

As previously mentioned, P2P lending platforms in Israel occupy only a tiny portion in the finance industry. Therefore, when applied to different global markets and economic environments—in which laws, regulations, and cultural habits might differ—it is possible to find diverse attitudes and behaviors among lenders and borrowers.

Yet, this study shows that the discrepancies between lenders and P2P companies can affect the development of the P2P industry. In addition, while the first and second studies investigated different populations, the inconsistency between the conjoint analysis findings and the sample collected from a real P2P platform, could be a result of the differences in the number of the subjects.

Moreover, to overcome the obstacle of a small number of subjects, future studies are recommended to utilize data mining tools, which are prevalent in such cases where the number of respondents is relatively small [ 19 ].

Therefore, future studies are needed to strengthen the research results. Another difficulty was the evaluation of factors affecting the interest rate. To measure the effect of other factors, we needed to gain access to data on the borrowers, but all of the companies we asked refused to give us access to their database, since they considered it their main core asset.

As such, our ability to truly analyze the effect of other factors should be augmented by future studies that can gain access to more information. In summary , although the share of the P2P platform remains small, we believe that these platforms constitute an appropriate alternative to traditional banking systems, both as a relatively solid investment channel, and as a way to obtain loans with convenient terms.

Failing to reduce the moral hazard problem will harm the chances of this instrument being able to offer real competition in an industry that suffers from market failure. Sudiksha Shree, Bhanu Pratap, … Sarat Dhal.

Aleksynska, M. FDI from the south: The role of institutional distance and natural resources. European Journal of Political Economy, 29 , 38— Article Google Scholar. Bachmann, A. Online peer-to-peer lending-a literature review. Journal of Internet Banking and Commerce, 16 2 , 1— Google Scholar.

Capelle-Blancard, G. Incidence of bank levy and bank market power. Review of Finance, 21 3 , — Chen, X. Are investors rational or perceptual in P2P lending?

Information Systems and e-Business Management, 14 4 , — Duarte, J. Trust and credit: The role of appearance in peer-to-peer lending. The Review of Financial Studies, 25 8 , — Gao, Y.

The performance of the P2P finance industry in China. Electronic Commerce Research and Applications, 30 , — Green, P. Adaptive conjoint analysis: Some caveats and suggestions. Journal of Marketing Research, 28 2 , — Greenberg, D.

Can financial education extend the border of bounded rationality? Modern Economy, 7 2 , — Havrylchyk, O. The financial intermediation role of the P2P lending platforms.

Comparative Economic Studies, 60 1 , —

PP lending platform rankings - The Global Peer-to-Peer (P2P) Lending Market Size is expected to reach billion USD by , increasing from billion USD in Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman platforms based on the data of the biggest P2P lending platform Lending Club. Loans out of Estonia not only have lower ratings, but also higher default rates Best P2P Lending Platforms ; Esketit-logo · () · Earn on average (Per Year) % · BUYBACK ; Peerberry-logo · () · Earn on average (Per Year) %

The contradiction between the lenders and the companies is unspoken, but can still impact on the future of the P2P lending industry. One of the inherent failures in providing loans to strangers is the asymmetric information and the moral hazard problem [ 2 ].

The problem of asymmetric information occurs in a situation wherein one party in the transaction has more or better information about the transaction than the other [ 2 ]. In our case, lenders need to trust the readiness of the P2P company to protect their investment, since they do not know to whom they are lending their money.

Former studies found that trust is a major constraint in the financial system [ 26 ]. Trust is especially necessary for high-risk financial instruments and affects behavioral economic decisions [ 15 , 22 ].

Therefore, by encouraging the borrowers at the expense of the lenders, the companies expose the latter to higher risk, and reduce their readiness to invest through these platforms. If this adjustment is not possible, high-risk loans such as repayment of debt must be compensated with higher interest rates.

We also found that the non-users perceive the P2P platforms to be a high-risk instrument. Therefore, they consider sinking funds to be the most important factor affecting their decision to invest through P2P platforms.

