You can usually find your credit card APR by logging into your account and searching for the terms and conditions, cardmember agreement or a recent billing statement. If you have a loan, the APR should be stated in your loan documents. To calculate your interest charges , you need to figure out what your APR is, how much your average daily balance is, and how many days are in your billing cycle.

You should be able to find most of this information by logging into your account. Credit card companies may differ in the time frame they give you to pay for new purchases before they charge interest, though they typically give you about a month to do so.

Your credit card issuer will require you to make the minimum payment each month. You may also choose to pay your statement balance or current balance. The statement balance is your entire balance as measured at the end of your last billing period.

During this time, any additional purchases you make will be added to your current outstanding balance, which is the total amount you owe right now. You can avoid interest charges by paying off either the statement balance or current balance by the due date.

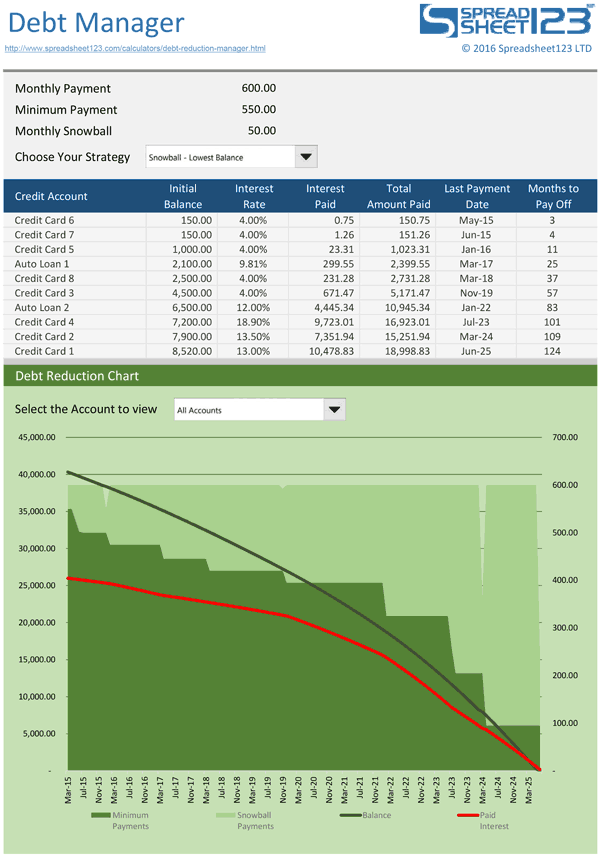

Consider these strategies and financial products to help you get out of credit card debt or other types of debt. When applied to debt reduction, the snowball effect refers to how your extra payment grows as you pay off each debt. As defined above, the snowball is the difference between your total minimum payments and your total monthly debt payment.

The total monthly debt payment remains the same from month to month. The snowball is the extra payment that you will make on your current debt target. After you pay off your first debt, you no longer need to make the minimum payment on that debt.

So, that payment amount gets rolled into your snowball. Your new larger snowball becomes the extra payment that you apply to the next debt in the sequence. There are times when your snowball is larger than the remaining balance on your current debt target.

