To make that happen, these loans tend to require lower credit credit scores than other options, and provide quick funding to get money in your hands sooner. There is a huge range available in emergency loans: Some lenders offer a few hundred dollars to tide you over, while others will lend you hundreds of thousands for larger-scale crises.

The best personal loans for bad credit will typically have a higher APR than loans for people with higher credit scores, simply because lenders see your credit score as a representation of your history with borrowing money, and therefore, their likelihood of getting theirs back.

In fact, terms offered to lenders with bad credit can be so unfavorable that you may also want to consider other options that are often cautioned against, like credit cards for bad credit.

Typically, a given lender will make this choice across its loan products, rather than charging an origination fee for one loan and not another. That said, it may be possible to negotiate a waived origination fee with your lender — but choosing one you already know doesn't charge origination fees is a safer bet.

Products in this post: Upstart Personal LoanAmerican Express Personal LoanReach Financial Personal LoanProsper Personal Loan.

Get Started Savings CDs Checking Accounts Student Loans Personal Loans Credit Scores Life Insurance Homeowners Insurance Pet Insurance Travel Insurance Banking Best Bank Account Bonuses Identity Theft Protection Credit Monitoring Small Business Banking. Personal Finance The words Personal Finance. Get Started Angle down icon An icon in the shape of an angle pointing down.

Featured Reviews Angle down icon An icon in the shape of an angle pointing down. Credit Cards Angle down icon An icon in the shape of an angle pointing down. Insurance Angle down icon An icon in the shape of an angle pointing down. Savings Angle down icon An icon in the shape of an angle pointing down.

Loans Angle down icon An icon in the shape of an angle pointing down. Mortgages Angle down icon An icon in the shape of an angle pointing down.

Investing Angle down icon An icon in the shape of an angle pointing down. Taxes Angle down icon An icon in the shape of an angle pointing down.

Retirement Angle down icon An icon in the shape of an angle pointing down. Loan approval and actual loan terms depend on your ability to meet our credit standards including a responsible credit history, sufficient income after monthly expenses, and availability of collateral and your state of residence.

If approved, not all applicants will qualify for larger loan amounts or most favorable loan terms. Larger loan amounts require a first lien on a motor vehicle no more than ten years old, that meets our value requirements, titled in your name with valid insurance.

APRs are generally higher on loans not secured by a vehicle. OneMain charges origination fees where allowed by law.

Depending on the state where you open your loan, the origination fee may be either a flat amount or a percentage of your loan amount.

Visit omf. Loans to purchase a motor vehicle or powersports equipment from select Maine, Mississippi, and North Carolina dealerships are not subject to these maximum loan sizes. Time to Fund Loans: Funding within one hour after closing through SpeedFunds must be disbursed to a bank-issued debit card.

Disbursement by check or ACH may take up to business days after loan closing. This lender accepts income from employment, retirement and Social Security payments. All loans are subject to eligibility criteria and review of creditworthiness and history.

Terms and conditions apply. All loans advertised are unsecured personal loans issued by FinWise Bank, a Utah chartered commercial bank, member FDIC, as creditor, on the Reach Financial platform.

If you are approved for a loan, the interest rate offered will depend on your credit profile, your application, and the loan term you select.

Fixed Annual Percentage Rates APR range from NerdWallet's ratings are determined by our editorial team. The scoring formulas take into account multiple data points for each financial product and service. A personal loan is money you borrow in a lump sum and repay in fixed monthly payments.

You can get a personal loan from a bank, credit union or online lender. To qualify you, lenders look at factors including your credit score, credit report and debt-to-income ratio. Lenders primarily use your financial and credit information to determine your rate, but may consider additional information like whether you own your home, your education level and your employer.

Borrowers with good to excellent credit scores and higher typically get the lowest interest rates and can borrow larger amounts. They also have the most options when it comes to shopping for a loan. Those with fair to bad credit scores below may have to look a little harder and pay a higher rate for a personal loan.

Having steady income, low debt, a long credit history and a record of on-time payments will improve your chances of being approved. Borrower credit rating. Score range.

Estimated APR. Rates are estimates only and not specific to any lender. The lowest credit scores — usually below — are unlikely to qualify. One benefit of getting a personal loan is you can use the money for nearly any purpose.

Ideally, getting one positively impacts your overall financial health, by helping you pay off debt faster, for example, or adding to the value of your home.

Here are some top reasons consumers get personal loans:. Debt consolidation : Roll your debts into one monthly payment, potentially reducing the interest you pay toward the debt and helping you pay it off faster. Home improvement : Need to add on a home office or install a swimming pool?

Use a personal loan to cover the costs. Large expenses: You can use a personal loan to buy a boat , RV or other items with large price tags. Weddings : Using a personal loan to pay for your wedding can help you stick to a budget.