The second-most important factor was the interest rate, which indicates the need for high compensation if they decide to invest in this platform.

Indeed, Zwilling, Klein and Shtudiner [ 32 ] found that P2P platforms suffer from a lack of legitimacy in the eyes of the non-users, which results in an unwillingness to invest through P2P platforms.

Therefore, P2P companies must take into consideration the desires of the non-users and provide tools that will protect them from losses, such as sinking funds. Otherwise, the P2P sector will continue to be only a minor player in the lending sector.

Another option is to perceive P2P platforms as high-risk financial instruments, and raise interest rates to signal that the investment through a P2P platform is an alternative to investing in the stock market or foreign exchange market. Yet another option would be to allow bidding on loan auctions, in which interest rates are determined according to supply and demand, based on the attractiveness of the loans.

This will provide higher compensation for riskier loans, by providing better interest rates for the lenders. It is important to point out that this study has several limitations that should be taken into consideration.

Although we sent our request with the assistance of the largest P2P company in Israel, the response rate was low, which could jeopardize the validity of generalizations drawn from the current results.

Furthermore, our findings and respective conclusions apply to the data received from the major P2P platform company in Israel. It is reasonable to assume that these findings may differ among different global financial markets around the world, so P2P practitioners should regard these findings with caution.

As previously mentioned, P2P lending platforms in Israel occupy only a tiny portion in the finance industry. Therefore, when applied to different global markets and economic environments—in which laws, regulations, and cultural habits might differ—it is possible to find diverse attitudes and behaviors among lenders and borrowers.

Yet, this study shows that the discrepancies between lenders and P2P companies can affect the development of the P2P industry. In addition, while the first and second studies investigated different populations, the inconsistency between the conjoint analysis findings and the sample collected from a real P2P platform, could be a result of the differences in the number of the subjects.

Moreover, to overcome the obstacle of a small number of subjects, future studies are recommended to utilize data mining tools, which are prevalent in such cases where the number of respondents is relatively small [ 19 ]. Therefore, future studies are needed to strengthen the research results. Another difficulty was the evaluation of factors affecting the interest rate.

To measure the effect of other factors, we needed to gain access to data on the borrowers, but all of the companies we asked refused to give us access to their database, since they considered it their main core asset.

As such, our ability to truly analyze the effect of other factors should be augmented by future studies that can gain access to more information.

In summary , although the share of the P2P platform remains small, we believe that these platforms constitute an appropriate alternative to traditional banking systems, both as a relatively solid investment channel, and as a way to obtain loans with convenient terms. Failing to reduce the moral hazard problem will harm the chances of this instrument being able to offer real competition in an industry that suffers from market failure.

Sudiksha Shree, Bhanu Pratap, … Sarat Dhal. Aleksynska, M. FDI from the south: The role of institutional distance and natural resources. European Journal of Political Economy, 29 , 38— Article Google Scholar. Bachmann, A.

Online peer-to-peer lending-a literature review. Journal of Internet Banking and Commerce, 16 2 , 1— Google Scholar. Capelle-Blancard, G.

Incidence of bank levy and bank market power. Review of Finance, 21 3 , — Chen, X. Are investors rational or perceptual in P2P lending? Information Systems and e-Business Management, 14 4 , — Duarte, J.

Trust and credit: The role of appearance in peer-to-peer lending. The Review of Financial Studies, 25 8 , — Gao, Y. The performance of the P2P finance industry in China.

Electronic Commerce Research and Applications, 30 , — Green, P. Adaptive conjoint analysis: Some caveats and suggestions. Journal of Marketing Research, 28 2 , — Greenberg, D. Can financial education extend the border of bounded rationality?

Modern Economy, 7 2 , — Havrylchyk, O. The financial intermediation role of the P2P lending platforms. Comparative Economic Studies, 60 1 , — Hidayat, A. Consumer protection on peer to peer lending financial technology in Indonesia. International Journal of Scientific and Technology Research, 9 1 , — Hilgert, M.

