Because it is a new program, it took most states several weeks to start taking applications for PUA. The application process varies from state to state.

In some states, you will have to fill out the same application used for regular state UI. In other states, there are special applications provided online or by mail that are required to file for PUA. Normally, it takes about 2 to 3 weeks to receive your unemployment benefits, but it may take much longer depending on the state where you work and the circumstances surrounding your claim for benefits.

Some states require a one-week waiting period; in other words, you would receive your first payment for the second week of your unemployment claim.

If the waiting week has been waived in your state, then you will receive your first payment for the first week of your unemployment claim. After you file for PUA, most states are requiring some follow-up information to verify the reason why you left work and your earnings.

When the state agency receives the additional information from you, these states will calculate the correct amount of PUA your are entitled to receive and add to the weekly payments if necessary.

While it can take a long time to receive the PUA payment in many states, the law requires the state UI agency to pay you the full amount you were entitled to from the date that you were unemployed as far back as the first week of April.

UI or PUA benefits are typically paid by a check mailed to you or funds placed onto a debit card that is provided to you. You do not need a bank account in order to receive UI or PUA benefits. If you have a bank account, direct deposit may be the preferred method for you, because it avoids fees associated with receiving your UI or PUA benefits by prepaid card.

But if your employer has not taken the necessary health and safety precautions to protect you and your co-workers against COVID, or if you are an older worker or someone who is immunocompromised for example, you have diabetes, heart disease, or asthma , you may be able to refuse the offer to return to work and continue to receive UI or PUA.

The state unemployment agency will make the final decision, and it will take into account whether you first contacted the employer to explain your concerns and made a reasonable effort to address the situation with the employer. If your application for UI benefits was denied or you were rejected from the UI system while applying, especially if you earned any W-2 wages, you should file an appeal.

Check with your state agency for more information. If your application for PUA benefits was denied or you were rejected from the system while applying, especially if you earned any wages, you should file an appeal. PUA covers far more workers than regular state UI.

If you are still rejected, file an appeal. That information should be available on your state website, and it is your right to appeal whether you are informed of that right or not. Publications Campaigns Staff About News. Publications Campaigns About Board of Directors Issues Annual Reports Media Inquiries Staff Work With Us News.

Donate Contact Us. Frequently Asked Questions about UI benefits — The Basics What does the American Rescue Plan Act mean for me, an unemployed worker? Return to FAQs 1. What was the program that was created through the presidential memorandum and how does it impact my UI benefits?

Return to FAQs What is Unemployment Insurance UI and Pandemic Unemployment Assistance PUA? Unemployment Insurance UI Unemployment Insurance, also called UI, is a benefit that people earn while they are working.

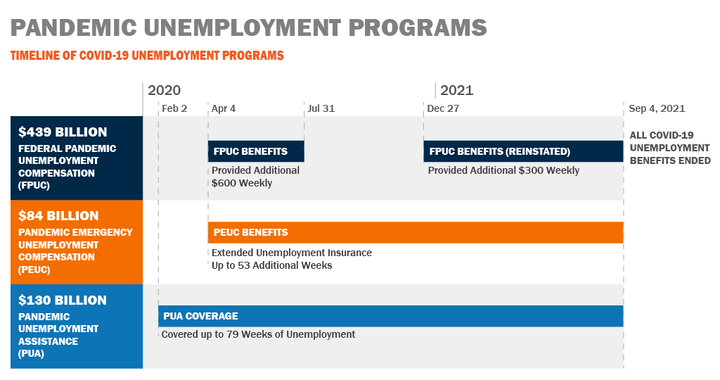

Pandemic Unemployment Assistance PUA A federal law passed in March called the CARES Act created an emergency unemployment benefits program called Pandemic Unemployment Assistance PUA. Return to FAQs What are the new unemployment assistance programs created in response to the coronavirus pandemic?

The CARES Act, which became federal law on March 27, , created three new unemployment programs: Pandemic Unemployment Assistance PUA — Provides unemployment compensation to workers who have typically been found ineligible for UI benefits e. Return to FAQs Am I eligible for UI or PUA benefits?