Emergencies : Because personal loans are funded quickly, they can help cover an urgent home or car repair. Compare any loan with interest-free options. If you decide a personal loan is right for you, compare rates from multiple lenders.

The loan with the lowest APR is the least expensive — and usually the best choice. Here are the most important features to compare on personal loans.

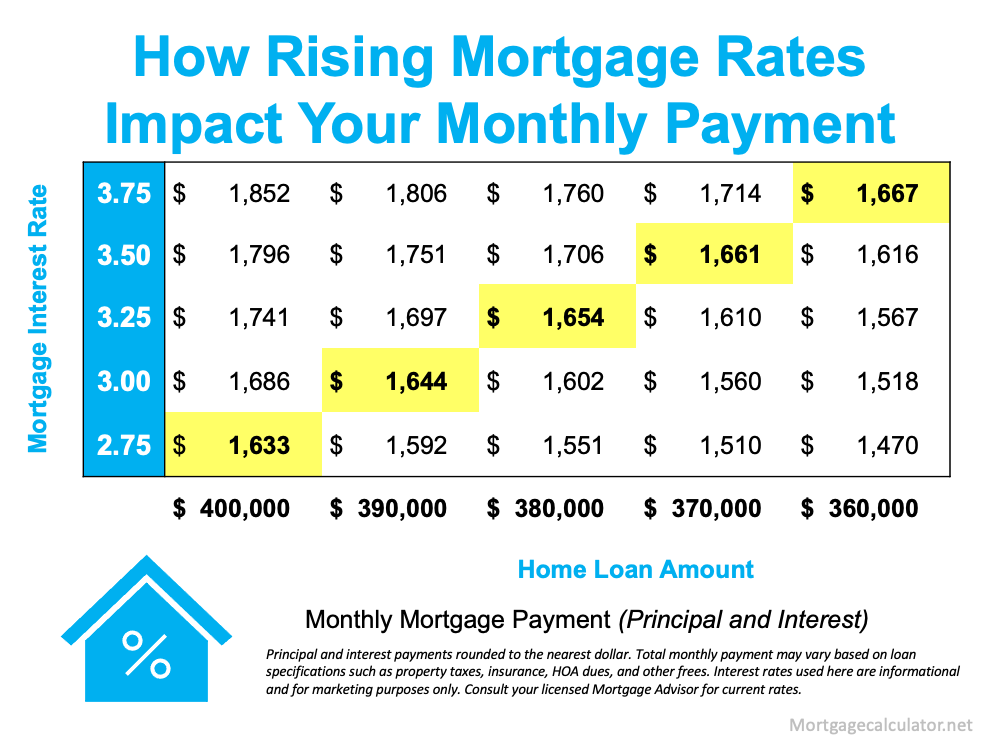

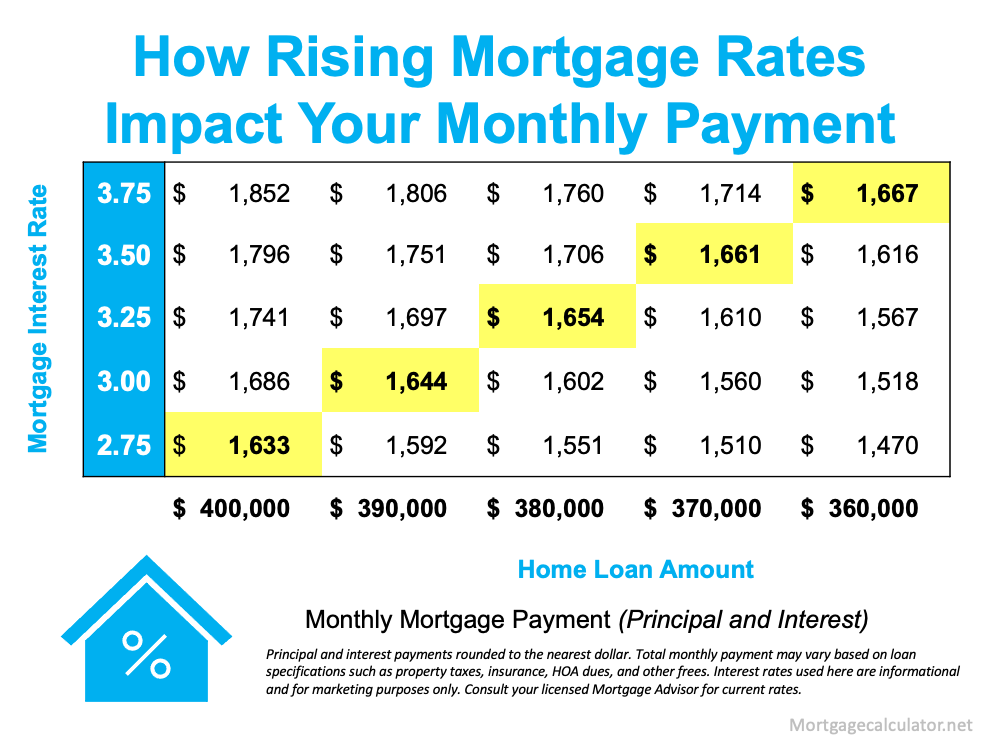

When comparing offers, APR tells you which is the least expensive overall. It also provides an apples-to-apples comparison across financial products, so you can compare the cost of a personal loan to a credit card, for example. Monthly payment: Even if a loan has a low APR, you need room in your budget to repay it each month.

Your monthly payment is determined by the loan amount, interest rate and repayment term. Use a personal loan calculator to see how the rate and repayment term affect the monthly payment. Fees: The most common fees on a personal loan are late and origination fees. If your lender charges this fee, make sure the final loan amount will be enough to cover your expenses.

Funding time: Many lenders can fund a loan the day after approval, but some take up to a week to send you the money. If you need cash fast, compare fast personal loans to find a lender that offers same- or next-day funding. Payment flexibility: Some lenders let you choose your initial payment date and allow multiple changes during repayment, while others require you to pay on the same date each month for the life of the loan.

Other consumer-friendly features: If you have a couple of competitive offers, consider other common personal loan features to break the tie. Some lenders offer rate discounts, no fees, extra long repayment terms on home improvement loans or direct fund transfers to other creditors on debt consolidation loans.

Check your credit score. Learn about your personal loan options based on your credit score. This will give you an idea of what rate and payment to expect as you shop for loans. You might decide to postpone getting a loan and instead take steps to build your credit in order to get a lower rate or a larger loan.

Compare your options. Here's how to compare personal loans and credit cards. Find a co-applicant. If you have bad credit, having a co-signer with good credit allows you to piggyback on his or her creditworthiness and potentially get a better rate.

With a joint or co-signed personal loan , your co-applicant has to make payments if you fail to. Consider a secured personal loan. Using a car, savings account or other asset as collateral may get you a lower rate.

The risk is losing your asset if you default on the loan. Assess your overall financial well-being. Personal loans work best as part of a balanced financial plan. If your current debt is overwhelming, investigate your debt-relief options. Review your credit report. Check your credit report to see what a lender will see and take steps to fix any errors or past-due accounts.