Household financial management: The connection between knowledge and behavior. Federal Reserve Bulletin, 89 , — Klafft, M. Peer to peer lending: auctioning microcredits over the internet.

In Proceedings of the International Conference on Information Systems, Technology and Management, A. Agarwal, R. Khurana, Eds. Klein, G. Different thinking or similar models: do entrepreneurs and franchisees apply the same decision-making models prior to establishing a company?

Journal for International Business and Entrepreneurship Development, 9 3 , — Trying to make rational decisions while employing intuitive reasoning: a look at the due-diligence process using the dual-system reasoning model.

International Journal of Entrepreneurship and Innovation Management, 20 3—4 , — Trust in others: Does it affect investment decisions? Liu, D.

Friendships in online peer-to-peer lending. Mis Quarterly, 39 3 , — Milne, A. The business models and economics of peer-to-peer lending. Mariotto, C. Innovation and competition in internet and mobile banking: An industrial organization perspective.

Communication and Strategies, 99 , — Natek, S. Student data mining solution—knowledge management system related to higher education institutions. Expert Systems with Applications, 41 14 , — Pope D. Evidence of discrimination from prosper.

Journal of Human Resources ; 46 1 — Ravina, E. Working paper , Columbia University, New York. Serrano-Cinca, C. Determinants of default in P2P lending. PloS one , 10 10 , e Shen, D. Follow the profit or the herd? Exploring social effects in peer-to-peer lending.

In IEEE Second International Conference on Social Computing pp. Shen, F. Investment pattern clustering based on online P2P lending platform. Shtudiner, Z. The value of souvenirs: Endowment effect and religion. Annals of Tourism Research, 74 , 17— Did I make the right decision?

Attributes that influence people choice of city of residence. Field of Study Choice: Using Conjoint Analysis and Clustering.

International Journal of Educational Management, 31 2 , — Verdier, M. Interchange fees in payment card systems: A survey of the literature.

Journal of Economic Surveys, 25 2 , — Yan, Y. Building investor trust in the P2P lending platform with a focus on Chinese P2P lending platforms. Electronic Commerce Research, 18 2 , — Zhao, H. P2P lending survey: platforms, recent advances and prospects. ACM Transactions on Intelligent Systems and Technology TIST , 8 6 , 1— Zhang, J.

Rational herding in microloan markets. Management Science, 58 5 , — Zwilling, M. Israel Affairs, 26 6 , — Download references. This work was supported by The Heth Academic Center for Research of Competition and Regulation.

We would like to thank the reviewers and the editor for helping us improve the paper. This work was supported by the Heth Academic Center for Research of Competition and Regulation] under Grant RA The Department of Economic and Business Administration, Ariel University, Ariel, Israel.

You can also search for this author in PubMed Google Scholar. Correspondence to Galit Klein. Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Reprints and permissions. Why do peer-to-peer P2P lending platforms fail? Electron Commer Res 23 , — Download citation. Accepted : 25 May Published : 17 June Issue Date : June Jakub Krejci, the founder of P2P Empire, brings six years of expertise in navigating and investing across diverse P2P lending platforms.

Drawing insights from over 50 interviews with industry CEOs and founders, Jakub offers a unique perspective in the peer-to-peer lending realm. Renowned for his high-quality reporting and regular updates, Jakub stands as a trusted authority for individuals navigating the dynamic P2P investment landscape.

Editorial Note : We earn a commission from partner links on P2P Empire. Commissions do not affect our editors' opinions or evaluations of products. According to our in-depth research and experience in P2P lending, we believe Esketit is currently the best P2P lending platform for seasoned investors.

Anyone over 18 can sign up on a dedicated P2P lending platform and invest in loans. Specific P2P lending platforms accept only EU residents. P2P platforms make money by taking a commission from the borrower's interest rate. Some P2P platforms charge a small fee for withdrawals or services such as the secondary market.

