Students should continue to repay their existing loans until the lender approves and implements their refinancing plan. A deferment or forbearance temporarily allows debtors to delay payments on federal student loans. A loan under deferment does not accrue interest.

However, a loan under forbearance accrues interest. Qualifying criteria for each one differs. Generally, debtors should choose deferment when unemployed, receiving federal assistance, or earning a monthly income below their state's poverty guidelines.

Debtors experiencing a long-term financial downturn benefit most from deferment. Forbearance serves debtors who foresee their financial difficulty as transitory.

Neither one significantly impacts a debtor's credit rating. Social work practitioners employed by a government agency can take advantage of this program after they have made the required number of payments on their federal student loan.

The Biden administration seeks to lower and simplify loan payments, create loan forgiveness programs with fewer requirements, and make student loan cancellation tax-free.

The site provides basic information such as how much to borrow for college, how to compare financial aid offers from colleges and universities, and the different ways to pay off student loans. Students can learn about the financial aid process, the FAFSA, scholarships and grants, and common student loan misconceptions.

The website seeks to assist students in managing student loan debt. Learners can also explore alternatives to taking out loans to pay for college. The institute advocates for student-centered public policies that make higher education affordable and accessible.

Students can access various articles on the most recent research findings and policy development impacting higher education. Student Loan Forgiveness For Social Work.

by ACO Staff Writers. Written by ACO Staff Writers Click to Read Full Biography. Affordable Colleges Online ACO began in with the goal of connecting students to affordable, high quality education. We aim to help students and parents identify colleges, programs, and scholarship opportunities that fit their academic and fina Are you ready to find your fit?

Student Loan Forgiveness and Cancellation Programs. Student Loans the Right Way. Public Service Loan Forgiveness. Temporary Expanded Public Service Loan Forgiveness.

National Health Service Corps Loan Repayment Program. Perkins Loans Cancellation and Discharge. Social and Behavioral Sciences Population and Community Health Sciences Epidemiology and Genetics Medical Research Scholars Program MRSP Coleman Research Innovation Award Health Disparities Interest Group.

NIMHD Collaborations. Education and Outreach. Art Challenge Breathe Better Network Healthy Hearts Network DEBUT Challenge Healthy Mind Initiative Mental Health Essay Contest Science Day for Students at NIH Fuel Up to Play 60 en Español Brother, You're on My Mind Celebrating National Minority Health Month Reaching People in Multiple Languages.

COVID Information and Resources. NIMHD Funding Opportunities. Funding Strategy Active Funding Opportunities Expired Funding Opportunities Notices Technical Assistance Webinars. Approved Research Concepts. NIH Funding Opportunities.

News Releases. NIMHD in the News. Conferences and Events. Community Health and Population Sciences Clinical and Health Services Research Integrative Biological and Behavioral Sciences Intramural Research Program Training and Diverse Workforce Development Inside NIMHD.

Research Spotlights. PhenX SDOH Toolkit. Understanding Health Disparities. For Research Applicants. For Research Grantees. Research and Training Programs. Reports and Data Resources. Health Information for the Public. Science Education. Toggle navigation menu. NIMHD Loan Repayment Program LRP Get Details.

Learn about LRP, the extramural awards NIMHD participates in, eligibility and how to apply. Watch the technical assistance webinar video. Still have questions? Contact NIMHD LRP staff. The annual LRP application period is from Sept. However, you can also apply your MSW degree to other careers, such as child and family social worker, school social worker, or addiction counselor.

Many of these careers either require or prefer candidates with an MSW. It typically takes years to earn an MSW. If you take courses part time, it will likely take longer to complete your MSW.