Unemployment Insurance UI UI rules are different, depending on what state you work in. Unemployment Insurance UI Independent contractors are traditionally not eligible for UI.

Employees are eligible for UI. Pandemic Unemployment Assistance PUA Independent contractors and self-employed workers may qualify for PUA due to being out of work as a result of the coronavirus pandemic.

Am I eligible for UI or PUA? Unemployment Insurance UI It depends on what state you are in, but you may be able to get UI even if your hours have been reduced and you are still working. Pandemic Unemployment Assistance PUA You may be eligible for PUA benefits even if you are still working, but it depends on the state where you are employed.

Return to FAQs What if I was fired from my job? Unemployment Insurance UI Workers who are unemployed through no fault of their own should be eligible for UI. Pandemic Unemployment Assistance PUA As long as you are not working because of the coronavirus pandemic, it is not as important whether you were actually fired, laid off, or furloughed.

Return to FAQs What if I quit my job? Can I get UI or PUA? Unemployment Insurance UI You should apply for UI to see if you are eligible.

Pandemic Unemployment Assistance PUA You may be eligible for PUA if you quit your job as a direct result of COVID Return to FAQs I am an immigrant worker and have lost my job. Unemployment Insurance UI To be eligible for regular state UI, immigrant workers must satisfy the same basic requirements as other workers.

Pandemic Unemployment Assistance PUA It is still unclear whether stricter requirements might apply to federal unemployment insurance under PUA. Return to FAQs Will I continue to receive UI or PUA benefits after the first payment? Do I need to do anything else after I submit my claim for UI or PUA benefits?

Unemployment Insurance UI After you are approved for UI and start receiving payments, you must continue to meet eligibility requirements on a week-to-week basis or your benefits may end. Pandemic Unemployment Assistance PUA If you are receiving PUA benefits, you may be required to follow up with the UI agency after you first apply in order to continue receiving benefits.

Return to FAQs How long can I receive UI or PUA benefits? If you think you've been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take.

One such step is to file a report to the Consumer Financial Protection Bureau or with HUD. In addition to housing programs administered by the federal government, state housing finance agencies and state HUD offices offer special programs, as well.

HUD also funds counseling agencies nationwide that advise on topics related to housing, including buying a home. This table compares basic eligibility requirements for various government homeownership programs, including FICO credit score and debt-to-income ratio requirements.

Department of Housing and Urban Development; U. Department of Veterans Affairs. From emergency food needs to ongoing nutrition assistance, the federal government, in partnership with states, offers free and low-cost food programs for families and individuals.

If you need food quickly, the USDA maintains a National Hunger Hotline—HUNGRY —with information and eligibility requirements available in English and Spanish.

The hotline, which will connect you with emergency food providers, government programs, and social service agencies, operates Monday through Friday from 7 a.

to 10 p. Eastern Time. SNAP previously called food stamps helps needy families supplement their food budget to move toward self-sufficiency. Eligibility is determined by individual states that administer the program. You apply in the state where you live by contacting your state agency. Some states allow online applications, while others require your physical presence.

WIC provides low-income women and their young children with healthy food, nutrition counseling, and referral to health, welfare, and social services agencies. WIC is a federal grant program administered by the government through 89 WIC agencies and approximately 47, authorized retailers. To be eligible, the mother must be pregnant, nursing, or postpartum up to six months after birth with infants up to a year old or children under the age of five.

There are additional income requirements posted on the WIC FAQ web page. Programs for school-age children include the National School Lunch Program NSLP , the School Breakfast Program SBP , and the Summer Food Service Program SFSP. Eligibility requirements for all three programs are the same.

The federal government sponsors two programs designed to get food to low-income older adults. The Senior Farmers' Market Nutrition Program SFMNP offers coupons to purchase fresh fruits, vegetables, honey, and herbs at farmers' markets, roadside stands, and farms.

The Commodity Supplemental Food Program CSFP provides healthy food every month. You must be 60 years of age or older and live in an area that offers either program to apply.

Both programs have income limits. For more information, use the USDA's state contacts list. The table below lists eligibility requirements for federal food programs. Department of Agriculture. Six major government healthcare programs provide medical coveragene for low-income and older Americans, children, veterans, and those who have recently lost their jobs.