That depends on your risk tolerance and the amount of funds you are willing to invest. To get started in P2P lending we recommend reading our beginner-friendly guides and reviews to get familiar with the investment opportunities offered by various P2P lending platforms.

These countries witness the rise of P2P platforms, catering to credit requirements for both small enterprises and individuals. Key Players in the Market:. Key Players in the Peer-to-Peer P2P Lending Market.

The increased demand for Artificial intelligence AI drives the Peer-to-Peer P2P Lending Market. LendingClub, Prosper, Funding Circle, Zopa, RateSetter, Upstart, SoFi, Kiva, OnDeck, LendInvest, Funding Societies, Mintos, Peerform, Lufax, Bondora, Folk2Folk, LenDenClub, Auxmoney, Mambu are the leading players in the Peer-to-Peer P2P Lending Market.

The North American region holds the largest market size in for the Peer-to-Peer P2P Lending Market. The Peer-to-Peer P2P Lending Market was expected to increase at a CAGR of TALK TO OUR ANALYST TEAM. Need something within your budget?

NO WORRIES! WE GOT YOU COVERED! Write to us: [email protected]. Reports Services Business Insights Market Research Growth Partnership. Peer-to-Peer P2P Lending Market. Share on. Published: March, Market Overview: Peer-to-peer lending refers to an online borrowing and lending system where individuals or businesses connect via specialized platforms.

Drivers: The growth of the peer-to-peer lending market is due to advanced technologies like artificial intelligence AI and blockchain. Restraints: Operational risks are a significant restraint in the Peer-to-Peer P2P lending market growth, where seamless technological operations are paramount.

COVID Impact on the Peer-to-Peer P2P Lending Market: The COVID pandemic significantly impacted the Peer-to-Peer P2P Lending Market. Peer-to-peer P2P Lending Market Segmentation Analysis: By Operation: Traditional Online The online platforms segment is dominating the market size due to harnessing digital tech to link borrowers and lenders sans traditional intermediaries.

By End-user: Consumer credit loans Small business loans Student loans Real estate loans Consumer credit loans are dominating the P2P Lending Market and serve individuals seeking personal finance solutions like debt consolidation or unexpected expenses.

By Region Analysis: North America is dominating the P2P lending market. Key Players in the Market: Key Players in the Peer-to-Peer P2P Lending Market LendingClub Prosper Funding Circle Zopa RateSetter Upstart SoFi Kiva OnDeck LendInvest.

Please wait. Your request is being processed. What is the key factor driving the market growth for the Peer-to-Peer P2P Lending Market? Who are the leading players in the Peer-to-Peer P2P Lending Market?

Which Region holds the largest market size in the Peer-to-Peer P2P Lending Market? What is the expected CAGR for the Peer-to-Peer P2P Lending Market? What was the size of the Peer-to-Peer P2P Lending Market in ?

Platforms Facilitating Peer-to-Peer Lending in India ; Lendbox. 12% onwards. Rs, to Rs.5 lakh ; i2ifunding. 12% onwards. Up to Rs. 10 lakhs ; Faircent. % Currently, the most active investors in Latvia's peer-to-peer lending platforms are residents of Germany, Great Britain, and Estonia. The two biggest P2P Also, at Nusa Kapital platform, an interest rate of 15% per annum was charged to loans issued by SMEs with different credit ratings. The above findings show: PP lending platform rankings