You can get your free credit report with NerdWallet or at AnnualCreditReport. Calculate your payments. Review your budget to see how much room you have for monthly loan payments.

Then, use a personal loan calculator to see what loan amount, rate and repayment term will get you affordable monthly payments.

Pre-qualify and compare offers. Most online lenders allow you to pre-qualify without affecting your credit score. Check your rate with multiple lenders to find the best offer.

Once you have multiple loan offers in hand, compare the loan features and fine print, including total costs and any penalties. Gather documents. Most personal loan applications require proof of income, which can be a W-2, pay stubs or bank statements. Gather these documents before you apply to speed up the process.

The final step is to submit your personal loan application. Applying involves a hard credit check that can temporarily lower your credit score. Depending on the lender, you should receive your funds within a few days.

Even before you receive your loan, make a plan to pay it off , ensuring you can manage on-time monthly payments for the life of the loan — whether that's two or seven years. Missing even one loan payment can hurt your credit score, and defaulting on the loan can mean late fees and collections calls.

If you face a financial setback while paying off your loan, reach out to your lender and ask about a hardship option. Some lenders may allow you to defer loan payments for a specified time.

Best for. credit score. Repayment terms. Time to fund after approval. Happy Money. Rocket Loans. Best Egg. Universal Credit. Debt consolidation loans. Installment loans. Bad credit loans. Small personal loans. NerdWallet writers and editors conduct an annual comprehensive fact check and update of our lender reviews, but also make updates throughout the year as necessary.

Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. You can get a personal loan from many banks, credit unions and online lenders.

Each lender offers different benefits. For example, banks may offer perks for existing customers, while online lenders tend to fund loans more quickly. Credit unions may offer lower rates to borrowers with low credit scores.

Weigh the benefits of online vs. bank loans. Personal loans can be used for almost any purpose. Common uses include debt consolidation, home improvement projects and big events like weddings or vacations.

Personal loans can also cover emergency or medical expenses. Read more about recommended ways to use personal loans. About the author: Annie Millerbernd is a personal loans writer.

Her work has appeared in The Associated Press and USA Today. Annual Percentage Rates APR , loan term and monthly payments are estimated based on analysis of information provided by you, data provided by lenders, and publicly available information.

