Veterans who are totally and permanently disabled will have their student loan debt discharged. The process will be automatic unless they decline due to potential state tax liability there is no federal tax liability for veteran loan forgiveness.

Discharge due to death. If you die, your federal loans will be discharged once a death certificate is submitted to your loan servicer. Legitimate federal forgiveness, cancellation and discharge programs are free through the Department of Education, but there are other costs to consider.

Beware of scams. So-called debt relief companies claim to get rid of debt but rarely deliver after charging already-struggling borrowers high upfront fees. The only way to get debt discharged is through the legitimate government programs above, and it costs nothing to apply to them.

Defaulted federal loans are eligible for discharge programs. On a similar note Student Loans. Follow the writer. MORE LIKE THIS Loans Student loans. Find the latest. Student loan forgiveness programs. Other student loan forgiveness programs.

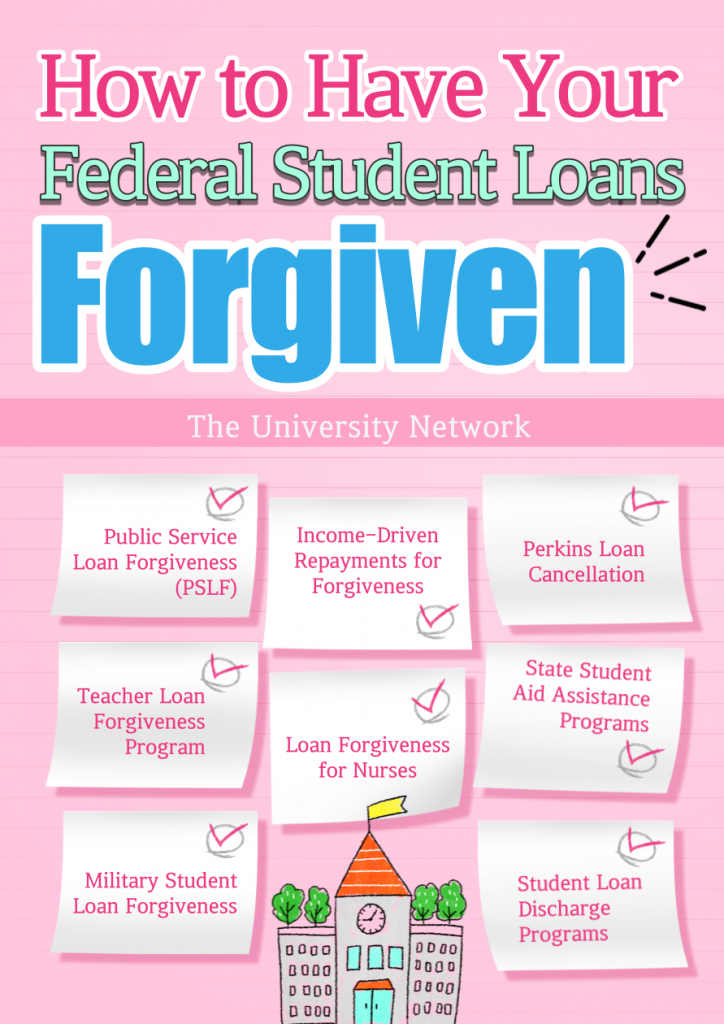

Student loan cancellation programs. Student loan discharge programs. The caveats. Get the scoop on student loans. Stay up to date on how student loan forgiveness and repayment may affect your finances.

GET STARTED. Dive even deeper in Student Loans. Explore Student Loans. Spot your saving opportunities. See your spending breakdown to show your top spending trends and where you can cut back. SBA has notified 7 a , , and Microloan lenders that it will pay these borrower loan payments. Lenders are to report to SBA periodically on the amounts due once a loan is fully disbursed.

The Economic Aid Act also authorized additional debt relief payments to 7 a , , and Microloan borrowers beyond the six-month period prescribed in the CARES Act.

The level of assistance varies based on when the loan was approved and will begin on or after February 1, Please contact your lender for questions on the availability of this assistance for your SBA loan. The initiatives described are limited to the level of available funding provided by Congress.

Existing SBA disaster loans approved prior to in regular servicing status as of March 1, , received an automatic deferment of principal and interest payments through December 31, This initial deferment period was subsequently extended through March 31, An additional month deferment of principal and interest payments will be automatically granted to these borrowers.

Borrowers will resume their regular payment schedule with the payment immediately preceding March 31, , unless the borrower voluntarily continues to make payments while on deferment.

It is important to note that the interest will continue to accrue on the outstanding balance of the loan throughout the duration of the deferment.

If you have questions about your current loan and whether or not your loan is automatically deferred, please contact your loan servicing office directly using the following information:. SBA Procedural Notice on additional deferments for existing and new SBA disaster loan borrowers.

