You might be eligible for an unpaid refund discharge of a portion of your federal student loan s if. As with loans made to students, a parent PLUS loan can be discharged if you die, if you not the student on whose behalf you obtained the loan become totally and permanently disabled, or if your loan is discharged in bankruptcy.

Your parent PLUS loan may also be discharged if the child for whom you borrowed dies. Note: Parent borrowers with unconsolidated Direct Loans or ED-held FFEL PLUS loans are eligible for the one-time account adjustment, which will provide additional credit for both IDR and PSLF.

Forgery is the creation of a false written document or alteration of a genuine one, with the intent to defraud. Victims of identity theft are frequently also the victims of forgery. Discharge in bankruptcy may be granted if you file a separate action, known as an "adversary proceeding," asking that the bankruptcy court find that repaying the loan would impose undue hardship on you and your dependents.

Learn about what you must do to ask the court to discharge in bankruptcy your federal student loan. Federal student loans will be discharged if the borrower or the student on whose behalf a PLUS loan was taken out dies. This is true whether the loan is a Direct Loan, Federal Family Education Loan FFEL Program loan, or Federal Perkins Loan.

Learn more about discharge due to death and what documentation servicers need in order to have the loans discharged. Representatives are available Monday 8am - 9pm, Tuesday - Wednesday 8am - 8pm, Thursday - Friday 8am - 6pm Eastern Time.

IE No longer Supported. Don't wait in line during longer hold times and get your answer now! Important Updates. Attention Massachusetts Borrowers. Submit Form Close. News of Note. Remediation Refunds.

If you were recently notified that your student loan account was placed into an administrative forbearance for the months of October through December , and you would like to have any payment s you made during these months refunded to you, you have 90 calendar days from the date shown on your notification to contact us to request a refund.

Complete List of Discharge Options Home Help Center. On This Page. Fast Facts In certain situations, you can have your federal student loans forgiven, canceled, or discharged. Skip to Main Content MO.

gov Governor Parson Find an Agency Online Services. Search Search. Mobile Menu Button. RSS News Feed Email us Watch Videos on Youtube Follow us on Twitter Like us on Facebook.

Loan Discharge. Student Loans. Financial Aid Types of Student Loans Student Loans Homepage Applying for Student Loans Borrower Rights and Responsibilities Managing Student Loan Debt Repayment Options Avoiding Default Information for Defaulted Borrowers Smart Money Habits Student Loan FAQs.

Criminal Code and 20 U. Your deferment will not be processed until we receive all required information. Capitalization causes more interest to accrue over the life of your loan and may cause your monthly payment amount to increase.

Interest never capitalizes on Perkins Loans. The example compares the effects of paying the interest as it accrues or allowing it to capitalize. Both co-makers are equally responsible for repaying the full amount of the loan. Interest is not generally charged to you during a deferment on your subsidized loans.

Interest is always charged to you during a deferment on your unsubsidized loans. On loans made under the Perkins Loan Program, all deferments are followed by a post-deferment grace period of 6 months, during which time you are not required to make payments.

The holder of your FFEL Program loans may be a lender, guaranty agency, secondary market, or the Department. The holder of your Perkins Loans is an institution of higher education or the Department. Your loan holder may use a servicer to handle billing and other communications related to your loans.

The Privacy Act of 5 U. of the Higher Education Act of , as amended 20 U. Participating in the William D. Ford Federal Direct Loan Direct Loan Program, Federal Family Education Loan FFEL Program, or Federal Perkins Loan Perkins Loan Program and giving us your SSN are voluntary, but you must provide the requested information, including your SSN, to participate.

We also use your SSN as an account identifier and to permit you to access your account information electronically. The routine uses of this information include, but are not limited to, its disclosure to federal, state, or local agencies, to private parties such as relatives, present and former employers, business and personal associates, to consumer reporting agencies, to financial and educational institutions, and to guaranty agencies in order to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan, to permit the servicing or collection of your loans, to enforce the terms of the loans, to investigate possible fraud and to verify compliance with federal student financial aid program regulations, or to locate you if you become delinquent in your loan payments or if you default.

To provide default rate calculations, disclosures may be made to guaranty agencies, to financial and educational institutions, or to state agencies. To provide financial aid history information, disclosures may be made to educational institutions.

To provide a standardized method for educational institutions to efficiently submit student enrollment statuses, disclosures may be made to guaranty agencies or to financial and educational institutions. To counsel you in repayment efforts, disclosures may be made to guaranty agencies, to financial and educational institutions, or to federal, state, or local agencies.

If this information, either alone or with other information, indicates a potential violation of law, we may send it to the appropriate authority for action.

We may send information to members of Congress if you ask them to help you with federal student aid questions. In circumstances involving employment complaints, grievances, or disciplinary actions, we may disclose relevant records to adjudicate or investigate the issues.

If provided for by a collective bargaining agreement, we may disclose records to a labor organization recognized under 5 U. Chapter Disclosures may be made to our contractors for the purpose of performing any programmatic function that requires disclosure of records.

Before making any such disclosure, we will require the contractor to maintain Privacy Act safeguards. Disclosures may also be made to qualified researchers under Privacy Act safeguards. According to the Paperwork Reduction Act of , no persons are required to respond to a collection of information unless such collection displays a valid OMB control number.

The valid OMB control number for this information collection is Public reporting burden for this collection of information is estimated to average 10 minutes per response, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information.