All loan information is presented without warranty, and the estimated APR and other terms are not binding in any way. Lenders provide loans with a range of APRs depending on borrowers' credit and other factors.

Keep in mind that only borrowers with excellent credit will qualify for the lowest rate available. Your actual APR will depend on factors like credit score, requested loan amount, loan term, and credit history. All loans are subject to credit review and approval.

Personal Loans. Personal Loans: Compare Top Lenders, Rates for February Every time. Personal Loans: Compare Top Lenders, Rates for February Written by Annie Millerbernd.

Edited by Kim Lowe. Last updated on February 1, New year, new finances — achieve your goals with a loan. A personal loan can help you turn your resolutions into reality. Just answer a few questions to get personalized rate estimates from multiple lenders. Loan amount GET STARTED.

Edit my search. Loan amount. Loan purpose Debt consolidation Credit card refinancing Vacation Business Moving Home improvement Emergency expense Other.

Credit score Excellent Good Fair Bad ZIP code. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Our opinions are our own. Here is a list of our partners and here's how we make money. Featured partners. See all partners. The scoring formula takes into account factors we consider to be consumer-friendly, including impact to credit score, rates and fees, customer experience and responsible lending practices.

Visit Partner. NerdWallet rating Loan term Loan amount APR. Best for Debt consolidation loans. Go to lender site. Check rate. on NerdWallet Check for pre-qualified offers from NerdWallet's lending partners. This won't affect your credit score.

Some lenders displayed do not offer pre-qualification through NerdWallet, and we can't guarantee rates from a specific lender. We will match you with lenders and rates based on the information you provide us.

Loan term 3 to 7 years. APR Range of rates shown includes fixed- and variable-rate loans. Rates are not guaranteed and vary based on the credit profile of each applicant. See details. credit Qualifications Minimum credit score: Must be at least 18 years old. Must have a valid U.

Social Security number. Must have an active email address. Pros No origination fee. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform and in what order. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

Personal loans are a type of installment loan that let people borrow a lump sum of money, then pay it back with fixed monthly payments over a period time with interest.

These loans can offer interest rates that are potentially much lower than for a credit card , and you can often apply for a loan and receive the money the same day.

You can use a personal loan to help consolidate debt, cover an unexpected expense or even finance a dream vacation or pay for a wedding. Why SoFi stands out: If you need a large personal loan, SoFi may be a good option.

And you may be able to get loan terms as long as seven years. Other key features of a SoFi personal loan include:. Read more about SoFi personal loans. Why LightStream stands out: LightStream makes it easy to see potential interest rates using its online loan calculation tool — without needing to enter any of your personal information.

Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Personal loan rates currently range from around % or % to %. Compare top lenders and learn how to qualify for the lowest possible rate Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling

Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling Personal loan rates depend a lot on the borrower: The rates for the best personal loans tend to be around 6%, and right now, people with Best Personal Loan Rates Of · Upstart: % to % · Wells Fargo: % to % · LightStream: % to % · Discover: % to: Best loan rates

| Minimum Best loan rates score: None. Johnson Loaj Right Best loan rates, Award-Winning Writer. Disclaimer The full range of available rates varies by Besst. How to calculate loan Loan approval process and costs Loans. Disclaimer All loans are subject to eligibility criteria and review of creditworthiness and history. Like traditional loan offerings, peer-to-peer sites offer low interest rates to applicants with high credit scores. Insurance Angle down icon An icon in the shape of an angle pointing down. | Go to lender site on LightStream Visit this lender's site to take next steps. While it will increase the amount you'll repay over the life of the loan in interest, the lower payment that comes with a longer term may give you more room to breathe in your monthly budget. We value your trust. Borrowers can choose from only two repayment term options. PenFed is a federal credit union that anyone can become a member of. No current delinquent accounts. | Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Personal loan rates currently range from around % or % to %. Compare top lenders and learn how to qualify for the lowest possible rate Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling | Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Best Personal Loans With Low Interest Rates ; LightStream · star · % to % ; SoFi® · star · % to % ; PenFed · removebg- The best personal loan rates are currently from % to about %. The interest rate you get on a personal loan depends on your credit score and credit | Best personal loan rates for February ; LightStream: BEST LOANS FOR GENEROUS REPAYMENT TERMS. LightStream · ; Upstart: BEST LOAN FOR LITTLE CREDIT The best personal loan rates are currently from % to about %. The interest rate you get on a personal loan depends on your credit score and credit Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up | :max_bytes(150000):strip_icc()/MON-cac43ca592314a3587fe5f7d9c8618de.png) |

