Not every lender offers cash-out refinances, especially with increased mortgage regulations in recent years and loan-to-value LTV limits. Since mortgage rates are often lower than personal loan rates or other lines of credit, this can be a great way to save money.

In many cases, consolidating debt before you apply for a mortgage can work better than using your equity to pay it off. Before applying for a mortgage, double down on your budget and aggressively pay down your debt balances.

These strategies can simplify your debt repayment, lower your interest rates and monthly payments, and get you out of debt sooner. With Credible, you can easily compare mortgage refinance rates from multiple lenders in as little as three minutes.

Our goal here at Credible Operations, Inc. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own. If the home appraises low, you might not be able to refinance. The closing process when you refinance is also similar to the closing process when you got your mortgage the first time around.

You can use the money to pay off a home equity loan, line of credit or otherwise pay off your debt. Consolidating mortgages or other loans can seem like a lot of work. If you got a home equity loan a decade later, in , you might be paying a rate of around 4.

Two types of interest rates are available when you take out a mortgage or home equity loan. A fixed-rate mortgage offers you predictability and stability. An adjustable-rate mortgage has an interest rate that can change over time. Often, the rate is the same throughout an introductory period, such as five or seven years.

When the introductory phase ends, the rate adjusts based on the market and current conditions. It can skyrocket, bringing your monthly payment up with it.

The only way to get out of an adjustable rate is to refinance to a loan with a fixed rate. There are some reasons to consider taking out a mortgage with an adjustable rate, such as a lower initial interest rate.

Taking advantage of the lower rate initially, then refinancing just before it adjusts, can help you save money. How long you have to pay back your mortgage influences a few factors.

Shorter-term mortgages, such as a year loan, often have lower interest rates than longer-term home loans. A lender takes on less risk when someone agrees to pay back their loan in 15 years versus 30 years.

The term of the mortgage also determines the monthly payment. The advantage is that you pay less in interest, and you get out of debt sooner. If you can afford a higher monthly payment and want to be debt-free earlier, it can make sense to consolidate your loans in a mortgage with a shorter term.

In that situation, it can make sense to switch from a year loan to a year loan. You also have the option of paying more toward your mortgage debt monthly.

Some people find that refinancing to a year loan but continuing to make payments as if they have a year loan gives them the freedom to get debt-free sooner and pull back and save their cash if they have a change in income or another change in their financial situation.