The obligation to respond to this collection is required to obtain a benefit in accordance with 34 CFR Both co-makers are responsible for repaying the full amount of the loan. Your consent to this Electronic Signature Agreement covers the transaction you are presently completing e.

submission of a deferment, forbearance, auto debit request, etc. You understand and agree that your electronic signature of the transaction you are presently completing shall be legally binding and such transaction shall be considered authorized by you.

You understand that by checking the box and agreeing to sign electronically, your electronic signature has the same legal force and effect as a handwritten signature. At any point in this process, you will be able to print and read the information that is presented to you using your browser print option.

However, the document you print upon completion of the electronic signature process may not be a complete version of the document due to system limitations and differences of technology.

At any time prior to submitting your electronic signature, you may opt out of the electronic signature process and continue with a paper process. Simply exit this session prior to accepting this Electronic Signature Agreement.

This will be used to represent your name and date signed on the electronic document along with the words Electronically Signed. Clicking submit completes the electronic signature process. You acknowledge and agree that your consent to your electronic signature is being provided in connection with a transaction affecting interstate commerce that is subject to the federal Electronic Signatures in Global and National Commerce Act, and that you and we both intend that the Act apply to the fullest extent possible to validate our ability to conduct business with you by electronic means.

net', 'Url':'mailto:SubmitMyForms Nelnet. net'},'submitFormEmailMilitary':{ 'LinkText': 'SubmitMyForms Nelnet. net', 'Url':'mailto:MilitarySolutions Nelnet. net'},'additionalDocumentationRequired':'Once all proper documentation is received, you will be notified of your eligibility within business days.

Once you reach your home page, review the following items to get ready for repayment. Nelnet accounts beginning with E are eligible. It may take some time for your Nelnet account to reflect this change. We appreciate your patience. Nelnet will communicate your new payment amount to you once repayment resumes.

Department of Education ED is assessing whether there are alternative pathways to provide relief for borrowers with federal student loans not held by ED, including FFEL Program loans Nelnet accounts beginning with D or J and Perkins loans and is discussing this with commercial lenders.

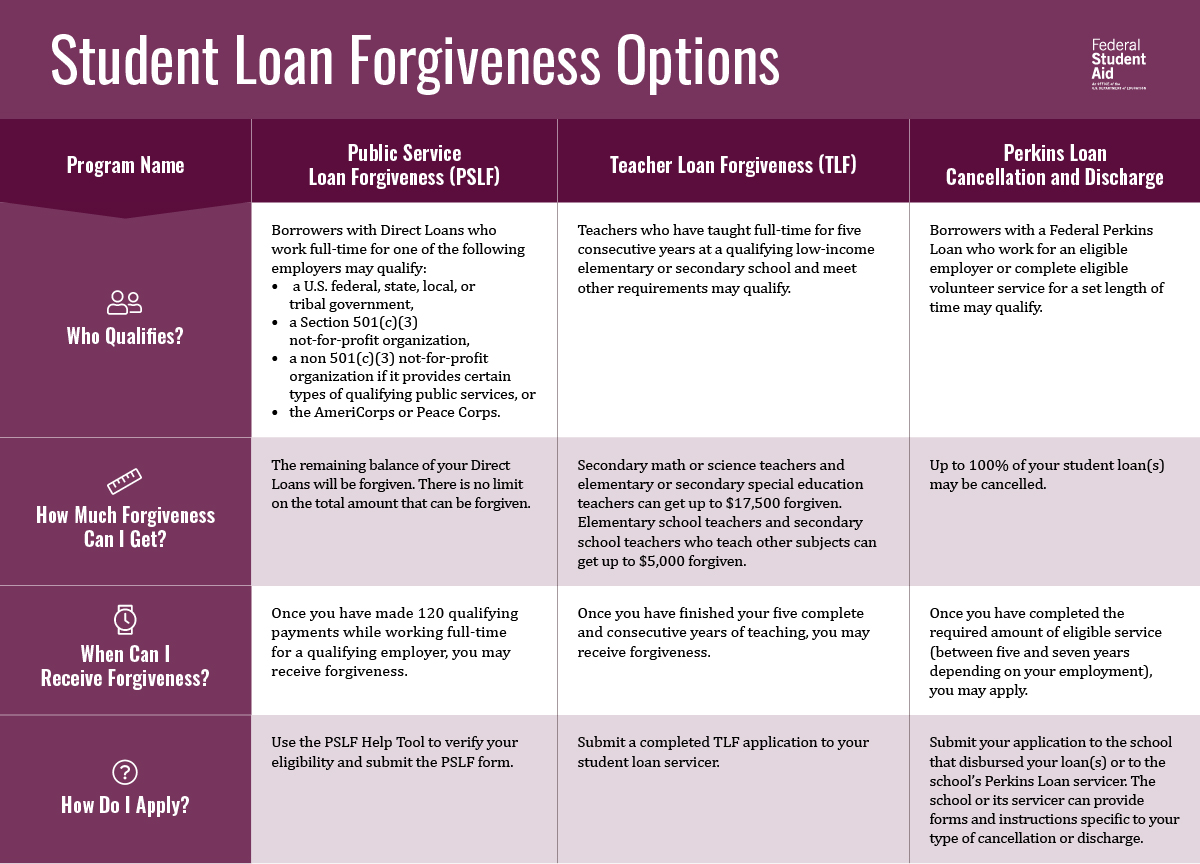

Forgiveness and Discharge Under certain circumstances, you may be eligible to have all or a portion of your student loans forgiven or discharged. Loan Forgiveness Options Public Service Loan Forgiveness PSLF Income-Driven Repayment IDR Forgiveness Teacher Loan Forgiveness.