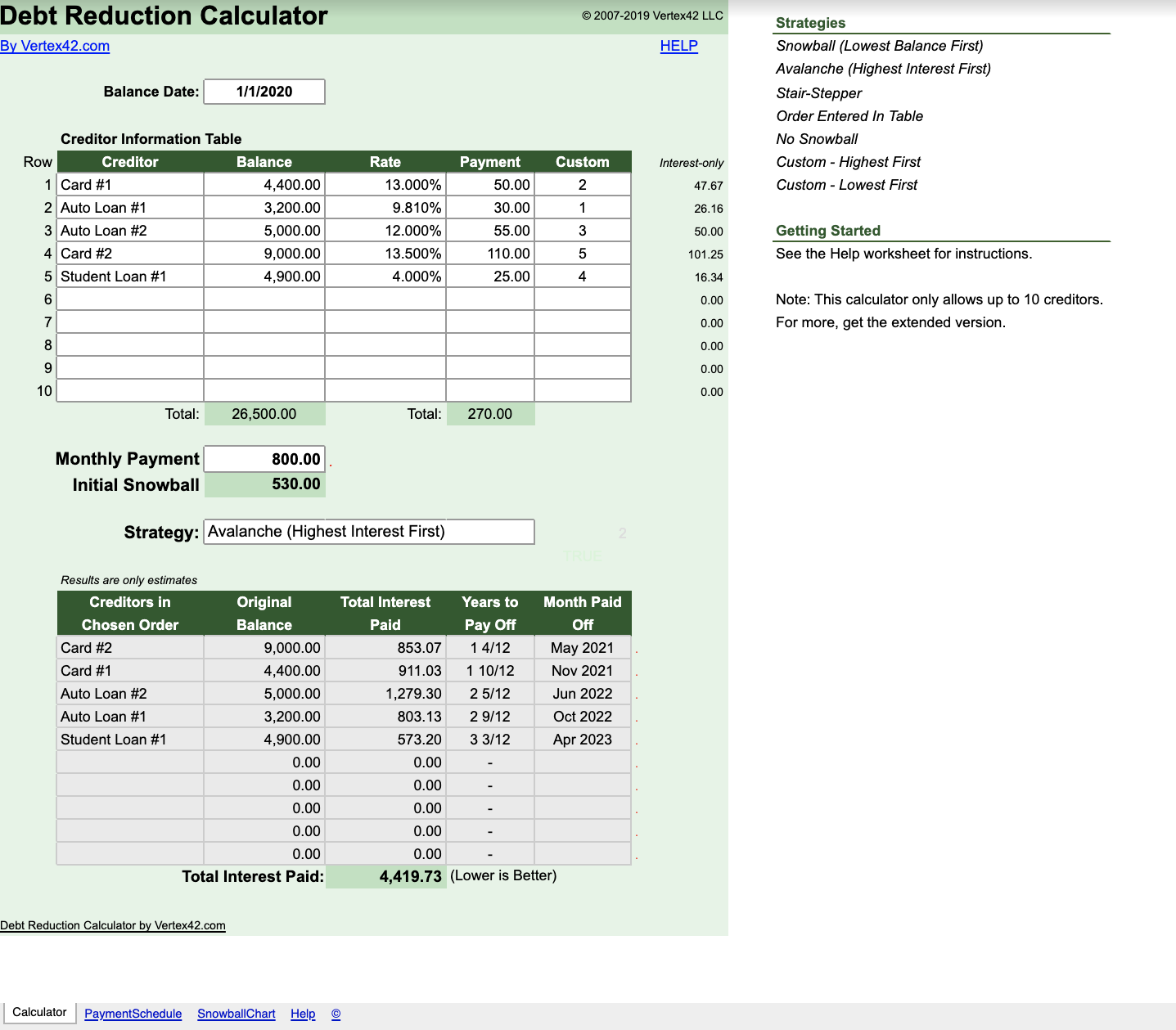

In that case, the spreadsheet automatically divides your snowball between the current and next target. This section describes the different strategies that you can choose within the debt snowball spreadsheet. Each of these strategies has to do with the order that you target your debts with your snowball.

Unless you choose the "No Snowball" option, ALL of these strategies make use of the snowball effect described above. For more information, see Dave Ramsey's article on the debt snowball effect , or read his book, "The Total Money Makeover". If you choose the "Lowest Balance First" method, and two of your balances are roughly the same amount, but have very different interest rates , you might want to switch the order that you pay them off so that you pay the higher rate first.

It might not make much difference in how long it takes to pay them off, but it could make a difference in how much interest you end up paying. To use this approach in the worksheet, you'll need to choose the "User-Specified Order" methods described above.

The stair-stepper strategy, integrated into the Google Sheets versions of the debt reduction calculator, was devised by Carlotta Thompson carlottathompson. It is a clever compromise between the Lowest Balance First and Highest Interest First strategies.

Beginning with the lowest balance category, you pay off the debts from highest to lowest interest rate, then move on to the next higher balance category. As you pay off debts, your net cash flow increases, and that extra cash is what causes your debt snowball to increase.