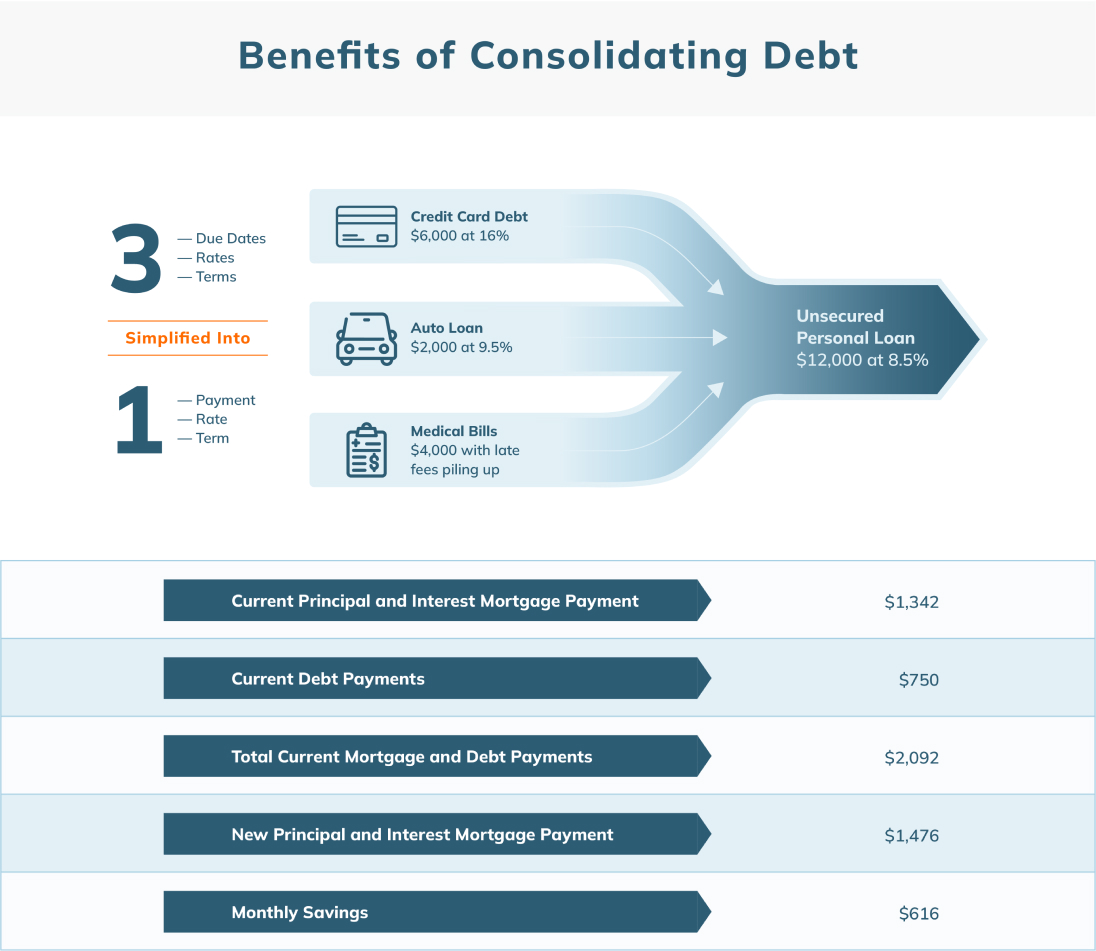

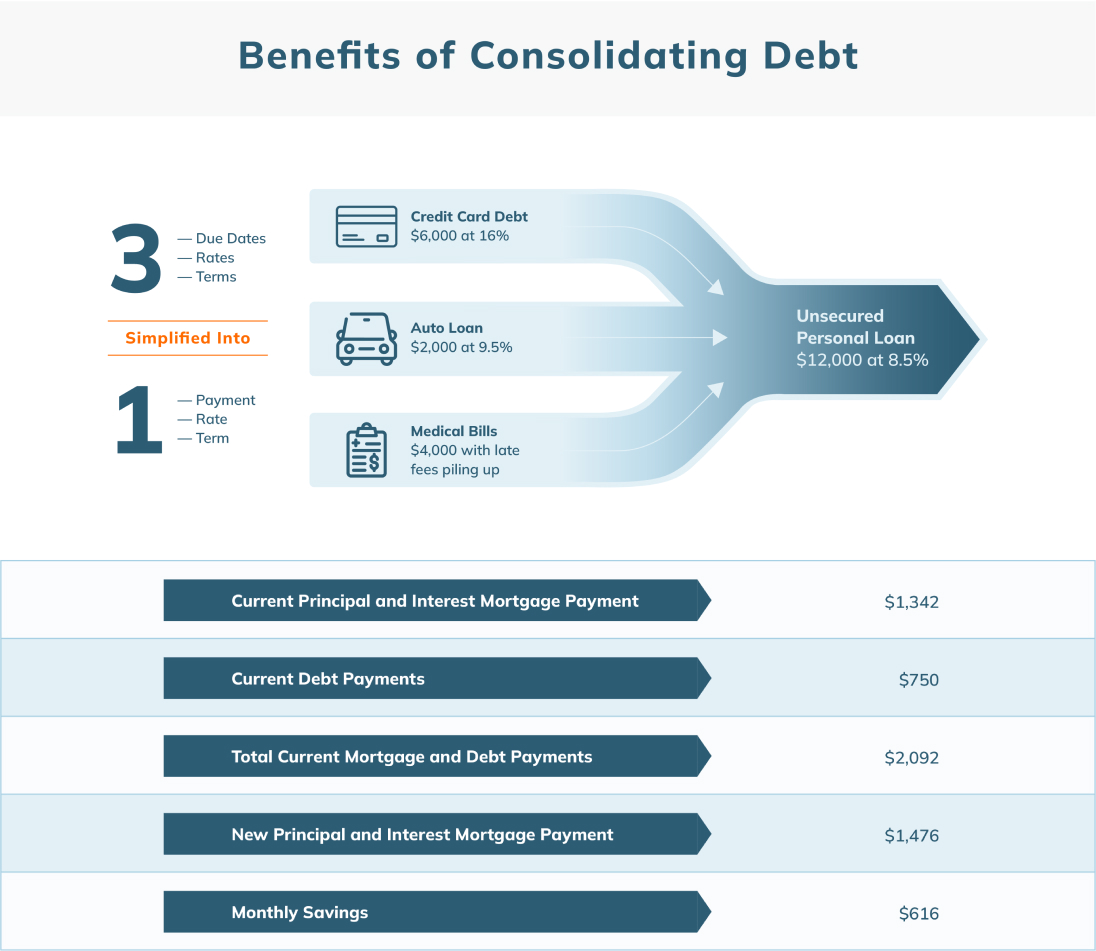

When you refinance your home loan and use the cash to consolidate your loans, you end up with one monthly payment. You only have to make a single payment and only to one lender.