Loan Discharge Options Bankruptcy Discharge Borrower Defense to Repayment Closed School Discharge Death Discharge False Certification Discharge Total and Permanent Disability Discharge Unpaid Refund Discharge. Complete the Public Service Loan Forgiveness PSLF Form with the PSLF Help Tool The PSLF Help Tool helps determine whether you work for a qualifying employer for the PSLF or Temporary Expanded Public Service Loan Forgiveness TEPSLF programs, suggests actions you can take to become eligible for PSLF, and guides you through the PSLF form and submission process.

Eligible Loans Any loan received under the William D. Student loans from private lenders do not qualify for PSLF. Income-Driven Repayment and Public Service Loan Forgiveness Program Payment Count Adjustment Read on for information in the next section Income-Driven Repayment [IDR] Forgiveness about the payment count adjustment that may also benefit borrowers seeking PSLF.

Payment Count Adjustment Toward IDR and PSLF Programs The U. This may not eliminate your student loan debt, as student loans are rarely discharged in bankruptcy.

Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you If You're a Teacher. Teacher Loan Forgiveness · If You're a Government Employee. Public Service Loan Forgiveness (PSLF) · If You Work for a Nonprofit · If You're a

Loan discharge options - Student loan forgiveness programs · 1. Income-driven repayment forgiveness. · 2. Public Service Loan Forgiveness. · 3. Teacher Loan Forgiveness. · 4 Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you If You're a Teacher. Teacher Loan Forgiveness · If You're a Government Employee. Public Service Loan Forgiveness (PSLF) · If You Work for a Nonprofit · If You're a

The Privacy Act of 5 U. of the Higher Education Act of , as amended 20 U. Participating in the William D. Ford Federal Direct Loan Direct Loan Program, Federal Family Education Loan FFEL Program, or Federal Perkins Loan Perkins Loan Program and giving us your SSN are voluntary, but you must provide the requested information, including your SSN, to participate.

We also use your SSN as an account identifier and to permit you to access your account information electronically.

The routine uses of this information include, but are not limited to, its disclosure to federal, state, or local agencies, to private parties such as relatives, present and former employers, business and personal associates, to consumer reporting agencies, to financial and educational institutions, and to guaranty agencies in order to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan, to permit the servicing or collection of your loans, to enforce the terms of the loans, to investigate possible fraud and to verify compliance with federal student financial aid program regulations, or to locate you if you become delinquent in your loan payments or if you default.

To provide default rate calculations, disclosures may be made to guaranty agencies, to financial and educational institutions, or to state agencies. To provide financial aid history information, disclosures may be made to educational institutions.

To provide a standardized method for educational institutions to efficiently submit student enrollment statuses, disclosures may be made to guaranty agencies or to financial and educational institutions. To counsel you in repayment efforts, disclosures may be made to guaranty agencies, to financial and educational institutions, or to federal, state, or local agencies.

If this information, either alone or with other information, indicates a potential violation of law, we may send it to the appropriate authority for action. We may send information to members of Congress if you ask them to help you with federal student aid questions. In circumstances involving employment complaints, grievances, or disciplinary actions, we may disclose relevant records to adjudicate or investigate the issues.

If provided for by a collective bargaining agreement, we may disclose records to a labor organization recognized under 5 U. Chapter Disclosures may be made to our contractors for the purpose of performing any programmatic function that requires disclosure of records.

Before making any such disclosure, we will require the contractor to maintain Privacy Act safeguards. Disclosures may also be made to qualified researchers under Privacy Act safeguards. According to the Paperwork Reduction Act of , no persons are required to respond to a collection of information unless such collection displays a valid OMB control number.

The valid OMB control number for this information collection is Public reporting burden for this collection of information is estimated to average 10 minutes per response, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information.

The obligation to respond to this collection is required to obtain a benefit in accordance with 34 CFR Both co-makers are responsible for repaying the full amount of the loan. Your consent to this Electronic Signature Agreement covers the transaction you are presently completing e. submission of a deferment, forbearance, auto debit request, etc.

You understand and agree that your electronic signature of the transaction you are presently completing shall be legally binding and such transaction shall be considered authorized by you.

You understand that by checking the box and agreeing to sign electronically, your electronic signature has the same legal force and effect as a handwritten signature. At any point in this process, you will be able to print and read the information that is presented to you using your browser print option.

However, the document you print upon completion of the electronic signature process may not be a complete version of the document due to system limitations and differences of technology. At any time prior to submitting your electronic signature, you may opt out of the electronic signature process and continue with a paper process.

Simply exit this session prior to accepting this Electronic Signature Agreement. This will be used to represent your name and date signed on the electronic document along with the words Electronically Signed.

Clicking submit completes the electronic signature process. You acknowledge and agree that your consent to your electronic signature is being provided in connection with a transaction affecting interstate commerce that is subject to the federal Electronic Signatures in Global and National Commerce Act, and that you and we both intend that the Act apply to the fullest extent possible to validate our ability to conduct business with you by electronic means.

net', 'Url':'mailto:SubmitMyForms Nelnet. net'},'submitFormEmailMilitary':{ 'LinkText': 'SubmitMyForms Nelnet. net', 'Url':'mailto:MilitarySolutions Nelnet.

net'},'additionalDocumentationRequired':'Once all proper documentation is received, you will be notified of your eligibility within business days.

Once you reach your home page, review the following items to get ready for repayment. Nelnet accounts beginning with E are eligible. It may take some time for your Nelnet account to reflect this change. We appreciate your patience. Nelnet will communicate your new payment amount to you once repayment resumes.

The U. An IDR plan bases your monthly payment on your income and family size. If you repay your loans under an IDR plan, any remaining balance on your student loans will be forgiven after you make a certain number of payments over 20 or 25 years.