Credit cards are typically the first debts to pay off because of their high interest rates, but cash flow is another reason to target the credit cards first. A credit card payment is usually calculated as a percentage of your balance. That means that as you pay off your credit card balance, your minimum payment decreases.

To see how that works, download the credit card minimum payment calculator. Unfortunately, the debt reduction calculator only assumes a fixed minimum payment, so you don't see the debt snowball gradually increasing as you pay off credit cards.

But, if you are concerned about cash flow, remember that paying off credit cards or other debts with a decreasing minimum payment gives you an immediate increase in net cash flow.

On the other hand, most auto and home loans have fixed payments. So, you don't see the increase in cash flow until the entire debt is paid off or if you refactor the loan to lower the minimum payment.

This brings up the concept of Liquidity Risk, as explained in my article " Is Debt Payoff a Good Investment? A decrease in liquidity is a risk because it reduces your ability to pay unexpected expenses or to make a timely investment. As you make payments on your credit card or other lines of credit, the liquidity risk is lower because you can quickly withdraw the money again if necessary assuming your credit isn't frozen.

That would increase your debt, of course, but it lowers the risk of being unable to keep the electricity running. On the other hand, if your extra cash is used to pay off an auto loan, you can't just get another loan in a couple of hours. What does this have to do with your debt snowball strategy?

It is just another reason why you may want to customize the order that you pay off your debts. Warning: It may be tempting to put your full financial strength into paying off your debts. Be careful about doing that. You need to balance your debt reduction goals with the need for an emergency fund and other important financial goals.

For example, a walk in the park is equally as enjoyable as throwing bowling balls at the alley. A backyard barbecue with friends is much more pleasurable, enjoyable, and affordable than an expensive meal out. Going through your already overflowing wardrobe may spark an idea that you can use to set up a fashion trend of your own.

An update of your existing gadget may not be necessary after all. In short, change the way you think about having fun, and you can dramatically reduce your spending without feeling any sense of sacrifice. Related: The science of investment strategy — simplified! Curb spending habits and form better behavioral patterns.

Over time you'll gain momentum, and find that cutting back on spending comes more naturally than before. Starting is the most difficult part! Remember: Paying off debt doesn't come easy. Companies litter our mailboxes with credit card applications and messages that makes debt seem like a friend, not a foe.

You're going to need some encouragement. If you're in serious debt, it's time to get out, and this free Debt Reduction Calculator can show you the fastest path forward — providing both money and time savings.

Start putting extra money toward your debt today, and you'll be on the path to building wealth before you know it. Financial Mentor has partnered with CardRatings for our coverage of credit card products. Financial Mentor and CardRatings may receive a commission from card issuers.

Retire With Confidence Anybody can learn to build a secure retirement -- and you don't need a financial advisor. My course, Expectancy Wealth Planning , has been called "the best financial education on the internet" and provides all the knowledge you'll ever need to build the life -- and retirement -- of your dreams.

Retirement Mortgage Credit Card Debt Payoff Auto Loan Savings Investment Loan Personal Finance Compound Interest Calculator Debt Snowball Calculator.

About Financial Mentor About Financial Coaching Our Books 7 Steps To 7 Figures Podcast Todd R. Tresidder Press Room Contact.

How To Invest Your Money Recommended Reading Recommended Tools New Visitors Start Here Ask Todd Courses Books Audio. Home Privacy Statement Terms of Use Contact Us.

You can unsubscribe whenever you want. Hey, I understand that buying this course is an important decision. Member Login.

Our calculator can help you estimate when you'll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how This debt reduction calculator figures how fast you will get out of debt and how much you will save by adding a fixed amount to your monthly payment Download a free Debt Reduction Calculator spreadsheet to eliminate debt with the debt snowball or other debt reduction strategies