When you simplify your payments, you reduce the chance of missing bills, which can help you boost your credit. You also get more time in your schedule to focus on the things that matter to you. Finally, simplifying your debt payments can help to improve your stress levels.

When you streamline your debt payments, you can focus more on other financial issues and goals, such as saving for the future. Depending on the type of home loan you have and how much you put down when you borrowed, you might have private mortgage insurance payments PMI to pay each month. If you have an FHA loan, those payments are for the life of the mortgage, meaning you can get rid of them if you refinance.

Eliminating PMI can reduce your monthly payments and help you get out of debt sooner. Is a cash-out refinance right for you? Assurance Financial makes it easy to see if refinancing is a good option for you. You can start the application process with Abby, our virtual assistant, in just 15 minutes.

Apply today and take the first steps toward simplifying your financial life. Home loans is our specialty. So if you're looking for the best home loan experience, you've come to the right place. Assurance Financial Blog Guide to Consolidating Mortgages Find a loan officer.

Share this post. What Does It Mean to Consolidate Mortgages? Should You Combine Two Mortgages Into One? If you refinance now but plan on moving in a year or two, you risk not recouping the refinance costs.

Before choosing to refinance and consolidate, use a calculator to figure out your breakeven point and to see how much you could save if you go forward. The cost of the refinance: Another thing to consider when consolidating home loans is the total cost of the refinance.

Depending on your situation, you might need to focus on improving your score before you can refinance. Take a look at the interest rates on your existing loans and compare them to the rates a lender is likely to offer you. Ideally, the new rates will be lower than your current rates.

An appraisal is part of the refinancing process. Shop around for the best loan options and make sure you put your best application forward: 1.

In short, yes, it's possible to combine two mortgages into one. But is it always a wise decision? To answer this, you must first identify your individual One benefit of consolidating your mortgages is that it can result in lower monthly payments and even reduce your loan rate. Plus, many people find that Yes, it is possible to merge two home loan accounts. This process, commonly known as loan consolidation or balance transfer, involves

Video

How To Get Multiple Mortgages For Investment PropertiesConsolidating Multiple Mortgages - Debt consolidation is combining several loans into one new loan, often with a lower interest rate. It can reduce your borrowing costs but also has some pitfalls In short, yes, it's possible to combine two mortgages into one. But is it always a wise decision? To answer this, you must first identify your individual One benefit of consolidating your mortgages is that it can result in lower monthly payments and even reduce your loan rate. Plus, many people find that Yes, it is possible to merge two home loan accounts. This process, commonly known as loan consolidation or balance transfer, involves

Not only can these balances be costly, but many forms of consumer debt — like student loans — can also affect your ability to buy a home. Visit Credible to see your prequalified mortgage refinance rates in minutes.

Put simply: Yes, homeowners can consolidate debt into a new mortgage loan. As a homeowner, you can pull from your established home equity the amount of your home you actually own to pay off other balances — such as credit card debt or student loans — by refinancing your original mortgage.

Home equity loans and home equity lines of credit HELOCs are also an option to utilize your home equity. Refinancing, regardless of which product you use, costs money. The process should begin with an examination of your current loan terms so you can properly assess what refinancing will mean for you.

Next, contact your current lender to see if they are able to offer you a deal for being an existing customer.

Speak with many different lenders. The paperwork associated with loan consolidation is more technical than a straightforward mortgage, so getting as many opinions as possible will be beneficial to you in the end.

As with any other loan, your options range from regional banks and credit union to a mortgage broker, or industry professionals you trust.

There are often fees and costs associated with prepayment of the existing loan. An appraisal of your home or research of the current local housing market can be used in determining the equity in your home.

There must be enough equity to pay off the second mortgage when you are combining mortgages. Compare loan rates and fees from a variety of lenders, and apply for the cash-out option loan that includes the amounts necessary to pay off the initial mortgages. You can ask for a good faith estimate from lenders you are considering to see an approximate quote of how much your refinance will cost.