Medicare is a federal health insurance program primarily for those 65 and older. Medicare is commonly divided into four parts.

Medicare Part A covers for inpatient hospital stays and nursing care. Medicare Part B covers doctor's visits, tests, flu shots, physical therapy, and chemotherapy.

Medicare Part C, otherwise known as Medicare Advantage , is Medicare Parts A and B coverage provided by a private insurer. Medicare Part D is Medicare's prescription drug benefit program, which is an optional benefit administered by private insurance companies.

Medicare is funded through a combination of payroll taxes and participant premiums, deductibles, and copays. Employees and employers each pay a 1. This tax is levied only on employees, not employers. Medicare's resources are pooled into trust funds: the Hospital Insurance Trust Fund , which funds Part A, and the Supplemental Medical Insurance Trust Fund, which is funded by premiums and other income, and pays for Parts B and D.

If you are still working and covered by employer health insurance when you are three months away from your 65th birthday, discuss your Medicare options and requirements with your human resources department.

You can also consult " How to Apply for Medicare Only " on the Social Security website. gov is home to the Health Insurance Marketplace , created by the Affordable Care Act ACA , an Obama administration program designed to make affordable health insurance available to uninsured Americans.

Anyone who doesn't have health insurance can obtain coverage through the Marketplace. Those who fall below certain income limits can receive subsidies that lower the cost of coverage.

The Marketplace normally has an annual enrollment period to obtain or change coverage. For , open enrollment begins November 1, and runs through January 16, Medicaid and the Children's Health Insurance Program CHIP are related but have slightly different requirements.

Medicaid is for low-income families and individuals. CHIP is for dependents under age 19 whose parents earn too much to qualify for Medicaid but not enough to pay for private health insurance coverage.

Both programs are federally funded in part and run at the state level. Each state has its own rules but must follow federal guidelines. You can apply for Medicaid and CHIP through the ACA Health Insurance Marketplace or your state Medicaid agency. The primary criteria to receive VA healthcare benefits are that you be a military veteran or former member of the National Guard or Reserve who served on active duty and was not dishonorably discharged.

Specific eligibility depends on when you served and for how long. The rules are complicated but well explained on the VA's website. Health coverage under the Consolidated Omnibus Budget Reconciliation Act COBRA is mandated by federal law for employees and their dependents when they lose their job or experience a reduction in work hours.

One huge downside to COBRA coverage is the cost. When you lose your job, whatever amount your employer was contributing toward your health insurance goes away, and you have to pay the entire cost yourself.

State health departments offer programs in addition to those available at the federal level. Use the USA. gov state health departments link to find out what is offered in your state, information about eligibility requirements, and how to apply.

The primary government retirement programs are Social Security for most citizens 65 and over who qualify through their work history and the Federal Employee Retirement System FERS for certain government employees who are not covered by Social Security.

If you have paid into the Social Security system for at least 10 years, you can apply for Social Security retirement benefits for yourself or as a spouse if you meet the following four requirements:. You can also apply for Medicare when you apply for Social Security if you are within three months of age FERS, which replaced the Civil Service Retirement System CSRS in , provides benefits to civilian government workers through three programs: a Basic Benefit Plan, Social Security, and the Thrift Savings Plan TSP.

Eligibility for FERS benefits is determined by your age and number of years of service. The CSRS and FERS planning and applying websites provide complete information depending on how close you are to retirement.

The Internal Revenue Service IRS sponsors several tax-assistance programs to make federal and, in some cases, state tax filing easier and possibly free. The process and what you need to have to file are all explained in this Free File infographic. You can get help choosing a product using the Free File Online Lookup Tool.

The fillable forms tool lets you file electronically but does not include state forms. The IRS has two in-person tax assistance programs: the Volunteer Income Tax Assistance VITA program and the Tax Counseling for the Elderly TCE.

Both offer free tax-preparation assistance to qualified individuals. TCE is for citizens aged 60 or older. Small businesses are the beneficiaries of several long-standing government assistance loan programs, most of them originating from the Small Business Administration SBA. The USDA offers several programs aimed at all sectors of the agricultural community.