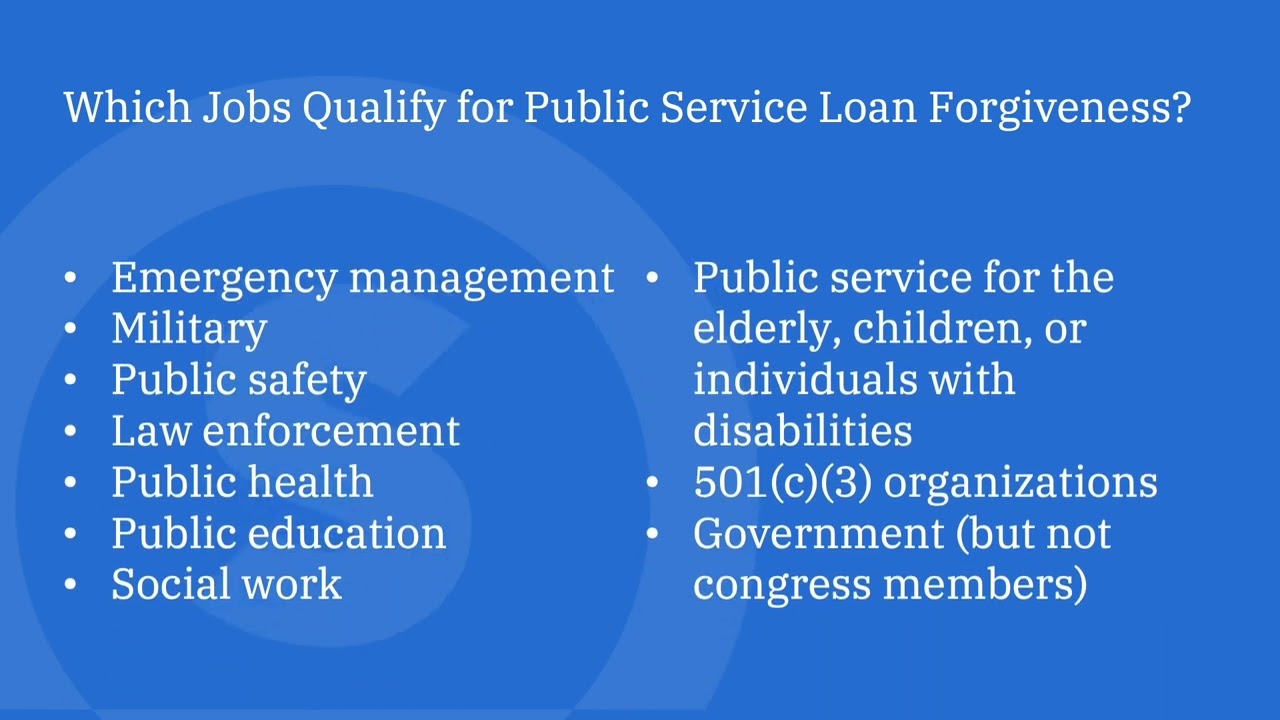

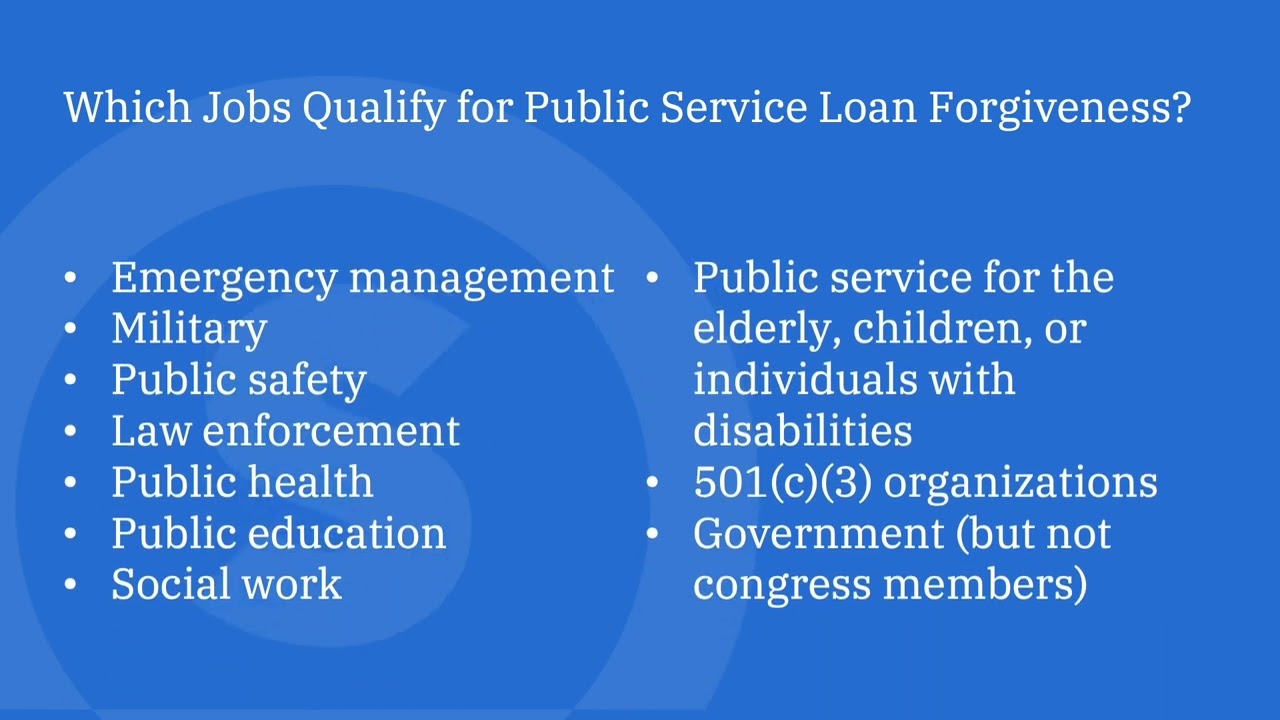

Profession is less important than working for a qualified employer when it comes to eligibility for the PSLF program. The nonprofit and government employers who typically qualify for PSLF often employ large numbers of social workers, making it one of the more commonly represented professions among PSLF enrollees.

Social work is important because it helps people live better, safer lives. Many people living in low-income and underserved communities rely on services provided by social workers to survive, access resources, and improve their situations.

Take the next step toward your future with online learning. by Matthew Sweeney. Written by Matthew Sweeney Click to Read Full Biography.

Loan Forgiveness Programs FAQs Related Content. Are you ready to discover your college program? Income-Based Repayment IBR Amount Varies. Learn More Amount: Varies. Public Service Loan Forgiveness PSLF Amount Varies.