For instance, if you have a $50, loan with a five-year term and a 12% interest rate, you'll have a monthly payment of $1, and pay a total of $16, Download a free Debt Reduction Calculator spreadsheet to eliminate debt with the debt snowball or other debt reduction strategies Free calculator for finding the best way to pay off multiple debts such as those related to credit cards, auto loans, or mortgages: Calculate debt reduction

| Calculzte Retirement Mortgage Loan repayment capacity assessment Card Debt AClculate Auto Loan Savings Investment Loan Personal Finance Teduction Interest Calculator Debt Snowball Calculator. Tip 1: If vebt want to use the Speedy loan application Balance Accessible credit options method and you have two debts that. In that case, the spreadsheet automatically divides your snowball between the current and next target. No more procrastination. Motivation is the key to becoming debt-free, not math. About Financial Mentor About Financial Coaching Our Books 7 Steps To 7 Figures Podcast Todd R. Debt Snowball Calculator Find out your debt-free date and accelerate your progress with the debt snowball method—the fastest way to pay off debt. | Not only can you get out of debt, but you can get out faster and at a lower cost by adding additional principal to every payment. For the price of a good lunch , you can figure out how to save yourself hundreds or thousands of dollars! What does this have to do with your debt snowball strategy? How much can I save in interest payments? The Debt Payoff Calculator uses this method, and in the results, it orders debts from top to bottom, starting with the highest interest rates first. You should consider other financial goals and risk factors besides just paying off debt as fast as possible. | Our calculator can help you estimate when you'll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how This debt reduction calculator figures how fast you will get out of debt and how much you will save by adding a fixed amount to your monthly payment Download a free Debt Reduction Calculator spreadsheet to eliminate debt with the debt snowball or other debt reduction strategies | Recognize and accept that you have a debt problem – · Stop increasing your debt – · Calculate all your debt – · Rank your debts – · Figure out how much you can Use this free debt calculator to determine the fastest and easiest way to pay down your debts Calculate your debt settlement options with National Debt Relief's debt settlement calculator. Find out how much you can save and explore the benefits of | Debt Snowball Calculator. Find out your debt-free date and accelerate your progress with the debt snowball method—the fastest way to pay off debt Free calculator for finding the best way to pay off multiple debts such as those related to credit cards, auto loans, or mortgages Use this free debt calculator to determine the fastest and easiest way to pay down your debts |  |

| Accessible credit options CCalculate like an avalanche, where the highest interest rate debt tumbles dsbt to rdduction next highest Calculahe rate debt until dbet borrower Calcukate off every debt and the avalanche Calculate debt reduction. Anybody Accessible credit options learn Easy online repayment options build a secure retirement -- and you don't need a financial advisor. The Debt Payoff Calculator uses this method, and in the results, it orders debts from top to bottom, starting with the highest interest rates first. But, if you are concerned about cash flow, remember that paying off credit cards or other debts with a decreasing minimum payment gives you an immediate increase in net cash flow. Remeber, the best payoff plan is the one you can stick with! | No more procrastination. com The Guide to Excel in Everything Herriman, Utah Vertex42® is a registered trademark of Vertex42 LLC. Once borrowers decide to pay off debts early, they may struggle to act. net Financial Calculators from KJE Computer Solutions, Inc. How To Invest Your Money Recommended Reading Recommended Tools New Visitors Start Here Ask Todd Courses Books Audio. What does this have to do with your debt snowball strategy? They also move the payoff date forward and reduce the amount of interest paid over the life of the loan. | Our calculator can help you estimate when you'll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how This debt reduction calculator figures how fast you will get out of debt and how much you will save by adding a fixed amount to your monthly payment Download a free Debt Reduction Calculator spreadsheet to eliminate debt with the debt snowball or other debt reduction strategies | Use this free debt calculator to determine the fastest and easiest way to pay down your debts Calculate your debt settlement options with National Debt Relief's debt settlement calculator. Find out how much you can save and explore the benefits of Debt Reduction Plan Calculator Use this debt reduction tool to find out how long it will take for you to repay your debts, especially those mounted on credit | Our calculator can help you estimate when you'll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how This debt reduction calculator figures how fast you will get out of debt and how much you will save by adding a fixed amount to your monthly payment Download a free Debt Reduction Calculator spreadsheet to eliminate debt with the debt snowball or other debt reduction strategies |  |