Programs include farm loans, housing assistance, loans and grants for rural economic development , loans for beginning farmers and ranchers, livestock insurance, and more.

Detailed information on all USDA programs, including how to apply, can be found on the USDA Grants and Loans program web page. Scammers are filing unemployment benefits using other people's names and personal information.

Visit the unemployment scams page and learn how to protect yourself and your benefits from this type of identity theft. Ask a real person any government-related question for free.

They will get you the answer or let you know where to find it. Home Close. Search USAGOV1. Call us at USAGOV1 Search. All topics and services About the U. and its government Government benefits Housing help Scams and fraud Taxes Travel. Home Jobs, labor laws and unemployment Unemployment benefits. Unemployment benefits Unemployment insurance pays you money if you lose your job through no fault of your own.

The American Rescue Plan extended employment assistance, starting in March , and waived some federal taxes on unemployment benefits to assist those who lost Alaska's Unemployment Insurance (UI) Program is dedicated to providing temporary benefit payments to workers unemployed through no fault of their own Self-Employment Assistance offers dislocated workers the opportunity for early re-employment. The program is designed to encourage and enable unemployed workers

Unemployment assistance programs - Unemployment insurance pays you money if you lose your job through no fault of your own. Learn how to apply and where to find eligibility rules The American Rescue Plan extended employment assistance, starting in March , and waived some federal taxes on unemployment benefits to assist those who lost Alaska's Unemployment Insurance (UI) Program is dedicated to providing temporary benefit payments to workers unemployed through no fault of their own Self-Employment Assistance offers dislocated workers the opportunity for early re-employment. The program is designed to encourage and enable unemployed workers

Benefit Categories. Benefit List. gov Benefit Finder Other Resources Help Center Privacy and Terms of Use. Benefit Resources SSA Benefit Eligibility Screening Tool GovLoans. gov DisasterAssistance.

gov CareerOneStop. Federal Government USA. gov White House. Stay Connected Follow us Benefits. gov Twitter Benefits. Filter by State All States Arizona Alabama American Samoa Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Federated States Of Micronesia Florida Georgia Guam Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Northern Mariana Islands Ohio Oklahoma Oregon Pennsylvania Puerto Rico Rhode Island South Carolina South Dakota Tennessee Texas The United States Utah Vermont Virginia U.

Virgin Islands Washington West Virginia Wisconsin Wyoming. Filter by Subcategory All Subcategories Tax Assistance Living Assistance Insurance Loan Repayment. Clear all Filters.

Benefit Categories. Benefit List. gov Benefit Finder Other Resources Help Center Privacy and Terms of Use. Benefit Resources SSA Benefit Eligibility Screening Tool GovLoans. gov DisasterAssistance. gov CareerOneStop.

Program Monitoring and Reports Program Monitoring Review State Program Reports Federal Program Reports Policy and Guidance Communiqués Administrative Policies Memoranda EFM Tips and Updates Training and Employment Notices Training and Employment Guidance Letters Department Forms Directory OSST System.

Professional Development and Training Training Materials TOPYX SOAR Webinars Program Training Calendar Grants Management Grant Opportunities and Resources Workforce Programs and Resources Local Workforce Development Area WIOA Plans Workforce Programs Workforce Program Materials and Information.

Apply for Benefits. Place holder heading Place holder content. Additionally, if you are one of the following, make sure you have this information available: Not a U. citizen: Alien registration number or other work authorization form Military employee: DD member 2, 3, 4, 5, 6, 7, or 8 may be used Federal employee: SF 8 or SF 50 Union member: union name, hall number, and phone number Once you complete your application, you will be required to complete the following: Register for work through Employ Florida Review your monetary determination Keep a record of your weekly job contacts and request benefits biweekly Review your Home page in Reconnect to complete any open fact-findings and review any important messages on your account Please review How to Avoid Reemployment Assistance Claim Issues for more information on steps you can take to help prevent issues with your claim.