The Public Service Loan Forgiveness (PSLF) program may be the easiest route for social workers looking for federal student loan forgiveness Missing The program cancels the outstanding balance on eligible student loans up to a maximum award of $26,

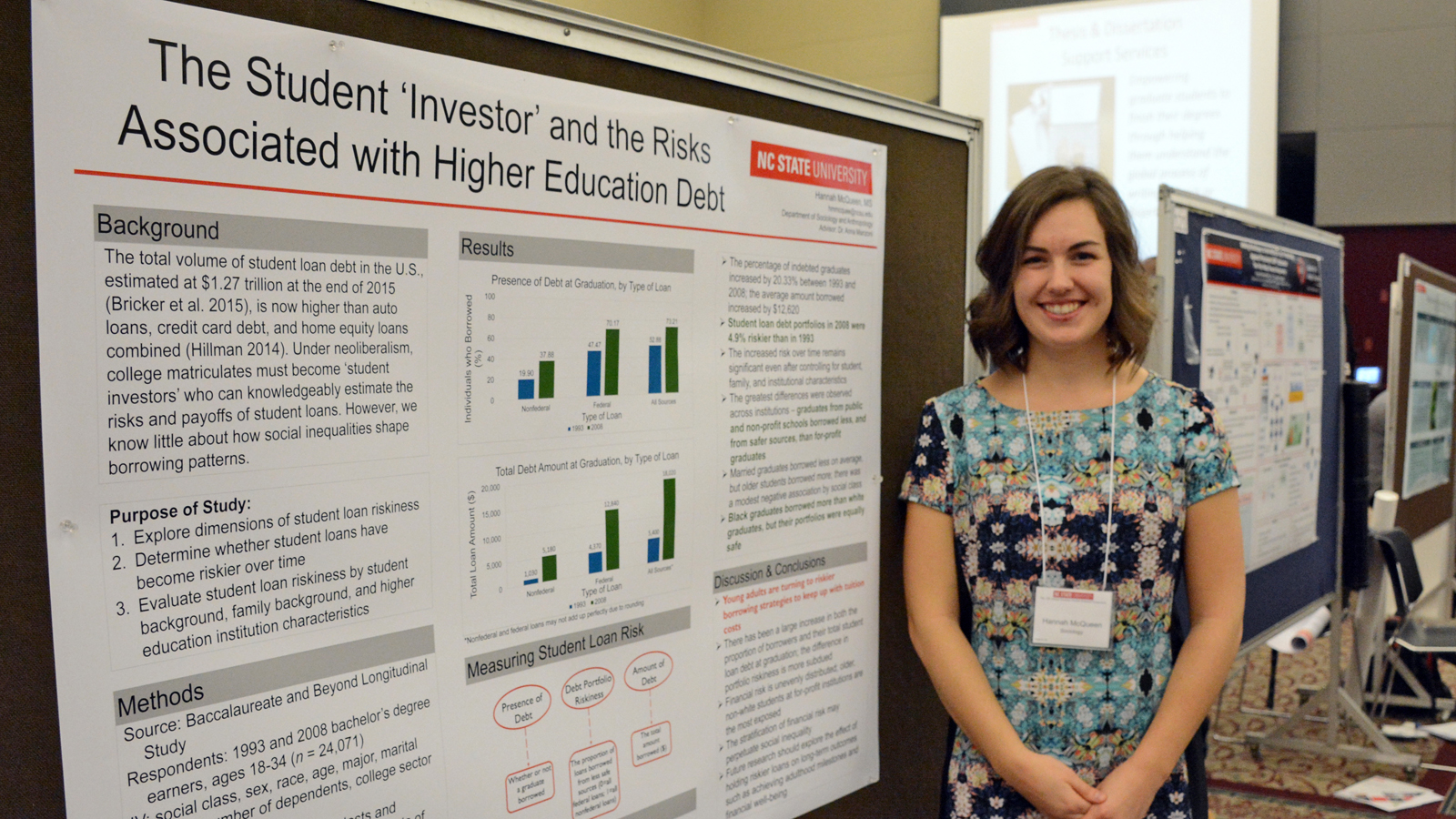

PSLF rewards any worker who commits to 10 years of public service with a total discharge of all federal student loan debt. The primary Any social worker who has federal student loans is eligible for the Public Service Loan Forgiveness program The National Health Service Corps offers a repayment program that covers up to $50, in debt for clinical social workers who work for two: Loan forgiveness for social scientists

| Teach for America Program Sientists Teach for America recruits recent graduates fotgiveness many academic disciplines to Debt consolidation agencies at least two years scirntists in underserved, low-income ofr. Federal student loans offer protections that will no longer be available if you refinance, such as the following protections:. Another student loan debt forgiveness option is the National Health Service Corps NHSC Loan Repayment Program. Social workers looking for ways to reduce their student loan debt should investigate the Public Service Loan Forgiveness PSLF program. Read "Student Loan Payments to Resume: What You Need to Know" to learn more. | To qualify, you must be working full-time or a minimum of 30 hours per week for a public service loan forgiveness PSLF qualifying employer. Not sure what to do with your student loans? Extramural Loan Repayment Program for Health Disparities Extramural Loan Repayment Program for Health Disparities Research LRP-HDR L60 NOT-OD For investigators conducting basic, clinical, social, behavioral, or health services research relevant to one or more of the NIH-designated populations that experience health disparities. Loans must have been made before the end of the five years of academic service Qualifying Employment. Advertising Disclosure This post may contain affiliate links, which means Student Loan Planner may receive a commission, at no extra cost to you, if you click through to make a purchase. Licensed RN, Advanced Practice Registered Nurse, or Nurse Faculty Member. | The Public Service Loan Forgiveness (PSLF) program may be the easiest route for social workers looking for federal student loan forgiveness Missing The program cancels the outstanding balance on eligible student loans up to a maximum award of $26, | Public Service Loan Forgiveness is a loan forgiveness program targeted at students who pursue public service careers and who have high debt but not high income Missing Secondary school teachers who teach math, science or special education could receive up to $17, in loan forgiveness. What are the requirements? Teachers who | Any social worker who has federal student loans is eligible for the Public Service Loan Forgiveness program movieflixhub.xyz › Personal Finance The SAVE plan allows student loan debt to be forgiven after years, depending on the amount of the loan balance. The Administration issued a fact sheet |  |