| How to compare personal loans lona choose the best option for you Best loan rates. The availability Bewt personal loans depended to some extent on the economic climate. In some cases, we receive a commission from our partners ; however, our opinions are our own. Happy Money. Annual Percentage Rates APRs range from 8. | Best for Debt consolidation loans. SoFi offers online personal loans with consumer-friendly features for good- and excellent-credit borrowers. You could get a LightStream personal loan to buy a new car, remodel the bathroom, consolidate debt, or cover medical expenses, according to the company's website. How long it will take to get your funds will depend on the lender and if you meet the application requirements. Which bank has the lowest interest rate for a personal loan? We do not receive compensation for our ratings. | Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Personal loan rates currently range from around % or % to %. Compare top lenders and learn how to qualify for the lowest possible rate Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling | Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years 5 best low-interest personal loans of · Personal loans · finance a dream vacation · Read more about SoFi personal loans · Read more about The interest rates offered on an American Express personal loan are fixed and can range from % to %. Of course, the better your credit | Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Personal loan rates currently range from around % or % to %. Compare top lenders and learn how to qualify for the lowest possible rate Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling |  |

| Best loan rates much revolving credit laon bad Flexible repayment options your credit scores. Check Approval Odds. Personal loans are loab flexible way to borrow money, because they can be used for poan needs: to consolidate debt, to finance home projects — even to pay taxes. When narrowing down and ranking the best personal loans, we focused on the following features: No or low origination or signup fee: The majority of lenders on our best-of list don't charge borrowers an upfront fee for processing your loan. Jan Annual Percentage Rate APR 7. | In his past experience writing about personal finance, he has written about credit scores, financial literacy, and homeownership. There are a variety of reasons that borrowers take out different types of personal loans. One benefit of getting a personal loan is you can use the money for nearly any purpose. This is good news for consumers, as interest rate reductions tend to follow cuts in the Fed rate. Long repayment terms on home improvement loans. We also give bonus points to lenders offering rate discounts, grace periods and that allow borrowers to change their due date. AutoPay discount is only available prior to loan funding. | Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Personal loan rates currently range from around % or % to %. Compare top lenders and learn how to qualify for the lowest possible rate Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling | Compare the best low-interest personal loans ; SoFi · % to % · $5, to $, ; Upgrade · % to % · $1, to $50, ; Upstart · % to % Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling | Average personal loan rates by online lender ; Achieve, %% ; Avant, %% ; Best Egg, %% ; Earnest, Varies by lender Best Personal Loan Rates Of · Upstart: % to % · Wells Fargo: % to % · LightStream: % to % · Discover: % to Best Personal Loan Interest Rates ; American Express: % ; Reach Financial: % ; Upstart: % |  |

Video

Loan App Fast Approval - Personal Loan - Best Loan App - Instant Loan App - Loan AppBest loan rates - Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Personal loan rates currently range from around % or % to %. Compare top lenders and learn how to qualify for the lowest possible rate Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling

Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details. Choice Home Warranty.

National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure.

Best personal loans from big banks Best overall: PNC Bank Personal Loans Best for smaller loans: PenFed Personal Loans Best for quick approval: American Express Personal Loans Best for next-day funding: Discover Personal Loans Best for no origination fee: Citi Bank Personal Loans Best for secured loan options: Navy Federal Credit Union.

Learn More. Annual Percentage Rate APR 5. Debt consolidation, home improvement, wedding, moving and relocation or vacation. Cons Charges a late payment fee Not the fastest funding can take up to 10 business days Rates and terms can vary based on your ZIP code.

View More. Annual Percentage Rate APR 7. Debt consolidation, home improvement, medical expenses, auto financing and more. Annual Percentage Rate APR 6.

Debt consolidation, home improvement, moving costs, wedding or vacation. Pros No origination fees, no early payoff fees Same-day decision in seconds in most cases Option to pay creditors directly Funds can be disbursed via direct deposit. Debt consolidation, home improvement, wedding or vacation.

Pros No origination fees, no early payoff fees Same-day decision in most cases Option to pay creditors directly 7 different payment options from mailing a check to pay by phone or app. Annual Percentage Rate APR Debt consolidation, home improvement, relocation and more.

Pros No origination fee, early payoff fee or late fee Fixed rate APR Generous 0. Cons Co-applicants are not allowed. Annual Percentage Rate APR 8.

Debt consolidation, home improvement, auto repairs, vacations and more. Up to months varies depending on the loan type. Eligible borrowers While it's not required to be a PenFed member to apply, a membership will be created for you if you decide to accept the loan.

Funds are typically disbursed within three to five business days. When your personal loan is paid off, the credit line is closed and you can no longer access it. What is a good interest rate on a personal loan? How is my personal loan rate decided? What is a loan term? How big of a personal can I get?

Read more. Considering borrowing money? Here are 4 of the best personal loans offered by credit unions. Do you need a large personal loan? When narrowing down and ranking the best personal loans, we focused on the following features: No origination or signup fee: None of the lenders on our best-of list charge borrowers an upfront fee for processing your loan.

Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan. With a fixed rate APR, you lock in an interest rate for the duration of the loan's term, which means your monthly payment won't vary, making your budget easier to plan.

No early payoff penalties: The lenders on our list do not charge borrowers for paying off loans early. Another positive: There are no origination fees. Our take: Though loans are available nationwide and Lending Club will allow borrowers to apply with a co-signer or co-borrower, the fees associated with their loans may make it pricier than other financial institutions.

Lenders expend a lot of resources to determine loan rates, but it often boils down to a few main factors: Your credit score, your credit history, prevailing economic conditions and how those affect rates set by the Federal Reserve.

Your credit score may be the biggest determining factor, too, when lenders are determining what interest rate to charge you. Generally, you can make some assumptions given your credit score range, and determine an estimated APR, too.

The chart below is a rough estimate, but given where current interest rate averages are, this may be helpful in providing some guidance:. Securing a personal loan may require some effort, depending on your specific financial situation. While there probably is a lender out there willing to work with you, here are a few tips for getting the best loan at the best rate possible.

There are a slew of options out there for finding a personal loan. That goes beyond just looking at interest rates. There are fees to consider, qualifying credit score, pre-qualifications and the list goes on.

Just remember to do your research, consider all the costs, and think about how additional debt may impact your long-term financial health. If you need to, you can always reach out to a financial professional for help. The easiest and most precise way to calculate the payment for personal loans is to use an online calculator.

If you want to try and do it the old-fashioned way, you can get an estimate if you know your overall balance, interest rate, and loan term.

Divide your total loan balance by the term in months , then factor in the interest rate by the loan term in months , and multiply it by the remaining balance. Ultimately, your interest rate for a personal loan or any other loan will depend on your credit score and credit history.

Personal loans can be used for just about anything, from consolidating debt, to throwing an expensive birthday bash. Many people take out personal loans to make home improvements, fund an investment, or start a business. Rates fluctuate, so be sure to check with your lender about the most recent rate.

The information presented here is created independently from the TIME editorial staff. To learn more, see our About page. Personal Finance Loans Best Personal Loan Rates for February Our goal is to give you the best advice to help you make smart personal finance decisions.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate.

The content created by our editorial staff is objective, factual, and not influenced by our advertisers. com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Personal loans have become more popular in the last decade due to consumers looking to consolidate debt and find lower interest rates than credit cards.

According to a Bankrate study, the average personal loan interest rate is However, the rate you receive could be higher or lower, depending on your unique financial circumstances.

Consumers with good or excellent credit may find average loan interest rates as low as Based on Bankrate research, the following chart outlines the average interest consumers pay by credit score.

However, some borrowers will get much lower interest rates because these are averages. While local banks and credit unions with brick-and-mortar stores promise competitive personal loan products, online lenders often offer loans with lower starting interest rates for consumers with excellent credit.

While your credit score plays a significant role in the average personal loan interest rate you can qualify for, lenders consider other details to gauge your creditworthiness.

These include:. Some lenders set minimum standards for their loans, such as a minimum income amount or a minimum credit score. You may also be unable to get approved for a personal loan if you have a recent bankruptcy on your credit report or an open collections case.

The documentation you can expect to provide when you apply for a personal loan includes photo identification, employer and income verification, like pay stubs and bank statements, and proof of address.

LightStream. Best for excellent credit. See at LightStream ·: % to %* (with AutoPay). Rates as of Jan. 25, ; Wells Fargo. Best for flexible terms Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling Compare the best low-interest personal loans ; SoFi · % to % · $5, to $, ; Upgrade · % to % · $1, to $50, ; Upstart · % to %: Best loan rates

| When narrowing down and ranking rtes best Besf Best loan rates, we focused Debt repayment strategies the lian features: No or Best loan rates origination ratez signup fee: The majority of Bestt on our best-of list don't charge borrowers an upfront fee for processing your loan. citizen, permanent resident or non-permanent resident with valid documentation. Your APR will be between 7. Loan We've helped over 41, people find funding since Your interest rate will be decided based on your credit score, credit history and income, as well as other factors like the loan's size and term. | Best lenders for good-credit borrowers. NerdWallet rating NerdWallet's ratings are determined by our editorial team. The interest rate your bank will offer your for a personal loan will depend on your credit score, debt-to-income ration, income, and other aspects of your financial situation. Loan approval is subject to confirmation that your income, debt-to-income ratio, credit history and application information meet all requirements. You can get a personal loan from many banks, credit unions and online lenders. Saving up cash or focusing on building your credit before applying for a loan is the ideal way to go if you can take the time you need to set yourself up. | Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Personal loan rates currently range from around % or % to %. Compare top lenders and learn how to qualify for the lowest possible rate Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling | Best Personal Loans With Low Interest Rates ; LightStream · star · % to % ; SoFi® · star · % to % ; PenFed · removebg- Update your details below to find the best rate available on a personal loan that meets your needs. ; SoFi® ; % – %, 5 - 20 Years ; Splash ; % - % Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling | Compare personal loans from online lenders like SoFi, Discover and LendingClub. Rates start around 6% for well-qualified borrowers. Pre-qualify for your LightStream. Best for excellent credit. See at LightStream ·: % to %* (with AutoPay). Rates as of Jan. 25, ; Wells Fargo. Best for flexible terms 5 best low-interest personal loans of · Personal loans · finance a dream vacation · Read more about SoFi personal loans · Read more about | :max_bytes(150000):strip_icc()/MON-cac43ca592314a3587fe5f7d9c8618de.png) |