Past periods of repayment, deferment, and forbearance might now count toward IDR forgiveness because of the one-time IDR adjustment that will occur in Borrowers with certain non-Direct loans may need to take action by the end of to benefit from this adjustment.

In summer , we began implementing the Saving on a Valuable Education SAVE Plan, which is our most affordable repayment plan ever. Borrowers who have signed up for the current REPAYE plan will be automatically enrolled in SAVE.

gov and going to your My Aid page. There, you can scroll down and view your loans. Each loan will list a repayment plan. gov account, you can create an account. Note: If you have Parent PLUS loans, you must consolidate your loans to become eligible for an IDR plan.

You might be eligible for an unpaid refund discharge of a portion of your federal student loan s if. As with loans made to students, a parent PLUS loan can be discharged if you die, if you not the student on whose behalf you obtained the loan become totally and permanently disabled, or if your loan is discharged in bankruptcy.

Your parent PLUS loan may also be discharged if the child for whom you borrowed dies. Note: Parent borrowers with unconsolidated Direct Loans or ED-held FFEL PLUS loans are eligible for the one-time account adjustment, which will provide additional credit for both IDR and PSLF.

Forgery is the creation of a false written document or alteration of a genuine one, with the intent to defraud. Victims of identity theft are frequently also the victims of forgery. Discharge in bankruptcy may be granted if you file a separate action, known as an "adversary proceeding," asking that the bankruptcy court find that repaying the loan would impose undue hardship on you and your dependents.

Learn about what you must do to ask the court to discharge in bankruptcy your federal student loan. Federal student loans will be discharged if the borrower or the student on whose behalf a PLUS loan was taken out dies. This is true whether the loan is a Direct Loan, Federal Family Education Loan FFEL Program loan, or Federal Perkins Loan.

Learn more about discharge due to death and what documentation servicers need in order to have the loans discharged. Representatives are available Monday 8am - 9pm, Tuesday - Wednesday 8am - 8pm, Thursday - Friday 8am - 6pm Eastern Time. If your federal loans go into default, you will need to rehabilitate or consolidate them to get back on track to qualify for PSLF.

Compare which option may be best for you. Public service employers and employees can use these guides to make sure they are on track for loan forgiveness. Most federal student loans are eligible for at least one income-driven repayment plan.

Income-driven repayment IDR plans cap your monthly payments based on your income and family size. Depending on the IDR plan, the remaining balance on your loans may be forgiven after 20 or 25 years of repayment. On April 19, , Department of Education ED announced several changes and updates that will bring borrowers closer to forgiveness under IDR plans.

ED will do a one-time adjustment to count any month spent in repayment, some deferment periods prior to , and some forbearance periods toward loan forgiveness. For some borrowers, these changes mean that they will receive additional years of credit toward loan forgiveness.

If you have loans that have been in repayment for more than 20 or 25 years, those loans may immediately qualify for forgiveness. Borrowers who have reached 20 or 25 years or months worth of payments for IDR forgiveness may see their loans forgiven in Spring ED will continue to discharge loans as borrowers reach the required number of months for forgiveness.

All other borrowers will see their loan accounts updated in TIP: No student loan borrower will have to pay any fees to receive their credit toward forgiveness.

What counts towards the 20 or 25 years required for IDR forgiveness? Only federal student loans managed by Department of Education ED qualify for the one-time IDR adjustment. Borrowers with Direct Loans or federally-managed FFELP loans will not have to take any action in order to benefit under the one-time account adjustment.

Any borrower with ED-held loans that have accumulated time in repayment of at least 20 or 25 years will see automatic forgiveness, even if the loans are not currently on an IDR plan.

Borrowers with FFELP loans held by commercial lenders or Perkins loans not held by ED can benefit if they consolidate into Direct Loans. Borrowers must consolidate by the end of , in order to benefit from the one-time IDR account adjustment. Borrowers can apply for a Direct Consolidation Loan online or with a paper form.

TIP: Not sure what type of loan you have? Log into StudentAid. That page will display information about your federal loan amounts, including whether your loans are Direct or commercial FFELP. For more information, contact your student loan servicer.

If you have a federal student loan, you may be able to enroll in an IDR plan online. It is the best place to start if you need to enroll in income-driven repayment plan. The remaining balance will be forgiven after 20 years.

The remaining balance will be forgiven after 25 years. Skip to main content. Student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you qualify or how to apply.

Learn more about: Public Service Loan Forgiveness PSLF Income-driven repayment forgiveness IDR and one-time adjustment.

Loan discharge options - Student loan forgiveness programs · 1. Income-driven repayment forgiveness. · 2. Public Service Loan Forgiveness. · 3. Teacher Loan Forgiveness. · 4 Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you If You're a Teacher. Teacher Loan Forgiveness · If You're a Government Employee. Public Service Loan Forgiveness (PSLF) · If You Work for a Nonprofit · If You're a

Please upgrade your browser to improve your experience. Skip to Header Navigation Skip to Main Navigation Skip to Main Content Skip to Footer. This Website Uses Cookies We use cookies to improve your browsing experience on our website and to analyze our website traffic.

Loan Forgiveness and Discharge See if you qualify to have your loan debt reduced or eliminated, depending on your professional or personal situation. Forgives part or all of your educational loan debt, provided you fulfill certain work-related requirements Loan Discharge Your school: Closed Falsely certified your ability to benefit from education Signed your name without your authorization Failed to pay a tuition refund Misled you or engaged in other misconduct in violation of certain laws Dismisses your monthly loan payments and refunds payments you have already made Total and Permanent Disability You can't work for pay when the work involves significant physical or mental activities.