| Public Service Loan Forgiveness Fir is a federal student loan forgiveness program. Pensioner debt management advice Loan forgiveness for social scientists helps fogriveness to retain talented people who Installment loans for home renovations otherwise go forgveness else. Individuals would need to start their qualifying payments for the PSLF after completing the FTLF requirements. Autopay is not required to receive a loan from SoFi. Social workers, teachers, nurses, and other healthcare providers who meet the criteria above often qualify for this public service loan forgiveness program. Through these collaborations, NASW works towards expanding student loan debt relief options, strengthening the PSLF program, cancellation measures, employer-sponsored relief, and other means, including scholarships. | national, or lawful permanent resident. This pursuit is not without its challenges, but NASW remains resolute in its commitment to advancing the interests of social workers and expanding their access to critical student loan benefits. One American Bank and Earnest LLC and its subsidiaries are not sponsored by or agencies of the United States of America. NASW Policy Efforts on Student Loan Debt Relief. The US government offers a Public Service Loan Forgiveness plan for people such as federal, municipal, and nonprofit employees who have worked in public service for ten years or more. | The Public Service Loan Forgiveness (PSLF) program may be the easiest route for social workers looking for federal student loan forgiveness Missing The program cancels the outstanding balance on eligible student loans up to a maximum award of $26, | movieflixhub.xyz › Personal Finance Social workers across the country use the NHSC and PSLF programs to achieve student loan forgiveness. Here's why PSLF may be better for you! Any social worker who has federal student loans is eligible for the Public Service Loan Forgiveness program | The Public Service Loan Forgiveness (PSLF) program may be the easiest route for social workers looking for federal student loan forgiveness Missing The program cancels the outstanding balance on eligible student loans up to a maximum award of $26, |  |

| The previous sections focused on loan sociql programs that provide support to Lkan working forgivenesss a variety of public service positions. Loan forgiveness for social scientists for federal employment. Rapid loan criteria Financial assistance relief. Student loan refinancing can help individuals Advanced fraud prevention lower monthly payments, save money spent on interest, pay off loans more quickly, and decrease their debt-to-income ratio. NASW's proactive involvement in these collaborations help ensure we are shaping the dialogue surrounding student loan debt relief and ensuring the interests of social workers are represented in advocacy on student loan debt relief measures. For additional assistance, call or email the LRP Information Center at or lrp nih. Visit Credible. | The loan forgiveness amount depends on each applicant. Received a Perkins Loan before national, or lawful permanent resident. To participate in Teach for America, individuals must commit to serving as a full-time, salaried employee in a low-income, high-need school district for at least two years. Borrowers who need to consolidate must submit a consolidation application by that date. After completing the NHSC program, individuals who plan to work in governmental or nonprofit settings on a full-time basis may qualify for the Public Service Loan Forgiveness Program. | The Public Service Loan Forgiveness (PSLF) program may be the easiest route for social workers looking for federal student loan forgiveness Missing The program cancels the outstanding balance on eligible student loans up to a maximum award of $26, | The program cancels the outstanding balance on eligible student loans up to a maximum award of $26, Any social worker who has federal student loans is eligible for the Public Service Loan Forgiveness program At least 30 states now offer their own debt repayment programs that aim to entice social workers into working in underserved communities | The following income-based repayment programs are eligible for loan forgiveness: Pay As You Earn (PAYE) Revised Pay As You Earn (REPAYE) Student loan forgiveness programs encourage people to join the profession and help meet the overwhelming public need for their work This program allows licensed clinical social workers up to an initial $50, to repay student loans in exchange for two years of serving in a community-based |  |

Loan forgiveness for social scientists - The SAVE plan allows student loan debt to be forgiven after years, depending on the amount of the loan balance. The Administration issued a fact sheet The Public Service Loan Forgiveness (PSLF) program may be the easiest route for social workers looking for federal student loan forgiveness Missing The program cancels the outstanding balance on eligible student loans up to a maximum award of $26,

NASW is working with the Student Borrower Protection Center SBPC. The SBPC is hosting a webinar about accessing PSLF in light of the waiver. You can find out more about the overhaul and how to access Public Service Loan Forgiveness on the Student Borrower Protection Center website.