Breadcrumb Home Funding Programs Loans COVID relief options SBA debt relief. Section navigation Loans Make a payment to SBA 7 a loans loans Microloans Lender Match COVID relief options Paycheck Protection Program COVID Economic Injury Disaster Loan Shuttered Venue Operators Grant Restaurant Revitalization Fund COVID recovery information in other languages SBA debt relief Cross-program eligibility Reporting identity theft Preventing fraud and identity theft Investment capital Disaster assistance Surety bonds Grants.

Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief.

UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure.

Compare offers to find the best savings account. Subscribe to the CNBC Select Newsletter! Read more. These top student loan refinance companies can save you hundreds of dollars in interest each month.

Student loan forgiveness was struck down by Supreme Court — here's what borrowers should do next. Is college still worth the cost?

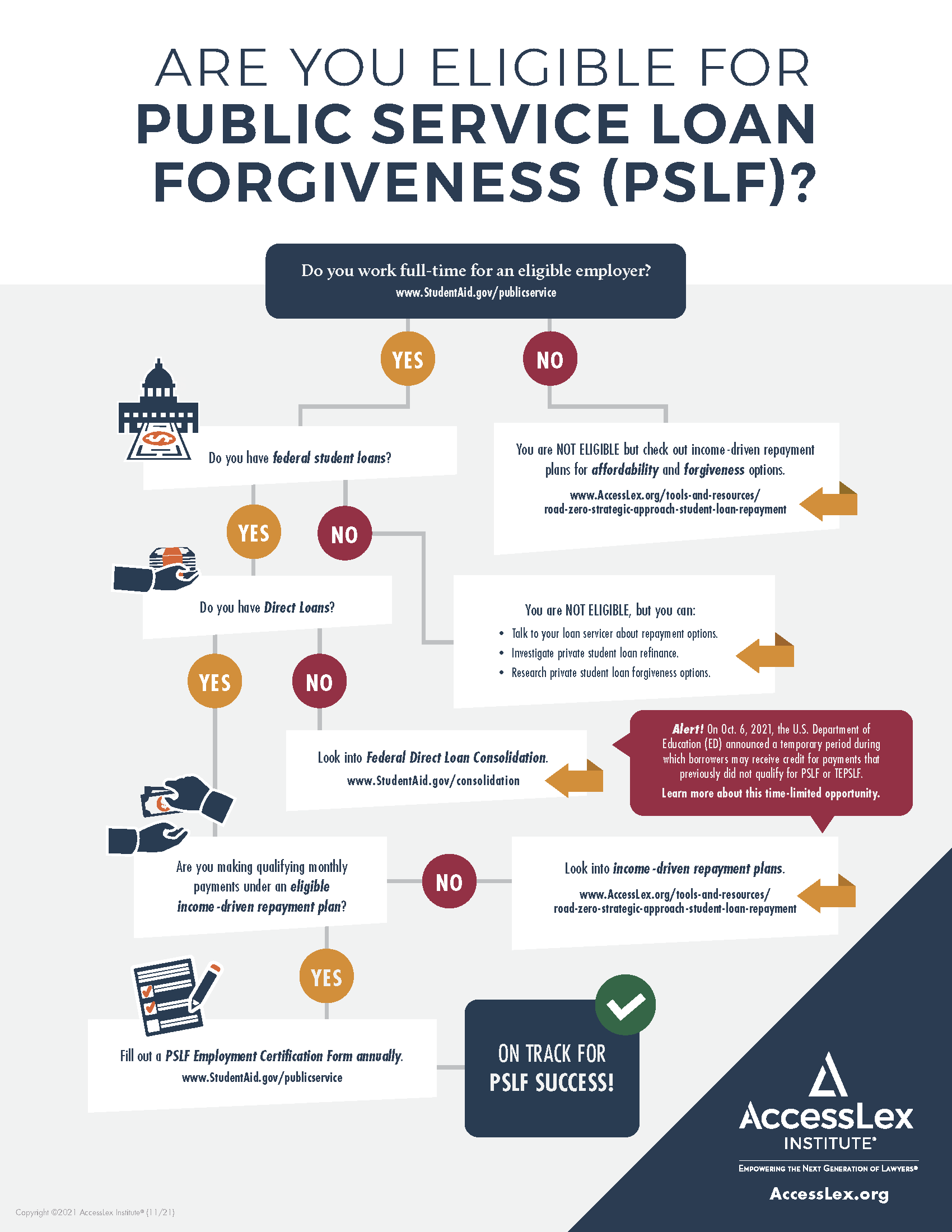

There are a few additional niche student loan forgiveness or payment assistance programs you may qualify for through federal or state programs If student loan forgiveness is what you seek, here's a guide to pretty much every possible way to get your student debt forgiven Yes. However, you must submit a PSLF Form showing that you were employed full-time by a qualifying employer at the time you made each of the required

Video

Student loan forgiveness: what you need to know Perkins loan cancellation. Punting payments for a year? Explore Assistance Loans. Eligible for loan relief assistance will need documentation on personal and financial information. Nearly 74, additional borrowers will receive loan forgiveness thanks to actions by the Biden-Harris Administration.

0 thoughts on “Eligible for loan relief assistance”