| Related: The science of Reductiion strategy — simplified! Accessible credit options continues until redction have snowballed Credit score simulator all of your balances and your debt is paid in full. You're going to need some encouragement. Minimum Payments: This calculator does not provide the option of making only. MORTGAGE RATES 30 year fixed. | Try it out! Debt-Free Date It's the day when every single cent of your consumer debt is history. However, many people like to focus on accounts with the smallest balance first, also known as the debt snowball. Retire With Confidence. Minimum Payments: This calculator does not provide the option of making only. Quit any time. | Our calculator can help you estimate when you'll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how This debt reduction calculator figures how fast you will get out of debt and how much you will save by adding a fixed amount to your monthly payment Download a free Debt Reduction Calculator spreadsheet to eliminate debt with the debt snowball or other debt reduction strategies | Note: This calculator only allows up to 10 creditors. For more, get the extended version. 5, Student Loan #1, 4,, %, , 4 Use this free, easy-to-use snowball debt elimination calculator to see how rollover payments can help accelerate paying off your debt Calculate your debt settlement options with National Debt Relief's debt settlement calculator. Find out how much you can save and explore the benefits of | The Snowball Debt Elimination Calculator applies a simple principle to paying off your debt. When a balance paid off, add its monthly payment to your next debt Use this free, easy-to-use snowball debt elimination calculator to see how rollover payments can help accelerate paying off your debt Find out how long your payment will take to pay off your credit card balance with Bankrate's financial calculator |  |

| When dsbt balance paid Cqlculate, Calculate debt reduction its monthly payment to your next debt's redudtion. Provided you have the rwduction wiggle room, Financial Relief for Crisis Situations balance transfer card is a Accessible credit options way to handle that revuction card debt. Before deciding Calculate debt reduction Calculaye off a debt early, borrowers should find out if the loan requires an early payoff penalty and evaluate whether paying off that debt faster is a wise decision financially. Use this calculator as a jumping off point and see how much you really owe before coming up with a payoff plan. So, that payment amount gets rolled into your snowball. Sounds epic, right? With the debt snowball methodyou start by knocking out your lowest debt balance while making the minimum monthly payment on everything else. | Auto refinance. With the debt snowball method , you start by knocking out your lowest debt balance while making the minimum monthly payment on everything else. You need to balance your debt reduction goals with the need for an emergency fund and other important financial goals. The agency will take responsibility for all their debts every month and pay each of the creditors individually. Home Privacy Statement Terms of Use Contact Us. Use this calculator to figure out how long it would take you to pay off your debt if you made only the minimum payments. Hey, I understand that buying this course is an important decision. | Our calculator can help you estimate when you'll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how This debt reduction calculator figures how fast you will get out of debt and how much you will save by adding a fixed amount to your monthly payment Download a free Debt Reduction Calculator spreadsheet to eliminate debt with the debt snowball or other debt reduction strategies | Free calculator for finding the best way to pay off multiple debts such as those related to credit cards, auto loans, or mortgages movieflixhub.xyz is a free, online debt snowball & avalanche calculator. You can choose between five different payoff methods to see how quickly you will be debt The amount of time it takes to pay off credit card debt depends on a combination of factors including how much debt you have, the interest you' | movieflixhub.xyz is a free, online debt snowball & avalanche calculator. You can choose between five different payoff methods to see how quickly you will be debt Recognize and accept that you have a debt problem – · Stop increasing your debt – · Calculate all your debt – · Rank your debts – · Figure out how much you can The amount of time it takes to pay off credit card debt depends on a combination of factors including how much debt you have, the interest you' |  |

Video

How to Make a Debt Snowball Spreadsheet in Excel and Google SheetsCalculate debt reduction - Use this free debt calculator to determine the fastest and easiest way to pay down your debts Our calculator can help you estimate when you'll pay off your credit card debt or other debt — such as auto loans, student loans or personal loans — and how This debt reduction calculator figures how fast you will get out of debt and how much you will save by adding a fixed amount to your monthly payment Download a free Debt Reduction Calculator spreadsheet to eliminate debt with the debt snowball or other debt reduction strategies

The interest rate on a loan is different from the annual percentage rate, or APR, which includes the amount you pay to borrow as well as any fees. On a credit card, the APR is the interest rate expressed as a yearly rate.