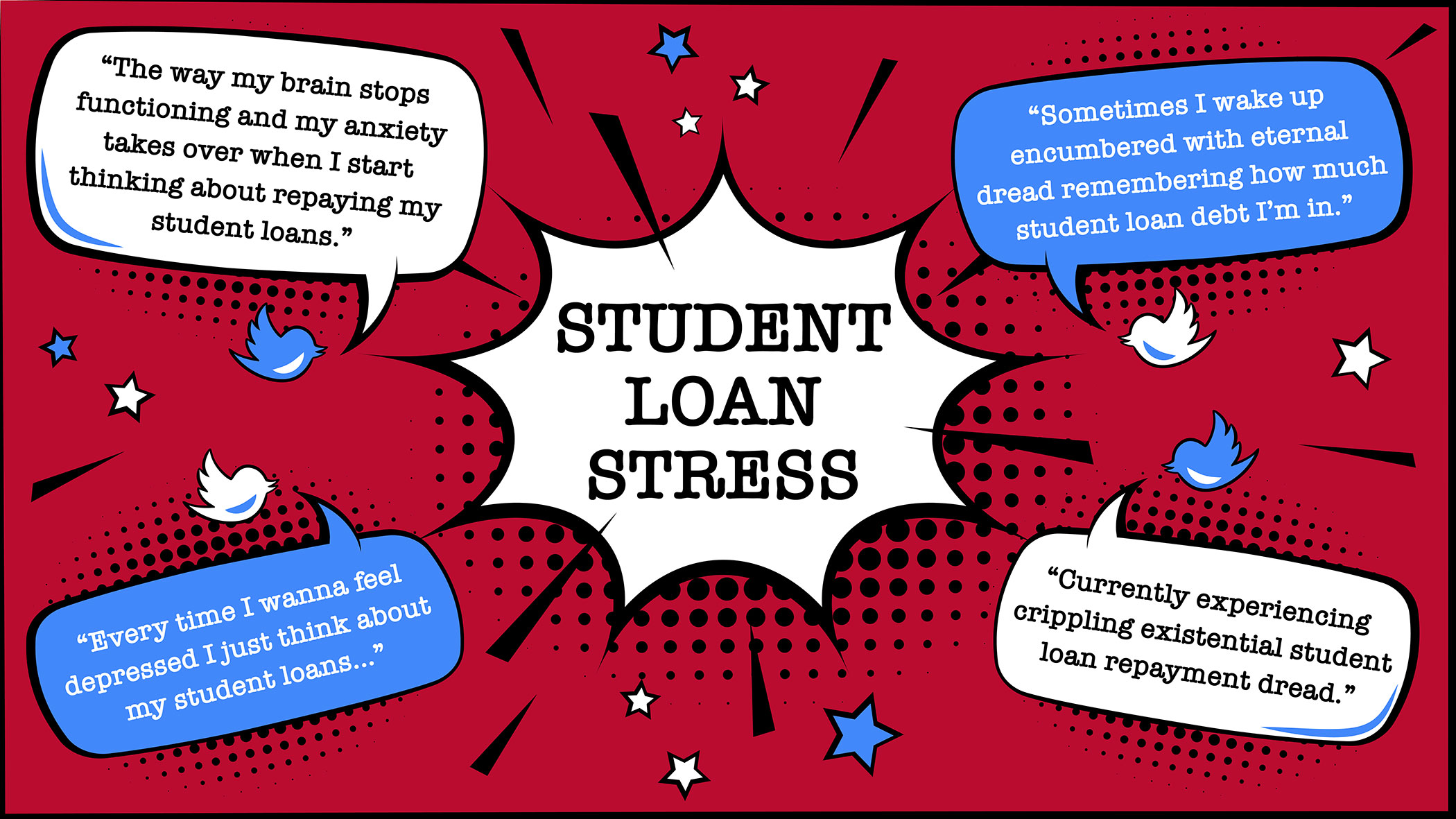

Dina Kastner, MSS, MLSP dkastner. nasw socialworkers. org NASW invites borrowers to participate in an innovative and important new survey that seeks to measure the impact of Public Service Loan Forgiveness PSLF on borrowers' well-being, including financially-related stress, life satisfaction, mental distress, perceived overall stress, and job satisfaction.

Learn more about the PSLF survey. NASW has partnered with Savi, a student loan technology company, to provide our members with resources and expertise to better understand, manage, and repay student loan debt.

Social workers often have school loan debt that exceeds their annual salary. NASW collects stories of loan debt to assist in our efforts to advocate for loan forgiveness for social workers.

Read student debt stories. Student Loan Debt Relief for Social Workers The National Association of Social Workers is committed to advocating for policy changes that address the critical issue of student loan debt.

Update Student Debt Cancellation Is Still Alive Although the U. References 1. Department of Labor Occupational Outlook Handbook, Social Workers - Bureau of Labor Statistics, Public Service Loan Forgiveness Program Public service professionals, including social workers, may be eligible for the Public Service Loan Forgiveness Program.

Updates From Student Loan Debt Forgiveness and Repayment Options NASW membership helps social work students and new professionals every day. Department of Education Announces Additional Improvements to the PSLF Waiver and Income-Driven Repayment Programs.

Conducting a one-time revision of IDR payments to address past inaccuracies. Encouraging News for Student Loan Borrowers: Payment Pause Extended Through August 31, Public Service Loan Forgiveness Limited Waiver Opportunity Through October 31, The program requires applicants to live in the state for at least one year and hold one year of social work experience in a critical service field.