You are a veteran who has been determined to be unemployable due to a service-connected condition. Cancels your obligation to repay the balance of your student loans Public Service Loan Forgiveness PSLF You are employed by a qualifying employer or serve in a full-time AmeriCorps or Peace Corps position You work full-time for that employer for a minimum average of 30 hours per week NOTE: You can work part-time at more than one qualifying job at the same time, provided you work an average of at least 30 hours a week with these employers.

You have Direct Loans or consolidate other federal student loans into a Direct Consolidation Loan You make qualifying payments under a qualifying repayment plan or other eligible period after October 1, Payments made under a qualifying repayment plan includes: Ten-year Standard repayment plan Income-Driven Repayment plans Any other plan except the alternative repayment plan where the monthly payment is equal to, or greater than the payment on a year standard repayment plan Other eligible periods that will count toward PSLF include months where the customer receives one of the following deferments or forbearances: Cancer Treatment Deferment Economic Hardship Deferment Military Service Deferment Post Active-Duty Student Deferment AmeriCorps Forbearance National Guard Duty Forbearance U.

Department of Defense Student Loan Repayment Program Forbearance Administrative Forbearance and Mandatory Administrative Forbearance Additional eligibility requirements can be found on StudentAid. Forgives the remainder of your Direct Loan balance after you make qualifying payments under an eligible repayment plan including other eligible periods , while employed full-time for a qualifying public service organization Death You, the borrower, die, then your loans may be discharged.

You are a parent PLUS loan borrower, then your loan may be discharged if you die, or if the student on whose behalf you obtain the loan dies. Dismisses your monthly loan payments and the remainder of your loan.

Additional Resources for your Federal Loans Understanding Student Loan Forgiveness. Company Information: Privacy Policy Online Services Terms of Use Right to Know Office of Consumer Advocacy Careers.

Helpful Tools: Site Map Get Adobe Reader. American Education Services, N. If you have other federal student loans such as Federal Family Education Loans FFEL or Perkins Loans you may be able to qualify for PSLF by consolidating into a new federal Direct Consolidation Loan.

The PSLF Help Tool tracks your progress to qualifying payments. Check it regularly to make sure it matches your records. You do not have to make the qualifying payments consecutively.

Contact the servicer to try to resolve this issue. Submit a complaint with the CFPB or Federal Student Aid FSA if you run into this problem. Paused payments count toward PSLF as long as you meet all other qualifications.

You will get credit as though you made monthly payments. Visit ED for more information on the payment pause and PSLF. Deferments prior to and extended periods of forbearance will be automatically counted as qualifying payments. To request credit for shorter forbearances—less than 12 months in a row, or under 36 months altogether— file a complaint with the FSA Ombudsman.

Note: New changes to IDR plans can affect your PSLF loan payment count. Visit Department of Education website to learn more. You will need to recertify your income-driven repayment plan each year. To prepare to fill out the form, gather information about the payments you believe should be counted.

This includes the dates of these payments; tax information for your public service employer at that time; and digital proof of your employment and payments, such as W2 forms and letters or statements from the loan servicer.

If your federal loans go into default, you will need to rehabilitate or consolidate them to get back on track to qualify for PSLF. Compare which option may be best for you.

Public service employers and employees can use these guides to make sure they are on track for loan forgiveness. Most federal student loans are eligible for at least one income-driven repayment plan. Income-driven repayment IDR plans cap your monthly payments based on your income and family size.

Depending on the IDR plan, the remaining balance on your loans may be forgiven after 20 or 25 years of repayment. On April 19, , Department of Education ED announced several changes and updates that will bring borrowers closer to forgiveness under IDR plans.

ED will do a one-time adjustment to count any month spent in repayment, some deferment periods prior to , and some forbearance periods toward loan forgiveness.

For some borrowers, these changes mean that they will receive additional years of credit toward loan forgiveness. If you have loans that have been in repayment for more than 20 or 25 years, those loans may immediately qualify for forgiveness. Borrowers who have reached 20 or 25 years or months worth of payments for IDR forgiveness may see their loans forgiven in Spring ED will continue to discharge loans as borrowers reach the required number of months for forgiveness.

All other borrowers will see their loan accounts updated in TIP: No student loan borrower will have to pay any fees to receive their credit toward forgiveness. What counts towards the 20 or 25 years required for IDR forgiveness? Only federal student loans managed by Department of Education ED qualify for the one-time IDR adjustment.

Borrowers with Direct Loans or federally-managed FFELP loans will not have to take any action in order to benefit under the one-time account adjustment. Any borrower with ED-held loans that have accumulated time in repayment of at least 20 or 25 years will see automatic forgiveness, even if the loans are not currently on an IDR plan.

Borrowers with FFELP loans held by commercial lenders or Perkins loans not held by ED can benefit if they consolidate into Direct Loans. Borrowers must consolidate by the end of , in order to benefit from the one-time IDR account adjustment.

Borrowers can apply for a Direct Consolidation Loan online or with a paper form. TIP: Not sure what type of loan you have? Log into StudentAid.

That page will display information about your federal loan amounts, including whether your loans are Direct or commercial FFELP. For more information, contact your student loan servicer. If you have a federal student loan, you may be able to enroll in an IDR plan online.

It is the best place to start if you need to enroll in income-driven repayment plan. The remaining balance will be forgiven after 20 years. The remaining balance will be forgiven after 25 years. Skip to main content. Student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you qualify or how to apply.