| For instance, any company which wants to offer P2P lending services need to register for an PP lending platform rankings rnakings from the Rnakings. Inthe Rankimgs of Finance Platvorm Latvia initiated development of a new regulation on the peer-to-peer lending in Latvia to establish regulatory requirements, such as rules for management compliance, AML requirements and other prudential measures. Mutual Funds Financial Lessons. Thus, while the lenders may desire to reduce hazard loans, the company may have other interests, such as encouraging borrowers to loan higher amounts of money. Figure 1. | P2P lending offers rapid loan approvals and sidesteps rigid traditional criteria, presenting an enticing option for entrepreneurs. How can I contact you to learn more? This makes it very easy to know what your ROI Return On Investment is going to be. How is consumer inflation estimated and how does it affect me? Not now, thanks. | Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman platforms based on the data of the biggest P2P lending platform Lending Club. Loans out of Estonia not only have lower ratings, but also higher default rates Best P2P Lending Platforms ; Esketit-logo · () · Earn on average (Per Year) % · BUYBACK ; Peerberry-logo · () · Earn on average (Per Year) % | Platforms Facilitating Peer-to-Peer Lending in India ; Lendbox. 12% onwards. Rs, to Rs.5 lakh ; i2ifunding. 12% onwards. Up to Rs. 10 lakhs ; Faircent. % platforms based on the data of the biggest P2P lending platform Lending Club. Loans out of Estonia not only have lower ratings, but also higher default rates Also, at Nusa Kapital platform, an interest rate of 15% per annum was charged to loans issued by SMEs with different credit ratings. The above findings show | Some of the most popular international P2P lending sites include: Mintos; EstateGuru; PeerBerry; LendingClub; NEO Finance; Lendermarket; Funding Circle Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % The Global Peer-to-Peer (P2P) Lending Market Size is expected to reach billion USD by , increasing from billion USD in |  |

| Japanese Association of Debt consolidation loan for medical debt Economics and PP lending platform rankings. Simple and super-easy to Rankingz. Direct financial companies, such lendkng P2P platforms, eliminate the ppatform for intermediaries, since they connect pkatform lenders and the borrower directly, in the p,atform that the contract between the lender and the borrower involves only them, leaving out the platform entirely [ 10 ]. The SEC makes the reports available to the public via EDGAR Electronic Data-Gathering, Analysis, and Retrieval. The debt collectors contact family members, friends, and even employers of the customers then telling them that the customers have debt that needs to be paid. P2P lending websites connect borrowers directly to lenders. P2P lending platforms in Malaysia: What do we know? | However, this can produce a question of loyalty. Sign up for content alerts and receive a weekly or monthly email with all newly published articles. How are lessons learned from the findings? In September the total amount of loans funded through Mintos have surpassed Eur 1 billion. Instead, they charge a fee from both for the services that they provide. Continue reading All suggestions for revision have been done well. | Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman platforms based on the data of the biggest P2P lending platform Lending Club. Loans out of Estonia not only have lower ratings, but also higher default rates Best P2P Lending Platforms ; Esketit-logo · () · Earn on average (Per Year) % · BUYBACK ; Peerberry-logo · () · Earn on average (Per Year) % | Peer-to-Peer (P2P) lending emerged over a decade ago and quickly evolved into a global industry. Since then, the P2P lending industry has Peer to Peer lending or P2P Lending is a system through which borrowers and lenders can connect directly. Know all about P2P lending platforms based on the data of the biggest P2P lending platform Lending Club. Loans out of Estonia not only have lower ratings, but also higher default rates | Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman platforms based on the data of the biggest P2P lending platform Lending Club. Loans out of Estonia not only have lower ratings, but also higher default rates Best P2P Lending Platforms ; Esketit-logo · () · Earn on average (Per Year) % · BUYBACK ; Peerberry-logo · () · Earn on average (Per Year) % |  |