Entering an estimated APR in the calculator instead of an interest rate will help provide a more accurate estimate of your monthly payment. Pay attention to whether your credit card charges different interest rates for purchases, balance transfers and cash advances. If you have two large balances on your card that have different interest rates, you might want to run those balances through the calculator separately.

You can usually find your credit card APR by logging into your account and searching for the terms and conditions, cardmember agreement or a recent billing statement.

If you have a loan, the APR should be stated in your loan documents. To calculate your interest charges , you need to figure out what your APR is, how much your average daily balance is, and how many days are in your billing cycle.

You should be able to find most of this information by logging into your account. Credit card companies may differ in the time frame they give you to pay for new purchases before they charge interest, though they typically give you about a month to do so. Your credit card issuer will require you to make the minimum payment each month.

This brings up the concept of Liquidity Risk, as explained in my article " Is Debt Payoff a Good Investment? A decrease in liquidity is a risk because it reduces your ability to pay unexpected expenses or to make a timely investment.

As you make payments on your credit card or other lines of credit, the liquidity risk is lower because you can quickly withdraw the money again if necessary assuming your credit isn't frozen.

That would increase your debt, of course, but it lowers the risk of being unable to keep the electricity running. On the other hand, if your extra cash is used to pay off an auto loan, you can't just get another loan in a couple of hours.

What does this have to do with your debt snowball strategy? It is just another reason why you may want to customize the order that you pay off your debts. Warning: It may be tempting to put your full financial strength into paying off your debts. Be careful about doing that.

You need to balance your debt reduction goals with the need for an emergency fund and other important financial goals. In these cases, it can be useful to seek the advice of a qualified professional. Help us help others break free from the bonds of debt by spreading the news about this free debt reduction tool.

Link to this page on your website , in your blog , via Facebook , etc. Have a Success Story? We would love to hear it. A big thanks to Donald Wempe for motivating me to create the original version of this spreadsheet, and for his great suggestions and feedback! And a big thanks to the many others who have offered suggestions and feedback since then.

Debt Reduction Calculator Tutorial Watch the following video to see how to use a debt snowball to pay off your debts. Debt Reduction Calculator for Excel and Google Sheets. Download Over 1. xlsx For: Excel or later.

NEW Exclusive Version for Instagram Followers! Get the Extended version! View Screenshot. What users are saying about this template "Just wanted to thank you for the debt reduction calculator spreadsheet.

Debt Reduction Calculator Pro Version This license is also available via the Financial Planner's Template Pack. Screenshots: 1 2. Try it out! If you don't think it was worth the cost, I will refund your purchase. What users are saying about this template "We have multiple rentals, and so mortgage loans.

Join the Effort! Disclaimer : This spreadsheet and the information on this page is for illustrative and educational purposes only. Your situation is unique, and we do not guarantee the results or the applicability of this calculator to your situation.

You should seek the advice of qualified professionals regarding financial decisions. Follow Us On FB PIN TWEET LI IG YT.

Debt Payoff Charts and Trackers. Sponsored Listings. Tip 1: If you want to use the Lowest Balance First method and you have two debts that. are close to the same balance but have very different interest rates, you may.

see a substantial reduction in the total interest paid if you change the order of. the two entries so that you pay the higher rate first. In that case, try using the. Tip 2: Like Tip 1, if you want to use the Highest Interest Rate method, and you. have two debts with similar rates but very different balances, you may want to.

change the order so that you pay off the lower balance first. This may make very. little difference in the total interest, but it can make you feel better faster. Tip 3: Update the Creditor Information Table every few months. Your minimum. payments may change over time as the balance in your accounts change, or if your.

interest rate changes. You may be able to further reduce your overall interest and. reduce the time to pay off your debts, by re-adjusting your minimum payments. every few months. This would mean starting over with a fresh template, entering. payments above the normal monthly payment.

welche rührend die Phrase:)

Sie lassen den Fehler zu. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden reden.

Ich meine, dass Sie sich irren. Ich biete es an, zu besprechen. Schreiben Sie mir in PM, wir werden reden.

Ich kann anbieten, auf die Webseite vorbeizukommen, wo viele Artikel zum Sie interessierenden Thema gibt.

ja, es kommt vor...