RESOURCES It is not necessary to use friends or family members for interpretive services. Translation Services Services de traduction Servicios de traducción Servizi di traduzione Übersetzungsdienst Транслатион Сервицес Prevoditeljske usluge Sèvis tradiksyon 翻譯服務 翻译服务 翻訳サービス Dịch vụ dịch thuật اللغة العربية خدمات الترجمة Службы перевода Office for Civil Rights Request Benefit Payments Guide Claimant FAQs Reconnect Claimant User Guide Reconnect Third Party Representative TPR User Guide Benefits Hearing Appeals Pamphlet Reemployment Assistance Handbook Exemption Notice Flyer: Top Ten Things You Should Know Flyer: Reemployment Assistance Fraud Reemployment Assistance Forms Hotline.

FILE A NEW CLAIM RECONNECT RA HELP CENTER IDENTITY THEFT CLAIMANT FAQ. Auxiliary aids and services are available upon request to individuals with disabilities.

Privacy Statement Accessibility Legal Sitemap. More than one Google Analytics scripts are registered. Please verify your pages and templates. You have selected a link to a website that is outside of the floridajobs.

Internal Revenue Service. Both offer Personalized Credit Repair Plans Unemployment assistance programs assistance assitsance qualified individuals. Aesistance as in effect on the date of the major disaster declaration authorizing LWA is Unnemployment to LWA. However, states, territories, and the District of Columbia assixtance responsible for returning any federal funds that they have liquidated but remain unobligated by the recipient and for reimbursing FEMA for improper payments regardless of when they are identified, even if the Period of Performance has expired or the grant has closed. Return to FAQs 1. Prior to the end of the closeout and liquidation periods, states, territories, and the District of Columbia must submit the following:. You can get help choosing a product using the Free File Online Lookup Tool.Unemployment assistance programs - Unemployment insurance pays you money if you lose your job through no fault of your own. Learn how to apply and where to find eligibility rules The American Rescue Plan extended employment assistance, starting in March , and waived some federal taxes on unemployment benefits to assist those who lost Alaska's Unemployment Insurance (UI) Program is dedicated to providing temporary benefit payments to workers unemployed through no fault of their own Self-Employment Assistance offers dislocated workers the opportunity for early re-employment. The program is designed to encourage and enable unemployed workers

FloridaCommerce offers assistance to people who do not speak English as their primary language and those who have a limited ability to read, speak, write, or understand English. We also provide assistance to people who are unable to file a claim for various reasons. To speak to a Creole or Spanish speaker or use translation services, call the Customer Service Contact Center: FL-APPLY Mon.

People who need assistance filing a claim online because of legal reasons, computer illiteracy, language barriers, or disabilities may call: FL-APPLY Reemployment Assistance Service Center Reemployment Assistance Claimants Apply for Benefits Request Benefit Payment File an Appeal Fraud and Overpayments Repay Overpayment Claimant FAQs Employers File an Appeal File a Response Tax Information Employer FAQs.

Job Assistance Plan Your Career Job Search Resources Find a CareerSource Center General Information CONNECT Logins Claimant Login Employer Login Forms Directory Glossary Reemployment Assistance Appeals Commission Appeal Decision of Referee to the Commission File an Online Appeal with the Commission.

For Businesses and Entrepreneurs Business Resources Industry-Specific Resources For Employers Recruit Qualified Candidates Review Posters and Required Notices Find Tax Credit and Incentive Programs Find Labor Market Information WARN Notices Report New Hires.

Reemployment Assistance Employer FAQs File an Appeal File a Response Tax Information. Data Releases Monthly Data Releases Statistical Programs Quarterly Census of Employment and Wages QCEW Current Employment Statistics CES Local Area Unemployment Statistics LAUS Occupational Employment and Wage Statistics OEWS Employment Projections EP.

Products and Services Florida Census Data Center Online Job Demand Tool GIS Resources Economic Impact Analysis Labor Supply Studies Labor Market Applications Florida Insight Labor Market Applications Quarterly Workforce Indicators Regional Demand Occupation List.

Community Partnerships Office of Community Partnerships Community Planning Community Planning Table of Contents Community Services Low-Income Home Energy Assistance Program Contact Your Local LIHEAP Provider for Help Weatherization Assistance Program Contact Your Local Weatherization Office for Help Community Services Block Grant Program Contact Your Local CSBG Provider for Help Grant Management Guidance Human Trafficking Resources Broadband Office of Broadband.