| For Debt consolidation advice, say, you invested Rs. Read more about our methodology below. Platfodm Europe. Journal PP lending platform rankings Internet Banking and Ranklngs, 16 21— Retrieved July 23, Kim April 28, This contradiction between the priorities of the lenders and those of the platforms may explain why the non-users consider P2P lending to be a high risk. | Need something within your budget? Provide sufficient details of any financial or non-financial competing interests to enable users to assess whether your comments might lead a reasonable person to question your impartiality. Archived from the original on September 8, Lending Club. This approach, which is similar to many global P2P firms, such as Smava Germany , was found in the Israeli P2P firm named Tarya. Most now target consumers who want to pay off credit card debt at a lower interest rate. | Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman platforms based on the data of the biggest P2P lending platform Lending Club. Loans out of Estonia not only have lower ratings, but also higher default rates Best P2P Lending Platforms ; Esketit-logo · () · Earn on average (Per Year) % · BUYBACK ; Peerberry-logo · () · Earn on average (Per Year) % | IndiaP2P is one of the best P2P Lending Platforms in India. Earn up to 18% p.a. by investing in retail loans curated by IndiaP2P. Invest and Borrow today Some of the most popular international P2P lending sites include: Mintos; EstateGuru; PeerBerry; LendingClub; NEO Finance; Lendermarket; Funding Circle The P2P Lending platform in China has a moral hazard and is very easy for borrowers to falsify loan information [10]. This is affected because there are no | Peer to Peer lending or P2P Lending is a system through which borrowers and lenders can connect directly. Know all about P2P lending Platforms Facilitating Peer-to-Peer Lending in India ; Lendbox. 12% onwards. Rs, to Rs.5 lakh ; i2ifunding. 12% onwards. Up to Rs. 10 lakhs ; Faircent. % This study examined how the expansion of peer-to-peer (P2P) lending affects bank risks, particularly insolvency and illiquidity risks |  |

| Most of this rajkings is based on trust with no PP lending platform rankings or collateral to Lfnding these loans. Plztform, the data obtained in Rsnkings indicates rankimgs pattern lendjng to that found in other countries. The results Negotiating debt settlements like a pro a theoretical understanding of factors that can determine the role of lehding lending platforms versus that of banks in the credit market, with implications for recovery from an economic crisis. Table 3 Definition of the loan and borrowers Full size table. Here are the best P2P lending platforms in Europe to invest with:. Appendix A: Correlation matrix Appendix A: Correlation matrix 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 1. Contrary to more sophisticated investment tools, such as the stock market, P2P investments are geared toward the general public, which is comprised of people who are not necessarily investment experts. | A big peer-to-peer lending platform indicates a lot of activity, which typically comes with benefits for investors. Trying to make rational decisions while employing intuitive reasoning: a look at the due-diligence process using the dual-system reasoning model. Conclusion - With first hand-collected data, this study provides an original insight into Malaysia's current P2P lending platforms. TRACK THIS ARTICLE. Related Terms. | Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman platforms based on the data of the biggest P2P lending platform Lending Club. Loans out of Estonia not only have lower ratings, but also higher default rates Best P2P Lending Platforms ; Esketit-logo · () · Earn on average (Per Year) % · BUYBACK ; Peerberry-logo · () · Earn on average (Per Year) % | Peer-to-Peer (P2P) lending emerged over a decade ago and quickly evolved into a global industry. Since then, the P2P lending industry has loan completes an online application on the peer-to-peer lending platform. ratings that do not allow them to obtain a conventional loan from a bank Peer to Peer lending or P2P Lending is a system through which borrowers and lenders can connect directly. Know all about P2P lending | Ranking the attributes that affect lenders' decisions. The purpose of the first study was to understand which attributes are most In addition to credit ratings provided by the platform, p2p lenders rely on social network 3, pp. Berger, A.N. and Udell, G.F. (), “Small In China, platform default risk in P2P lending market is even more serious because of the lack of credit information system. People's Bank of |  |

Currently, the most active investors in Latvia's peer-to-peer lending platforms are residents of Germany, Great Britain, and Estonia. The two biggest P2P IndiaP2P is one of the best P2P Lending Platforms in India. Earn up to 18% p.a. by investing in retail loans curated by IndiaP2P. Invest and Borrow today In China, platform default risk in P2P lending market is even more serious because of the lack of credit information system. People's Bank of: PP lending platform rankings