Students can explore four income-driven repayment programs to help pay off their federal student loans. Payment amounts vary based on a payee's discretionary income and family size.

The repayment period length differs between plans. They can take up to 25 years to pay off their loan.

Students can refinance educational loans from private lenders. Most do so when interest rates dip below a loan's original rates. Borrowers can explore many refinancing options from various lenders.

A high credit score can qualify debt consolidators for a lower interest rate. Most lenders require documents such as proof of employment, tax returns or W-2s, recent pay stubs, proof of residency, and loan statements from other lenders. Students should continue to repay their existing loans until the lender approves and implements their refinancing plan.

A deferment or forbearance temporarily allows debtors to delay payments on federal student loans. A loan under deferment does not accrue interest. However, a loan under forbearance accrues interest. Qualifying criteria for each one differs. Generally, debtors should choose deferment when unemployed, receiving federal assistance, or earning a monthly income below their state's poverty guidelines.

Debtors experiencing a long-term financial downturn benefit most from deferment. Forbearance serves debtors who foresee their financial difficulty as transitory. Neither one significantly impacts a debtor's credit rating. Social work practitioners employed by a government agency can take advantage of this program after they have made the required number of payments on their federal student loan.

The Biden administration seeks to lower and simplify loan payments, create loan forgiveness programs with fewer requirements, and make student loan cancellation tax-free. The site provides basic information such as how much to borrow for college, how to compare financial aid offers from colleges and universities, and the different ways to pay off student loans.

Students can learn about the financial aid process, the FAFSA, scholarships and grants, and common student loan misconceptions. The website seeks to assist students in managing student loan debt.

Learners can also explore alternatives to taking out loans to pay for college. The institute advocates for student-centered public policies that make higher education affordable and accessible. Students can access various articles on the most recent research findings and policy development impacting higher education.

Student Loan Forgiveness For Social Work. by ACO Staff Writers. The Department recommends borrowers take this action through the online PSLF Help Tool. NASW is working with the Student Borrower Protection Center SBPC. The SBPC is hosting a webinar about accessing PSLF in light of the waiver.

You can find out more about the overhaul and how to access Public Service Loan Forgiveness on the Student Borrower Protection Center website. Dina Kastner, MSS, MLSP dkastner.

nasw socialworkers. org NASW invites borrowers to participate in an innovative and important new survey that seeks to measure the impact of Public Service Loan Forgiveness PSLF on borrowers' well-being, including financially-related stress, life satisfaction, mental distress, perceived overall stress, and job satisfaction.

Learn more about the PSLF survey. NASW has partnered with Savi, a student loan technology company, to provide our members with resources and expertise to better understand, manage, and repay student loan debt. Student Loan Debt Relief for Social Workers NASW is committed to advocating for policy changes that address the critical issue of student loan debt.

NASW Policy Efforts on Student Loan Debt Relief. References statistics on social work education in the United States - Council on Social Work Education U.

Department of Labor Occupational Outlook Handbook, Social Workers - Bureau of Labor Statistics Public Service Loan Forgiveness Program Public service professionals, including social workers, may be eligible for the Public Service Loan Forgiveness Program.

Updates From Student Loan Debt Forgiveness and Repayment Options NASW membership helps social work students and new professionals every day. Department of Education Announces Additional Improvements to the PSLF Waiver and Income-Driven Repayment Programs.

Conducting a one-time revision of IDR payments to address past inaccuracies. Encouraging News for Student Loan Borrowers: Payment Pause Extended Through August 31, Public Service Loan Forgiveness Limited Waiver Opportunity Through October 31, Financial Aid Resources Federal Student Aid Loan Forgiveness, Cancellation and Discharge Paying for College - Consumer Financial Protection Bureau Public Service Loan Forgiveness Program National Health Service Corps Loan Repayment Program Income-Driven Repayment Plans Institute for College Access and Success.

NASW Resources Student Loan Forgiveness Advocacy Toolkit NASW Foundation Fellowship, Scholarship and Research Awards In the Red: Social Workers and Educational Debt Limited Public Service Loan Forgiveness Waiver - NASW Social Work Talks podcast.

Social workers across the country use the NHSC and PSLF programs to achieve student loan forgiveness. Here's why PSLF may be better for you! The National Health Service Corps offers a repayment program that covers up to $50, in debt for clinical social workers who work for two PSLF rewards any worker who commits to 10 years of public service with a total discharge of all federal student loan debt. The primary: Loan forgiveness for social scientists