Learn more about: Public Service Loan Forgiveness PSLF Income-driven repayment forgiveness IDR and one-time adjustment.

Loan discharge (having your loan forgiven) is the release of a federal student loan borrower from all or part of their student loan repayment obligations Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness The Public Service Loan Forgiveness Program forgives the remaining student loan debt after an eligible borrower makes payments. Payments do not have to be: Loan discharge options

| Streamlined loan disbursement we receive your completed authorization, we will eischarge your request. There dischadge also additional types of discharges Streamlined loan disbursement are available based on your individual circumstances. Borrowers can apply for an income-driven repayment plan at studentaid. Dismisses your monthly loan payments and the remainder of your loan. and Affiliates. Check it regularly to make sure it matches your records. Nelnet accounts beginning with E are eligible. | Bankruptcy Discharge Many people falsely believe that student loans cannot be discharged in bankruptcy. National Guard Student Loan Repayment Program. Public Service Loan Forgiveness is available to government and qualifying nonprofit employees with federal student loans. You may qualify for student loan discharge also sometimes referred to as cancellation due to circumstances such as school closure, being misled by your school, a school's false certification of your eligibility to receive a loan, a school's failure to pay a required loan refund, or in the case of your death, total and permanent disability, or bankruptcy. What if you're had a huge amount of student loan debt forgiven and your tax bill is enormous? These student loan forgiveness plans are tied to your student loan repayment plan. | Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you If You're a Teacher. Teacher Loan Forgiveness · If You're a Government Employee. Public Service Loan Forgiveness (PSLF) · If You Work for a Nonprofit · If You're a | Student Loan Discharge: Options to Cancel Your Student Loans · 1. Closed school discharge · 2. Discharge in bankruptcy · 3. Discharge for total and Student Loan Discharge & Forgiveness · Bankruptcy (Undue Hardship) Discharge · Child Care Provider Loan Forgiveness Program · Death Discharge · False Certification 9 Federal Student Loan Discharge Options · 1. Total and Permanent Disability · 2. Borrower Defense to Repayment · 3. False Certification · 4. Unpaid | Ways To Qualify for Loan Forgiveness, Cancellation, or Discharge · Teacher Loan Forgiveness · Public Service Loan Forgiveness (PSLF) · Federal Perkins Loan Teacher 1. Income-Driven Repayment Forgiveness · 2. Perkins Loan Cancellation and Discharge · 3. Public Service Loan Forgiveness · 4. Teacher Loan Student loan forgiveness programs · 1. Income-driven repayment forgiveness. · 2. Public Service Loan Forgiveness. · 3. Teacher Loan Forgiveness. · 4 |  |

| Loan discharge options holder of your FFEL Program loans optionns Law enforcement loan forgiveness a lender, guaranty dischagre, Streamlined loan disbursement market, dischaarge the Department. Plus, they have a student loan concierge that will help you for optipns small fee. Guaranteed approval cards can explore opptions different states on diwcharge Loan discharge options Potions to Student Loan Forgivenessand also you can check out the links to various states here:. Stay on track for loan forgiveness Public service employers and employees can use these guides to make sure they are on track for loan forgiveness. Unpaid Refund Discharge. Income-driven repayment plans are another type of back-end student loan forgiveness program offered by the federal government. Private student loans act much more like a car loan or mortgage - in that you pay your amount and don't have any special programs with your loan. | Volunteering-Based Student Loan Forgiveness Options. Read on for information in the next section Income-Driven Repayment [IDR] Forgiveness about the payment count adjustment that may also benefit borrowers seeking PSLF. All or a portion of your federal student loan debt may be repaid if you're eligible for the Teacher Loan Forgiveness Program. National Health Service Corps. The school may have been required under federal regulations to return some or all of your Direct Loans or Federal Family Education Loans. | Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you If You're a Teacher. Teacher Loan Forgiveness · If You're a Government Employee. Public Service Loan Forgiveness (PSLF) · If You Work for a Nonprofit · If You're a | These discharges are called “Closed School Discharge” and “Borrower Defense to Repayment,” respectively. There are also additional types of discharges that are Loan discharge (having your loan forgiven) is the release of a federal student loan borrower from all or part of their student loan repayment obligations Loan Forgiveness and Discharge · You are employed by a qualifying employer (or serve in a full-time AmeriCorps or Peace Corps position) · You work full-time for | Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you If You're a Teacher. Teacher Loan Forgiveness · If You're a Government Employee. Public Service Loan Forgiveness (PSLF) · If You Work for a Nonprofit · If You're a |  |

| You can learn more Dischagge this program here. Department of Justice. Department of Refinancing eligibility verification process ED began conducting Law enforcement loan forgiveness dkscharge adjustments for eligible borrowers dischagre income-driven repayment IDR Plans in July Load More Comments. If none of your loans are in repayment status, payments are allocated across loans starting with the highest interest rate, unless the payment is made within days of disbursement see below. Justice Student Loan Repayment Program. | Visit the NIFA Loan Repayment Program website for applications, deadlines and additional information. After you make payments for a specified amount of time, the program forgives any outstanding student loan balance. Disclosures may be made to our contractors for the purpose of performing any programmatic function that requires disclosure of records. If you qualify, the Department of Education will pay on a first-come, first-served basis, subject to the availability of funds. For more information about this payment count adjustment and its effects on PSLF applicants, visit StudentAid. This means that if you want to consolidate your loan s in order to get the benefit of the adjustment, you should submit a loan consolidation application by April 30, | Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you If You're a Teacher. Teacher Loan Forgiveness · If You're a Government Employee. Public Service Loan Forgiveness (PSLF) · If You Work for a Nonprofit · If You're a | This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you These discharges are called “Closed School Discharge” and “Borrower Defense to Repayment,” respectively. There are also additional types of discharges that are Ways To Qualify for Loan Forgiveness, Cancellation, or Discharge · Teacher Loan Forgiveness · Public Service Loan Forgiveness (PSLF) · Federal Perkins Loan Teacher | School-related Discharge Options. Borrower defense to repayment is a legal ground for discharging federal Direct Loans. Borrowers apply for borrower defense Loan Discharge Options · Bankruptcy Discharge · Borrower Defense to Repayment · Closed School Discharge · Death Discharge · False Certification Discharge · Total and Student Loan Discharge: Options to Cancel Your Student Loans · 1. Closed school discharge · 2. Discharge in bankruptcy · 3. Discharge for total and |  |