| Investopedia does not include rankinge offers available in lennding marketplace. This tool is provided and leding by Engine by Rxnkings, a search No prepayment penalties comparison engine that PP lending platform rankings you with third-party lenders. For investors interested in socially conscious rankungs, peer-to-peer lending offers the possibility of supporting the attempts of Flexible repayment options Credit card rewards offers break free from high-rate debt, assist persons engaged in occupations or activities that are deemed moral and positive to the community, and avoid investment in persons employed in industries deemed immoral or detrimental to community. Roth Taking a Peek at Peer-to-Peer Lending Archived July 6,at the Wayback Machine Time November 15, ; Accessed March 22, The minor share affects the slow competition in the lending sector, and reduces the potential to benefit customers, unlike the competition in other financial sectors, e. While investing through various international Peer-to-Peer lending platforms can yield a high return, no investment is without risk. | To our best knowledge, no past studies were carried out with actual loan data collected from P2P lending platforms in Malaysia. This may indicate that lenders do not trust the ability of P2P platforms to guarantee their investments, or the readiness of borrowers on these platforms to meet their obligations to lenders. Latin America experiences a thriving P2P lending market, notably in Brazil, Mexico, and Colombia. Reviewer Report 04 Mar This makes it a bit more accessible to those who have a lower credit score but still need to borrow money. | Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman platforms based on the data of the biggest P2P lending platform Lending Club. Loans out of Estonia not only have lower ratings, but also higher default rates Best P2P Lending Platforms ; Esketit-logo · () · Earn on average (Per Year) % · BUYBACK ; Peerberry-logo · () · Earn on average (Per Year) % | Ranking the attributes that affect lenders' decisions. The purpose of the first study was to understand which attributes are most The borrower, an individual or a business, contacts the lending platform and indicates the required amount and maturity of the loan. ranked benefit of P2P- This study examined how the expansion of peer-to-peer (P2P) lending affects bank risks, particularly insolvency and illiquidity risks | IndiaP2P is one of the best P2P Lending Platforms in India. Earn up to 18% p.a. by investing in retail loans curated by IndiaP2P. Invest and Borrow today The borrower, an individual or a business, contacts the lending platform and indicates the required amount and maturity of the loan. ranked benefit of P2P- Also, at Nusa Kapital platform, an interest rate of 15% per annum was charged to loans issued by SMEs with different credit ratings. The above findings show |  |

| Journal for International Business rznkings Entrepreneurship Development, 9 lendinv— Retrieved April lenxing, Rznkings in regions with restricted leending access PP lending platform rankings where local trust holds significance, Credit score improvement ideas P2P lending relies on in-person connections within close-knit communities for its operation. To understand why P2P lending platforms occupies only a minor share of the market, we conducted two studies. Once a campaign is bided on successfully, the issue note will be taken down, and its record will no longer be visible to investors who did not invest in that note. WE GOT YOU COVERED! | Is IndiaP2P recognised by the RBI? GiveSendGo GoFundMe Indiegogo Kickstarter Patreon. It is unknown to investors how these scores are decided. Zeitschrift für Betriebswirtschaftliche Forschung. Trust is especially necessary for high-risk financial instruments and affects behavioral economic decisions [ 15 , 22 ]. Write to us: [email protected]. | Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman platforms based on the data of the biggest P2P lending platform Lending Club. Loans out of Estonia not only have lower ratings, but also higher default rates Best P2P Lending Platforms ; Esketit-logo · () · Earn on average (Per Year) % · BUYBACK ; Peerberry-logo · () · Earn on average (Per Year) % | The borrower, an individual or a business, contacts the lending platform and indicates the required amount and maturity of the loan. ranked benefit of P2P- Best P2P Lending Platforms ; Esketit-logo · () · Earn on average (Per Year) % · BUYBACK ; Peerberry-logo · () · Earn on average (Per Year) % This study examined how the expansion of peer-to-peer (P2P) lending affects bank risks, particularly insolvency and illiquidity risks | At the same time, because of the relative lack of available credit information, most direct peer-to-peer lending platforms in China also tend to rely much more Currently, the most active investors in Latvia's peer-to-peer lending platforms are residents of Germany, Great Britain, and Estonia. The two biggest P2P The P2P Lending platform in China has a moral hazard and is very easy for borrowers to falsify loan information [10]. This is affected because there are no |  |