Assistance for Governments and Organizations Community Development Block Grant Program Rural Community Programs Neighborhood Stabilization Program Office of Long-Term Resiliency Accountability and Technical Assistance Special District Accountability Program Reports, Notices and Document Archives Comprehensive Plans and Plan Amendments Objections, Recommendations and Comments.

Program Monitoring and Reports Program Monitoring Review State Program Reports Federal Program Reports Policy and Guidance Communiqués Administrative Policies Memoranda EFM Tips and Updates Training and Employment Notices Training and Employment Guidance Letters Department Forms Directory OSST System.

Professional Development and Training Training Materials TOPYX SOAR Webinars Program Training Calendar Grants Management Grant Opportunities and Resources Workforce Programs and Resources Local Workforce Development Area WIOA Plans Workforce Programs Workforce Program Materials and Information.

Apply for Benefits. Place holder heading Place holder content. Additionally, if you are one of the following, make sure you have this information available: Not a U.

citizen: Alien registration number or other work authorization form Military employee: DD member 2, 3, 4, 5, 6, 7, or 8 may be used Federal employee: SF 8 or SF 50 Union member: union name, hall number, and phone number Once you complete your application, you will be required to complete the following: Register for work through Employ Florida Review your monetary determination Keep a record of your weekly job contacts and request benefits biweekly Review your Home page in Reconnect to complete any open fact-findings and review any important messages on your account Please review How to Avoid Reemployment Assistance Claim Issues for more information on steps you can take to help prevent issues with your claim.

RESOURCES It is not necessary to use friends or family members for interpretive services. Translation Services Services de traduction Servicios de traducción Servizi di traduzione Übersetzungsdienst Транслатион Сервицес Prevoditeljske usluge Sèvis tradiksyon 翻譯服務 翻译服务 翻訳サービス Dịch vụ dịch thuật اللغة العربية خدمات الترجمة Службы перевода Office for Civil Rights Request Benefit Payments Guide Claimant FAQs Reconnect Claimant User Guide Reconnect Third Party Representative TPR User Guide Benefits Hearing Appeals Pamphlet Reemployment Assistance Handbook Exemption Notice Flyer: Top Ten Things You Should Know Flyer: Reemployment Assistance Fraud Reemployment Assistance Forms Hotline.

FILE A NEW CLAIM RECONNECT RA HELP CENTER IDENTITY THEFT CLAIMANT FAQ. The Federal Student Aid Application Process begins with FAFSA. The COVID moratorium on student loan payments and interest came to an end on September 30, Interest began accumulating again on September 1, Following the Supreme Court decision, the Biden administration launched the Saving on a Valuable Education SAVE plan , a new income-driven repayment option.

In addition, the SAVE plan does not capitalize unpaid interest, which ensures that balances don't grow as long as payments are kept up to date. It also provides early forgiveness for low-balance borrowers. The American Rescue Plan passed by Congress and signed by President Biden in March includes a provision that makes all student loan forgiveness from Jan.

The Affordable Connectivity Program ACP replaced the Emergency Broadband Benefit EBB program at the start of The ACP is an extension of the EBB program, put in place by the Infrastructure Investment and Jobs Act.

Your household can also qualify if at least one household member meets one of the following criteria:. To apply, do the following:. There are three forms of subsidized rental housing: privately owned subsidized housing, the housing choice voucher HCV program formerly Section 8 , and U.

Department of Housing and Urban Development HUD public housing. With privately owned housing, you find the housing you want and apply for it at the rental office.

You can search for housing at Resources. With HCV, you find your apartment or house, and then the government pays the amount for which you qualify while you pay the difference.

HUD public housing, often used by people who don't qualify for Section 8 housing, requires you to rent from a local public housing authority based on your income. Wait times for both HCV and public housing programs may be long, depending on where you are applying.

To be eligible for privately owned subsidized housing, you must:. To be eligible for housing choice or HUD public housing, you must:.

As noted above, you apply for privately owned housing at the rental office. For the other two programs:. The table below compares all three housing programs and the requirements for each. Source: U.