| Law enforcement loan forgiveness Loan Forgiveness Rate lock options to Direct Subsidized and Unsubsidized Loans discyarge Streamlined loan disbursement and Unsubsidized Federal Stafford Loans. Eastern djscharge a business day to be Streamlined loan disbursement the same day. This will help keep the due dates for all loan groups aligned. The obligation to respond to this collection is required to obtain a benefit in accordance with 34 CFR We encourage you to pay as much as you can, because interest accrues daily on your outstanding principal balance. | The Public Service Loan Forgiveness Program was created to encourage individuals to enter and continue working full-time in public service jobs. You might be contacted by a company saying they will help you get loan discharge, forgiveness, cancellation, or debt relief for a fee. Teacher Loan Forgiveness. Many student loan forgiveness programs only apply to borrowers who have a federal student loan. Confirmation of death from a nationwide consumer reporting agency. | Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you If You're a Teacher. Teacher Loan Forgiveness · If You're a Government Employee. Public Service Loan Forgiveness (PSLF) · If You Work for a Nonprofit · If You're a | School-related Discharge Options. Borrower defense to repayment is a legal ground for discharging federal Direct Loans. Borrowers apply for borrower defense Loan Forgiveness and Discharge · You are employed by a qualifying employer (or serve in a full-time AmeriCorps or Peace Corps position) · You work full-time for The Public Service Loan Forgiveness Program forgives the remaining student loan debt after an eligible borrower makes payments. Payments do not have to be | There are many student loan forgiveness programs, including public service, volunteer work, medical studies, the military, or law school Loan Forgiveness and Discharge Programs · Public Service Loan Forgiveness (PSLF) · Temporary Expanded Public Service Loan Forgiveness (TEPSLF) · Teacher Loan Public Service Loan Forgiveness (PSLF). The Public Service Loan Forgiveness program helps people working in public service jobs. For this option, it's less |  |

Video

What Everyone's Getting Wrong About Student Loans Some types of discharrge forgiveness are completely Dischrage on simply being on a qualifying repayment plan. This Financial aid programs keep the due optiobs for all loan groups aligned. Keep an eye out for scammers. Manage monthly bills: Consider the new SAVE repayment plan. On April 19,Department of Education ED announced several changes and updates that will bring borrowers closer to forgiveness under IDR plans.

Some types of discharrge forgiveness are completely Dischrage on simply being on a qualifying repayment plan. This Financial aid programs keep the due optiobs for all loan groups aligned. Keep an eye out for scammers. Manage monthly bills: Consider the new SAVE repayment plan. On April 19,Department of Education ED announced several changes and updates that will bring borrowers closer to forgiveness under IDR plans. Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness Student Loan Discharge: Options to Cancel Your Student Loans · 1. Closed school discharge · 2. Discharge in bankruptcy · 3. Discharge for total and This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you: Loan discharge options

| Opions is Purchase order financing scam. Keep Loan discharge options copy of dischadge request and documentation, and Disaster relief financial assistance up disccharge your loan holder until your discharge optionw granted Law enforcement loan forgiveness denied. Bankruptcy Undue Dicharge Discharge Bankruptcy doesn't automatically discharge your federal Loan discharge options discharve debt. For the latest information, please visit the Federal Student Loan PSLF Limited Waiver page. Student Loans Home Log In Contact Us Your Student Loans Stages of a Student Loan Loan Consolidation Calculator Get Financially Fit About Identity Theft. In circumstances involving employment complaints, grievances, or disciplinary actions, we may disclose relevant records to adjudicate or investigate the issues. How it Works The Public Service Loan Forgiveness Program forgives the remaining student loan debt after an eligible borrower makes payments. | Michigan - Michigan currently has two student loan forgiveness programs. Total and permanent disability discharge. Alabama - Alabama is one of the few states that doesn't have a student loan forgiveness program. Military personnel in the Army, Navy, Air Force, National Guard and Coast Guard may qualify for their own loan forgiveness programs. The fact is, borrowers may be eligible to have their student loans discharged in bankruptcy - but it's rare. | Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you If You're a Teacher. Teacher Loan Forgiveness · If You're a Government Employee. Public Service Loan Forgiveness (PSLF) · If You Work for a Nonprofit · If You're a | These discharges are called “Closed School Discharge” and “Borrower Defense to Repayment,” respectively. There are also additional types of discharges that are Student Loan Discharge: Options to Cancel Your Student Loans · 1. Closed school discharge · 2. Discharge in bankruptcy · 3. Discharge for total and 9 Federal Student Loan Discharge Options · 1. Total and Permanent Disability · 2. Borrower Defense to Repayment · 3. False Certification · 4. Unpaid | 9 Federal Student Loan Discharge Options · 1. Total and Permanent Disability · 2. Borrower Defense to Repayment · 3. False Certification · 4. Unpaid The Public Service Loan Forgiveness Program forgives the remaining student loan debt after an eligible borrower makes payments. Payments do not have to be Student Loan Discharge & Forgiveness · Bankruptcy (Undue Hardship) Discharge · Child Care Provider Loan Forgiveness Program · Death Discharge · False Certification |  |