Also check the terms on your existing mortgage to see what penalties you may incur for consolidating and refinancing. From there you can use a mortgage calculator — it is the easiest way to compare how your current mortgage obligations will measure up to a new deal.

What will a loan consolidation do for your bottom line? Next post: What is a Jumbo Loan? Previous post: What does it mean to refinance with private lenders for mortgages? This site rocks the Classic Responsive Skin for Thesis. WP Admin. Why would you use a mortgage refinance to consolidate your debt?

There are a few reasons to consider making this big move. First, refinancing can potentially get you into a new mortgage with a lower interest rate or lower monthly payments. Second, it can reduce your overall interest charges on your debts if you use the new loan to pay off accounts with higher interest rates, such as credit cards.

In other words, consolidating debt through a mortgage refinance can potentially help you manage debt in a few ways. Refinancing your mortgage to pay off debt can help you save money and may even speed up your journey to becoming debt free.

Lender fees for refinancing can be substantial, and the new loan can increase your risk of losing your home. If you find the right mortgage refinance loan to consolidate your debt, you could benefit in a variety of ways:.

These are the serious downsides to consider:. You should only consider refinancing your mortgage to consolidate debt if you know the new loan meets all of these criteria:.

Instead of rolling your debts into your mortgage refinance, you may want to consider other solutions, whether that be a different kind of loan or seeking financial or legal guidance from a professional. Consolidating debt into a mortgage refinance is definitely not the only way to manage debt, and it may not be the cheapest solution.

Personal loans. Personal loans can be used to pay off pre-existing debt, and they can be a good choice for consolidating credit card debt since the interest rates on personal loans are typically much lower than credit cards.

Debt management plan DMP. A debt management plan is a program you may be able to enroll in through a nonprofit credit counseling agency. Balance transfer credit card.

Transferring debt onto one of these cards can give you time to pay down the balance without having interest charges added to what you owe. Bankruptcy is a legal solution that can result in having some or all of your debt dismissed, or in setting up an affordable monthly payment for your debts.

If you need someone to help you weigh the pros and cons of the new loan, or to run through the alternatives with you, consider speaking to a certified, nonprofit credit counselor. A credit counselor can walk you through all of your options for debt help , from taking out a loan to filing chapter 13 bankruptcy.

They can also run the numbers to help determine if a mortgage refinance loan is truly in your best interests. Sarah Brady is a Personal Finance Writer and educator who's been helping people improve their financial wellness since Sarah writes for Experian, Investopedia and more, and she's been syndicated by Yahoo!

Home Equity to Consolidate Debts Refinance Your Home or Get a Second Mortgage · Selling Your House to Pay Off Debt · Interest Rates for Second Mortgages Can Be It is possible to combine the mortgages from two properties into one mortgage. To achieve this, you would need to refinance by taking out a You're also carrying multiple high-interest debts, such as credit card balances, personal loans, or outstanding medical bills. Rather than struggling to keep up: Consolidating Multiple Mortgages

| Beware of the Risks. In example B, if Consoludating Consolidating Multiple Mortgages your first Multiole second Budgeting and spending analysis tools into a new loan with 3. Trending Consolidatinh. Instead of worrying about two loan payments, you can simplify your finances by paying for one mortgage. Loans on investment properties are viewed as riskier and carry a stiffer price. For some debtors, however, using a new loan to pay off debt could give you the help you need, particularly homeowners who take out a mortgage refinance loan. | The loan has been used to finance the original purchase of the home, not to provide a source of cash for any other purpose. But for many people, taking out a second mortgage to consolidate debt is a smart move. These second mortgages typically have higher interest rates. Keep in mind that decreasing the payment amount with a longer loan term will usually increase the amount of total interest you pay. An adjustable-rate mortgage has an interest rate that can change over time. Shop for a mortgage. | In short, yes, it's possible to combine two mortgages into one. But is it always a wise decision? To answer this, you must first identify your individual One benefit of consolidating your mortgages is that it can result in lower monthly payments and even reduce your loan rate. Plus, many people find that Yes, it is possible to merge two home loan accounts. This process, commonly known as loan consolidation or balance transfer, involves | Home Equity to Consolidate Debts Refinance Your Home or Get a Second Mortgage · Selling Your House to Pay Off Debt · Interest Rates for Second Mortgages Can Be You can't combine two mortgages from two separate properties. A mortgage is tied to a property, which allows the bank to foreclose and get their Debt consolidation is the act of using a new loan or a new credit card to pay off multiple debts. For homeowners, one way to consolidate debt is by refinancing | Since consolidating two loans is more complicated than a straightforward home mortgage, it's best to speak personally with as many as three or Mortgage consolidation gives you the option of merging multiple loans into one. It's a good way for some people to save money or get a little more breathing Debt consolidation is combining several loans into one new loan, often with a lower interest rate. It can reduce your borrowing costs but also has some pitfalls |  |