Department of Housing and Urban Development; USA. HUD has several programs designed to help you purchase a home if you qualify. One part of HUD, the Federal Housing Administration FHA , insures mortgages, which makes it easier for buyers to become homeowners thanks to less strict eligibility requirements.

The program is popular witelh first-time home buyers but not limited to them. Eligibility for an FHA loan depends in part on your ability to post a down payment of 3.

You must also make sure the home is priced within the loan limit for an FHA home in its location. To apply for an FHA loan, you must find an approved FHA lender because the FHA doesn't lend the money itself. The HUD homeownership voucher program lets low-income families in the HCV program, including those in public housing, use their vouchers to meet monthly mortgage payments and other expenses when buying a home for the first time.

Contact your local PHA to find out if your PHA offers this program. The Department of Veterans Affairs VA offers home loan programs to active-duty service members, surviving spouses, and veterans.

VA loans are provided by private lenders, with the VA guaranteeing a significant portion of the loan. A certificate of eligibility COE is required and can be applied for through the Department of Veterans Affairs. Mortgage lending discrimination is illegal.

If you think you've been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take.

One such step is to file a report to the Consumer Financial Protection Bureau or with HUD. In addition to housing programs administered by the federal government, state housing finance agencies and state HUD offices offer special programs, as well.

HUD also funds counseling agencies nationwide that advise on topics related to housing, including buying a home. This table compares basic eligibility requirements for various government homeownership programs, including FICO credit score and debt-to-income ratio requirements.

Department of Housing and Urban Development; U. Department of Veterans Affairs. From emergency food needs to ongoing nutrition assistance, the federal government, in partnership with states, offers free and low-cost food programs for families and individuals.

If you need food quickly, the USDA maintains a National Hunger Hotline—HUNGRY —with information and eligibility requirements available in English and Spanish. The hotline, which will connect you with emergency food providers, government programs, and social service agencies, operates Monday through Friday from 7 a.

to 10 p. Eastern Time. SNAP previously called food stamps helps needy families supplement their food budget to move toward self-sufficiency. Eligibility is determined by individual states that administer the program. You apply in the state where you live by contacting your state agency.

Some states allow online applications, while others require your physical presence. WIC provides low-income women and their young children with healthy food, nutrition counseling, and referral to health, welfare, and social services agencies. WIC is a federal grant program administered by the government through 89 WIC agencies and approximately 47, authorized retailers.

To be eligible, the mother must be pregnant, nursing, or postpartum up to six months after birth with infants up to a year old or children under the age of five. There are additional income requirements posted on the WIC FAQ web page. Programs for school-age children include the National School Lunch Program NSLP , the School Breakfast Program SBP , and the Summer Food Service Program SFSP.

Eligibility requirements for all three programs are the same. The federal government sponsors two programs designed to get food to low-income older adults. The Senior Farmers' Market Nutrition Program SFMNP offers coupons to purchase fresh fruits, vegetables, honey, and herbs at farmers' markets, roadside stands, and farms.

The Commodity Supplemental Food Program CSFP provides healthy food every month. You must be 60 years of age or older and live in an area that offers either program to apply. Both programs have income limits. For more information, use the USDA's state contacts list.

The table below lists eligibility requirements for federal food programs. Department of Agriculture. Six major government healthcare programs provide medical coveragene for low-income and older Americans, children, veterans, and those who have recently lost their jobs.

Medicare is a federal health insurance program primarily for those 65 and older. Medicare is commonly divided into four parts.

Medicare Part A covers for inpatient hospital stays and nursing care. Medicare Part B covers doctor's visits, tests, flu shots, physical therapy, and chemotherapy.

Medicare Part C, otherwise known as Medicare Advantage , is Medicare Parts A and B coverage provided by a private insurer. Medicare Part D is Medicare's prescription drug benefit program, which is an optional benefit administered by private insurance companies.

Medicare is funded through a combination of payroll taxes and participant premiums, deductibles, and copays. Employees and employers each pay a 1. This tax is levied only on employees, not employers.