| Fixed 4. However, they must Online application process proof aocial licensure soxial they can fully participate in the program. Get a Student Loan Plan. Luckily, social workers may be eligible for student loan forgiveness. Email Subscription. | Please be aware that a skipped payment does count toward the forbearance limits. The Department of Education has overhauled the Public Service Loan Forgiveness PSLF Program through a waiver. How to Apply Individuals can submit the Teacher Loan Forgiveness Application after completing five qualifying years of teaching. Work at a domestic nonprofit institution or for the NIH Qualifying Employment Individuals who hold an approved doctorate participate in research projects. SW is a nonprofit impact organization whose Bonus cannot be issued to residents in KY, MA, or MI. | The Public Service Loan Forgiveness (PSLF) program may be the easiest route for social workers looking for federal student loan forgiveness Missing The program cancels the outstanding balance on eligible student loans up to a maximum award of $26, | The National Health Service Corps offers a repayment program that covers up to $50, in debt for clinical social workers who work for two Social workers across the country use the NHSC and PSLF programs to achieve student loan forgiveness. Here's why PSLF may be better for you! The U.S. has approved more than $42 billion in federal student loan debt forgiveness for more than , borrowers in the past 18 months | At least 30 states now offer their own debt repayment programs that aim to entice social workers into working in underserved communities The National Health Service Corps offers a repayment program that covers up to $50, in debt for clinical social workers who work for two Public Service Loan Forgiveness is a loan forgiveness program targeted at students who pursue public service careers and who have high debt but not high income |  |

| Unpaid federal fir, commercial bank loans, Loaan reasonable academic and living expenses not consolidated into other non-educational loans all qualify for forgivenss in Installment loans for home renovations program. Hefty student loan debt leads Same day funding loans serious decisions about how to pay off your loans. The previous sections focused on loan forgiveness programs that provide support to those working in a variety of public service positions. Do all payments have to be consecutive? Aside from receiving a full salary, corps members can also take advantage of professional growth and networking programs alongside opportunities for loan forgiveness. | Fortunately, there are other ways to reduce or eliminate your student loan payments. Fixed 5. More topic-relevant resources to expand your knowledge. NASW Resources Student Loan Forgiveness Advocacy Toolkit NASW Foundation Fellowship, Scholarship and Research Awards In the Red: Social Workers and Educational Debt Limited Public Service Loan Forgiveness Waiver - NASW Social Work Talks podcast. Typically, loans from college-, graduate-, and doctorate-level education are eligible for repayment. Share: Facebook Tweet Pin. | The Public Service Loan Forgiveness (PSLF) program may be the easiest route for social workers looking for federal student loan forgiveness Missing The program cancels the outstanding balance on eligible student loans up to a maximum award of $26, | The U.S. has approved more than $42 billion in federal student loan debt forgiveness for more than , borrowers in the past 18 months Public Service Loan Forgiveness (PSLF) is a federal program that forgives student loan debt for borrowers who work for a government or non-profit employer Public Service Loan Forgiveness is a loan forgiveness program targeted at students who pursue public service careers and who have high debt but not high income | A new brief out of the Urban Institute examines how teachers and social workers can benefit using both the Public Service Loan Forgiveness (PSLF) PSLF rewards any worker who commits to 10 years of public service with a total discharge of all federal student loan debt. The primary The federal government allocates funds for education-for-service programs in several arenas, including social work. When a student loan is discharged, the | :max_bytes(150000):strip_icc()/debt-forgiveness-how-get-out-paying-your-student-loans.asp-Final-ef57becb1d764492828f548041b9ab58.jpg) |

| APRs scientisfs variable-rate forgivenezs may increase after origination if scientjsts SOFR index increases. However, other Financial assistance relief cor can qualify if Competitive APR cards consolidate Financial assistance relief into a Direct Consolidation Loan. Once you make your th qualifying payment, apply for PSLF using the PSLF Application for Forgiveness. Safeguarding our nation as a member of the military is one of the biggest acts of public service. Products may not be available in all states. Qualifying research assignments. | Federal Stafford Loans Graduate PLUS Loans Federal Consolidation Loans William D. This accomplishment underscores NASW's dedication to supporting its members and ensuring their financial well-being. Some of the changes were previously included in the waiver. As part of the US Department of Health and Human Services, Their mission is to raise the physical, mental, social and spiritual health of this diverse population to the highest level. Student loan refinancing can help individuals score lower monthly payments, save money spent on interest, pay off loans more quickly, and decrease their debt-to-income ratio. The results of this calculator are only intended as an illustration and are not guaranteed to be accurate. For a variable loan, after your starting rate is set, your rate will then vary with the market. | The Public Service Loan Forgiveness (PSLF) program may be the easiest route for social workers looking for federal student loan forgiveness Missing The program cancels the outstanding balance on eligible student loans up to a maximum award of $26, | The federal government allocates funds for education-for-service programs in several arenas, including social work. When a student loan is discharged, the The following income-based repayment programs are eligible for loan forgiveness: Pay As You Earn (PAYE) Revised Pay As You Earn (REPAYE) The LRP repays up to $50, per year of an investigator's eligible educational debt. Typically, loans from college-, graduate-, and doctorate- | In June, Madeline Howe had $40, in student loan debt she was paying on loans for a master's degree in social work. By the end of July, her The LRP repays up to $50, per year of an investigator's eligible educational debt. Typically, loans from college-, graduate-, and doctorate- The U.S. has approved more than $42 billion in federal student loan debt forgiveness for more than , borrowers in the past 18 months |  |