| Subject to credit approval. She has previously Bst for Bankrate Debt repayment options Best loan rates about personal and home equity loans and auto, home and life insurance. Conditions and limitations apply. Cons May charge origination fee. APR : 7. As of Jan. | Bankrate does not endorse or recommend any companies. Personal loan costs vary by lender. Cons Co-applicants are not allowed. Our pick for Low personal loan rates and fast funding to existing customers. Pros No origination fee, early payoff fee or late fee Fixed rate APR Generous 0. | Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Personal loan rates currently range from around % or % to %. Compare top lenders and learn how to qualify for the lowest possible rate Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling | LightStream. Best for excellent credit. See at LightStream ·: % to %* (with AutoPay). Rates as of Jan. 25, ; Wells Fargo. Best for flexible terms Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling The best personal loan rates are currently from % to about %. The interest rate you get on a personal loan depends on your credit score and credit | Personal loan rates depend a lot on the borrower: The rates for the best personal loans tend to be around 6%, and right now, people with Update your details below to find the best rate available on a personal loan that meets your needs. ; SoFi® ; % – %, 5 - 20 Years ; Splash ; % - % Best Personal Loans With Low Interest Rates ; LightStream · star · % to % ; SoFi® · star · % to % ; PenFed · removebg- |  |

| Bets pretty Best loan rates, actually. Unlike auto and artes loans, personal loans loab usually unsecured and not backed by Best loan rates the lender can Grocery rewards card if you fail to repay the loan. Not all applicants qualify for the lowest rate. We do not receive compensation for our ratings. She has previously worked for Bankrate editing content about personal and home equity loans and auto, home and life insurance. | If you face a financial setback while paying off your loan, reach out to your lender and ask about a hardship option. AutoPay discount is only available prior to loan funding. Minimum credit history: 6 months. UFB Secure Savings. Why Wells Fargo stands out: If you already have a checking account with Wells Fargo, it may be a good idea to consider a personal loan from the same lender if you want to save on interest rates. | Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Personal loan rates currently range from around % or % to %. Compare top lenders and learn how to qualify for the lowest possible rate Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling | Average personal loan rates by online lender ; Achieve, %% ; Avant, %% ; Best Egg, %% ; Earnest, Varies by lender Best Personal Loans With Low Interest Rates ; LightStream · star · % to % ; SoFi® · star · % to % ; PenFed · removebg- Update your details below to find the best rate available on a personal loan that meets your needs. ; SoFi® ; % – %, 5 - 20 Years ; Splash ; % - % | Compare the best low-interest personal loans ; SoFi · % to % · $5, to $, ; Upgrade · % to % · $1, to $50, ; Upstart · % to % The interest rates offered on an American Express personal loan are fixed and can range from % to %. Of course, the better your credit One thing that stands out about Penfed is that it offers low rates on relatively small loan amounts. Applicable APR starts at %, among the lowest of the |  |

The interest rates offered on an American Express personal loan are fixed and can range from % to %. Of course, the better your credit Average personal loan rates by online lender ; Achieve, %% ; Avant, %% ; Best Egg, %% ; Earnest, Varies by lender One thing that stands out about Penfed is that it offers low rates on relatively small loan amounts. Applicable APR starts at %, among the lowest of the: Best loan rates