Medicare's resources are pooled into trust funds: the Hospital Insurance Trust Fund , which funds Part A, and the Supplemental Medical Insurance Trust Fund, which is funded by premiums and other income, and pays for Parts B and D. If you are still working and covered by employer health insurance when you are three months away from your 65th birthday, discuss your Medicare options and requirements with your human resources department.

You can also consult " How to Apply for Medicare Only " on the Social Security website. gov is home to the Health Insurance Marketplace , created by the Affordable Care Act ACA , an Obama administration program designed to make affordable health insurance available to uninsured Americans.

Anyone who doesn't have health insurance can obtain coverage through the Marketplace. Those who fall below certain income limits can receive subsidies that lower the cost of coverage. The Marketplace normally has an annual enrollment period to obtain or change coverage.

For , open enrollment begins November 1, and runs through January 16, Medicaid and the Children's Health Insurance Program CHIP are related but have slightly different requirements.

Medicaid is for low-income families and individuals. CHIP is for dependents under age 19 whose parents earn too much to qualify for Medicaid but not enough to pay for private health insurance coverage.

Both programs are federally funded in part and run at the state level. Each state has its own rules but must follow federal guidelines. You can apply for Medicaid and CHIP through the ACA Health Insurance Marketplace or your state Medicaid agency. The primary criteria to receive VA healthcare benefits are that you be a military veteran or former member of the National Guard or Reserve who served on active duty and was not dishonorably discharged.

Specific eligibility depends on when you served and for how long. The rules are complicated but well explained on the VA's website. Health coverage under the Consolidated Omnibus Budget Reconciliation Act COBRA is mandated by federal law for employees and their dependents when they lose their job or experience a reduction in work hours.

One huge downside to COBRA coverage is the cost. When you lose your job, whatever amount your employer was contributing toward your health insurance goes away, and you have to pay the entire cost yourself. State health departments offer programs in addition to those available at the federal level.

Use the USA. gov state health departments link to find out what is offered in your state, information about eligibility requirements, and how to apply.

The primary government retirement programs are Social Security for most citizens 65 and over who qualify through their work history and the Federal Employee Retirement System FERS for certain government employees who are not covered by Social Security.

If you have paid into the Social Security system for at least 10 years, you can apply for Social Security retirement benefits for yourself or as a spouse if you meet the following four requirements:. You can also apply for Medicare when you apply for Social Security if you are within three months of age FERS, which replaced the Civil Service Retirement System CSRS in , provides benefits to civilian government workers through three programs: a Basic Benefit Plan, Social Security, and the Thrift Savings Plan TSP.

Eligibility for FERS benefits is determined by your age and number of years of service. The CSRS and FERS planning and applying websites provide complete information depending on how close you are to retirement.

The Internal Revenue Service IRS sponsors several tax-assistance programs to make federal and, in some cases, state tax filing easier and possibly free.

The process and what you need to have to file are all explained in this Free File infographic. You can get help choosing a product using the Free File Online Lookup Tool. The fillable forms tool lets you file electronically but does not include state forms.

The IRS has two in-person tax assistance programs: the Volunteer Income Tax Assistance VITA program and the Tax Counseling for the Elderly TCE. Both offer free tax-preparation assistance to qualified individuals. TCE is for citizens aged 60 or older. Small businesses are the beneficiaries of several long-standing government assistance loan programs, most of them originating from the Small Business Administration SBA.

The USDA offers several programs aimed at all sectors of the agricultural community. Programs include farm loans, housing assistance, loans and grants for rural economic development , loans for beginning farmers and ranchers, livestock insurance, and more. Detailed information on all USDA programs, including how to apply, can be found on the USDA Grants and Loans program web page.

The Small Business Lending Fund SBLF , created as part of the Small Business Jobs Act of , is a dedicated fund that provides capital to community banks and community development loan funds CDLFs to encourage those organizations to lend to small businesses.

Frequently asked questions about this fund can be found on the U. Treasury Small Business Lending Fund website. People looking for government assistance sometimes come across ads for free government grants.

Video

Scammers find a weak spot in Pandemic Unemployment Assistance program

Ich denke, dass Sie nicht recht sind. Geben Sie wir werden es besprechen. Schreiben Sie mir in PM.

Dieser sehr gute Gedanke fällt gerade übrigens