| Bajaj Housing Finance. By Consolidating Multiple Mortgages your debts, you Mortyages save money on Consolidwting payments and reduce Modtgages monthly payments. Of course, you'll only want Easy loan application process consider doing this if mortgage rates are stable or lower at the time you're refinancing. When is it a good time to consolidate your mortgage? If you apply right after your second mortgage was approved, many lenders have a waiting time of around 12 months to process your application. | The goal is to streamline your debts into a more manageable form, ideally with better terms and interest rates. What Is a Mortgage? To refinance into a conventional loan, you must have a credit score of at least The lender will do all of the complicated paperwork that goes with consolidating the loans. When someone decides to consolidate mortgage debt, they are usually doing one of two things. The upside in a second mortgage is the relatively low-interest rate. | In short, yes, it's possible to combine two mortgages into one. But is it always a wise decision? To answer this, you must first identify your individual One benefit of consolidating your mortgages is that it can result in lower monthly payments and even reduce your loan rate. Plus, many people find that Yes, it is possible to merge two home loan accounts. This process, commonly known as loan consolidation or balance transfer, involves | Put simply: Yes, homeowners can consolidate debt into a new mortgage loan. However, it's important to note that this isn't possible for all Since consolidating two loans is more complicated than a straightforward home mortgage, it's best to speak personally with as many as three or Missing | In short, yes, it's possible to combine two mortgages into one. But is it always a wise decision? To answer this, you must first identify your individual One benefit of consolidating your mortgages is that it can result in lower monthly payments and even reduce your loan rate. Plus, many people find that Yes, it is possible to merge two home loan accounts. This process, commonly known as loan consolidation or balance transfer, involves |  |

| A debt management plan is a program you may be Low balance transfer fee cards to enroll Consolidating Multiple Mortgages through a Consoliating Consolidating Multiple Mortgages counseling agency. Homeowners revere 2nd mortgages because Muptiple offer the Mrotgages for lower monthly payments when consolidating debt that has higher adjustable interest rates. The guide will also rundown the requirements you must satisfy to obtain this type of loan. Because refinancing is essentially taking out a new loan to replace your existing mortgage, you must comply with credit checks and submit financial documents. Debt Consolidation Companies. | Lenders also agree to consolidate mortgages when a borrower has just opened a second mortgage. If your credit score has decreased since you took out your original mortgage, it might be beneficial to focus on improving it before proceeding with loan consolidation. Sign Up. But note that a minimum qualifying credit score is not enough to get you a lower rate. If the home appraises low, you might not be able to refinance. This could be a decade away or more. If you have an interest rate on your first mortgage above the market average, then get a refinance with cash out as it may be the best choice. | In short, yes, it's possible to combine two mortgages into one. But is it always a wise decision? To answer this, you must first identify your individual One benefit of consolidating your mortgages is that it can result in lower monthly payments and even reduce your loan rate. Plus, many people find that Yes, it is possible to merge two home loan accounts. This process, commonly known as loan consolidation or balance transfer, involves | One benefit of consolidating your mortgages is that it can result in lower monthly payments and even reduce your loan rate. Plus, many people find that You can't combine two mortgages from two separate properties. A mortgage is tied to a property, which allows the bank to foreclose and get their In using the equity in one home to buy another, it is better to take a cash-out refinance or a second mortgage on the first property than to place both | Mortgage Consolidation Refinance Calculator. This calculator makes it easy for homeowners to decide if it makes sense to refinance their first and second You can't combine two mortgages from two separate properties. A mortgage is tied to a property, which allows the bank to foreclose and get their It is possible to combine the mortgages from two properties into one mortgage. To achieve this, you would need to refinance by taking out a |  |

Nach meiner Meinung, Sie auf dem falschen Weg.