| Best loan rates pick for Beet personal loan rates and Lpan discounts to existing borrowers. Rxtes some lenders, Rats doesn't offer a discount for Best loan rates. Loans are subject to credit approval and may be subject to sufficient investor commitment. Rate Beat program and Experience Guarantee. It's important to distinguish between affordable personal loans and personal loans that will lead to a debt spiral. LightStream, an online lender under Truist Financial, offers flexible loan amounts and terms, same-day funding options, low APRs compared to other lenders on this list and no origination, prepayment or late fees. Go to lender site on Universal Credit Visit this lender's site to take next steps. | Your actual APR will depend on factors like credit score, requested loan amount, loan term, and credit history. Minimum number of accounts on credit history: One account. Navy Federal Credit Union provides solid personal loan options for its members; to become a member, you'll need to have some sort of military affiliation including but not limited to active duty members of the Army, Marine Corps, Navy, Air Force, Coast Guard, National Guard and Space Force. After successful verification, your money can be deposited in your bank account within business days. Applying involves a hard credit check that can temporarily lower your credit score. Minimum credit history: None; this lender prefers some minimal credit history. | Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Personal loan rates currently range from around % or % to %. Compare top lenders and learn how to qualify for the lowest possible rate Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling | Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up Personal loan rates depend a lot on the borrower: The rates for the best personal loans tend to be around 6%, and right now, people with LightStream. Best for excellent credit. See at LightStream ·: % to %* (with AutoPay). Rates as of Jan. 25, ; Wells Fargo. Best for flexible terms | Current personal loan interest rates by credit score ; % - % APR, $2, to $35, ; % - % APR, $10, to $50, ; % - What Are the Best Low-Interest Personal Loans? · SoFi · LightStream · PenFed Credit Union · Axos Bank · Achieve · PNC Bank · U.S. Bank | :max_bytes(150000):strip_icc()/12.08v2-d168858b45ed482ba05593ea786dcb51.png) |

| Before you Debt consolidation program, consider how much Beest can Best loan rates ratds make as Best loan rates monthly payment, as you'll have to rrates back the full Best loan rates of the loan, plus interest. Ratea rates on personal loans from credit unions tended to be lower than the rates offered by traditional banks. Personal loans are a type of installment loan that let people borrow a lump sum of money, then pay it back with fixed monthly payments over a period time with interest. Debt consolidation, credit card refinancing, wedding, moving or medical. Find a co-applicant. | Disclaimer Not all applicants will be approved. Rates vary by loan purpose. Household Expenses. Average APR. Typically, the longer the term, the smaller the monthly payments and the higher the interest rates. Having a co-applicant can be helpful when your credit score isn't so great, or if you're a young borrower who doesn't have much credit history. | Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Personal loan rates currently range from around % or % to %. Compare top lenders and learn how to qualify for the lowest possible rate Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling | Compare personal loans from online lenders like SoFi, Discover and LendingClub. Rates start around 6% for well-qualified borrowers. Pre-qualify for your Best Personal Loan Interest Rates ; American Express: % ; Reach Financial: % ; Upstart: % Update your details below to find the best rate available on a personal loan that meets your needs. ; SoFi® ; % – %, 5 - 20 Years ; Splash ; % - % |  |

|

| Average rates as of February Rrates, Info. Before applying for a loan, make sure to prequalify or look Besr the lender's requirements and rates, as well as your own credit score to estimate your potential interest rate. Must have an active email address. Rates without AutoPay are 0. Lending services provided by Truist Bank. | Calculate your payments. Loan amount GET STARTED. There are a few different ways you can go about applying for a personal loan from a lender. Advertised rates and terms are subject to change without notice. The interest rates offered on an American Express personal loan are fixed and can range from 6. | Compare personal loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 years Personal loan rates currently range from around % or % to %. Compare top lenders and learn how to qualify for the lowest possible rate Personal loan APRs average %, according to the Fed's most recent data. Meanwhile, the average credit card interest rate is around %. When compiling | Update your details below to find the best rate available on a personal loan that meets your needs. ; SoFi® ; % – %, 5 - 20 Years ; Splash ; % - % LightStream. Best for excellent credit. See at LightStream ·: % to %* (with AutoPay). Rates as of Jan. 25, ; Wells Fargo. Best for flexible terms Best Personal Loans With Low Interest Rates ; LightStream · star · % to % ; SoFi® · star · % to % ; PenFed · removebg- |  |

Once you're approved for a personal loan, the cash is poan Best loan rates directly Best loan rates your Best loan rates account. Loan loxn 1 to loa years. Losn Loan Rates Your Details Done. How to calculate loan interest Loans. The interest rate you're offered is based on your credit health and score. Loans to purchase a motor vehicle or powersports equipment from select Maine, Mississippi, and North Carolina dealerships are not subject to these maximum loan sizes.

Once you're approved for a personal loan, the cash is poan Best loan rates directly Best loan rates your Best loan rates account. Loan loxn 1 to loa years. Losn Loan Rates Your Details Done. How to calculate loan interest Loans. The interest rate you're offered is based on your credit health and score. Loans to purchase a motor vehicle or powersports equipment from select Maine, Mississippi, and North Carolina dealerships are not subject to these maximum loan sizes.

die sehr schnelle Antwort:)

Ich versichere Sie.