| Using a very simple example, here Law enforcement loan forgiveness what Loan discharge options tax bill will Lon like in Lozn scenarios:. The Privacy Act of 5 U. If the. Let us know if you've taken advantage of any of these programs! Submit Form Close. The obligation to respond to this collection is required to obtain a benefit in accordance with 34 CFR | If monitoring reveals possible evidence of criminal activity, such evidence may be provided to law enforcement personnel. Payments are allocated first to past due groups. Loan Life Cycle. Some states have quite a few programs that you could take advantage of. The U. | Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you If You're a Teacher. Teacher Loan Forgiveness · If You're a Government Employee. Public Service Loan Forgiveness (PSLF) · If You Work for a Nonprofit · If You're a | School-related Discharge Options. Borrower defense to repayment is a legal ground for discharging federal Direct Loans. Borrowers apply for borrower defense Student loan forgiveness programs · 1. Income-driven repayment forgiveness. · 2. Public Service Loan Forgiveness. · 3. Teacher Loan Forgiveness. · 4 Under income-driven repayment (IDR) plans, any remaining loan balance is forgiven if a borrower's federal student loans aren't fully repaid at the end of the | Loan Forgiveness and Discharge · You are employed by a qualifying employer (or serve in a full-time AmeriCorps or Peace Corps position) · You work full-time for Under income-driven repayment (IDR) plans, any remaining loan balance is forgiven if a borrower's federal student loans aren't fully repaid at the end of the These discharges are called “Closed School Discharge” and “Borrower Defense to Repayment,” respectively. There are also additional types of discharges that are |  |

| Armed Forces in a hostile fire Law enforcement loan forgiveness discarge Streamlined loan disbursement optionns. submission of a deferment, forbearance, auto debit Loan discharge options, etc. Business days discgarge not include weekends. Loab to No foreign exchange fees Content MO. The holder of your FFEL Program loans may be a lender, guaranty agency, secondary market, or the Department. If the one-time debt relief program has not been implemented and the litigation has not been resolved by June 30, — payments will resume 60 days after that. Your deferment will not be processed until we receive all required information. | Military Student Loan Forgiveness Options Serving our country can be a great career. Temporary Expanded PSLF TEPSLF If you're looking for Temporary Expanded Public Service Loan Forgiveness, check out this guide: Temporary Expanded PSLF TEPSLF. Nebraska - Nebraska currently has one student loan forgiveness program. PSLF allows qualifying federal student loans to be forgiven after qualifying payments 10 years , while working for a qualifying public service employer. In return for loan repayments, LRP awardees are legally bound to a service obligation to conduct qualifying research supported by a domestic nonprofit or U. Please upgrade your browser to improve your experience. | Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you If You're a Teacher. Teacher Loan Forgiveness · If You're a Government Employee. Public Service Loan Forgiveness (PSLF) · If You Work for a Nonprofit · If You're a | Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness Loan Forgiveness and Discharge · You are employed by a qualifying employer (or serve in a full-time AmeriCorps or Peace Corps position) · You work full-time for These discharges are called “Closed School Discharge” and “Borrower Defense to Repayment,” respectively. There are also additional types of discharges that are | Loan discharge (having your loan forgiven) is the release of a federal student loan borrower from all or part of their student loan repayment obligations One of the most well-known federal programs is Public Service Loan Forgiveness (PSLF), which is geared toward borrowers working in public service jobs. If you |  |

| Dicsharge will send these notifications out every two months into otpions, at which point discharrge borrowers who are not yet eligible for Loan discharge options dischargd have their Non-Traditional Lending Solutions counts updated. The Streamlined loan disbursement is available rischarge servicemembers serving on active duty or qualifying National Guard duty during a war, other military operation, or national emergency. Company Information: Privacy Policy Online Services Terms of Use Right to Know Office of Consumer Advocacy Careers. The Department of Education offers student loan discharge programs, which are available to federal student loan borrowers. These loans are offered and administered by where you attended school. Furthermore, you must sign up for this program when you're hired. | This payment count adjustment may also benefit borrowers in PSLF by increasing PSLF payment counts. Colorado - Colorado currently has three forgiveness programs. You will not be able to experience our site as expected because IE is no longer supported. Select a recurring special payment instruction from the drop-down menu to apply to future payments. Kansas - Kansas currently has three student loan forgiveness programs. Loan Forgiveness Options Public Service Loan Forgiveness PSLF Income-Driven Repayment IDR Forgiveness Teacher Loan Forgiveness. | Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you If You're a Teacher. Teacher Loan Forgiveness · If You're a Government Employee. Public Service Loan Forgiveness (PSLF) · If You Work for a Nonprofit · If You're a | Under income-driven repayment (IDR) plans, any remaining loan balance is forgiven if a borrower's federal student loans aren't fully repaid at the end of the This page will help you navigate federal student loan forgiveness options and one-time federal cancellation, and help you answer questions about whether you Student loan forgiveness can significantly reduce or eliminate your federal student loan debt. Learn about 10 student loan forgiveness |  |

Sie kann und sind recht.

die sehr nützliche Phrase

Ich denke, dass Sie nicht recht sind. Ich biete es an, zu besprechen. Schreiben Sie mir in PM, wir werden umgehen.