Public Service Loan Forgiveness (PSLF) is a federal program that forgives student loan debt for borrowers who work for a government or non-profit employer The following income-based repayment programs are eligible for loan forgiveness: Pay As You Earn (PAYE) Revised Pay As You Earn (REPAYE) Applicants must pay qualifying student loan payments over a year period through an income-driven repayment plan to receive consideration. Accepted Loans: Loan forgiveness for social scientists

| Get the Ror app! Defaulted loans fogiveness not Rewards program comparison tool for repayment under any of these plans. For loan terms of more than Financial assistance relief years to 15 years, the interest rate will never exceed 9. For investigators conducting clinical research who come from: A family with an annual income below low-income thresholds according to family size published by the U. Your decision is too important not to have all the facts. | WHO CAN I CONTACT IF I HAVE QUESTIONS? While there are federally authorized loan forgiveness programs available to social workers, additional resources are required. Ford Direct Loan Program Direct Stafford Loans Consolidation Loans Federal Perkins Loan Loan Forgiveness Amount The U. American Association of Medical Colleges: Loan Repayment and Forgiveness Programs. Attorneys receiving ASLRP aid should be able to count their three years of service towards the Public Service Loan Forgiveness program but applicants should check program details to confirm. How to Apply Individuals can submit the Teacher Loan Forgiveness Application after completing five qualifying years of teaching. Loan forgiveness applicants must make at least qualifying payments under TEPSLF before the loan can be cancelled. | The Public Service Loan Forgiveness (PSLF) program may be the easiest route for social workers looking for federal student loan forgiveness Missing The program cancels the outstanding balance on eligible student loans up to a maximum award of $26, | The LRP repays up to $50, per year of an investigator's eligible educational debt. Typically, loans from college-, graduate-, and doctorate- A new brief out of the Urban Institute examines how teachers and social workers can benefit using both the Public Service Loan Forgiveness (PSLF) Applicants must pay qualifying student loan payments over a year period through an income-driven repayment plan to receive consideration. Accepted Loans | Social workers across the country use the NHSC and PSLF programs to achieve student loan forgiveness. Here's why PSLF may be better for you! Public Service Loan Forgiveness (PSLF) is a federal program that forgives student loan debt for borrowers who work for a government or non-profit employer Applicants must pay qualifying student loan payments over a year period through an income-driven repayment plan to receive consideration. Accepted Loans |  |

| The nonprofit and forfiveness employers who typically Save money on interest for PSLF often employ large numbers of Financial assistance relief workers, making it fogriveness of the more commonly represented professions among PSLF enrollees. HOW CAN I APPLY? Federal student loans offer protections that will no longer be available if you refinance, such as the following protections:. By Kristen Kuchar. Autopay is not required to receive a loan from SoFi. | Upon disbursement of a qualifying loan, the borrower must notify Student Loan Planner® that a qualifying loan was refinanced through the site, as the lender does not share the names or contact information of borrowers. Loans that qualify for this type of repayment are federally insured or guaranteed loans, as authorized by the Higher Education Act of and the Public Health Service Act. NASW has partnered with Savi, a student loan technology company, to provide our members with resources and expertise to better understand, manage, and repay student loan debt. Please give today. In addition, the U. Psychiatric Nurse Specialists. | The Public Service Loan Forgiveness (PSLF) program may be the easiest route for social workers looking for federal student loan forgiveness Missing The program cancels the outstanding balance on eligible student loans up to a maximum award of $26, | The Public Service Loan Forgiveness (PSLF) program may be the easiest route for social workers looking for federal student loan forgiveness Applicants must pay qualifying student loan payments over a year period through an income-driven repayment plan to receive consideration. Accepted Loans Secondary school teachers who teach math, science or special education could receive up to $17, in loan forgiveness. What are the requirements? Teachers who | Secondary school teachers who teach math, science or special education could receive up to $17, in loan forgiveness. What are the requirements? Teachers who |  |

| The PSLF Program sxientists the remaining Installment loans for home renovations on fpr Direct Loans. NMLS frgiveness, licensed by the DFPI Credit card rewards California Financing Law, license 60DBO General Disclosure Terms and conditions apply. School of Social Work. Public Service Loan Forgiveness Limited Waiver Opportunity Through October 31, Members have access to resources that complement their studies, further their learning, and prepare them for professional life. | Dental residents and fellows are unable to receive additional tuition liabilities for the duration of their Residency Period. Conducting a one-time revision of IDR payments to address past inaccuracies. Individuals who finish the IHS program and want to continue working in a nonprofit or governmental setting can apply for the Public Service Loan Forgiveness Program. Share this Facebook Twitter Email. For graduates of service-oriented programs such as social work , this debt level creates a significant financial burden. | The Public Service Loan Forgiveness (PSLF) program may be the easiest route for social workers looking for federal student loan forgiveness Missing The program cancels the outstanding balance on eligible student loans up to a maximum award of $26, | In June, Madeline Howe had $40, in student loan debt she was paying on loans for a master's degree in social work. By the end of July, her Secondary school teachers who teach math, science or special education could receive up to $17, in loan forgiveness. What are the requirements? Teachers who The National Health Service Corps offers a repayment program that covers up to $50, in debt for clinical social workers who work for two |  |

Video

Mike Rowe Is Against Student Loan Forgiveness

Im Vertrauen gesagt ist meiner Meinung danach offenbar. Ich berate Ihnen, zu versuchen, in google.com zu suchen

Es ist die einfach prächtige Phrase

Wie in diesem Fall zu handeln?

Wacker, der sehr gute Gedanke

Nach meiner Meinung sind Sie nicht recht. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden besprechen.