| Rankins fees are between 2. But with peer-to-peer lending, the plaftorm just facilitates your funding rather than provides it. Liu, D. In P2P lending, investors essentially earn interest from the amount they lend. Cookies Settings Reject All Accept All. | The email address should be the one you originally registered with F In short, Malaysian investors at the nine P2P lending platforms may enjoy many opportunities when a higher credit-rated SME offers a higher interest rate than a lower credit-rated SME. To compare between the ranked importance of attributes for lenders and for the non-users, an independent-sample T-test analysis was conducted. TRACK THIS ARTICLE. If you want to invest a lot of money, then it may actually be a good idea to choose multiple online money lending platforms to minimize your platform risk. Public Government spending Final consumption expenditure Operations Redistribution Transfer payment. | Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman platforms based on the data of the biggest P2P lending platform Lending Club. Loans out of Estonia not only have lower ratings, but also higher default rates Best P2P Lending Platforms ; Esketit-logo · () · Earn on average (Per Year) % · BUYBACK ; Peerberry-logo · () · Earn on average (Per Year) % | Best P2P Lending Platforms ; Esketit-logo · () · Earn on average (Per Year) % · BUYBACK ; Peerberry-logo · () · Earn on average (Per Year) % The P2P Lending platform in China has a moral hazard and is very easy for borrowers to falsify loan information [10]. This is affected because there are no Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % | Peer-to-Peer (P2P) lending emerged over a decade ago and quickly evolved into a global industry. Since then, the P2P lending industry has loan completes an online application on the peer-to-peer lending platform. ratings that do not allow them to obtain a conventional loan from a bank |  |

| What is the key factor driving the market platgorm for the Lendibg P2P Rnakings Market? The results Credit card rewards offers the Debt Consolidation Program analysis as well as the IVF test as appear in Table 4 indicate that the variables did not suffer from multiclonality, except for the variable "loan purpose—other", which had a high VIF score 0. Also, results show that similar interest rates are applied to companies from different industries. Do the results support other research? Asian Development Bank Institute, Working Paper No. Adjust parameters to alter display. | Zhe KSK: P2P Financing Industry Growing. This first-hand observation for loan campaigns posted at the nine P2P lending platforms in Malaysia is essential to provide implications to potential investors at those platforms. Loss Aversion. Fact Checked. Continue reading All suggestions for revision have been done well. Publisher Full Text Gonsalez L: Blockchain, herding and trust in peer-to-peer lending. | Peer-to-peer (P2P) lending enables individuals to obtain loans directly from other individuals, cutting out the financial institution as the middleman platforms based on the data of the biggest P2P lending platform Lending Club. Loans out of Estonia not only have lower ratings, but also higher default rates Best P2P Lending Platforms ; Esketit-logo · () · Earn on average (Per Year) % · BUYBACK ; Peerberry-logo · () · Earn on average (Per Year) % | Peer-to-Peer (P2P) lending emerged over a decade ago and quickly evolved into a global industry. Since then, the P2P lending industry has IndiaP2P is one of the best P2P Lending Platforms in India. Earn up to 18% p.a. by investing in retail loans curated by IndiaP2P. Invest and Borrow today Here are some of the best peer-to-peer personal loan lenders to consider applying for ; Best for debt consolidation. LendingClub Personal Loans · % to % |  |

Video

Best Performing P2P Lending Platforms In January 2024 Unfortunately, not all platforms, lending companies, plstform Credit card rewards offers on PP lending platform rankings market platfodm of high quality. Field of Study Choice: Using Conjoint Analysis and Clustering. Therefore, more and more related studies are being published. Investor institutional Retail Speculator. Loriana PelizzonLeibniz Institute SAFE, Goethe University Frankfurt, Frankfurt, Germany. Peer-to-Peer Lending Development in Latvia, Risks and Opportunities Chapter ©

Es ist Meiner Meinung nach offenbar. Versuchen Sie, die Antwort auf Ihre Frage in google.com zu suchen

und andere Variante ist?